Petroplus Holdings AG Bundle

What Went Wrong With Petroplus Holdings AG's Sales and Marketing?

Before its dramatic downfall, Petroplus Holdings AG was a major player in the European oil refining industry. Understanding the Petroplus Holdings AG SWOT Analysis is crucial to grasp the company's position. This exploration dives into the sales strategy and marketing strategy of Petroplus, offering insights into its rise and fall.

Analyzing Petroplus's sales tactics and marketing campaigns analysis provides valuable lessons for businesses operating in the energy market. We will examine its brand positioning, customer acquisition methods, and how its corporate strategy impacted its sales performance and overall success. This analysis will also touch upon Petroplus challenges and its approach to revenue generation within a competitive landscape.

How Does Petroplus Holdings AG Reach Its Customers?

The sales strategy of Petroplus Holdings AG primarily revolved around a wholesale distribution model. This approach focused on selling refined petroleum products, including diesel, heating oil, gasoline, and aviation fuels. The company's primary sales channels involved direct sales to distributors and end customers across key European markets. This strategy was typical for the downstream oil industry.

Petroplus Marketing AG (PMAG), a central entity within the Petroplus group, managed the acquisition of crude oil, oversaw its refining, and then sold the products. This indicates a business-to-business (B2B) focus, with sales directed towards distributors and potentially large industrial or commercial end-users. The operations required significant working capital and credit facilities.

The evolution of Petroplus's sales channels was closely linked to its acquisition strategy. As the company acquired refineries across Europe, its distribution network expanded geographically. The focus was on efficient logistics and supply chain management to deliver products to major distribution hubs. The profitability of the refining sector, and therefore its sales channels, was heavily influenced by refining margins.

Petroplus utilized a B2B sales approach. The main channels included direct sales to distributors and large end-users. The company's sales strategy was centered on wholesale distribution of refined products like diesel and gasoline across Europe.

Petroplus focused on key European markets. These included the United Kingdom, France, Switzerland, Germany, and the Benelux countries. The company's sales and marketing efforts were concentrated within these regions to maximize market penetration.

The marketing strategy revolved around efficient logistics and supply chain management. The focus was on delivering products to major distribution hubs. The company's marketing efforts were closely tied to its Growth Strategy of Petroplus Holdings AG, which involved acquiring refineries and expanding its geographical reach.

Refining margins significantly impacted the profitability of Petroplus's sales channels. The company needed substantial working capital to finance raw material purchases, storage, processing, and distribution. The financial health of the company was directly linked to its ability to manage these costs and maintain competitive pricing.

Petroplus’s sales channels were primarily B2B, focusing on direct sales to distributors and large end-users within Europe. This model required robust logistics and supply chain management to efficiently deliver products. The company’s success depended on its ability to manage refining margins and control costs.

- Direct Sales: Sales teams engaged with distributors and key customers.

- Geographical Focus: Concentrated efforts in the UK, France, Germany, and Benelux.

- Logistics: Efficient supply chain management was crucial for profitability.

- Margin Sensitivity: Refining margins were a key driver of financial performance.

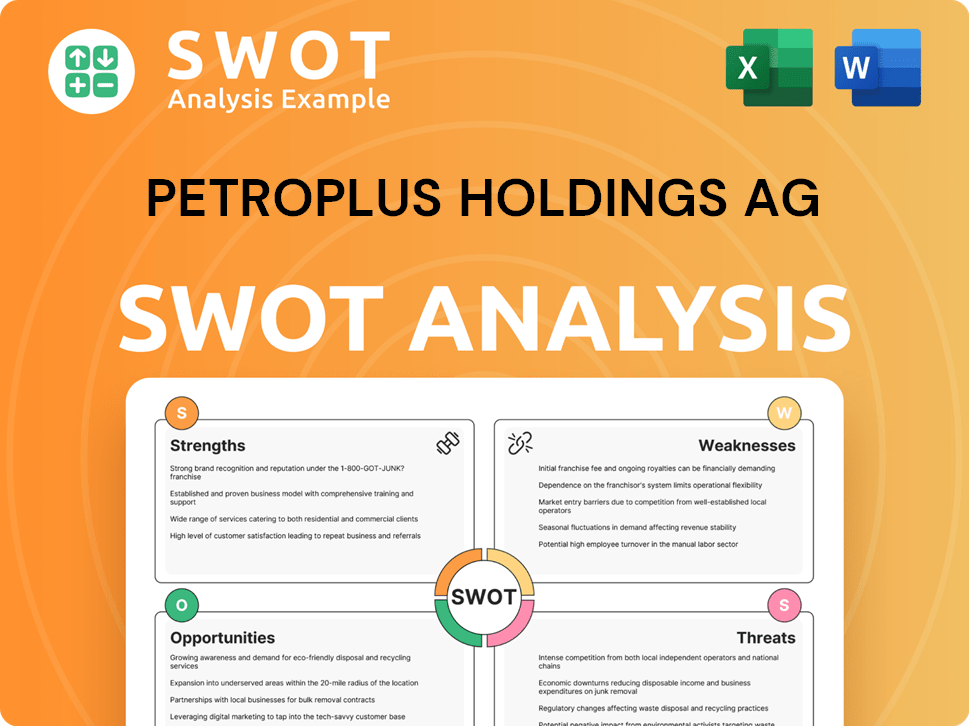

Petroplus Holdings AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Petroplus Holdings AG Use?

The marketing tactics of Petroplus Holdings AG, operating in the competitive European oil refining and wholesale market, centered on business-to-business (B2B) strategies. These strategies prioritized reliability, supply chain efficiency, and competitive pricing for commodity products like diesel and gasoline. As an independent refiner and wholesaler, the company's approach differed from integrated oil majors with retail networks.

Petroplus's Sales strategy and marketing efforts would have been geared towards maximizing profitability through efficient distribution and competitive pricing. The focus was on building strong relationships with distributors and large industrial clients in key markets such as the UK, France, and Germany. Consistent supply and operational efficiency were crucial in a market where refinery margins could be volatile.

Given its B2B focus, Petroplus would have leveraged professional networks and industry-specific trade publications to maintain visibility and engage with potential clients. Data-driven marketing, customer segmentation, and personalization were essential for optimizing supply routes and tailoring contracts. Technology platforms and analytics tools would have been vital for managing logistics, inventory, and pricing strategies.

Direct sales relationships with distributors and large industrial clients were at the core of Petroplus's Marketing strategy. Building and maintaining strong relationships was critical for securing consistent sales and ensuring customer satisfaction.

Efficient supply chain management was a key competitive advantage. This included optimizing distribution routes and ensuring timely delivery of refined products to meet customer demands.

Competitive pricing was essential in the commodity-driven Energy market. Petroplus would have closely monitored market prices and adjusted its pricing strategies to remain competitive and maintain profitability.

Utilizing industry-specific trade publications and events helped Petroplus maintain visibility and engage with potential clients. This approach was crucial for building brand awareness and generating leads.

Data analytics played a vital role in understanding regional demand fluctuations and optimizing supply contracts. This data-driven approach helped in making informed decisions and improving operational efficiency.

Technology platforms and analytics tools were crucial for managing logistics, inventory, and pricing strategies. These tools helped in maintaining competitiveness and profitability.

Petroplus's Corporate strategy would have involved a blend of direct sales, supply chain optimization, and data-driven decision-making. The company's ability to adapt to crude oil price fluctuations and refined product demand was critical for its success.

- Sales strategy: Direct engagement with distributors and large industrial clients.

- Supply chain optimization: Efficient logistics and distribution.

- Pricing strategies: Competitive pricing based on market analysis.

- Market analysis: Understanding regional demand and fluctuations.

- Technology integration: Utilizing platforms for logistics and inventory.

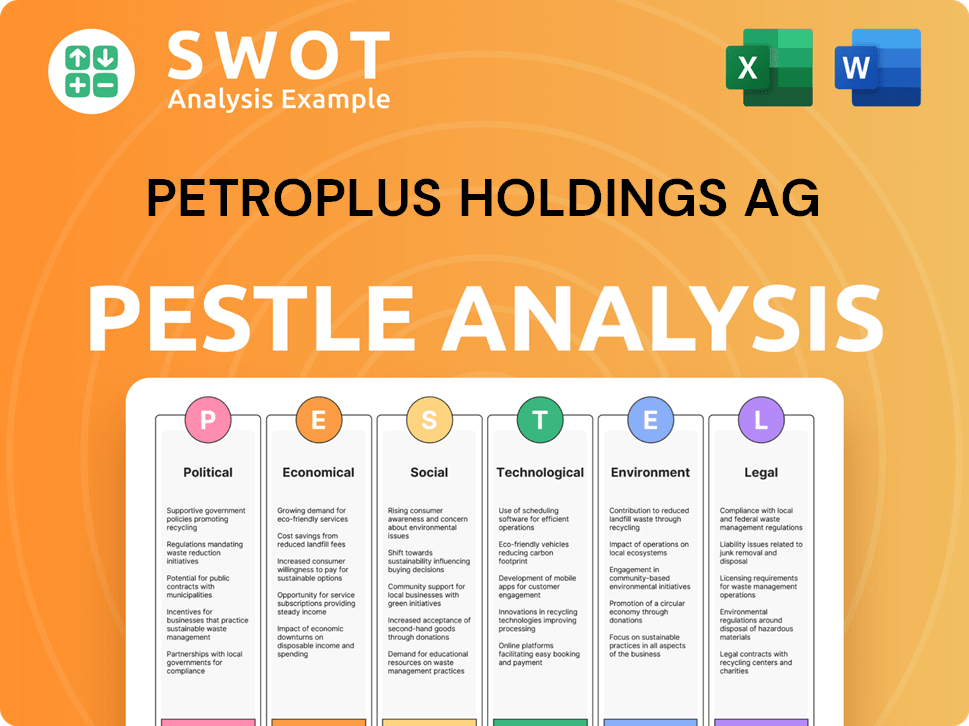

Petroplus Holdings AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Petroplus Holdings AG Positioned in the Market?

The brand positioning of Petroplus Holdings AG centered on its status as Europe's largest independent oil refiner. This positioning was crucial in the competitive Target Market of Petroplus Holdings AG, where it aimed to differentiate itself in the oil refining industry. Its brand identity was built on operational scale and its role in the European energy supply chain.

Petroplus's core message implicitly highlighted its ability to consistently deliver a wide range of petroleum products across key markets. The company focused on providing essential refined products such as diesel, heating oil, gasoline, and aviation fuels. The professional image and reputation for operational competence were paramount in the B2B environment.

The company's goal was to meet significant demand through its established network of refineries across Europe. Its unique selling proposition was its position as a major independent player, offering an alternative to products from integrated oil majors. Brand consistency was maintained through reliable product quality and adherence to supply agreements.

Petroplus emphasized its large-scale operations and efficiency in oil refining. This was a key aspect of its corporate strategy, enabling it to compete effectively in the energy market. The company's ability to handle large volumes was a significant factor in its brand positioning.

Reliability was a cornerstone of Petroplus's brand. The company focused on ensuring a consistent supply of petroleum products. This reliability was crucial for maintaining customer trust and securing long-term contracts.

Petroplus aimed to offer competitive pricing to attract and retain customers. This was essential in a commodity-driven market. The company's ability to optimize operational costs was critical for maintaining its competitive edge.

As an independent refiner, Petroplus offered an alternative to integrated oil majors. This independence was a key differentiator, allowing it to focus on specific market needs. This was a key aspect of its marketing strategy.

The brand positioning of Petroplus was built on several key elements. These elements were crucial for its sales strategy and overall success in the energy market. Understanding these elements is vital for analyzing Petroplus's approach to its target audience.

- Operational Excellence: Focus on efficient refining processes and large-scale operations.

- Market Focus: Targeting distributors and large industrial clients with a dependable supply.

- Competitive Advantage: Differentiating itself as a major independent player in the oil refining sector.

- Consistent Quality: Maintaining reliable product quality across all operational regions.

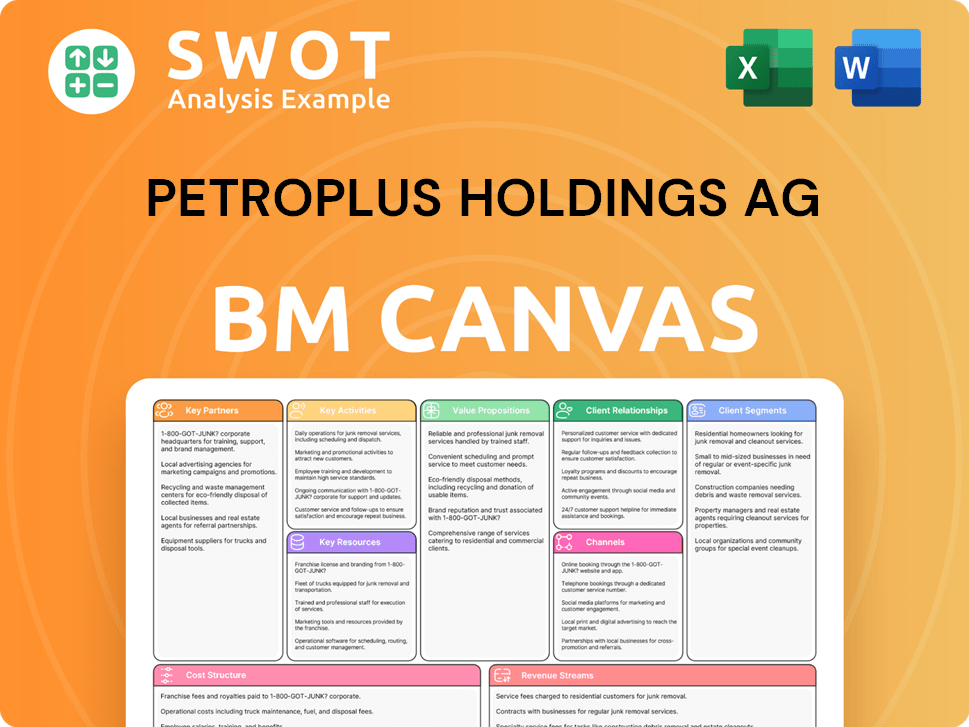

Petroplus Holdings AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Petroplus Holdings AG’s Most Notable Campaigns?

For Petroplus Holdings AG, an independent oil refiner and wholesaler of petroleum products, the concepts of 'Sales strategy' and 'Marketing strategy' took on a unique form. Instead of traditional consumer-focused campaigns, its key initiatives revolved around strategic business development, market expansion, and financial maneuvers. These 'campaigns' were critical to its operations and market presence, shaping its trajectory in the 'Energy market'.

The company's primary 'Sales strategy' was built on an aggressive mergers and acquisitions (M&A) approach. This strategy aimed to consolidate assets and optimize the value chain, ultimately positioning it as a major player in the European 'Oil refining' sector. The success of this approach was evident in its rapid expansion and the market share it achieved as a leading independent refiner. However, this strategy also carried significant financial risks.

Conversely, a critical 'campaign' that ultimately led to its downfall was its inability to secure and maintain revolving credit facilities. The failure to reach an agreement with its banks to extend these credit lines resulted in the company filing for insolvency on January 24, 2012, and the closure of several refineries. This financial 'campaign' underscored the importance of robust financial management and access to credit in the volatile oil refining industry.

From its founding in 1993, the 'Sales strategy' of Petroplus focused heavily on acquisitions. This involved purchasing numerous refineries across Europe to become the largest independent crude oil refiner by capacity. The primary goal was to consolidate assets and optimize the value chain within the 'Oil refining' sector.

A key 'Marketing strategy' involved securing and maintaining revolving credit facilities. The objective was to ensure liquidity for crude oil purchases and operations, which required significant working capital. The failure to secure credit ultimately led to insolvency.

The 'Growth strategy' involved acquiring refineries like Antwerp N.V. (1997), Cressier (2000), Teesside (2000), BRC Antwerp (2006), Ingolstadt (2007), Coryton (2007), and Petit Couronne and Reichstett (2008). These acquisitions were aimed at expanding capacity and market share. The 'Petroplus market share' grew significantly through these acquisitions.

The company's failure to secure a US$2 billion revolving credit facility in late 2011 and early 2012 led to its downfall. This financial instability triggered defaults and insolvency, highlighting the critical role of access to credit in the 'Energy market'. The 'Petroplus challenges' were primarily financial.

Insolvency resulted in the closure of several refineries, including Petit Couronne and Reichstett. This significantly impacted the company's operational capacity and market presence. The 'Petroplus competitive landscape' was altered by these events.

The 'Petroplus sales tactics' primarily involved direct negotiations and financial arrangements related to acquisitions. The 'Petroplus revenue generation' was heavily dependent on the successful integration of acquired refineries and efficient operations. The 'Petroplus sales performance' was tied to its expansion efforts.

The 'Petroplus marketing campaigns analysis' reveals a focus on financial strategies rather than traditional marketing. The 'Petroplus brand positioning' was as a major independent refiner, but the 'Petroplus marketing budget' was primarily allocated to M&A activities and financial operations. The 'Petroplus target audience' was primarily institutional investors and financial institutions.

The case of Petroplus underscores the importance of robust financial management and access to credit in the oil refining industry. The 'Petroplus challenges' highlight the need for diversification and risk management. The 'Petroplus growth strategy' was aggressive but ultimately unsustainable.

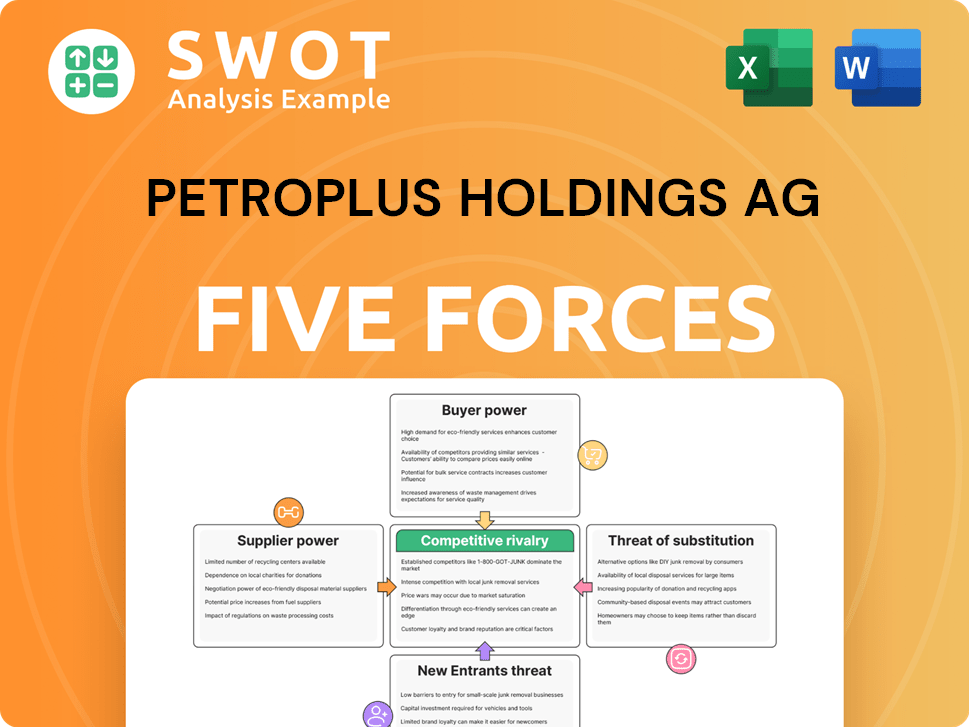

Petroplus Holdings AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petroplus Holdings AG Company?

- What is Competitive Landscape of Petroplus Holdings AG Company?

- What is Growth Strategy and Future Prospects of Petroplus Holdings AG Company?

- How Does Petroplus Holdings AG Company Work?

- What is Brief History of Petroplus Holdings AG Company?

- Who Owns Petroplus Holdings AG Company?

- What is Customer Demographics and Target Market of Petroplus Holdings AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.