Pinnacle Financial Partners Bundle

How Does Pinnacle Financial Partners Outperform the Competition?

Established in 2000, Pinnacle Financial Partners has redefined financial services by prioritizing client relationships and personalized service. Their unique approach has fueled impressive growth, but how do they actually bring their products and services to customers? This article dives into the Pinnacle Financial Partners SWOT Analysis to uncover the secrets behind their sales and marketing success.

Pinnacle Financial Partners' success hinges on a powerful sales and marketing strategy that emphasizes attracting top talent and building strong client relationships. Their 'talent-driven' model has significantly impacted their growth, outpacing competitors in the financial services industry. We'll explore their sales process overview, revealing how Pinnacle Bank sales and marketing efforts contribute to their impressive market penetration strategies and overall growth strategy. This analysis will also examine their competitive analysis strategy and how they maintain a strong brand awareness strategy.

How Does Pinnacle Financial Partners Reach Its Customers?

The sales and marketing strategy of Pinnacle Financial Partners, or PNFP, centers on a direct sales model, emphasizing personal relationships and experienced financial professionals. This approach, a key element of the Revenue Streams & Business Model of Pinnacle Financial Partners, is designed to foster client loyalty and drive growth. The company focuses on recruiting seasoned bankers, often from other institutions, who bring established client bases with them.

As of December 31, 2024, Pinnacle employed 3,565.5 full-time equivalent associates, reflecting its commitment to a 'people-centric' strategy. The success of this approach is evident in the recruitment of 161 new revenue producers in 2024, a 50.5% increase over 2023. The company continued this trend, adding 33 revenue producers in Q1 2025.

While the company maintains traditional physical retail locations, its growth strategy prioritizes expansion in high-growth urban markets across the Southeast. This is achieved through new branch openings and strategic hiring. For example, in April 2025, Pinnacle expanded its presence in Virginia with a full-service team in Richmond, building on existing operations. This approach allows Pinnacle Bank to deepen relationships and increase market share in targeted urban areas.

Pinnacle's primary sales channel is direct, relying on financial professionals to build and maintain client relationships. This 'people-centric' approach is a key differentiator in the market. Experienced bankers are recruited to bring established client relationships to the company.

Pinnacle maintains traditional physical retail locations, but the focus is on strategic expansion in high-growth urban markets. New branches and strategic hires support this growth strategy. Expansion in areas like Virginia reflects a shift towards deepening market share.

The company utilizes its website and online banking platforms to offer convenience to clients. Approximately 49% of commercial clients use internet banking. Strategic alliances, such as the investment in Banker's Healthcare Group (BHG), contribute to market reach.

The direct sales model emphasizes client acquisition through experienced bankers. Relationship management is a core focus, with clients often following bankers to Pinnacle. This approach contributes to significant loan and deposit growth.

Pinnacle Financial Partners employs a multi-faceted approach to sales and marketing, combining direct sales, physical presence, and digital channels. This strategy supports the company's overall growth objectives, focusing on building strong client relationships and expanding market share.

- Direct Sales: Emphasizes personal relationships with experienced financial professionals.

- Physical Retail: Strategic expansion in high-growth urban markets.

- Digital Platforms: Online banking and website for customer convenience.

- Strategic Alliances: Partnerships to expand market reach.

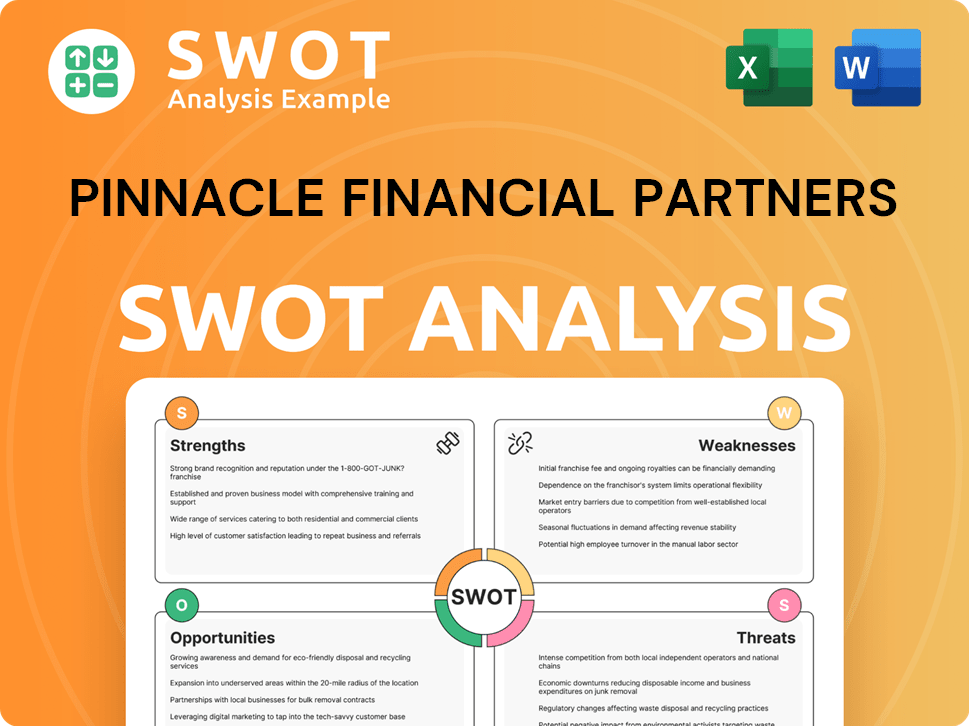

Pinnacle Financial Partners SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Pinnacle Financial Partners Use?

The marketing tactics of Pinnacle Financial Partners, a financial services provider, prioritize relationship-building and community engagement over traditional advertising. This approach focuses on recruiting experienced financial professionals who bring their existing client relationships, effectively acting as brand ambassadors. Digital channels are used for client service and support, rather than broad awareness campaigns.

Community involvement is a cornerstone of Pinnacle's marketing strategy. The company actively participates in local initiatives, sponsors events, and encourages employee volunteerism. This grassroots approach enhances brand visibility and reputation within its target markets, which include businesses, real estate professionals, and affluent households.

The company's marketing strategy aims to build deep financial relationships with its target audience. Pinnacle Financial Partners' sales strategy and marketing efforts are designed to cultivate strong connections within the communities it serves, focusing on personalized service and local engagement.

Pinnacle Financial Partners' sales and marketing approach relies heavily on its financial professionals. These individuals, recruited with existing client relationships, serve as key brand ambassadors. This strategy is central to their customer acquisition strategy.

While not used for broad awareness campaigns, digital tactics are important for client service. Pinnacle offers online and mobile banking, a 24/7 client service center, and automated account management. This focus enhances client relationship management.

Community involvement is a core component of Pinnacle's marketing. They support local charities and sponsor events to enhance brand visibility. For example, in April 2024, they donated $25,000 to the Carolina Theatre of Durham.

Pinnacle engages in local events to align its brand with local experiences. This includes events like a 'Nashville songwriter's night' and participation in The Players Championship golf tournament in Jacksonville. These activities support their brand awareness strategy.

Pinnacle's strategy implicitly targets businesses, real estate professionals, and affluent households. This focus allows for deep financial relationships. Their market penetration strategies are tailored to these specific groups.

Pinnacle's online presence includes press releases and investor presentations. This indicates a commitment to transparent communication with stakeholders. This approach supports their overall growth strategy.

Pinnacle Financial Partners' marketing strategy focuses on relationship-building and community engagement, avoiding traditional mass media. This approach includes recruiting experienced financial professionals, utilizing digital tools for client convenience, and active participation in community initiatives.

- Relationship-Focused Approach: Emphasizes personal connections and referrals.

- Community Involvement: Supports local charities and sponsors events to enhance brand visibility. In April 2024, Pinnacle donated $25,000 to the Carolina Theatre of Durham.

- Digital Convenience: Provides online and mobile banking, 24/7 client service, and automated account management.

- Targeted Marketing: Focuses on businesses, real estate professionals, and affluent households.

- Transparent Communication: Uses press releases and investor presentations to keep stakeholders informed.

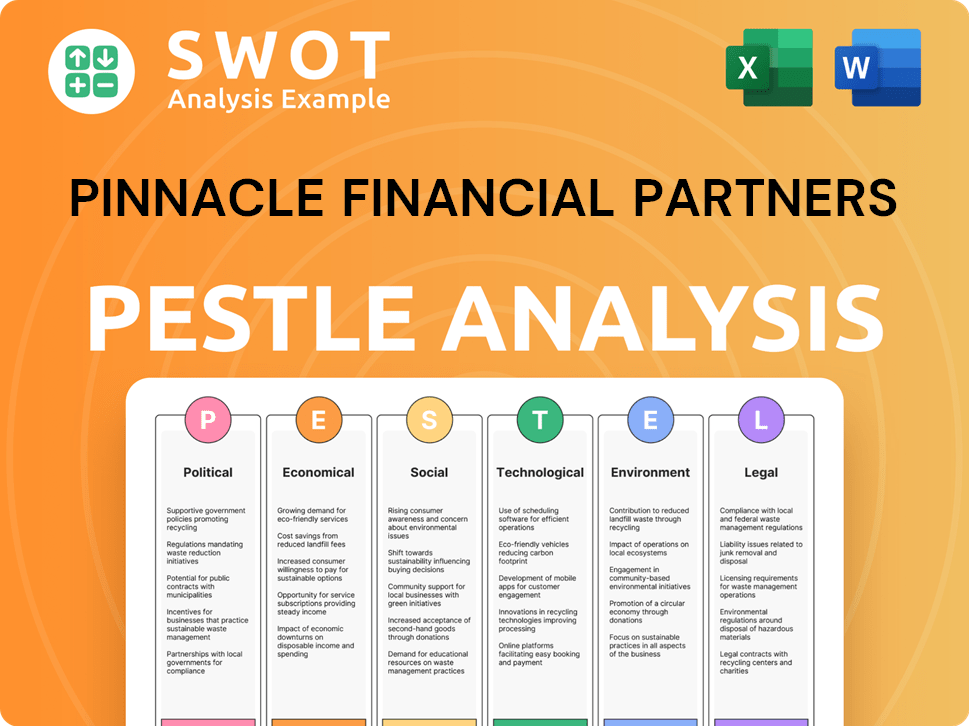

Pinnacle Financial Partners PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Pinnacle Financial Partners Positioned in the Market?

The brand positioning of Pinnacle Financial Partners centers on delivering 'distinctive service and effective advice,' aiming to be the premier financial services firm and employer in the Southeast. This strategy emphasizes a personalized, relationship-driven banking model, combining the comprehensive services of a large institution with the personal touch of a community bank. This approach is achieved by recruiting and retaining highly skilled financial professionals dedicated to building long-term client relationships.

Pinnacle differentiates itself from competitors, particularly larger banks, by prioritizing a people-centric approach and the deep expertise of its associates. The firm's commitment to service is evident in its annual client survey, where 97% of clients rate the firm as 'recognizably better' than its competitors. The brand's communication style is professional, trustworthy, and client-focused, reflecting its dedication to providing effective advice and exceptional convenience. The Target Market of Pinnacle Financial Partners is clearly defined.

Pinnacle primarily targets businesses, real estate professionals, and affluent consumers who seek a comprehensive and personalized financial relationship. The appeal is based on high-quality, consistent service delivered by experienced professionals. The firm's consistent recognition as a 'Great Place to Work' by FORTUNE magazine (No. 9 in 2025) and 'America's Best Banks to Work For' by American Banker reinforces its brand identity and commitment to its employees, which in turn translates to better client service. Brand consistency is maintained across various touchpoints, from in-person interactions with financial advisors to its online banking platforms, all designed to offer a seamless and 'wow' experience for clients.

The Pinnacle Financial Partners sales strategy focuses on relationship building and personalized service. The sales process emphasizes understanding client needs and providing tailored financial solutions. This approach is supported by a highly trained sales team.

The Pinnacle Financial Partners marketing strategy includes a mix of digital and traditional marketing efforts. The firm uses content marketing, social media, and community engagement to build brand awareness. Client testimonials and referrals are also crucial.

Pinnacle Bank sales teams are structured to foster client relationships and provide expert financial advice. The sales process involves needs assessments, product recommendations, and ongoing support. This approach drives customer satisfaction.

Pinnacle Bank marketing efforts aim to reach target audiences through various channels. The marketing mix includes digital advertising, public relations, and community events. The goal is to enhance brand visibility.

The integrated Pinnacle Financial Partners sales and marketing approach emphasizes a customer-centric strategy. This approach combines personalized sales with targeted marketing to attract and retain clients. The firm uses data analytics to refine its strategies.

- Personalized sales strategies.

- Targeted marketing campaigns.

- Data-driven decision-making.

- Emphasis on client relationships.

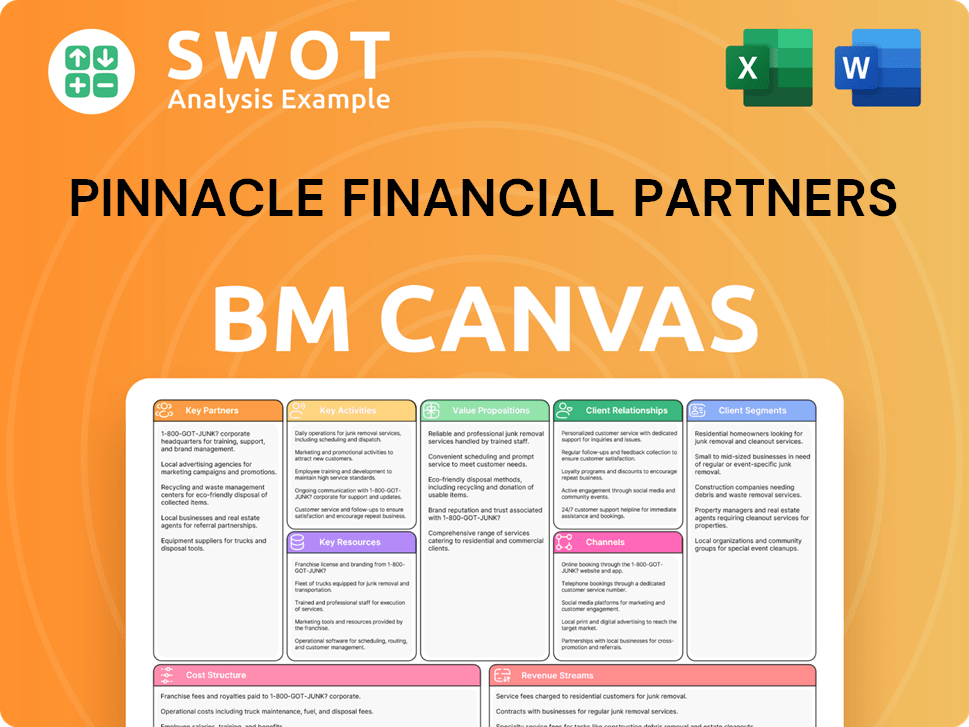

Pinnacle Financial Partners Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Pinnacle Financial Partners’s Most Notable Campaigns?

The sales and marketing strategy of Pinnacle Financial Partners, a key focus for Owners & Shareholders of Pinnacle Financial Partners, relies heavily on talent acquisition and relationship building rather than traditional advertising. This approach is central to its business model, emphasizing the recruitment of experienced financial professionals. The goal is to attract top-tier bankers with established client bases, driving organic growth through their existing relationships.

This strategy has proven successful, with new hires significantly contributing to loan and deposit growth. The bank's consistent recognition as a 'Great Place to Work' also plays a vital role in its brand-building efforts. These accolades attract both talent and clients, reinforcing the company's commitment to its employees and its distinctive service promise.

Another key component of Pinnacle's marketing strategy involves expanding into new urban markets across the Southeast. This expansion strategy, combined with community involvement, aims to penetrate new markets and build brand awareness. Overall, the firm's approach is a blend of strategic recruitment, positive brand recognition, and targeted market expansion to drive growth and maintain a strong market presence.

Pinnacle's primary marketing strategy revolves around recruiting experienced financial professionals. In 2024, they successfully recruited 161 revenue-producing associates. This talent-driven approach aims to bring in established client relationships, directly impacting loan and deposit growth.

Consistent recognition as a 'Great Place to Work' serves as a powerful brand-building tool. These accolades highlight the firm's strong internal culture, attracting both talent and clients. This supports the external brand promise of distinctive service.

Ongoing expansion into new urban markets is a key initiative. The firm's entry into Richmond, Virginia, in April 2025, is an example of this strategy. The objective is to penetrate new markets by leveraging its relationship-driven approach.

Community involvement, such as a $25,000 donation to the Carolina Theatre of Durham in April 2024, supports local engagement. Such initiatives contribute to brand building and strengthen community ties.

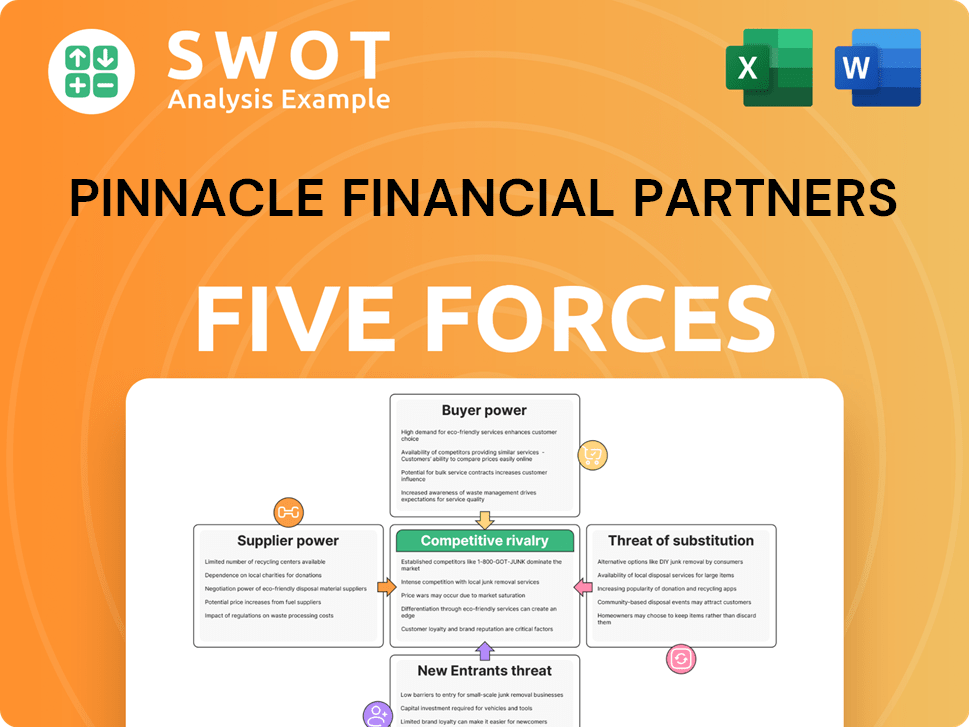

Pinnacle Financial Partners Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pinnacle Financial Partners Company?

- What is Competitive Landscape of Pinnacle Financial Partners Company?

- What is Growth Strategy and Future Prospects of Pinnacle Financial Partners Company?

- How Does Pinnacle Financial Partners Company Work?

- What is Brief History of Pinnacle Financial Partners Company?

- Who Owns Pinnacle Financial Partners Company?

- What is Customer Demographics and Target Market of Pinnacle Financial Partners Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.