QCR Holdings Bundle

How Does QCR Holdings Navigate the Competitive Financial Landscape?

In the ever-evolving financial services sector, understanding the QCR Holdings SWOT Analysis is crucial for investors and strategists alike. QCR Holdings, a multi-bank holding company, has consistently adapted its approach to thrive, especially following strategic acquisitions like the 2023 Guaranty Bank deal. This analysis dives into their sales and marketing strategy, revealing how QCR Holdings builds its brand and drives growth.

This exploration will dissect the core elements of QCR Holdings' sales and marketing strategy, from its initial community-focused approach to its current, expansive digital engagement. We will examine the specific marketing tactics employed, the company's brand positioning in a crowded market, and the distinguishing features of recent sales and marketing campaigns. A deep dive into QCR Holdings' sales plan development and marketing initiatives will provide actionable insights for anyone seeking to understand and emulate their success.

How Does QCR Holdings Reach Its Customers?

The sales strategy of QCR Holdings, a financial services company, centers on a multi-channel approach. This strategy combines traditional methods with digital platforms to connect with its diverse customer base. The core of its sales operations relies on its subsidiary banks, which serve as physical retail locations.

These physical branches offer a full range of services, including commercial and consumer banking, trust, and asset management. Direct sales teams within these branches focus on building relationships with local businesses and high-net-worth individuals. This approach is crucial for the commercial banking segment, where personal interaction is highly valued.

The company has likely shifted towards enhanced digital adoption in its sales channels. Online banking platforms and mobile applications allow customers to access services remotely, expanding the company's reach beyond its physical locations. The integration of online and offline channels aims to create a seamless customer experience.

QCR Holdings utilizes its subsidiary banks as physical retail locations. These branches offer a complete suite of financial services. Direct sales teams cultivate relationships with local businesses and high-net-worth individuals.

Online banking platforms and mobile applications are key digital channels. Customers can manage accounts and loans remotely. Digital channels expand the company's reach beyond physical branches, supporting the QCR Holdings marketing strategy.

The acquisition of Guaranty Bank in 2023 expanded QCR Holdings' asset base. This acquisition also integrated Guaranty Bank's branch network. This strategic move solidified its physical presence in key markets.

QCR Holdings aims to create an omnichannel experience. This allows seamless customer journeys across all touchpoints. The integration of online and offline channels is key to this strategy.

The sales strategy of QCR Holdings is a multi-channel approach, combining physical branches with digital platforms. This strategy focuses on building customer relationships and expanding market reach. The company's approach includes direct sales teams and strategic acquisitions.

- Physical Branches: Serve as retail locations for direct sales and relationship building.

- Digital Channels: Online banking and mobile apps for remote access.

- Acquisitions: Expanding market presence through strategic mergers.

- Omnichannel Experience: Seamless customer journeys across all channels.

For more details on the company's history, you can read the Brief History of QCR Holdings.

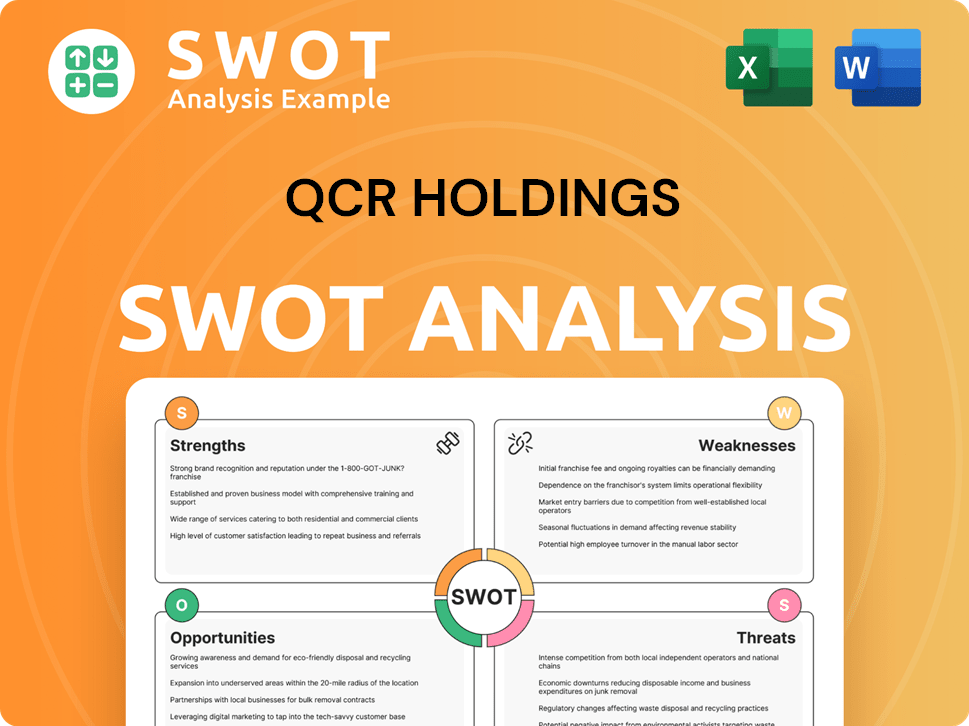

QCR Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does QCR Holdings Use?

The marketing tactics employed by QCR Holdings are designed to boost brand recognition, generate leads, and drive sales across its range of financial products and services. Their approach likely involves a blend of digital and traditional strategies, tailored to reach diverse customer segments. The overall QCR Holdings strategy aims to create a strong market presence and foster customer loyalty.

In the digital space, QCR Holdings likely leverages content marketing, SEO, and paid advertising to enhance online visibility and engage potential clients. Social media platforms are also key for brand interaction and promoting financial literacy. Furthermore, email marketing is probably used for nurturing leads and communicating product updates. These efforts are part of the broader marketing strategy QCR Holdings utilizes.

Beyond digital, QCR Holdings may use traditional media like local print ads and radio spots to connect with community-based audiences, particularly for consumer banking services. Participation in local events and sponsorships also helps build community relations and increase brand visibility. The company's Sales strategy QCR Holdings is therefore a multifaceted approach.

QCR Holdings likely uses content marketing to educate potential clients on financial topics. SEO helps improve visibility in online searches, and paid advertising targets specific demographics. This is a core component of their digital marketing strategy.

Social media platforms are used for brand engagement, customer service, and promoting financial literacy. Email marketing campaigns nurture leads and communicate product updates or personalized offers. These tactics are crucial for customer engagement.

Traditional media like local print ads and radio spots may be used to reach community-based audiences. Participation in local events and sponsorships helps build community relations. These efforts support local brand recognition.

QCR Holdings likely analyzes customer demographics and transaction data to segment its audience and personalize marketing messages. This approach aims for higher engagement and conversion rates. Data analysis is key.

Financial institutions typically use CRM systems, marketing automation platforms, and business intelligence tools. These tools help manage customer interactions and derive insights from marketing data. Technology is essential.

The marketing mix has evolved to integrate digital channels more deeply, reflecting the broader industry trend towards a blended approach. This maximizes reach and engagement. Digital integration is a priority.

QCR Holdings' approach to data-driven marketing likely involves analyzing customer demographics and transaction data to segment its audience and personalize marketing messages, aiming for higher engagement and conversion rates. Financial institutions commonly use CRM systems, marketing automation platforms, and business intelligence tools to manage customer interactions and gain actionable insights from marketing data. For example, in 2024, the financial services sector allocated approximately 11.2% of its marketing budget to digital channels, reflecting a shift towards blended strategies. The evolution of the marketing mix integrates digital channels more deeply, mirroring the industry trend towards a blended approach that maximizes reach and engagement. For more information on how QCR Holdings positions itself in the market, consider reading about the Competitors Landscape of QCR Holdings.

QCR Holdings likely focuses on several key marketing initiatives to drive growth and customer engagement. These initiatives are designed to support their overall sales and marketing goals.

- Content Marketing: Creating educational content to build trust and attract potential clients.

- SEO Optimization: Improving online visibility through search engine optimization.

- Paid Advertising: Running targeted ad campaigns on relevant platforms.

- Social Media Engagement: Using social media for brand building and customer service.

- Email Marketing: Nurturing leads and communicating with existing customers.

- Community Involvement: Participating in local events and sponsorships.

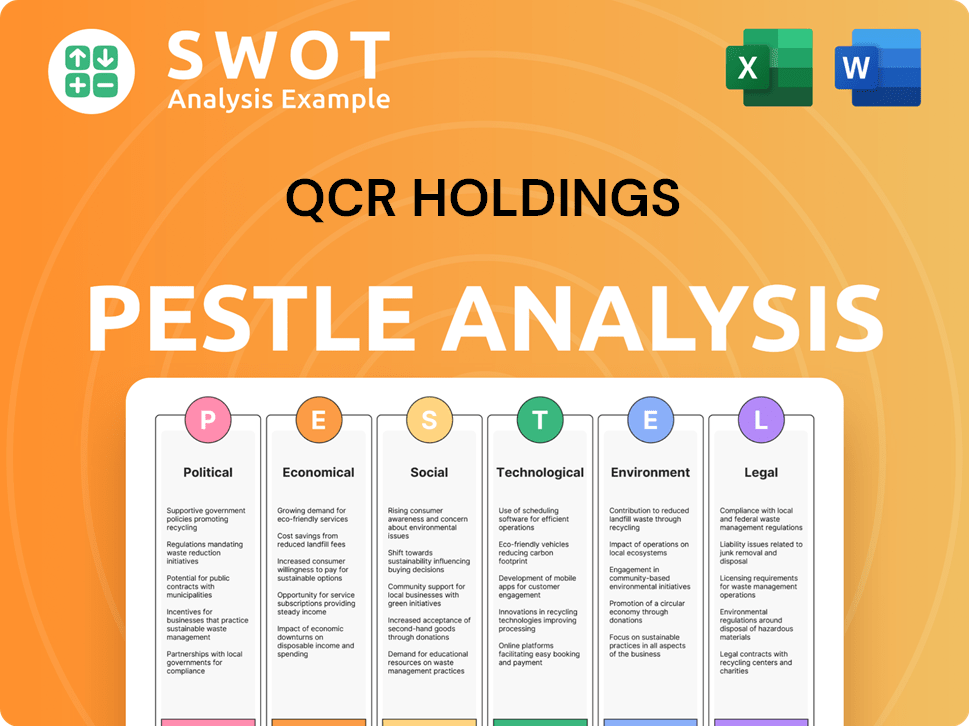

QCR Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is QCR Holdings Positioned in the Market?

QCR Holdings positions itself as a community-focused financial partner. This brand positioning emphasizes personalized banking, trust, and comprehensive services, targeting both businesses and individuals. The core message likely highlights trust, expertise, and a commitment to understanding unique financial needs, differentiating it from larger, less personal banks.

The company's brand identity is likely conveyed through a professional yet approachable visual identity and a knowledgeable, reassuring tone. Customer experience prioritizes responsiveness and tailored solutions, appealing to those valuing strong relationships with their financial institution. This approach is crucial in a competitive landscape, ensuring a cohesive customer experience across all touchpoints.

The Target Market of QCR Holdings is likely drawn to its focus on localized service and deep market understanding. While specific brand perception data isn't readily available, the company's growth and acquisitions, such as Guaranty Bank, suggest a positive market perception and effective brand strategy. Maintaining a strong brand is essential, especially as consumer preferences evolve, such as the increasing demand for digital banking services.

The sales strategy for QCR Holdings likely involves a relationship-based approach. This focuses on building trust and providing tailored financial solutions. Sales efforts probably concentrate on understanding client needs and offering personalized services.

Marketing initiatives for QCR Holdings probably emphasize community engagement and digital presence. This includes local advertising, online marketing, and content that highlights expertise and customer success stories. The goal is to build brand awareness and attract new clients.

QCR Holdings' business strategy likely centers on organic growth and strategic acquisitions. This includes expanding its service offerings and geographic reach. The company aims to increase its market share and provide comprehensive financial solutions.

Sales plan development probably involves setting specific targets and performance metrics. This includes identifying key performance indicators (KPIs) and regularly monitoring sales team performance. The focus is on optimizing the sales process for efficiency.

Marketing campaigns could include digital advertising, content marketing, and community events. These campaigns would likely highlight QCR Holdings' commitment to customer service and financial expertise. The aim is to attract and retain customers.

Sales performance analysis involves tracking sales data, identifying trends, and evaluating sales team effectiveness. This data helps to refine sales strategies and improve overall performance. Regular analysis is crucial for continuous improvement.

Target market analysis involves identifying and understanding the needs of specific customer segments. This includes analyzing demographics, financial goals, and preferences. This analysis informs marketing and sales strategies.

Competitive analysis involves evaluating competitors' marketing strategies and market positioning. This helps QCR Holdings to identify its unique selling propositions and differentiate its offerings. The goal is to gain a competitive edge.

The digital marketing strategy likely includes a strong online presence, SEO optimization, and social media engagement. The company may use targeted advertising to reach specific customer segments. This strategy is designed to enhance brand visibility and generate leads.

- Search Engine Optimization (SEO) to improve online visibility.

- Social Media Marketing to engage with customers and build brand awareness.

- Content Marketing to provide valuable information and establish expertise.

- Email Marketing to nurture leads and communicate with customers.

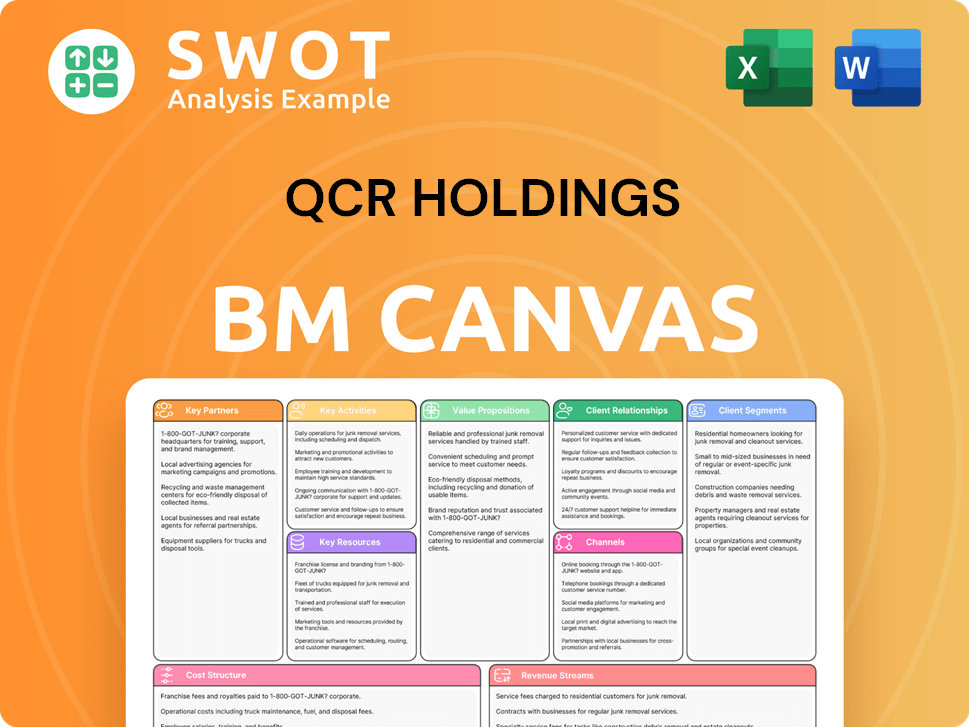

QCR Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are QCR Holdings’s Most Notable Campaigns?

The sales and marketing strategy of QCR Holdings, while not always explicitly detailed in individual campaigns, is evident through its strategic actions and communications. These actions often revolve around significant corporate initiatives and ongoing service promotions, designed to enhance market presence and customer value. Understanding these initiatives offers insights into how QCR Holdings approaches sales and marketing, driving both customer acquisition and retention.

A key focus of QCR Holdings' strategy is to leverage corporate milestones, such as acquisitions, to communicate expanded capabilities and value. These efforts are crucial for reassuring existing customers and attracting new ones. Additionally, the company consistently emphasizes its specialized services, such as wealth management, to target specific customer segments and differentiate itself in the competitive financial landscape. This approach is supported by various marketing initiatives focused on delivering comprehensive financial solutions.

The company's approach to sales and marketing is multifaceted, often involving a blend of direct communication, digital content, and personalized outreach. These strategies are designed to build strong customer relationships and promote a wide range of financial services. The effectiveness of these efforts is measured through growth in key areas, such as assets under management and customer base expansion, reflecting the success of their sales and marketing initiatives.

The acquisition of Guaranty Bank in 2023 served as a major campaign, aiming to integrate operations and communicate the enhanced value proposition. Key channels included direct customer communications and press releases. The resulting financial reports showed a substantial increase in assets, demonstrating the success of this strategic move. This also aligns with QCR Holdings' broader Revenue Streams & Business Model of QCR Holdings.

Ongoing promotion of wealth management and trust services targets high-net-worth individuals and businesses. This includes personalized outreach, seminars, and targeted digital content. Success is measured by growth in assets under management and client base expansion. This is a key aspect of QCR Holdings' sales and marketing strategy, aiming to differentiate through comprehensive financial solutions.

While specific details are not always public, QCR Holdings likely employs digital marketing strategies. These include targeted advertising, content marketing, and social media engagement. The aim is to increase brand awareness and drive traffic to its services. The effectiveness is measured by website traffic, lead generation, and customer engagement metrics.

QCR Holdings probably uses CRM systems to manage customer interactions and track sales performance. This allows for personalized communication and efficient sales processes. Analyzing sales data and customer feedback helps optimize sales strategies. CRM integration supports both sales and marketing efforts.

The success of QCR Holdings' sales and marketing efforts is evaluated using several key metrics. These metrics provide insights into the effectiveness of their strategies and inform future decisions.

- Assets Under Management (AUM): Growth in AUM is a primary indicator of success in wealth management services.

- Client Base Expansion: Increase in the number of clients, especially for specialized services, shows effective customer acquisition.

- Market Share: Expanding market share indicates successful competitive positioning and sales strategy.

- Customer Satisfaction: Measured through surveys and feedback, indicating the quality of services and customer relationships.

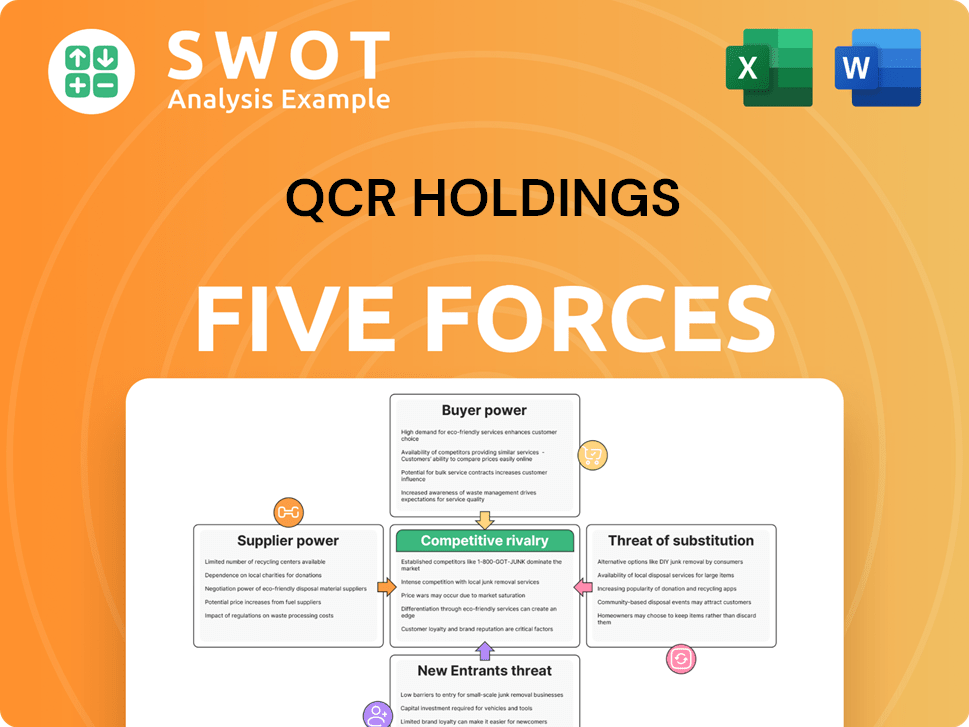

QCR Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QCR Holdings Company?

- What is Competitive Landscape of QCR Holdings Company?

- What is Growth Strategy and Future Prospects of QCR Holdings Company?

- How Does QCR Holdings Company Work?

- What is Brief History of QCR Holdings Company?

- Who Owns QCR Holdings Company?

- What is Customer Demographics and Target Market of QCR Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.