Credicorp Bundle

What Drives Credicorp's Success: Mission, Vision, and Values?

Every successful financial institution needs a strong foundation, and for Credicorp Company, that foundation is built on a clear mission, a compelling vision, and a set of unwavering core values. Understanding these elements is key to grasping Credicorp's strategic direction and its approach to the ever-changing financial landscape.

Credicorp's Credicorp SWOT Analysis reveals how these principles shape its strategy across universal banking, microfinance, insurance, and investment management. Exploring the Credicorp Mission, Credicorp Vision, and Credicorp Core Values provides a crucial lens through which to analyze its long-term goals and its impact on society, offering insights for investors, analysts, and anyone interested in the company's future outlook.

Key Takeaways

- Credicorp's framework guides its strategic direction and operations in Latin America.

- The mission emphasizes client needs and financial inclusion, crucial for success.

- Core values provide a strong ethical foundation for responsible business practices.

- Alignment with these principles is essential for navigating future challenges.

Mission: What is Credicorp Mission Statement?

Credicorp's mission is 'to efficiently provide products and services that meet our client's needs, promoting financial inclusion and stakeholder's satisfaction.'

Let's delve deeper into the Credicorp Mission and what it means for the company and its stakeholders.

The core of the Credicorp Mission is a strong focus on client needs. This client-centric approach drives the development and delivery of financial products and services. The company aims to understand and address the specific financial requirements of its diverse client base.

Credicorp offers a wide array of financial products and services. These include universal banking, microfinance, insurance and pensions, and investment management. This diverse portfolio ensures that Credicorp can cater to a broad spectrum of financial needs.

A key component of the Credicorp Mission is the promotion of financial inclusion. This is particularly evident in their microfinance operations through Mibanco and digital initiatives like Yape. The goal is to bring financial services to underserved populations.

Credicorp's mission emphasizes the importance of stakeholder satisfaction. This includes customers, employees, shareholders, and the communities they serve. The company aims to create value for all stakeholders.

Credicorp primarily operates in Peru and other Latin American countries. This regional focus allows the company to tailor its products and services to the specific needs of these markets. Credicorp's strategy is to leverage its understanding of the local markets.

The unique value proposition of Credicorp lies in the efficient provision of tailored financial solutions. They also have a strong emphasis on financial inclusion. This combination sets them apart in the market.

Credicorp's mission is strongly reflected in its business operations. For instance, Mibanco, their microfinance arm, has disbursed over $5.5 billion in loans to micro-entrepreneurs between 2020 and 2024, directly addressing financial inclusion. The rapid growth of Yape, their mobile payment application, is another example. Yape has over 14 million users as of Q1 2024, significantly contributing to financial inclusion in Peru. This customer-centric and inclusion-focused approach aligns with the needs of the markets Credicorp serves. This mission guides Credicorp's Credicorp Strategy and helps define its Credicorp Goals.

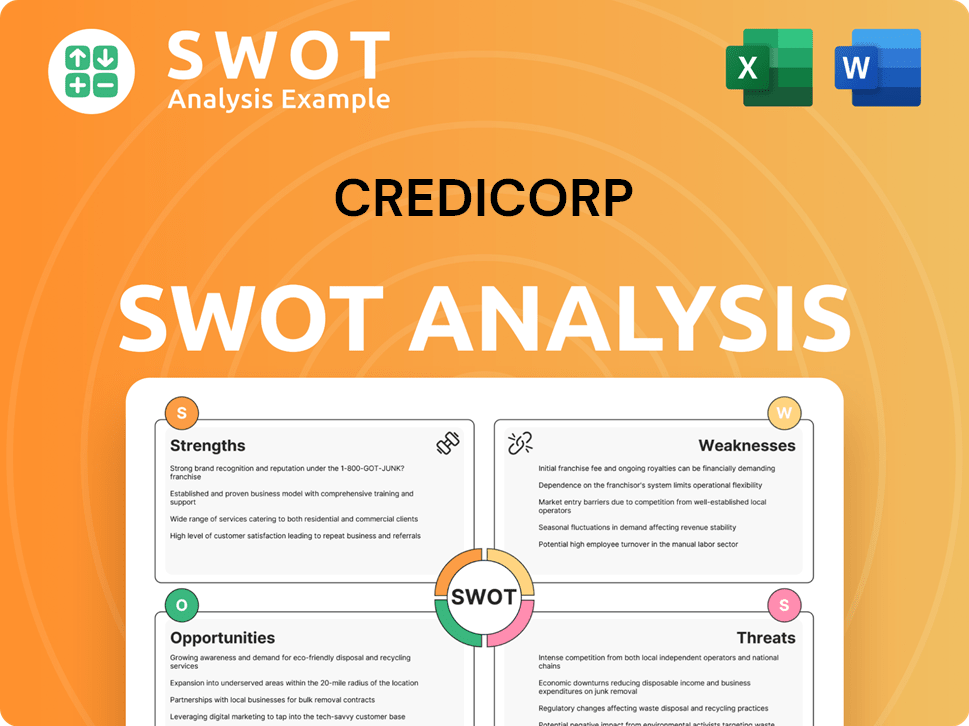

Credicorp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Credicorp Vision Statement?

Credicorp's vision is 'to be a sustainable financial business leader in Latin America, guided by a great purpose, future-oriented and focused on generating superior value for our employees, customers, shareholders, and the countries we operate in.'

Let's delve into the specifics of Credicorp's vision and its implications for the company's future. Understanding the Credicorp Vision is crucial for grasping the company's long-term strategy and its commitment to stakeholders. This vision statement serves as a guiding star for the company's actions and decisions.

The vision explicitly targets leadership within Latin America. This focus suggests an ambition to expand its market share and influence across the region. This is a key component of Credicorp's long-term goals.

The emphasis on "sustainable" highlights a commitment to responsible business practices and long-term viability. This includes environmental, social, and governance (ESG) considerations. This is a key aspect of Credicorp's ethical standards.

This suggests a mission-driven approach, implying that Credicorp is motivated by more than just profit. This aligns with the company's Credicorp Mission and overall Credicorp Strategy.

This indicates a proactive approach to innovation and adaptation to the changing financial landscape. Credicorp is likely investing in technologies and strategies to remain competitive. This is a key element of Credicorp's approach to innovation.

The focus on generating superior value for all stakeholders underscores a commitment to creating a positive impact across the board. This includes employees, customers, shareholders, and the countries in which Credicorp operates. This is how Credicorp defines success.

The vision explicitly mentions employees, customers, shareholders, and the countries of operation, highlighting Credicorp's commitment to all of them. This is a key aspect of Credicorp's commitment to customers and Credicorp's employee values.

Credicorp's vision, as stated, is ambitious and comprehensive. It reflects a desire for market leadership, sustainable growth, and a positive impact on all stakeholders. The company's success in achieving this vision will depend on its ability to execute its strategies effectively and adapt to the evolving financial landscape. For more insights into Credicorp's strategic direction, consider exploring the Growth Strategy of Credicorp.

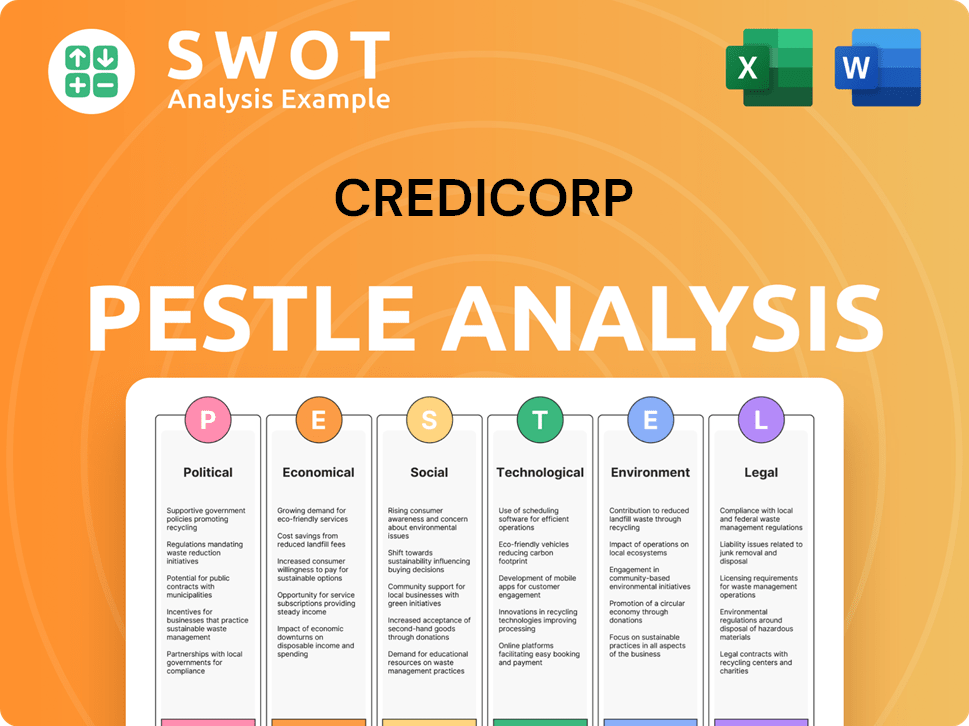

Credicorp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Credicorp Core Values Statement?

Understanding the core values of Credicorp is crucial for grasping its operational philosophy and its approach to stakeholders. These values guide the company's actions and shape its corporate identity, influencing everything from product development to community involvement.

Respect is a foundational value at Credicorp, influencing interactions with employees, customers, and communities. This value translates into user-friendly services, an inclusive workplace, attentive customer service, and ethical business practices. This commitment fosters a positive environment both internally and externally, contributing to Credicorp's reputation.

Fairness ensures equitable treatment and opportunities for all stakeholders. This includes fair lending practices, transparent fee structures, and unbiased processes. Fairness builds trust and reinforces Credicorp's reputation, ensuring all customers receive equal consideration.

Honesty underscores transparency and integrity in all actions and communications, particularly vital in financial services. This value promotes open communication and accountability within the company, building long-term trust with customers through transparent dealings. It ensures Credicorp operates with integrity and adheres to all regulatory requirements.

Sustainability reflects Credicorp's commitment to long-term economic, social, and environmental well-being. This value influences product development, encouraging environmentally conscious practices and social responsibility initiatives. Credicorp considers the environmental and social impact of its operations and investments, promoting financial health and inclusion. According to recent reports, companies with strong sustainability practices often experience improved financial performance and enhanced brand reputation, aligning with Credicorp's long-term goals.

These four core values – Respect, Fairness, Honesty, and Sustainability – are fundamental to understanding the Credicorp Core Values and contribute to its unique corporate identity. These values shape Credicorp's Strategy and its approach to achieving its Credicorp Goals. To further understand how these values are put into practice, explore the Marketing Strategy of Credicorp. Next, delve into how Credicorp's Mission and Credicorp Vision influence the company's strategic decisions.

How Mission & Vision Influence Credicorp Business?

Credicorp's mission and vision are not just aspirational statements; they are the bedrock upon which the company builds its strategic decisions. These guiding principles shape how Credicorp allocates resources, develops new products, and engages with its stakeholders.

The Credicorp Mission, "Contribute to improving lives by driving the changes that our countries need," and its Credicorp Vision to be a "sustainable financial business leader in Latin America," directly influence the company's strategic priorities and Credicorp Strategy. This alignment ensures that every major decision, from product development to market expansion, is made with these core tenets in mind. The impact on society is a key focus.

- Financial Inclusion: Credicorp's commitment to financial inclusion is a direct result of its mission. This includes significant investments in microfinance through Mibanco and the development of the mobile payment platform, Yape.

- Digital Transformation and Innovation: The vision of being future-oriented and the mission's call to accelerate change drive Credicorp's robust innovation strategy and digital transformation efforts.

- Sustainability Integration: The commitment to being a sustainable financial business leader is reflected in Credicorp's environmental policy, responsible investment policies, and sustainable loan targets.

Credicorp's dedication to financial inclusion is a tangible demonstration of its mission. Through its microfinance operations, such as Mibanco, and the innovative Yape platform, Credicorp is actively working to bring financial services to underserved populations. Between 2020 and 2024, Credicorp financially included 5.7 million people in Peru through Yape and BCP, highlighting the company's commitment to its Credicorp Goals. This focus aligns with the company's broader strategy to expand its market reach and positively impact the communities it serves. Consider exploring the Target Market of Credicorp to understand the demographic impact.

Credicorp's vision of being a future-oriented leader is driving a significant digital transformation. This involves substantial investments in technology, data analytics, and innovative digital platforms. The company aims to generate 10% of risk-adjusted revenues from new business models by 2026, showcasing a clear link between its vision and strategic objectives. This proactive approach to innovation allows Credicorp to enhance efficiency, improve customer experience, and remain competitive in a rapidly evolving financial landscape. This is a key component of Credicorp’s business philosophy.

Sustainability is deeply integrated into Credicorp's operations, reflecting its vision of being a sustainable financial leader. This commitment is evident in its updated corporate environmental policy, responsible and sustainable investment policies, and ambitious targets for sustainable lending. BCP, for example, aims to disburse over US$1.5 billion in sustainable loans in 2024. These initiatives not only build long-term resilience but also appeal to environmentally and socially conscious investors and customers, demonstrating Credicorp's ethical standards.

CEO Gianfranco Ferrari has emphasized the company's robust performance and long-term growth strategy, linking it directly to innovation and disruption. His leadership underscores the importance of adapting to market changes and proactively shaping the future of financial services in the region. This strategic vision ensures that Credicorp remains at the forefront of the industry, constantly seeking new ways to improve and expand its services. This is a reflection of Credicorp's corporate governance.

Credicorp's definition of success extends beyond financial metrics, encompassing its impact on society. The company actively measures its contributions to financial inclusion, environmental sustainability, and community development. This holistic approach ensures that Credicorp's growth is aligned with its mission to improve lives and drive positive change. This commitment is a key part of Credicorp's key principles.

Credicorp's future outlook is closely tied to its ability to innovate and adapt to evolving market dynamics. The company's focus on digital transformation, sustainable practices, and customer-centric solutions positions it well for long-term growth. Credicorp's commitment to these areas will be crucial in shaping its future and maintaining its leadership position in Latin America. This is a reflection of Credicorp's future outlook.

Credicorp's mission, vision, and core values are not just words; they are the driving force behind its strategic decisions, shaping its approach to financial inclusion, digital transformation, and sustainability. These elements collectively define how Credicorp Company operates and how it intends to achieve its long-term goals. Now, let's delve into the upcoming chapter: Core Improvements to Company's Mission and Vision.

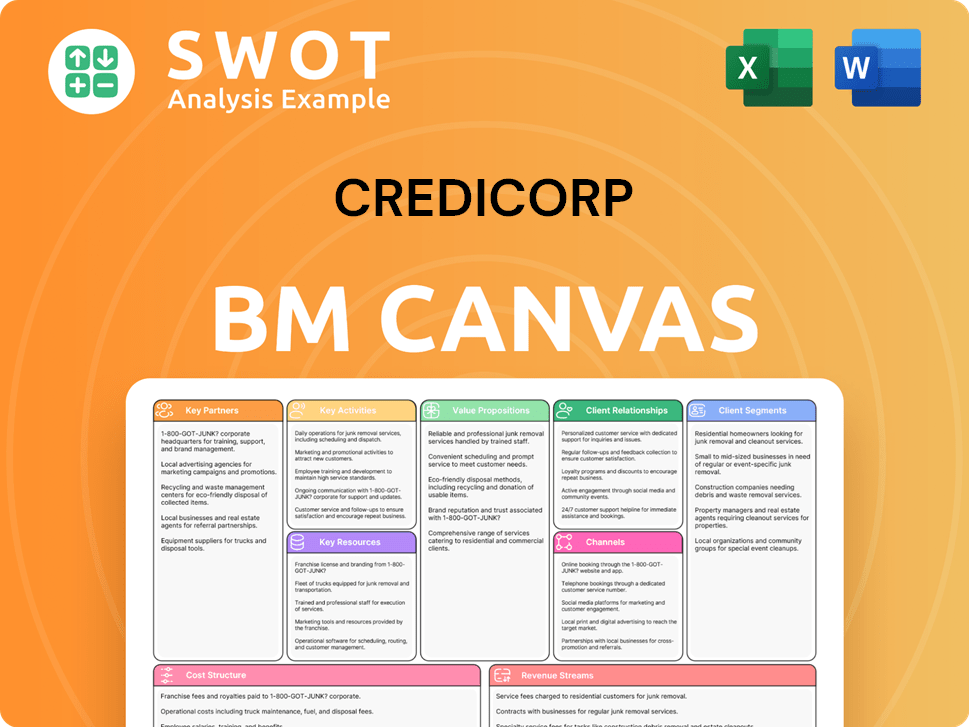

Credicorp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Credicorp's foundational statements provide a strong framework, there's always room for enhancement to ensure they remain impactful and relevant in today's dynamic environment. These improvements focus on strengthening Credicorp's commitment to social impact and environmental sustainability, aligning with evolving stakeholder expectations and industry best practices.

Strengthening the Credicorp Mission by incorporating quantifiable social impact goals can significantly enhance its effectiveness. For example, adding a target to reach a specific number of unbanked individuals or support a certain amount of small businesses would provide clearer direction and allow for measurable progress, aligning with the company's existing focus on financial inclusion. This would also demonstrate a tangible commitment to the Credicorp Goals of fostering economic development and social progress in the regions it serves.

Elevating the importance of environmental sustainability within the Credicorp Vision is crucial. Explicitly mentioning a commitment to addressing climate change or supporting the transition to a low-carbon economy would resonate with global trends and investor expectations, signaling a stronger commitment to environmental responsibility. This would further solidify Credicorp's Company position as a forward-thinking institution.

Increasing transparency in reporting on the Credicorp Core Values can build greater trust with stakeholders. This could involve publishing detailed reports on the company’s progress towards its social and environmental goals, including specific metrics and data. By providing clear and accessible information, Credicorp can demonstrate its commitment to accountability and build stronger relationships with investors and the community.

Integrating technology-driven solutions into the Credicorp Strategy for social impact can create further opportunities. This could involve investing in fintech platforms that promote financial inclusion or developing digital tools to support sustainable business practices. By embracing innovation, Credicorp can amplify its positive impact and remain at the forefront of the evolving financial landscape. To understand the origins of this company, you can read about the Brief History of Credicorp.

How Does Credicorp Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for achieving its strategic goals and fostering a strong organizational culture. This section examines how Credicorp Company translates its foundational principles into tangible actions and measurable outcomes.

Credicorp demonstrates its commitment to its mission and vision through various strategic initiatives and operational practices. These actions reflect its dedication to financial inclusion, sustainability, and long-term value creation. The company's approach is designed to ensure that its core values are not just aspirational statements but guiding principles for its daily operations.

- Yape's Success: The rapid expansion of Yape, Credicorp's mobile payment platform, exemplifies the Credicorp Mission of financial inclusion. Yape has successfully brought millions of previously unbanked Peruvians into the formal financial system. As of Q1 2024, Yape boasts over 15 million users, processing over $2 billion in monthly transactions, demonstrating its significant impact on financial inclusion.

- ESG Integration: Credicorp actively integrates Environmental, Social, and Governance (ESG) factors into its investment decisions and lending practices. This aligns with its vision of being a sustainable leader. In 2023, Credicorp allocated over $500 million in sustainable loans, supporting projects with positive environmental and social impacts.

- Sustainable Finance Growth: The company is actively increasing its sustainable finance portfolio. Credicorp aims to have 15% of its total loan portfolio in sustainable finance by the end of 2026.

Leadership plays a pivotal role in embedding the Credicorp Core Values and Credicorp Strategy throughout the organization. The actions and decisions of top executives directly influence the company's culture and strategic direction. Credicorp's leadership team actively promotes and reinforces its core principles through various initiatives.

The integration of the Sustainability Office under the Chief Strategy Officer in 2024 underscores Credicorp's commitment to sustainability at the highest level. This strategic alignment ensures that sustainability considerations are central to the company's long-term planning and decision-making processes. This move reflects the company's focus on its Mission, Vision & Core Values of Credicorp.

Executive compensation models at Credicorp include indicators linked to sustainability performance. This approach ensures that leadership incentives are aligned with the company's values and vision. A portion of executive bonuses is now tied to achieving specific ESG targets, further motivating leaders to prioritize sustainability initiatives.

Credicorp communicates its mission, vision, and values through various channels to ensure transparency and accountability. This includes its official website, investor presentations, and comprehensive sustainability reports. These channels provide stakeholders with clear insights into the company's strategic direction and its commitment to its core principles.

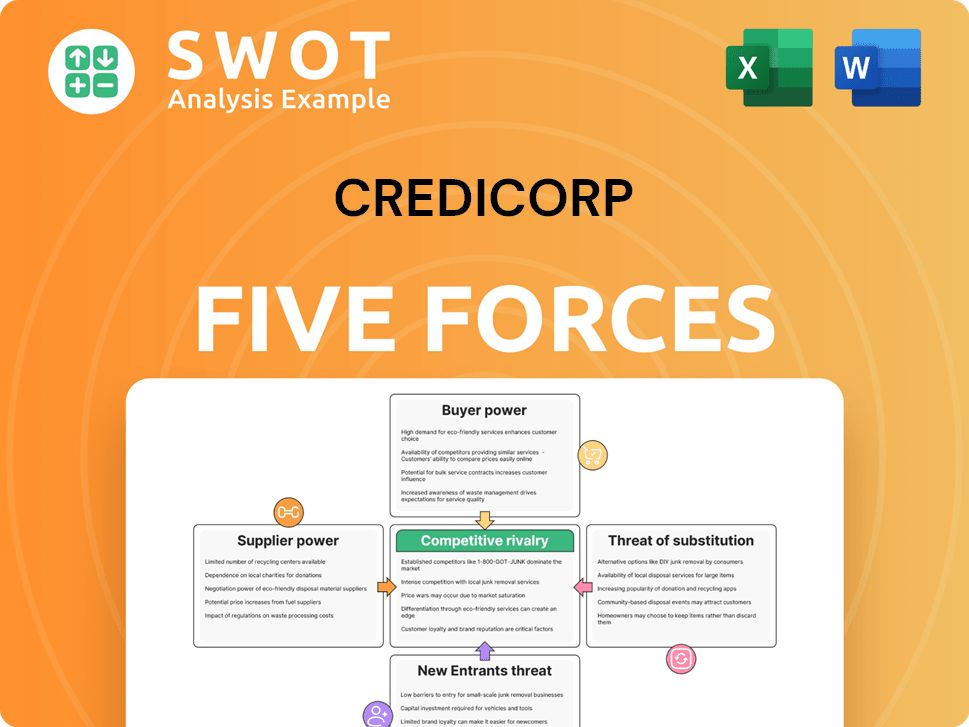

Credicorp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Credicorp Company?

- What is Competitive Landscape of Credicorp Company?

- What is Growth Strategy and Future Prospects of Credicorp Company?

- How Does Credicorp Company Work?

- What is Sales and Marketing Strategy of Credicorp Company?

- Who Owns Credicorp Company?

- What is Customer Demographics and Target Market of Credicorp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.