Icahn Enterprises Bundle

What Drives Icahn Enterprises? Unveiling Its Mission, Vision, and Values

Understanding a company's core principles is vital for any investor or strategist. This is especially true for a complex entity like Icahn Enterprises, a diversified holding company steered by the legendary Carl Icahn. Delving into its mission, vision, and core values provides critical insights into its strategic direction and operational philosophy.

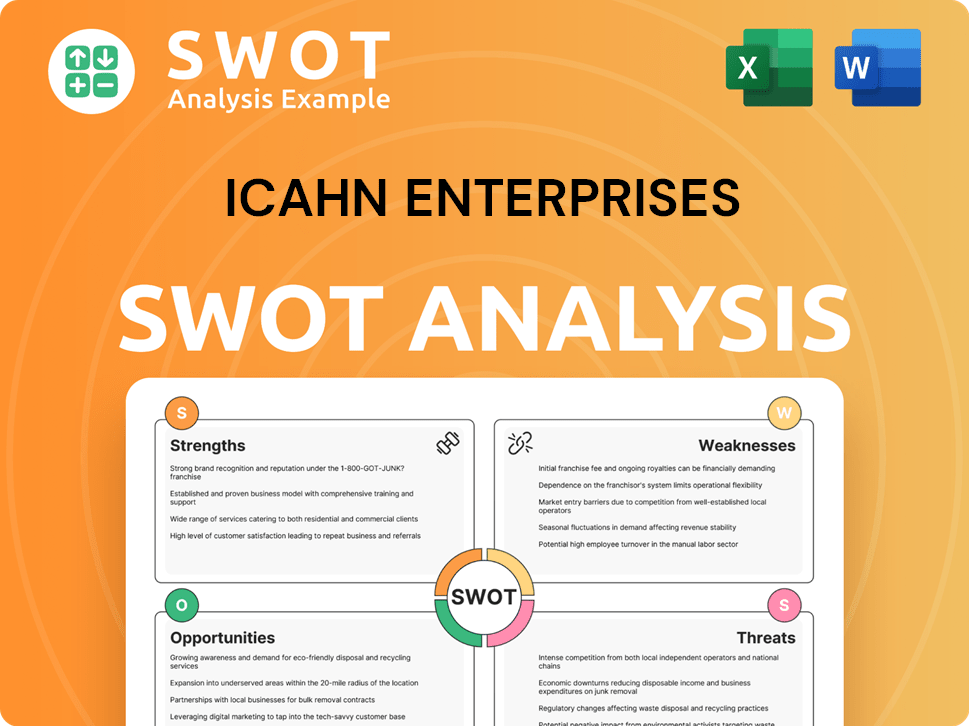

Icahn Enterprises' Icahn Enterprises SWOT Analysis provides a detailed look at the company's strengths, weaknesses, opportunities, and threats, further illuminating its strategic positioning. Examining the "Company Values" of Icahn Enterprises reveals the foundation of its investment strategy and corporate governance. This analysis offers a comprehensive understanding of Carl Icahn's business philosophy and the ethical guidelines that shape its actions, impacting its long-term goals and stakeholder relationships.

Key Takeaways

- Icahn Enterprises focuses on value creation via active ownership and long-term investments.

- Their strength lies in revitalizing underperforming businesses and exploiting market inefficiencies.

- Diversification and sector volatility pose challenges to their financial performance.

- Success hinges on continued adherence to value creation and strategic acumen.

- The core purpose is enhancing value through strategic intervention and capital allocation.

Mission: What is Icahn Enterprises Mission Statement?

Icahn Enterprises' mission is to create and maximize shareholder value through strategic investments, active ownership, and operational improvements within its portfolio companies, guided by a contrarian investment philosophy.

Delving into the core of Icahn Enterprises' operational strategy reveals a mission deeply rooted in value creation. While a formal, concise mission statement may not be readily available, the company's actions and the philosophy of its founder, Carl Icahn, provide a clear understanding of its objectives. This mission is not merely a statement but a driving force behind every strategic move.

Icahn Enterprises' mission is realized through active ownership. They don't just invest; they engage. This involves acquiring significant stakes in companies and actively participating in their strategic direction to drive performance improvements.

A key element of the mission is identifying undervalued assets. This involves a keen eye for companies trading below their intrinsic value, often due to market inefficiencies or operational issues. The goal is to capitalize on these opportunities.

Once a position is established, Icahn Enterprises actively works to improve the performance of its portfolio companies. This can involve advocating for changes in management, strategic shifts, or asset divestitures to unlock value.

The ultimate goal is value maximization for shareholders. Every action, from investment decisions to operational improvements, is geared towards increasing the value of the company and, consequently, the returns for its investors. This is a core tenet of their corporate philosophy.

Icahn Enterprises often employs a contrarian investment philosophy, going against the prevailing market sentiment. This approach allows them to identify opportunities that others may overlook, contributing to their ability to find undervalued assets.

A significant part of the mission involves focusing on operational improvements within acquired entities. This hands-on approach distinguishes Icahn Enterprises, as they actively work to enhance efficiency and profitability.

The mission of Icahn Enterprises is a dynamic one, constantly adapting to market conditions while remaining firmly rooted in its core principles. The company's commitment to its mission is evident in its actions. For example, the company's investment in Herbalife, and subsequent actions, demonstrate the commitment to this mission. Their investment strategy, as explored in Revenue Streams & Business Model of Icahn Enterprises, is a direct reflection of this mission. This commitment to value creation, active ownership, and operational improvements defines Icahn Enterprises' approach to business and investment.

Icahn Enterprises SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Icahn Enterprises Vision Statement?

While Icahn Enterprises L.P. doesn't have a formally stated vision statement, their actions suggest a vision: to generate substantial, long-term value through strategic investments and operational improvements across a diversified portfolio, aiming for significant returns even in volatile markets.

Delving into the implicit vision of Icahn Enterprises requires an understanding of its operational approach. This section analyzes the vision based on their investment strategies and market behavior.

The Icahn Enterprises vision is rooted in value creation. This involves identifying undervalued assets, implementing strategic changes, and ultimately, increasing shareholder value. This approach is a core element of their corporate philosophy.

The scope of their vision is broad, encompassing various industries. Their ambition is reflected in their willingness to take on complex and sometimes risky ventures. The long-term goals are clear: to achieve superior returns.

The realism of the vision is supported by Carl Icahn's track record. The aspirational aspect lies in the continuous pursuit of opportunities and the aim to generate strong returns. This is a key element of their investment strategy.

Recent financial results, such as the Q1 2025 net loss of $422 million, highlight the challenges. However, strategic moves, like the tender offer for CVR Energy shares, demonstrate their ongoing pursuit of value. This showcases their commitment to excellence.

Icahn Enterprises operates across multiple sectors, including Automotive, Energy, Food Packaging, and Real Estate. This diversification is a key component of their risk management strategy, allowing them to spread investments. Understanding the impact on the market is crucial.

The proposed tender offer for CVR Energy shares is a recent example of their strategic maneuvers. This demonstrates their commitment to identifying and capitalizing on opportunities. Their leadership principles are evident in these actions.

The Icahn Enterprises mission vision is further clarified by their actions. For instance, the acquisition and restructuring of companies like CVR Energy reflect a vision of long-term value creation. This involves not only improving the performance of existing holdings but also identifying and capitalizing on new investment opportunities. To understand the full scope of their operations, consider the Target Market of Icahn Enterprises.

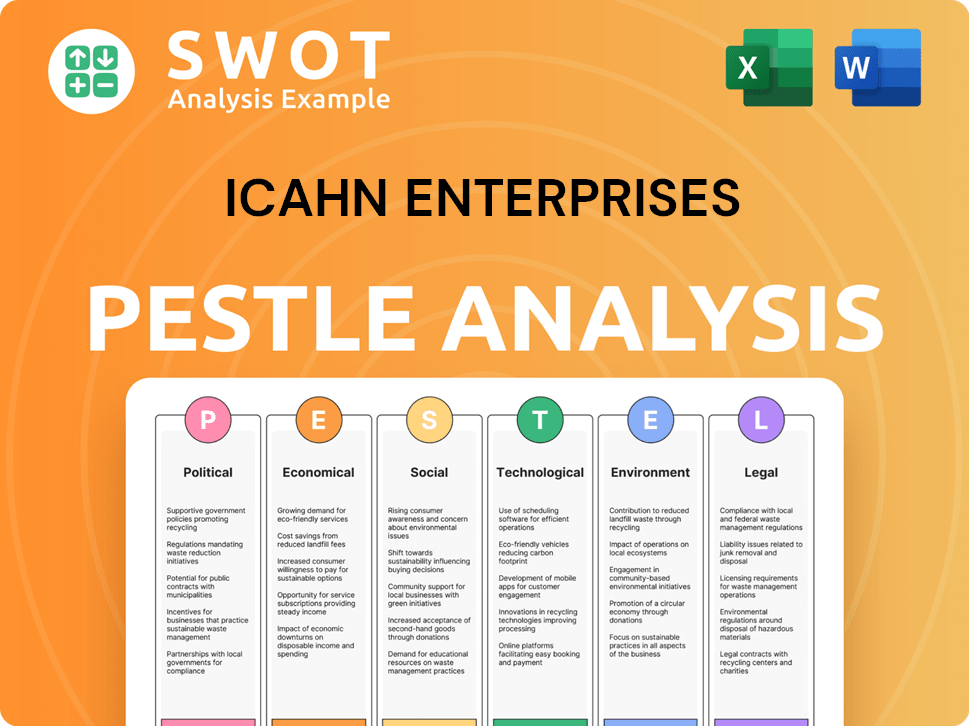

Icahn Enterprises PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Icahn Enterprises Core Values Statement?

While Icahn Enterprises L.P. doesn't explicitly publish a detailed list of core values, understanding the company's operational approach and Carl Icahn's public statements provides valuable insight into its underlying principles. These values shape the company's investment strategy and corporate philosophy.

Value creation is the cornerstone of Icahn Enterprises' strategy. The company actively seeks undervalued assets and implements strategies to enhance their worth, focusing on maximizing shareholder returns. This is evident in their rigorous due diligence and willingness to implement significant operational changes. For example, in 2023, Icahn Enterprises reported a net loss attributable to Icahn Enterprises of $1.1 billion, but the company continues to pursue value creation through strategic investments and activism.

Activism is a defining characteristic of Icahn Enterprises' approach, involving active engagement with the management and boards of companies they invest in. This often includes advocating for changes, challenging existing leadership, and pushing for strategies believed to enhance value. This active approach differentiates Icahn Enterprises from passive investors.

Strategic acumen is crucial for identifying opportunities, negotiating deals, and implementing effective strategies across diverse industries. This value is demonstrated through significant acquisitions, divestitures, and the ability to navigate challenging market conditions. The company's ability to adapt and execute strategic plans is a key driver of its performance.

Accountability, especially within corporate leadership, is a value emphasized by Carl Icahn. This suggests a commitment to strong governance and demanding performance from the leadership of their portfolio companies. This focus on accountability is a key element of their investment philosophy and corporate governance. The company's focus on accountability is also reflected in its detailed financial reporting and investor communications.

These core values, as inferred from the company's actions and statements, shape the unique identity of Icahn Enterprises, emphasizing active ownership and a strong focus on financial performance. Understanding these principles provides a deeper understanding of their investment strategy and corporate philosophy. To further understand the context of these values, explore the Brief History of Icahn Enterprises. Next, we will explore how the company's mission and vision influence its strategic decisions.

How Mission & Vision Influence Icahn Enterprises Business?

The mission and vision of Icahn Enterprises, though not explicitly detailed, profoundly shape its strategic decisions and operational approaches. This influence is most evident in its investment strategies and the pursuit of long-term value creation, guided by the principles of its founder, Carl Icahn.

Icahn Enterprises' investment strategy is deeply rooted in Carl Icahn's activist investment philosophy. This involves identifying undervalued companies, acquiring significant stakes, and advocating for changes to unlock value. The company's approach is characterized by a hands-on involvement in its portfolio companies, often leading to significant strategic and operational overhauls.

- Activist Investing: Icahn Enterprises actively seeks out companies where it believes it can influence strategic decisions to improve performance.

- Value Creation Focus: The primary goal is to enhance the value of its investments, whether through operational improvements, strategic shifts, or ultimately, divestitures.

- Sector Diversification: Investments span various sectors, allowing for diversification and the ability to capitalize on opportunities across different industries.

A prime example of Icahn Enterprises' influence is its majority ownership in CVR Energy. The recent tender offer to acquire additional shares demonstrates a continued belief in the energy asset's potential. This investment reflects a commitment to long-term value creation through strategic oversight and operational improvements within the energy sector.

Icahn Enterprises' history includes successful divestitures of businesses like Federal-Mogul, Tropicana, and American Railcar Industries. These actions showcase the company's strategy of identifying, enhancing, and realizing value through strategic exits. Such moves are integral to the mission of maximizing returns on investments.

The automotive segment's current challenges have prompted new initiatives and strategies, illustrating the company's adaptability. This proactive approach to industry-specific difficulties demonstrates the commitment to maintaining and improving the value of its investments. The company continuously evaluates and adjusts its strategies to navigate market dynamics effectively.

While specific metrics directly tied to the mission and vision are not always explicit, the company's financial performance is a key indicator of success. Revenue, net income, and changes in indicative net asset value reflect progress in creating value. These metrics provide insights into the effectiveness of the company's strategies and the realization of its goals.

Carl Icahn's quotes, such as "I like winning," highlight the drive for success that aligns with the value-creation mission. His business philosophy emphasizes a proactive, results-oriented approach that permeates the company's culture. This leadership style shapes both long-term planning and day-to-day operations across all segments.

Icahn Enterprises' actions and strategies also influence its relationships with stakeholders, including shareholders, employees, and the broader market. The company's commitment to creating value and its activist approach can affect investor confidence and market perceptions. Understanding these relationships is crucial for assessing the company's overall impact.

Icahn Enterprises' mission, vision, and core values are deeply intertwined with its investment strategy and corporate philosophy, driving its approach to value creation and market influence. To gain a broader perspective on the competitive landscape, consider exploring the Competitors Landscape of Icahn Enterprises. Next, we will examine Core Improvements to Company's Mission and Vision.

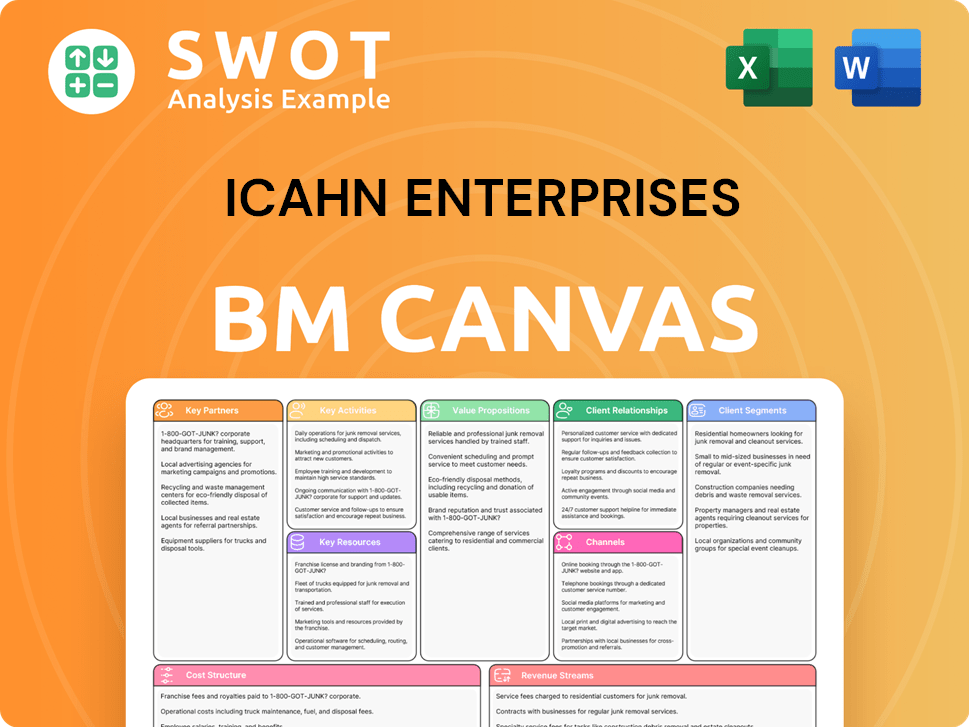

Icahn Enterprises Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Icahn Enterprises has a well-established investment approach, formally articulating and refining its mission and vision could enhance its alignment with contemporary market expectations and stakeholder priorities. These improvements offer opportunities to strengthen the company's long-term prospects and solidify its position in an evolving business landscape.

Integrating a commitment to sustainability into the Icahn Enterprises' vision is crucial, especially considering the increasing importance of environmental, social, and governance (ESG) factors in investment decisions. This would align with the growing trend where investors, representing a significant portion of the market, are increasingly prioritizing companies with strong ESG profiles. For instance, in 2024, ESG-focused assets under management are projected to reach $50 trillion globally, highlighting the financial significance of sustainability.

Defining a clear vision for technological innovation across its diverse segments is essential for Icahn Enterprises to remain competitive. By embracing technological advancements, the company can drive operational efficiencies, develop new products, and adapt to the rapid changes impacting all industries. For example, companies that prioritize digital transformation often experience a 20-30% increase in operational efficiency, demonstrating the potential impact of embracing innovation.

Adapting the mission and vision to address changing consumer behaviors and expectations regarding corporate responsibility and ethical practices is beneficial for long-term growth. This includes enhancing transparency, ethical guidelines, and stakeholder engagement. According to recent studies, companies with strong ethical practices often see a 10-15% improvement in customer loyalty and brand reputation, impacting the overall success of Owners & Shareholders of Icahn Enterprises.

Formally articulating and publicizing core values can help shape the company culture and guide decision-making processes. This can include emphasizing values such as integrity, excellence, and a commitment to long-term value creation. A clear articulation of core values can lead to improved employee engagement, with studies showing that companies with well-defined values often experience a 20-30% increase in employee satisfaction and productivity.

How Does Icahn Enterprises Implement Corporate Strategy?

The implementation of Icahn Enterprises' Mission Vision and Core Values is primarily demonstrated through its strategic actions and the active involvement of its leadership. This chapter explores how the company translates its stated principles into tangible business practices.

A cornerstone of Icahn Enterprises' implementation strategy is the direct involvement of its leadership, particularly Carl Icahn. His significant ownership stake and historical activism play a crucial role in shaping the company's strategic direction, reinforcing its commitment to value creation.

- Carl Icahn's influence is evident in the company's investment decisions and operational strategies.

- His history of advocating for change within portfolio companies aligns with the company's focus on maximizing shareholder value.

- The company's structure and governance facilitate this hands-on approach to management and investment.

Icahn Enterprises actively implements its strategy through operational improvements and restructuring initiatives within its acquired businesses. These efforts aim to enhance performance and profitability, which is a direct reflection of their Core Values.

These actions are taken to improve the overall financial health and long-term viability of the acquired companies. For example, in 2023, Icahn Enterprises reported a net loss attributable to Icahn Enterprises of $319 million, highlighting the need for strategic adjustments and operational enhancements across its diverse holdings. This is a clear demonstration of their Company Values.

While specific formal programs for reinforcing the Mission Vision aren't readily available, Icahn Enterprises uses investor relations materials and public announcements to communicate its strategic approach and priorities. This helps keep stakeholders informed about the company's progress.

These communications are crucial for maintaining transparency and building trust with investors and other stakeholders. The company's approach to stakeholder relationships is a key aspect of its overall strategy, as highlighted in the Marketing Strategy of Icahn Enterprises.

The alignment between Icahn Enterprises' stated approach to value creation and its actual business practices is evident in its history of strategic acquisitions, divestitures, and efforts to improve the performance of its diverse holdings. This consistency is key to their success.

The company's actions, such as restructuring underperforming businesses or making strategic investments, reflect its commitment to its stated goals. For instance, the decision to reduce the quarterly distribution, while potentially impacting unitholders, could be seen as a measure to preserve capital and align with a long-term value strategy during challenging periods. This demonstrates their commitment to Icahn Enterprises long-term goals.

The implementation of Icahn Enterprises' strategy has faced scrutiny, particularly regarding the recent reduction in the quarterly distribution. This decision, while potentially aligned with a long-term value strategy, has raised questions among unitholders and analysts.

These challenges highlight the complexities of implementing a value-driven strategy, especially during periods of market volatility. The company’s ability to navigate these challenges will be critical to its future success. The company's commitment to excellence is tested during these times.

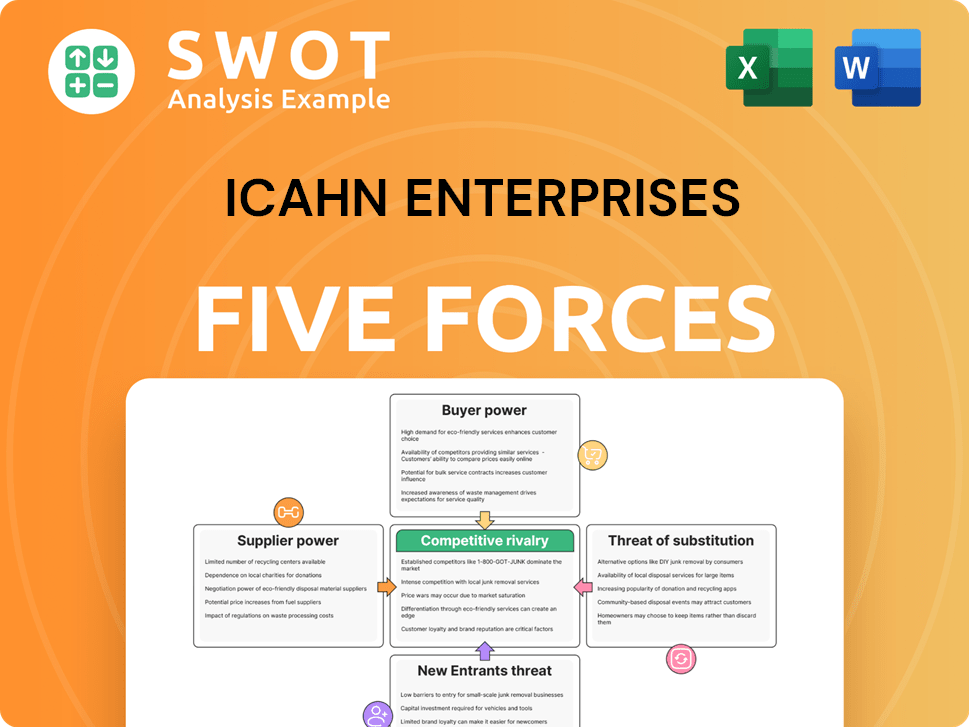

Icahn Enterprises Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Icahn Enterprises Company?

- What is Competitive Landscape of Icahn Enterprises Company?

- What is Growth Strategy and Future Prospects of Icahn Enterprises Company?

- How Does Icahn Enterprises Company Work?

- What is Sales and Marketing Strategy of Icahn Enterprises Company?

- Who Owns Icahn Enterprises Company?

- What is Customer Demographics and Target Market of Icahn Enterprises Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.