Petroplus Holdings AG Bundle

What Defined Petroplus Holdings AG's Strategic Compass?

Uncover the foundational principles that once guided Petroplus Holdings AG, a major player in Europe's oil refining sector. Explore the critical role of mission, vision, and core values in shaping a company's direction and influencing its strategic choices.

Even in liquidation, understanding the Petroplus Holdings AG SWOT Analysis, mission, vision, and core values offers crucial insights into its corporate strategy and business philosophy. These elements, if clearly defined, would have represented the company's organizational goals and ethical guidelines. Delving into these aspects provides valuable lessons about the impact of company values and the importance of a strong long-term vision.

Key Takeaways

- Petroplus's ambition to be Europe's largest independent oil refiner, though ultimately unsuccessful, demonstrates the power of a clear vision.

- The company's focus on reliable product delivery and market leadership shaped its operational focus and established its market presence.

- External market pressures and internal financial vulnerabilities underscored the need for adaptability and resilience.

- The energy sector must embrace sustainability, technological innovation, and diversification for future success.

- The industry must evolve beyond fuel production to become a driving force for sustainable energy solutions.

Mission: What is Petroplus Holdings AG Mission Statement?

Petroplus Holdings AG's inferred mission was 'to efficiently refine crude oil and reliably supply high-quality petroleum products to meet Europe's energy demands.'

Analyzing the mission of Petroplus Holdings AG provides valuable insights into its corporate strategy and operational focus. While a specific, officially stated mission statement isn't readily available, the company's actions and market position strongly suggest a core purpose centered on European energy supply. This mission shaped the company's strategic objectives and guided its day-to-day operations.

Petroplus primarily targeted distributors and end-users across Europe. Key markets included the United Kingdom, France, Switzerland, Germany, and the Benelux countries. These customers relied on Petroplus for a consistent supply of essential petroleum products.

The company's primary offerings were refined petroleum products. These included diesel, heating oil, gasoline, and aviation fuels. These products were derived from crude oil refining, a core aspect of Petroplus's business philosophy.

Petroplus operated primarily within the European market. It was the largest independent oil refiner and wholesaler in the region by capacity. This focus on Europe defined its strategic objectives and long-term vision.

Petroplus's value proposition rested on its extensive refining capacity, strategic distribution network, and reliable supply. This allowed it to meet the energy needs of a wide range of customers. The company's core value examples were reliability and efficiency.

The mission was reflected in the acquisition and operation of multiple refineries. Key facilities included the Coryton, Ingolstadt, and Cressier refineries. In 2011, these refineries had a combined throughput of approximately 667,000 barrels/day.

The mission was primarily customer-centric, prioritizing the fulfillment of Europe's energy needs. This focus on meeting market demand through reliable supply was central to Petroplus's business principles. Despite the company's liquidation, its focus on product supply continued.

The impact of Petroplus Holdings AG's values is evident in its operational choices. For instance, in 2011, the company refined approximately 14.5 million tons of crude oil. Even after its financial difficulties, the commitment to supplying gasoline components in 2024 demonstrates the lasting effects of its mission. Understanding the company's mission is critical for anyone analyzing its business principles and organizational goals.

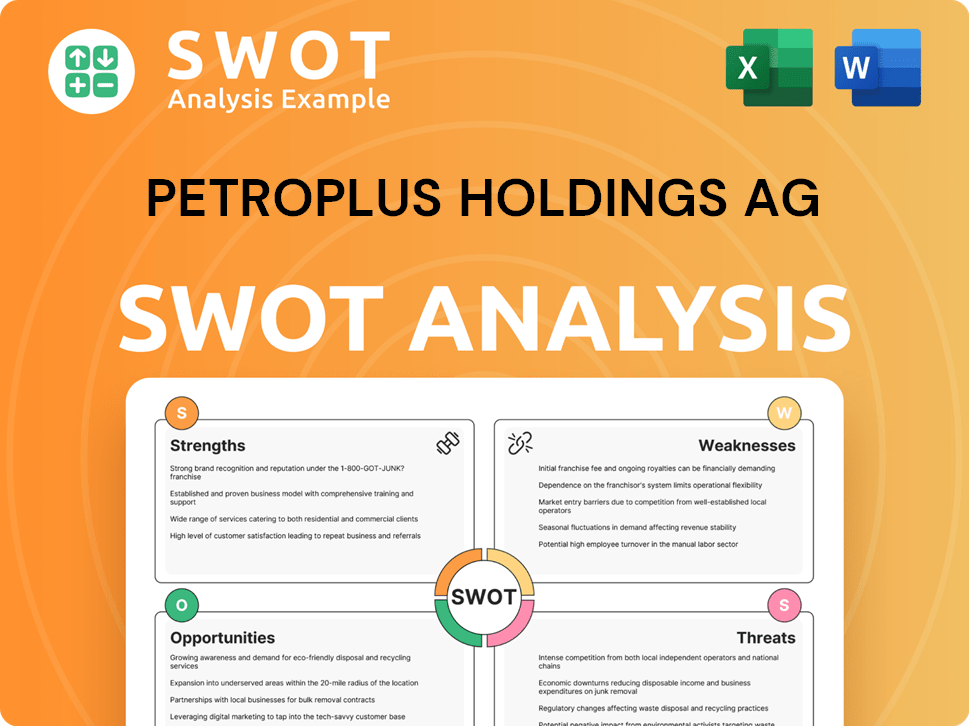

Petroplus Holdings AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Petroplus Holdings AG Vision Statement?

While a formal vision statement for Petroplus Holdings AG isn't readily available, a plausible vision statement reflecting the company’s ambitions could be: "To be the leading and most reliable independent energy provider in Europe, driving sustainable growth and innovation in petroleum refining."

Exploring the vision of Petroplus Holdings AG, even in the absence of an official statement, offers insights into its strategic aspirations. This inferred vision statement provides a framework for understanding the company's intended direction and the values it likely prioritized. Let's delve into the key aspects of this potential vision and its implications.

The ambition to be the "leading" independent energy provider in Europe clearly signals a desire for market dominance. This implies a focus on expanding market share, potentially through acquisitions and strategic partnerships. The scope is geographically focused on Europe, reflecting the company's operational footprint.

The emphasis on "driving sustainable growth and innovation" suggests a long-term perspective. This indicates a commitment to adapting to industry changes, possibly including investments in cleaner fuel production or more efficient refining processes. The term "innovation" hints at a forward-thinking approach.

This vision would have aimed for industry disruption by positioning Petroplus at the forefront of refining efficiency and potentially cleaner fuel production. The company aimed to challenge existing market dynamics through operational excellence and technological advancements.

Petroplus's aggressive growth strategy, marked by acquisitions like Coryton and Petit Couronne, initially supported the vision of market leadership. However, the pursuit of "sustainable growth" proved challenging, leading to insolvency in 2012. The vision was ambitious, but external factors and internal vulnerabilities ultimately undermined its achievability.

The European refining market faces ongoing challenges. Projected declines in refining capacity, with estimates of a 10% to 30% reduction over the next decade, highlight the sector's volatility. This environment underscores the difficulties Petroplus faced and the broader pressures on the industry. The Marketing Strategy of Petroplus Holdings AG provides further context on the company's approach.

The vision statement implies several strategic objectives, including expanding refining capacity, improving operational efficiency, and adapting to changing market demands. These objectives would have been crucial for achieving the company's long-term goals. Understanding these objectives helps clarify the company's business philosophy and the values that underpinned its operations.

Analyzing the Petroplus Holdings AG mission vision and core values through the lens of a potential vision statement offers valuable insights into the company's organizational goals and business principles. While the company's history presents challenges, the examination of its aspirational goals provides valuable lessons for understanding corporate strategy and the impact of company values in the volatile energy sector. The Petroplus Holdings AG company culture was likely shaped by its pursuit of market leadership and the challenges it faced in achieving sustainable growth. Understanding these aspects provides a more complete picture of Petroplus's strategic objectives and how it aimed to define its ethical guidelines.

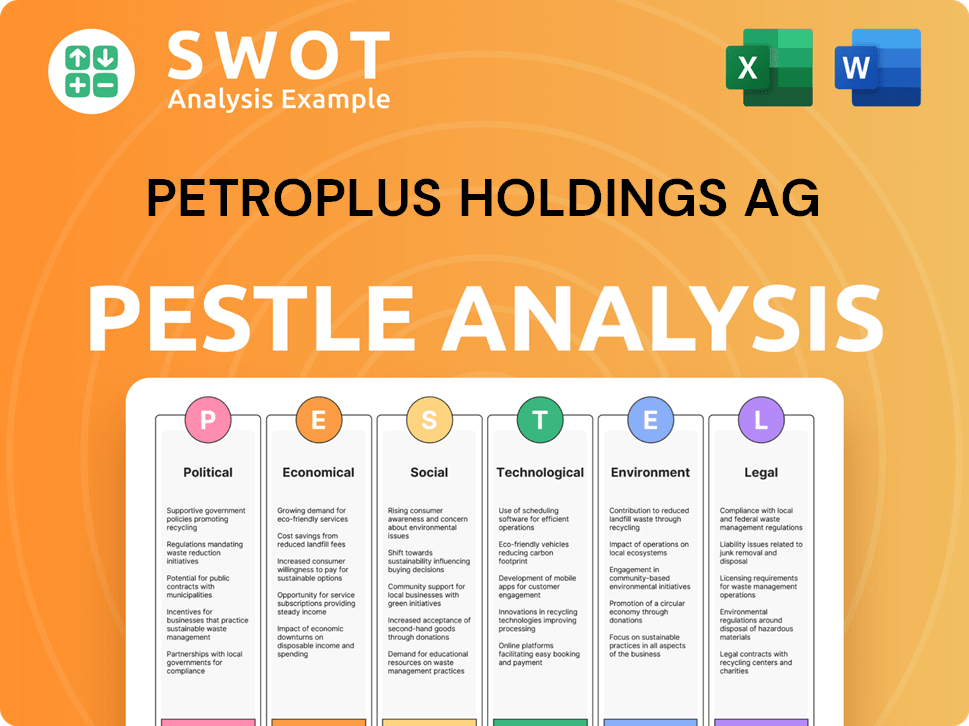

Petroplus Holdings AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Petroplus Holdings AG Core Values Statement?

While specific core values for Petroplus Holdings AG are not explicitly documented in readily available sources, we can infer a set of values based on industry best practices, the company's operational focus, and commitments made by related entities. These values would have likely guided the company's operations and interactions with stakeholders.

This value would have prioritized the well-being of employees, communities, and the environment. It would have manifested in rigorous safety protocols, adherence to environmental regulations, and investments in technologies to minimize the company's environmental footprint. This commitment is increasingly vital, as the energy sector faces growing pressure to reduce emissions; for example, the International Energy Agency (IEA) projects that global investment in clean energy will need to triple by 2030 to meet climate goals, reaching approximately $4.5 trillion annually. This would have been a key differentiator for Petroplus Holdings AG.

Operational excellence would have been crucial in the competitive refining industry, focusing on maximizing output, minimizing waste, and controlling costs. This value would have involved optimizing refining processes, producing high-quality fuels, and employing lean methodologies. In the refining industry, even small efficiency gains can translate into significant financial benefits; for example, a 1% improvement in energy efficiency across the sector could save billions of dollars annually.

Ensuring a consistent supply of petroleum products to distributors and end-customers would have been paramount. This value would have involved tailoring products to meet specific market demands and building strong, long-term client relationships based on trust and dependability. In the fuel market, reliability is a key driver of customer loyalty, with studies showing that consistent product quality and timely delivery significantly impact customer retention rates.

Integrity would have guided all business dealings, ensuring transparency, honesty, and adherence to legal and regulatory frameworks. This value would have fostered an environment of accountability and ethical decision-making, crucial for maintaining trust with stakeholders in a highly regulated industry. Ethical conduct is increasingly important, with consumers and investors demanding greater corporate social responsibility; for example, companies with strong ethical reputations often experience higher valuations and better access to capital. This would have been a cornerstone of Petroplus Holdings AG's business philosophy.

These core values, if formally adopted and consistently applied, would have shaped Petroplus Holdings AG's corporate culture and strategic direction. Understanding these potential values provides insight into the company's potential

How Mission & Vision Influence Petroplus Holdings AG Business?

Even without explicit documentation, the inferred mission and vision of Petroplus Holdings AG significantly shaped its strategic decisions. This influence is evident in the company's aggressive expansion and operational focus, driving its ambition to become a leading player in the European refining sector.

Petroplus Holdings AG's strategic decisions were deeply intertwined with its implied mission and vision. The company's pursuit of becoming Europe's largest independent crude oil refiner, a key organizational goal, directly fueled its ambitious acquisition strategy.

- Between 1997 and 2008, Petroplus acquired several refineries, including Coryton (UK), Ingolstadt (Germany), and Petit Couronne (France).

- By 2011, the company's refining capacity reached approximately 667,000 barrels/day across its European refineries.

- These acquisitions were a direct manifestation of its strategic intent to dominate the independent refining sector.

The company's focus on refining a diverse range of products, such as diesel, gasoline, and aviation fuels, and distributing them across major European markets demonstrates a strategic decision to cater to broad energy demands. This aligns with the inferred mission of reliably supplying high-quality petroleum products.

Petroplus's emphasis on unbranded bulk sales to distributors and end-customers further highlights a strategy centered on efficient volume distribution rather than brand-driven consumer marketing. This operational focus was crucial for achieving its goals.

The need for substantial working capital and credit facilities, essential for operating its assets and managing inventory, shaped Petroplus's financial strategy. This capital-intensive approach, while necessary, ultimately contributed to its financial vulnerabilities.

Faced with challenges like low refinery margins and overcapacity, Petroplus attempted to secure alternative financing and considered asset sales. These efforts, however, were ultimately unsuccessful, highlighting the impact of external factors.

During its operational period, Petroplus's significant refining capacity and its position as Europe's largest independent refiner served as key metrics of its success. These metrics reflected the company's strategic alignment with its inferred mission and vision.

The actions and strategic trajectory of Petroplus Holdings AG clearly indicate a strong alignment with the inferred principles of market leadership, operational efficiency, and reliable supply in the European refining sector. This alignment, although ultimately unsustainable, guided the company's operations.

In essence, the Mission, Vision & Core Values of Petroplus Holdings AG, even if not explicitly stated, were deeply embedded in its strategic decision-making process, influencing acquisitions, market focus, and financial strategies. Understanding this influence sets the stage for examining the core improvements to the company's mission and vision.

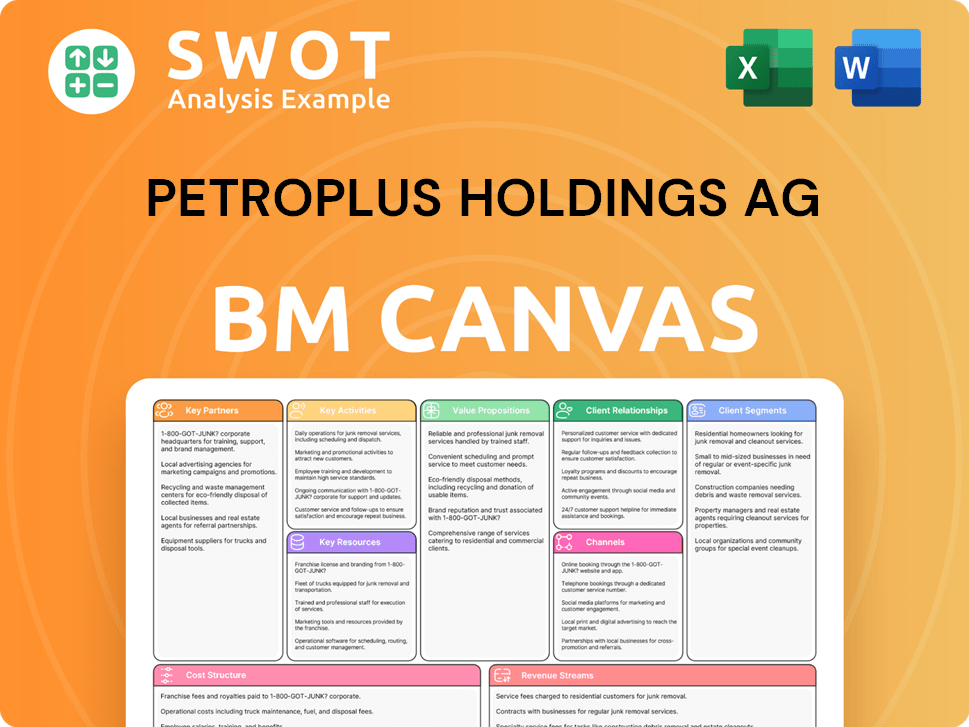

Petroplus Holdings AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

Analyzing the hypothetical mission and vision statements of Petroplus Holdings AG reveals opportunities for enhancement, particularly in light of evolving industry trends and market dynamics. These improvements focus on aligning the company's strategic objectives with the demands of a changing energy landscape and ensuring long-term sustainability.

The inferred mission and vision could have been strengthened by explicitly incorporating a commitment to sustainability and the energy transition. This would have positioned Petroplus Holdings AG as a forward-thinking entity, adapting to the growing demand for cleaner energy solutions and the increasing scrutiny of carbon emissions. The global shift towards sustainable aviation fuel (SAF), projected to grow significantly in the coming years, highlights the importance of such adaptations. This would have been a crucial part of their Company's Competitors Landscape.

A focus on innovation, particularly in refining technologies and product diversification, would have been beneficial. This could have included exploring opportunities in biofuels, hydrogen production, or carbon capture, aligning with the projected growth in light distillates (CAGR of over 1.8% through 2034). This would have allowed Petroplus to better address the changing market demands and potentially tap into new revenue streams.

Incorporating a broader view of societal impact and stakeholder engagement could have enhanced the company's mission and vision. This could have involved highlighting commitments to community development, ethical sourcing, and transparent operations. The emphasis on corporate social responsibility (CSR) is increasingly important for attracting investors and maintaining a positive public image.

The mission and vision could have been improved by building in greater adaptability to future market shifts. This includes acknowledging the potential decline in traditional fuel demand and the need to diversify into new product offerings. The European refining capacity is expected to shrink by 10% to 30% over the next decade, underlining the importance of such flexibility.

How Does Petroplus Holdings AG Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible actions and fostering a cohesive organizational culture. This section explores how Petroplus Holdings AG, despite its insolvency, would have likely implemented its implied mission and vision within its corporate strategy.

Leadership played a pivotal role in reinforcing Petroplus Holdings AG's (implied) mission and vision. Strategic decisions, such as the aggressive acquisition of refineries, were direct implementations of the company's strategic objectives.

- The acquisition of the Coryton Refinery in the UK (2007) and the Petit Couronne Refinery in France (2008) significantly expanded refining capacity, supporting the vision of being a major independent refiner. According to a 2008 report, these acquisitions increased Petroplus's total refining capacity by approximately 30%, demonstrating a clear commitment to growth.

- These actions communicated a commitment to market leadership to all stakeholders, including investors and employees.

- Leadership's commitment to these objectives would have been reflected in capital allocation decisions, operational strategies, and risk management practices.

Consistent messaging about Petroplus's role as a vital supplier of petroleum products across Europe would have been essential for communicating its mission and vision. This communication would have been crucial for solidifying the company's standing in the market and among its stakeholders.

The company's extensive distribution network in key markets like the UK, France, Germany, and Switzerland would have reinforced its mission and vision by ensuring product availability. Involvement in industry events would have served as a communication channel for its strategic direction.

Petroplus's operational performance, as reflected in its financial reports, would have served as a means of communicating its progress toward its mission and vision. The company's commitment to efficiency and reliability would have been demonstrated through its operational practices.

Engaging with stakeholders, including investors, employees, and customers, would have been vital for aligning their expectations with the company's strategic goals. Transparency in reporting and open communication channels would have been essential for maintaining trust and support.

Alignment between Petroplus Holdings AG's stated or implied Company Values and actual business practices would have been critical for building a strong corporate culture and achieving its organizational goals. This section examines how the company's values would have been reflected in its operations.

- The meticulous management of its complex logistics infrastructure, including pipelines, terminals, and storage tanks, would have been essential for ensuring the efficient handling and distribution of crude oil and refined products. This directly supports the company's business principles.

- The focus on refining a variety of products, such as diesel, heating oil, and aviation fuels, which served essential needs across Europe, would have demonstrated a commitment to reliability and customer satisfaction. The company's ability to meet diverse market demands would have been a key indicator of its operational success.

- In a large-scale industrial operation like oil refining, adherence to safety regulations and operational efficiency protocols would have been paramount, implicitly supporting the values of safety and operational excellence. According to industry reports, the oil and gas sector has an average of 2.5 incidents per million hours worked, highlighting the importance of safety protocols.

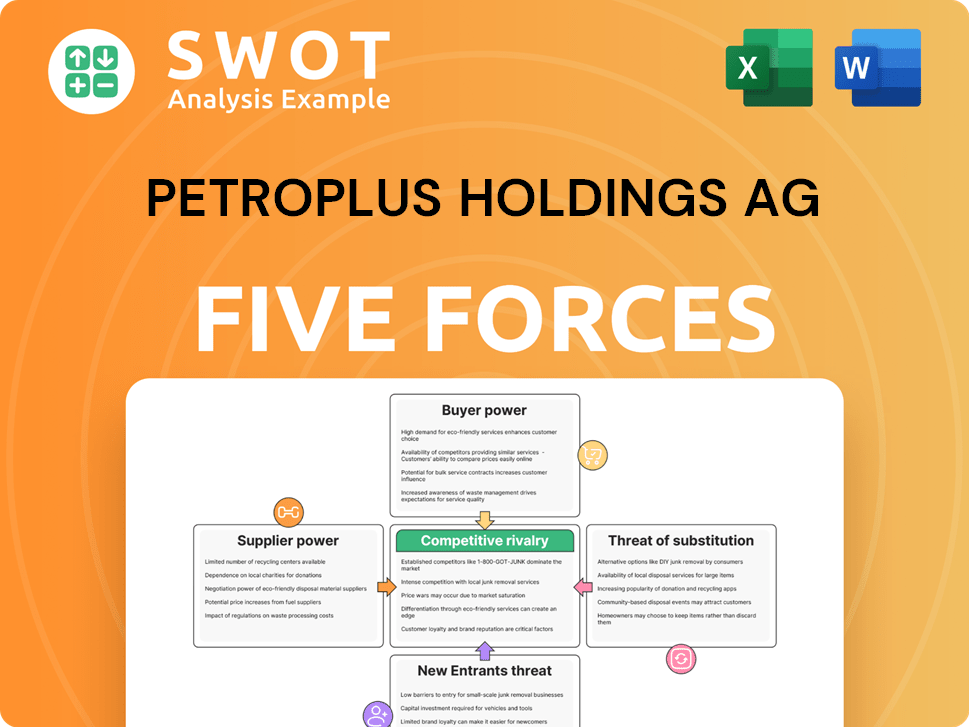

Petroplus Holdings AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petroplus Holdings AG Company?

- What is Competitive Landscape of Petroplus Holdings AG Company?

- What is Growth Strategy and Future Prospects of Petroplus Holdings AG Company?

- How Does Petroplus Holdings AG Company Work?

- What is Sales and Marketing Strategy of Petroplus Holdings AG Company?

- Who Owns Petroplus Holdings AG Company?

- What is Customer Demographics and Target Market of Petroplus Holdings AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.