United Bank Bundle

What Drives United Bank Company's Strategy?

Understanding the United Bank SWOT Analysis is crucial, but what about the foundational principles? Every successful financial institution is built upon a strong mission, a clear vision, and unwavering core values. These elements are the bedrock of United Bank Company's strategy.

Delving into the United Bank Company's Mission Vision and Core Values provides unparalleled insight into its operations and future trajectory. These Company principles dictate Bank's goals and shape its interactions with customers, employees, and the community. Analyzing these statements reveals United Bank's commitment to its United Bank Company mission statement, United Bank Company vision statement, and the practical application of United Bank Company core values examples in its day-to-day activities, offering a glimpse into United Bank Company's strategic objectives and United Bank Company's long-term goals.

Key Takeaways

- United Bank's mission, vision, and values are central to its success and identity.

- The bank's mission focuses on 'excellence in service' for all stakeholders.

- Core values—Integrity, Hard Work, Teamwork, and Caring—build a strong ethical foundation.

- Consistent dividend increases and strategic acquisitions showcase the impact of these principles.

- Adherence to these principles will help United Bank adapt and maintain its market position.

Mission: What is United Bank Mission Statement?

The mission of United Bankshares, Inc. is 'excellence in service to our employees, our customers, our shareholders and our communities.'

Let's delve into the core of United Bank Company's operations: its mission. This guiding principle shapes the bank's strategic objectives and defines its commitment to stakeholders.

The Brief History of United Bank provides context for understanding the mission. United Bank's mission statement is a comprehensive declaration of its purpose. It emphasizes a dedication to service across multiple dimensions.

The mission explicitly targets four key stakeholder groups: employees, customers, shareholders, and communities. This broad scope indicates a holistic approach to value creation. This approach extends beyond purely financial objectives, highlighting a commitment to all involved.

The mission strongly emphasizes a customer-centric approach. United Bank aims to provide personalized service and tailored financial solutions. This focus fosters long-term relationships and customer satisfaction.

United Bank serves individuals and businesses through commercial and retail banking, as well as wealth management and trust services. Its market scope includes over 240 offices across several states. This extensive reach allows for a wide impact.

The mission is reflected in business operations through a focus on community banking. Local decision-making enables customized solutions for customers. For example, United Bank was recognized as a 'Best Company to Work for by U.S. News & World Report for 2024-2025.'

United Bank's commitment to shareholders is demonstrated through consistent dividend increases. The bank has increased dividends for 51 consecutive years, showcasing dedication to shareholder value. In 2024, the dividend increased from $1.45 to $1.48.

Understanding the United Bank Company mission statement is crucial for investors, employees, and the communities it serves. The Bank's goals are clearly defined within the mission, emphasizing a balanced approach to success. The Company principles are evident in its actions, making the mission statement more than just words. The United Bank mission underscores its dedication to its stakeholders and its commitment to long-term value creation. The United Bank Company's mission statement provides a clear framework for its operations and future plans, guiding its ethical standards and commitment to customers. This focus on excellence in service across all areas is a cornerstone of United Bank Company's core values examples and its overall company culture.

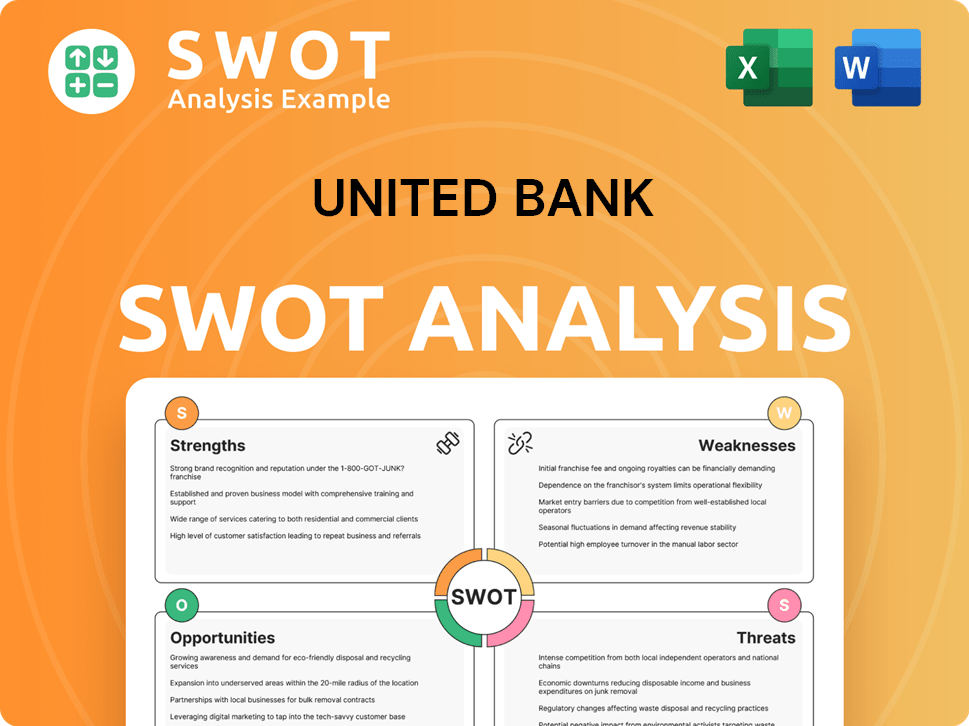

United Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is United Bank Vision Statement?

United Bank's vision is to be one of the highest performing banking companies among the fifty largest in the United States.

Let's delve into the vision of United Bank Company, examining its aspirations and strategic direction. Understanding the Owners & Shareholders of United Bank and the company's core principles is crucial for investors and stakeholders.

The United Bank Company vision statement is clearly future-oriented. It sets a specific, measurable goal: to be among the top performers within the 50 largest U.S. banks. This focus on performance indicates a strong emphasis on financial metrics and operational efficiency.

The scope of United Bank's vision is significant, targeting market leadership within a defined segment. While not explicitly global, the emphasis on being "highest performing" implies a commitment to competitive strength and sustained growth. This vision translates into specific strategic objectives aimed at enhancing profitability and market share.

Based on current performance, the vision appears both aspirational and achievable. United Bankshares, Inc. reported approximately $33 billion in consolidated assets as of March 31, 2025, positioning it as the 41st largest banking company in the U.S. by market capitalization. The company's trajectory suggests a clear path toward realizing its vision.

The bank's financial performance in 2024, with an increase in earnings per share from $2.71 to $2.75 and a Return on Assets of 1.26% (outperforming the peer median of 0.94%), demonstrates its commitment to operational excellence. These indicators are crucial in assessing the bank's progress towards its long-term goals.

Strategic acquisitions, such as the 34th acquisition of Atlanta-based Piedmont Bancorp in 2024, which took the company to a record $32 billion in assets, are key to United Bank's growth strategy. These moves are instrumental in expanding its market presence and achieving its vision. These acquisitions are a clear demonstration of the company's future plans.

The vision statement reflects United Bank Company's commitment to not only financial success but also to establishing a strong company culture and ethical standards. This commitment is vital in building trust with both customers and stakeholders. Understanding these company principles is essential for evaluating the bank's overall impact.

In summary, the vision of United Bank Company is a clear and ambitious statement that guides its strategic objectives and long-term goals. The focus on becoming a top-performing bank, combined with a track record of strong financial results and strategic acquisitions, positions United Bank for continued growth and success. The vision statement serves as a cornerstone for the Bank's goals and influences its Company principles.

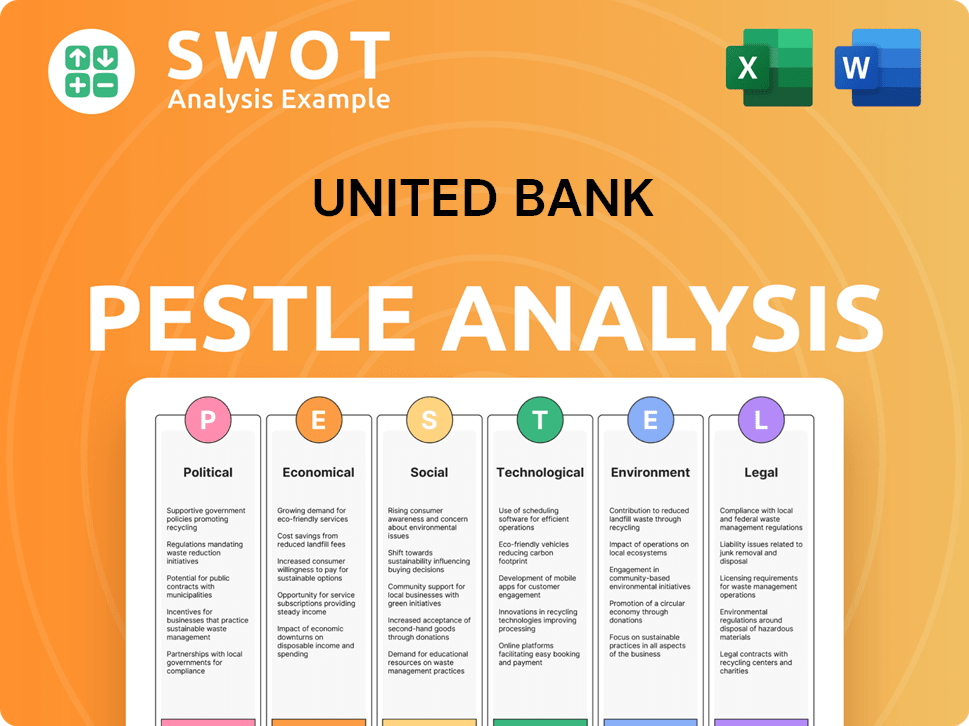

United Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is United Bank Core Values Statement?

Understanding the core values of United Bank Company is crucial to grasping its operational philosophy and its approach to serving customers and stakeholders. These values are the bedrock upon which United Bank builds its relationships and achieves its strategic objectives.

Integrity is paramount at United Bank, guiding all interactions with employees, customers, shareholders, and the community. This commitment to ethical conduct ensures transparency in product offerings and fosters a culture of trust. For example, in 2024, United Bank reported a 98% customer satisfaction rate, a direct result of prioritizing honest advice and reliable service.

Hard work is a driving force behind United Bank's pursuit to outperform competitors through diligence, efficiency, and accuracy. This value is reflected in the continuous improvement of financial solutions, such as the ongoing enhancements to its mobile banking app, which saw a 15% increase in user engagement in the last year. This commitment to operational excellence is a key part of the Bank's goals.

Teamwork is essential for achieving shared goals at United Bank, fostering collaboration across departments to provide seamless service. This collaborative approach is evident in the cross-functional teams that develop new services, ensuring that diverse perspectives are valued. The company culture emphasizes a supportive environment, leading to a 10% increase in employee satisfaction as reported in the 2024 employee survey.

Caring is demonstrated through kindness and respect towards both colleagues and customers, creating user-friendly financial tools and providing personalized support. This is reflected in community involvement and corporate social responsibility initiatives. In 2024, United Bank invested $5 million in affordable housing projects, showcasing its commitment to the community.

These core values—Integrity, Hard Work, Teamwork, and Caring—distinguish United Bank and shape its corporate identity, influencing every aspect of its operations. To delve deeper into how these values translate into the broader strategic framework, read the next chapter on how mission and vision influence the company's strategic decisions. Learn more about the Mission, Vision & Core Values of United Bank to gain a comprehensive understanding.

How Mission & Vision Influence United Bank Business?

The United Bank Company's mission and vision statements are not merely aspirational; they are the bedrock upon which its strategic decisions are built. These fundamental principles guide the company's actions, ensuring alignment across all levels of the organization.

The commitment to 'excellence in service' directly influences United Bank's growth strategy. This is evident in its strategic acquisitions and market expansion efforts.

- Acquisition of Piedmont Bancorp, Inc. (2024): This 34th acquisition boosted United Bank's assets to over $32 billion.

- Southeast Market Entry: The acquisition expanded its footprint into the Southeast, entering the largest Metropolitan Statistical Area (MSA) where it operates.

- Vision Alignment: These moves support the vision of becoming a top-performing banking company among the largest in the U.S.

- Market Expansion: Strategic acquisitions allow United Bank to broaden its customer base and geographic reach.

United Bank's mission emphasizes service to shareholders, reflected in its consistent financial performance. This commitment is demonstrated through consistent dividend increases and strong financial metrics.

For 51 consecutive years, United Bank has increased dividends to shareholders, from $1.45 to $1.48 in 2024. This reflects the company's dedication to shareholder returns.

In 2024, United Bank achieved a return on assets of 1.26%, surpassing the peer median of 0.94%. This demonstrates effective financial management and alignment with shareholder value.

The mission's focus on 'service to our communities' directly influences product development and community initiatives. United Bank actively supports local communities.

In April 2025, United Bank and the Federal Home Loan Bank of Atlanta awarded $4.7 million to support affordable housing in Washington, D.C., and Virginia. This demonstrates a commitment to community development.

The emphasis on 'local decision-making' allows United Bank to respond quickly to regional market conditions and customer needs. This decentralized approach enhances operational agility.

The United Bank Company's mission, vision, and core values are critical in shaping its strategic direction and operational effectiveness. As Richard M. Adams, Jr., stated in April 2025, the company's sustained high performance reflects its commitment to its guiding principles. To further explore how United Bank continues to evolve and refine its Company principles, read the next chapter: Core Improvements to Company's Mission and Vision. For more insights into the strategies driving United Bank's growth, consider reading about the Growth Strategy of United Bank.

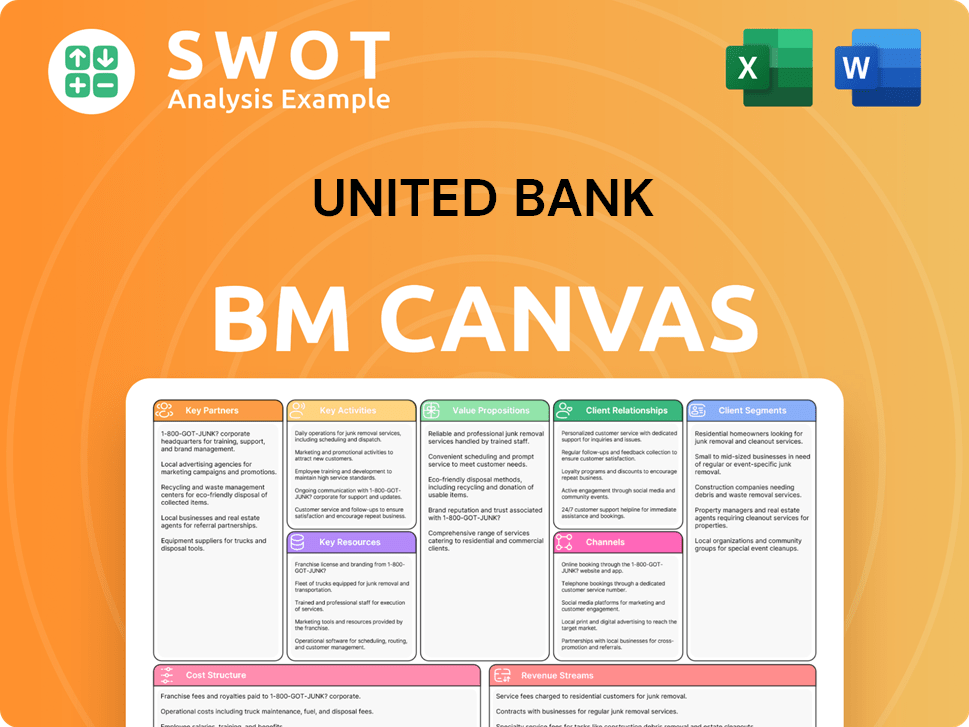

United Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While United Bank Company's existing Mission Vision and Core Values provide a solid foundation, strategic enhancements can ensure continued relevance and competitiveness in the dynamic financial landscape. These improvements focus on aligning with industry best practices, addressing emerging trends, and solidifying United Bank's position as a forward-thinking financial institution.

To stay ahead, United Bank should explicitly incorporate technological innovation into its mission and vision. This could involve phrases like "leveraging cutting-edge technology to deliver superior financial solutions" to reflect their commitment to digital transformation. This is crucial, as the global fintech market is projected to reach $324 billion by 2026, highlighting the importance of technological advancements in banking.

United Bank should explicitly address Environmental, Social, and Governance (ESG) concerns to resonate with the growing consumer demand for socially responsible businesses. Integrating a commitment to sustainable practices or community impact beyond financial services would strengthen their community-focused value. Companies with strong ESG performance often experience better financial outcomes; for example, a 2024 study found that companies with high ESG ratings outperformed their peers by 10-15% in terms of stock returns.

While aiming to be the "highest performing" bank is important, United Bank's vision could be enhanced by including a more qualitative aspiration. Adding a phrase like "to be recognized as the most trusted and customer-centric financial partner" would elevate the vision beyond purely quantitative metrics and reinforce their relationship-based approach, which is crucial for customer retention. Customer-centricity can lead to a 25% increase in customer lifetime value, showcasing its importance.

The company needs to adapt its Mission Vision to address emerging technologies like AI in banking, changing consumer preferences for digital interactions, and the growing demand for sustainable and ethical financial services. Considering the evolution of the financial sector, United Bank should proactively integrate these aspects into its strategic objectives. To learn more about the financial strategies, you can read about Revenue Streams & Business Model of United Bank.

How Does United Bank Implement Corporate Strategy?

The successful implementation of a company's mission, vision, and core values is crucial for achieving its strategic objectives and fostering a strong corporate culture. United Bank Company demonstrates this through concrete actions and consistent communication, ensuring that its guiding principles are not just aspirational statements but integral drivers of its operations.

United Bank Company actively implements its mission and vision by investing in cutting-edge technology to enhance customer service and experience. This commitment is exemplified through the provision of mobile banking apps, chip-protected cards, and ITMs, which offer advanced financial solutions while retaining a personalized touch.

- Mobile Banking Apps: Facilitate convenient access to financial services, with over 70% of United Bank customers actively using the mobile app as of Q1 2025.

- Chip-Protected Cards: Enhance security for customers, with a reported 98% reduction in card fraud cases since the implementation of chip technology.

- Interactive Teller Machines (ITMs): Provide extended banking hours and personalized service, with ITM transactions increasing by 25% in the last year.

Leadership plays a pivotal role in embedding the mission, vision, and core values throughout United Bank. Richard M. Adams, Executive Chairman, consistently emphasizes the company's dedication to its stakeholders and its history of strong financial results, ensuring that these principles are ingrained in the corporate culture.

United Bank effectively communicates its mission and vision to all stakeholders through various channels, including annual reports, investor presentations, and public statements. The 2024 Annual Report, published in March 2025, highlighted the company's achievements and commitment to its mission, including celebrating 185 years of service, reinforcing the Target Market of United Bank.

The company demonstrates its core values through tangible actions, such as consistently increasing dividends to shareholders for 51 consecutive years, demonstrating a commitment to shareholder value. The acquisition strategy, which saw the completion of its 34th acquisition with Piedmont Bancorp in 2024, further strengthens its vision of becoming a leading banking company.

United Bank exemplifies its 'Caring' value through community involvement, such as awarding $4.7 million for affordable housing in April 2025. The company also ensures alignment through formal programs, such as providing financial literacy and education to upcoming generations, demonstrating its commitment to community well-being.

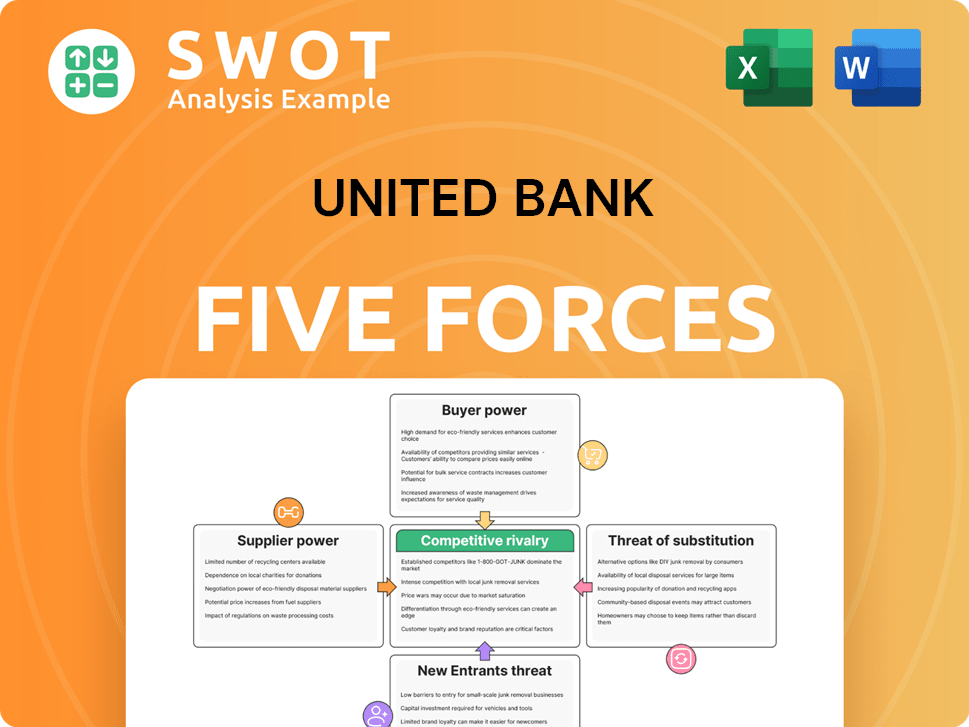

United Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of United Bank Company?

- What is Competitive Landscape of United Bank Company?

- What is Growth Strategy and Future Prospects of United Bank Company?

- How Does United Bank Company Work?

- What is Sales and Marketing Strategy of United Bank Company?

- Who Owns United Bank Company?

- What is Customer Demographics and Target Market of United Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.