UMB Financial Bundle

What Drives UMB Financial's Success?

Understanding a company's core principles is crucial for any investor or strategist. Delving into the UMB Financial SWOT Analysis is a great way to start. This analysis provides a unique perspective on the company's strategic direction.

This exploration of UMB Financial's mission, vision, and core values is essential for grasping its corporate culture and long-term strategy. Discover how UMB Financial's commitment to its UMB Company Values shapes its interactions with stakeholders and influences its business practices. Learn how UMB Financial's core values examples guide its decisions and contribute to its success in the financial services sector, especially in light of its recent acquisition and expansion.

Key Takeaways

- UMB's core values of integrity, customer focus, and community involvement are central to its success.

- The Heartland Financial acquisition in early 2025 highlights UMB's growth-oriented vision.

- A strong mission, vision, and values are essential for building trust and long-term success in finance.

- UMB's commitment to its guiding principles positions it well for future growth and market leadership.

Mission: What is UMB Financial Mission Statement?

UMB Financial's mission is 'to know our customers and anticipate their needs; advocate and advise; innovate and surprise.'

Let's delve into the core of UMB Financial's operational philosophy: its mission. This statement acts as the North Star, guiding the company's actions and interactions with its stakeholders. Understanding this mission is crucial for anyone seeking to understand UMB's strategic direction and its approach to the financial services industry.

At the heart of the UMB Financial Mission lies a commitment to trust and integrity. This isn't just a buzzword; it's a deeply ingrained principle. UMB understands that trust is the cornerstone of any successful financial relationship, especially in a landscape where Growth Strategy of UMB Financial is essential.

The UMB Financial Mission places a strong emphasis on knowing and anticipating customer needs. This customer-centric approach is reflected in their service delivery. They strive to understand each client's unique financial situation to provide tailored solutions.

UMB Financial's mission includes a commitment to advocacy and advice. They position themselves as trusted advisors, guiding clients through complex financial decisions. This proactive approach helps clients make informed choices.

Innovation and the desire to surprise customers are integral parts of the UMB Financial Mission. They continuously seek new ways to improve their services and exceed customer expectations. This forward-thinking approach is key to long-term success.

UMB Financial serves commercial, retail, and institutional clients. Their services span banking, asset management, and wealth management. This diverse range allows them to cater to a broad spectrum of financial needs.

Their primary market is the Midwest and Southwest, with national and international reach for business and institutional clients. Their value proposition lies in a long-standing tradition of integrity and a deep understanding of customer needs. This focus helps them stand out in a competitive market.

The UMB Financial Mission is not just a statement; it's a reflection of their corporate culture and strategic direction. The company's commitment to its mission is evident in its actions, fostering long-term client relationships and delivering comprehensive financial solutions. For example, UMB's associate average tenure is over eight years, and a significant portion of their client base has been with them for over a decade, demonstrating the success of their mission-driven approach. The company's dedication to its mission is further reflected in its financial performance and its ongoing efforts to adapt and innovate in the ever-changing financial landscape. Understanding the UMB Financial Mission is essential for grasping the company's core values and its long-term vision.

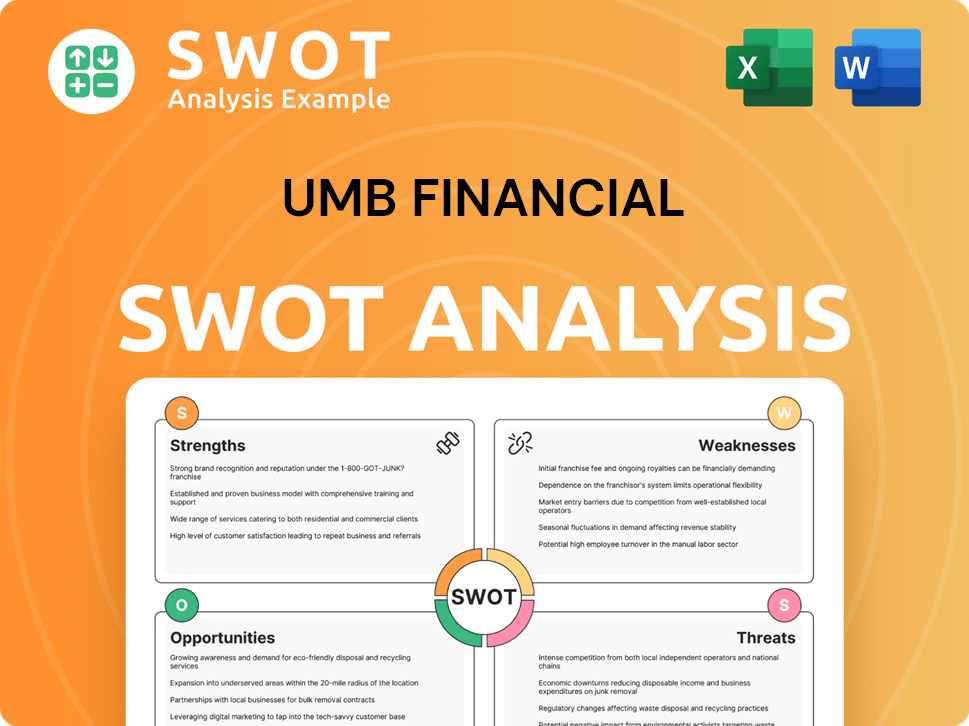

UMB Financial SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is UMB Financial Vision Statement?

While a formal, concise vision statement isn't readily available, UMB Financial's vision appears to be: "To be a leading regional financial services provider, recognized for its commitment to clients, employees, and communities, while driving sustainable growth and shareholder value."

Delving into the UMB Financial Vision, we can ascertain the company's future aspirations based on its strategic actions and stated objectives. The most significant indicator of their vision is the recent acquisition of Heartland Financial, which closed in January 2025. This pivotal move provides substantial insights into UMB Financial's long-term goals.

The Heartland Financial acquisition is a clear signal of UMB's ambition to become a leading regional banking entity. This expansion strategy is focused on increasing its footprint across a 13-state network, aiming for greater market penetration and influence. This aligns with their broader UMB Financial Strategy of achieving sustained growth.

The acquisition significantly boosts UMB's assets and nearly doubles its retail deposit base. This increase in scale is designed to enhance their capabilities in private wealth management and commercial banking services. This expansion allows UMB to offer a wider array of financial products and services to a larger customer base.

The UMB Financial Vision includes a focus on sustained growth and shareholder value. By strategically expanding its geographic presence and service offerings, UMB aims to improve its financial performance. This includes increasing revenue, profitability, and overall market capitalization.

A key component of the UMB Financial Vision is a commitment to its clients. This involves providing excellent customer service, building strong relationships, and offering tailored financial solutions. This customer-centric approach is central to their long-term success.

UMB Financial's vision extends to serving the communities in which it operates. This commitment involves supporting local initiatives, promoting economic development, and contributing to the well-being of the communities they serve. This is a crucial aspect of their UMB Company Values.

The vision of UMB Financial is both realistic and aspirational. It builds upon the company's existing strengths and market position, leveraging its established reputation and financial stability. This approach enables UMB to pursue significant growth while maintaining a strong foundation. For more information about the company's financial standing, see Owners & Shareholders of UMB Financial.

In summary, the UMB Financial Vision is centered around strategic expansion, enhanced capabilities, sustainable growth, and a strong commitment to its customers, employees, and communities. This vision is designed to position UMB as a leading regional financial services provider, driving long-term value for its shareholders and stakeholders. Understanding What is UMB Financial's mission statement and its core values is crucial to grasping the company's overall strategy and future direction.

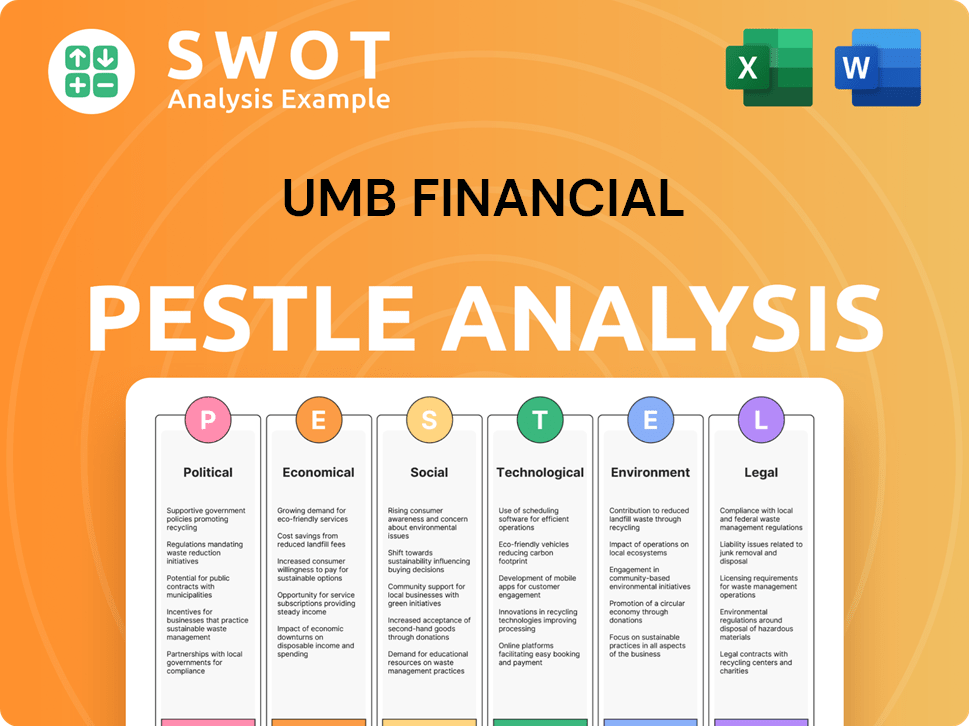

UMB Financial PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is UMB Financial Core Values Statement?

Understanding the core values of UMB Financial Corporation is crucial to grasping its operational philosophy and its approach to building lasting relationships. These values, which are integral to the UMB Financial Mission, Vision, and Core Values, guide the company's actions and shape its corporate culture.

Integrity is a foundational UMB Company Value, reflecting the company's commitment to ethical conduct and transparency. This commitment is evident in their prudent business practices and governance, fostering strong, long-term relationships with customers. UMB's focus on integrity helps build confidence in its financial stewardship, a key differentiator in the industry.

Trust is a cornerstone of UMB's relationships, closely linked to integrity and built through consistent service and open communication. UMB fosters a welcoming and enriching company culture where associates feel supported. This emphasis on trust differentiates UMB in the financial sector, where clients seek a reliable partner for their financial well-being, as highlighted in Competitors Landscape of UMB Financial.

Strength reflects UMB's financial stability and resilience, demonstrated by its ability to navigate economic fluctuations for over a century. This is evident in their strong financial performance, including a net income of $441.2 million for 2024 and robust credit quality metrics, with net charge-offs of 0.10% of average loans. This strength provides customers with confidence in UMB's ability to safeguard their assets.

UMB demonstrates commitment to its customers, communities, and associates through actions like exceeding customer expectations and significant community involvement. In 2024, UMB Financial Corporation and its Charitable Foundation provided over $5.8 million in total giving to non-profits. This commitment fosters loyalty and reinforces their role as a responsible corporate citizen, directly influencing UMB Financial's core values examples.

These core values are the bedrock of UMB's corporate identity, shaping its UMB Financial Strategy and influencing every aspect of its operations. Next, we will explore how the UMB Financial Mission and Vision influence the company's strategic decisions and overall direction.

How Mission & Vision Influence UMB Financial Business?

The mission, vision, and core values of UMB Financial significantly shape its strategic decisions and operational practices. These guiding principles influence everything from customer interactions to long-term growth initiatives, creating a cohesive and focused corporate strategy.

UMB Financial's mission, "to know our customers and anticipate their needs; advocate and advise; innovate and surprise," directly fuels its customer-centric approach. This focus is evident in the company's emphasis on building lasting relationships and providing tailored financial solutions. This mission-driven strategy contributes to a high average associate tenure and enduring client relationships.

- Emphasis on understanding and anticipating customer needs.

- Provision of tailored financial solutions.

- Building strong, long-term client relationships.

- High average associate tenure, reflecting a stable and experienced workforce.

The vision of expanding market presence and becoming a leading regional bank is a driving force behind UMB Financial's strategic moves. The acquisition of Heartland Financial, finalized in January 2025, exemplifies this vision.

This acquisition significantly increased UMB's asset base and geographic footprint, aligning perfectly with its growth ambitions. The integration is expected to provide accretion benefits, further demonstrating the strategic alignment with growth objectives. This expansion is a clear indicator of how UMB Financial's vision translates into concrete actions.

UMB Financial's core values, including integrity and commitment, guide its daily operations and interactions with stakeholders. This is reflected in the company's strong community involvement and significant donations to non-profits. UMB Company Values also emphasize diversity and inclusion, shaping internal practices and contributing to a more representative workforce.

The impact of UMB Financial's mission, vision, and values is evident in its financial performance. In the first quarter of 2025, average loans increased by 27.8% and average deposits increased by 32.3% on a linked-quarter basis, partly due to the HTLF acquisition, but legacy UMB also saw increases. Full-year 2024 net income was $441.2 million, demonstrating strong financial health.

Mariner Kemper, UMB Financial Corporation's chairman and chief executive officer, highlights the importance of the company's operating fundamentals. Kemper emphasizes these fundamentals as the core of their investment thesis for shareholders, pointing to a successful 2024 driven by strong growth in fee income businesses. He also expressed excitement about the Heartland Financial merger and its integration.

The alignment between UMB Financial's mission, vision, and core values creates a cohesive strategy, driving both short-term performance and long-term growth. This integrated approach ensures that every aspect of the business, from customer service to strategic acquisitions, is guided by a shared set of principles.

The influence of UMB Financial's UMB Financial Mission, vision, and core values is undeniable, shaping its strategy and driving its success. These principles provide a framework for decision-making, fostering a customer-centric approach, and guiding the company toward its growth objectives. Read on to discover the Core Improvements to Company's Mission and Vision.

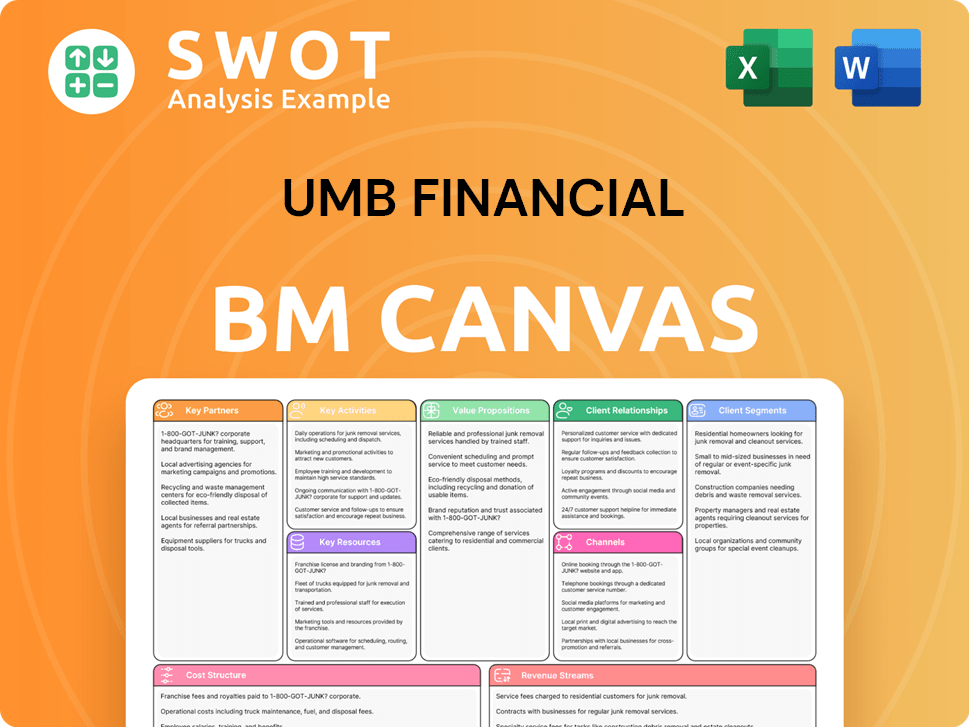

UMB Financial Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While UMB Financial's current statements provide a solid foundation, strategic refinements can enhance their impact and relevance in today's dynamic financial landscape. These improvements aim to strengthen UMB's position, attract key stakeholders, and drive sustainable growth.

UMB Financial's current vision could be strengthened by explicitly stating its long-term aspirations for market position and innovation. This would provide a clearer roadmap for the future, helping to guide strategic decisions and communicate UMB Financial's vision and goals to both internal and external stakeholders. For example, a vision statement could articulate a goal to be a top-tier financial institution in a specific market segment within a defined timeframe, fostering a more focused UMB Financial Strategy.

To reflect the increasing importance of digital transformation, UMB Financial should incorporate a more explicit mention of technological innovation within its mission or vision. Highlighting the role of technology in achieving its goals, such as "innovate and surprise," would resonate with tech-savvy customers and talent, and it would also reflect the importance of UMB Financial's mission. This could involve a commitment to developing cutting-edge digital solutions and leveraging emerging technologies like AI and blockchain to enhance customer experiences and operational efficiency. For instance, the global fintech market is projected to reach $698.4 billion by 2028, according to a report by Grand View Research, highlighting the urgency of digital transformation in the financial sector.

UMB Financial can strengthen its brand image and attract environmentally conscious stakeholders by overtly integrating sustainability and environmental considerations into its core statements. While UMB Financial's Corporate Citizenship and ESG Report details its efforts, explicitly referencing this commitment in its mission or vision would enhance its appeal to investors and customers who prioritize ESG factors. This could involve a commitment to sustainable practices, such as reducing carbon emissions, investing in renewable energy, and promoting responsible lending, which is increasingly important to younger generations and the overall UMB Corporate Culture.

To ensure that the UMB Financial Core Values are not just words but are actively demonstrated, UMB Financial should provide more examples of How UMB Financial integrates its values into its business. Highlighting specific initiatives and programs that exemplify these values will strengthen the connection between the company's stated principles and its actions. This could include employee recognition programs, community outreach efforts, and transparent reporting on ethical business practices. For instance, in 2023, companies with strong ESG performance saw a 10% higher return on equity compared to those with weaker ESG scores, which emphasizes the importance of UMB Financial's commitment to its core values.

How Does UMB Financial Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible actions and outcomes. UMB Financial demonstrates this commitment through various initiatives and practices that reinforce its foundational principles.

Leadership plays a pivotal role in embedding the UMB Financial Mission, vision, and core values throughout the organization. Mariner Kemper, Chairman and CEO, consistently emphasizes the importance of these principles in public statements and internal communications.

- This top-down approach ensures that the values are not just words on paper but are actively lived and practiced by all employees.

- Regular communication and reinforcement from the leadership team help to create a strong UMB Corporate Culture aligned with the company's strategic goals.

- Leadership's commitment fosters a sense of purpose and shared identity among employees, which is crucial for achieving long-term success.

UMB Financial's strategic initiatives directly support its UMB Financial Vision and mission. These initiatives are designed to expand the company's footprint and enhance its service offerings.

The strategic acquisition of Heartland Financial is a prime example of UMB Financial's commitment to its vision of becoming a leading regional bank. This acquisition allows UMB Financial to expand its geographical presence and customer base.

Ongoing investment in technology and digital resources reflects UMB Financial's mission to innovate and anticipate customer needs. This includes enhancing online banking platforms, mobile apps, and other digital tools.

UMB Financial communicates its UMB Company Values to stakeholders through its corporate culture, community involvement, and public reporting. The 2024 Corporate Citizenship and ESG Report details the company's efforts related to employer standards, community connections, environmental policies, and governance.

UMB Financial's commitment to its core values is evident in its community support initiatives and employee programs. These initiatives demonstrate how the company translates its values into action.

- Community Support: In 2024, UMB Financial provided $5.5 million in grants and closing costs to first-time homebuyers and a total of $5.8 million in giving to non-profits.

- Associate Development and Well-being: Programs supporting associate development and well-being reflect UMB Financial's commitment to its employees.

- Volunteer Time Off and Matching Gift Programs: These formal programs encourage associates to live out the company's values in their communities.

- Financial Literacy Programs: UMB Financial offers financial literacy programs to help customers and communities make informed financial decisions.

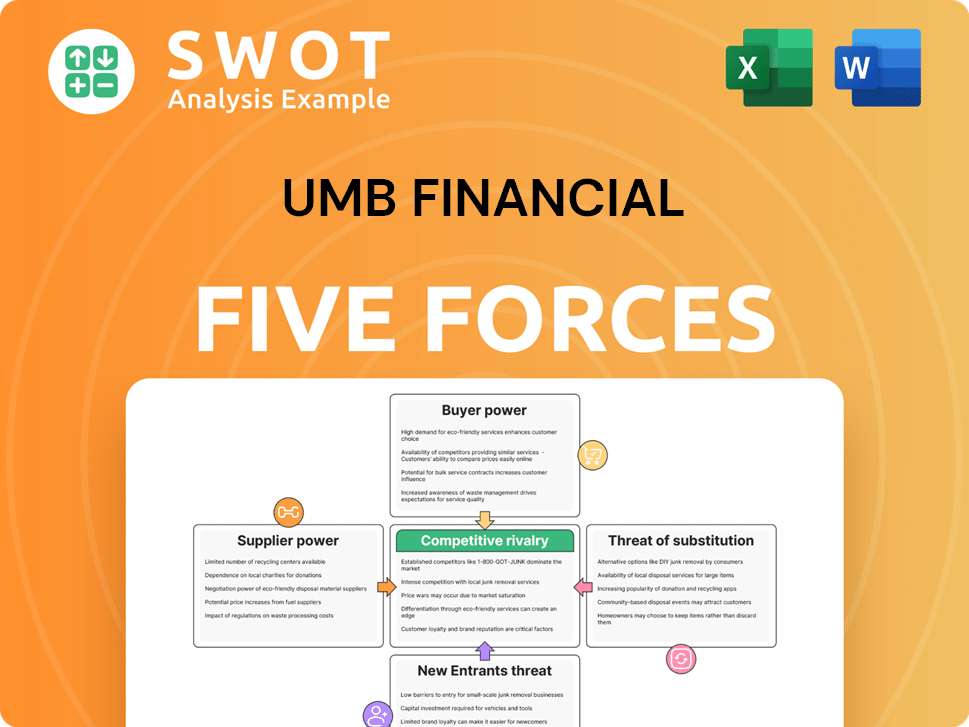

UMB Financial Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UMB Financial Company?

- What is Competitive Landscape of UMB Financial Company?

- What is Growth Strategy and Future Prospects of UMB Financial Company?

- How Does UMB Financial Company Work?

- What is Sales and Marketing Strategy of UMB Financial Company?

- Who Owns UMB Financial Company?

- What is Customer Demographics and Target Market of UMB Financial Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.