Audacy Bundle

Who Really Owns Audacy Now?

Ever wondered who pulls the strings at a major media player like Audacy? The Audacy SWOT Analysis reveals the intricate web of ownership that dictates its future. From its humble beginnings as Entercom to its current status as a leading audio content provider, understanding Audacy's ownership is key. This exploration unveils the dramatic shifts in control following its recent financial restructuring.

The story of Audacy, a significant media company with a vast network of radio stations, is a tale of evolution, challenges, and transformation. Its journey from Entercom to Audacy, marked by a pivotal bankruptcy filing, has dramatically altered its ownership landscape. Understanding the current structure, including the role of debtholders, is crucial for anyone looking to understand the company's strategic direction and future prospects. This deep dive will explore the key players and how their influence shapes the future of Audacy.

Who Founded Audacy?

The story of Audacy (formerly Entercom Communications Corp.) began in 1968. Joseph Field founded the company with a vision to build a strong presence in the radio broadcasting industry. His leadership and vision were critical in the early years, setting the stage for the company's growth.

While specific details of the initial ownership structure are not readily available from the early years, Joseph Field's continued role as Chairman of the Board until his passing in 2021 indicates his sustained influence. His son, David Field, took over as President and CEO in 2002, demonstrating a family legacy in the company's leadership and early ownership.

Early ownership likely involved capital contributions from Joseph Field and potentially a small group of private investors or family members. As a private entity in its early stages, detailed breakdowns of angel investments or friends and family stakes are not publicly disclosed. However, the consistent leadership of the Field family suggests a concentrated ownership and control in the early years, reflecting their vision for building a significant presence in the radio broadcasting industry.

The early ownership of Audacy was primarily held by the Field family and possibly a small group of private investors. As a media company in its nascent stages, the exact equity split among founders and early backers isn't fully available in public records. However, the Field family's consistent leadership points to a concentrated ownership structure. The company's focus was on acquiring and operating radio stations, which formed the foundation of its business model.

- Joseph Field's role as Chairman until 2021 highlights his long-term influence.

- David Field's appointment as President and CEO in 2002 signifies family involvement.

- Early agreements about vesting schedules, buy-sell clauses, or founder exits would have been private.

- The early structure laid the groundwork for the company's eventual growth and public listing.

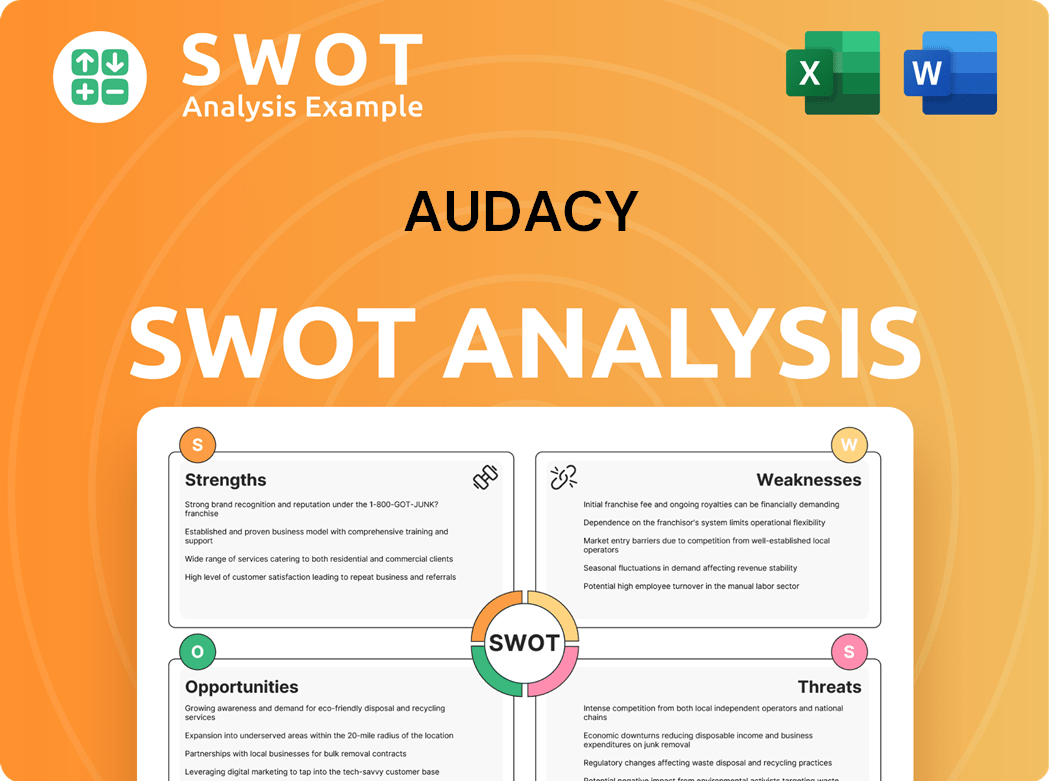

Audacy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Audacy’s Ownership Changed Over Time?

The evolution of Audacy's ownership has been marked by significant changes. Initially, Entercom Communications Corp. went public, though the exact IPO details aren't readily available in recent public records. A pivotal moment was the 2017 acquisition of CBS Radio, valued at about $1.7 billion. This deal expanded its market reach and diversified its assets. The merger diluted existing Entercom shareholders and introduced new institutional investors holding CBS Radio's equity.

The most recent shift occurred in January 2024 with a prepackaged Chapter 11 bankruptcy filing, from which Audacy emerged in March 2024. This restructuring converted approximately $1.6 billion of debt into equity, transferring control to senior secured lenders. Pre-petition shareholders saw their equity interests extinguished. The new major stakeholders are former debtholders, primarily institutional investors and hedge funds. The restructuring aimed to reduce total debt from about $1.9 billion to $350 million, improving the balance sheet. This change was a response to financial challenges, including declining advertising revenue and a heavy debt load, fundamentally altering the company's strategic and governance landscape. You can read more about the Growth Strategy of Audacy.

| Event | Date | Impact |

|---|---|---|

| Acquisition of CBS Radio | 2017 | Expanded market presence and diversified assets. |

| Chapter 11 Bankruptcy Filing | January 2024 | Transferred ownership to senior secured lenders. |

| Emergence from Bankruptcy | March 2024 | Reduced debt and altered the ownership structure. |

Audacy ownership has transformed significantly through acquisitions and restructuring. The 2017 CBS Radio acquisition was a major step. The 2024 bankruptcy reshaped the ownership, transferring control to creditors.

- The company's debt was reduced from approximately $1.9 billion to $350 million.

- The pre-petition shareholders lost their equity.

- The new major stakeholders are institutional investors and hedge funds.

- The changes reflect financial challenges and strategic shifts.

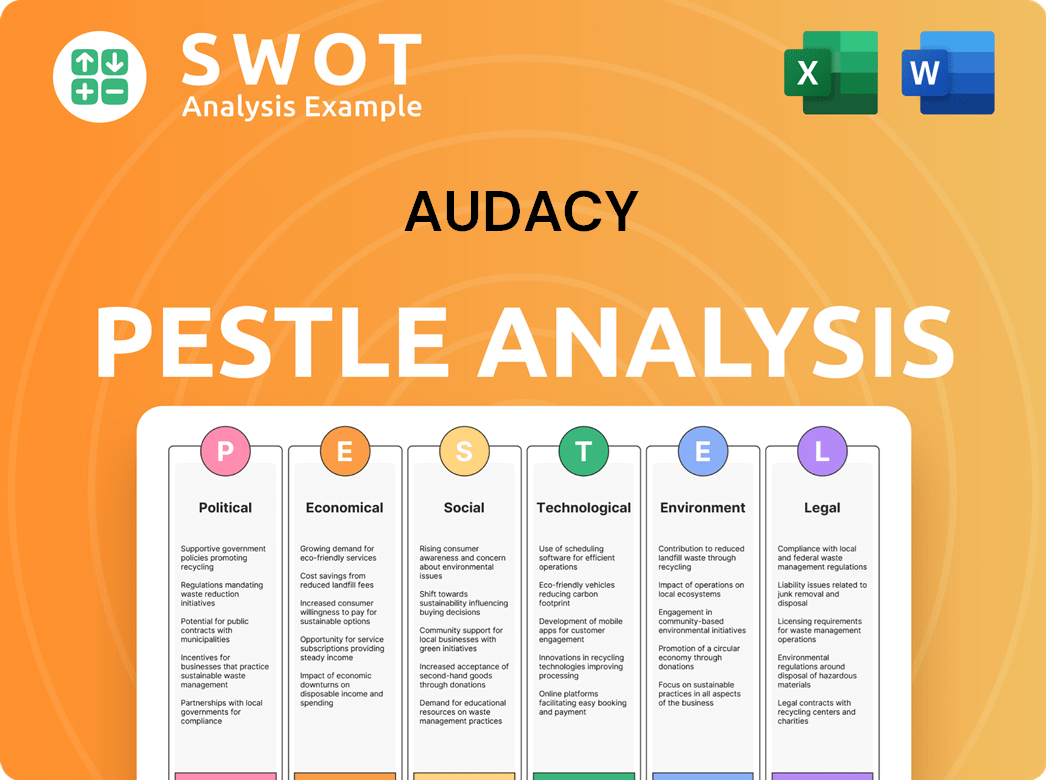

Audacy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Audacy’s Board?

Following its restructuring in March 2024, the composition of the Audacy Board of Directors has been significantly altered to reflect the new ownership structure. While specific details regarding board members and their affiliations with major shareholders are not yet fully available in easily accessible public filings as of early June 2025, it is typical for new equity holders, primarily the former debtholders, to appoint representatives to the board. David Field continues to serve as CEO, and it is highly likely he retains a board seat to ensure leadership continuity. This transition is crucial for the future of the Audacy company.

The board's influence is critical in guiding Audacy's strategic direction, with members likely representing the interests of the new institutional owners who now hold the majority of the company's equity. The focus since emerging from bankruptcy has been on stabilization and operational improvement under the new ownership. The strategic decisions made by the board will be vital for the future success of Audacy in the competitive media landscape. For more information on Audacy's target audience, you can read Target Market of Audacy.

| Board Member | Role | Affiliation |

|---|---|---|

| David Field | CEO | Likely Board Member |

| TBD | Board Member | Representing New Equity Holders |

| TBD | Board Member | Representing New Equity Holders |

The voting structure post-bankruptcy is expected to be a standard one-share-one-vote system, given the conversion of debt to equity. Any previous dual-class shares or special voting rights would likely have been eliminated or significantly diluted during the bankruptcy process. This shift ensures that the new board's decisions are based on the interests of the current shareholders. The Audacy ownership structure now reflects a more traditional corporate governance model, with the board playing a central role in strategic planning and oversight. The company operates numerous radio stations and is a significant media company.

The Board of Directors has been reconstituted post-bankruptcy.

- David Field likely remains on the board.

- New board members represent the new equity holders.

- Voting structure is expected to be one-share-one-vote.

- Focus is on stabilizing and improving operations.

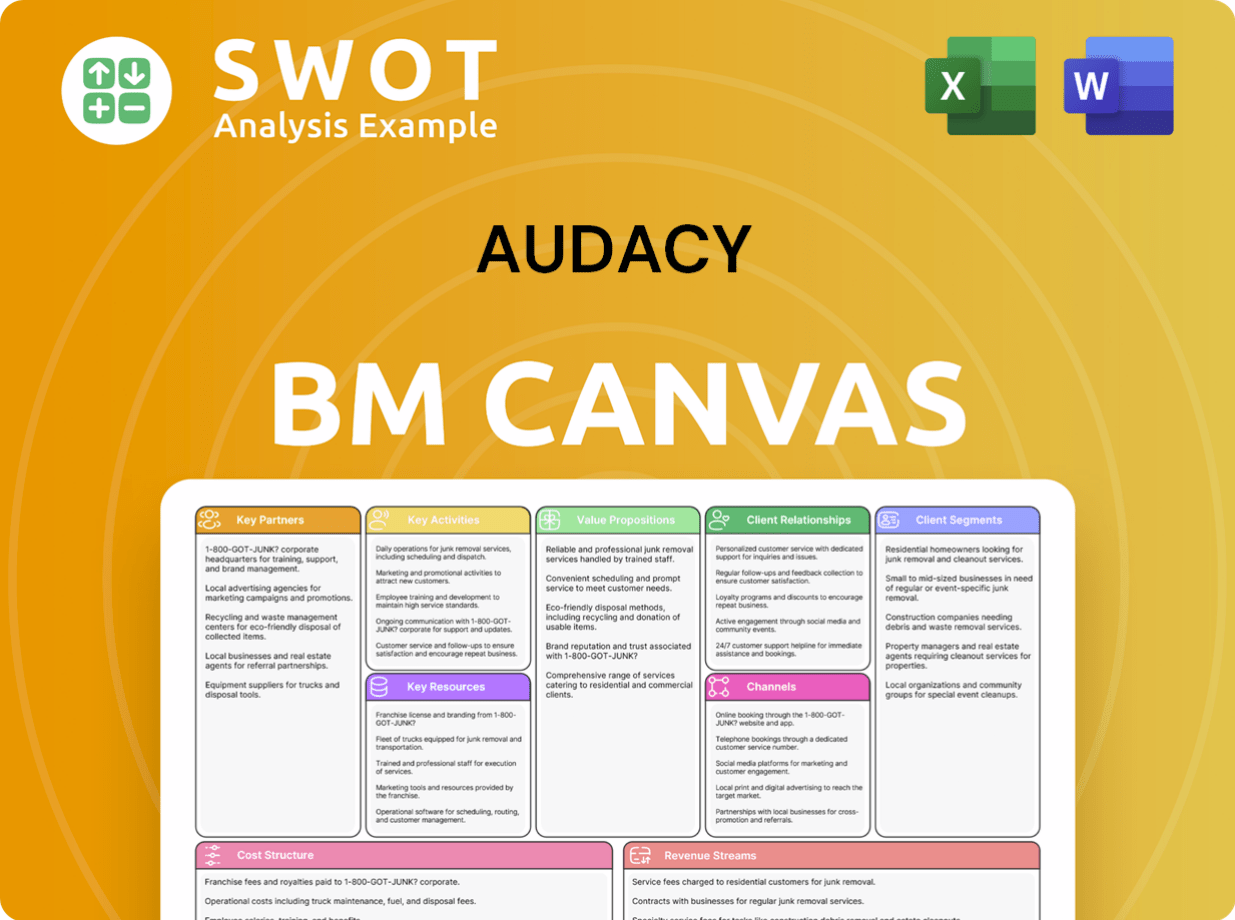

Audacy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Audacy’s Ownership Landscape?

Over the past few years, the ownership of the media company, Audacy, has been significantly shaped by its financial restructuring. The most critical event was the prepackaged Chapter 11 bankruptcy filing in January 2024, followed by its emergence from bankruptcy in March 2024. This process fundamentally changed the ownership structure, transferring control from the pre-petition shareholders to the company's former senior secured lenders. This shift was driven by the need to address a substantial debt burden and navigate a challenging advertising market. In the fourth quarter of 2023, Audacy's net revenue decreased by 2% to $305.3 million compared to the previous year.

Industry trends in media ownership, such as increasing institutional ownership and consolidation, are evident in Audacy's recent history. The company's restructuring aligns with a broader trend of traditional media companies adapting to digital disruption and economic pressures. Founder dilution, a common occurrence as companies mature and seek external capital, resulted in the complete loss of pre-petition equity in Audacy's case. The new ownership structure, now dominated by former debtholders, suggests a strong emphasis on financial performance and debt reduction in the near to medium term. For more insights into the company's financial operations, you can explore the Revenue Streams & Business Model of Audacy.

The Chapter 11 bankruptcy filing in January 2024 and subsequent emergence in March 2024 were pivotal events. These events led to a shift in control from pre-petition shareholders to the company's former senior secured lenders.

The restructuring aimed to address a substantial debt load and navigate a tough advertising market. The company's net revenue decreased in the fourth quarter of 2023. The new ownership structure focuses on financial performance and debt reduction.

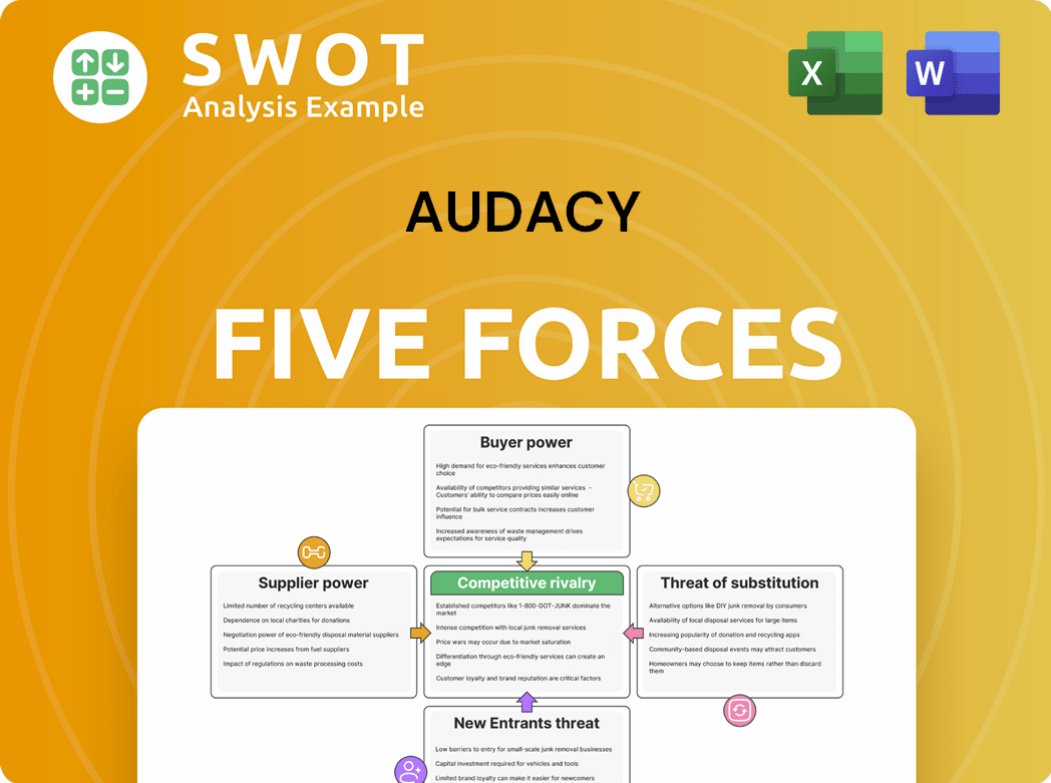

Audacy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Audacy Company?

- What is Competitive Landscape of Audacy Company?

- What is Growth Strategy and Future Prospects of Audacy Company?

- How Does Audacy Company Work?

- What is Sales and Marketing Strategy of Audacy Company?

- What is Brief History of Audacy Company?

- What is Customer Demographics and Target Market of Audacy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.