Brookshire Grocery Bundle

Who Really Owns Brookshire Grocery Company?

Unraveling the ownership structure of Brookshire Grocery Company (BGC) is key to understanding its strategic moves in the competitive grocery market. Knowing who controls a company like Brookshire's reveals its priorities and long-term goals. This deep dive explores the heart of BGC's identity, tracing its roots back to its family-owned beginnings.

Founded in 1928 by Wood T. Brookshire, the company's commitment to customer service and quality products has been a constant. Today, with over 200 stores under banners like Brookshire's and Super 1 Foods, BGC remains a significant player in the Texas grocery stores landscape. To gain even deeper insights, consider exploring a detailed Brookshire Grocery SWOT Analysis to see how its ownership impacts its market position and future strategies.

Who Founded Brookshire Grocery?

The story of Brookshire Grocery Company (BGC) began on September 1, 1928, when Wood T. Brookshire opened a small, 2,500-square-foot grocery store in downtown Tyler, Texas. This marked the inception of what would become a significant player in the Texas grocery market. Wood T. Brookshire started with a team of just four employees, setting the foundation for a business deeply rooted in community service.

From its inception, Brookshire Grocery Company has been a family-owned and operated business. Wood T. Brookshire's vision was centered on exceptional customer service, tenacity, and a competitive spirit. While specific details about the initial equity split aren't publicly available, the core principle of family ownership has been a constant throughout BGC's history.

Before founding BGC, Wood T. Brookshire and his cousin W.A. Brookshire separated from 'Brookshire Brothers,' founded by Wood's older brothers in 1921. In 1929, Wood and W.A. Brookshire took control of four stores in Tyler, Texas, officially establishing Brookshire Grocery Company. This separation was crucial in defining the distinct family ownership that continues to characterize Brookshire Grocery Company today.

Wood T. Brookshire's commitment to community and strong values shaped the company's culture from the start. The early focus was on building a business that prioritized customer service and competitive practices. This commitment to family ownership and community service has been a cornerstone of Brookshire Grocery Company's identity.

- Founded by Wood T. Brookshire in 1928.

- Initially, the company started with four employees.

- The company's roots are in Tyler, Texas.

- The company has always been family-owned.

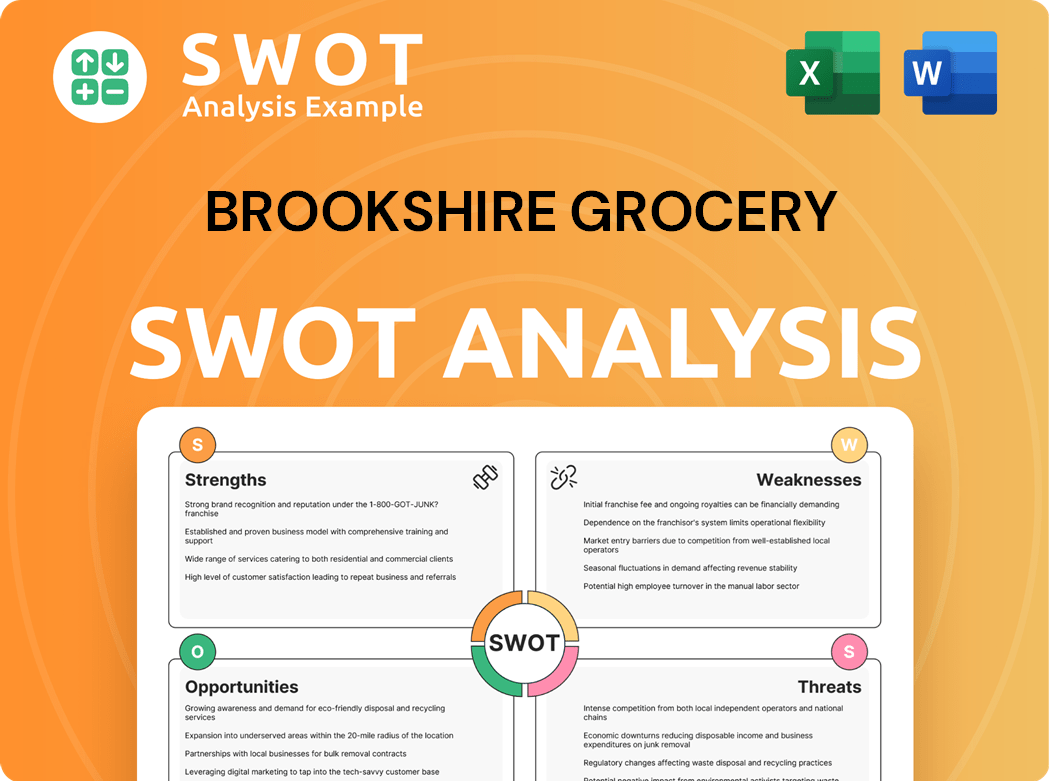

Brookshire Grocery SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Brookshire Grocery’s Ownership Changed Over Time?

Since its establishment in 1928, Brookshire Grocery Company (BGC) has remained a privately held, family-owned business. This structure means it doesn't have publicly traded shares or the Securities and Exchange Commission (SEC) filings that public companies do. Instead, its ownership has evolved through family successions and strategic acquisitions. The company's growth strategy has involved both organic expansion and strategic acquisitions, such as the purchase of former Walmart Express stores and Winn-Dixie stores.

The company's expansion strategy includes the acquisition of 25 former Walmart Express stores in 2016, which were rebranded as Spring Market. In 2018, BGC acquired eight Louisiana Winn-Dixie stores, which were then reopened under the Super 1 Foods banner. A significant acquisition in the first quarter of 2022 involved the purchase of Reasor's, an Oklahoma-based grocer with 17 stores, which became BGC's fifth banner. These acquisitions highlight BGC's focus on regional expansion and increasing its market share. The Marketing Strategy of Brookshire Grocery includes a focus on maintaining its family-owned status and core values.

| Year | Acquisition | Impact |

|---|---|---|

| 2016 | Walmart Express Stores | Expanded presence with Spring Market banner. |

| 2018 | Louisiana Winn-Dixie Stores | Increased market share under the Super 1 Foods banner. |

| 2022 | Reasor's | Added a fifth banner and expanded into Oklahoma. |

The primary stakeholder is the Brookshire family, who have owned and operated the company since its inception. Brad Brookshire, a grandson of the founder Wood T. Brookshire, is the current Chairman and Chief Executive Officer. The involvement of the third and fourth generations in leadership roles emphasizes the family's commitment to the company's long-term growth. As of November 2024, Forbes lists BGC as a family-owned grocery company with an estimated revenue of $4.4 billion in 2024. This underscores the company's commitment to maintaining its family-owned status and core values.

Brookshire Grocery Company remains a privately held, family-owned business, which impacts its operational strategies and long-term goals.

- The Brookshire family's continued involvement ensures consistent values.

- Strategic acquisitions have fueled regional growth.

- The company's focus is on long-term sustainability and maintaining its family-owned status.

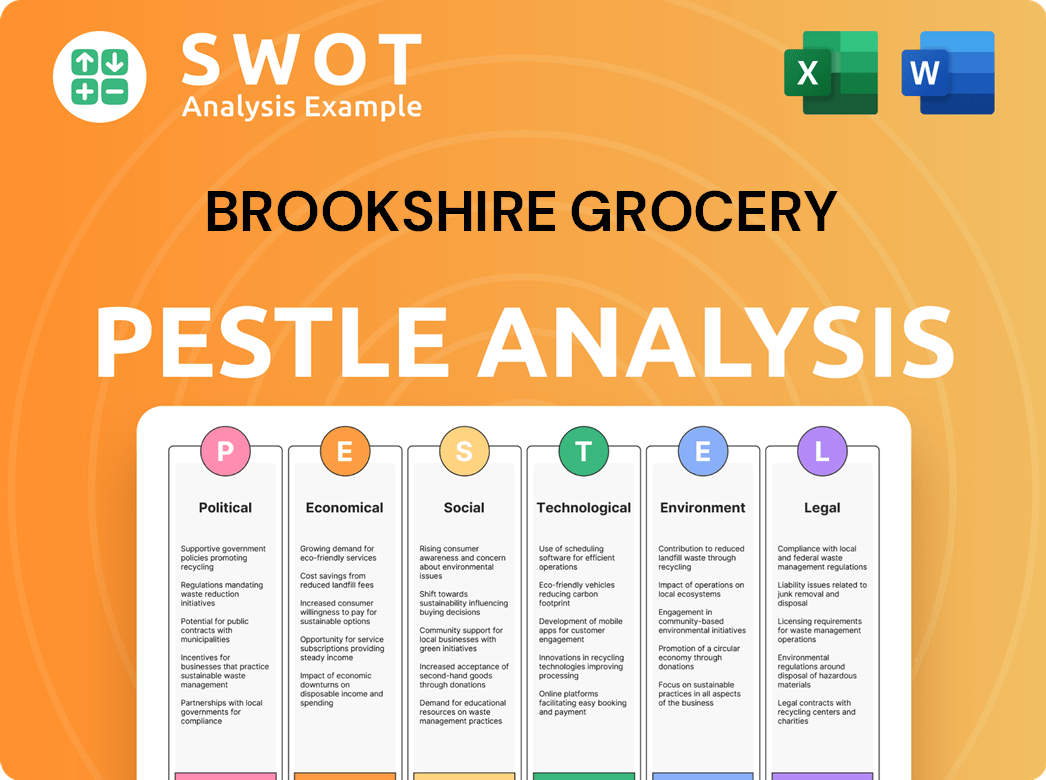

Brookshire Grocery PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Brookshire Grocery’s Board?

As a privately held entity, the specifics of the board of directors for the Brookshire Grocery Company (BGC) are not publicly available in the same manner as for publicly traded companies. However, the company's ownership structure is explicitly rooted in family leadership, with the Brookshire family at the helm since 1928. Brad Brookshire, a grandson of the founder, currently serves as Chairman and Chief Executive Officer, indicating the family's significant influence in key decision-making processes. This family-centric approach suggests that the board is likely composed primarily of family members or individuals closely associated with the Brookshire family, ensuring that governance and strategic direction are heavily influenced by family interests.

The company emphasizes the active involvement of the third and fourth generations of the Brookshire family in both the board of directors and company leadership roles. This continued family involvement underscores a commitment to maintaining family control over the company's operations and strategic direction. While the precise composition of the board and the specifics of voting rights are not disclosed, the consistent messaging points to a family-driven governance model. This approach contrasts with publicly traded entities, where board composition and voting structures are subject to more stringent disclosure requirements.

| Board Member | Title | Relationship |

|---|---|---|

| Brad Brookshire | Chairman and CEO | Grandson of Founder |

| Family Members | Board Members | Third and Fourth Generations |

| Not Publicly Disclosed | Other Board Members | Details not available |

The BGC maintains that it 'does not yield to political activism in shaping corporate governance,' which further highlights its internal, family-driven decision-making processes. This stance reinforces the idea that the company's governance structure prioritizes internal control and family values over external pressures. To understand the company's origins, one might find value in exploring the Brief History of Brookshire Grocery.

Brookshire Grocery Company (BGC) is a privately held, family-owned business. The Brookshire family has owned and led the company since 1928. Brad Brookshire, a grandson of the founder, is the Chairman and CEO.

- Family-centric control model.

- Third and fourth generations are active in the board and leadership.

- Decision-making is primarily internal and family-driven.

- BGC does not publicly disclose board details like publicly traded companies.

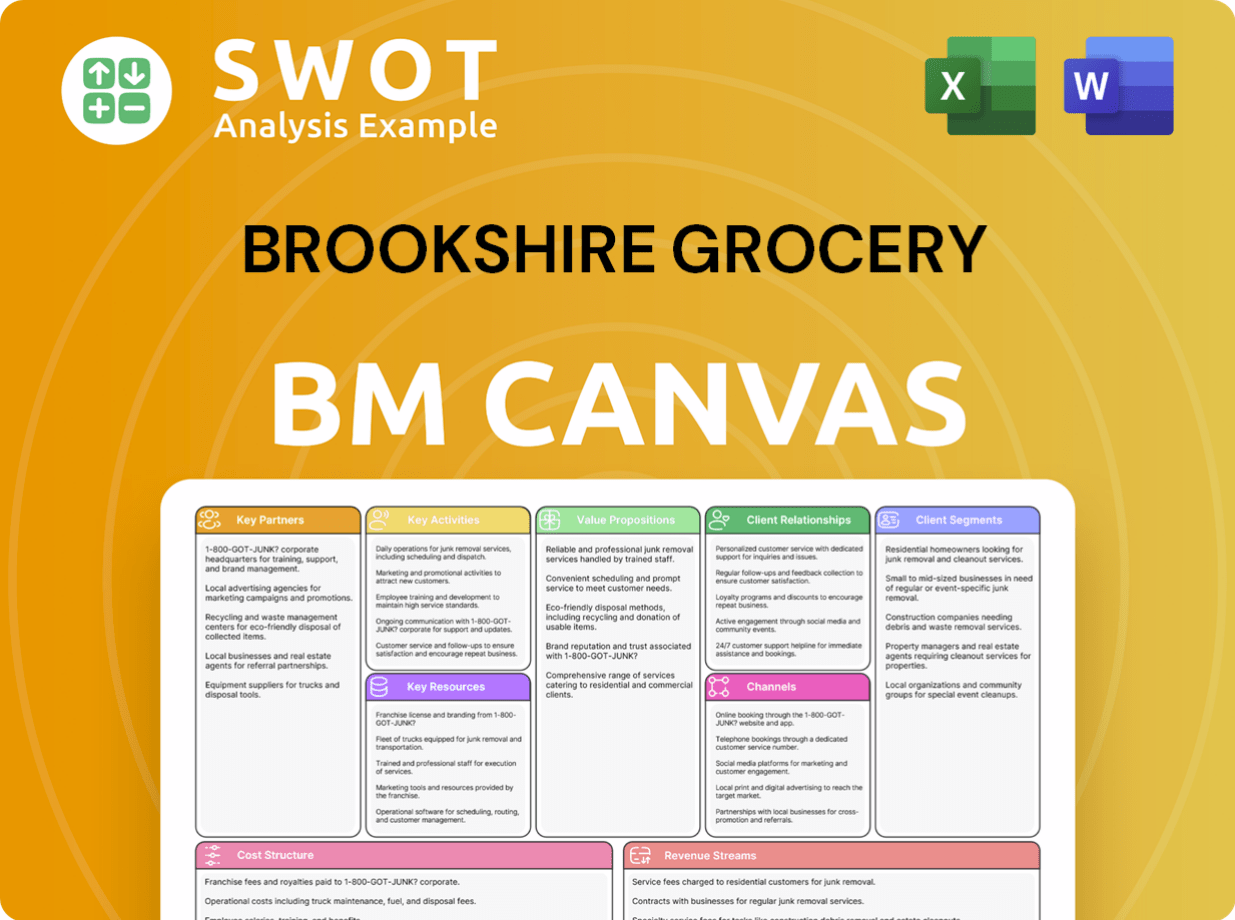

Brookshire Grocery Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Brookshire Grocery’s Ownership Landscape?

In the past few years, Brookshire Grocery Company (BGC) has focused on strategic expansion and solidifying its market position. A key move was the acquisition of Reasor's in early 2022, adding 17 stores and expanding BGC's presence into Oklahoma. This demonstrates BGC's ongoing strategy to grow its operational footprint and diversify its banner portfolio. The company continues to operate as a family-owned business, with the Brookshire family actively involved in leadership.

Recent developments also highlight BGC's focus on supply chain partnerships and technological integration. In August 2024, Local Bounti Corporation began supplying fresh produce to over 180 Brookshire's stores. Furthermore, Alpha Modus Corp. filed a patent infringement lawsuit against Brookshire Grocery Company in November 2024, indicating the company's engagement with retail technology advancements. The company's revenue figures vary depending on the source, with estimates around $3.5 billion for 2024 and $4.4 billion reported by Forbes in November 2024, with in-store grocery sales being the major share.

The current ownership structure of Brookshire Grocery Company remains firmly rooted in family ownership. There have been no public announcements or indications of changes to this structure, reinforcing the company's commitment to long-term, sustainable growth as a family-run enterprise. The company's commitment to family ownership underscores its focus on long-term growth and stability within the competitive landscape of Texas grocery stores and beyond.

The acquisition of Reasor's in 2022 expanded BGC's operations into Oklahoma, adding a fifth banner to its portfolio. This strategic move enhanced its market presence. This expansion reflects BGC's growth strategy.

Partnerships with companies like Local Bounti Corporation, which began shipping produce to over 180 stores in August 2024, highlight a focus on fresh offerings. These partnerships help BGC stay competitive.

Revenue estimates for 2024 vary, with figures around $3.5 billion and $4.4 billion reported by Forbes in November 2024. In-store grocery sales contribute the most to the revenue. Pharmacy and fuel sales also contribute significantly.

The company remains family-owned and operated, with no indication of a shift towards privatization or public listing. The Brookshire family's active involvement in leadership ensures continuity. This structure supports long-term growth.

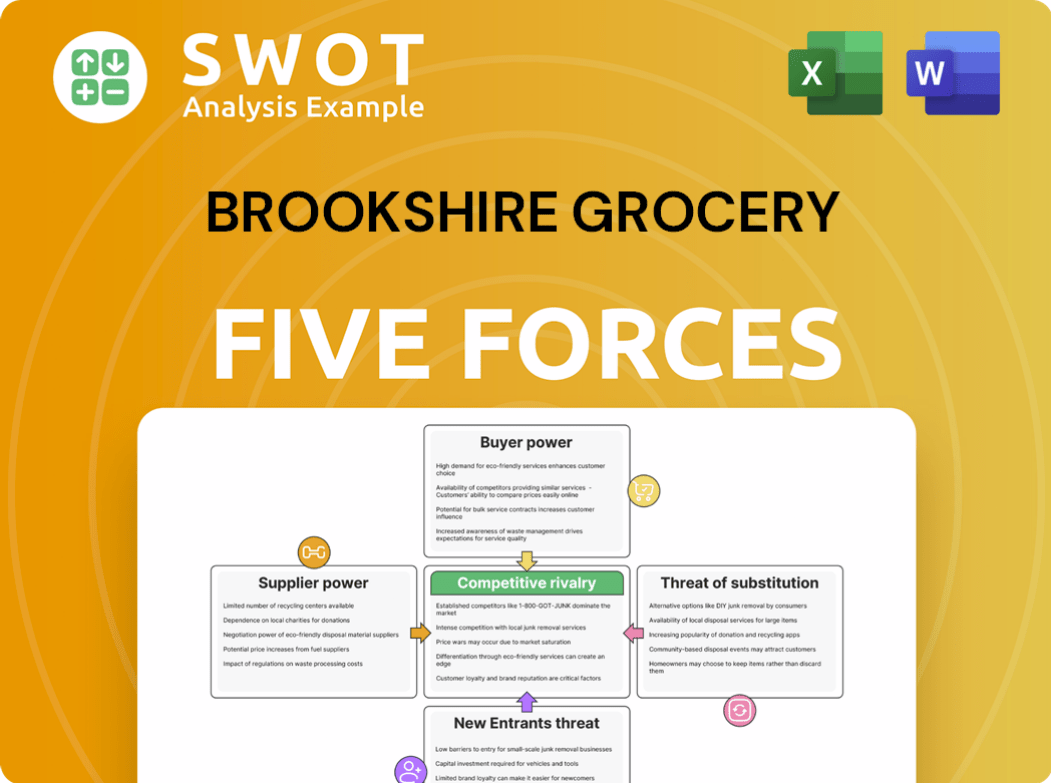

Brookshire Grocery Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Brookshire Grocery Company?

- What is Competitive Landscape of Brookshire Grocery Company?

- What is Growth Strategy and Future Prospects of Brookshire Grocery Company?

- How Does Brookshire Grocery Company Work?

- What is Sales and Marketing Strategy of Brookshire Grocery Company?

- What is Brief History of Brookshire Grocery Company?

- What is Customer Demographics and Target Market of Brookshire Grocery Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.