Burckhardt Compression Holding Bundle

Who Really Controls Burckhardt Compression Holding?

Uncover the ownership secrets behind Burckhardt Compression Holding AG, a titan in the world of Burckhardt Compression Holding SWOT Analysis and compression technology. Understanding the ownership structure of a publicly traded company like this Swiss company is crucial for anyone looking to make informed investment decisions. From its roots to its current status, the evolution of Burckhardt Compression ownership tells a compelling story of growth and strategic alignment.

This exploration into Burckhardt Compression ownership delves into the key players shaping its destiny. We'll examine the influence of major shareholders and the impact on its financial performance. Whether you're investigating Burckhardt Compression stock information, or simply curious about who owns this industrial giant, this analysis provides essential insights. Learn about the company's history and how to invest in Burckhardt Compression, including details on its market capitalization and investor relations.

Who Founded Burckhardt Compression Holding?

The origins of Burckhardt Compression trace back to 1844, marking the beginning of its journey in the industrial machinery sector. The company's early days were in Winterthur, Switzerland, where it started as Burckhardt. Information on the specific equity split and individual shareholdings of the earliest founders isn't readily available in public domain information.

The initial ownership structure of Burckhardt Compression most likely involved its founders. These individuals, driven by a vision of precision engineering, invested capital and expertise to establish the company. This setup was typical of 19th-century industrial enterprises, focusing on building a foundation for operations.

While the exact names and equity contributions of the original founders aren't widely publicized, early ownership would have been held by the individuals or families who initiated the venture. Early backers, if any, would have likely been private individuals or local financiers, rather than institutional investors. Agreements during this nascent stage would have focused on establishing operational capital, defining responsibilities, and ensuring the company's survival and initial growth. The founding team’s vision for high-quality, reliable industrial equipment would have been intrinsically linked to the distribution of control, ensuring that those committed to this vision held the reins.

Early ownership of Burckhardt Compression was concentrated among its founders. The company's initial backers were likely private individuals or local financiers. The focus was on establishing capital and defining responsibilities.

- The company's history began in 1844 in Winterthur, Switzerland.

- Early ownership details are not extensively documented in public records.

- The initial focus was on building a foundation for operations.

- Agreements in the early stages centered on operational capital and responsibilities.

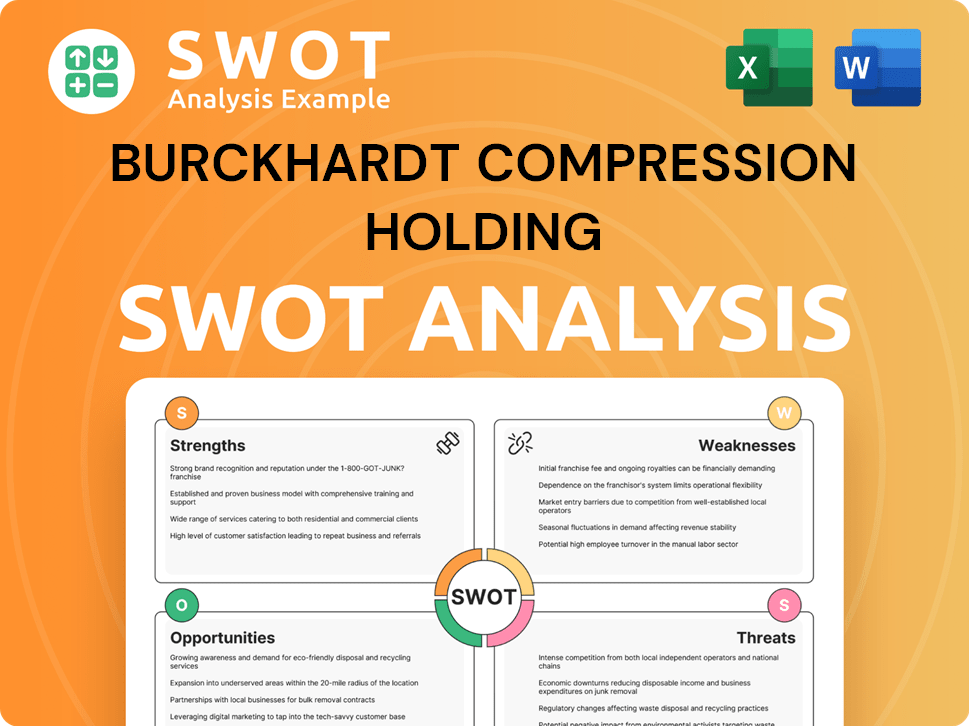

Burckhardt Compression Holding SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Burckhardt Compression Holding’s Ownership Changed Over Time?

The evolution of Burckhardt Compression Holding's ownership reflects a significant transition from its origins. Initially part of Sulzer AG, a prominent Swiss industrial firm, Burckhardt Compression operated under its umbrella for a considerable period. A pivotal shift occurred in 2002 when it was spun off from Sulzer AG. This strategic move transformed Burckhardt Compression into an independent, publicly traded entity, listed on the SIX Swiss Exchange. This transition broadened its shareholder base, attracting both institutional and individual investors and altering the dynamics of its corporate governance.

The company's ownership structure has evolved considerably since its initial public offering. The spin-off from Sulzer AG in 2002 marked a crucial step, leading to a diversified shareholder base. As a Swiss company, Burckhardt Compression's ownership is largely influenced by institutional investors, mutual funds, and individual shareholders. This structure is typical for a publicly traded company in the industrial sector. The move towards public listing has generally enhanced market transparency and influenced the company's strategic focus on global expansion and innovation in compression technology.

| Event | Date | Impact on Ownership |

|---|---|---|

| Spin-off from Sulzer AG | 2002 | Transitioned from a subsidiary to an independent, publicly listed company. |

| Initial Public Offering (IPO) | 2002 | Broadened the shareholder base, attracting institutional and individual investors. |

| Ongoing Market Activity | 2002-Present | Shareholder composition fluctuates, with institutional investors holding significant stakes. |

As of April 2024, the ownership of Burckhardt Compression is primarily distributed among institutional investors, mutual funds, and individual shareholders. Major institutional shareholders, including asset managers and pension funds, hold substantial stakes, influencing strategic decisions. These holdings often range from 3% to over 10% of the total outstanding shares. The company's annual reports and SEC filings, if applicable, provide detailed breakdowns of share ownership, highlighting a diversified shareholder base, which is common for publicly traded companies in Switzerland. This structure implies that while large institutional investors have significant influence, the company's strategy is not dictated by a single dominant shareholder. For further insights, you can explore the latest Burckhardt Compression Holding stock information.

Burckhardt Compression's ownership has evolved significantly since its spin-off from Sulzer AG in 2002, transitioning to a publicly traded model. The shareholder base is now primarily composed of institutional investors, mutual funds, and individual shareholders.

- Institutional investors hold significant stakes.

- The company is listed on the SIX Swiss Exchange.

- Ownership is diversified, with no single dominant shareholder.

- The move to public listing increased market transparency.

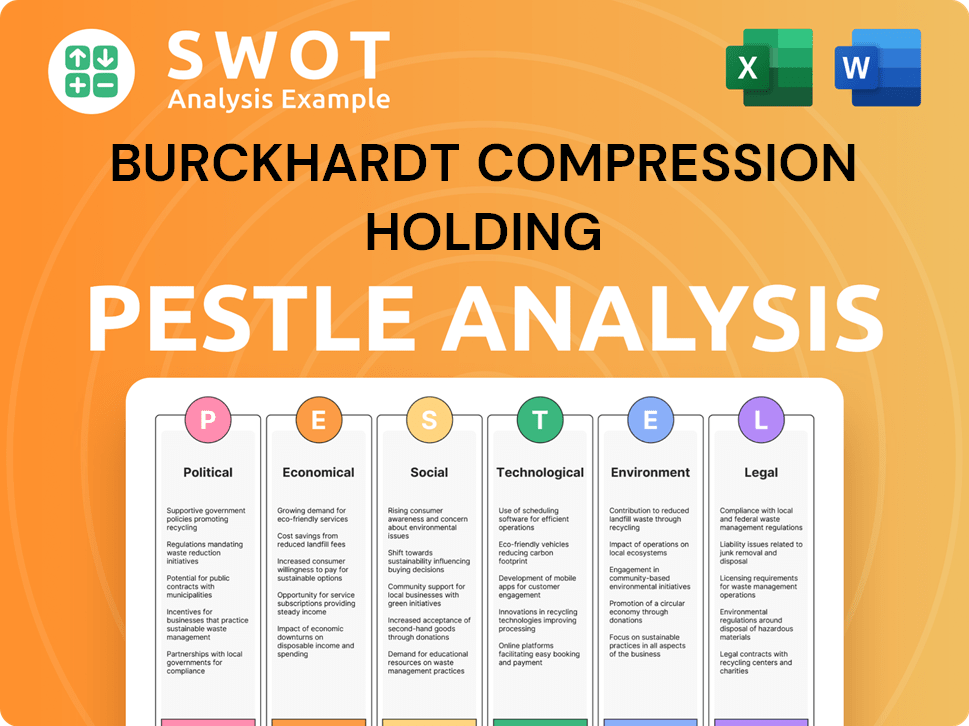

Burckhardt Compression Holding PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Burckhardt Compression Holding’s Board?

The Board of Directors of Burckhardt Compression Holding AG, a Swiss company, is pivotal in the company's governance. As of the latest information available in 2024, the board includes a mix of independent members and those potentially representing significant shareholder interests. The Chairman of the Board, along with other board members, brings expertise in areas such as engineering, finance, and international business. This structure aims to balance the interests of various shareholder groups while ensuring effective oversight.

The board's composition is subject to scrutiny during annual general meetings, where shareholders elect board members. Major institutional investors can significantly influence these elections due to their substantial holdings. The current board oversees the company's strategic direction, financial performance, and risk management, adhering to sound corporate governance principles. For detailed insights into the company's growth strategy, you can refer to this article: Growth Strategy of Burckhardt Compression Holding.

| Board Member | Role | Expertise |

|---|---|---|

| (Example) | Chairman | Engineering |

| (Example) | Member | Finance |

| (Example) | Member | International Business |

Burckhardt Compression operates under a one-share-one-vote principle. This means each outstanding share carries equal voting rights. This structure ensures that voting power is directly proportional to share ownership. This democratic voting structure is common for Swiss publicly traded companies and promotes equitable representation of shareholder interests. The absence of special voting rights or golden shares means that strategic decisions are made through a consensus of the board, ultimately accountable to the collective body of shareholders. This approach is crucial for understanding Burckhardt Compression ownership and its governance structure.

Each share of Burckhardt Compression carries equal voting rights, ensuring fair representation for all shareholders.

- Shareholders elect board members.

- Major institutional investors can influence elections.

- Strategic decisions are made through board consensus.

- No special voting rights exist.

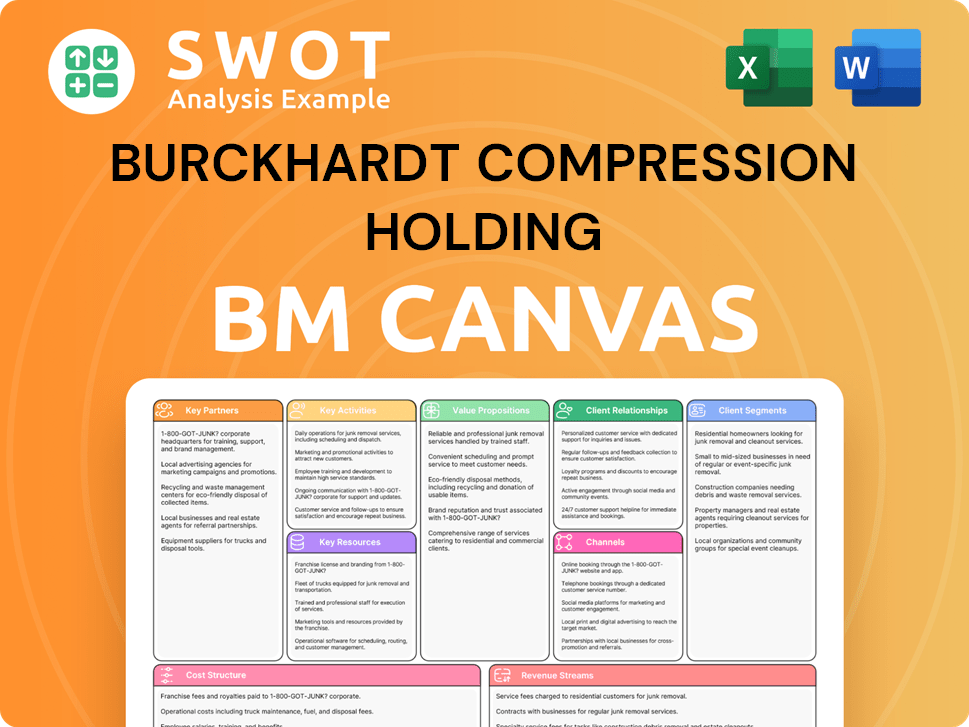

Burckhardt Compression Holding Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Burckhardt Compression Holding’s Ownership Landscape?

Over the past few years (2022-2025), the ownership structure of Burckhardt Compression Holding has remained relatively stable. The Swiss company, a publicly traded company, has not experienced any major shifts in control or significant mergers and acquisitions that would drastically alter its ownership profile. However, routine financial activities like share buyback programs and dividend distributions have influenced the distribution of shares among existing shareholders. These actions are typical for a well-established company and are designed to manage capital and reward investors.

Institutional investors, including large asset managers and pension funds, continue to hold substantial stakes in Burckhardt Compression. This reflects a broader trend of increasing institutional ownership across various sectors. Founder dilution, a common occurrence as companies mature and raise capital, has likely occurred over the decades. The company's focus remains on organic growth, innovation in compression technology, and strategic partnerships within its niche markets. For those interested in understanding the fundamentals, you can explore the Revenue Streams & Business Model of Burckhardt Compression Holding.

Burckhardt Compression ownership is characterized by a stable and diversified institutional base. The company's investor relations communications and annual reports emphasize long-term value creation for shareholders. Significant changes in leadership or founder departures, if any, would be publicly disclosed. The overall trend suggests a consistent approach to maintaining a stable ownership structure, which is typical for a mature industrial firm listed on a major stock exchange.

| Metric | Value (2024) | Source |

|---|---|---|

| Market Capitalization | Approximately CHF 3.5 Billion | Company Financial Reports |

| Institutional Ownership | Approximately 70% | Company Financial Reports |

| Dividend Yield | Approximately 2% | Company Financial Reports |

The ownership structure of Burckhardt Compression Holding has remained stable, with no significant changes in control. The company's focus is on organic growth and technological innovation.

Institutional investors hold a significant stake in Burckhardt Compression, reflecting a trend of increasing institutional ownership. This provides stability.

The company prioritizes long-term value creation for its shareholders, as highlighted in its investor relations communications. This includes dividends.

Burckhardt Compression is a publicly traded company with a strong market position. The company's stability is typical for a well-established industrial firm.

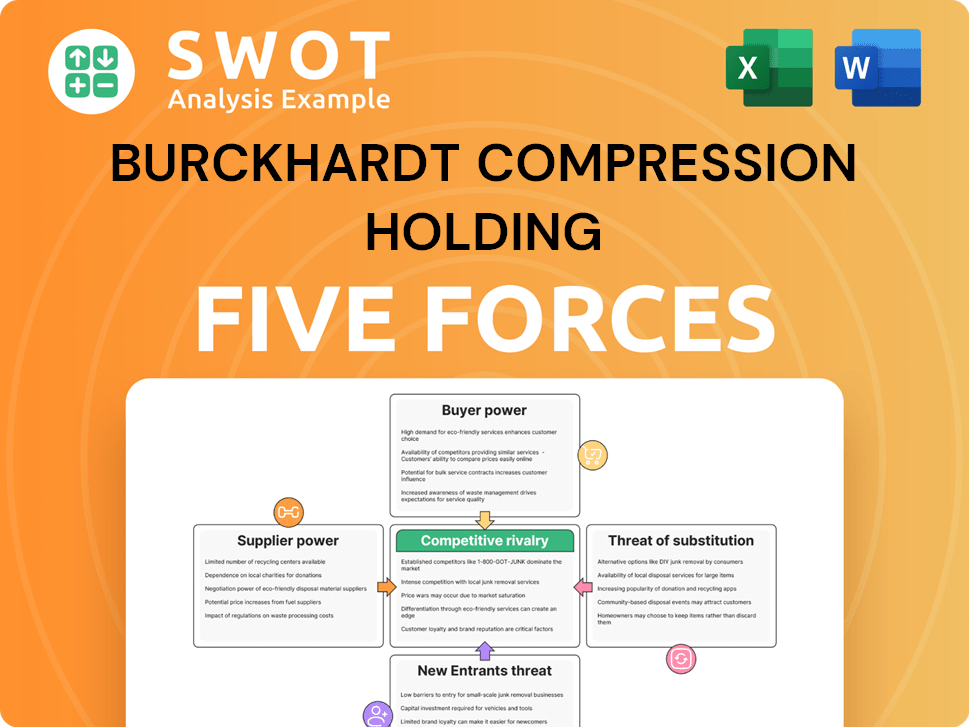

Burckhardt Compression Holding Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Burckhardt Compression Holding Company?

- What is Competitive Landscape of Burckhardt Compression Holding Company?

- What is Growth Strategy and Future Prospects of Burckhardt Compression Holding Company?

- How Does Burckhardt Compression Holding Company Work?

- What is Sales and Marketing Strategy of Burckhardt Compression Holding Company?

- What is Brief History of Burckhardt Compression Holding Company?

- What is Customer Demographics and Target Market of Burckhardt Compression Holding Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.