Cintas Bundle

Who Really Owns Cintas?

Ever wondered who pulls the strings at a company worth billions? Understanding the Cintas SWOT Analysis and its ownership structure is key to grasping its strategic moves and future potential. From its humble beginnings as Acme Industrial Laundry Company in 1929 to its current status, Cintas' journey is a fascinating case study in corporate evolution.

This deep dive into Cintas ownership explores the evolution of the Cintas company, from its founders to the influence of today's key players. We'll uncover the dynamics behind its IPO in 1983, examining how the Cintas parent company's ownership has shaped its trajectory. Discover the answers to questions like: Who founded Cintas? Is Cintas a publicly traded company? What is the Cintas stock ticker symbol? This analysis provides a comprehensive look at Cintas history and the forces driving its success.

Who Founded Cintas?

The story of the Cintas Corporation begins in 1929 with Richard 'Doc' Farmer and his wife, Amelia Farmer, who established the Acme Industrial Laundry Company. Their initial venture focused on collecting, cleaning, and reselling used rags from factories, marking the genesis of what would become a major player in the uniform and facility services industry. This early phase set the stage for the company's evolution and its eventual prominence.

In the early 1940s, Hershell Farmer, Doc's son, took over the business, steering it toward providing shop towels and renaming it Acme Wiper and Industrial Laundry. This shift reflected a strategic adaptation to meet the changing needs of industrial clients. Later, Richard 'Dick' Farmer, Hershell's son, joined the company in 1957, contributing significantly to its expansion and transformation.

Under Dick Farmer's leadership, the company expanded into uniform rental in 1959, and by 1964, it was renamed Acme Uniform and Towel Supply. This move marked a critical step toward diversification and growth. The company officially changed its name to Cintas in 1972 and went public in 1983, solidifying its position in the market.

Founded in 1929 as Acme Industrial Laundry Company by Richard and Amelia Farmer.

Hershell Farmer took over in the early 1940s, shifting focus to shop towels.

Dick Farmer introduced uniform rental in 1959, a pivotal move.

Renamed Acme Uniform and Towel Supply in 1964 and Cintas in 1972.

Cintas became a publicly traded company in 1983.

Early management, including the Farmer family, held significant stock ownership.

While specific early equity splits for the founders are not fully documented, Doc Farmer held a significant stake, owning 52% of the company during his tenure as chairman. This strong insider ownership was crucial in the company's early years. The company's success can be seen in its financial results, with the company's revenue reaching approximately $8.8 billion in fiscal year 2024. For more details on the company's target market, consider reading about the Target Market of Cintas.

- The Farmer family's significant stock ownership aligned their interests with the company's success.

- This structure fostered a culture of commitment and long-term vision from the outset.

- The company's evolution from a laundry service to a uniform and facility services giant showcases its strategic adaptability.

- The shift to uniform rental was a key driver of growth, expanding its service offerings.

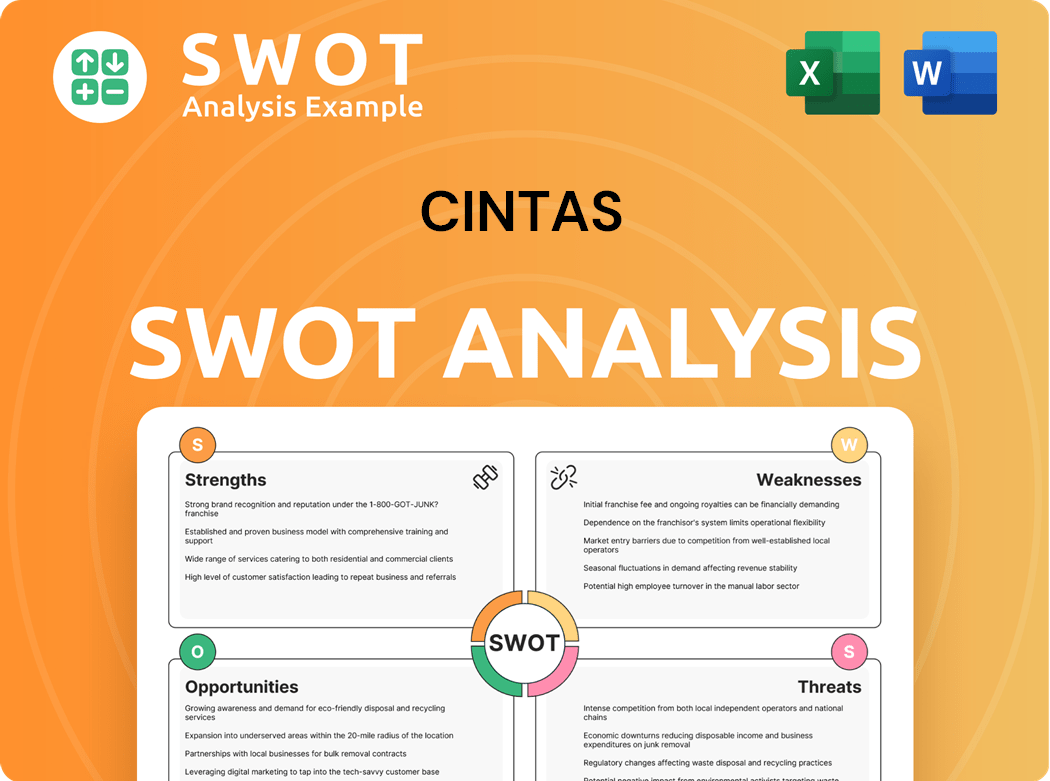

Cintas SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Cintas’s Ownership Changed Over Time?

The evolution of Cintas ownership has been marked by key milestones, starting with its initial public offering in 1983. This transition to a publicly traded entity significantly broadened its shareholder base. As of June 2025, the market capitalization of Cintas Corporation (CTAS) stands at approximately $89.63 billion USD, reflecting its substantial growth and market presence over the years. The ownership structure has evolved to include a mix of institutional investors, insiders, and public shareholders, each playing a role in shaping the company's direction.

The company's strategic moves, including acquisitions, have also influenced its ownership landscape. For example, the acquisition of G&K Services in 2017 for $2.2 billion expanded Cintas's market reach. More recently, the buyouts of Paris Uniform Services (March 2024) and SITEX (February 2024) have further consolidated its position. These acquisitions, along with organic growth, have altered the company's financial profile and, consequently, the dynamics of its ownership.

| Ownership Category | Percentage of Shares | Approximate Shares Held (as of June 2025) |

|---|---|---|

| Institutional Shareholders | 64.20% | Data Not Available |

| Insiders | 10.96% | Data Not Available |

| Retail Investors | 24.84% | Data Not Available |

The major institutional shareholders, as of June 2025, include Vanguard Group Inc. with 37,859,304 shares, BlackRock, Inc. with 28,748,176 shares, and State Street Corp with 15,036,161 shares. The Farmer family, the original founders, maintains a significant stake, with nearly 40 family members collectively holding approximately 14% of the publicly traded firm as of February 2024. Scott D. Farmer, the founder's son and current Executive Chairman, is the largest individual shareholder, owning 27.26 million shares, representing 6.75% of the company as of May 2025. This long-term family involvement has been a key factor in the company's customer-centric approach. Learn more about the Revenue Streams & Business Model of Cintas.

Cintas's ownership structure includes institutional investors, insiders, and retail investors.

- Institutional investors hold a significant portion of the shares.

- The Farmer family, the founders, continue to have a substantial ownership stake.

- Strategic acquisitions have shaped the company's market position and ownership dynamics.

- The company's stock ticker symbol is CTAS.

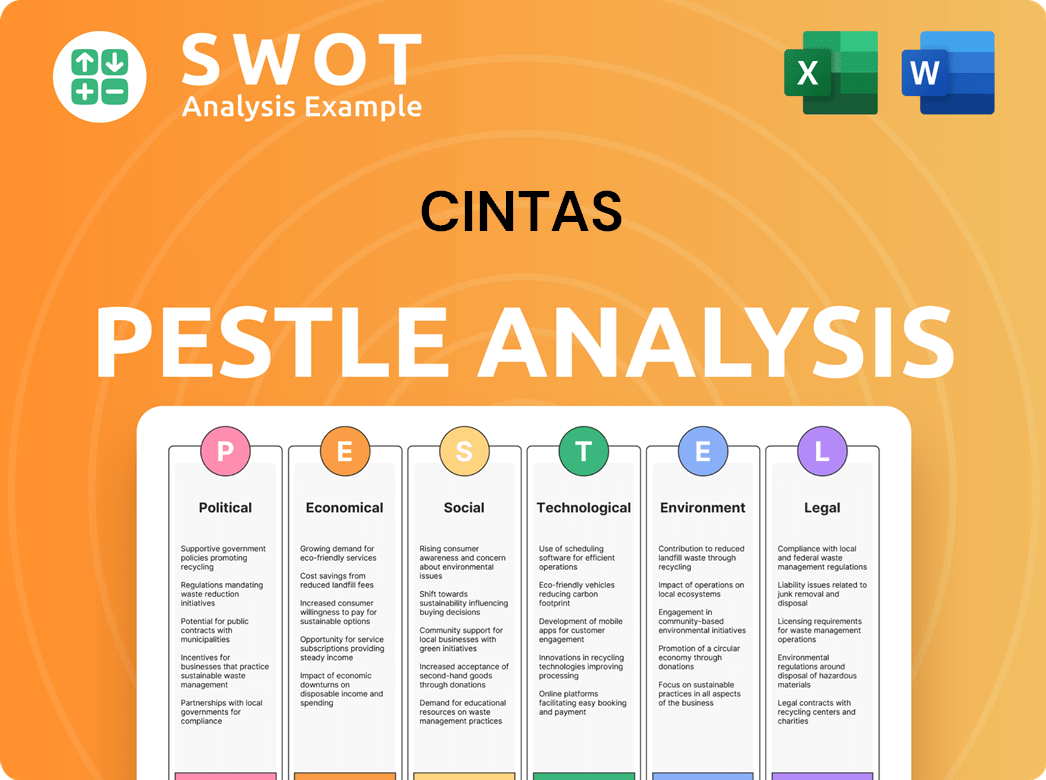

Cintas PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Cintas’s Board?

The Board of Directors at Cintas Corporation oversees the company's strategic direction and governance. The board typically consists of between 9 and 11 directors, a size the company deems appropriate and regularly reviews. Directors are elected by a majority vote, except in cases where the number of nominees exceeds the number of available director positions, in which case a plurality vote is used. The Nominating and Corporate Governance Committee is responsible for identifying and recommending candidates, with a focus on including qualified female and racially/ethnically diverse candidates.

The board's composition and oversight are critical for ensuring effective governance. The board's role includes setting strategic direction, overseeing financial performance, and ensuring compliance with legal and ethical standards. The company's commitment to diversity in its board nominations reflects a broader trend toward more inclusive corporate governance practices. The board's structure and processes directly impact the company's ability to adapt to market changes and maintain stakeholder confidence. The Marketing Strategy of Cintas is also influenced by the board's decisions.

| Director | Title | Since |

|---|---|---|

| Scott D. Farmer | Executive Chairman | 2003 |

| Todd M. Schneider | President and Chief Executive Officer | 2024 |

| J. Michael Hansen | Lead Independent Director | 2008 |

The voting structure at Cintas is based on a one-share-one-vote principle for common stock. Holders of common stock are entitled to one vote per share on all matters submitted to shareholders. The company's articles of incorporation limit the right of shareholders to call special meetings to holders of 50% or more of the voting shares. Additionally, directors can only be removed for cause and by a two-thirds affirmative vote of the shares entitled to vote. Scott D. Farmer, as Executive Chairman, holds a significant stake, reflecting the Farmer family's influence.

The Board of Directors at Cintas Corporation plays a crucial role in the company's governance and strategic oversight.

- The board size is typically between 9 and 11 directors.

- Directors are elected by a majority vote.

- The company uses a one-share-one-vote structure.

- Scott D. Farmer, the Executive Chairman, holds a significant individual stake.

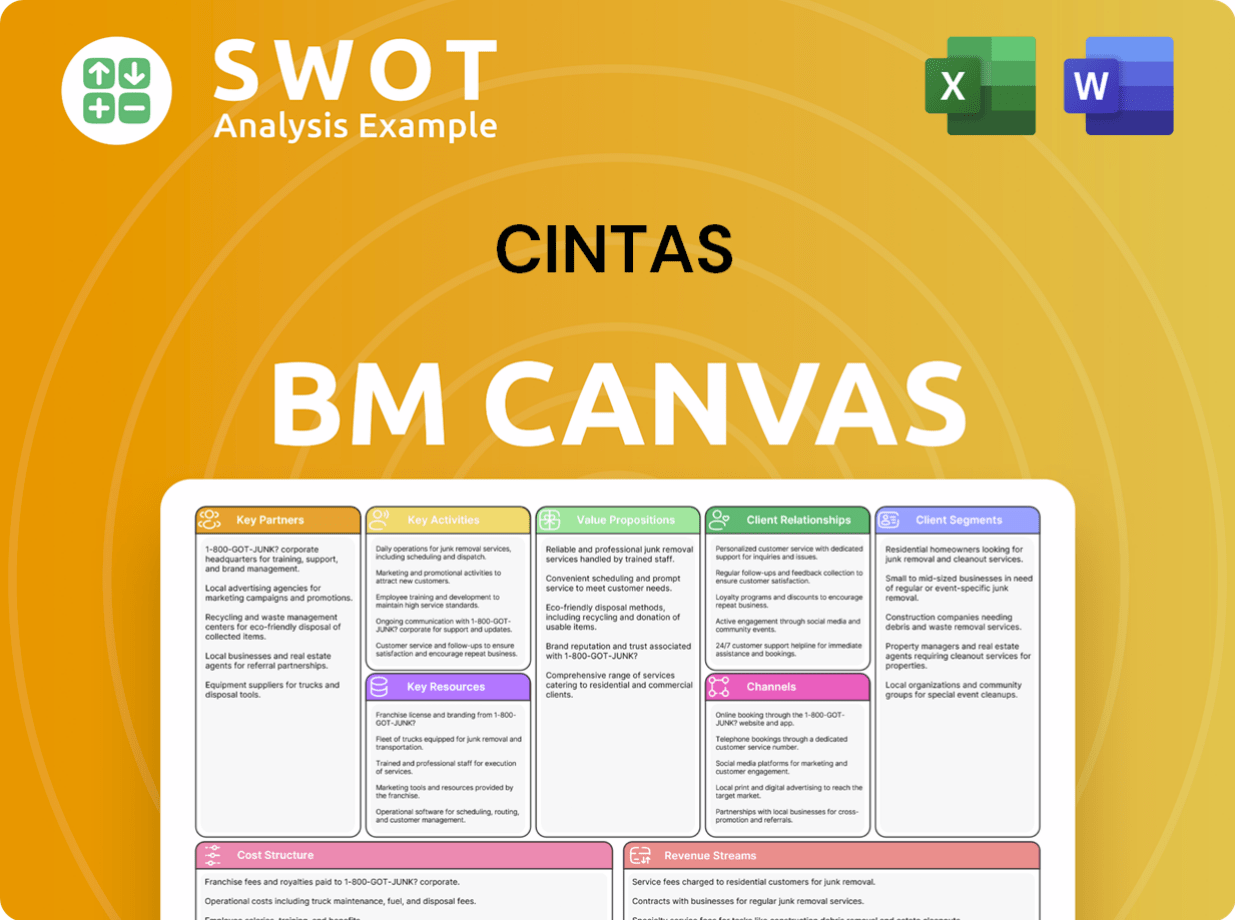

Cintas Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Cintas’s Ownership Landscape?

Over the past few years, Cintas's growth strategy has significantly influenced its ownership profile. For fiscal year 2025, the company projects revenues between $10.255 billion and $10.32 billion, reflecting an approximate 7.1% year-over-year increase. This growth, coupled with strategic financial moves, has shaped the landscape of who owns the

The

| Metric | Value | Year |

|---|---|---|

| Projected Revenue | $10.255 - $10.32 billion | Fiscal Year 2025 |

| Share Buybacks | $678.1 million | First Nine Months of Fiscal Year 2025 |

| Dividend Payments | $453.7 million | First Nine Months of Fiscal Year 2025 |

| Institutional Ownership | Approximately 64.07% | May 2025 |

Leadership transitions and strategic acquisitions also play a role in understanding the

Institutional investors hold approximately 64.07% of Cintas's stock as of May 2025, showing significant institutional interest. The Farmer family, while having seen some dilution, still maintains a significant ownership stake around 14%. This indicates a blend of institutional and family influence.

Todd Schneider became CEO in 2021, succeeding Scott Farmer, who remained as executive chairman. In April 2025, Scott Garula was appointed to replace Mike Hansen as CFO, starting May 31, 2025. These changes reflect the company's ongoing evolution.

Cintas projects strong revenue growth for fiscal year 2025, with an estimated range of $10.255 to $10.32 billion. The company is focused on share buybacks and dividend increases. Strategic acquisitions, like Paris Uniform Services and SITEX, are also part of the growth strategy.

Cintas terminated discussions about acquiring UniFirst Corporation in March 2025. This decision signals a shift towards other growth strategies, including smaller acquisitions and continued share buybacks. This strategic move impacts the future of the company.

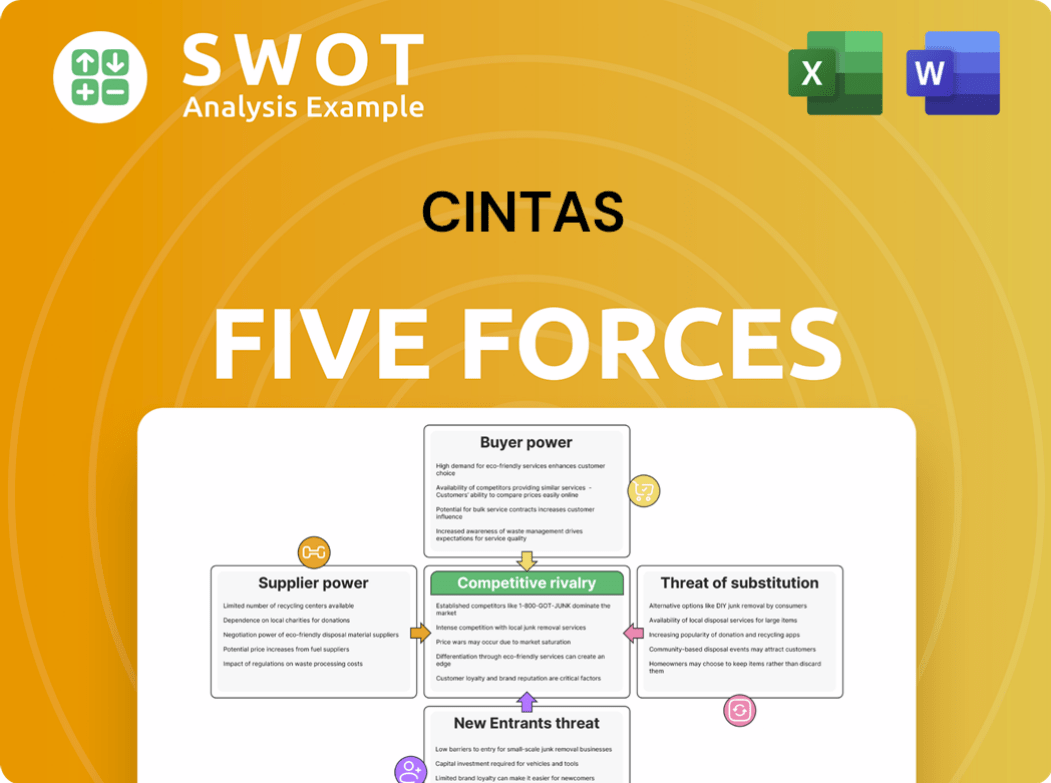

Cintas Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Cintas Company?

- What is Competitive Landscape of Cintas Company?

- What is Growth Strategy and Future Prospects of Cintas Company?

- How Does Cintas Company Work?

- What is Sales and Marketing Strategy of Cintas Company?

- What is Brief History of Cintas Company?

- What is Customer Demographics and Target Market of Cintas Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.