Credicorp Bundle

Who Really Owns Credicorp?

Unraveling the ownership structure of Credicorp is key for anyone looking to understand the company's trajectory. From its inception in 1995, Credicorp has been a pivotal player in the Peruvian financial market. Knowing the major Credicorp SWOT Analysis is the first step to understand the company.

This deep dive into Credicorp ownership will explore the evolution of its Credicorp shareholders, from its initial formation to its current status as a financial powerhouse. We'll examine the key players, including institutional investors and the board of directors, and provide insights into the Credicorp stock and the overall Credicorp structure. Understanding Who owns Credicorp is crucial for anyone interested in Credicorp financials.

Who Founded Credicorp?

The establishment of Credicorp Ltd. in 1995 marked a significant event in the financial landscape, primarily through a strategic exchange offer rather than a traditional founding by individual entrepreneurs. This unique approach involved the consolidation of existing financial institutions, setting the stage for a diversified financial services group. The company's formation was designed to acquire controlling stakes in prominent Peruvian financial entities.

Credicorp's formation was a strategic move to consolidate and integrate existing financial powerhouses. This approach facilitated the creation of a diversified financial services group. The company's structure and early ownership were shaped by the acquisition of major stakes in established Peruvian financial institutions.

The initial focus was on acquiring controlling interests in Banco de Crédito del Perú (BCP), Atlantic Security Holding Corporation (ASHC), and Pacífico Seguros (PPS). The acquisition of these entities was crucial in establishing Credicorp's early ownership structure. Credicorp's early ownership structure was characterized by the acquisition and consolidation of existing financial powerhouses, reflecting a vision of creating a diversified financial services group.

Credicorp's formation involved acquiring controlling stakes in key Peruvian financial institutions.

In October 1995, Credicorp acquired significant stakes in BCP, ASHC, and PPS.

Shares of Credicorp began trading on the NYSE soon after the acquisitions.

The company further solidified its control by acquiring remaining shares of ASHC in March 1996.

BCP, a key acquisition, has a long history dating back to 1889.

The initial public offering of Credicorp shares occurred shortly after the acquisitions.

The initial Credicorp ownership structure was defined by the acquisition of major stakes in established Peruvian financial institutions. This approach led to a rapid public listing on the New York Stock Exchange. The early Credicorp shareholders included a broad distribution of ownership, rather than concentrated founder ownership. The company's structure reflects a strategic move to consolidate and integrate existing financial powerhouses. For more insights into the company's market approach, consider reading about the Marketing Strategy of Credicorp.

- Credicorp's formation involved acquiring controlling stakes in key Peruvian financial institutions.

- In October 1995, Credicorp acquired significant stakes in BCP, ASHC, and PPS.

- Shares of Credicorp began trading on the NYSE soon after the acquisitions.

- The company further solidified its control by acquiring remaining shares of ASHC in March 1996.

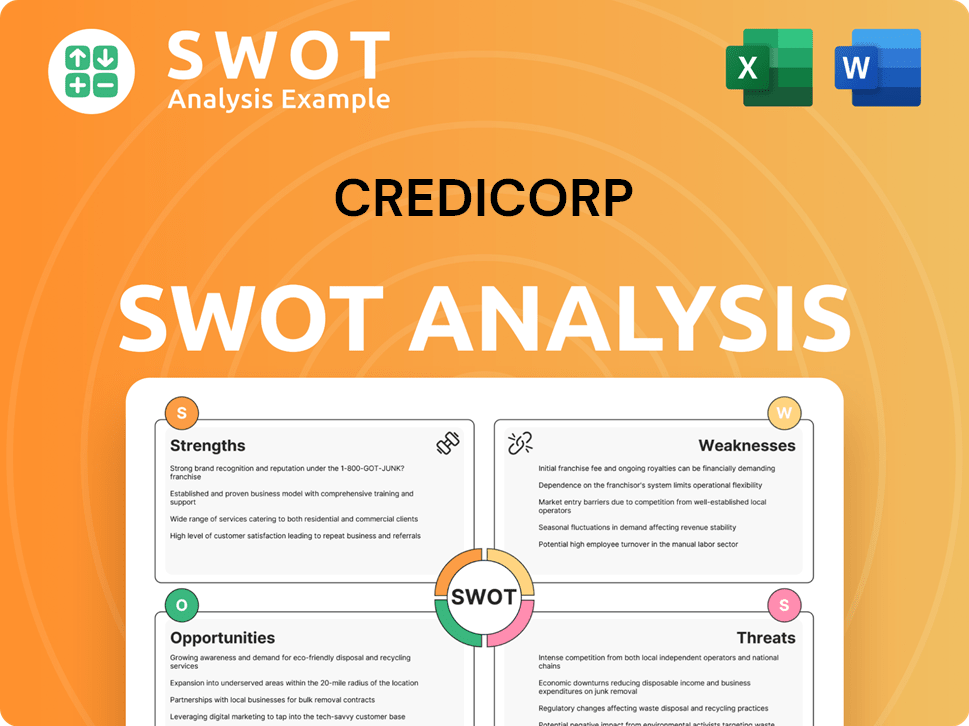

Credicorp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Credicorp’s Ownership Changed Over Time?

The evolution of Credicorp's ownership has been marked by significant milestones since its initial public offering (IPO) on the New York Stock Exchange in October 1995. The company's debut share price was US$11.61 (adjusted for stock dividends). As of June 12, 2025, Credicorp's market capitalization has reached $17.35 billion, reflecting its growth and market performance over the years. This growth is a key indicator of the company's financial health and its ability to attract and retain investors.

Credicorp's ownership structure is currently dominated by institutional investors. According to data from June 5, 2025, Credicorp Ltd. (US:BAP) has 627 institutional owners and shareholders, collectively holding 67,039,144 shares. Key institutional shareholders include Dodge & Cox, BlackRock, Inc., and Fmr Llc. The Romero Family remains a notable major stakeholder, holding 14.58% of shares, equivalent to 11,596,742 shares, while Atlantic Security Holding Corp. holds 18.38%, or 14,620,846 shares. These figures demonstrate the significant influence of institutional investors and the ongoing interest in Credicorp stock.

| Shareholder | Shares Held (as of June 5, 2025) | Percentage of Ownership |

|---|---|---|

| Dodge & Cox | Data not available | Data not available |

| BlackRock, Inc. | Data not available | Data not available |

| Fmr Llc | Data not available | Data not available |

| Romero Family | 11,596,742 | 14.58% |

| Atlantic Security Holding Corp. | 14,620,846 | 18.38% |

The company's strategic acquisitions have also played a crucial role in shaping its ownership and structure. In 2012, Credicorp expanded its footprint by acquiring majority stakes in Correval (Colombia) and IM Trust (Chile), forming Credicorp Capital. The acquisition of Ultraserfinco in Colombia in 2019 further strengthened its regional presence. More recently, on March 13, 2025, Credicorp completed the acquisition of Empresas Banmédica's remaining 50% interest, becoming the sole owner of both the private medical insurance business and Pacífico S.A. Entidad Prestadora de Salud (Pacífico EPS) in Peru. These moves reflect a strategy of consolidation and regional expansion, impacting its governance and market position. For more insights into Credicorp's strategic direction, consider reading about the Growth Strategy of Credicorp.

Credicorp's ownership structure is primarily influenced by institutional investors and major shareholders like the Romero Family. Recent acquisitions and strategic moves have reshaped the company's structure.

- Institutional investors hold a significant portion of Credicorp stock.

- The Romero Family and Atlantic Security Holding Corp. are major stakeholders.

- Strategic acquisitions have expanded Credicorp's regional presence.

- Credicorp's market cap is $17.35 billion as of June 12, 2025.

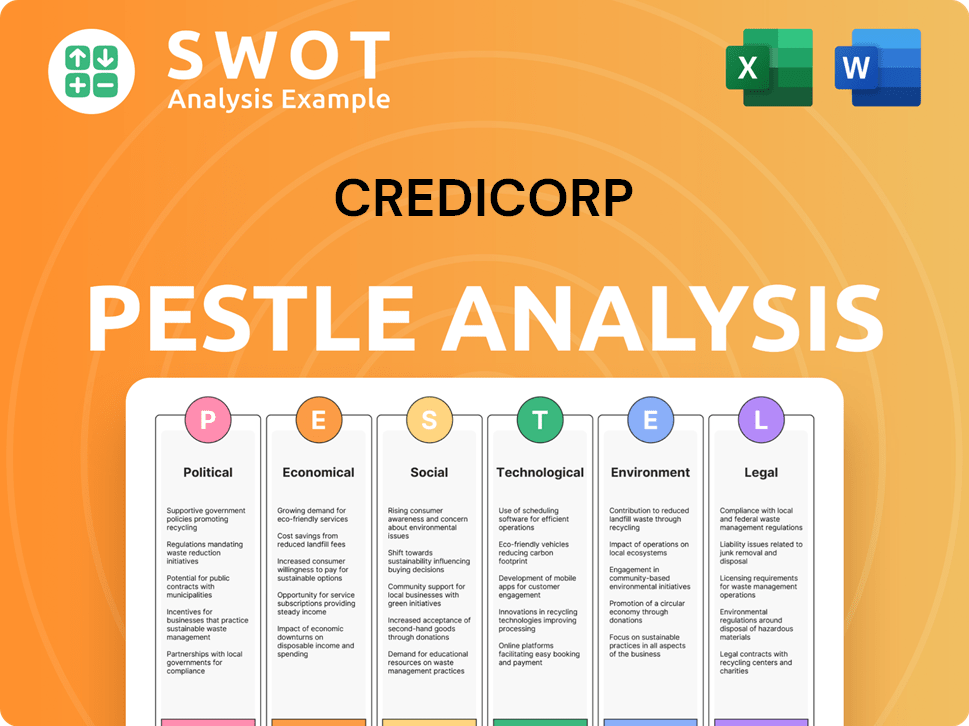

Credicorp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Credicorp’s Board?

The Board of Directors of Credicorp Ltd. is pivotal in governing the company, with members representing major shareholders, long-standing figures, and independent members. Luis Romero Belismelis has been the Chairman since 1995, bringing extensive experience from his previous role as Chairman of Banco de Crédito del Perú. Other key figures include Reynaldo Llosa and Mr. Verme, both with long tenures as directors of Banco de Crédito del Perú and Credicorp since the 1990s. Mr. Yarur, who joined the Credicorp board in 2002, also served as a director of Banco de Crédito del Perú. Mr. Ortiz de Zevallos, an independent board member since 2005, adds to the board's oversight.

The board's composition suggests a balance between continuity and independent oversight. The presence of long-serving directors, some with ties to the company's founding and major shareholders, indicates their influence. Independent members contribute to the board's balance. The board has the power to delegate day-to-day management, as per the by-laws. The specific voting structure is not detailed in the provided information, but the board's structure suggests a focus on stability and experienced leadership.

| Director | Role | Tenure |

|---|---|---|

| Luis Romero Belismelis | Chairman | Since 1995 |

| Reynaldo Llosa | Director | Since 1995 |

| Mr. Verme | Director | Since 1995 |

| Mr. Yarur | Director | Since 2002 |

| Mr. Ortiz de Zevallos | Independent Director | Since 2005 |

Understanding the Credicorp ownership structure is crucial for investors. The board's composition, including long-tenured members and independent directors, provides insight into the company's governance. Examining the board of directors and their roles helps to understand the dynamics of Credicorp shareholders and how they influence the company. For more detailed information on Credicorp's financial performance, you can refer to other resources.

The Board of Directors at Credicorp includes a mix of long-standing members and independent directors, ensuring experienced leadership and oversight.

- The Chairman, Luis Romero Belismelis, has been in the role since 1995, bringing extensive experience.

- Long-serving directors like Reynaldo Llosa and Mr. Verme, along with independent members, contribute to a balanced governance structure.

- The board's structure reflects a focus on stability and experienced leadership, crucial for understanding Credicorp's ownership.

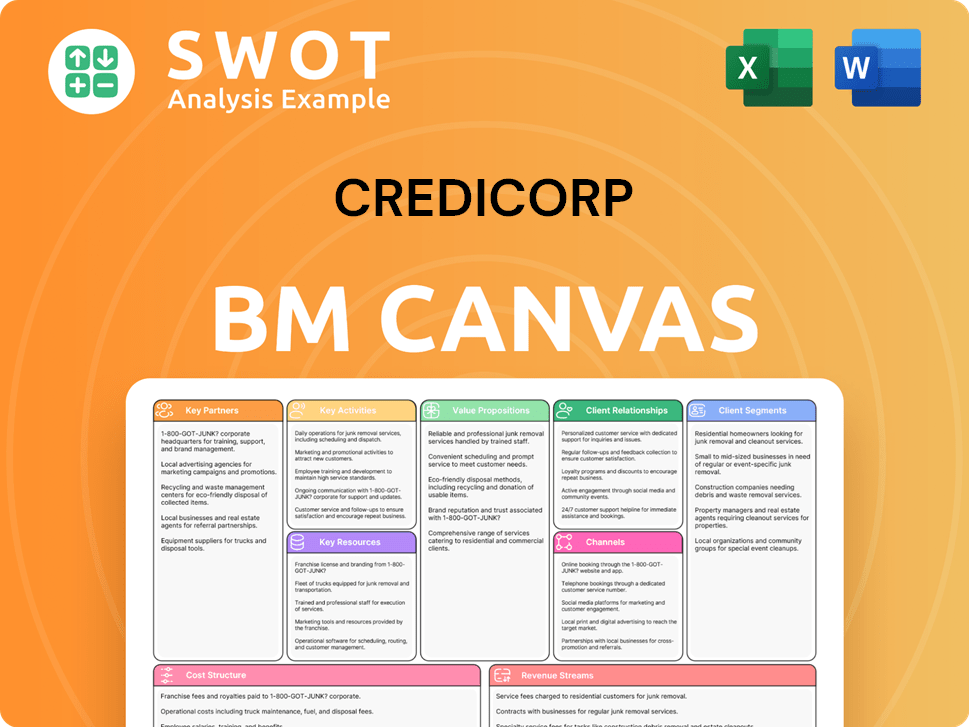

Credicorp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Credicorp’s Ownership Landscape?

Over the past few years, the ownership landscape of Credicorp has seen notable shifts and strategic moves. A significant development was the full acquisition of Empresas Banmédica's remaining stake in a joint venture, finalized on March 13, 2025. This move solidified Credicorp's control over its private medical insurance and Pacífico EPS operations in Peru. Furthermore, Credicorp acquired Joinnus, a Peruvian event ticketing startup, expanding into digital services through its venture capital arm, Krealo. These actions reflect Credicorp's focus on strengthening its position in the insurance and healthcare sectors, as well as its commitment to the Peruvian entrepreneurial ecosystem.

In terms of shareholder returns, Credicorp declared a cash dividend of S/40.00 per share for the fiscal year 2024, totaling S/3,775,292,680.00, set to be paid on June 13, 2025, to shareholders of record on May 19, 2025. This dividend reflects the company's solid financial performance in 2024 and its ability to generate sustainable earnings. Examining the structure of Credicorp ownership, as of June 5, 2025, the company had 627 institutional owners, holding over 67 million shares. The regular filings with the SEC, like the Form 20-F for the year ended December 31, 2024, filed on April 25, 2025, and quarterly earnings releases, provide transparency on the company's financial health and potential ownership changes.

Institutional investors actively manage their positions in Credicorp. For instance, in Q4 2024, ITAU UNIBANCO HOLDING S.A. and CANADA PENSION PLAN INVESTMENT BOARD increased their holdings significantly, while GENESIS INVESTMENT MANAGEMENT, LLP and MONDRIAN INVESTMENT PARTNERS LTD. decreased theirs. This highlights the dynamic nature of Credicorp shareholders and the ongoing adjustments by major institutional investors. To understand more about the company's financial strategy, you can explore Target Market of Credicorp.

| Key Development | Date | Details |

|---|---|---|

| Acquisition of Banmédica JV | March 13, 2025 | Credicorp became the sole owner of the private medical insurance business and Pacífico EPS in Peru. |

| Acquisition of Joinnus | Completed | Expansion into digital services via Krealo. |

| 2024 Dividend | June 13, 2025 | S/40.00 per share, totaling S/3,775,292,680.00. |

Credicorp is a publicly traded company, with a significant portion of its stock held by institutional investors. The company's ownership structure is dynamic, with regular adjustments by major shareholders.

Key institutional holders include ITAU UNIBANCO HOLDING S.A., CANADA PENSION PLAN INVESTMENT BOARD, and others. These investors actively manage their positions, influencing the company's stock performance.

Credicorp has expanded its portfolio through strategic acquisitions, such as the full acquisition of Empresas Banmédica's joint venture and the purchase of Joinnus. These moves align with the company's growth strategy.

Credicorp's strong financial performance in 2024 allowed it to declare a substantial cash dividend of S/40.00 per share, reflecting its ability to generate sustainable earnings and reward shareholders.

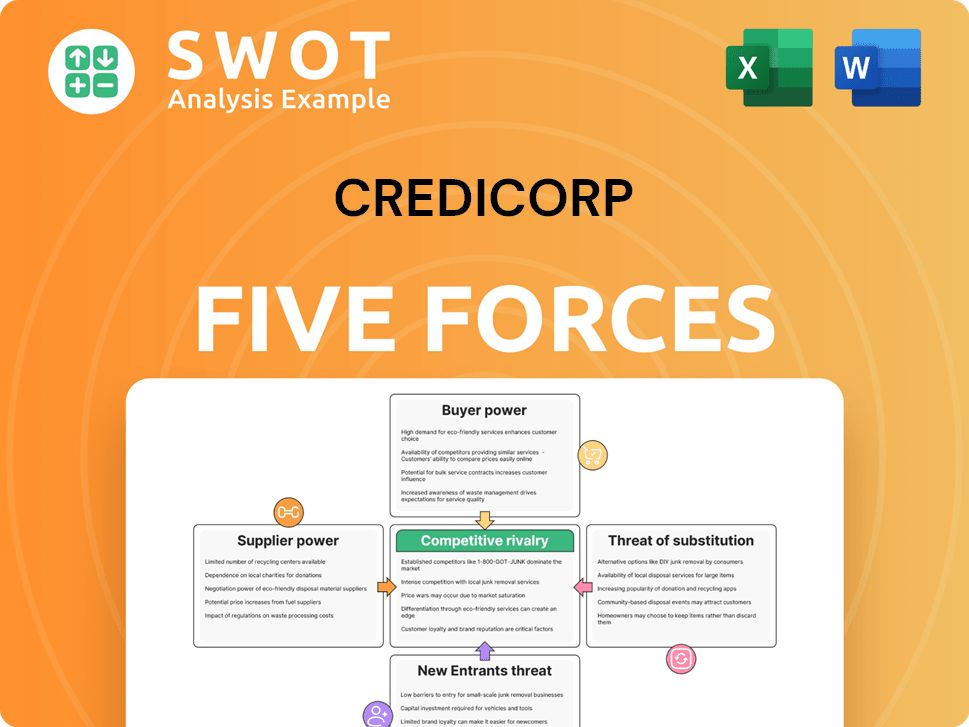

Credicorp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Credicorp Company?

- What is Competitive Landscape of Credicorp Company?

- What is Growth Strategy and Future Prospects of Credicorp Company?

- How Does Credicorp Company Work?

- What is Sales and Marketing Strategy of Credicorp Company?

- What is Brief History of Credicorp Company?

- What is Customer Demographics and Target Market of Credicorp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.