Denali Therapeutics Bundle

Who Really Controls Denali Therapeutics?

Understanding who owns Denali Therapeutics is crucial for anyone tracking the biotechnology sector. This knowledge unlocks insights into the company's strategic priorities, its access to capital, and its potential for growth in the competitive landscape of neurodegenerative disease research. Unraveling the Denali Therapeutics SWOT Analysis will help you understand the company's position.

Founded in 2013, Denali Therapeutics has quickly become a key player, and its ownership structure reflects its evolution from a startup to a publicly traded entity. This analysis will explore the major stakeholders, including institutional investors and the Denali Therapeutics executives, providing a comprehensive view of who shapes the company's future. Delving into the Denali Therapeutics ownership structure offers a window into its financial health and long-term prospects, including its stock performance and market cap.

Who Founded Denali Therapeutics?

The story of Denali Therapeutics begins in August 2013, with its co-founding by a team of accomplished scientists and executives. The company was formed with a clear vision: to tackle neurodegenerative diseases. This focus, combined with the founders' deep expertise, was crucial in attracting early investment and setting the stage for Denali's future.

Key figures behind Denali's inception include Ryan Watts, Ph.D., Marc Tessier-Lavigne, Ph.D., and Alexander Schuth, M.D., Ph.D. Each brought extensive experience from leadership roles at Genentech, a major player in the biotechnology industry. Their combined expertise in neuroscience and drug development formed the foundation of Denali's innovative approach to treating brain disorders.

The founders' initial equity stakes aren't publicly detailed. However, it's typical for scientific founders to hold significant portions of the company in its early stages. Denali's initial funding round of $217 million indicates strong investor confidence from the start. This early backing from venture capital firms, alongside the founders' contributions, shaped the original distribution of control within the company.

The founders of Denali Therapeutics included Ryan Watts, Marc Tessier-Lavigne, and Alexander Schuth.

Denali secured a $217 million Series A financing round.

The founders brought extensive experience in neuroscience and drug development from Genentech.

Denali's initial focus was on developing treatments for neurodegenerative diseases.

Early investors, including venture capital firms, acquired significant equity alongside the founders.

Early agreements included standard vesting schedules to ensure founder commitment over time.

The initial ownership of Denali Therapeutics was shaped by a significant Series A funding round, which brought in venture capital firms alongside the founders. While the exact equity distribution among the founders isn't public, their substantial experience and the large initial investment suggest they retained considerable stakes. Early agreements likely included vesting schedules to ensure the founders remained committed. This early structure was crucial in setting the stage for Denali's growth and its approach to tackling neurodegenerative diseases.

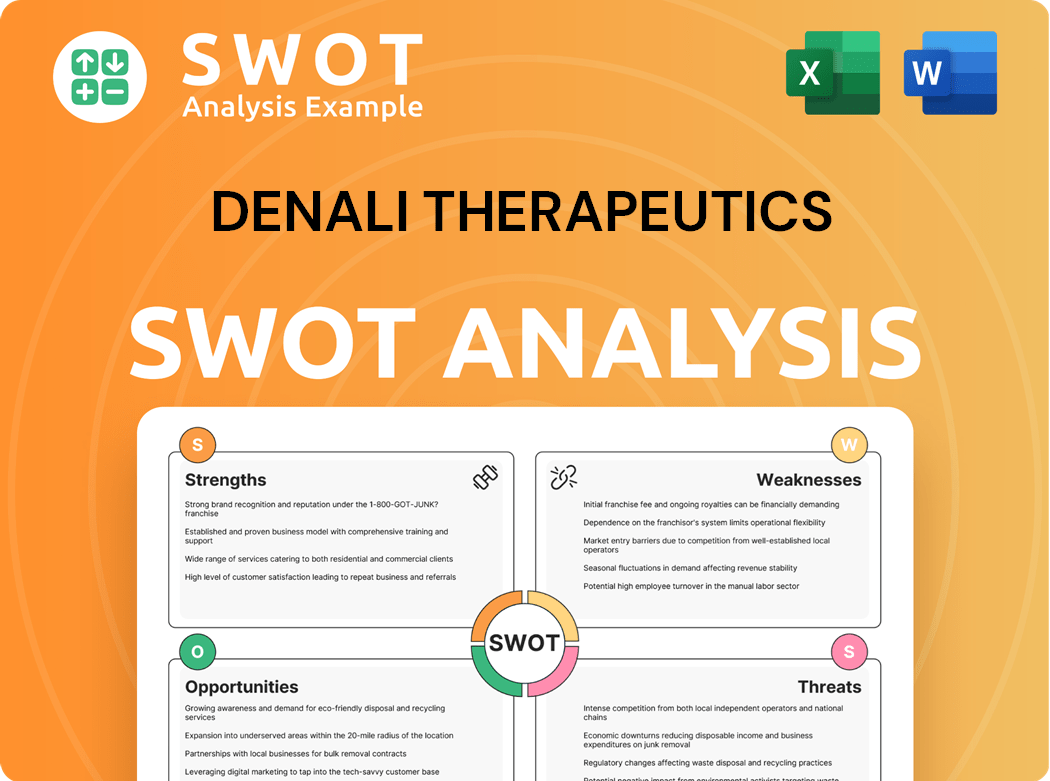

Denali Therapeutics SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Denali Therapeutics’s Ownership Changed Over Time?

The ownership structure of Denali Therapeutics has significantly evolved since its inception. A pivotal moment was the Initial Public Offering (IPO) on December 8, 2017. The IPO involved the offering of 15,000,000 shares of common stock at $18.00 per share, resulting in approximately $270 million in gross proceeds. This transition marked a shift from private, venture-backed ownership to a publicly traded model, broadening the investor base to include various institutional and individual investors. This strategic move provided Denali with increased capital and visibility within the biotechnology sector.

The evolution of Denali Therapeutics' ownership structure is a dynamic process, influenced by various factors including market performance, strategic partnerships, and further equity offerings. Understanding the ownership landscape is crucial for investors and stakeholders alike, as it provides insights into the company's governance, strategic direction, and long-term prospects. The shift towards institutional ownership often reflects confidence in the company's growth potential and its ability to execute its strategic objectives in the competitive pharmaceutical market. For a deeper dive into their marketing approaches, you can explore the Marketing Strategy of Denali Therapeutics.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | December 8, 2017 | Transitioned from private to public ownership; broadened investor base. |

| Subsequent Equity Offerings | Ongoing | Dilution of existing shareholders' stakes; increased capital for operations and research. |

| Institutional Investment | Ongoing | Increased institutional ownership; potential influence on company strategy and governance. |

As of early 2025, Denali Therapeutics ownership is largely held by institutional investors. Major institutional shareholders include investment management firms and mutual funds. For example, as of March 31, 2025, The Vanguard Group, Inc. held 10.74% of Denali's shares, and BlackRock, Inc. held 8.49%. Other significant institutional holders include FMR LLC (Fidelity Management & Research Company LLC) and Capital Research Global Investors. The founders retain stakes, but their ownership has diluted over time due to subsequent equity offerings and the IPO. The concentration of ownership among major institutional investors can influence company strategy and governance through their significant voting power.

Denali Therapeutics' ownership structure has transformed significantly since its IPO. The transition from a privately held company to a publicly traded entity has reshaped its investor base.

- Institutional investors hold a major portion of the company's shares.

- The IPO raised substantial capital, aiding research and development.

- Ownership concentration among institutional investors can impact strategic decisions.

- Understanding ownership is key for investors assessing long-term prospects.

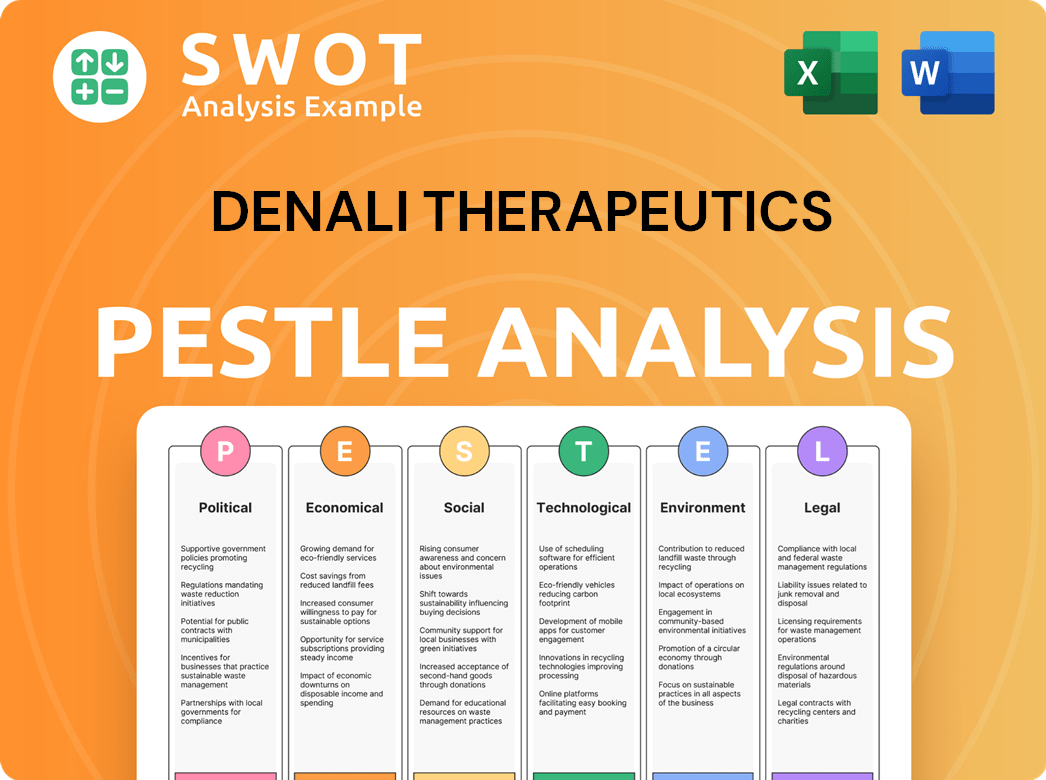

Denali Therapeutics PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Denali Therapeutics’s Board?

The Board of Directors of Denali Therapeutics, as of early 2025, is composed of individuals with expertise in the biotechnology and pharmaceutical industries. Key figures include Ryan Watts, Ph.D., the Chief Executive Officer and co-founder, ensuring founder representation. The board also includes independent directors and representatives from major institutional investors and venture capital firms. This structure aims to provide a balance of perspectives for effective governance. Understanding the Growth Strategy of Denali Therapeutics is also essential when evaluating the board's decisions.

The board's composition reflects a strategic approach to governance, balancing founder representation with the interests of major shareholders and independent oversight. The presence of independent directors is crucial for ensuring unbiased decision-making and effective oversight of the company's operations. The board's role is pivotal in guiding the company's strategic direction, overseeing financial performance, and ensuring compliance with regulatory requirements. The board's decisions significantly influence Denali Therapeutics' trajectory in the competitive biotechnology market.

| Board Member | Title | Affiliation |

|---|---|---|

| Ryan Watts, Ph.D. | Chief Executive Officer | Denali Therapeutics |

| (Information not publicly available as of early 2025) | Director | (Information not publicly available as of early 2025) |

| (Information not publicly available as of early 2025) | Director | (Information not publicly available as of early 2025) |

Denali Therapeutics operates with a one-share-one-vote structure, ensuring that voting power is directly proportional to equity ownership. This standard voting structure means that each share of common stock entitles the holder to one vote on all matters submitted to a vote of stockholders. The absence of dual-class shares or special voting arrangements maintains a straightforward alignment between ownership and voting rights. Institutional investors hold significant stakes, and their collective voting power influences key corporate decisions. There have been no widely publicized proxy battles or activist investor campaigns against Denali Therapeutics, as of early 2025.

The voting structure at Denali Therapeutics is straightforward, with one share equating to one vote, which is a common practice. The influence of large institutional investors is considerable, affecting significant corporate decisions.

- One-share-one-vote structure.

- Institutional investors hold significant influence.

- Voting power directly proportional to equity ownership.

- No special voting arrangements are publicly known.

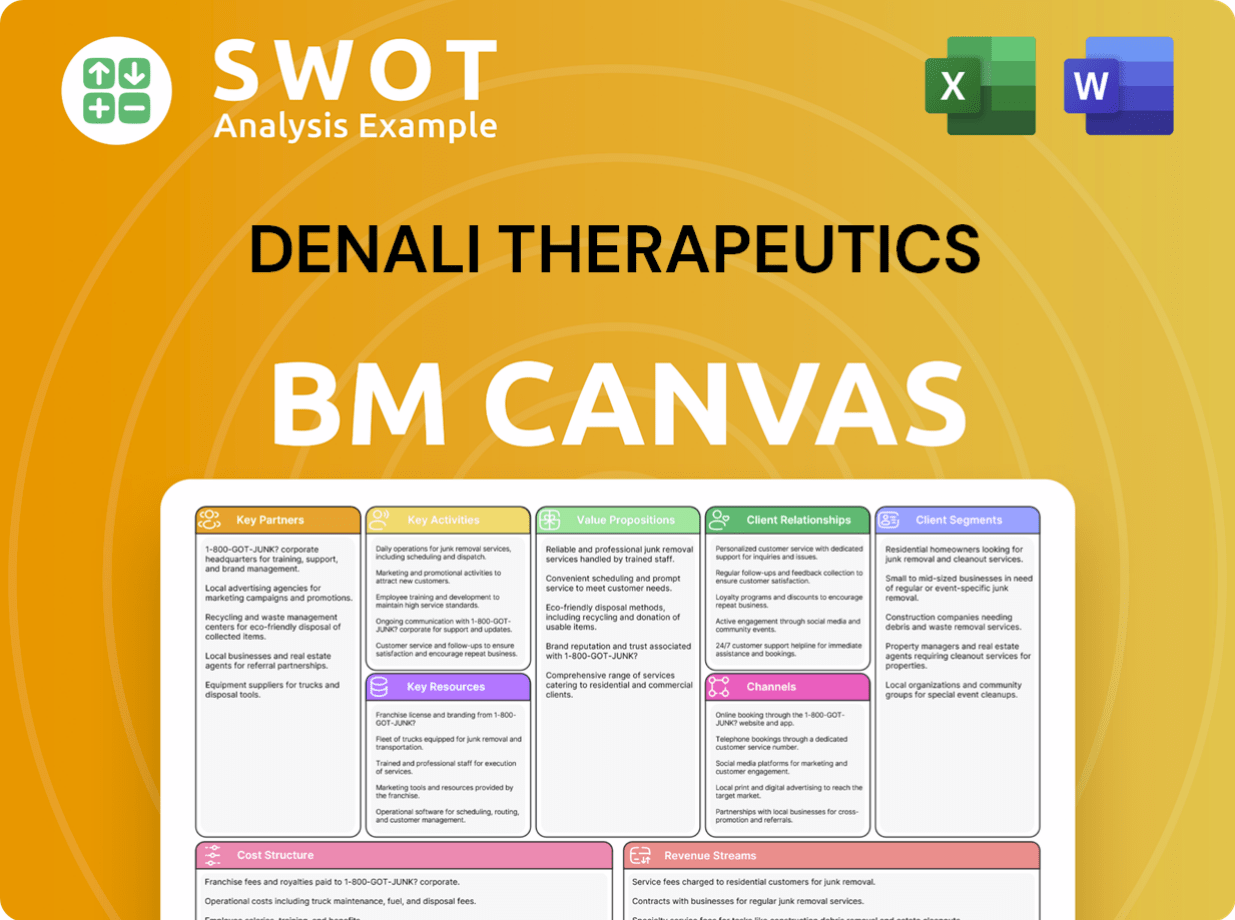

Denali Therapeutics Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Denali Therapeutics’s Ownership Landscape?

Over the past three to five years, Denali Therapeutics has experienced shifts in its ownership profile, influenced by its research and development activities. Collaborations with larger pharmaceutical companies, such as the ongoing partnership with Biogen, can attract new institutional investors. These partnerships often de-risk development and provide additional funding, impacting Denali Therapeutics investors.

Industry trends also play a role in Denali Therapeutics ownership. The biotechnology sector has seen increased institutional ownership as large funds seek exposure to innovative therapies and growth opportunities. While founder dilution is a natural consequence of multiple funding rounds and IPOs, the core leadership team at Denali, including co-founder and CEO Ryan Watts, remains instrumental in driving the company's strategy and vision. As Denali Therapeutics progresses its clinical pipeline and potentially brings new therapies to market, its financial performance and market capitalization could lead to further shifts in its institutional ownership profile and attract a broader range of investors.

| Metric | Value (as of Q1 2024) | Source |

|---|---|---|

| Market Capitalization | Approximately $4.7 billion | Yahoo Finance |

| Institutional Ownership | Around 80% | Nasdaq.com |

| Cash and Equivalents | $1.16 billion | Denali Therapeutics Q1 2024 Earnings Report |

The biotechnology sector's dynamic nature means that Denali Therapeutics stock ownership can change. No public statements have been made regarding future ownership changes or potential privatization. For a better understanding of the competitive environment, consider reading the Competitors Landscape of Denali Therapeutics.

Major shareholders include institutional investors and key executives. The exact percentage of ownership varies over time due to trading activity. Understanding Denali Therapeutics major shareholders provides insight into the company's direction.

The leadership team, including the CEO, significantly influences company strategy. The Denali Therapeutics executives and board of directors shape the company's decisions. This impacts the perception of investors and the Denali Therapeutics stock price history.

Denali Therapeutics financial reports and Denali Therapeutics annual revenue are critical for assessing the company's performance. Monitoring the Denali Therapeutics market cap and financial health is crucial for investors. Understanding these factors helps inform investment decisions.

Interested investors can learn how to invest in Denali Therapeutics through various brokerage platforms. The Denali Therapeutics stock symbol is essential for tracking the stock. Stay informed about the company's progress by following its Denali Therapeutics research and development and Denali Therapeutics drug pipeline.

Denali Therapeutics Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Denali Therapeutics Company?

- What is Competitive Landscape of Denali Therapeutics Company?

- What is Growth Strategy and Future Prospects of Denali Therapeutics Company?

- How Does Denali Therapeutics Company Work?

- What is Sales and Marketing Strategy of Denali Therapeutics Company?

- What is Brief History of Denali Therapeutics Company?

- What is Customer Demographics and Target Market of Denali Therapeutics Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.