Haverty Furniture Bundle

Who Really Owns Haverty Furniture?

Uncover the intricate ownership structure of Haverty Furniture, a company steeped in history and navigating a dynamic retail landscape. With a recent CEO succession plan announced for January 1, 2025, understanding the key players behind Haverty's is more crucial than ever. From family roots to institutional investors, this analysis provides a comprehensive view of who shapes the future of this iconic furniture retailer.

Founded in 1885, Haverty Furniture SWOT Analysis has evolved significantly, making understanding its ownership a key to grasping its strategic direction. Exploring "Who owns Haverty's" reveals a fascinating journey from its family-owned beginnings to its current status as a publicly traded company. This exploration will provide insights into the stakeholders influencing Haverty's, its operational strategies, and its position within the competitive retail furniture market. The shift in leadership and the company's financial performance, including its first-quarter 2024 results, further highlight the importance of understanding the company's ownership dynamics.

Who Founded Haverty Furniture?

The story of Haverty Furniture Company, a prominent name in the retail furniture industry, began in 1885. The company was founded in Atlanta, Georgia, by James Joseph (J.J.) Haverty and his brother Michael Haverty. This marked the start of what would become a significant presence in the furniture market.

Initially, the brothers launched their venture with a modest capital of $600 from J.J. Haverty and an equal amount borrowed. This initial investment funded a single storefront, setting the foundation for the company's future expansion. The early years were crucial for establishing the brand and laying the groundwork for growth.

In 1889, the Havertys partnered with Amos G. Rhodes, owner of a neighboring furniture store. This collaboration led to the formation of the Rhodes-Haverty Furniture Company. The new entity issued 200 shares of stock, which were distributed among the three partners, marking a shift toward a more structured ownership model.

The initial investment included $600 from J.J. Haverty and an equal amount in borrowed capital. This funding was used to establish the first storefront in Atlanta.

In 1889, the company partnered with Amos G. Rhodes to form Rhodes-Haverty Furniture Company. This partnership issued 200 shares of stock.

J.J. Haverty expanded the business westward to St. Louis, Missouri, and acquired interests in smaller showrooms. This expansion was key to establishing a wider market presence.

The partnership with Rhodes dissolved amicably in November 1908. Stores were divided, and J.J. Haverty purchased the main Atlanta location.

After the split, the business reverted to its original name, Haverty Furniture Company. This marked a return to its roots and a focus on the Haverty family's vision.

Following the split, the 200 ownership shares were distributed among members of the Haverty family. This structure solidified the family's control.

Understanding the evolution of Haverty's ownership provides insight into its long-term strategies. The company's history reflects a transition from a partnership to a family-focused structure, which has influenced its growth and market position. For more detailed information, you can read about the Growth Strategy of Haverty Furniture.

- Founders: J.J. Haverty and Michael Haverty.

- Early Partnership: Rhodes-Haverty Furniture Company, with 200 shares issued.

- Dissolution: The split in 1908 led to the company reverting to its original name.

- Family Control: Ownership shares were distributed among the Haverty family members.

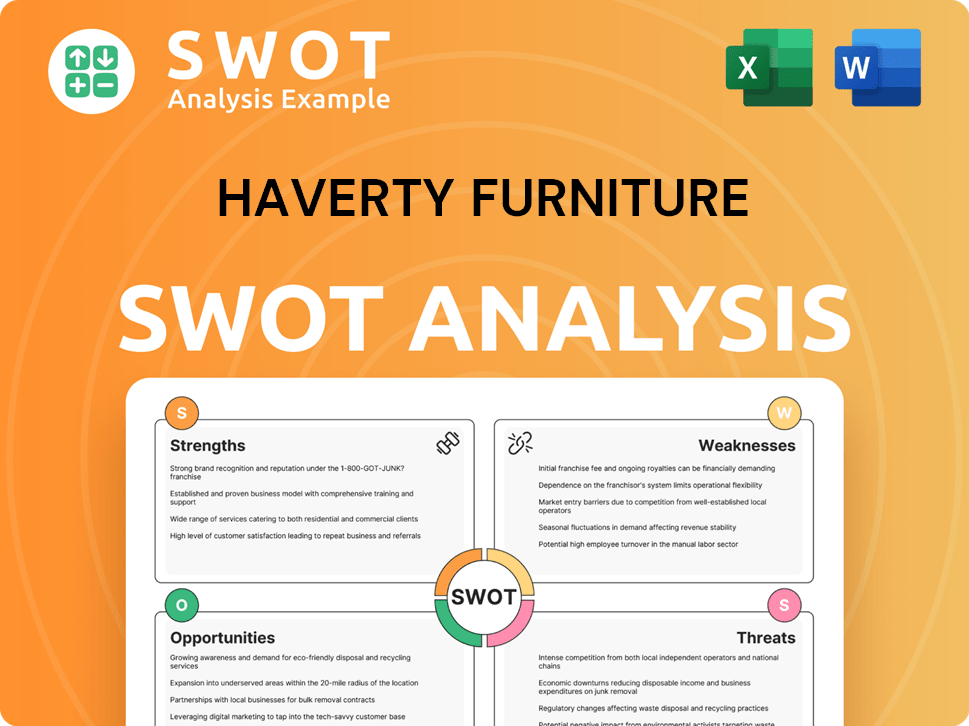

Haverty Furniture SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Haverty Furniture’s Ownership Changed Over Time?

The journey of Haverty Furniture Companies, Inc. into the public domain began on October 1, 1929. This strategic move, listing shares on the New York Stock Exchange (NYSE: HVT), provided access to capital for expansion. The company also trades Class A common stock under the ticker (NYSE: HVTA). This initial public offering (IPO) was a pivotal moment, enabling growth just before the onset of economic challenges.

The ownership structure of Haverty's has evolved, with institutional investors holding a significant stake. This evolution reflects the company's growth and its position in the retail furniture market. Understanding the ownership structure is crucial for investors and stakeholders alike, providing insights into the company's strategic direction and financial stability.

| Key Events | Impact | Date |

|---|---|---|

| Initial Public Offering (IPO) | Transition to a publicly traded company, access to capital markets | October 1, 1929 |

| Institutional Investment | Significant ownership by institutional investors | Ongoing |

| Insider Holdings | Slight increase in insider ownership | May 2025 |

As of May 2025, institutional investors hold a substantial portion of Haverty's stock, with their ownership remaining at 78.64%. Major institutional shareholders as of March 31, 2025, include BlackRock, Inc., Dimensional Fund Advisors LP, Pzena Investment Management, Inc., The Vanguard Group, Inc., and Renaissance Technologies LLC. Insider holdings have slightly increased to 1.74% in May 2025. Clarence H. Smith, the Executive Chairman, remains the largest individual shareholder, owning 8.23% of the company as of May 2025. The company's ownership structure, which includes a mix of institutional investors, insiders, and retail shareholders, influences its strategic decisions and financial performance. For a deeper dive into how the company has grown, check out the Growth Strategy of Haverty Furniture.

Haverty Furniture's ownership is primarily composed of institutional investors, with a noticeable presence of insider ownership. This structure supports the company's strategic direction and financial health.

- Institutional ownership remains significant at 78.64% as of May 2025.

- Insider holdings have increased slightly to 1.74% in May 2025.

- Clarence H. Smith is the largest individual shareholder, holding 8.23% as of May 2025.

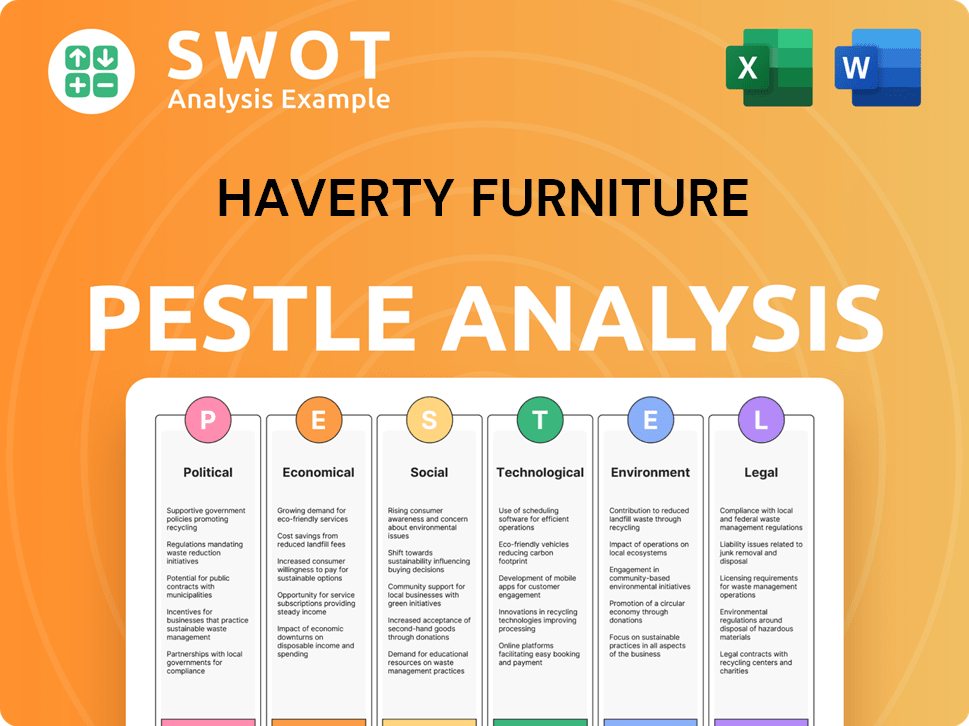

Haverty Furniture PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Haverty Furniture’s Board?

As of January 1, 2025, the board of directors of Haverty Furniture Companies, Inc. saw some key changes. Steven G. Burdette stepped into the roles of President and Chief Executive Officer and also joined the board. Clarence H. Smith, who previously served as CEO, now serves as Executive Chairman. Rawson Haverty, Jr., a former Senior Vice President of Real Estate and Development, is also a director. With Burdette's addition, the board now consists of 10 directors.

The current board structure reflects a blend of management and independent representation, ensuring diverse perspectives in decision-making. This composition is crucial for guiding the strategic direction of the company in the competitive retail furniture market. Understanding the leadership and their roles is key to grasping the operational dynamics of Haverty Furniture.

| Director | Title | Notes |

|---|---|---|

| Steven G. Burdette | President and CEO | Joined the board on January 1, 2025 |

| Clarence H. Smith | Executive Chairman | Former CEO |

| Rawson Haverty, Jr. | Director | Former Senior VP of Real Estate and Development |

Haverty Furniture operates with a dual-class share structure, which significantly impacts voting power. The Class A common stock (HVTA) offers superior voting rights compared to the common stock (HVT). HVTA holders have a 10:1 voting advantage on all matters subject to shareholder vote and separately elect 75% of the board of directors. While HVTA shares can be converted to HVT at any time, the reverse is not permitted. For investors looking into the company's structure, it's important to understand these differences in share classes. For more information, you can check out the Competitors Landscape of Haverty Furniture.

Haverty's ownership structure is split between common stock (HVT) and Class A common stock (HVTA).

- HVTA shares have a 10:1 voting advantage.

- HVTA holders vote separately for 75% of the board.

- HVTA shares can convert to HVT, but not the other way around.

- As of May 16, 2025, a cash dividend of $0.32 per share on common stock and $0.30 per share on Class A common stock.

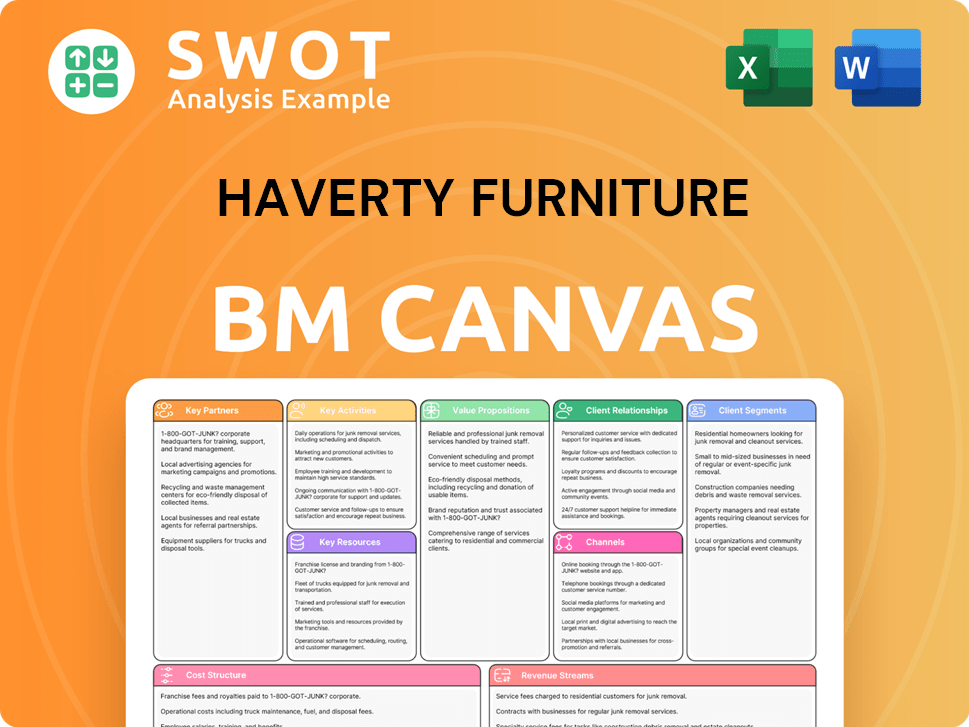

Haverty Furniture Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Haverty Furniture’s Ownership Landscape?

In the past few years, there have been notable shifts in the leadership and ownership of Haverty Furniture. On January 1, 2025, Clarence H. Smith retired as CEO and transitioned to Executive Chairman, with Steven G. Burdette taking over as President and CEO. This planned succession marks Burdette as only the 7th CEO in the company's long history.

Regarding Haverty's ownership, institutional investors continue to hold a significant portion of the company's stock. As of May 2025, institutional ownership remained stable at 78.64%. Insiders slightly increased their holdings from 1.63% to 1.74%. Major institutional investors, such as BlackRock, Inc. and The Vanguard Group, Inc., consistently maintain substantial shares. Some hedge funds, like Goldman Sachs Group Inc., increased their positions in the fourth quarter of 2024, while others, such as Jane Street Group, LLC, decreased their holdings.

| Shareholder Type | Ownership Percentage (May 2025) | Notable Investors |

|---|---|---|

| Institutional | 78.64% | BlackRock, Inc., Dimensional Fund Advisors LP, The Vanguard Group, Inc. |

| Insiders | 1.74% | |

| Other | Remaining |

Haverty's financial performance in early 2025 reflects market dynamics, including a weak housing market and low consumer confidence. For the first quarter ended March 31, 2025, consolidated sales decreased by 1.3% to $181.6 million, and comparable store sales decreased by 4.8% compared to the same period in 2024. Despite these challenges, the company reported improved gross margins of 61.2% in Q1 2025, up from 60.3% in Q1 2024, and diluted earnings per common share of $0.23, up from $0.14. The company returned $25.5 million to shareholders in full-year 2024. For more details, you can read about Revenue Streams & Business Model of Haverty Furniture.

Institutional investors dominate Haverty's ownership, holding a significant majority of the shares. Insiders also hold a small but notable percentage.

Steven G. Burdette became the new President and CEO on January 1, 2025, succeeding Clarence H. Smith.

Sales decreased slightly in Q1 2025, but gross margins improved, and the company returned capital to shareholders.

Haverty expects gross profit margins between 60.0% and 60.5% in 2025, with plans for capital expenditures and retail square footage expansion.

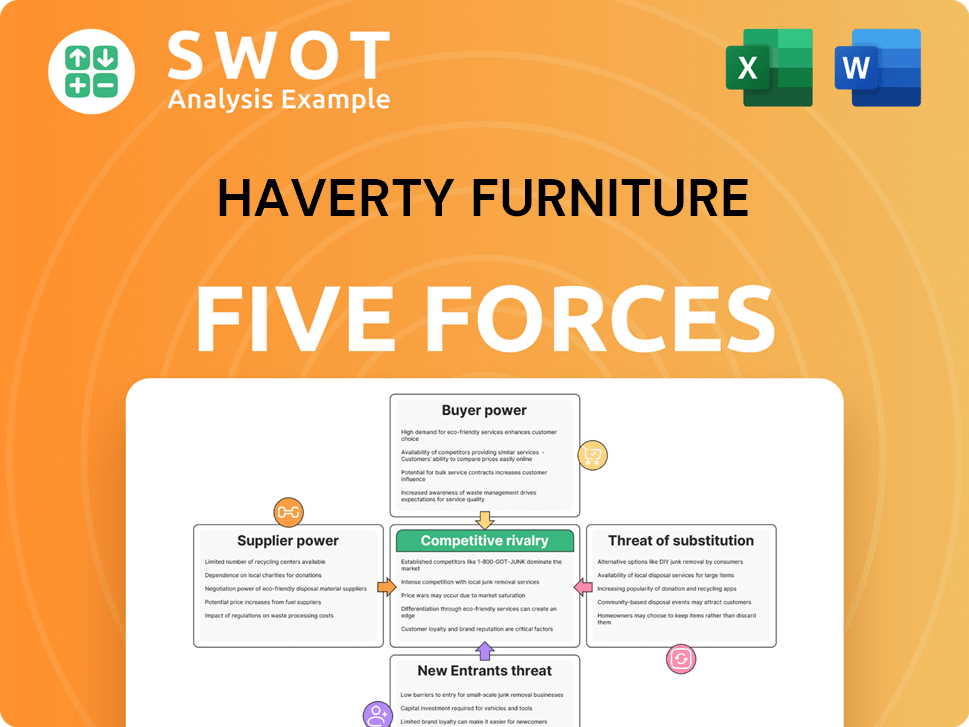

Haverty Furniture Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Haverty Furniture Company?

- What is Competitive Landscape of Haverty Furniture Company?

- What is Growth Strategy and Future Prospects of Haverty Furniture Company?

- How Does Haverty Furniture Company Work?

- What is Sales and Marketing Strategy of Haverty Furniture Company?

- What is Brief History of Haverty Furniture Company?

- What is Customer Demographics and Target Market of Haverty Furniture Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.