Karex Bundle

Who Really Owns the World's Largest Condom Maker?

Understanding the Karex SWOT Analysis reveals more than just market strategies; it uncovers the very fabric of its ownership. From its humble beginnings as a family venture to its current status as a publicly traded entity, Karex's ownership story is a fascinating tale of growth. Discover how this transformation has shaped the company's direction and its impact on the global market.

The evolution of Karex company, from its founding in 1988 to its current global presence as a leading Karex manufacturer, is intrinsically tied to its ownership structure. Knowing Who owns Karex is crucial for anyone interested in the Karex stock and its future. This exploration will provide a detailed look into the key players and their influence on this major player in the consumer products and services sector, including Karex brands.

Who Founded Karex?

The story of the Karex company begins with the Goh family. The foundation was laid in Muar, Johor, where Goh Huang Chiat owned a rubber tree farm and factory.

The official establishment of the condom manufacturing business occurred in 1988. This pivotal moment was spearheaded by Goh Huang Chiat's sons, Goh Siang and Goh Leng Kian.

Goh Siang, a chemical engineer, and Goh Leng Kian, a mechanical engineer, utilized their expertise to design and build the condom machines, which were crucial to the company's manufacturing capabilities. The initial ownership of the company was primarily held by the founding brothers.

The company's roots are firmly planted in the Goh family's rubber business.

The founders' engineering backgrounds were key in setting up the manufacturing processes.

The Goh family maintained significant control, holding a majority stake even after going public.

The company's early focus was on producing high-quality rubber products, particularly condoms.

The founders capitalized on the global commodities crash and the rising awareness of HIV/AIDS to establish their business.

Public records provide limited information on early backers, disputes, or buyouts.

At the time of the company's initial public offering, the Goh family maintained a substantial ownership stake, with approximately 56% in 2016 and 57.6% in 2017, demonstrating their continued influence over the Karex ownership. Publicly available details about early investors, specific equity splits, or early ownership disputes are scarce. The company's early growth was driven by the founders' vision and the market opportunities presented by the global commodities crash in the mid-1980s and the rising awareness of HIV/AIDS. These factors shaped the initial trajectory of the Karex company as a key Karex manufacturer in the global market.

The founders, Goh Siang and Goh Leng Kian, were central to the company's establishment.

- The Goh family's control was significant from the start.

- The founders' engineering skills were crucial for manufacturing.

- Market conditions influenced the early growth of the business.

- Limited public information is available on early ownership details.

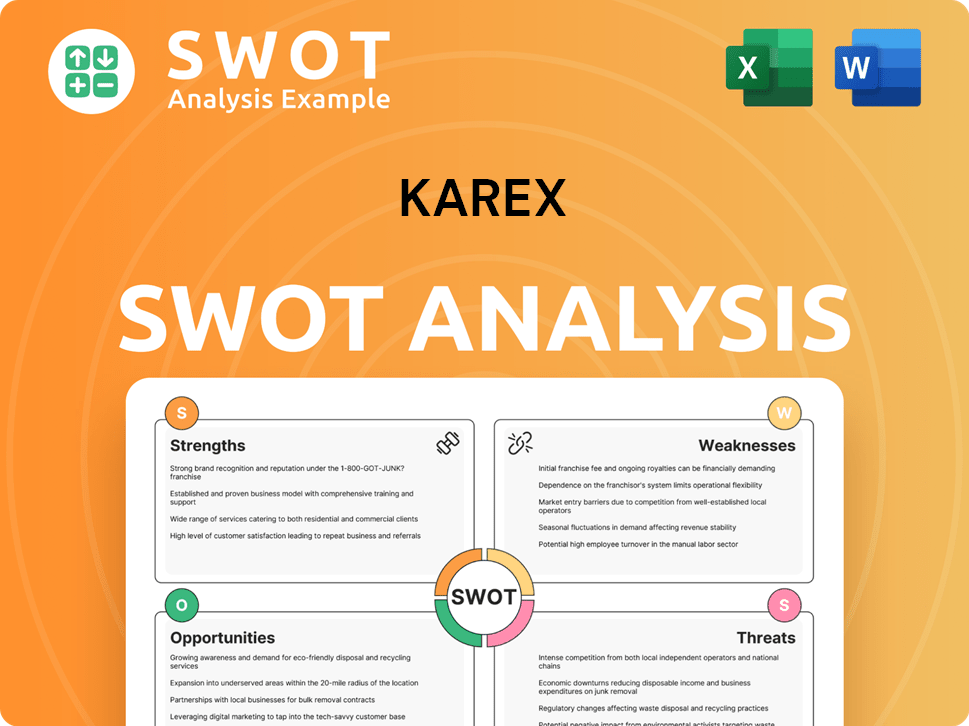

Karex SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Karex’s Ownership Changed Over Time?

The evolution of Karex's ownership structure has been marked by key events, most notably its Initial Public Offering (IPO) on November 6, 2013. This IPO, which took place on the Main Market of Bursa Malaysia, involved the issuance of new shares and an offer for sale, raising approximately RM74.92 million. This transition from a privately held entity to a publicly traded company significantly broadened its investor base, changing the dynamics of who owns the Karex company.

The IPO's impact was substantial, opening the door to institutional and retail investors. The listing provided access to capital for expansion, such as the development of a larger factory in Pontian, Johor. This expansion aimed to double the annual production capacity of condoms, from three billion to six billion units by the end of 2015, reflecting the company's growth strategy and the influence of its evolving ownership landscape.

| Ownership Milestone | Date | Impact |

|---|---|---|

| IPO on Bursa Malaysia | November 6, 2013 | Transition from private to public ownership, broadening investor base. |

| Factory Expansion | By the End of 2015 | Increased production capacity from three to six billion condoms annually, driven by capital raised through the IPO. |

| Continued Family Involvement | 2024-2025 | Family members remain on the board, ensuring continuity and influence in governance. |

As of May 27, 2025, the major shareholders of the Karex company include Karex One Ltd. with 17.5%, BNP Paribas with 16.9%, and Maryen Holdings Limi with 11.5%. Institutional investors also play a significant role, with Abrdn Asia Ltd. holding 5.78% and Abrdn Malaysia Sdn. Bhd. holding 5.52% as of June 4-5, 2025. The Goh family, the founders, historically held a significant stake, with 57.6% in 2017, although recent specific percentages are not available. This shift indicates a diverse ownership structure, balancing family influence with institutional investment.

The Karex manufacturer has seen a shift from family ownership to a more diversified structure with institutional investors.

- The IPO in 2013 was a pivotal moment, opening the company to a broader investor base.

- Major shareholders as of May 2025 include Karex One Ltd., BNP Paribas, and Maryen Holdings Limi.

- Institutional investors like Abrdn Asia Ltd. and Abrdn Malaysia Sdn. Bhd. hold significant stakes.

- The Goh family continues to have representation on the board, maintaining some influence.

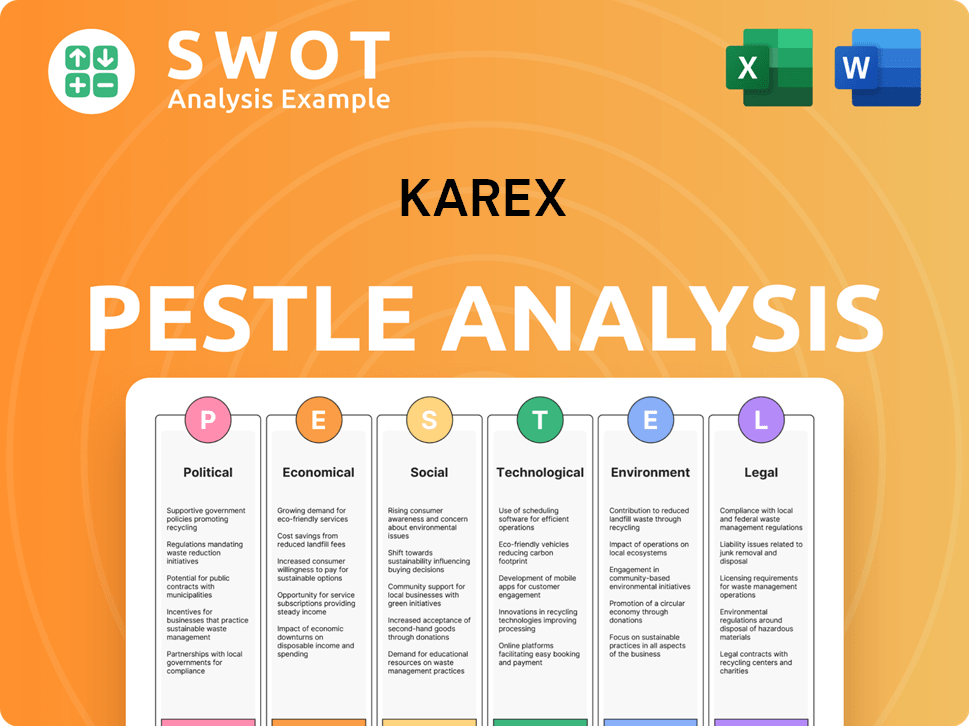

Karex PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Karex’s Board?

As of January 2, 2025, the board of directors for the Karex company comprises a blend of executive, non-executive, and independent directors. This structure aims to provide a balance of operational expertise and independent oversight. The current board includes Prof. Dato' Dr. Adeeba Binti Kamarulzaman as Chairwoman, alongside other independent and non-independent non-executive directors. Executive directors include Mr. Goh Leng Kian and Mr. Goh Miah Kiat, the latter also serving as the Chief Executive Officer.

The presence of founding family members, such as Goh Leng Kian and Goh Miah Kiat, indicates a continued family influence in the Karex ownership structure. Ms. Kung Chin Woon's appointment as an Independent Non-Executive Director and Chairwoman of the Nomination Committee, effective January 2, 2025, reflects ongoing efforts to maintain robust corporate governance. The board composition, with its mix of independent and executive directors, is designed to provide oversight and strategic guidance, ensuring the long-term interests of the family remain represented in decision-making.

| Director | Role | Status |

|---|---|---|

| Prof. Dato' Dr. Adeeba Binti Kamarulzaman | Chairwoman | Independent Non-Executive Director |

| Dato' Edward Siew Mun Wai | Director | Independent Non-Executive Director |

| Mr. Chew Fook Aun | Director | Independent Non-Executive Director |

| Madam Lam Jiuan Jiuan | Director | Non-Independent Non-Executive Director |

| Madam Goh Yen Yen | Director | Non-Independent Non-Executive Director |

| Ms. Kung Chin Woon | Director | Independent Non-Executive Director |

| Mr. Goh Leng Kian | Director | Executive Director |

| Mr. Goh Miah Kiat | CEO | Executive Director |

Karex Berhad operates under a one-share-one-vote structure, typical for companies listed on Bursa Malaysia. The company's constitution includes provisions for the re-election of directors. There is no publicly available information on recent proxy battles or governance controversies. The board's composition aims to provide oversight and strategic guidance, while the presence of family members ensures the original vision and long-term interests are represented. The Karex manufacturer continues to adapt to market dynamics.

The company adheres to a one-share-one-vote structure, which is standard for companies listed on Bursa Malaysia, ensuring equitable voting rights for all shareholders. The board composition includes a mix of independent and executive directors, promoting effective oversight and strategic direction.

- One-share-one-vote structure.

- Mix of independent and executive directors.

- Family representation on the board.

- Focus on long-term interests and vision.

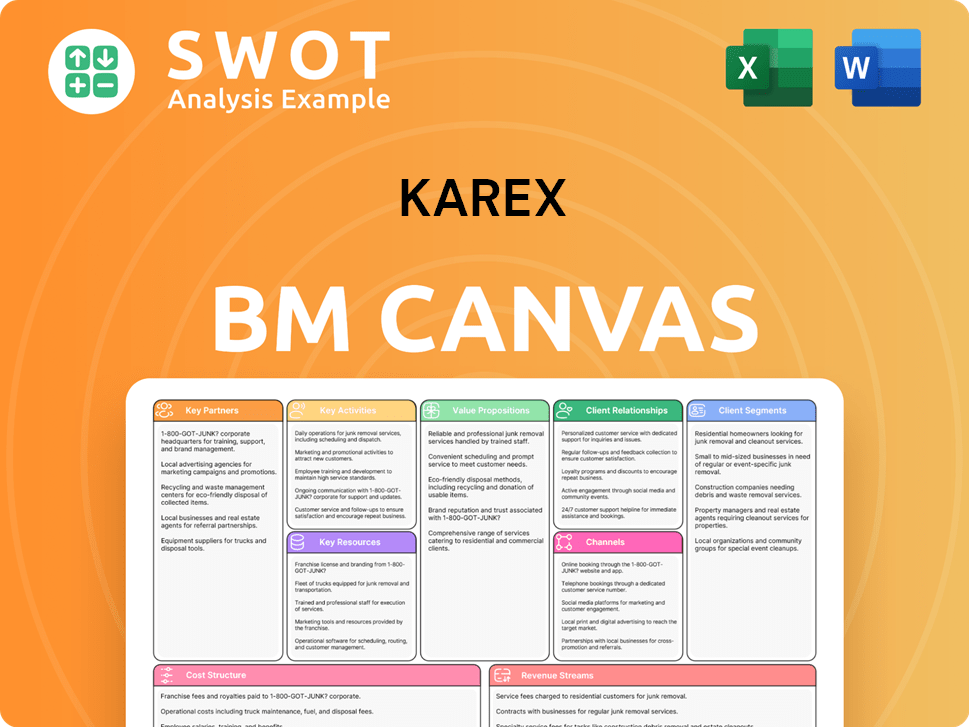

Karex Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Karex’s Ownership Landscape?

In recent years, the ownership of the Karex company has been shaped by strategic shifts and market dynamics. For the nine months ending March 31, 2025, the company reported revenues of RM 377.63 million. Despite a slight decrease from the previous year, the company declared a single-tier interim dividend of 0.50 sen per share for the financial year ending June 30, 2025, payable on June 24, 2025. The company's market capitalization, as of June 10, 2025, was approximately RM 837.50 million. These financial results and market valuations provide context for understanding the company's ownership profile and its performance.

Significant changes in the board of directors, effective January 2, 2025, included the appointment of Ms. Kung Chin Woon as a new Independent Non-Executive Director and Prof. Dato' Dr. Adeeba Binti Kamarulzaman as Chairwoman of the Board. These appointments reflect the company's ongoing focus on corporate governance and board refreshment. Institutional ownership remains a key factor, with firms like Abrdn Asia Ltd. and BNP Paribas holding substantial stakes, influencing the company’s strategic direction and long-term value.

| Metric | Value | Date |

|---|---|---|

| Revenue (9 Months) | RM 377.63 million | March 31, 2025 |

| Market Capitalization | RM 837.50 million | June 10, 2025 |

| Dividend per Share | 0.50 sen | June 30, 2025 |

The company is focusing on higher-margin products, particularly its own brands and the introduction of synthetic condoms, with OBM commanding gross profit margins exceeding 50%. Karex has also been actively pursuing mergers and acquisitions to strengthen distribution channels. The global condom market is projected to grow at a CAGR of 9.8% between 2025 and 2034, reaching approximately USD 12.3 billion by 2034, driven by increasing sexual health awareness and e-commerce adoption.

The ownership structure of the Karex company is influenced by institutional investors. Key stakeholders include firms like Abrdn Asia Ltd. and BNP Paribas.

The company's revenue for the nine months ending March 31, 2025, was RM 377.63 million. A dividend of 0.50 sen per share was declared for the financial year ending June 30, 2025.

The company is shifting towards OBM to improve profit margins. The global condom market is projected to grow, supporting Karex's high-value product strategy.

The company is focusing on higher-margin products, particularly its own branded products and the introduction of synthetic condoms. The company's market capitalization as of June 10, 2025, stood at RM 837.50 million.

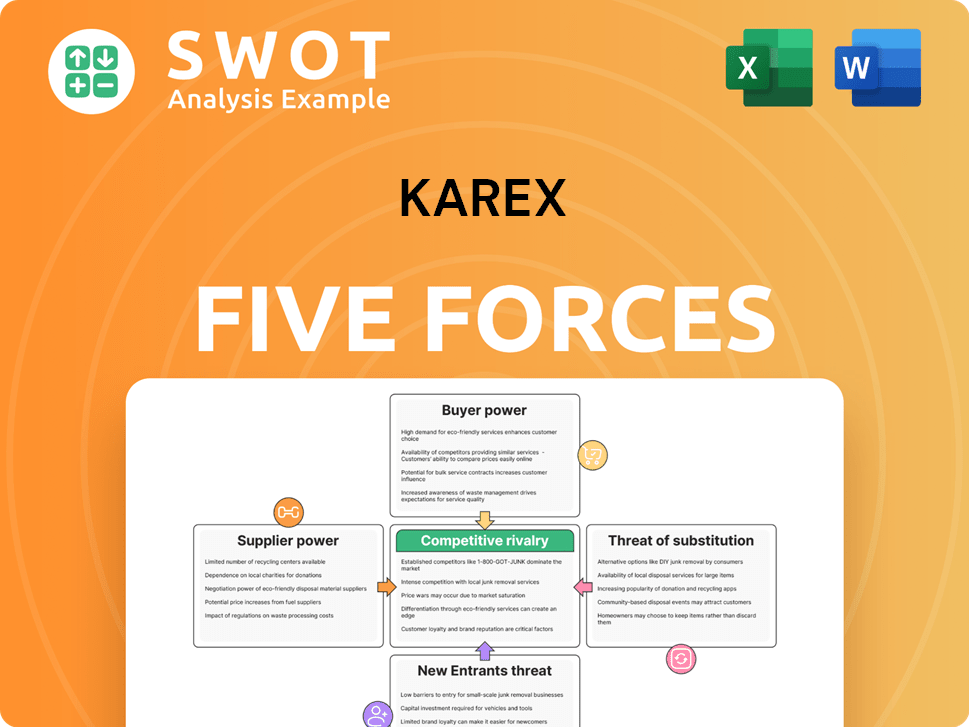

Karex Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Karex Company?

- What is Competitive Landscape of Karex Company?

- What is Growth Strategy and Future Prospects of Karex Company?

- How Does Karex Company Work?

- What is Sales and Marketing Strategy of Karex Company?

- What is Brief History of Karex Company?

- What is Customer Demographics and Target Market of Karex Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.