Konami Group Bundle

Who Really Controls Konami Group?

Ever wondered who pulls the strings behind gaming giants like Metal Gear Solid and eFootball? Understanding Konami Group SWOT Analysis reveals the critical importance of knowing its ownership structure. From its humble beginnings to its current global presence, Konami's evolution is a testament to how ownership influences strategic decisions and market dominance. Uncover the key players shaping the future of this entertainment titan.

This exploration into Konami ownership will dissect the Konami parent company and its intricate web of Konami subsidiaries, providing insights into the individuals and entities that hold significant sway. We'll examine the Konami history, including the founder's influence and the role of major investors. This deep dive will help you understand the Konami Group's strategic direction and its potential for growth, considering factors like Who is the CEO of Konami, the Konami Group headquarters location, and the impact of Konami's shareholders on its financial performance.

Who Founded Konami Group?

The story of Konami Group Corporation begins with its founder, Kagemasa Kōzuki, who established the company on March 21, 1969. Initially, the business centered around the rental and repair of jukeboxes. The company later shifted its focus to amusement machines, marking the start of its journey in the entertainment industry.

Konami Industry Co., Ltd. was officially incorporated on March 19, 1973. The name 'Konami' is a combination of the names of its founding members: Kagemasa Kōzuki, Yoshinobu Nakama, and Tatsuo Miyasako. This early phase was crucial in setting the stage for Konami's future growth.

While specific details about the initial ownership distribution among the founders are not widely available, the Kōzuki family has maintained a significant ownership stake. The company's transition from jukeboxes to amusement machines in its early years was a key strategic move.

Konami was founded by Kagemasa Kōzuki in 1969. The company started as a jukebox rental and repair business.

Konami Industry Co., Ltd. was officially incorporated in 1973. This marked a shift towards manufacturing amusement machines.

The name 'Konami' is derived from the names of the founders: Kōzuki, Nakama, and Miyasako. The company's name is a portmanteau.

Initially, Konami focused on jukebox services. The company later transitioned to amusement machine manufacturing.

The Kōzuki family has maintained a significant ownership stake in Konami. The family's ownership is a key aspect of Konami's structure.

Details on early backers and angel investors are not widely available. Information on early investors is limited.

The Brief History of Konami Group shows that the company's early success in the arcade market, with its first coin-operated video game released in 1978, was a pivotal moment. As of 2022, the Kōzuki family held a substantial ownership share, underscoring their enduring influence on the company. The company's evolution reflects a strategic shift from its initial jukebox business to a major player in the entertainment industry, with a focus on arcade games and, later, home video games.

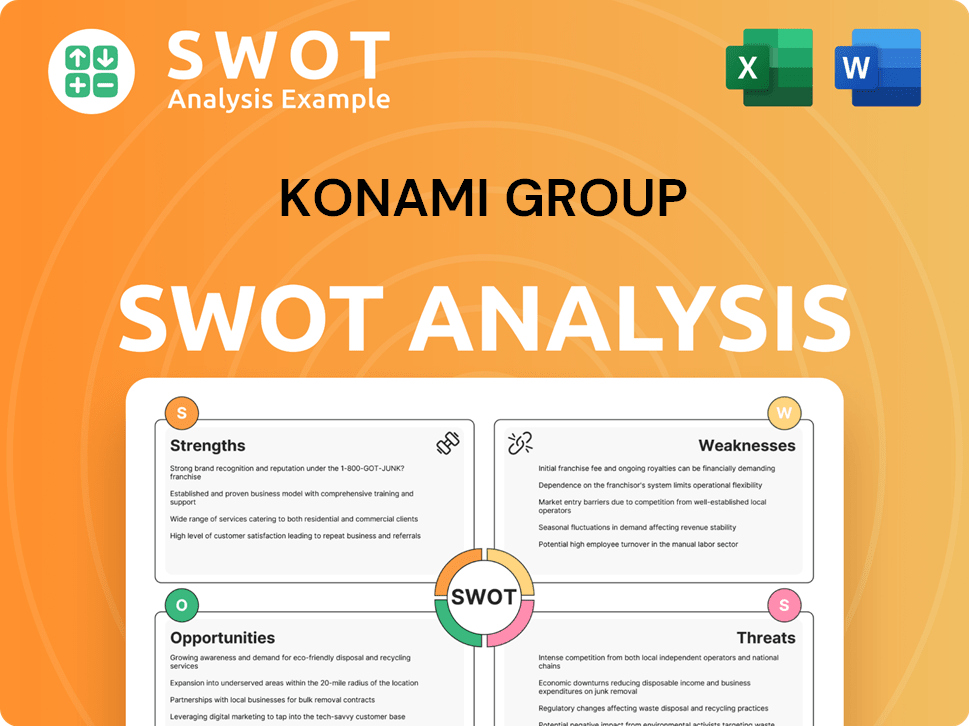

Konami Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Konami Group’s Ownership Changed Over Time?

The ownership structure of the Konami Group has evolved significantly since its inception. Initially, the company was privately held, but it later became a publicly traded entity, which opened it up to a broader range of investors. This transition marked a key shift in its ownership dynamics. The company's restructuring into a holding company in 2005 further solidified its structure, with various business segments operating under the Konami Corporation umbrella.

The company is listed on the Tokyo Stock Exchange (TYO: 9766) and the London Stock Exchange (LSE: KNM), which has influenced its ownership over time. The presence of institutional investors and entities tied to the founding family has shaped the company's direction. The shift from private to public ownership and the subsequent changes in major shareholding reflect the company's growth and adaptation within the global market.

| Shareholder | Percentage of Shares (as of March 31, 2025) | Number of Shares (in thousands) |

|---|---|---|

| Master Trust Bank of Japan, Ltd. (Trust Account) | 18.95% | 27,196 |

| Kozuki Foundation | 11.92% | 17,100 |

| KOZUKI HOLDING B.V. | 10.94% | 15,700 |

| Custody Bank of Japan, Ltd. (Trust Account) | 10.16% | 14,577 |

| KONAMI GROUP CORPORATION | 5.54% | 7,943 |

| Kozuki Capital Corporation | 4.91% | 7,048 |

| JP MORGAN CHASE BANK 380815 | 4.55% | 6,530 |

As of March 31, 2025, Konami Group Corporation had 143,500,000 issued shares and 21,822 shareholders. The Master Trust Bank of Japan, Ltd. (Trust Account) holds the largest share, with 18.95%. The Kozuki family's continued presence through various entities highlights their enduring influence. If you want to learn more, check out the Marketing Strategy of Konami Group.

Konami's ownership structure includes a mix of institutional investors and entities related to the founding family, reflecting a balance of corporate and family influence.

- The Master Trust Bank of Japan, Ltd. is a major shareholder.

- The Kozuki family maintains a significant stake through various holdings.

- Konami is a publicly traded company on the Tokyo and London Stock Exchanges.

- The company's structure includes Konami Digital Entertainment Co., Ltd. as a key subsidiary.

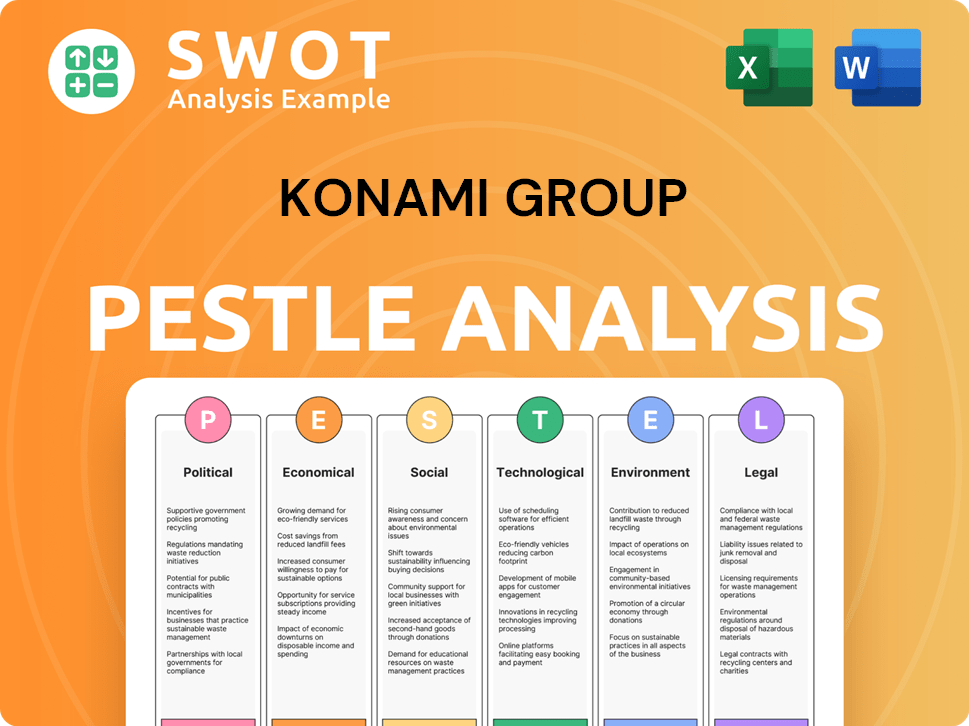

Konami Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Konami Group’s Board?

The current Board of Directors of Konami Group Corporation, as of June 26, 2025, is composed of nine members, including four Outside Directors. Kagemasa Kōzuki serves as the Representative Director and Chairman, while Kimihiko Higashio is the Representative Director and President, also acting as Group CEO. Other key directors include Hideki Hayakawa, Yoshihiro Matsuura, and Katsunori Okita. The Audit & Supervisory Committee includes Outside Directors Yasushi Higuchi, Kaori Yamaguchi, Kimito Kubo, and Yoko Zetterlund. These Outside Directors are designated as Independent Directors under Tokyo Stock Exchange regulations, bringing diverse management experience to the board.

The composition of the board reflects a commitment to both internal expertise and external oversight, ensuring a balanced approach to corporate governance. The presence of Independent Directors is crucial for maintaining transparency and accountability. The board's structure supports the company's strategic direction and operational efficiency, vital for navigating the competitive landscape of the gaming and entertainment industry. The company's approach to corporate governance is designed to enhance corporate value and ensure sound business practices. Shareholders can exercise their voting rights via mail or internet.

| Director | Title | Role |

|---|---|---|

| Kagemasa Kōzuki | Representative Director | Chairman of the Board |

| Kimihiko Higashio | Representative Director | President, Group CEO |

| Hideki Hayakawa | Director | |

| Yoshihiro Matsuura | Director | |

| Katsunori Okita | Director | |

| Yasushi Higuchi | Outside Director | Audit & Supervisory Committee Member |

| Kaori Yamaguchi | Outside Director | Audit & Supervisory Committee Member |

| Kimito Kubo | Outside Director | Audit & Supervisory Committee Member |

| Yoko Zetterlund | Outside Director |

The significant shareholding by the Kozuki family, through entities like Kozuki Foundation and KOZUKI HOLDING B.V., indicates that the founding family holds considerable influence and voting power within the company. This ownership structure plays a key role in the company's strategic direction. The General Meeting of Shareholders, scheduled for June 26, 2025, will address proposals such as the election of board members and revisions to director remuneration. For more information on how the company generates revenue, you can check out the Revenue Streams & Business Model of Konami Group.

The Board of Directors consists of nine members, including four Outside Directors. Kagemasa Kōzuki is the Chairman, and Kimihiko Higashio is the President and CEO. The Kozuki family retains substantial influence through significant shareholdings.

- The board structure includes both internal and external directors.

- Outside Directors are designated as Independent Directors.

- Shareholders can vote on key decisions during the General Meeting.

- The company emphasizes transparency and a shareholder-focused approach.

Konami Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Konami Group’s Ownership Landscape?

Over the past few years, Konami Group has experienced significant developments impacting its ownership and strategic direction. For the fiscal year ending March 31, 2025, Konami reported substantial financial growth. Total revenue increased by 17.0% year-on-year to ¥421,602 million, and profit attributable to owners rose by 26.2% to ¥74,692 million. The Digital Entertainment segment, including video games and the Yu-Gi-Oh! Trading Card Game, was a primary driver, with revenue up 22.5% to ¥305,187 million. This demonstrates strong performance across its business segments.

A notable recent change involves a business reorganization within the Konami Amusement subsidiary. In May 2025, a portion of its business was transferred to a newly established company, Konami Arcade Games Co., Ltd., effective October 1, 2025. This internal restructuring aims to create independent entities for arcade games and pachinko/pachislot machines. This strategic move is designed to accelerate decision-making and allow for flexible management tailored to each market. The company anticipates continued growth for the fiscal year ending March 31, 2026, projecting ¥430,000 million in revenue and ¥114,000 million in business profit.

| Metric | Fiscal Year Ended March 31, 2025 | Fiscal Year Ended March 31, 2024 |

|---|---|---|

| Total Revenue (¥ million) | 421,602 | 360,347 |

| Profit Attributable to Owners (¥ million) | 74,692 | 59,179 |

| Digital Entertainment Revenue (¥ million) | 305,187 | 248,923 |

Regarding ownership trends, institutional investors remain key shareholders. As of April 11, 2025, Konami Group Corporation had 248 institutional owners holding a total of 9,684,709 shares. Major institutional shareholders include Vanguard Total International Stock Index Fund, Vanguard Developed Markets Index Fund, iShares Core MSCI EAFE ETF, and iShares MSCI Japan ETF. While leadership changes have occurred at the subsidiary level, the top leadership at the Konami Group Corporation level, including Chairman Kagemasa Kōzuki and President Kimihiko Higashio, remains consistent as of June 2025. The company's commitment to returning value to shareholders is evident in its increased annual dividend per share, which reached a record ¥131 in fiscal 2024, with expectations for further increases in fiscal 2025.

Konami is a publicly traded company, with significant ownership held by institutional investors. The company's structure includes a parent company and various subsidiaries, each focusing on different aspects of the entertainment industry.

The current leadership includes Chairman Kagemasa Kōzuki and President Kimihiko Higashio. Leadership at the subsidiary level has seen some changes, but the top management at the group level has remained consistent.

Konami has shown strong financial performance, with increased revenue and profits in the fiscal year ending March 31, 2025. The Digital Entertainment segment is a major driver of growth.

The company anticipates continued growth, projecting further increases in revenue and business profit for the fiscal year ending March 31, 2026. This indicates a positive outlook for the company.

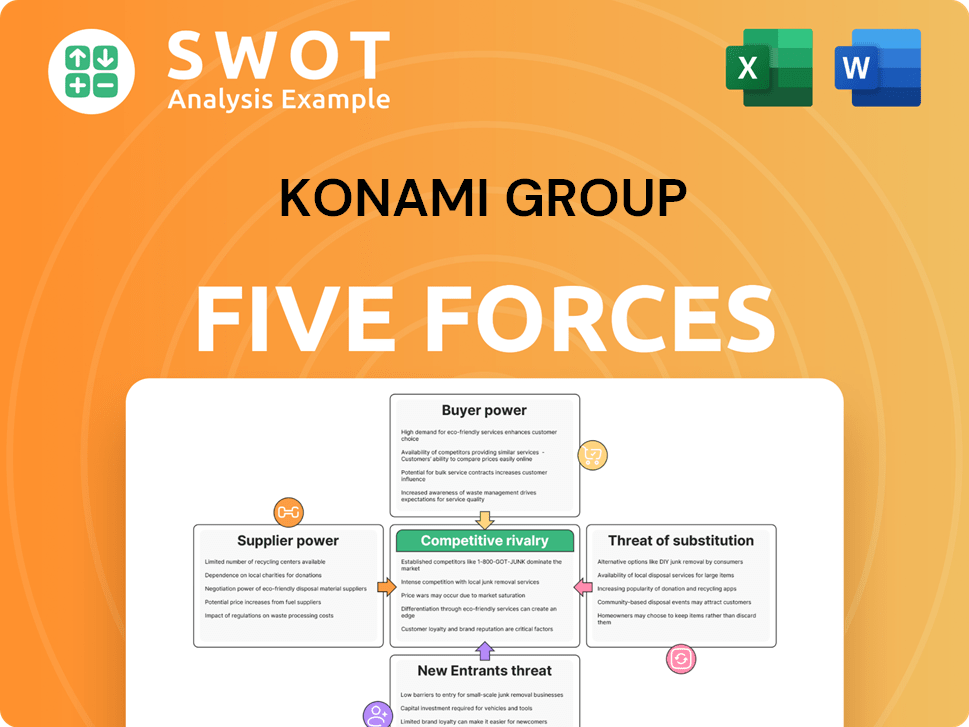

Konami Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Konami Group Company?

- What is Competitive Landscape of Konami Group Company?

- What is Growth Strategy and Future Prospects of Konami Group Company?

- How Does Konami Group Company Work?

- What is Sales and Marketing Strategy of Konami Group Company?

- What is Brief History of Konami Group Company?

- What is Customer Demographics and Target Market of Konami Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.