Nexstar Media Group Bundle

Who Really Controls Nexstar Media Group?

Unraveling the Nexstar Media Group SWOT Analysis is just the beginning; understanding its ownership structure is key to predicting its future. From its humble beginnings to its current status as a media giant, Nexstar's journey is a testament to strategic acquisitions and savvy market navigation. Knowing who owns Nexstar reveals the driving forces behind its decisions and its ability to adapt in the ever-changing media landscape.

This deep dive into Nexstar ownership explores the evolution of its shareholder base, from the initial vision of Nexstar CEO, Perry A. Sook, to the current roster of major investors. Investigating who owns Nexstar Media Group provides valuable insights into the company's strategic direction, financial health, and its influence on the media industry. Understanding the Nexstar stations and their ownership is crucial for anyone looking to understand the company's market position and future prospects, including its Nexstar Media Group SWOT Analysis.

Who Founded Nexstar Media Group?

The foundation of Nexstar Media Group, originally named Nexstar Broadcasting Group, was laid on June 17, 1996. Perry A. Sook, with over four decades of experience in the broadcasting industry, founded the company. His vision began with the acquisition of WYOU in Scranton, Pennsylvania, marking the start of what would become a significant media presence.

Early financial backing for Nexstar came from ABRY Partners, a private equity firm specializing in media and communications. ABRY Partners played a crucial role in helping Sook establish the company. However, they eventually exited their ownership in 2013, shifting the company's ownership structure.

The early years saw rapid expansion through strategic acquisitions. In 1997, Nexstar acquired WJET-TV in Erie, Pennsylvania, for $18.5 million. Further expansion occurred in January 1998 with the acquisition of three stations from the U.S. Broadcast Group for $64.3 million. This rapid growth set the stage for Nexstar's future trajectory.

Nexstar quickly expanded its portfolio through strategic acquisitions. These early moves were crucial in establishing its market presence and laying the groundwork for future growth. The acquisition of WJET-TV in 1997 and the stations from U.S. Broadcast Group in 1998 are prime examples.

A key strategy involved forming partnerships to navigate regulatory landscapes. The 'sale' of WYOU to Mission Broadcasting, followed by a shared-services agreement, showcased an innovative approach. This allowed Nexstar to expand its reach and optimize operations.

Perry A. Sook has been a constant presence in Nexstar's leadership since its inception. His role as Chairman and CEO has been critical to the company's strategic direction. His long-term vision has guided Nexstar's growth and evolution.

ABRY Partners provided the initial financial backing for Nexstar. Their investment was essential in helping Sook establish the company. They provided the necessary capital to facilitate early acquisitions and establish a solid foundation.

The early strategy focused on acquiring television stations and expanding its market presence. This involved both direct acquisitions and strategic partnerships. The goal was to build a robust portfolio of stations across different markets.

Nexstar demonstrated an early ability to navigate regulatory hurdles. The shared-services agreement with Mission Broadcasting allowed for market expansion. This approach helped the company grow while adhering to regulations.

The founding of Nexstar Media Group involved strategic acquisitions and innovative partnerships. Perry A. Sook's leadership and the initial backing from ABRY Partners were critical. The company's early moves shaped its future trajectory and established its presence in the media industry.

- Nexstar Media Group was founded by Perry A. Sook in 1996.

- ABRY Partners provided initial financial backing.

- Early acquisitions included WJET-TV and stations from U.S. Broadcast Group.

- Strategic partnerships and shared-services agreements were key to expansion.

Nexstar Media Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Nexstar Media Group’s Ownership Changed Over Time?

The ownership structure of Nexstar Media Group has transformed significantly since its inception. Originally named Nexstar Broadcasting Group, Inc., the company was established on May 17, 2001, under the name Nexstar Equity Corp. It transitioned to a publicly traded entity with its initial public offering (IPO) on November 24, 2003, raising $140 million by offering 10 million shares at $14.00 per share. This marked the beginning of a series of strategic moves that shaped its ownership landscape.

Key acquisitions have played a crucial role in shaping Nexstar's ownership. The acquisition of Media General in 2016 for $4.6 billion, finalized in 2017, led to the company's name change to Nexstar Media Group, Inc. The merger with Tribune Media in 2019, valued at $6.4 billion, further solidified Nexstar's position as the largest local broadcast television operator in the United States. These strategic acquisitions have expanded its market presence and influenced its ownership dynamics, making it a major player in the media industry.

| Event | Date | Impact |

|---|---|---|

| Initial Public Offering (IPO) | November 24, 2003 | Raised $140 million; transition to public ownership. |

| Acquisition of Media General | 2017 | Company name changed to Nexstar Media Group, Inc. |

| Merger with Tribune Media | 2019 | Solidified Nexstar's position as the largest local broadcast television operator. |

As of May 2025, institutional investors hold a significant portion of Nexstar Media Group's shares. There are 984 institutional owners and shareholders that have filed 13D/G or 13F forms with the SEC, holding a total of 39,256,929 shares. Major institutional shareholders include BlackRock, Inc., and Vanguard Group Inc. BlackRock, Inc. held 3,207,431 shares, representing 7.50% of ownership as of April 3, 2025. Vanguard Group Inc held 3,099,024 shares, representing 7.24%. Insider holdings slightly increased to 2.20% in May 2025. Perry A. Sook, the founder, Chairman, and CEO, owns 1.69% of the company's shares, valued at approximately $297.15 million. These holdings reflect a concentrated ownership among major investment firms and the founding leadership, influencing the company's strategic direction and capital allocation, as detailed in the Growth Strategy of Nexstar Media Group.

Nexstar Media Group's ownership structure is characterized by a mix of institutional and insider holdings, with significant influence from major investment firms and the founding leadership.

- Institutional investors hold a substantial portion of the shares.

- Key shareholders include BlackRock, Inc., and Vanguard Group Inc.

- Insider ownership includes holdings by the founder, Chairman, and CEO.

- Strategic acquisitions have expanded the company's market presence.

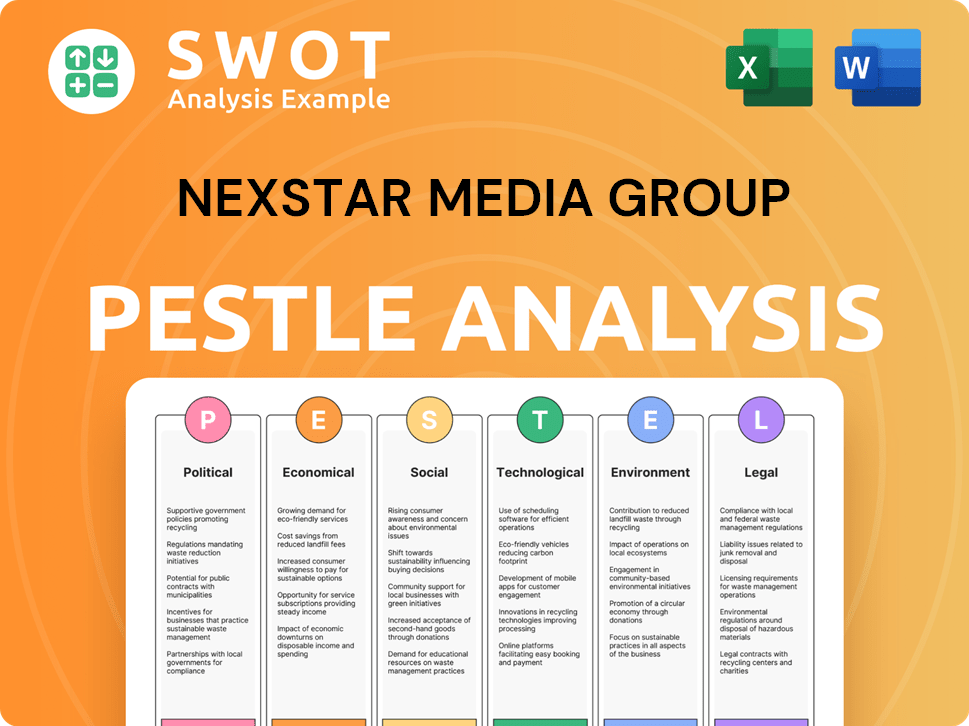

Nexstar Media Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Nexstar Media Group’s Board?

As of October 2024, the Board of Directors of Nexstar Media Group included 10 members, with 9 independent directors. The board composition reflects a commitment to diversity, including three women. Perry A. Sook, the founder, Chairman, and CEO since 1996, leads the board. Other board members include Geoff Armstrong, Bernadette Aulestia, Dennis J. FitzSimons, Jay M. Grossman, Ellen Johnson, Thomas McMillen, and Lisbeth McNabb. Ellen Johnson was appointed as an independent director in October 2024.

Jay M. Grossman, who joined the board in 1997, chairs the Compensation Committee. His presence reflects the historical involvement of ABRY Partners, though ABRY exited its ownership in 2013. The board's composition and leadership structure are crucial for the strategic direction and governance of the company. This structure is vital for the company's operations, including its numerous Nexstar stations.

| Board Member | Role | Notes |

|---|---|---|

| Perry A. Sook | Chairman and CEO | Founder of the company. |

| Ellen Johnson | Independent Director | Appointed in October 2024. |

| Jay M. Grossman | Independent Director | Chairperson of the Compensation Committee. |

The voting structure at Nexstar Media Group is based on a one-share-one-vote principle. As of April 21, 2025, there were 30,188,767 shares of common stock outstanding. This structure gives significant influence to major institutional shareholders. A shareholder proposal was submitted for the 2025 Annual Meeting, highlighting ongoing shareholder scrutiny regarding executive compensation and capital allocation. Nexstar's governance practices include annual elections, board refreshment, and stock ownership requirements for board members and senior management. Understanding the Growth Strategy of Nexstar Media Group is crucial for investors.

Nexstar Media Group's board includes experienced members with a focus on independent oversight.

- The one-share-one-vote structure gives significant power to shareholders.

- Shareholders are actively involved in monitoring executive compensation.

- Board refreshment and leadership structure are key aspects of Nexstar's governance.

Nexstar Media Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Nexstar Media Group’s Ownership Landscape?

Over the past few years, strategic moves have significantly shaped the ownership landscape of Nexstar Media Group. In 2024, the company demonstrated strong financial performance, reporting record annual revenue of $5.407 billion, a 9.6% increase from 2023. Nexstar returned $820 million to shareholders through dividends and share repurchases, representing 68% of its Adjusted Free Cash Flow, and reduced its debt by $327 million, achieving a net leverage of 2.91x. This financial strength has influenced investor confidence and ownership patterns.

In Q1 2025, Nexstar continued its financial discipline, repaying $31 million of debt and repurchasing 441,164 shares of common stock for $75 million. The company also increased its quarterly dividend by 10% to $1.86 per share. These actions, alongside strategic acquisitions, reflect Nexstar's commitment to enhancing shareholder value and adapting to market dynamics. The company's focus on profitability for The CW Network and preparation for the 2026 political cycle could further influence future ownership trends and financial performance. For more insights, consider exploring Revenue Streams & Business Model of Nexstar Media Group.

Institutional ownership in Nexstar has remained relatively stable. As of May 2025, institutional investors held 104.86% of the shares, while insider holdings increased slightly from 2.15% to 2.20%. Major institutional investors like BlackRock, Inc. and Vanguard Group Inc. have increased their positions in Q1 2025, showing sustained confidence in the company's strategic direction. Nexstar's management anticipates potential FCC action on ownership rules in late 2025, which could facilitate further M&A activity and potentially reshape the ownership structure.

Nexstar's acquisition of WBNX-TV in January 2025 expanded its presence. This strategic move created a duopoly in the Cleveland market, aligning with the company's growth strategy. The integration of WBNX as a CW affiliate is set for September 1, 2025.

A key investment in Video Gaming Entertainment Network (VENN) in October 2020 provided Nexstar with access to valuable content. This investment, part of a $26 million Series A funding round, highlights Nexstar's proactive approach to diversifying its media portfolio and leveraging its distribution capabilities.

Institutional investors continue to hold a significant portion of Nexstar's stock. The slight increase in insider holdings indicates confidence from within the company. Monitoring these trends provides insights into the overall stability and future outlook of the company.

Deregulation and political cycles are key strategic priorities. Anticipated FCC actions could influence future M&A. The focus on The CW Network and the 2026 political cycle are key factors influencing ownership dynamics and financial performance.

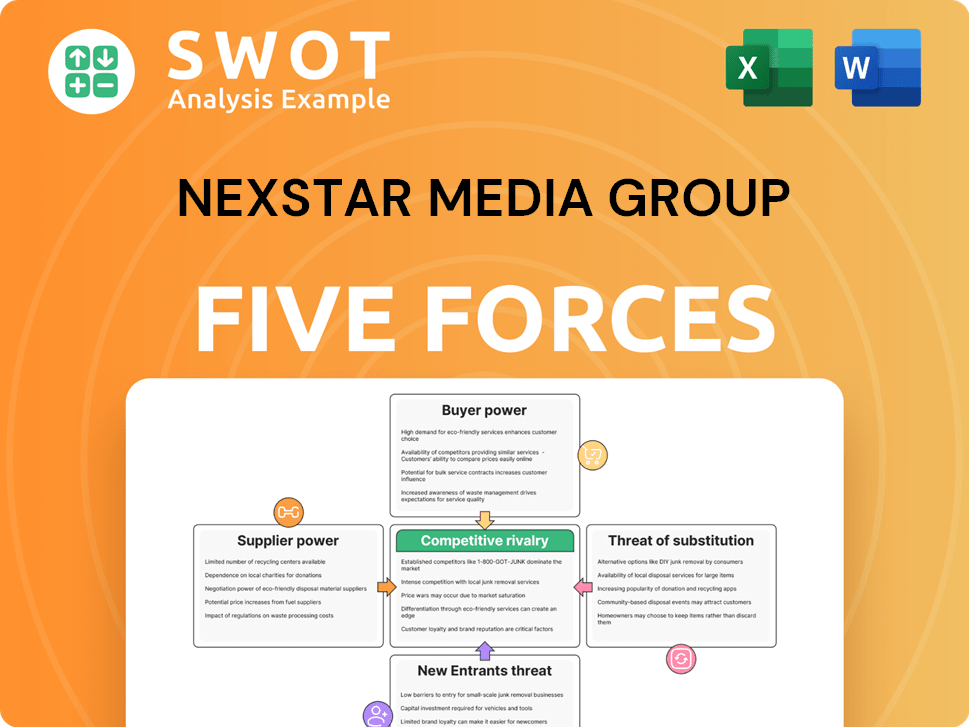

Nexstar Media Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Nexstar Media Group Company?

- What is Competitive Landscape of Nexstar Media Group Company?

- What is Growth Strategy and Future Prospects of Nexstar Media Group Company?

- How Does Nexstar Media Group Company Work?

- What is Sales and Marketing Strategy of Nexstar Media Group Company?

- What is Brief History of Nexstar Media Group Company?

- What is Customer Demographics and Target Market of Nexstar Media Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.