NextTrip Bundle

Who Really Owns NextTrip?

Understanding a company's ownership structure is paramount for investors and stakeholders alike. The story of NextTrip, a travel technology innovator, is particularly compelling, especially after a significant acquisition. Unraveling the details of "Who owns NextTrip" unveils critical insights into its strategic direction and future prospects.

NextTrip's journey, marked by its acquisition by Sigma Additive Solutions in late 2023, offers a fascinating case study in corporate ownership transitions. The company, now publicly traded under the ticker 'NTRP' since March 2024, presents a dynamic landscape for those seeking to understand the influence of NextTrip SWOT Analysis. This exploration will illuminate the key players behind NextTrip, including NextTrip executives, NextTrip investors, and the impact on NextTrip management, providing a comprehensive view of its ownership and its implications.

Who Founded NextTrip?

The story of NextTrip ownership took a significant turn in December 2023. This was marked by the acquisition of NextTrip Holdings, Inc. by Sigma Additive Solutions, Inc., which then became NextTrip, Inc.

This strategic move reshaped the company's structure and leadership. The acquisition, finalized on December 29, 2023, made NextTrip Holdings a wholly-owned subsidiary.

The acquisition also involved a reverse merger, which significantly impacted the ownership structure and the company's leadership.

Following the acquisition, the NextTrip Sellers, who were members of NextTrip Parent, received a substantial stake in the company. They were granted an aggregate of 156,007 restricted shares of the company's common stock.

- This represented 19.99% of the company's issued and outstanding common stock immediately before the acquisition's closing.

- William Kerby, formerly the CEO of NextTrip Holdings, Inc., assumed the role of Chief Executive Officer of the newly combined NextTrip, Inc.

- Jacob Brunsberg, the former President and CEO of Sigma Additive Solutions, Inc., stepped down from his executive roles but remained on the board of directors.

- Agreements included the potential for NextTrip Sellers to receive additional 'Contingent Shares' based on future business performance milestones.

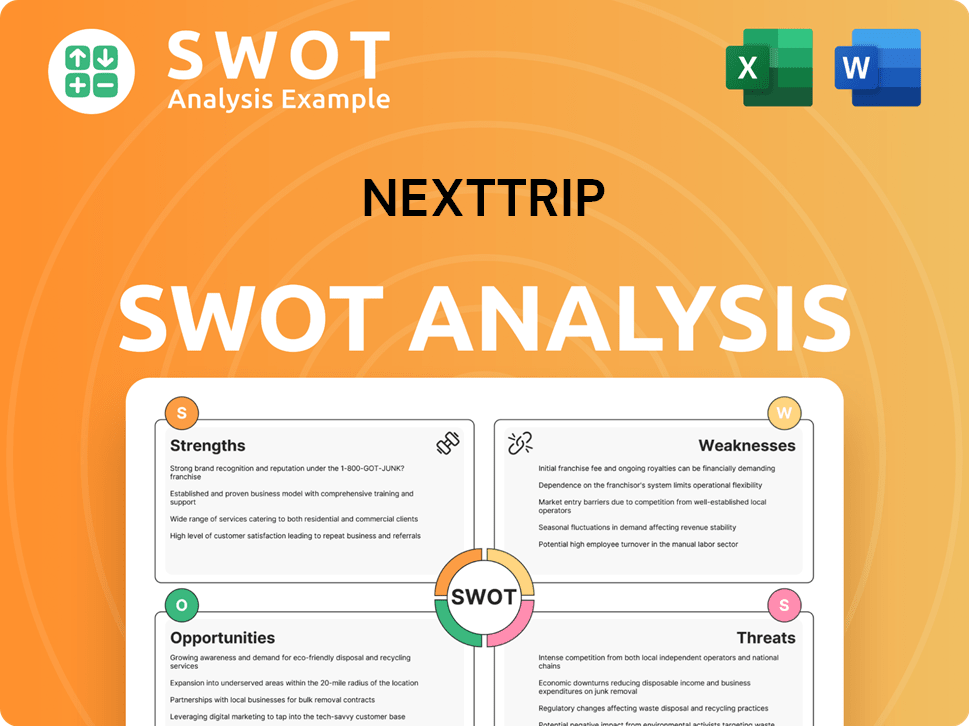

NextTrip SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has NextTrip’s Ownership Changed Over Time?

The ownership structure of NextTrip, Inc. has undergone a significant transformation, particularly following the December 2023 acquisition of NextTrip Holdings, Inc. by Sigma Additive Solutions, Inc. This transaction was treated as a reverse acquisition, with NextTrip Holdings effectively acquiring Sigma Additive Solutions.

As of March 28, 2025, the NextTrip Sellers, who were the members of NextTrip Parent, emerged as the dominant shareholders. They held approximately 4,550,000 shares, representing about 73.8% of the total outstanding shares of 6,163,525, thereby securing ownership and voting control. This shift in control was largely due to the issuance of 4,393,993 Contingent Shares to the NextTrip Sellers in March 2025, after the achievement of three business milestones. An additional 1,450,000 Contingent Shares were issued on May 5, 2025, following the fulfillment of the fourth and final milestone.

| Shareholder Category | Percentage of Ownership (as of May 2025) | Approximate Number of Shares |

|---|---|---|

| NextTrip Sellers | ~73.8% | ~4,550,000 |

| Institutional Investors | ~0.61% | Various |

| Insiders | ~3.44% | Various |

| Public Companies/Individual Investors | ~0.31% | Various |

Institutional ownership in NextTrip (NTRP) is relatively low, with roughly 0.61% of the company's stock held by institutional investors as of May 2025. Key institutional shareholders include Geode Capital Management, Llc, Vanguard Extended Market Index Fund Investor Shares (VEXMX), Fidelity Extended Market Index Fund (FSMAX), and UBS Group AG. Insiders hold 3.44% of the company's stock. Notable individual insiders, Donald P. Monaco and William Kerby, held 1,397,637 shares (78.98%) and 1,337,704 shares (75.60%) respectively, according to the latest available data. For more insights, you can explore the Marketing Strategy of NextTrip.

The ownership of NextTrip has shifted significantly, with the NextTrip Sellers now holding the majority stake.

- The reverse acquisition in December 2023 was a pivotal event.

- The issuance of Contingent Shares in March and May 2025 solidified the control of the NextTrip Sellers.

- Institutional ownership remains relatively minor, with insiders holding a notable percentage of shares.

- Donald P. Monaco and William Kerby are significant individual insiders.

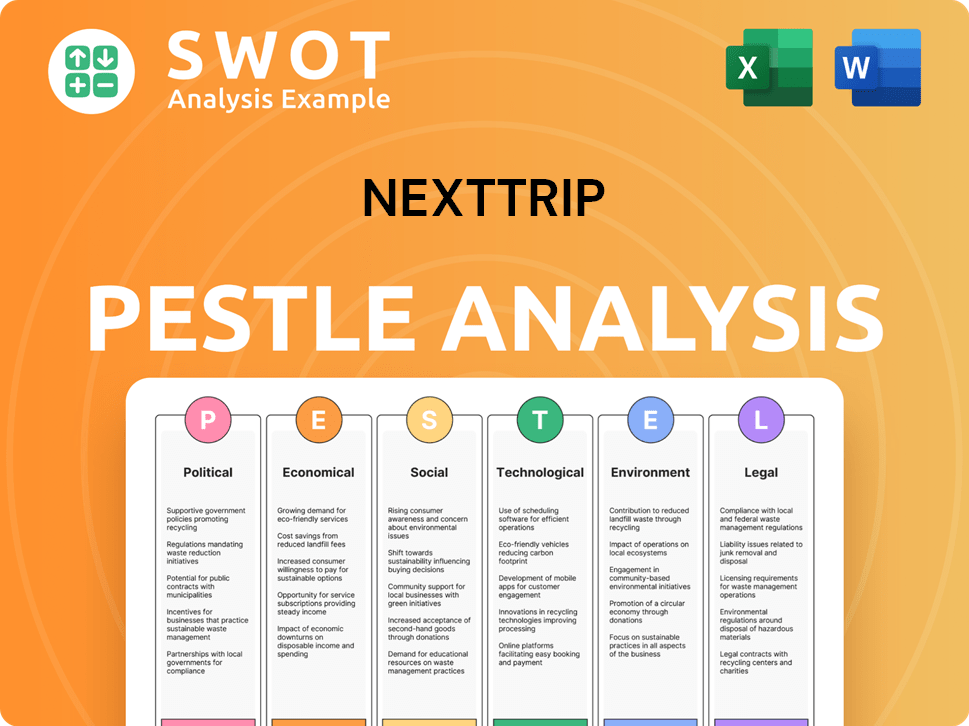

NextTrip PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on NextTrip’s Board?

The current board of directors of the company includes representatives from major shareholders alongside independent members. Donald P. Monaco holds the position of Chairman of the Board. Other key board members include Salvatore F. Battinelli and Dennis Duitch. William Kerby serves as the Chief Executive Officer, playing a crucial role in the company's leadership. Jacob Brunsberg, the former CEO of Sigma Additive Solutions, Inc., also serves as a director on the board. This structure reflects a balance between shareholder interests and independent oversight, which is a key factor in understanding Growth Strategy of NextTrip.

Following the issuance of Contingent Shares in March and May 2025, the NextTrip Representative was granted the right to appoint three new directors to the board. This demonstrates a direct link between significant shareholder milestones and board representation. As of March 28, 2025, the NextTrip Sellers held approximately 73.8% of the total outstanding shares, which gives them significant ownership and voting control within the company. The company's articles of incorporation allow the board of directors to designate preferred stock series and determine their voting powers, which could potentially affect the voting power of common stockholders.

The NextTrip Sellers hold a significant majority of the company's shares, giving them substantial voting power. This ownership structure is critical for understanding the company's strategic direction. The board's composition reflects a balance between shareholder interests and independent oversight.

- Donald P. Monaco serves as Chairman of the Board.

- William Kerby is the Chief Executive Officer.

- NextTrip Sellers hold approximately 73.8% of outstanding shares.

- The board can designate preferred stock series with specific voting powers.

NextTrip Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped NextTrip’s Ownership Landscape?

Over the past few years, significant shifts have occurred in the ownership structure of the NextTrip company. A major change was the December 2023 acquisition of NextTrip Holdings, Inc. by Sigma Additive Solutions, Inc. This event set the stage for subsequent share issuances tied to specific milestones. The total number of outstanding shares has seen substantial growth, with a 558.2% increase over the past year, primarily due to dilution.

A key development in March 2025 involved the issuance of 4,393,993 Contingent Shares to the NextTrip Sellers. This was followed by an additional 1,450,000 Contingent Shares in May 2025, contingent upon the achievement of business milestones. As a result, the NextTrip Sellers held approximately 73.8% of the total outstanding shares as of March 28, 2025, which solidified their control over the company. If you are interested in learning more about the company, read the Brief History of NextTrip.

| Ownership Event | Date | Impact |

|---|---|---|

| Acquisition of NextTrip Holdings, Inc. | December 2023 | Initiated ownership restructuring |

| Issuance of Contingent Shares | March 2025 | Increased NextTrip Sellers' ownership |

| Additional Issuance of Contingent Shares | May 2025 | Further increased NextTrip Sellers' ownership |

In April 2025, NextTrip completed the acquisition of the remaining 51% stake in Five Star Alliance, making it the sole owner of the luxury travel brand. Additionally, the company acquired the JOURNY TV channel in April 2025, expanding its media presence. To support its growth and operations, NextTrip secured a $3 million revolving line of credit from its Chairman in May 2025, aimed at minimizing shareholder dilution for critical near-term initiatives. The company's financial reports indicate a net loss of $10.12 million for the full year ended February 28, 2025, compared to a net loss of $7.33 million a year prior, and a working capital deficit of $105,577 as of February 28, 2025.

NextTrip ownership has seen major shifts, with significant increases in the number of outstanding shares due to acquisitions and milestone-based issuances. The NextTrip Sellers hold a significant majority stake.

NextTrip acquired Five Star Alliance and JOURNY TV, expanding its market presence. These acquisitions are part of the company's strategic growth plan.

The company reported a net loss for the fiscal year ending February 2025, along with a working capital deficit. The company is working to improve its financial situation.

A $3 million revolving line of credit was secured to support operations. This move aims to minimize shareholder dilution during crucial initiatives.

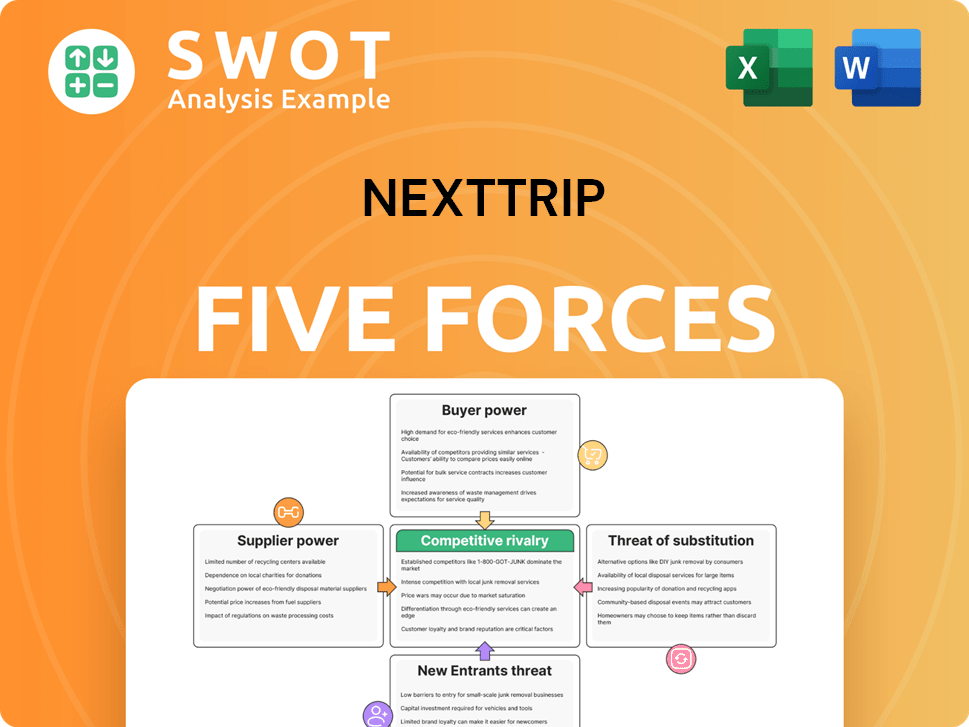

NextTrip Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of NextTrip Company?

- What is Competitive Landscape of NextTrip Company?

- What is Growth Strategy and Future Prospects of NextTrip Company?

- How Does NextTrip Company Work?

- What is Sales and Marketing Strategy of NextTrip Company?

- What is Brief History of NextTrip Company?

- What is Customer Demographics and Target Market of NextTrip Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.