Organon Bundle

Who Really Owns Organon Pharmaceuticals?

Understanding a company's ownership is crucial for investors and strategists alike. The story of Organon, a global healthcare company, is particularly compelling, having emerged from a major pharmaceutical spin-off. This transformation offers unique insights into strategic focus and market positioning, especially within the dynamic women's health sector. What impact does this ownership have on its future?

Organon's journey from a division of Merck & Co., Inc. to an independent entity highlights the strategic importance of dedicated ownership. Organon SWOT Analysis provides a deeper dive into the company's strengths and weaknesses. This exploration will uncover the evolution of Organon ownership, from its roots in Merck's portfolio to its current status as a publicly traded company, examining key investors and the impact of its structure on its mission to advance women's health. The focus will be on the Organon stock, Organon's history, and the relationship between Organon and its parent company.

Who Founded Organon?

The story of Organon's ownership differs from the typical startup narrative. It emerged not from individual founders but as a spin-off from the pharmaceutical giant, Merck. This unique origin shaped its initial ownership structure and subsequent trajectory within the pharmaceutical industry.

Organon's formation was a strategic move by Merck to unlock value from its women's health and established brands. This separation, finalized on June 2, 2021, involved distributing Organon shares to Merck's existing shareholders, making it a publicly traded company from its inception. This approach meant the initial ownership was broadly distributed among Merck's shareholders.

Consequently, Organon did not have traditional founders or early investors in the conventional sense. The company's creation was a corporate restructuring, and the initial ownership was determined by the distribution of shares to Merck shareholders. This structure underscores the company's unique position in the pharmaceutical landscape.

Merck shareholders received one share of Organon for every ten shares of Merck held. This distribution method immediately established Organon as a public company.

Organon's creation as a spin-off meant there were no individual founders or early investors who acquired stakes in the initial phase. The company's formation was a corporate restructuring.

The spin-off aimed to create a focused entity dedicated to women's health and established brands, aiming to unlock greater value for shareholders. This strategic decision drove the company's formation.

The initial ownership was broadly distributed among Merck's existing shareholders. This distribution method immediately established Organon as a public company.

The typical early agreements, such as vesting schedules or buy-sell clauses, were not applicable in this context. The terms of the spin-off governed the initial distribution and trading of Organon shares.

There were no initial ownership disputes or buyouts specific to Organon's formation beyond the mechanics of the spin-off itself. The process was a straightforward distribution of shares.

The spin-off from Merck established Organon as a publicly traded company, with its initial ownership distributed among Merck shareholders. This unique structure highlights the company's history and its relationship with its Organon parent company. For more insights into the company's market position, consider exploring the Target Market of Organon. As of early 2024, the company continues to operate with this initial public ownership structure, and the Organon stock symbol is (OGN). The company's financial performance, including revenue figures for 2023, reflects its operations within the pharmaceutical industry.

Organon's founding ownership structure is unique, having originated from a spin-off from Merck. This corporate restructuring resulted in a public company from its inception, with shares distributed to Merck shareholders.

- Organon's creation did not involve traditional founders or early investors.

- The spin-off aimed to unlock value from Merck's women's health and established brands.

- The initial ownership was broadly distributed among Merck's existing shareholders.

- The terms of the spin-off governed the initial distribution and trading of Organon shares.

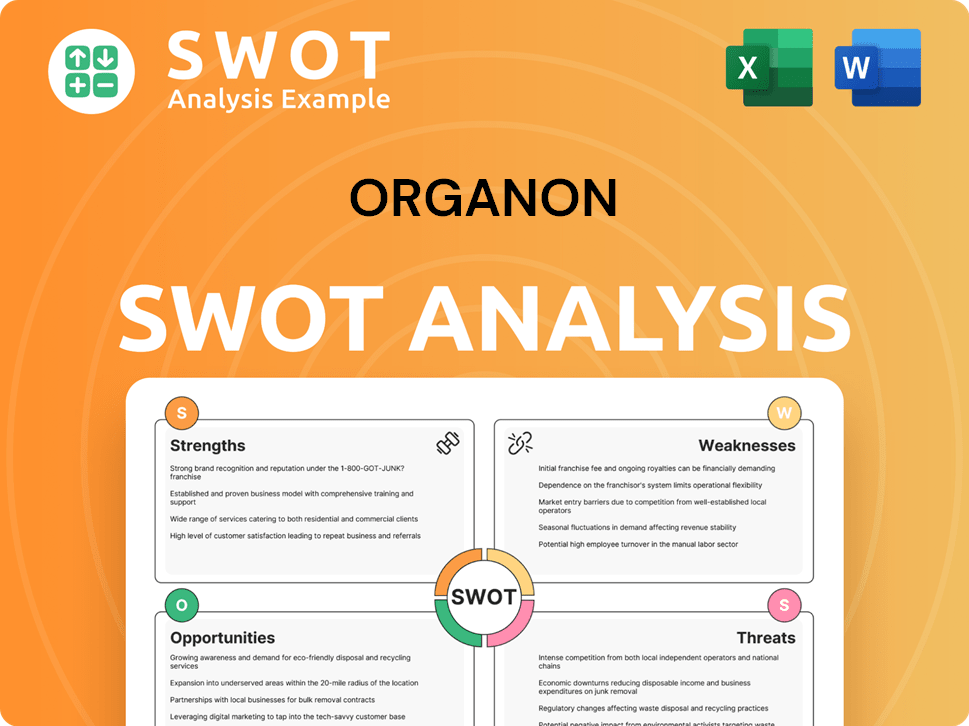

Organon SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Organon’s Ownership Changed Over Time?

The ownership structure of Organon, a pharmaceutical company, has evolved significantly since its spin-off. The company began trading publicly on June 2, 2021, with an initial market capitalization of roughly $9.8 billion. This marked a pivotal moment, transforming its ownership from a private entity to one governed by the dynamics of the public market, including institutional and individual investors.

As a publicly traded entity, Organon's ownership has been subject to the fluctuations of the stock market. Major shifts in shareholding are primarily driven by the buying and selling activities of institutional investors, mutual funds, and individual investors. The company's stock performance and strategic decisions are closely watched by these stakeholders, influencing the company's direction and financial health.

| Event | Date | Impact on Ownership |

|---|---|---|

| Spin-off from parent company | June 2, 2021 | Transitioned from private ownership to public trading, establishing an independent ownership structure. |

| Initial Public Offering (IPO) | June 2, 2021 | Determined initial shareholder base and market valuation, with shares available for public purchase. |

| Ongoing Market Activity | 2021-2025 | Continuous shifts in ownership due to trading by institutional and individual investors, impacting major shareholders. |

Currently, institutional investors are major stakeholders in Organon. Investment management firms and mutual funds hold significant portions of the company's shares. For example, as of early 2025, Vanguard Group Inc., BlackRock Inc., and State Street Corp. are among the largest institutional shareholders. These firms often hold substantial passive stakes, with percentages fluctuating based on market activity. For instance, Vanguard Group Inc. might hold approximately 11.5% of Organon's shares, BlackRock Inc. around 9.8%, and State Street Corp. about 4.5%. These figures are based on typical institutional holdings reported in SEC filings.

Organon's ownership structure is primarily influenced by institutional investors, such as Vanguard and BlackRock. These entities hold significant shares, impacting governance through voting rights.

- The company's initial market capitalization was approximately $9.8 billion.

- Institutional investors' stakes often range from 5% to over 10% of outstanding shares.

- Changes in major shareholding reflect investment strategies of large funds.

- Organon's strategy and governance are primarily guided by its independent board of directors.

These changes in major shareholding primarily reflect the investment strategies of large funds rather than direct strategic influence on Organon's day-to-day operations. However, the collective influence of institutional investors can impact governance through proxy voting on shareholder proposals and board elections. The Brief History of Organon provides further context on the company's evolution, including its relationship with its parent company and its journey to becoming a publicly traded entity. Organon's strategy and governance are primarily guided by its independent board of directors and management team, with the broader shareholder base providing oversight through their voting rights.

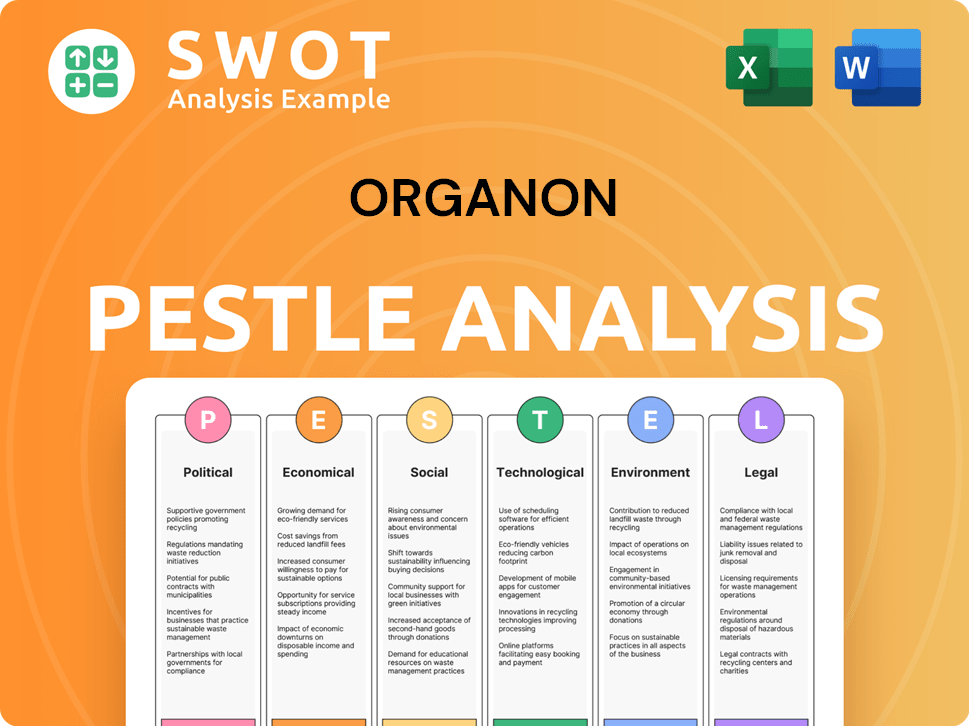

Organon PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Organon’s Board?

The current Board of Directors of Organon, a prominent player in Organon pharmaceuticals, is composed of a mix of independent directors and individuals with extensive industry experience. As of early 2025, the board typically includes experts in pharmaceuticals, women's health, finance, and global business. This structure aims for a majority of independent directors to ensure objective oversight. For instance, Kevin Ali serves as the Chief Executive Officer and a board member, while Carrie Cox serves as the independent Chair of the Board. Other board members come from backgrounds in large pharmaceutical companies, investment banking, and public policy, bringing diverse perspectives to the table.

The board members do not directly represent major shareholders, as Organon is a widely held public company. They are elected by shareholders to act in the best interests of the company and all its shareholders. The voting structure for Organon's common shares is typically one-share-one-vote, standard for most publicly traded companies in the United States. There are no known dual-class shares or special voting rights that would grant outsized control to any single entity. This ensures that voting power is directly proportional to the number of shares owned, reflecting a commitment to fair governance within the realm of Organon ownership.

| Board Member | Title | Background |

|---|---|---|

| Kevin Ali | Chief Executive Officer | Pharmaceuticals |

| Carrie Cox | Independent Chair of the Board | Healthcare, Pharmaceuticals |

| Specific board members | Various | Pharmaceuticals, Investment Banking, Public Policy |

Organon has not faced significant public proxy battles or activist investor campaigns since its spin-off. Its governance has focused on establishing itself as an independent entity and executing its strategy in women's health. The board's role is to provide strategic guidance, oversee management, and ensure long-term value creation for all shareholders. For more insights, consider exploring the Marketing Strategy of Organon.

Organon's board includes independent directors and industry experts, ensuring diverse perspectives. The voting structure is one-share-one-vote, maintaining equitable shareholder power. The company has not faced significant governance controversies, focusing on its women's health strategy.

- Diverse Board Composition: A mix of independent and experienced directors.

- Equitable Voting: One-share-one-vote structure.

- Strategic Focus: Emphasis on women's health and long-term value.

- Governance Stability: No major proxy battles or activist campaigns.

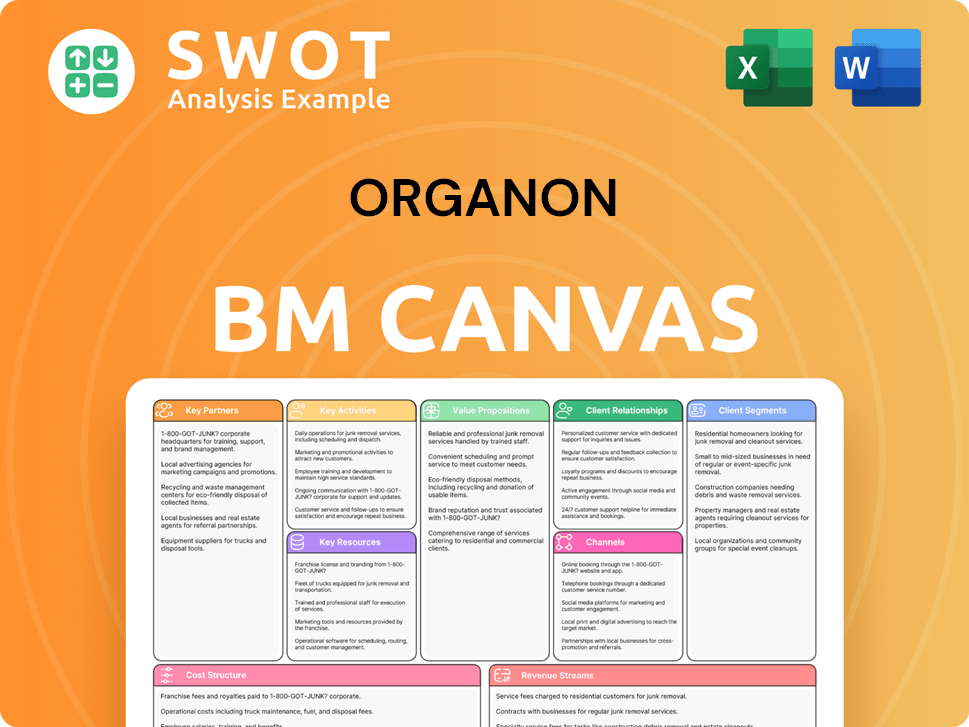

Organon Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Organon’s Ownership Landscape?

Since its spin-off in June 2021, the ownership structure of Organon, a prominent player in the pharmaceutical sector, has evolved into that of a typical publicly traded entity. Over the past few years, the company has prioritized establishing its independent operations and executing its women's health strategy. Recent activities have focused on strategic partnerships and smaller acquisitions to enhance its product portfolio rather than large-scale mergers and acquisitions that would drastically alter its ownership. For example, in 2024, Organon continued to pursue business development opportunities. The leadership changes have been part of normal corporate evolution, and no major founder departures have impacted ownership, given its spin-off origin.

Institutional investors primarily drive new strategic investments, increasing their stakes based on market performance and investment theses. As of early 2025, institutional ownership in Organon remains high, reflecting its inclusion in various indices and the investment strategies of large asset managers. While founder dilution is not applicable in Organon's case due to its spin-off, the broader trend of consolidation in the pharmaceutical industry could, in the long term, lead to M&A activities that would alter its ownership. However, Organon's distinct focus on women's health positions it uniquely within the market. The company's focus remains on organic growth and strategic partnerships to expand its global footprint in women's health. To understand Organon's position in the market, consider the Competitors Landscape of Organon.

The company's financials and market performance have influenced investor behavior, with the stock symbol being OGN. The company's focus on women's health and strategic partnerships will likely continue to shape its ownership dynamics in the coming years. As of the latest reports, the company's revenue for 2023 was a key indicator of its market position and investor interest. The company's headquarters is located in Jersey City, New Jersey. The company is a publicly traded entity.

Institutional investors hold a significant portion of Organon stock, reflecting its presence in various market indices and the investment strategies of large asset managers. This high level of institutional ownership indicates confidence in the company's long-term prospects and its strategic focus on women's health.

Organon has been actively pursuing strategic partnerships and smaller acquisitions to bolster its product portfolio, particularly within the women's health sector. These partnerships are crucial for expanding its global footprint and enhancing its product offerings, contributing to its organic growth strategy.

The market performance of Organon, reflected in its stock price (OGN), influences investor behavior and ownership trends. The company's financial results, including its 2023 revenue, are key indicators of its market position and investor interest, driving decisions related to shareholding and investment strategies.

The absence of major founder departures or significant share buybacks since the spin-off suggests a period of relative stability in Organon's ownership structure. This stability allows the company to focus on its core business strategies and long-term growth initiatives without major disruptions.

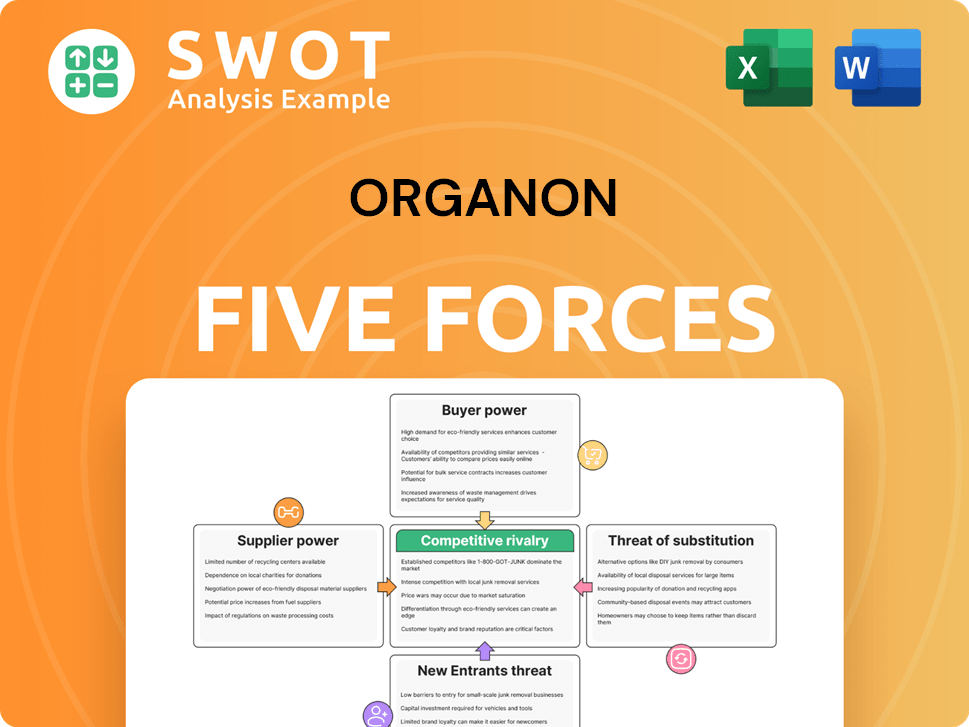

Organon Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Organon Company?

- What is Competitive Landscape of Organon Company?

- What is Growth Strategy and Future Prospects of Organon Company?

- How Does Organon Company Work?

- What is Sales and Marketing Strategy of Organon Company?

- What is Brief History of Organon Company?

- What is Customer Demographics and Target Market of Organon Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.