Petroplus Holdings AG Bundle

Who Really Owned Petroplus Holdings AG?

Understanding the ownership structure of a company is crucial for grasping its trajectory and potential risks. The story of Petroplus Holdings AG, once a giant in European oil refining, offers a compelling case study in how ownership shifts can impact a company's fate. From its initial backers to its eventual downfall, exploring the Petroplus Holdings AG SWOT Analysis is key to understanding its complex history.

Delving into the Petroplus ownership structure reveals a tale of ambition, financial challenges, and ultimately, bankruptcy. This article investigates the Petroplus company's evolution, tracing its major stakeholders and analyzing the factors that led to its financial troubles. We'll explore the Petroplus history, including its assets and the key players involved in its demise and subsequent liquidation.

Who Founded Petroplus Holdings AG?

The story of Petroplus Holdings AG begins in 1993, initially as Petroplus International N.V., established in the Netherlands. The early focus of the Petroplus company was on strategic acquisitions to expand its market presence and operational capabilities.

While the exact details of the founders and their initial ownership stakes aren't fully available in the provided information, the company's early actions suggest a clear ambition to grow through strategic acquisitions. This approach was crucial in shaping the company's early years and its subsequent evolution.

Petroplus history includes its listing on the Amsterdam Stock Exchange in August 1998. This marked the first step into the public market, allowing for broader investment and capital raising to fuel its expansion plans.

Petroplus International N.V. was listed on the Amsterdam Stock Exchange in August 1998, opening up opportunities for wider investment and capital growth.

The company's early strategy was to grow through acquisitions, a key element in its development and market positioning.

In April 2005, a holding company acquired Petroplus International N.V., leading to its delisting from the Euronext Amsterdam, marking a shift to private ownership.

A new management team, including Thomas D. O'Malley as chairman and CEO, was put in place in May 2006, signaling a strategic shift.

The acquisition of European Petroleum Holdings N.V. (EPH), including the BRC refinery in Antwerp, Belgium, occurred during this period.

In August 2006, Argus and RIVR merged and relocated to Switzerland, rebranding as Petroplus Holdings AG.

The acquisition in April 2005, which led to the delisting from Euronext Amsterdam, marked a transition to private ownership. This was followed by the recruitment of a new management team in May 2006, including Thomas D. O'Malley. The acquisition of European Petroleum Holdings N.V. (EPH) and its assets, including the BRC refinery, further shaped the company. Finally, the company went public again on the Swiss Stock Exchange (SIX: PPHN) in November 2006. To learn more about the company's strategic moves, consider reading about the Growth Strategy of Petroplus Holdings AG.

The ownership of Petroplus Holdings AG has seen significant shifts, from its initial public listing to periods of private ownership and subsequent relisting.

- 1998: Initial public listing on the Amsterdam Stock Exchange.

- 2005: Delisting from Euronext Amsterdam following an acquisition.

- 2006: Relisting on the Swiss Stock Exchange (SIX: PPHN).

- Early ownership was focused on acquisitions and expansion.

- The company's history includes strategic acquisitions and changes in ownership structure.

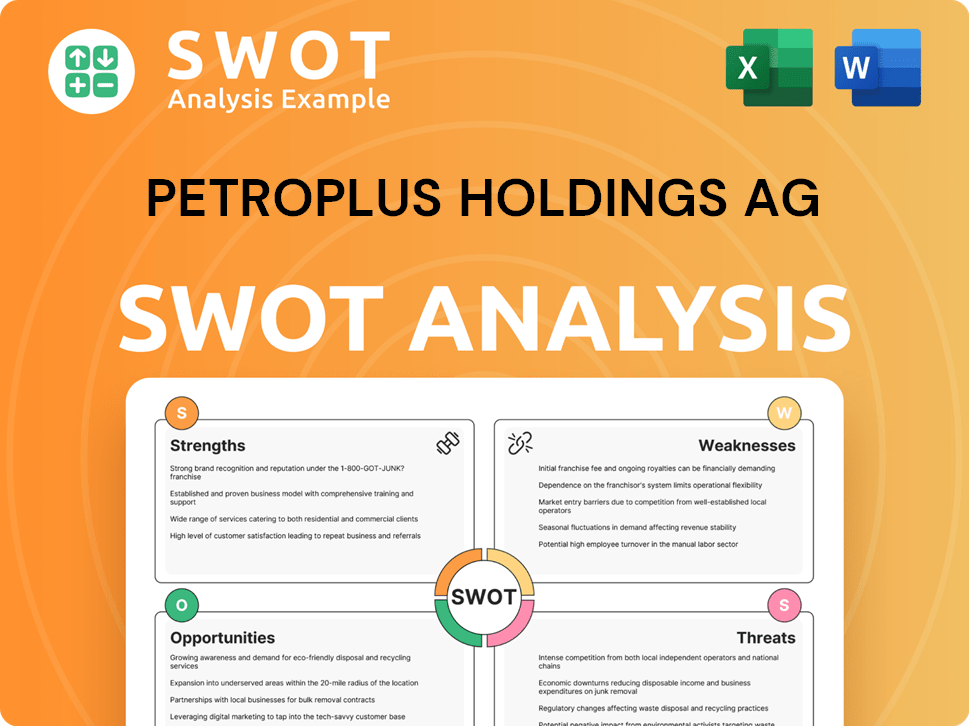

Petroplus Holdings AG SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Petroplus Holdings AG’s Ownership Changed Over Time?

The ownership of Petroplus Holdings AG underwent significant changes throughout its operational history. Initially listed on the Amsterdam Stock Exchange in August 1998, the Petroplus company was taken private by RIVR in April 2005, leading to its delisting. This marked a transition from public to private ownership, a key event in the Petroplus history.

The private phase was short-lived. In November 2006, Petroplus Holdings AG, now headquartered in Zug, Switzerland, launched an IPO on the Swiss Stock Exchange (SIX: PPHN), re-establishing itself as a publicly traded entity. This allowed both institutional and individual investors to purchase shares. However, the company faced financial difficulties, culminating in a $1 billion credit line freeze in December 2011, which, alongside low refining margins, led to the Petroplus bankruptcy filing on January 24, 2012.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering | August 1998 | Public listing on the Amsterdam Stock Exchange, allowing public shareholding. |

| Acquisition by RIVR | April 2005 | Taken private, delisting from Euronext Amsterdam, shifting to private ownership. |

| Initial Public Offering on SIX | November 2006 | Re-established as a publicly traded company on the Swiss Stock Exchange. |

| Credit Line Freeze and Insolvency Filing | December 2011 / January 2012 | Led to default on senior notes and convertible bonds, effectively ending public ownership and initiating liquidation. |

By December 31, 2009, the shareholder base was diversified, with no single entity holding more than 3% of voting rights, except for FMR Corp., which increased its ownership to 6.53% by February 3, 2010. The Petroplus assets are in liquidation as of October 2024, with proceedings for entities like Petroplus Marketing AG ongoing, and preparations for the conclusion of proceedings continuing into 2025. Shares held by Petroplus Marketing AG in other group companies were deemed worthless, reflecting the insolvency of those entities.

Petroplus Holdings AG transitioned from public to private ownership and back again, demonstrating the volatility of the energy sector.

- The company's financial troubles led to its bankruptcy and liquidation.

- The ownership structure was diversified before the financial crisis.

- The liquidation process continues, with claims being collected as of late 2024.

- The article on the Petroplus company provides a detailed overview.

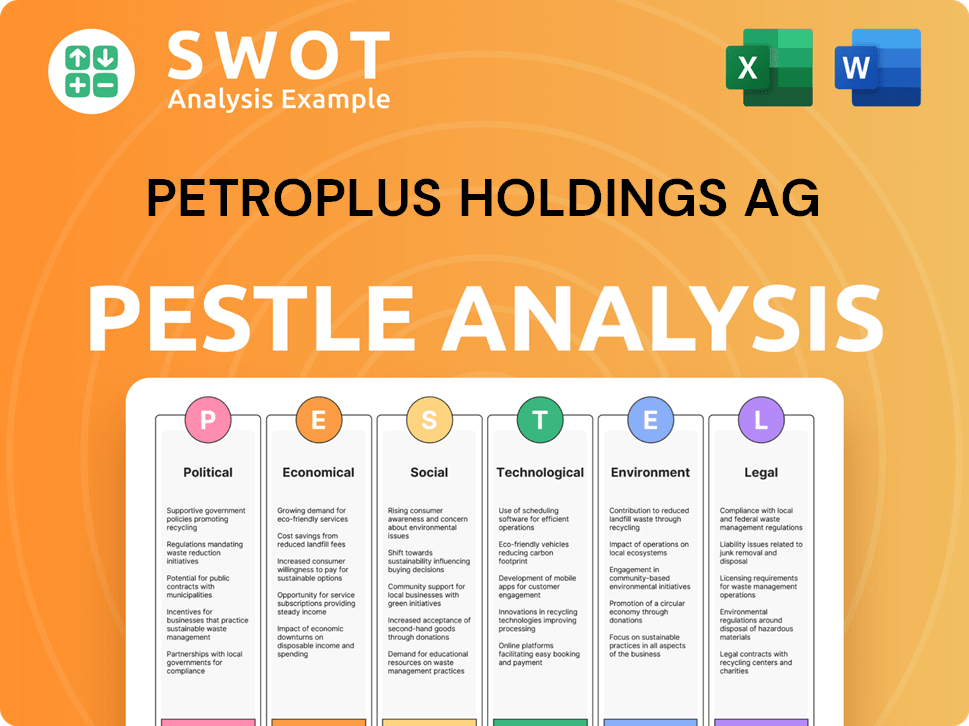

Petroplus Holdings AG PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Petroplus Holdings AG’s Board?

At the time leading up to its insolvency, the Board of Directors of Petroplus Holdings AG played a critical role. The board's primary objective was to ensure the safe shutdown of operations and to preserve value for all stakeholders. Key figures included Thomas D. O'Malley as Chairman and CEO, and Karyn F. Ovelmen as CFO. Other directors included Patrick Monteiro de Barros, Markus Dennler, Walter Gruebler, Robert J. Lavinia, Maria Livanos Cattaui, Eija Malmivirta, Werner G. Mueller, Patrick Power, and Ernst Weil. Jean-Paul Vettier was also the Chief Executive Officer at the time of the insolvency announcement.

The board's decisions were significantly influenced by the company's financial distress. The company faced frozen credit lines and failed negotiations with lenders. The board ultimately made the decision to file for insolvency. The company's management, including the Board, worked to avoid bankruptcy but were unable to reach an agreement with lenders due to the challenging European credit and refining markets. This period saw intense pressure from creditors, particularly banks, who served notices of acceleration on revolving credit facilities, triggering defaults on significant senior notes and convertible bonds totaling $1.75 billion. The board's decision to file for insolvency was a direct consequence of these failed negotiations and the inability to secure necessary financing to continue operations.

| Board Member | Role | Notes |

|---|---|---|

| Thomas D. O'Malley | Chairman and CEO | Key figure during the crisis. |

| Karyn F. Ovelmen | Chief Financial Officer | Played a key role in financial decisions. |

| Jean-Paul Vettier | Chief Executive Officer | CEO at the time of insolvency announcement. |

The general voting structure for a publicly traded company like Petroplus Holdings AG would typically be one-share-one-vote. There is no information in the provided context to suggest a dual-class share structure or special voting rights. In the face of financial challenges, the Board of Directors had to navigate complex situations. The Petroplus bankruptcy was primarily driven by severe financial distress and a lack of liquidity.

The Board of Directors of Petroplus Holdings AG played a crucial role in managing the company's financial difficulties leading up to its insolvency. The board's actions were primarily driven by frozen credit lines and failed negotiations with lenders. The company's inability to secure financing forced the board to file for insolvency.

- The board's primary goal was to ensure a safe shutdown and preserve value.

- Intense pressure from creditors, especially banks, led to defaults.

- The insolvency was a direct result of failed negotiations and lack of funding.

- The company's financial troubles and the resulting bankruptcy.

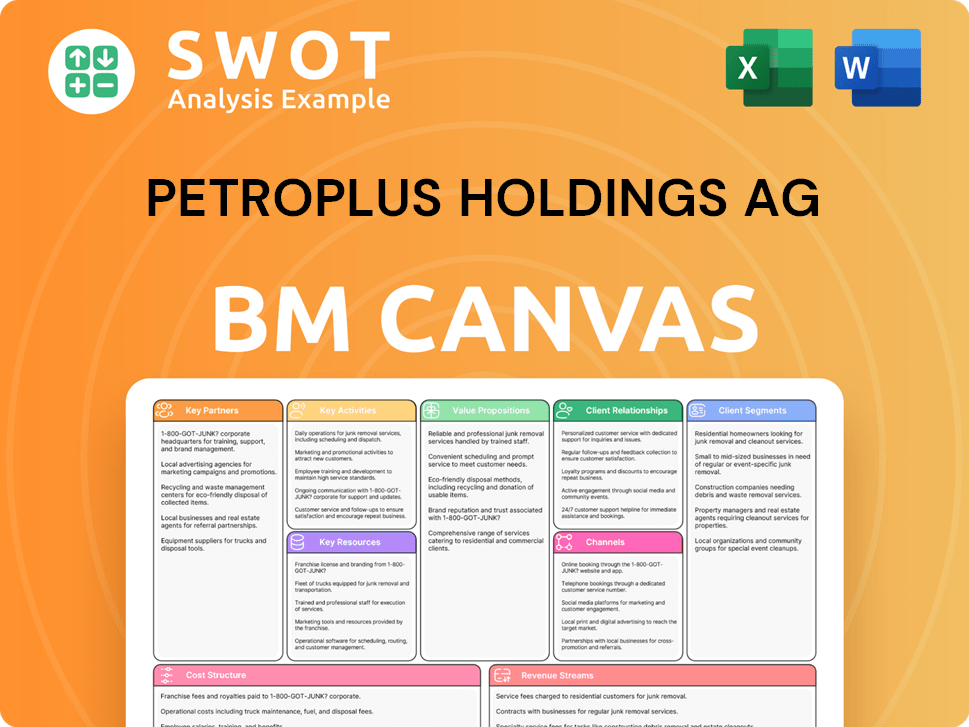

Petroplus Holdings AG Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Petroplus Holdings AG’s Ownership Landscape?

Regarding Petroplus Holdings AG, the company filed for insolvency on January 24, 2012, and has been in liquidation since then. Therefore, there are no recent developments concerning its operational Petroplus ownership profile in the traditional sense. The company, as a corporate entity, is out of business, and its current status is 'in liquidation.' This means there's no active trading or ownership changes to report.

The liquidation process has been ongoing for over a decade, and it involves subsidiaries like Petroplus Marketing AG, which is still undergoing debt restructuring. Liquidators are working to collect receivables and prepare for the conclusion of proceedings, with an expectation to provide a further circular on the Report on Activities by spring 2025. Interim payments have been made to creditors, with 30.8% already paid out and an estimated future dividend of around 0.2%. Shares held by Petroplus Marketing AG in other insolvent group companies have been recognized as worthless. For more context on the company’s Marketing Strategy of Petroplus Holdings AG.

| Aspect | Details | Status |

|---|---|---|

| Insolvency Filing | January 24, 2012 | Completed |

| Current Status | In Liquidation | Ongoing |

| Subsidiary in Liquidation | Petroplus Marketing AG | Ongoing (Debt Restructuring) |

| Creditor Payments | 30.8% paid out | Ongoing |

| Estimated Future Dividend | Around 0.2% | Projected |

In the wider European refining industry, large integrated oil companies are selling refining assets to independents and trading firms. This shift is driven by the nimbleness and cost-cutting capabilities of these independent firms. Nearly 400,000 barrels per day (b/d) of capacity, about 3% of Europe's total, are set to close in 2025. This includes facilities like the Grangemouth refinery in Scotland and portions of refineries in Germany. Additionally, new refineries in Africa and the Middle East are increasing competitive pressure on European refiners. The industry is also facing declining margins due to reduced local European demand from the energy transition and electrification, and stricter emissions regulations. Many refineries are expected to convert to biorefineries, electric fuels, or low-carbon hydrogen fuels by 2035 or face potential closure.

Petroplus Holdings AG was a Swiss-based refining company that once owned and operated several refineries across Europe. The company faced significant financial challenges, leading to its bankruptcy filing in 2012. The Petroplus history is marked by a rapid expansion followed by a swift decline.

The Petroplus bankruptcy was a complex process involving the liquidation of its assets and the restructuring of its debts. This involved selling off refineries and other assets to repay creditors. The bankruptcy proceedings have been ongoing for over a decade.

The Petroplus assets included several refineries located in various European countries. These assets were sold off during the liquidation process to satisfy the claims of creditors. The sale of assets was a key part of the Petroplus bankruptcy proceedings.

The European refining industry is seeing a trend of refinery closures and capacity reductions. The closure of these refineries is partly due to economic pressures and the shift to renewable energy sources. The industry is also facing declining margins due to reduced local European demand from the energy transition and electrification, and stricter emissions regulations.

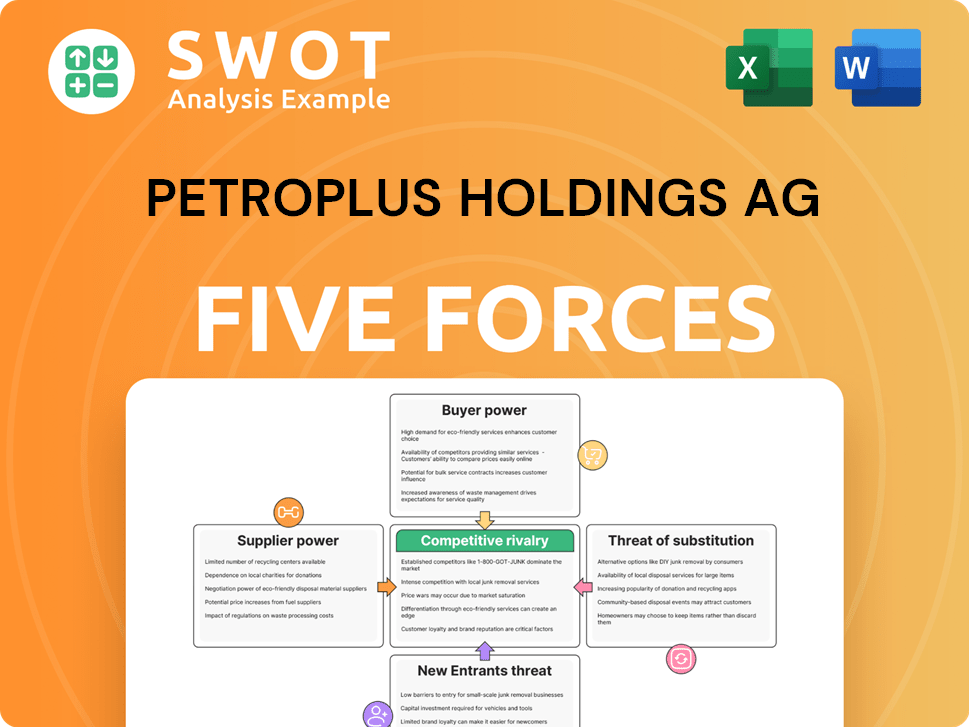

Petroplus Holdings AG Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Petroplus Holdings AG Company?

- What is Competitive Landscape of Petroplus Holdings AG Company?

- What is Growth Strategy and Future Prospects of Petroplus Holdings AG Company?

- How Does Petroplus Holdings AG Company Work?

- What is Sales and Marketing Strategy of Petroplus Holdings AG Company?

- What is Brief History of Petroplus Holdings AG Company?

- What is Customer Demographics and Target Market of Petroplus Holdings AG Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.