Pinnacle Financial Partners Bundle

Who Really Owns Pinnacle Financial Partners?

Unraveling the ownership structure of Pinnacle Financial Partners SWOT Analysis is key to understanding its strategic moves and future potential. Did you know that Pinnacle Financial, which started as a local Tennessee bank, has grown into a major player in the Southeast? Knowing who controls the reins provides critical insights for any investor or stakeholder.

From its inception on February 20, 2000, to its IPO in May 2002, Pinnacle Financial's ownership has transformed significantly. This analysis will explore the evolution of Pinnacle Financial ownership, from its founders' initial stakes to the current public shareholders, including major institutional investors. Understanding the Pinnacle Financial Partners SWOT Analysis is also essential to understand the company's financial performance and leadership.

Who Founded Pinnacle Financial Partners?

The genesis of Pinnacle Financial Partners dates back to February 20, 2000. On this day, twelve Nashville businessmen came together to establish the financial institution.

The core leadership team included M. Terry Turner, who took on the roles of president and chief executive officer; Robert A. McCabe, Jr., who served as chairman; and Hugh M. Queener, who was the chief administrative officer. These individuals previously held senior management positions at First American Corporation, a financial institution based in Nashville.

The founders saw an opportunity following the 1999 acquisition of First American Corporation by AmSouth Bancorporation. Their aim was to create a new bank focused on the local market.

The company was founded on February 20, 2000.

The founding leadership team consisted of M. Terry Turner, Robert A. McCabe, Jr., and Hugh M. Queener.

Pinnacle Financial Partners went public in May 2002 on the NASDAQ.

The founders of Pinnacle Financial Partners aimed to build a firm that prioritized its associates and clients. This approach was intended to drive shareholder returns. The bank began its operations on October 27, 2000. The company's stock symbol is PNFP, and it is publicly traded. As of December 31, 2023, the company reported total assets of approximately $46.6 billion.

- The founders' vision centered on prioritizing associates and clients.

- Pinnacle Financial Partners commenced banking operations on October 27, 2000.

- The company's initial public offering occurred in May 2002.

- As of December 31, 2023, the company had approximately $46.6 billion in total assets.

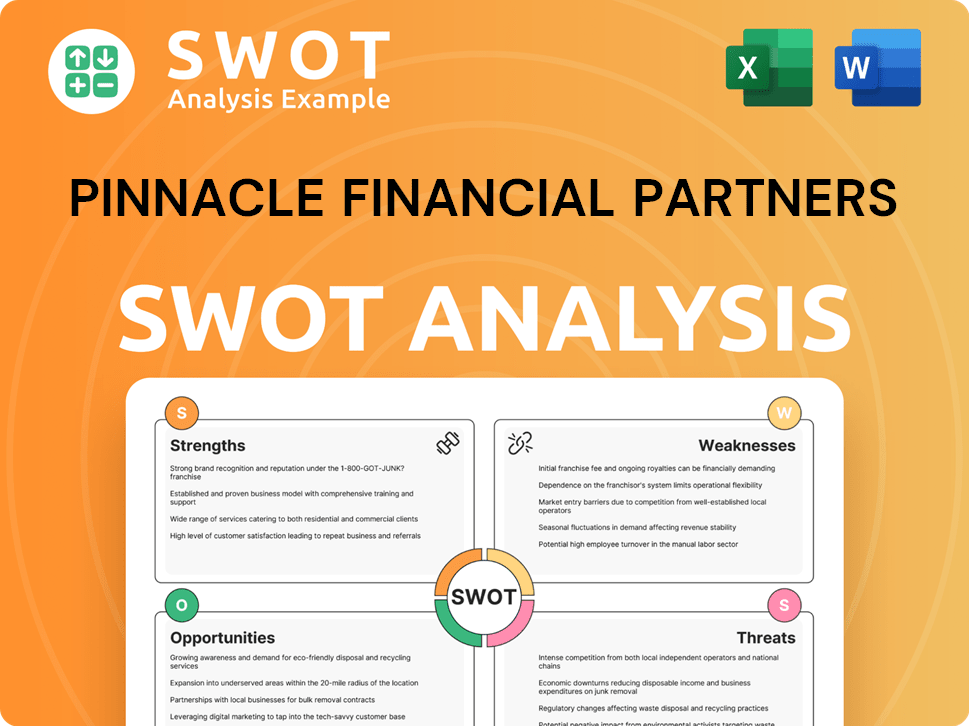

Pinnacle Financial Partners SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Pinnacle Financial Partners’s Ownership Changed Over Time?

The journey of Pinnacle Financial Partners as a publicly traded entity began in May 2002 when it launched its IPO, trading on NASDAQ under the symbol PNFP. This marked a pivotal moment, setting the stage for substantial growth and changes in its ownership structure. Since then, the company has experienced considerable expansion, driven by both organic growth and strategic acquisitions, which have influenced its ownership dynamics over time. The evolution of Pinnacle Financial Partners, and its ownership, reflects its strategic moves and market performance.

As of June 6, 2025, the ownership of Pinnacle Financial Partners is distributed among institutional shareholders (85.30%), insiders (4.93%), and retail investors (9.78%). This distribution highlights the significant role institutional investors play in the company's financial landscape. Strategic acquisitions, such as the 2017 purchase of BNC Bank, have also played a crucial role in expanding its operational footprint, contributing to the company's growth and financial standing. For further insights into its growth, consider reading about the Growth Strategy of Pinnacle Financial Partners.

| Ownership Category | Percentage (June 6, 2025) | Percentage (May 2025) |

|---|---|---|

| Institutional Shareholders | 85.30% | 86.45% |

| Insiders | 4.93% | N/A |

| Retail Investors | 9.78% | N/A |

Major institutional shareholders as of December 31, 2024, included The Vanguard Group, Inc. (9.39%), BlackRock, Inc. (9.25%), and T. Rowe Price Group, Inc. (5.51%). Other significant investors include State Street Global Advisors, Inc. (4.47%), and Dimensional Fund Advisors LP (3.92%). As of March 31, 2025, the company's total assets reached approximately $54.3 billion, underscoring its financial strength and market presence.

Pinnacle Financial Partners is primarily owned by institutional investors. The company's growth has been fueled by strategic acquisitions and organic expansion.

- Institutional investors hold a significant majority of the shares.

- The company's asset size reflects its strong market position.

- The acquisition of BNC Bank expanded Pinnacle's reach.

- The stock symbol for Pinnacle Financial Partners is PNFP.

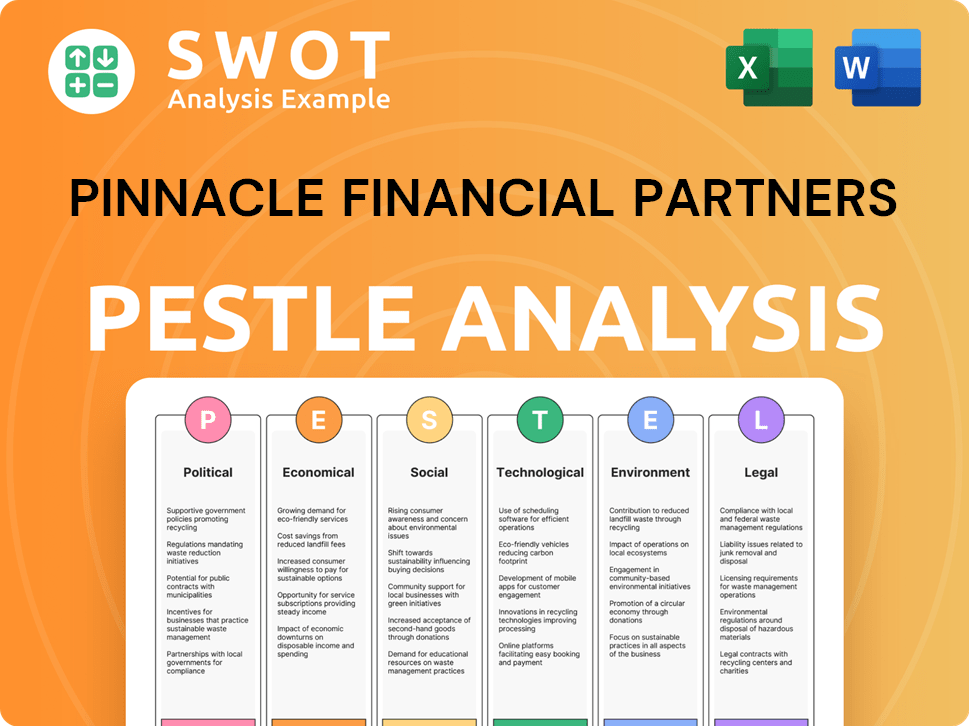

Pinnacle Financial Partners PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Pinnacle Financial Partners’s Board?

The current board of directors at Pinnacle Financial Partners plays a vital role in the company's governance. A significant portion of the directors meets the independence criteria as defined by Nasdaq's rules. The company's Bylaws allow for a board size ranging from five to twenty-five members. The company currently aims for a board size of twelve to fifteen members to ensure a balance of experience and individual accountability. The number of directors is determined by a majority vote from the full board.

At the Annual Meeting of Shareholders on April 15, 2025, all 12 directors were re-elected for another year. Voting results showed strong support for the directors. For instance, Abney S. Boxley, III received 56,860,879 votes in favor, with only 4,965,220 votes against. The board's composition and nomination process consider diversity and qualifications, although specific details on individual board members representing major shareholders are not explicitly stated. The voting structure generally follows a one-share-one-vote principle for common stock, which is required for significant corporate actions.

| Director | Votes For | Votes Against |

|---|---|---|

| Abney S. Boxley, III | 56,860,879 | 4,965,220 |

| Other Directors (Example) | Significant Majority | Minimal |

| Total Directors Re-elected | 12 | N/A |

The board has established Corporate Governance Guidelines to ensure effective policy and decision-making, with the goal of enhancing shareholder value. There have been no recent proxy battles or activist investor campaigns publicly highlighted as significantly shaping decision-making within Pinnacle Financial Partners. To understand the financial aspects of the company, you can explore the Revenue Streams & Business Model of Pinnacle Financial Partners.

The board of directors at Pinnacle Financial Partners is crucial for governance, with a focus on independence and diversity.

- The board size is optimized for effective oversight.

- Shareholders strongly support the re-election of directors.

- Corporate Governance Guidelines are in place to enhance shareholder value.

- The voting structure generally follows a one-share-one-vote principle.

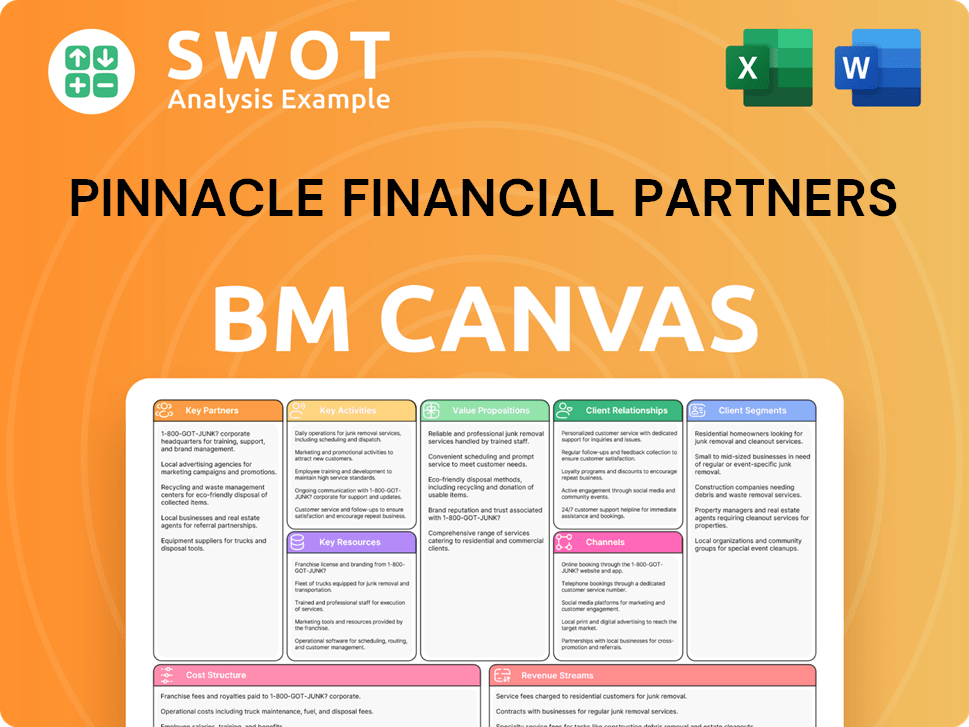

Pinnacle Financial Partners Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Pinnacle Financial Partners’s Ownership Landscape?

Over the past few years, Pinnacle Financial Partners has shown consistent financial strength and strategic management of its capital. In January 2024, the board approved a share repurchase program for up to $125.0 million of outstanding common stock, which was set to expire on March 31, 2025. This was followed by another share repurchase program for $125.0 million in January 2025, scheduled to begin after the first program ended and run through March 31, 2026. Despite these authorizations, the company did not repurchase any shares under the 2024 program or a previously approved program that expired on March 31, 2024.

As of June 6, 2025, institutional ownership remains a key trend for Pinnacle Financial Partners, with institutions holding 85.30% of the company. Although there was a slight decrease in institutional holdings of 4.21%, or 82,100K shares, over the last three months, institutional ownership was largely unchanged at 86.45% in May 2025. Insider holdings also saw a minor decrease, moving from 1.27% to 1.20% in May 2025. If you are looking for information about the Target Market of Pinnacle Financial Partners, this article may help.

| Metric | Value | Date |

|---|---|---|

| Institutional Ownership | 85.30% | June 6, 2025 |

| Insider Holdings | 1.20% | May 2025 |

| Total Assets | $54.3 billion | March 31, 2025 |

Furthermore, the company has maintained a history of paying quarterly dividends, with the most recent increase to $0.24 per share during the first quarter of 2025. Pinnacle Financial Partners continues to focus on organic growth and yield expansion within its earning asset portfolio. The firm's total assets reached approximately $54.3 billion as of March 31, 2025.

Institutional investors hold the majority stake in Pinnacle Financial Partners, demonstrating confidence in the company's performance. The company's financial strategy includes share repurchase programs and consistent dividend payments.

Total assets of Pinnacle Bank reached approximately $54.3 billion as of March 31, 2025. The company focuses on organic growth and yield expansion within its earning asset portfolio.

The company approved share repurchase programs in January 2024 and January 2025, signaling confidence in its financial health. These programs aim to return value to shareholders.

Pinnacle Financial Partners consistently pays quarterly dividends, with the most recent increase to $0.24 per share in the first quarter of 2025. This highlights the company's commitment to rewarding shareholders.

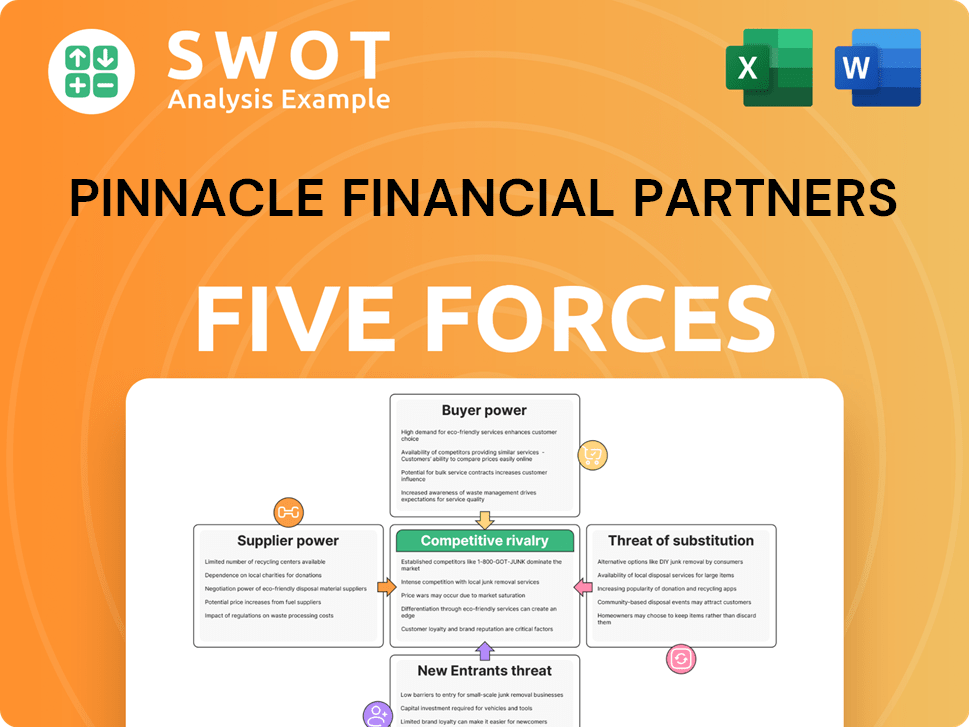

Pinnacle Financial Partners Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pinnacle Financial Partners Company?

- What is Competitive Landscape of Pinnacle Financial Partners Company?

- What is Growth Strategy and Future Prospects of Pinnacle Financial Partners Company?

- How Does Pinnacle Financial Partners Company Work?

- What is Sales and Marketing Strategy of Pinnacle Financial Partners Company?

- What is Brief History of Pinnacle Financial Partners Company?

- What is Customer Demographics and Target Market of Pinnacle Financial Partners Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.