SiteOne Landscape Supply Bundle

Who Really Calls the Shots at SiteOne Landscape Supply?

Unraveling the SiteOne Landscape Supply SWOT Analysis is just the beginning. Understanding SiteOne's ownership structure is key to grasping its strategic moves and long-term potential. From its roots with John Deere to its current status as a publicly traded entity, the journey of this landscape supply company is a fascinating case study in corporate evolution.

This deep dive into SiteOne ownership will explore how its transformation from a private equity-backed venture to a publicly traded company has shaped its trajectory. We'll examine the influence of major shareholders and the board of directors, offering insights into the forces driving this leading green industry player. Discover the answers to questions like: Who owns SiteOne Landscape Supply stock? Is SiteOne Landscape Supply publicly traded?

Who Founded SiteOne Landscape Supply?

The story of SiteOne Landscape Supply began in 2001, initially known as John Deere Landscapes. This marked the entry of Deere & Company into the wholesale landscape distribution market. The establishment of John Deere Landscapes was a strategic move, setting the stage for what would become a leading landscape supply company.

Deere & Company's initial steps involved acquiring key players in the green industry. McGinnis Farms, a nursery wholesaler, and Century Rain Aid, a distributor of landscape and irrigation supplies, were the first acquisitions. These moves swiftly positioned John Deere Landscapes as a significant national entity.

By acquiring these companies, John Deere Landscapes quickly established a widespread presence. It began with a network of over 200 stores across the U.S. and Canada, setting a strong foundation for future growth. This early expansion was crucial in establishing its market footprint.

Deere & Company's early strategy focused on acquiring established businesses. McGinnis Farms and Century Rain Aid were the first steps.

The acquisitions immediately gave John Deere Landscapes a national footprint. Over 200 stores across the U.S. and Canada were part of the initial network.

In 2007, the acquisition of LESCO expanded the company's reach. This acquisition was particularly impactful on the eastern seaboard.

Deere & Company maintained sole ownership of Landscape Holding, the entity that would become SiteOne, until late 2013.

The acquisitions of McGinnis Farms, Century Rain Aid, and LESCO were strategic moves. These moves were aimed at expanding the company's presence.

Deere & Company's entry into the landscape supply market was through acquisitions. The acquisitions were a key part of its strategy.

The acquisition of LESCO in 2007 further solidified John Deere Landscapes' position. This move significantly increased its store locations, particularly along the eastern seaboard. While specific details about the initial ownership structure are not publicly available, Deere & Company remained the sole owner of Landscape Holding, the entity that would eventually become SiteOne, until late 2013. For more insights, you can explore the Marketing Strategy of SiteOne Landscape Supply.

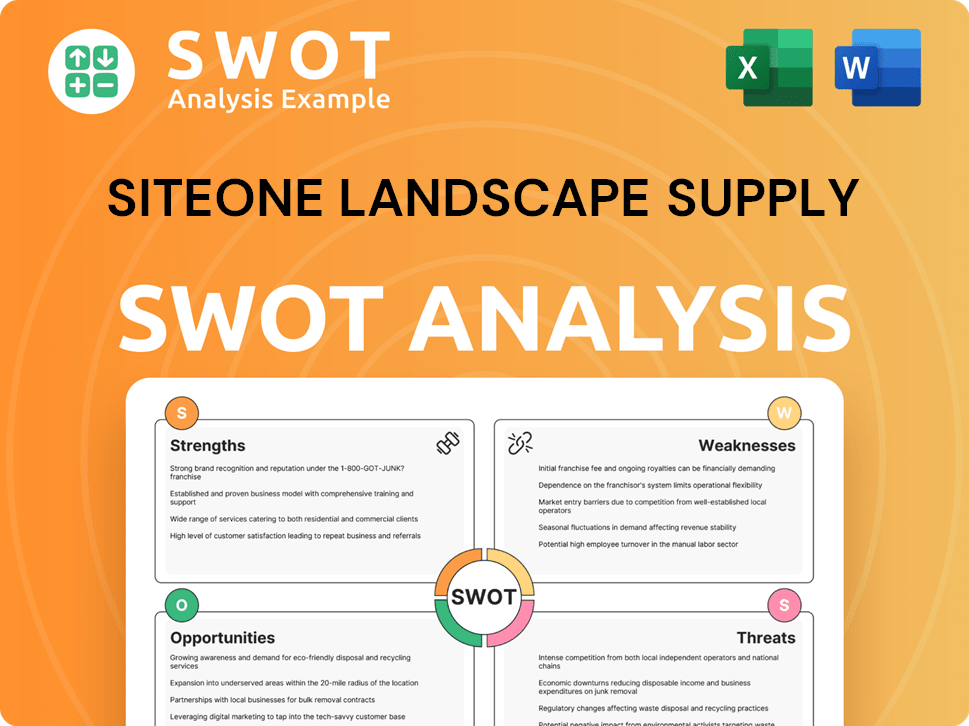

SiteOne Landscape Supply SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has SiteOne Landscape Supply’s Ownership Changed Over Time?

The ownership of SiteOne Landscape Supply has seen significant changes since its inception. The landscape supply company's journey began with a major shift in late 2013 when Clayton, Dubilier & Rice (CD&R), a private equity firm, acquired a majority stake in John Deere Landscapes from Deere & Company for $465 million. This transaction included CD&R's $174 million equity investment and Deere & Company receiving common shares, representing 40% of the new holding company's capital stock, along with approximately $314 million in cash. Following this acquisition, John Deere Landscapes was rebranded as SiteOne Landscape Supply on October 19, 2015.

In May 2016, SiteOne Landscape Supply went public, marking a pivotal moment in its ownership structure. The initial public offering (IPO) saw the sale of 10 million shares at $21 each. Prior to the IPO, CD&R held a 64% stake, and Deere & Co. held 25%. After the IPO, CD&R's ownership decreased to 45%, or roughly 17.8 million shares if the overallotment option was exercised. This transition to a publicly traded company broadened the investor base and introduced new dynamics to SiteOne's ownership.

| Event | Date | Impact on Ownership |

|---|---|---|

| CD&R Acquisition of John Deere Landscapes | Late 2013 | CD&R acquired a majority stake; Deere & Company retained a significant minority stake. |

| Rebranding to SiteOne Landscape Supply | October 19, 2015 | Reflected the new identity following the acquisition. |

| Initial Public Offering (IPO) | May 2016 | CD&R's ownership decreased; Deere & Co.'s stake diluted; public investors gained ownership. |

As of May 2025, the ownership of SiteOne Landscape Supply is diversified. Institutional investors hold about 56.52% of the company's stock, with insiders holding around 1.58%, and public companies and individual investors owning 41.90%. Major institutional shareholders include T. Rowe Price Associates Inc, Vanguard Group Inc, Kayne Anderson Rudnick Investment Management LLC, BlackRock, Inc., and Baillie Gifford & Co. For example, T. Rowe Price International Ltd. holds 13.52% (6,079,615 shares), Vanguard Fiduciary Trust Co. holds 9.209% (4,140,694 shares), and Kayne Anderson Rudnick Investment Management LLC holds 7.053% (3,171,508 shares). The total number of outstanding common shares was 44,964,924 as of February 14, 2025. Understanding the Competitors Landscape of SiteOne Landscape Supply provides further insights into the market dynamics.

SiteOne's ownership has evolved from private equity control to a mix of institutional and public investors.

- CD&R played a crucial role in the initial ownership transition.

- The IPO significantly altered the ownership structure.

- Institutional investors are the dominant shareholders as of May 2025.

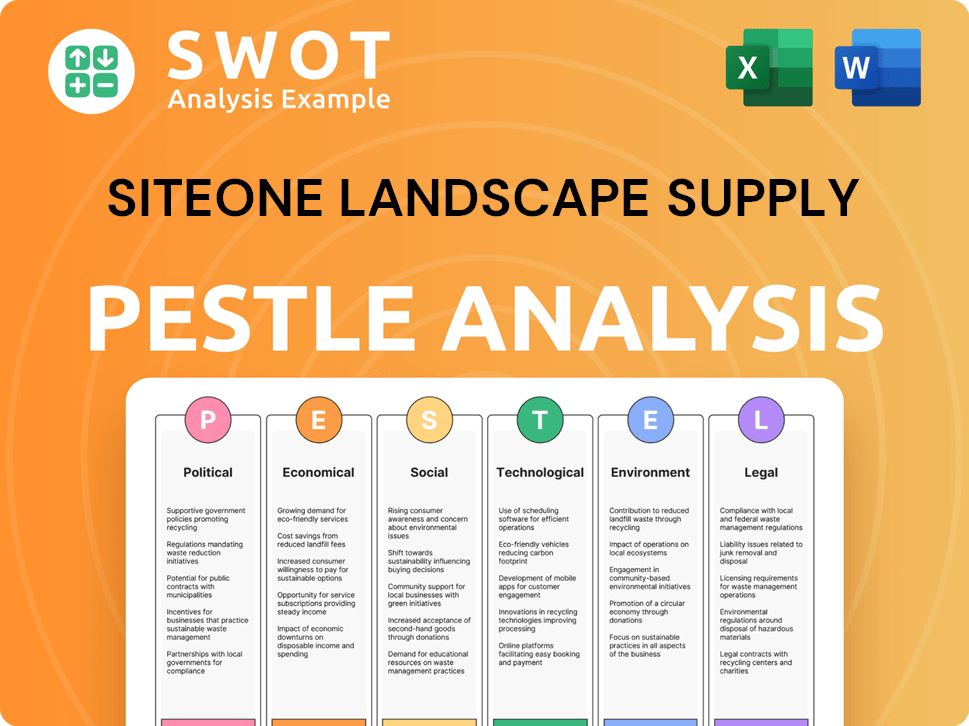

SiteOne Landscape Supply PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on SiteOne Landscape Supply’s Board?

The current board of directors at SiteOne Landscape Supply plays a vital role in guiding the landscape supply company. While specific details of the board's composition for 2025 were not fully available, the company has proposed changes to its corporate governance structure. This includes a move to eliminate the classified board structure, aiming for a single class of directors elected annually. This shift is designed to modernize governance practices and improve accountability to shareholders. The details of the board's current composition can be found in the company's filings.

Doug Black currently serves as the Chairman and CEO of SiteOne Landscape Supply. Moreover, Joseph Ketter, also from SiteOne Landscape Supply, holds the position of President of the National Association of Landscape Professionals Foundation Board of Directors for the 2024-2025 period. For more information about the company's overall strategy, consider reading about the Growth Strategy of SiteOne Landscape Supply.

| Board Member | Title | Affiliation |

|---|---|---|

| Doug Black | Chairman and CEO | SiteOne Landscape Supply |

| Joseph Ketter | President | National Association of Landscape Professionals Foundation Board of Directors |

| Additional Board Members | Information not fully available | Information not fully available |

Regarding SiteOne ownership and voting rights, each holder of common stock is generally entitled to one vote per share. This is for all matters brought to a stockholder vote. The company's certificate of incorporation grants common stockholders the exclusive right to vote for director elections and other purposes. Preferred stockholders typically do not have voting rights on these matters. Furthermore, the ability to remove a director is subject to any outstanding preferred stock rights. After a certain ownership threshold by initial equity investors, directors can only be removed for cause with the affirmative vote of a majority of outstanding common stock.

Understanding the voting structure is key for investors in SiteOne Landscape Supply. Each common stock share equals one vote, giving shareholders significant influence. This structure ensures that shareholders have a direct say in the company's direction.

- Common stockholders have exclusive voting rights for director elections and other matters.

- Preferred stockholders generally lack voting rights.

- Directors' removal depends on the rights of any outstanding preferred stock.

- Removal of directors requires a majority vote of outstanding common stock after specific ownership thresholds.

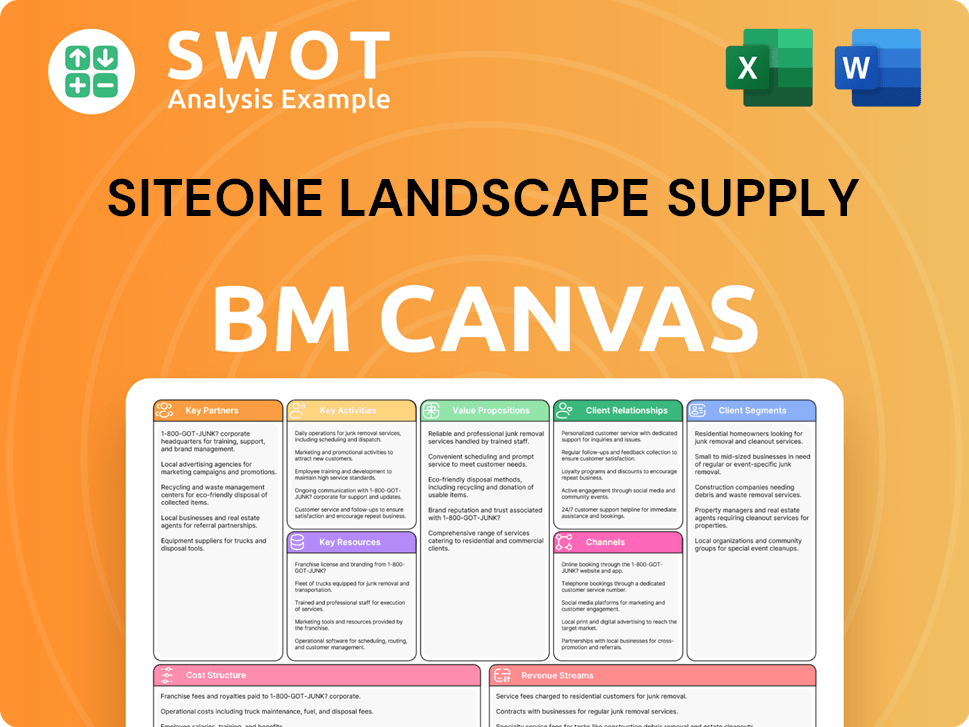

SiteOne Landscape Supply Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped SiteOne Landscape Supply’s Ownership Landscape?

Over the past few years, the landscape supply company, SiteOne Landscape Supply, has expanded significantly through acquisitions. As of April 2025, the company had completed a total of 62 acquisitions. These acquisitions have focused on building materials and crop inputs, allowing SiteOne to broaden its geographic reach and product offerings across the United States and Canada. Recent acquisitions in 2024 included Eggemeyer and a majority stake in Devil Mountain Wholesale Nursery. Custom Stone was also acquired in December 2024.

In terms of SiteOne ownership, institutional investors continue to hold a significant portion. As of May 2025, institutional ownership remained largely unchanged at 106.85%. Insider holdings saw a slight increase from 1.70% to 1.72%. The market capitalization was $6.51 billion as of Q3 2024, with revenue growth of 6.3% over the last twelve months, reaching $4.49 billion. The market cap was $5.131 billion as of April 30, 2025.

| Metric | Value | Date |

|---|---|---|

| Market Capitalization | $5.131 billion | April 30, 2025 |

| Institutional Ownership | 106.85% | May 2025 |

| Revenue Growth | 6.3% | Last Twelve Months (Q3 2024) |

A notable development in corporate governance is SiteOne's proposal in November 2024 to eliminate its classified board structure. This change, which will be put to a stockholder vote in 2025, indicates a trend towards greater shareholder influence and accountability. To learn more about the company, check out this Brief History of SiteOne Landscape Supply.

Institutional ownership remains a key factor in SiteOne's stock. Insider ownership has seen a slight increase. The company's market capitalization fluctuates, reflecting market conditions.

SiteOne continues to grow through strategic acquisitions. The focus is on expanding its product offerings and geographic footprint. Recent acquisitions include companies in the landscape supply and nursery sectors.

SiteOne proposed eliminating its classified board structure. This move aims to increase shareholder influence. The proposal is set for a stockholder vote in 2025.

The company's revenue growth was 6.3% over the last twelve months. The market capitalization was $6.51 billion as of Q3 2024. The market cap was $5.131 billion as of April 30, 2025.

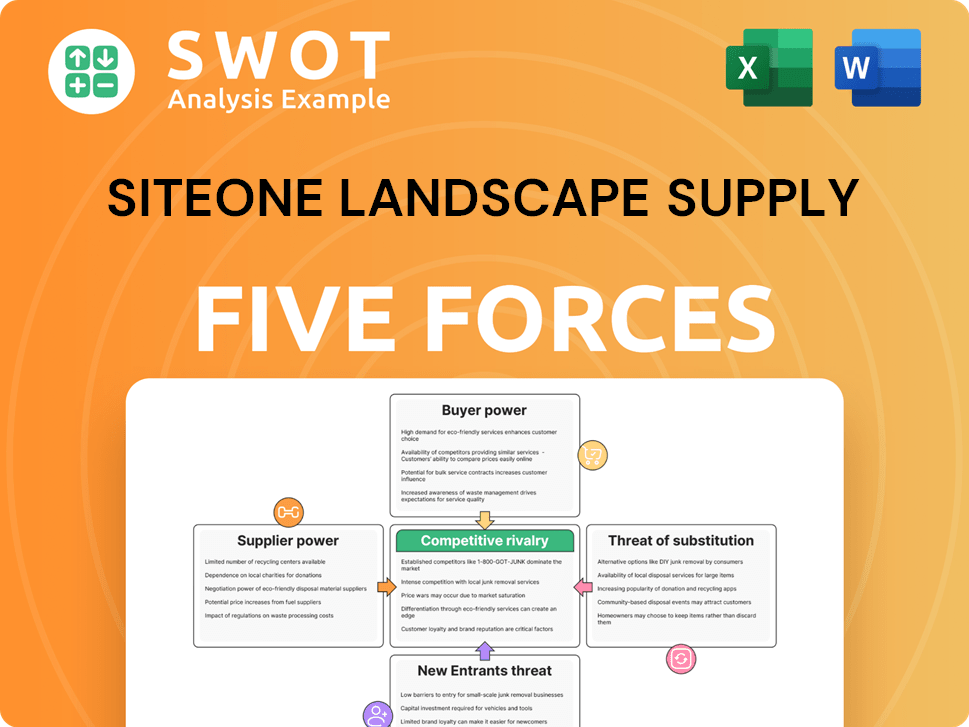

SiteOne Landscape Supply Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of SiteOne Landscape Supply Company?

- What is Competitive Landscape of SiteOne Landscape Supply Company?

- What is Growth Strategy and Future Prospects of SiteOne Landscape Supply Company?

- How Does SiteOne Landscape Supply Company Work?

- What is Sales and Marketing Strategy of SiteOne Landscape Supply Company?

- What is Brief History of SiteOne Landscape Supply Company?

- What is Customer Demographics and Target Market of SiteOne Landscape Supply Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.