Transcontinental Bundle

Who Really Controls Transcontinental?

Founded in 1976, Transcontinental Inc. (TC Transcontinental), a Canadian powerhouse, has transformed from a printing business into a North American leader in flexible packaging and publishing. Understanding the Transcontinental SWOT Analysis is key, but first, let's uncover the crucial question: Who owns Transcontinental Company?

This exploration into Transcontinental Company ownership will dissect the evolution of its ownership structure, from its inception to its current state. We'll examine the influence of major investors and the impact of being a publicly traded entity. Discovering the current owner of Transcontinental and its leadership will provide insights into the company's strategic direction and future prospects, including details on Transcontinental stock and financial information.

Who Founded Transcontinental?

The story of Transcontinental Inc. began in 1976 with the vision of Rémi Marcoux, who, along with Claude Dubois and André Kingsley, laid the foundation for what would become a significant player in the printing and media industries. Their initial focus was on flyer printing, a business that quickly generated substantial revenue. This early venture set the stage for the company's expansion and evolution in the years that followed.

Early on, Transcontinental demonstrated a knack for strategic diversification. The acquisition of Les Affaires and SIC magazines in 1979 marked the company's entry into the publishing sector, a move that broadened its portfolio. This, combined with the establishment of a door-to-door flyer distribution division, showcased a proactive approach to growth and market penetration.

A pivotal moment in the company's history was its initial public offering in 1984. Listing on the Montreal Exchange and later the Toronto Stock Exchange, Transcontinental opened itself up to public investment, which was a key step in its evolution. This transition also set the stage for changes in the company's ownership structure.

Founded in 1976 by Rémi Marcoux, Claude Dubois, and André Kingsley.

Generated C$2.9 million in revenue in its first year of operation.

Expanded with a flyer distribution division and entered the publishing industry in 1979.

Went public on the Montreal Exchange in 1984, followed by a listing on the Toronto Stock Exchange.

The Marcoux family has maintained significant control through a dual-class share structure.

Prior to January 2025, Capinabel Inc. held approximately 74.42% of the voting rights.

The ownership of Transcontinental Company has been significantly influenced by its founders, particularly the Marcoux family, who have historically held a substantial portion of the voting rights. This control has been maintained through a dual-class share structure, with Class B shares carrying significantly more votes per share than Class A shares. This structure has allowed the founding family to maintain a strong influence over the company's strategic direction. For more details on how the company generates revenue, you can read about the Revenue Streams & Business Model of Transcontinental.

Understanding the history of Transcontinental Inc. and who owns Transcontinental is crucial for investors and stakeholders. The founders' influence and the Marcoux family's continued control are key aspects of the company's ownership structure.

- Rémi Marcoux, along with partners, founded the company in 1976.

- The Marcoux family has maintained significant control over the company.

- A dual-class share structure has been instrumental in preserving the founders' influence.

- Capinabel Inc. held a substantial percentage of voting rights as of January 2025.

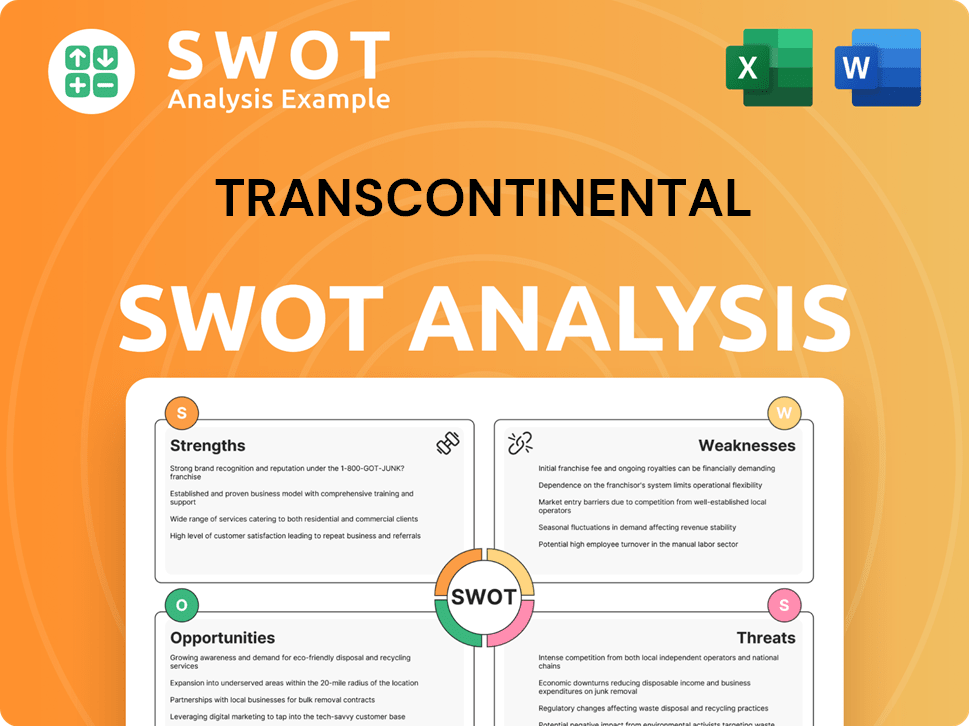

Transcontinental SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Transcontinental’s Ownership Changed Over Time?

The ownership structure of Transcontinental Inc. has evolved significantly since its initial public offering in 1984. The company, traded on the Toronto Stock Exchange under the symbols TCL.A and TCL.B, has seen its ownership landscape shaped by strategic decisions and market dynamics. Understanding the current ownership of Transcontinental Company is crucial for investors and stakeholders alike.

As of January 8, 2025, Transcontinental Inc. had 70,661,031 Class A Shares and 13,354,428 Class B Shares outstanding. The company's ownership is a mix of institutional investors and the founding family, with the latter maintaining a significant controlling stake. This structure reflects a balance between public market participation and family influence.

| Stakeholder | Shares Held | Percentage |

|---|---|---|

| Franklin Bissett Investment Management | 240,112 | 0.324% |

| SEI Investments Canada Co. | 209,770 | 0.283% |

| Mercer Global Investments Europe Ltd. | 132,079 | 0.1782% |

| Kingwest & Co. | 107,553 | 0.1451% |

The founding family, primarily through Capinabel Inc., remains a dominant force. As of January 20, 2025, Capinabel Inc. held 8,714,884 Class B Shares, representing approximately 91.67% of the outstanding Class B Shares and 65.86% of the voting rights. Strategic acquisitions and divestitures have also impacted the ownership structure. The 2018 acquisition of Coveris Americas, for instance, shifted the company's focus. More recently, the sale of its industrial packaging operations to Hood Packaging Corporation for US$95 million (approximately C$132 million) on October 28, 2024, further refined its portfolio. These moves, along with the company's Marketing Strategy of Transcontinental, are aimed at optimizing company strategy.

Transcontinental Company ownership is a blend of institutional and family control, with the founding family, through Capinabel Inc., holding a significant portion of the voting rights.

- The company's shares are publicly traded.

- Major stakeholders include institutional investors.

- Strategic acquisitions and divestitures have reshaped the company's focus.

- The Marcoux family, through Capinabel Inc., maintains substantial control.

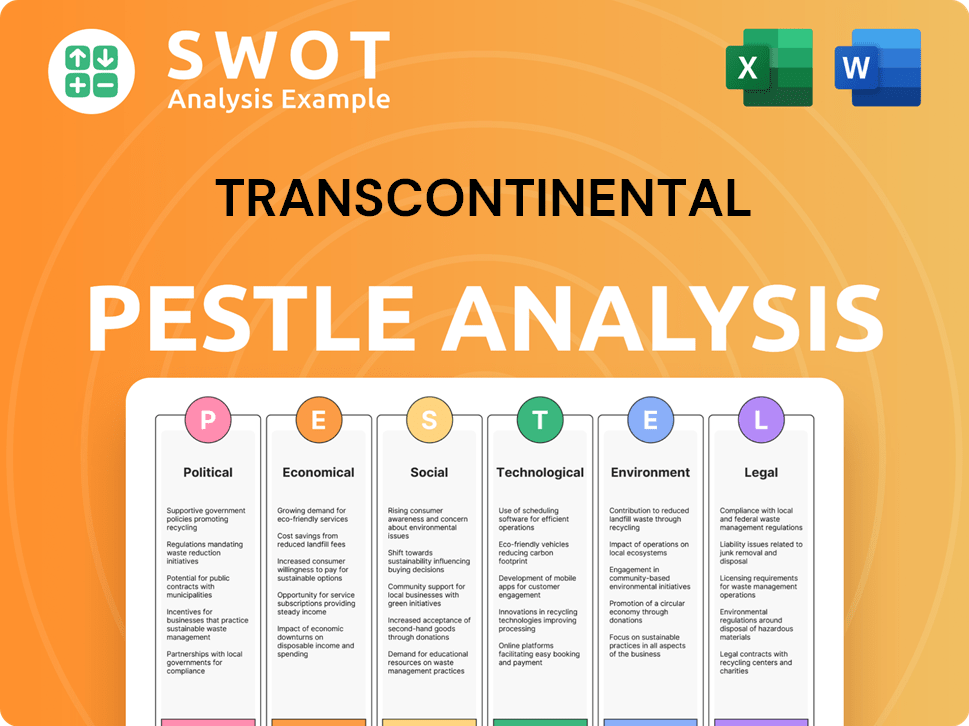

Transcontinental PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Transcontinental’s Board?

The Board of Directors of Transcontinental Inc. significantly influences the company's direction, shaped by its dual-class share structure. As of January 8, 2025, the company's structure includes Class A Subordinate Voting Shares, each with one vote, and Class B Shares, which offer holders twenty votes per share. This arrangement gives substantial control to Class B shareholders, particularly the Marcoux family through Capinabel Inc. Isabelle Marcoux, the Executive Chair of the Board since June 2023, oversees Strategy and Corporate Development. Rémi Marcoux, the founder, was named Founder Emeritus in March 2024 and is no longer on the Board.

The Board is a blend of members representing major shareholders and independent directors. While a comprehensive list of all board members and their specific affiliations requires a review of the most recent proxy circular, all directors, except Mr. Serge Boulanger (who has until September 9, 2027, to meet the requirement), held shares or deferred share units representing at least three times their annual compensation as of January 8, 2025, in line with the company's ownership guidelines for directors. This structure ensures alignment between the board members and the company's financial interests.

| Board Member | Position | Notes |

|---|---|---|

| Isabelle Marcoux | Executive Chair of the Board | Oversees Strategy and Corporate Development |

| Thomas Morin | President and CEO | Appointed June 7, 2023 |

| Donald LeCavalier | Executive Vice President and CFO | Expanded role |

The voting structure gives the Marcoux family considerable control. As of January 20, 2025, Capinabel Inc. held approximately 65.86% of the voting rights. This concentrated power allows the Marcoux family, via Capinabel, to effectively elect a majority of the directors. Recent changes include the appointment of Thomas Morin as President and CEO on June 7, 2023, succeeding Peter Brues. Donald LeCavalier also took on an expanded role as Executive Vice President and Chief Financial Officer. There have been no significant proxy battles or activist investor campaigns recently, likely due to the strong voting control of the Class B shares. This ownership structure significantly impacts the dynamics of the company, influencing decisions and the direction of the company.

The ownership of Transcontinental Company is primarily controlled by the Marcoux family through Capinabel Inc., holding a significant percentage of the voting rights. This structure allows them to influence the company's strategic direction and board composition. This structure impacts the dynamics of the company, influencing decisions and the direction of the company.

- The Marcoux family, through Capinabel Inc., holds approximately 65.86% of the voting rights as of January 20, 2025.

- Isabelle Marcoux serves as the Executive Chair of the Board.

- Thomas Morin is the current President and CEO, appointed in June 2023.

- The dual-class share structure grants significant control to Class B shareholders.

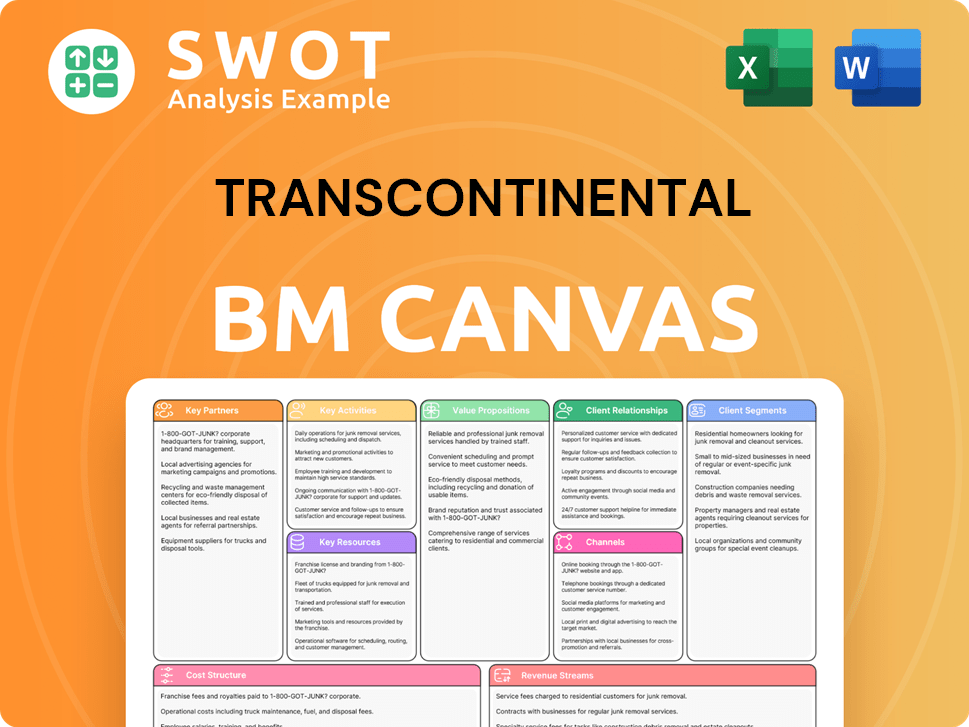

Transcontinental Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Transcontinental’s Ownership Landscape?

Over the past few years, the ownership profile of Transcontinental Inc. has been actively managed through strategic financial maneuvers. The company has employed share buyback programs to enhance long-term shareholder value. On June 12, 2024, the company was authorized to repurchase up to 3,662,967 Class A Subordinate Voting Shares and up to 668,241 Class B Shares between June 17, 2024, and June 16, 2025. During the first six months of fiscal year 2025 (ending April 27, 2025), it repurchased and canceled 934,434 Class A Subordinate Voting Shares and 3,600 Class B Shares for a total cash consideration of C$16.3 million. In the first quarter of fiscal 2025 (ending January 26, 2025), a total of 938,034 shares were repurchased for C$16.3 million. Since June 2024, a total of 3,005,251 shares have been repurchased for a total consideration of C$48.6 million, reflecting a commitment to returning capital to shareholders. These actions are key aspects of understanding Transcontinental Company ownership.

A significant development impacting the company was the sale of its industrial packaging operations to Hood Packaging Corporation for US$95 million (approximately C$132 million) on October 28, 2024. This divestiture aimed to reduce net debt and increase capital allocation flexibility, enabling targeted acquisitions in growth segments. The company also declared a special dividend of C$1.00 per share on April 23, 2025. These strategic moves highlight how Who owns Transcontinental adapts to market dynamics.

| Metric | Details | Financial Impact |

|---|---|---|

| Share Repurchases (Fiscal 2025 - Six Months) | 934,434 Class A Shares, 3,600 Class B Shares Repurchased and Cancelled | C$16.3 million cash consideration |

| Share Repurchases (Fiscal 2025 - Q1) | 938,034 Shares Repurchased | C$16.3 million |

| Share Repurchases (Since June 2024) | 3,005,251 Shares Repurchased | C$48.6 million |

| Industrial Packaging Sale | Sold to Hood Packaging Corporation | US$95 million (C$132 million) |

| Special Dividend | C$1.00 per share | Shareholder return |

In terms of leadership, Thomas Morin was appointed President and CEO on June 7, 2023, and Isabelle Marcoux transitioned to Executive Chair of the Board, overseeing Strategy and Corporate Development. Rémi Marcoux, the founder, was named Founder Emeritus in March 2024. These changes reflect strategic evolution and succession planning. Industry trends like increased institutional ownership are also evident. Moreover, the dual-class share structure ensures significant voting power for the Marcoux family. The company continues to project strong cash flow generation and debt reduction, with a focus on strategic investments and returning capital to shareholders. For more insights, consider reading about the Target Market of Transcontinental.

The company's ownership structure involves both institutional investors and the founding family. The Marcoux family maintains significant voting power.

Major shareholders include institutional investors and the Marcoux family. The company is publicly traded but has a dual-class share structure.

Thomas Morin was appointed President and CEO on June 7, 2023. Isabelle Marcoux is the Executive Chair of the Board.

The company focuses on strong cash flow generation and debt reduction. It also returns capital to shareholders through dividends and share buybacks.

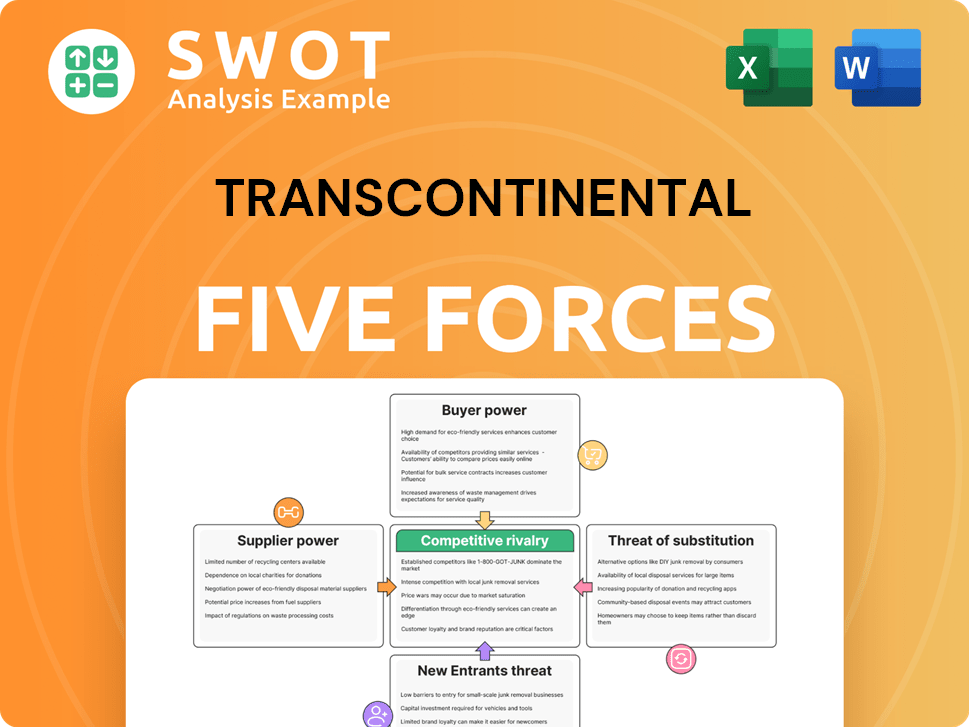

Transcontinental Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Transcontinental Company?

- What is Competitive Landscape of Transcontinental Company?

- What is Growth Strategy and Future Prospects of Transcontinental Company?

- How Does Transcontinental Company Work?

- What is Sales and Marketing Strategy of Transcontinental Company?

- What is Brief History of Transcontinental Company?

- What is Customer Demographics and Target Market of Transcontinental Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.