Simply Good Foods Bundle

Who Really Owns Simply Good Foods Company?

Understanding Simply Good Foods SWOT Analysis is crucial, but have you ever wondered who truly steers this nutritional snacking giant? The company's ownership structure is a dynamic landscape, significantly impacting its strategic decisions and market performance. From its origins with Atkins Nutritionals to its current publicly traded status, the evolution of Simply Good Foods Company's ownership tells a compelling story.

The story of Simply Good Foods Company ownership began with a strategic merger, transforming the well-known Atkins brand into a publicly traded entity. This shift, facilitated by Conyers Park Acquisition Corp., marked a pivotal moment in the company's history. As of early 2025, the company's ownership is primarily held by public shareholders, including institutional and individual investors, each playing a role in shaping its future. Exploring the details of Simply Good Foods stock ownership reveals valuable insights.

Who Founded Simply Good Foods?

The Simply Good Foods Company's ownership structure is unique, stemming from the merger of Atkins Nutritionals and Conyers Park Acquisition Corp. in 2017. This structure means there aren't traditional 'founders' in the sense of a startup. Instead, key figures like James M. Kilts and David J. West, through Conyers Park, played a pivotal role in creating the company as it exists today.

Atkins Nutritionals, a well-known brand in the low-carb market, became part of this new entity. The shareholders of Atkins Nutritionals received shares in the newly formed Simply Good Foods Company. This acquisition by a Special Purpose Acquisition Company (SPAC) shaped the early ownership landscape.

The initial public ownership was established through Conyers Park, which acted as the acquiring entity. Early shareholders of Conyers Park, along with institutional investors who participated in the SPAC's IPO, became the initial public shareholders of Simply Good Foods. The merger agreements, including lock-up periods, influenced the early ownership dynamics.

The merger of Atkins Nutritionals and Conyers Park Acquisition Corp. in 2017 formed The Simply Good Foods Company.

Conyers Park Acquisition Corp., a SPAC, facilitated the acquisition.

Atkins Nutritionals shareholders received shares in the newly formed company.

Early backers of Conyers Park became the initial public shareholders.

James M. Kilts and David J. West, through Conyers Park, were instrumental.

The company's formation differs from a traditional startup.

The formation of the Marketing Strategy of Simply Good Foods reveals that the ownership structure of Simply Good Foods Company is rooted in the merger with Conyers Park Acquisition Corp. in 2017. This unique structure means the company doesn't have traditional founders. Instead, the initial ownership was established through the SPAC and the exchange of shares by Atkins Nutritionals shareholders. Understanding this structure is crucial for investors and anyone interested in the company's history.

- The Simply Good Foods Company was formed through a merger, not a traditional founding.

- Conyers Park Acquisition Corp. facilitated the acquisition of Atkins Nutritionals.

- Early shareholders of Conyers Park became the initial public shareholders of the combined entity.

- The ownership structure reflects a transition from a private company (Atkins) to a publicly traded one.

Simply Good Foods SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Simply Good Foods’s Ownership Changed Over Time?

The Simply Good Foods Company became a publicly traded entity on July 7, 2017, through a merger with Conyers Park Acquisition Corp. This initial public offering (IPO) marked a significant shift in its ownership structure, moving from private to public shareholders. The initial market capitalization reflected the combined value of Atkins Nutritionals and the capital from the Special Purpose Acquisition Company (SPAC).

Since its IPO, the ownership of the Simply Good Foods Company has primarily been shaped by the dynamics of the public market. Institutional investors, mutual funds, and index funds now constitute the largest portion of its ownership. The acquisition of Quest Nutrition in 2019 for approximately $1 billion in cash also played a role, expanding its product portfolio and potentially influencing its shareholder base by attracting investors interested in the growing healthy snacking market.

| Shareholder | Percentage of Shares (as of March 31, 2024) |

|---|---|

| The Vanguard Group | 10.7% |

| BlackRock | 9.9% |

| Dimensional Fund Advisors | Significant |

As of early 2025, major institutional holders include investment management firms such as The Vanguard Group, BlackRock, and Dimensional Fund Advisors. These large institutional stakes are typical for a well-established public company and reflect broad market confidence in the company's strategy to expand its market share in the convenient nutrition sector.

The Simply Good Foods Company's ownership is largely comprised of institutional investors. Key players include The Vanguard Group and BlackRock, holding significant shares.

- The company went public in 2017 through a SPAC merger.

- Institutional investors hold the majority of shares.

- The acquisition of Quest Nutrition expanded the company's portfolio.

- Major shareholders influence the company's strategic direction.

Simply Good Foods PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Simply Good Foods’s Board?

The Board of Directors of the Simply Good Foods Company plays a vital role in its governance. As of early 2025, the board includes a blend of independent directors and individuals with connections to the company's history. James M. Kilts, known for his involvement with Conyers Park Acquisition Corp., serves as Executive Chairman. The board typically includes the CEO and a majority of independent directors, meeting NASDAQ listing standards.

The composition of the board and its decisions are regularly detailed in SEC filings, such as proxy statements. These filings provide insights into director nominations, executive compensation, and other governance matters, ensuring transparency and accountability to shareholders.

| Director | Title | Affiliation |

|---|---|---|

| James M. Kilts | Executive Chairman | Conyers Park Acquisition Corp. |

| Joseph E. Scalzo | President and CEO | Simply Good Foods |

| Other Independent Directors | Various | Independent |

The voting structure of the Simply Good Foods Company follows a one-share, one-vote principle, common in public companies. This structure ensures voting power aligns with each shareholder's economic interest. The absence of dual-class shares or special voting rights maintains a balanced approach to corporate governance, making the board accountable to a broad shareholder base.

The board's composition and decisions are regularly reviewed through SEC filings, such as proxy statements. This ensures transparency and accountability. The one-share, one-vote principle reinforces that voting power is proportional to the economic interest held by each shareholder.

- Board members include a mix of independent directors and those with company ties.

- Voting structure is based on a one-share, one-vote principle.

- Proxy statements detail director nominations and compensation.

- Large institutional investors ensure board accountability.

Simply Good Foods Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Simply Good Foods’s Ownership Landscape?

Over the past few years, Simply Good Foods Company has shown consistent growth, particularly after acquiring Quest Nutrition in 2019, which significantly boosted its revenue and market share. The company has also implemented share repurchase programs to return value to shareholders. For example, in January 2024, a $100 million share repurchase authorization was announced.

Industry trends indicate a rise in institutional ownership for consumer packaged goods companies like Simply Good Foods. While founder dilution is a common outcome of growth and public offerings, the company's leadership, including CEO Joseph Scalzo, continues to pursue strategic initiatives. There are no current plans for privatization or changes to its public listing status. The company is focused on organic growth, product innovation, and potential acquisitions, which could further shape its ownership structure.

The emphasis on health and wellness trends keeps Simply Good Foods an appealing investment within the food sector. The company's focus on acquisitions and organic growth is part of its strategy. To learn more about the company's background, you can check out this detailed article about Simply Good Foods.

| Metric | Value | Year |

|---|---|---|

| Revenue (TTM) | $1.2 Billion | 2024 |

| Market Capitalization | $3.2 Billion | 2024 |

| Shares Outstanding | Approximately 100 Million | 2024 |

Institutional ownership is increasing. Share repurchase programs are in place to return value to shareholders. The company continues to focus on strategic acquisitions and organic growth to expand its market presence.

The company is concentrating on organic growth, product innovation, and potential acquisitions. These strategies are designed to strengthen its position in the nutritional snacking market. The focus is to capitalize on health and wellness trends.

Simply Good Foods has shown solid revenue growth, driven by acquisitions like Quest Nutrition. The company's market capitalization reflects its strong position. The share repurchase programs are part of its financial strategy.

The company is well-positioned to benefit from the growing demand for healthy snacks. Continued innovation and strategic investments are expected to drive future growth. The company aims to maintain its leadership in the market.

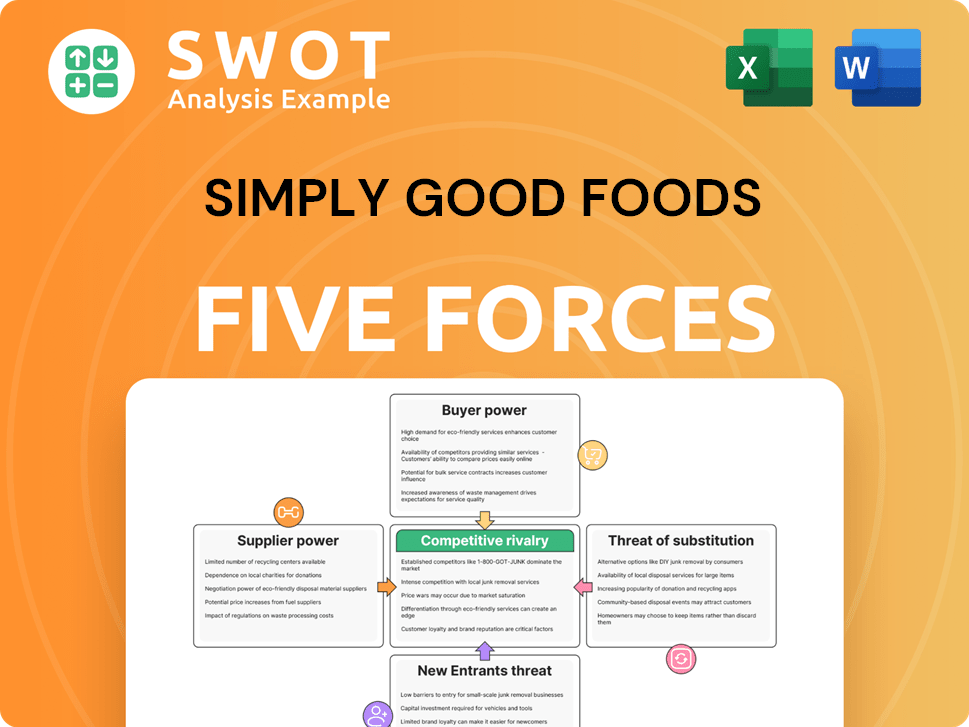

Simply Good Foods Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Simply Good Foods Company?

- What is Competitive Landscape of Simply Good Foods Company?

- What is Growth Strategy and Future Prospects of Simply Good Foods Company?

- How Does Simply Good Foods Company Work?

- What is Sales and Marketing Strategy of Simply Good Foods Company?

- What is Brief History of Simply Good Foods Company?

- What is Customer Demographics and Target Market of Simply Good Foods Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.