UniFirst Bundle

Who Really Owns UniFirst?

Ever wondered who steers the ship at UniFirst Corporation, a giant in the uniform and facility services industry? Understanding the UniFirst SWOT Analysis is just the beginning; the ownership structure reveals a lot about its strategic direction and long-term prospects. From its humble beginnings to its current market position, the story of Who owns UniFirst is a fascinating journey.

This deep dive into UniFirst ownership will explore the evolution of its shareholder base, from the founding family's initial imprint to the influence of institutional investors and public shareholders. Discover how these dynamics shape the company's governance and strategic decisions, impacting everything from UniFirst stock performance to its competitive edge in the market. Learn about UniFirst company history and how to buy UniFirst stock.

Who Founded UniFirst?

The story of UniFirst Corporation begins with its founder, Aldo Croatti, who established the business in 1936. Initially known as National Overall Dry Cleaning Company, the firm's roots were humble, but its vision was clear: to serve the needs of workers through uniform services. This early focus laid the foundation for its future in the uniform and facility services industry.

Aldo Croatti's initial ownership was a defining feature of the company. He not only spearheaded the business operations but also maintained a significant stake in the company's stock during its formative years. This strong ownership model helped shape the company's direction and growth strategy from the start.

As the company grew, the family's involvement deepened. Ronald Croatti and Cynthia Croatti, Aldo's children, took on significant executive roles, reflecting the family's ongoing commitment. While specific details of equity distribution beyond the Croatti family's control are not widely available from the company's early days, the family's influence was a key aspect of the company's identity.

The early years of UniFirst Corporation were marked by strong family ownership and a focus on uniform services. Aldo Croatti's vision and control were fundamental to the company's initial success and growth. The transition of leadership to his children further solidified the family's role in the company's evolution.

- Aldo Croatti founded the company in 1936.

- The company initially operated as National Overall Dry Cleaning Company.

- Family members later assumed key executive roles.

- The Croatti family maintained significant ownership.

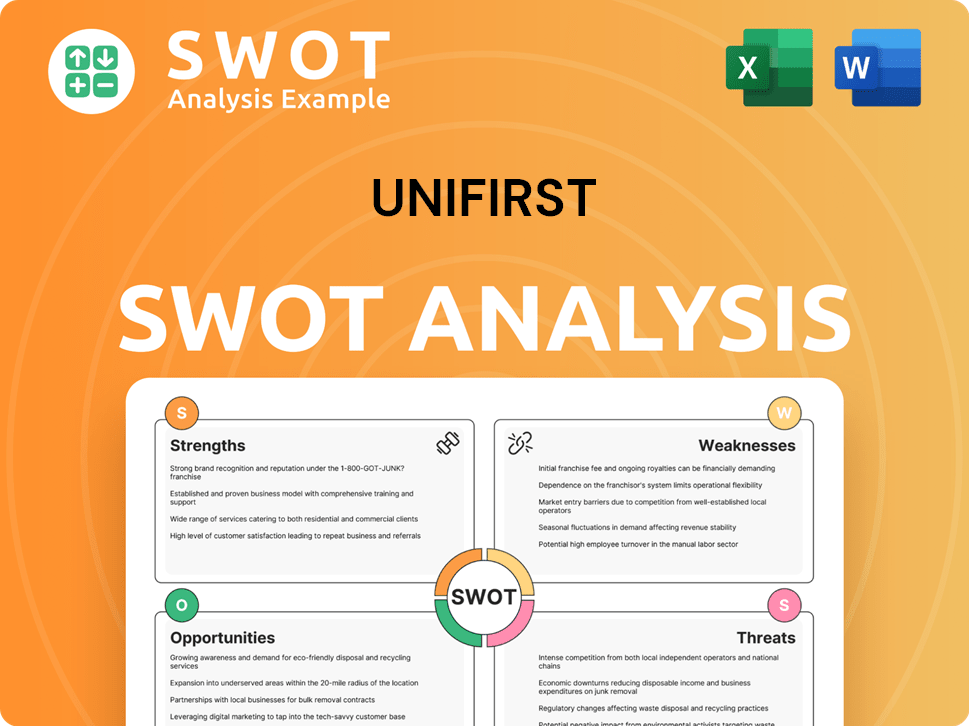

UniFirst SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has UniFirst’s Ownership Changed Over Time?

The evolution of UniFirst Corporation's ownership structure is marked by its transition to a publicly traded entity. The company went public on the New York Stock Exchange (NYSE) in 1983, initially under the ticker symbol IUS, which later changed to UNF in 1984. This move allowed for broader investment while the Croatti family retained significant control through a dual-class share system.

This structure, with its differential voting rights, has been a key element in shaping the company's ownership landscape. As of November 13, 2023, UniFirst had 15,127,118 shares of Common Stock and 3,590,295 shares of Class B Common Stock. The Class B shares, each with ten votes, are convertible into Common Stock, enabling the Croatti family to maintain a strong influence over company decisions.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | 1983 | Transitioned from private to public ownership, allowing external investment. |

| Stock Symbol Change | 1984 | Reflected operational and strategic shifts within the company. |

| Dual-Class Share Structure | Ongoing | Enabled the Croatti family to retain control despite public listing. |

As of April 2025, institutional investors hold a significant stake, approximately 88.35% of UniFirst's outstanding shares, with a total market value of about $3.39 billion. Insiders own a notable 193.52%, while retail investors hold 0.00%. Major institutional shareholders as of April 2025 include BlackRock Inc. with 2,322,798 shares and Vanguard Group Inc. with 1,708,242 shares. The Croatti family, particularly Marie Croatti, maintains substantial ownership, ensuring family influence over the company's strategic direction. For a deeper understanding of the competitive landscape, check out the Competitors Landscape of UniFirst.

UniFirst's ownership structure is a blend of public and private interests, with a strong emphasis on family control.

- The Croatti family, through a dual-class share structure, maintains significant voting power.

- Institutional investors hold a substantial portion of the outstanding shares.

- Marie Croatti is a key individual stakeholder, holding a significant percentage of the company's shares.

- The company's history includes an IPO and a stock symbol change, reflecting its growth and evolution.

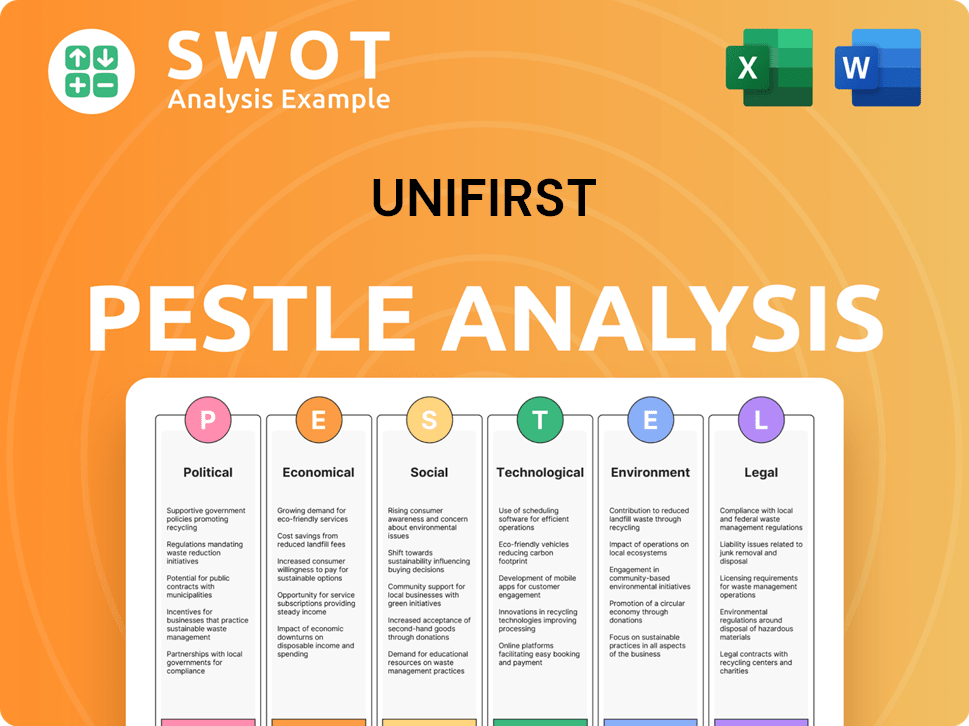

UniFirst PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on UniFirst’s Board?

The current board of directors at UniFirst Corporation reflects a blend of major shareholder representation and independent seats. However, the Croatti family's influence remains significant due to the company's dual-class share structure. The board is structured into three classes, each serving staggered three-year terms, with one class elected annually. This setup allows for a degree of continuity while also providing a mechanism for shareholder input.

As of January 14, 2025, Cynthia Croatti was reelected as a Class III Director, serving until the 2028 Annual Meeting. Her presence on the board, alongside other family members who hold considerable Class B shares, reinforces the family's control over the company. This structure directly impacts the dynamics of UniFirst company ownership, as the Croatti family's holdings grant them substantial voting power.

| Director | Class | Term Expires |

|---|---|---|

| Cynthia Croatti | III | 2028 |

| Steven S. Strazza | II | 2027 |

| Michael J. Croatti | I | 2026 |

The Croatti family, through their Class B shares, possesses super-voting power. Each share of Common Stock is entitled to one vote, while each share of Class B Common Stock is entitled to ten votes. As of the date of their Annual Report on Form 10-K, the Croatti family owned, directly or indirectly, more than two-thirds of the combined voting power of the outstanding shares. This allows them to effectively control most matters requiring shareholder approval. The structure ensures that the family can significantly influence the board's composition and strategic decisions, as demonstrated by their response to recent acquisition proposals. Understanding the UniFirst company ownership structure is key for investors looking at UniFirst stock.

The Croatti family maintains significant control through a dual-class share structure.

- Class B shares hold ten times the voting power of common shares.

- The family's voting power allows them to influence board composition and strategic decisions.

- In January 2025, the board rejected an acquisition offer, reflecting key stakeholder influence.

- For further insights, explore the Revenue Streams & Business Model of UniFirst.

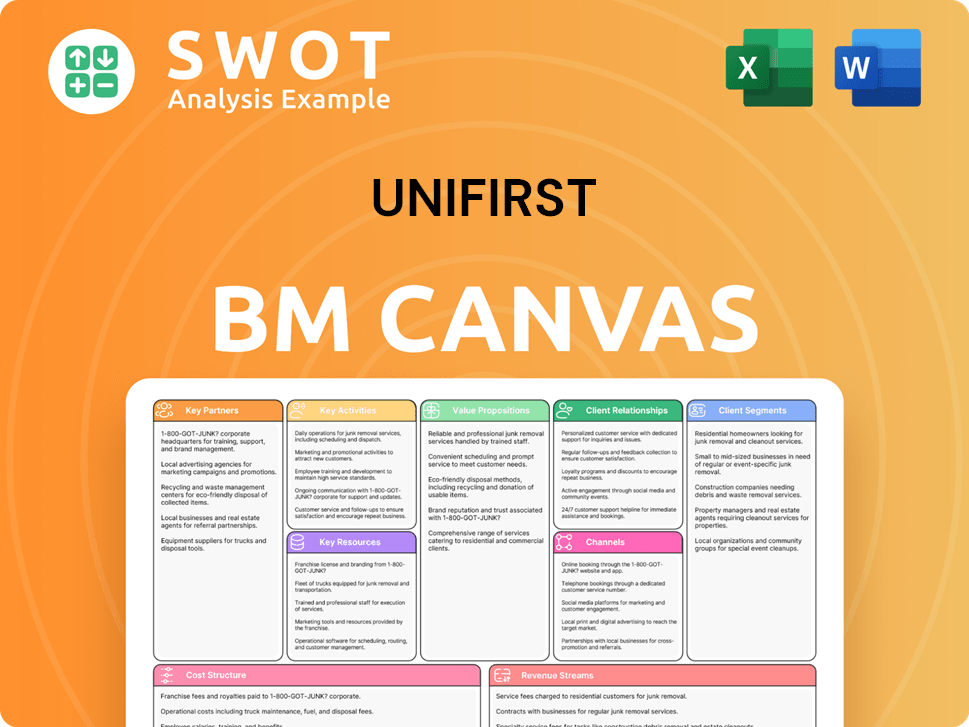

UniFirst Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped UniFirst’s Ownership Landscape?

Over the past few years, UniFirst Corporation has shown consistent trends in its ownership profile. As of April 2025, institutional investors hold a significant 88.35% of the company's outstanding shares, highlighting a strong institutional presence. This is further supported by data from May 2025 and March 2025, which show institutional ownership at 79.26% and 79.48%, respectively. Major institutional holders include BlackRock Inc. and Vanguard Group Inc. Notably, insiders, including the Croatti family, maintain a considerable stake, with Marie Croatti owning over 60% of the shares as of April 2025.

The company has also been actively involved in share buyback programs. In the first quarter of fiscal 2025 (ending November 30, 2024), UniFirst repurchased 33,605 shares of Common Stock for $6.4 million. The second quarter of fiscal 2025 (ending March 1, 2025) saw the repurchase of an additional 33,000 shares for $6.2 million. On April 8, 2025, UniFirst declared regular cash dividends and authorized a new $100 million share repurchase program. These actions reflect the company's strategy to return value to shareholders and manage its capital efficiently. The consistent institutional ownership and share repurchase programs are key aspects of understanding who owns UniFirst.

A significant event was the unsolicited acquisition proposal from Cintas Corporation in late 2024, offering $275 per share. However, UniFirst's Board of Directors rejected this offer in January 2025, emphasizing their confidence in the company's independent strategy and the influence of major shareholders. This rejection underscores the ownership structure's impact on strategic decisions and the commitment to maintaining UniFirst's operational independence.

| Metric | Value | Date |

|---|---|---|

| Institutional Ownership | 88.35% | April 2025 |

| Share Repurchase (Q1 FY25) | 33,605 shares for $6.4M | November 30, 2024 |

| Share Repurchase (Q2 FY25) | 33,000 shares for $6.2M | March 1, 2025 |

| Remaining Share Repurchase Authorization | $63.7 million | March 1, 2025 |

Institutional investors hold a substantial majority of UniFirst shares. The Croatti family remains a significant insider shareholder. Share repurchase programs are a key component of the company's financial strategy.

BlackRock Inc. and Vanguard Group Inc. are among the major institutional holders. Marie Croatti's significant ownership highlights insider influence. The ownership structure reflects a mix of institutional and insider control.

The company rejected an acquisition proposal from Cintas Corporation in early 2025. UniFirst continues to focus on organic growth and shareholder value. Recent share repurchase programs show commitment to returning value.

The consistent institutional ownership indicates confidence in UniFirst's performance. Insider holdings, particularly by the Croatti family, provide stability. Share buybacks support the stock's performance.

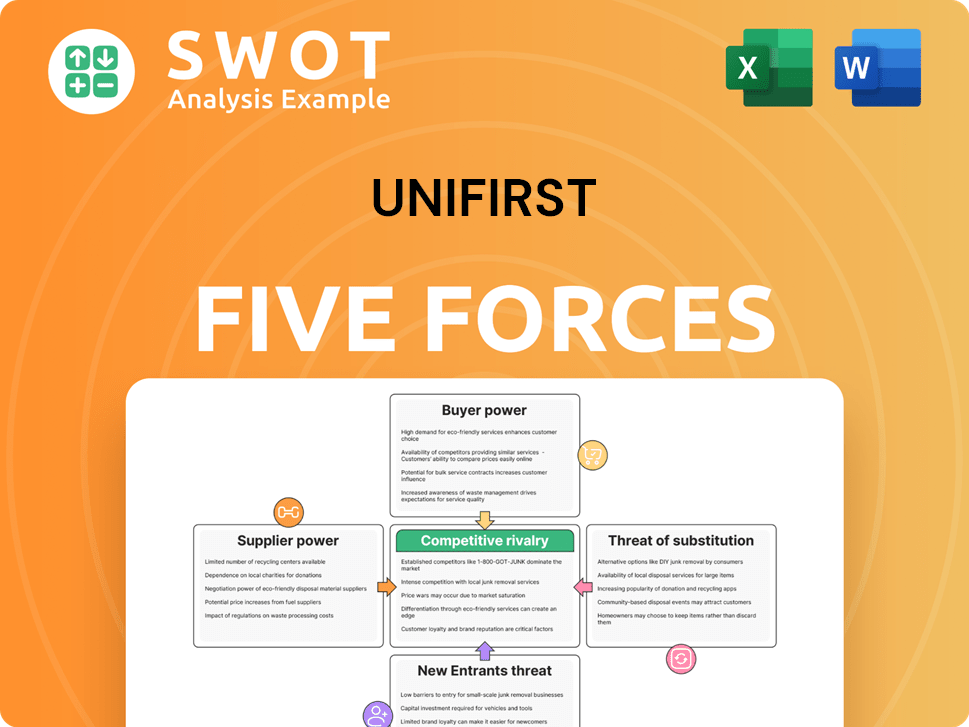

UniFirst Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UniFirst Company?

- What is Competitive Landscape of UniFirst Company?

- What is Growth Strategy and Future Prospects of UniFirst Company?

- How Does UniFirst Company Work?

- What is Sales and Marketing Strategy of UniFirst Company?

- What is Brief History of UniFirst Company?

- What is Customer Demographics and Target Market of UniFirst Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.