UCP, Inc. Bundle

Who Really Controls UCP, Inc.?

Unraveling the ownership structure of a company like UCP, Inc., a prominent player in real estate development, is key to understanding its strategic direction and potential for growth. From its inception as Union Community Partners, LLC, to its current standing, the evolution of UCP, Inc.'s ownership has significantly shaped its trajectory. Understanding the UCP, Inc. SWOT Analysis is crucial for any investor or stakeholder.

This exploration into UCP Inc. ownership will examine the influence of key investors, the role of its parent company, and the impact of its public shareholders. Knowing who owns UCP Inc. provides critical insights into its financial health and future prospects in the competitive real estate market. This analysis is essential for anyone seeking to understand UCP Inc.'s history and background, its current operational philosophy, and its commitment to disability advocacy.

Who Founded UCP, Inc.?

The story of UCP, Inc. begins in 2004 as Union Community Partners, LLC. The company was founded by Dustin L. Bogue, who continues to lead the company as President and Chief Executive Officer. Initially, the focus was on acquiring and developing land for residential construction, with the aim of selling lots to homebuilders.

Early ownership details beyond the founder are not extensively documented. However, a significant shift occurred in January 2008 when PICO Holdings, Inc. acquired the company. This acquisition marked a pivotal moment in the company's ownership structure.

Before its initial public offering (IPO), UCP, LLC was converted into a Delaware corporation and renamed UCP, Inc. As part of this conversion, PICO Holdings, Inc., the sole member of UCP, LLC, received all the common stock issued by UCP, Inc. This transformation solidified PICO Holdings, Inc. as the sole owner of UCP, Inc. before its public listing, answering the question of Who owns UCP Inc.

UCP, Inc. was founded in 2004 as Union Community Partners, LLC.

Dustin L. Bogue is the founder and currently serves as President and CEO.

The initial business model was land acquisition, entitlement, and development for residential construction.

PICO Holdings, Inc. acquired the company in January 2008.

UCP, LLC converted to UCP, Inc. before the IPO.

PICO Holdings, Inc. became the sole owner before the public listing.

The executive team, including Dustin L. Bogue, William J. La Herran (Chief Financial Officer and Treasurer), and James W. Fletcher (Chief Operating Officer), successfully guided the company through challenging economic times. Between its inception and 2012, the team managed over 40 land acquisition transactions. These transactions involved over 5,300 lots, with over $191.4 million in invested capital. For more information on the financial aspects of the company, you can read about the Revenue Streams & Business Model of UCP, Inc.

Understanding the early ownership and the evolution of UCP, Inc. provides a clear picture of its financial journey.

- Dustin L. Bogue founded the company.

- PICO Holdings, Inc. became the sole owner before the IPO. This answers the question of UCP Inc. ownership.

- The company made significant land acquisitions before 2012.

- The executive team navigated the company through the housing depression.

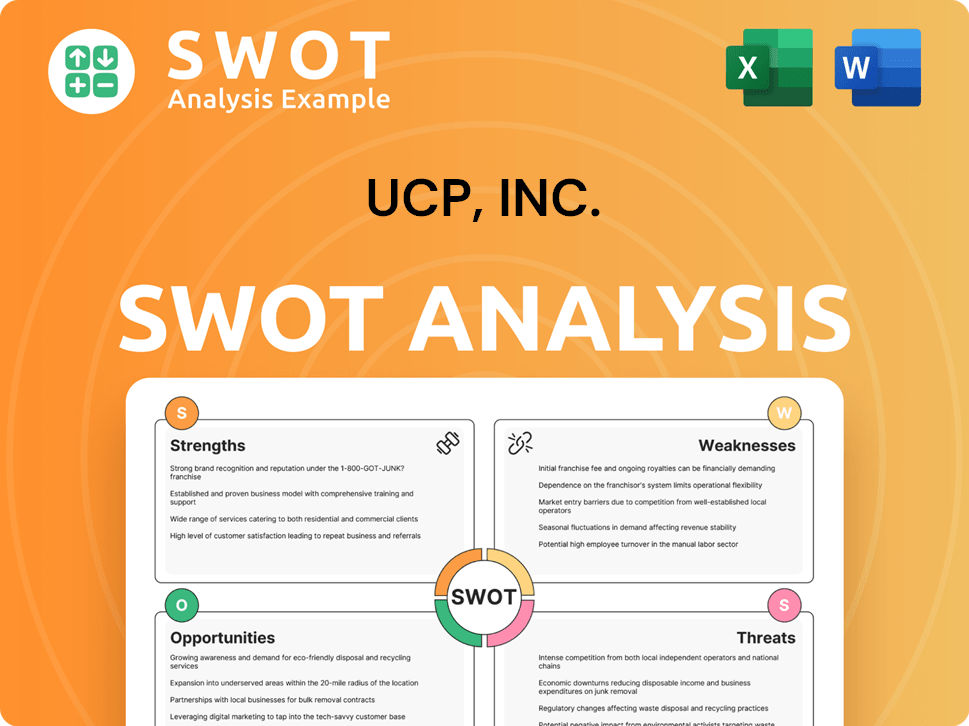

UCP, Inc. SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has UCP, Inc.’s Ownership Changed Over Time?

The ownership structure of UCP, Inc. has seen significant shifts over time. Initially, PICO Holdings, Inc. acquired UCP, Inc. in January 2008, making it a wholly-owned subsidiary. A pivotal moment occurred on July 23, 2013, with the completion of UCP, Inc.'s IPO. Following the IPO, PICO Holdings, Inc. maintained a controlling stake in UCP, Inc., influencing its strategic direction and governance.

Post-IPO, PICO Holdings, Inc. retained a majority of the voting power in UCP, Inc. and a majority economic interest in UCP, LLC, the subsidiary through which UCP operates its business. As of December 31, 2014, PICO owned 57.2% of the economic interests of UCP, LLC, while UCP, Inc. owned 42.8%. In April 2014, UCP, Inc. expanded its operations by acquiring Citizens Homes, Inc. These events highlight the evolution of the UCP Inc. ownership and its strategic growth.

| Date | Event | Impact on Ownership |

|---|---|---|

| January 2008 | Acquisition by PICO Holdings, Inc. | UCP, Inc. became a wholly-owned subsidiary of PICO. |

| July 23, 2013 | Initial Public Offering (IPO) | PICO retained majority voting power and economic interest. |

| April 2014 | Acquisition of Citizens Homes, Inc. | Expansion of UCP, Inc.'s operations. |

While specific current major institutional investors or their percentages beyond PICO are not readily available in recent public filings, the absence of recent 10-K (annual reports) and 10-Q (quarterly reports) filings for UCP, Inc. in the last 365 days suggests a change in its public reporting status. Fintel reports 0 institutional owners and shareholders that have filed 13D/G or 13F forms with the SEC, which indicates a highly concentrated ownership structure or that it may no longer be actively traded on major exchanges. For more information on the competitive landscape, consider reading about the Competitors Landscape of UCP, Inc.

The ownership of UCP Inc. has evolved significantly, starting with its acquisition by PICO Holdings, Inc. and later its IPO. PICO Holdings, Inc. has maintained substantial influence over UCP, Inc.'s strategy. The current ownership structure appears highly concentrated, with limited recent public filings.

- PICO Holdings, Inc. acquired UCP, Inc. in 2008.

- The IPO occurred in 2013, with PICO retaining control.

- Limited recent public filings suggest a potential change in reporting status.

- No institutional owners have filed 13F forms with the SEC.

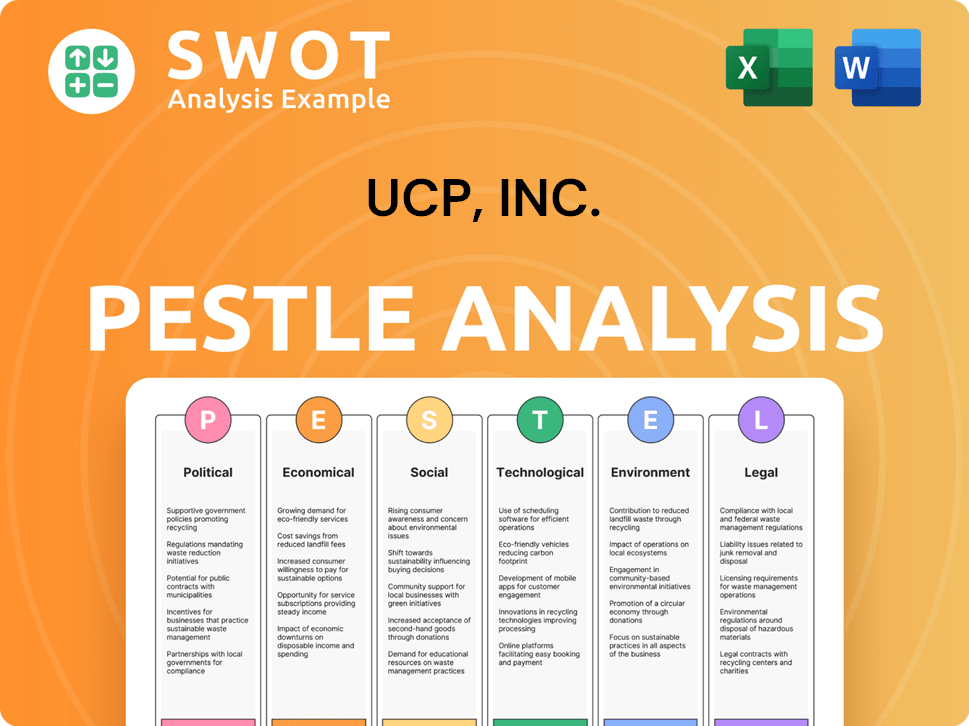

UCP, Inc. PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on UCP, Inc.’s Board?

The composition of the board of directors for UCP, Inc. is significantly influenced by its ownership structure. Historically, John R. Hart, formerly the President and CEO of PICO Holdings, Inc., a major shareholder, served on UCP, Inc.'s board. This reflects a common practice where significant shareholders have direct representation on the board. Unfortunately, current specific details about the board members, their affiliations, and the precise voting structure for UCP, Inc. are not readily available in recent public filings for 2024-2025.

In companies with a majority shareholder, the controlling entity often wields substantial voting power. Corporate governance emphasizes shareholder accountability and equal treatment, including the election of board members. However, the influence of a majority shareholder can affect market activity and price volatility. Publicly available information, such as 13D/G or 13F forms filed with the SEC, provides insights into major shareholders. However, Fintel indicates zero institutional owners filing such forms for UCP, Inc. (US:UCP), suggesting a non-public or highly consolidated ownership structure. The lack of recent proxy filings further limits public insight into governance matters.

| Board Member | Affiliation | Notes |

|---|---|---|

| John R. Hart | PICO Holdings, Inc. | Former President and CEO of PICO Holdings, Inc. |

| Information Not Available | Not Publicly Disclosed | Current board member details are not available in recent filings. |

| Information Not Available | Not Publicly Disclosed | Current board member details are not available in recent filings. |

Understanding the ownership structure is crucial for assessing a company's governance and potential risks. For more detailed insights into the marketing strategies of UCP, Inc., you can refer to Marketing Strategy of UCP, Inc..

The board of directors is influenced by major shareholders. The voting power is significantly held by the controlling entity. Public filings provide limited insights into the current board composition and voting structure.

- Majority shareholders often have significant voting power.

- Public information on the current board is limited.

- Corporate governance emphasizes shareholder accountability.

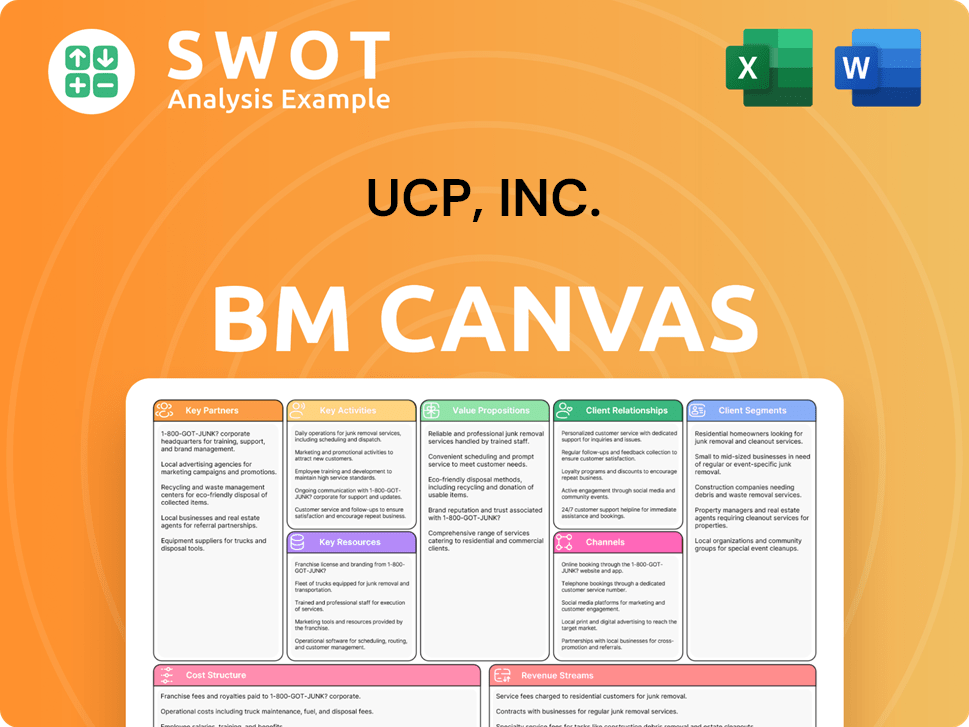

UCP, Inc. Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped UCP, Inc.’s Ownership Landscape?

Recent developments in the ownership of UCP, Inc. are difficult to ascertain due to the lack of recent public filings. The last significant ownership event widely reported was PICO Holdings, Inc.'s majority ownership following UCP, Inc.'s IPO in 2013 and the acquisition of Citizens Homes, Inc. in 2014. The absence of recent 10-K or 10-Q filings and the lack of institutional investors filing 13D/G or 13F forms suggest that UCP, Inc. may no longer be a publicly traded company or has altered its reporting status, potentially moving towards further privatization under PICO Holdings, Inc., or a different operational structure.

General industry trends, however, show increased institutional ownership and consolidation. The real estate sector, where UCP, Inc. operates, is experiencing active investment and acquisitions. For example, in April 2025, The Union Flats in Union City, California, was acquired for $81.6 million, and in February 2025, Summit Court in Union, New Jersey, was acquired for $131.5 million. Without updated public statements from UCP, Inc. or PICO Holdings, Inc., specific insights into UCP, Inc.'s future ownership changes are limited. For more information about the company, you can read the Brief History of UCP, Inc..

The current ownership structure of UCP Inc. is not fully transparent due to a lack of recent public filings. The last major known ownership event was PICO Holdings, Inc. holding the majority stake. This suggests a potential shift towards a more concentrated ownership model.

The real estate sector shows ongoing consolidation and acquisitions. Recent examples include The Union Flats being acquired for $81.6 million and Summit Court for $131.5 million. These activities reflect active investment within the sector.

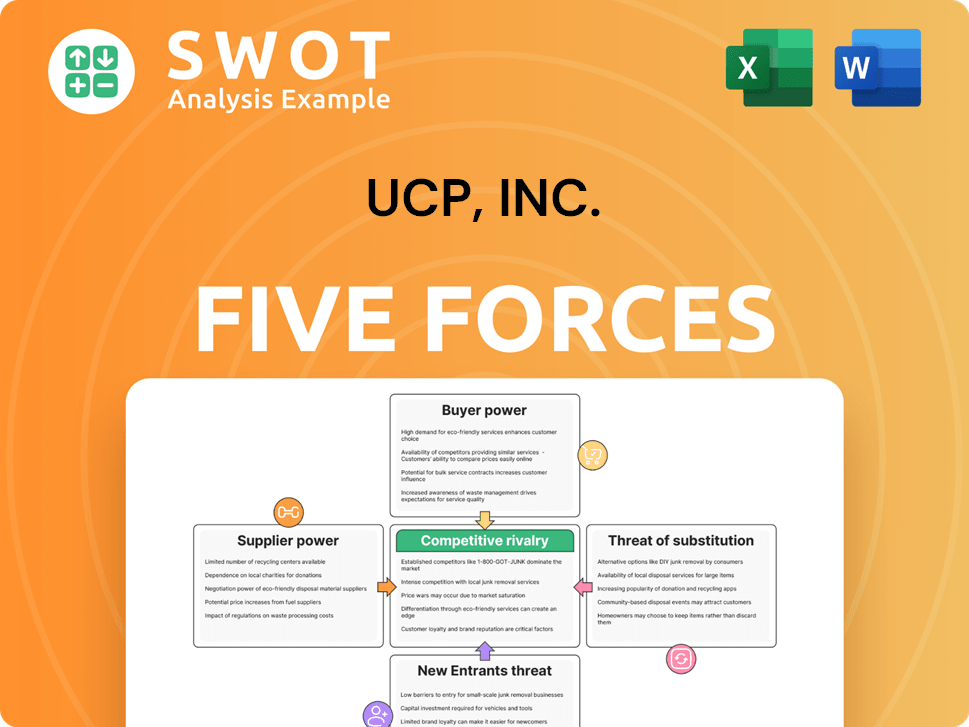

UCP, Inc. Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of UCP, Inc. Company?

- What is Competitive Landscape of UCP, Inc. Company?

- What is Growth Strategy and Future Prospects of UCP, Inc. Company?

- How Does UCP, Inc. Company Work?

- What is Sales and Marketing Strategy of UCP, Inc. Company?

- What is Brief History of UCP, Inc. Company?

- What is Customer Demographics and Target Market of UCP, Inc. Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.