VTEX Bundle

Who Really Owns the VTEX Company?

Unraveling the VTEX SWOT Analysis is just the beginning; understanding the VTEX ownership structure is crucial for any investor or business strategist. As a leading digital commerce platform, VTEX's trajectory is deeply intertwined with its ownership dynamics. From its founding to its current status, the evolution of who owns VTEX has shaped its strategic direction and growth potential.

The VTEX company, a global force in e-commerce, began its journey in Brazil in 1999, and its ownership structure has transformed significantly. Knowing who founded VTEX and who the current owners of VTEX are provides insights into the company's long-term vision. Examining VTEX's investors and major shareholders offers a comprehensive view of its governance and future prospects, including where VTEX headquarters is located.

Who Founded VTEX?

The VTEX company was established in 1999 by Mariano Gomide de Faria and Geraldo Thomaz. As the founders, they were the primary owners and architects of the company during its initial stages. Their shared vision centered on developing a robust e-commerce platform, which influenced how control was distributed early on.

Details regarding the initial equity split at VTEX's inception are not publicly available in terms of specific percentages or share numbers. However, Gomide de Faria and Thomaz were the driving forces behind the company from the beginning. This early ownership structure was crucial in setting the direction and strategy for the company.

In the early years, like many startups, VTEX likely secured funding from early backers, including angel investors, friends, and family. While the precise identities and stakes of these early investors haven't been widely publicized, such investments were typical for a company founded in the late 1990s. These initial investments were vital for fueling the company's growth and development.

Mariano Gomide de Faria and Geraldo Thomaz founded VTEX.

They were the primary owners and key figures in the early stages.

VTEX likely received funding from angel investors and family.

These early investments were crucial for the company's initial growth.

The initial equity split details are not publicly available.

The founders held significant control in the early days.

Vesting schedules and buy-sell clauses were likely used.

These agreements helped manage ownership and employee retention.

No major initial ownership disputes have been widely reported.

The founding team maintained control early on.

The founders' vision drove the company's direction.

Their focus was on a scalable e-commerce platform.

The founders, Mariano Gomide de Faria and Geraldo Thomaz, were central to VTEX's early ownership and strategic direction. Initial funding likely came from angel investors and early backers, although specific details of ownership splits are not available. Early agreements such as vesting schedules were likely in place to manage ownership. The founders' vision for a scalable e-commerce platform shaped the company's early trajectory.

- Founders: Mariano Gomide de Faria and Geraldo Thomaz.

- Early Funding: Angel investors, friends, and family.

- Ownership Structure: Details of the initial equity split are not publicly available.

- Strategic Direction: Focused on a scalable e-commerce platform.

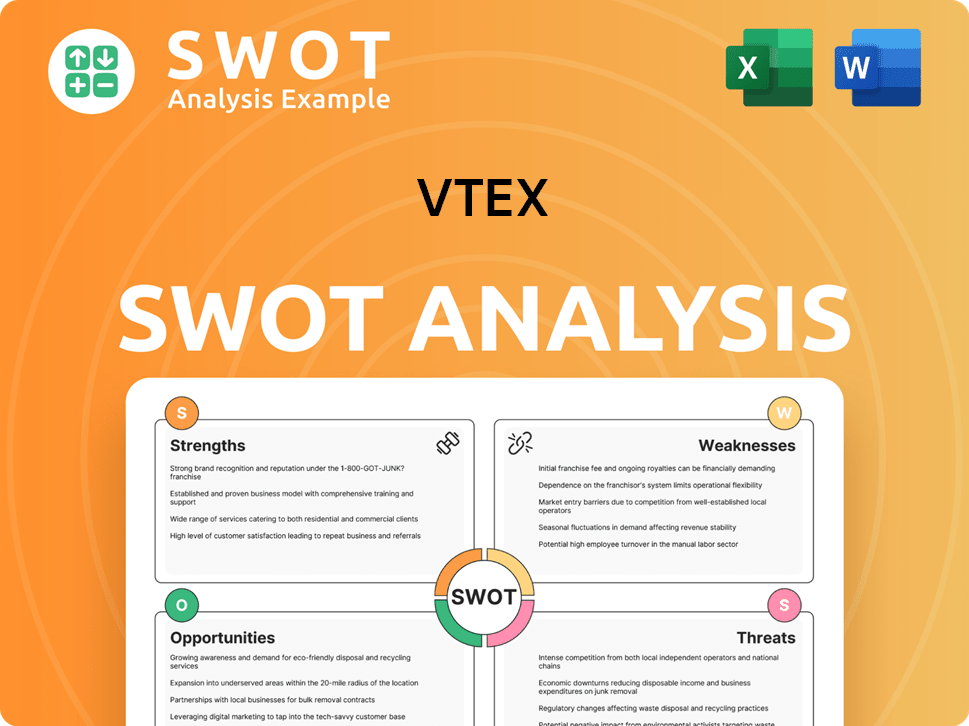

VTEX SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has VTEX’s Ownership Changed Over Time?

The ownership structure of the VTEX company has changed considerably, especially after its initial public offering (IPO) on the New York Stock Exchange (NYSE) on July 21, 2021. This transition moved VTEX from a privately held entity to a publicly traded company. At the IPO, shares were priced at $21.00, raising around $361 million. This resulted in an initial market capitalization of several billion dollars, signaling a significant shift in the company's financial landscape.

Following the IPO, major shareholding diversified. Institutional investors, mutual funds, and index funds acquired substantial stakes. By early 2024, prominent institutional investors included funds managed by BlackRock and Vanguard. SoftBank Latin America Fund remained a notable investor, maintaining a significant position. The founders, Mariano Gomide de Faria and Geraldo Thomaz, still hold considerable individual stakes, although their overall ownership percentage diluted post-IPO. They continue to exert influence through their leadership roles and board representation. Venture capital and private equity firms, such as Tiger Global Management, have also been key stakeholders, with their positions potentially changing over time.

| Event | Date | Impact on Ownership |

|---|---|---|

| IPO on NYSE | July 21, 2021 | Transitioned from private to public ownership; significant capital raised. |

| Institutional Investment | Post-IPO (Ongoing) | Increased ownership by funds like BlackRock and Vanguard; diversification of shareholder base. |

| Founder's Role | Ongoing | Founders retain influence despite dilution; continued leadership and board representation. |

Changes in major shareholding are regularly reported in SEC filings, such as 13F filings for institutional investors. These shifts in ownership have influenced company strategy, increasing the focus on shareholder value and adherence to public market regulations. The company's headquarters is located in New York, USA. The current owners of VTEX include institutional investors, the founders, and other key stakeholders from early funding rounds. The VTEX company's valuation and ownership structure continue to evolve with market dynamics.

VTEX's ownership has evolved significantly since its IPO, with a shift towards public ownership and institutional investors.

- The founders retain influence despite dilution.

- Major shareholders include institutional investors and SoftBank.

- Ownership changes are tracked through SEC filings.

- The company's strategy is influenced by shareholder value and market regulations.

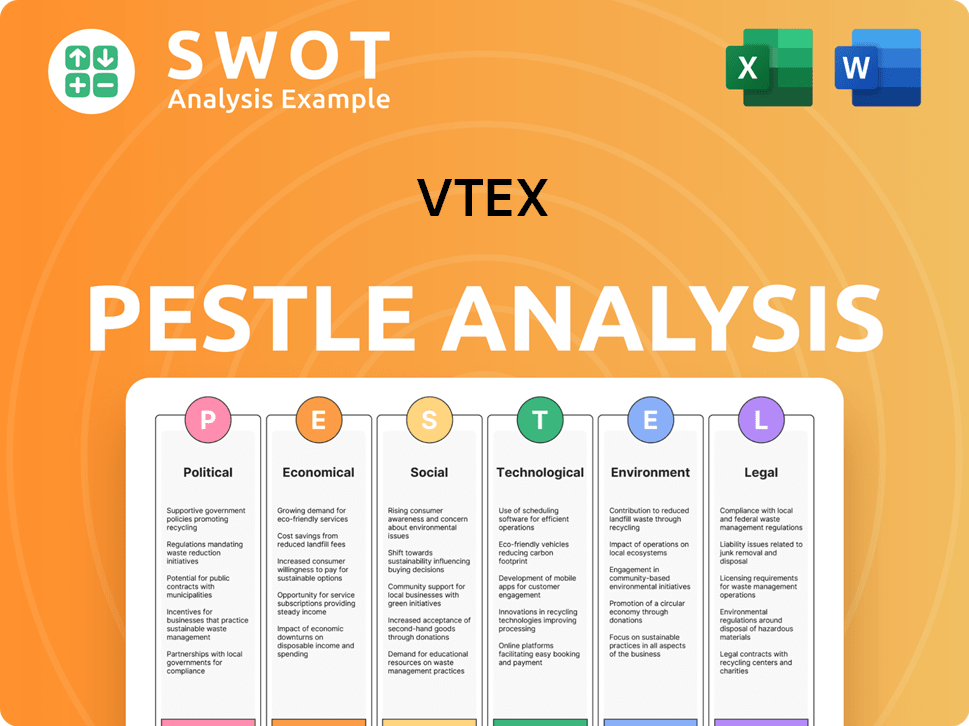

VTEX PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on VTEX’s Board?

The current board of directors of the VTEX company plays a vital role in its governance, balancing founder representation, major shareholders, and independent expertise. As of early 2024, the board includes co-founders Mariano Gomide de Faria and Geraldo Thomaz, who also serve as Co-CEOs. Their presence ensures the founding vision continues to influence strategic decisions. Understanding the VTEX ownership structure is key to grasping the company's direction.

The board also includes representatives from significant institutional investors. Representatives from investment funds that participated in pre-IPO funding rounds or hold substantial public stakes often occupy board seats. Independent directors, bringing external perspectives and expertise, are crucial for robust corporate governance. The exact composition and affiliations of each board member are detailed in VTEX's annual reports and proxy statements filed with the SEC. Knowing who owns VTEX is essential for investors.

| Board Member | Title | Affiliation |

|---|---|---|

| Mariano Gomide de Faria | Co-CEO, Director | VTEX Founder |

| Geraldo Thomaz | Co-CEO, Director | VTEX Founder |

| [Representative Name] | Director | Institutional Investor |

| [Independent Director Name] | Independent Director | Independent |

VTEX operates with a one-share-one-vote structure for its common shares. There are no publicly disclosed dual-class shares or special voting rights that would grant outsized control to specific individuals or entities beyond their proportional equity ownership. This structure promotes a more democratic voting process among shareholders. The VTEX company ownership structure is straightforward, which generally promotes shareholder alignment. Although there haven't been widely publicized proxy battles or activist investor campaigns that have significantly disrupted VTEX's governance in recent years, the standard one-share-one-vote system means that collective shareholder action, particularly from large institutional investors, can influence key decisions, including board elections and major corporate actions.

VTEX's board includes founders, institutional investors, and independent directors.

- Co-founders Mariano Gomide de Faria and Geraldo Thomaz are key figures.

- Institutional investors have board representation.

- The company uses a one-share-one-vote structure.

- Understanding the VTEX investors is crucial for assessing the company's future.

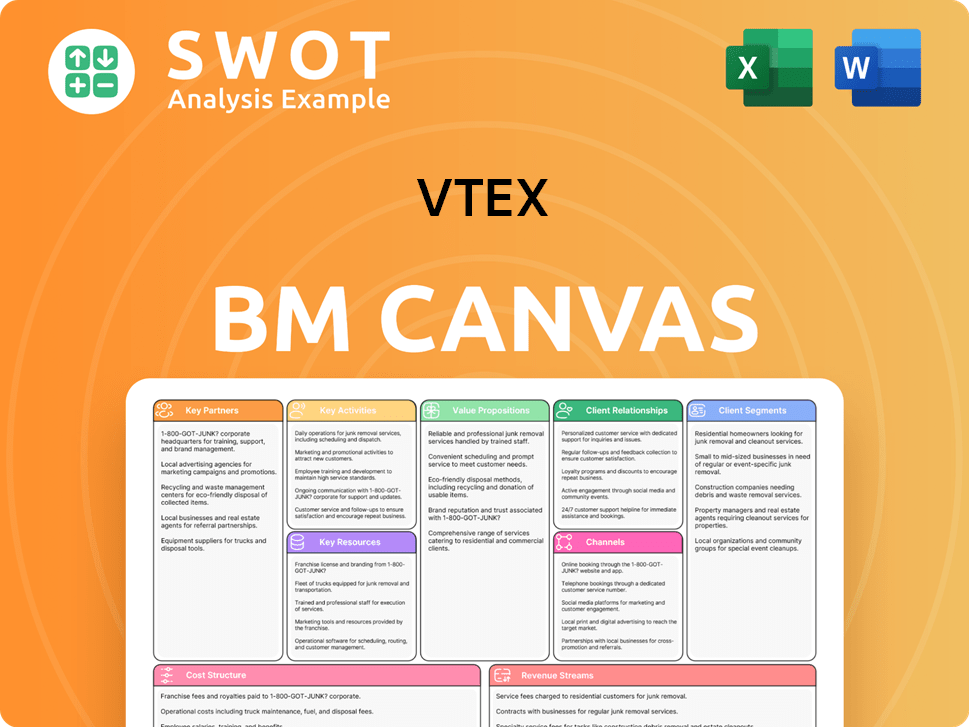

VTEX Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped VTEX’s Ownership Landscape?

In the past few years, the VTEX company has experienced significant shifts in its ownership structure, primarily driven by its initial public offering (IPO) in July 2021. This event marked a crucial turning point, broadening its shareholder base to include a multitude of public investors. Following the IPO, the company has concentrated on its growth strategies and market expansion. While there haven't been major share buybacks or secondary offerings, the natural course of public trading has led to continuous changes in institutional and individual holdings.

Industry trends often show increased institutional ownership for SaaS companies like VTEX after their IPOs, as large funds accumulate shares. This can lead to a gradual dilution of the VTEX founder's stake as the company grows and potentially issues more shares for acquisitions, employee incentives, or further capital raises. However, founders usually retain significant influence through their remaining equity and leadership roles. The e-commerce platform sector has also seen consolidation, with larger tech companies acquiring smaller players, which could lead to ownership changes through mergers and acquisitions.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| IPO | July 2021 | Increased public shareholders, broadened investor base. |

| Market Expansion | Ongoing | Continuous changes in institutional and individual holdings. |

| Industry Consolidation | Ongoing | Potential for ownership changes through mergers and acquisitions. |

As of early 2024, VTEX operates as a publicly traded company. Public communications and analyst reports primarily focus on financial performance, market expansion, and product development rather than major ownership overhauls. Any significant changes in leadership or founder departures would be material events impacting the ownership narrative and would be publicly disclosed. The company's ownership trends are largely aligned with other successful technology companies that have transitioned to the public markets, balancing founder influence with the broader interests of a diverse shareholder base. For more insights, you can check out the Growth Strategy of VTEX.

VTEX is currently a publicly traded company, with ownership distributed among various institutional and individual investors. The company's ownership structure has evolved since its IPO in July 2021.

The major shareholders include institutional investors and individual investors. The ownership structure is dynamic, with changes occurring due to market activities and investment decisions.

The VTEX founder likely retains a significant influence through their remaining equity and leadership roles. Founder's involvement is crucial in shaping the company's strategic direction.

The VTEX headquarters location is a key factor in understanding its operational and strategic focus. The physical location impacts the company's operations and market reach.

VTEX Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of VTEX Company?

- What is Competitive Landscape of VTEX Company?

- What is Growth Strategy and Future Prospects of VTEX Company?

- How Does VTEX Company Work?

- What is Sales and Marketing Strategy of VTEX Company?

- What is Brief History of VTEX Company?

- What is Customer Demographics and Target Market of VTEX Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.