YETI Bundle

Who Really Controls YETI?

Ever wondered who steers the ship at YETI, the powerhouse behind those rugged coolers and must-have drinkware? Understanding the YETI SWOT Analysis is crucial, but knowing the YETI ownership structure is key to unlocking its strategic moves and future potential. From its humble beginnings to its current status as a public company, the story of YETI company is a fascinating study in brand building and market dominance.

This deep dive into Who owns YETI will uncover the major players influencing the YETI brand, from the founders who envisioned it to the institutional investors shaping its destiny. We'll explore the YETI history, examine the key investment rounds, and identify the major shareholders who have a stake in its success. Understanding the YETI products and their impact on the market is also key to understanding the company's trajectory.

Who Founded YETI?

The story of YETI's beginnings is rooted in the frustration of two brothers, Roy and Ryan Seiders, who sought to create better coolers. Their journey began in 2006, driven by a need for more durable and high-performing products for outdoor enthusiasts. This marked the genesis of the YETI brand and its focus on quality.

The entrepreneurial spirit of the Seiders brothers was nurtured by their father, Roger Seiders, an outdoorsman and inventor. Ryan, with a background in the fishing rod industry, and Roy, who initially built custom boats, brought different experiences to the table. Their combined skills and passion laid the foundation for the YETI company.

Understanding the YETI ownership structure from the start provides insight into its growth. Ryan Seiders invested $100,000 from the sale of his previous company, securing a 49.5% stake. Roy Seiders held the remaining ownership, setting the stage for their initial direct-sales approach. This strategy was crucial in building the YETI brand.

Ryan Seiders' investment of $100,000 secured a 49.5% ownership stake. Roy Seiders held the other half. This initial investment was critical for launching the business and developing YETI products.

YETI initially focused on direct sales and building relationships with independent retailers. This approach allowed them to maintain control over their brand and build a loyal customer base. The strategy was key to the early YETI history.

In June 2012, Cortec Group acquired a two-thirds majority stake in YETI for $67 million. This investment helped the company expand. The Seiders brothers retained a 10% ownership each.

At the time of Cortec's investment, YETI had approximately $40 million in revenue. The company employed around 20 people. This growth showed the success of the YETI brand.

Following Cortec's investment, Roy and Ryan Seiders remained actively involved in the business. They continued to contribute to the YETI's growth. Their ongoing involvement was crucial.

Cortec Group's involvement aimed to help the founders navigate the next phase of YETI's expansion. They provided guidance and resources. This move was part of a broader strategy.

The early ownership structure of YETI, with the Seiders brothers at the helm, was crucial for establishing the brand. The YETI company's focus on quality and direct sales allowed it to cultivate a loyal customer base. The 2012 investment by Cortec Group marked a significant shift, providing capital and expertise to accelerate growth. For more insights, check out the Growth Strategy of YETI.

Understanding who owns YETI and its early history sheds light on its success. The Seiders brothers' initial investment and strategic approach were pivotal. The Cortec Group's involvement helped fuel expansion.

- Founders: Roy and Ryan Seiders.

- Initial Investment: Ryan Seiders invested $100,000.

- Early Strategy: Direct sales and independent retailers.

- 2012 Investment: Cortec Group acquired a majority stake.

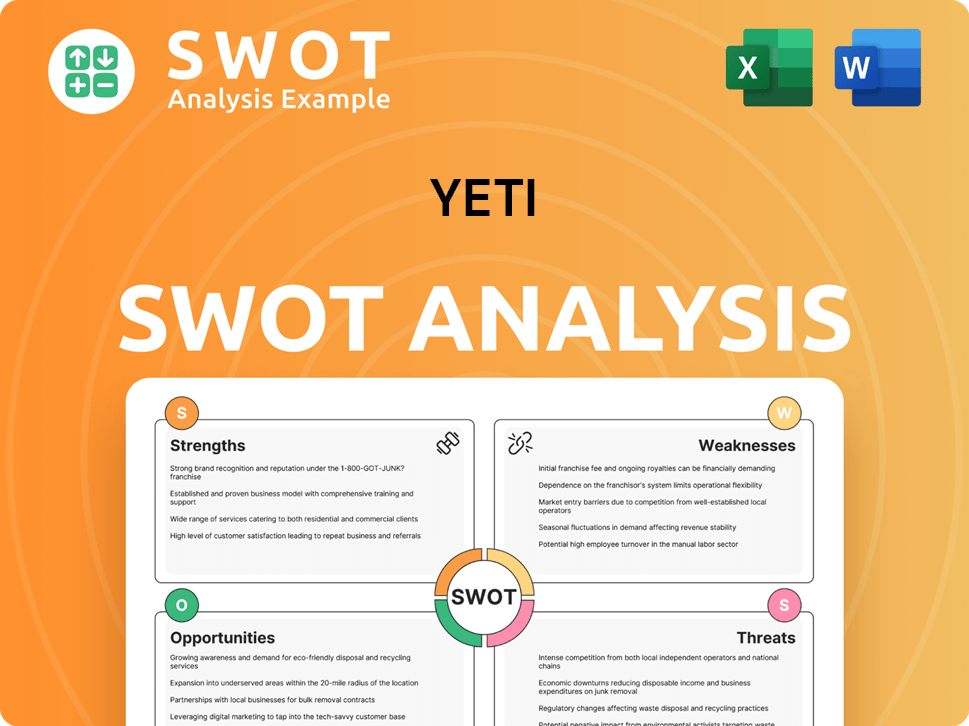

YETI SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has YETI’s Ownership Changed Over Time?

The evolution of YETI's ownership reflects its journey from a startup to a publicly traded company. Initially, private equity played a key role, with Cortec Group acquiring a majority stake in 2012. This investment fueled significant growth for the YETI brand, as net sales surged from $89.9 million in 2013 to $639.2 million by 2017. The path to going public was not without its challenges; an initial IPO filing in July 2016 was withdrawn before the company successfully went public on October 25, 2018.

The IPO on the New York Stock Exchange (NYSE) under the ticker symbol 'YETI' marked a pivotal moment. The offering involved the sale of 16 million shares at $18 per share, raising $288 million. Post-IPO, Cortec Group retained a majority of the voting shares, while founders Roy and Ryan Seiders maintained significant holdings. Cortec Group eventually divested its ownership through public market transactions by June 2020. This transition highlights the impact of strategic investments and the dynamics of ownership in the YETI company.

| Ownership Milestone | Date | Details |

|---|---|---|

| Cortec Group Acquisition | 2012 | Cortec Group acquired a majority stake in the company. |

| Initial IPO Filing | July 2016 | Filed for an IPO but withdrew it. |

| Successful IPO | October 25, 2018 | Listed on the NYSE; Cortec Group held a majority stake. |

| Cortec Group Divestiture | By June 2020 | Cortec Group sold its ownership through public market transactions. |

As of May 2025, YETI ownership is heavily influenced by institutional investors. With 858 institutional owners and shareholders, a total of 114,294,512 shares are held. Major players include BlackRock, Inc., Vanguard Group Inc, and Baillie Gifford & Co. Institutional holdings remained unchanged at 113.27% in May 2025. This concentration of ownership among institutional investors can significantly influence the company's strategic direction. To learn more about the company's business model, check out this article Revenue Streams & Business Model of YETI.

YETI's ownership structure has evolved significantly, from private equity backing to a public listing.

- Cortec Group's initial investment and subsequent divestiture played a crucial role in the company's growth.

- The IPO in 2018 marked a significant transition, with founders and institutional investors becoming key stakeholders.

- Institutional investors now hold a substantial portion of YETI company stock, influencing its strategic decisions.

- Understanding the YETI ownership structure provides insights into the company's financial trajectory and future direction.

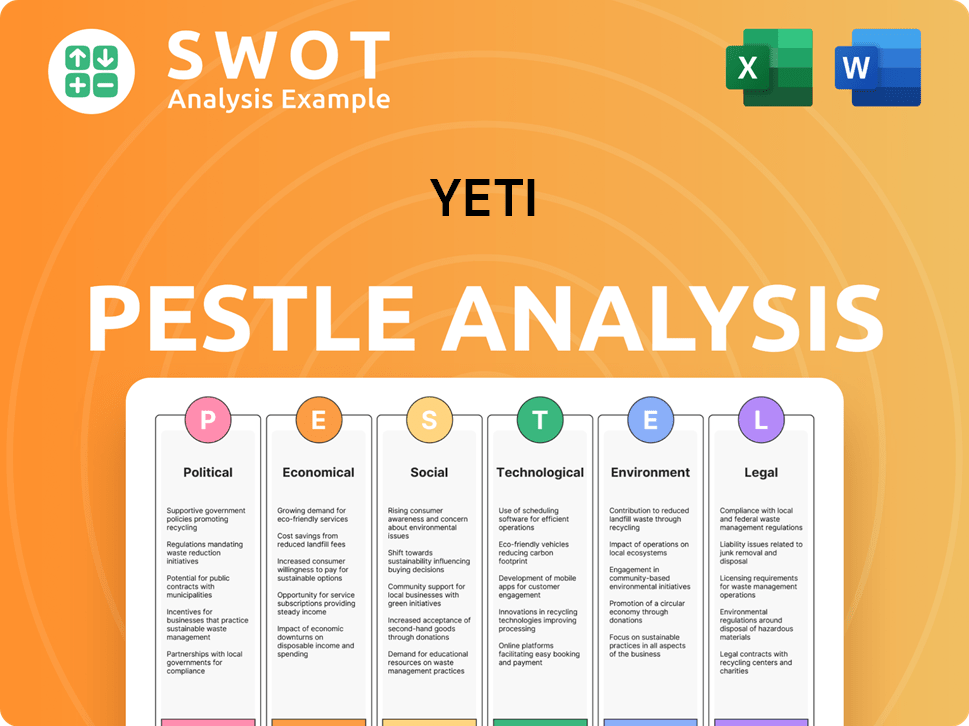

YETI PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on YETI’s Board?

As of March 2025, the board of directors of the YETI company consists of ten members, reflecting recent changes. This expansion followed discussions with Engaged Capital, an activist investor holding approximately 2% of YETI's common shares. The additions to the board include Magnus Welander and Arne Arens, bringing in expertise from the lifestyle and footwear industries, respectively. These appointments align with strategic changes pushed by Engaged Capital, impacting the company's direction.

Key figures in the current leadership structure include Matthew J. Reintjes as CEO and Director, Michael John McMullen as Senior Vice President, Chief Financial Officer, and Treasurer, and Robert K. Shearer as Chairman of the Board. Other independent directors include Alison Dean, Dustan E. Mccoy, Robert A. Katz, Elizabeth L. Axelrod, and Frank D. Gibeau. The influence of major institutional shareholders and activist investors is significant in shaping decision-making and corporate governance. To learn more about the company's origins, you can read a Brief History of YETI.

| Director | Title | Additional Information |

|---|---|---|

| Matthew J. Reintjes | CEO and Director | |

| Robert K. Shearer | Chairman of the Board | |

| Michael John McMullen | Senior Vice President, CFO, and Treasurer | |

| Alison Dean | Independent Director | |

| Dustan E. Mccoy | Independent Director | |

| Robert A. Katz | Independent Director | |

| Elizabeth L. Axelrod | Independent Director | |

| Frank D. Gibeau | Independent Director | |

| Magnus Welander | Director | Former CEO of Thule |

| Arne Arens | Director | Former CEO of Boardriders |

The voting structure isn't explicitly detailed in recent filings, but the 2018 IPO documents indicated a single class of common stock. The influence of major institutional shareholders and activist investors like Engaged Capital can significantly shape decision-making and corporate governance. Understanding the YETI ownership structure is crucial for investors and stakeholders alike, especially considering the company's market performance and strategic initiatives.

The YETI board has expanded to ten members as of March 2025, influenced by activist investor engagement.

- New directors include industry veterans like Magnus Welander and Arne Arens.

- The company's voting structure is primarily based on a single class of common stock.

- Major shareholders and activist investors significantly impact decision-making.

- Understanding YETI's leadership is key for evaluating the company.

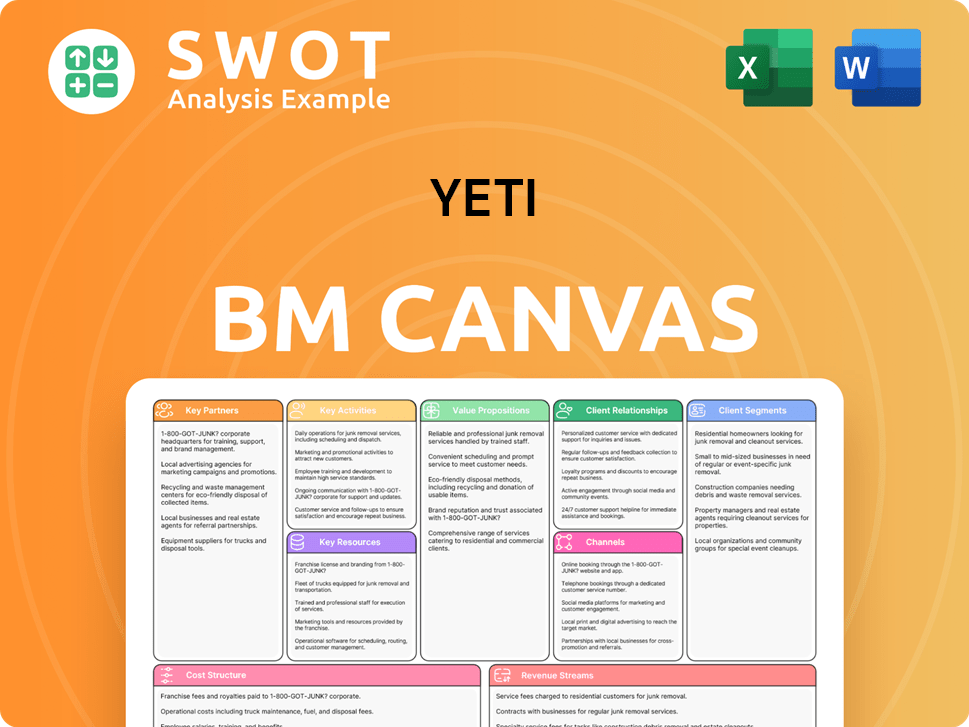

YETI Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped YETI’s Ownership Landscape?

Over the past few years, the ownership structure of the YETI company has seen significant shifts, primarily influenced by increased institutional investment and engagement from activist investors. As of May 2025, institutional investors hold a substantial stake in the company, with their holdings remaining steady at 113.27%. This strong institutional presence, including major investors such as BlackRock, Inc. and Vanguard Group Inc., demonstrates considerable confidence from large investment funds in the YETI brand.

A notable development is the collaboration agreement YETI entered into with Engaged Capital on March 14, 2025. Engaged Capital, which owns approximately 2% of YETI's common shares, has been pushing for strategic changes, including board expansion and a focus on growth initiatives. This engagement resulted in the expansion of YETI's board of directors and the appointment of two new independent directors in March 2025. This could also potentially position YETI as a target for private equity buyouts.

| Metric | Value | Year |

|---|---|---|

| Net Sales | $1.83 billion | 2024 |

| Net Income | $175.7 million | 2024 |

| International Sales Growth | 31% | 2024 |

| Share Repurchase Program | Up to $300 million | February 2024 |

| Expected International Growth | 15-20% | 2025 |

YETI has also been focused on diversifying its supply chain. The company aims for 90% of its U.S. drinkware capacity to be ex-China by the end of 2025, with less than 5% of its total cost of goods sold for the U.S. market coming from China starting in 2026. In 2024, YETI reported a 10% increase in net sales, reaching $1.83 billion, and a net income of $175.7 million. YETI also initiated a share repurchase program of up to $300 million in February 2024. For more insights into the consumer base, consider exploring the Target Market of YETI.

Institutional investors hold a significant portion of YETI's shares, indicating strong investment interest. Their holdings remained steady at 113.27% as of May 2025. Major players like BlackRock, Inc. and Vanguard Group Inc. are among the key institutional investors.

YETI entered into a cooperation agreement with Engaged Capital. Engaged Capital, holding approximately 2% of shares, advocated for strategic changes. This led to board expansion and a focus on growth initiatives.

In 2024, net sales increased by 10% to $1.83 billion. Net income reached $175.7 million. The company initiated a share repurchase program of up to $300 million in February 2024.

International sales increased by 31% in 2024. The company expects 15-20% international growth in 2025. Plans include further expansion in Asia and Europe.

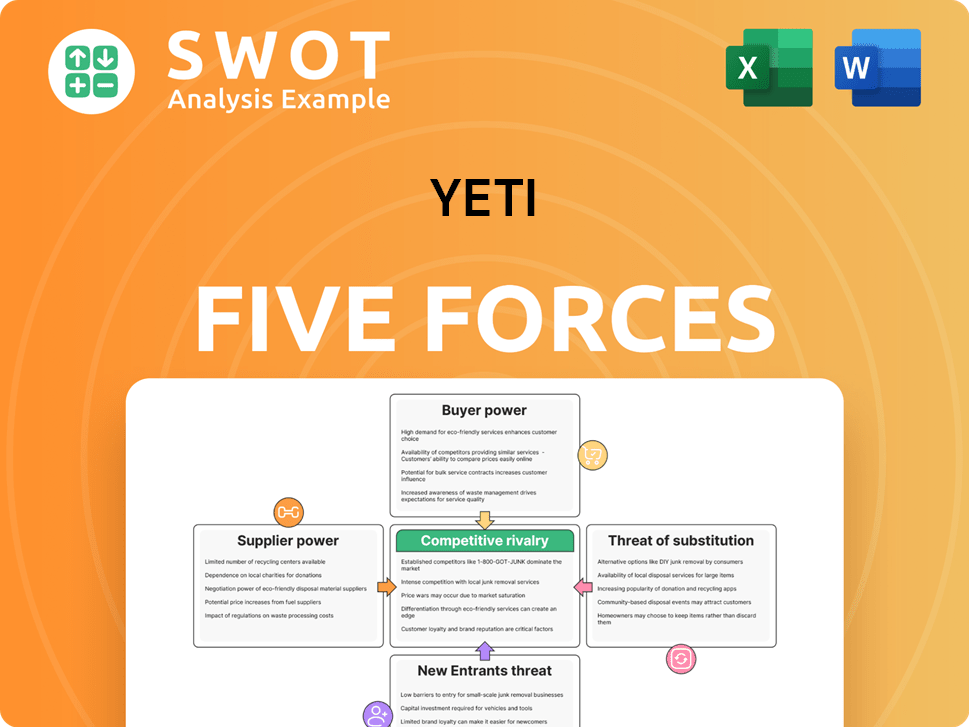

YETI Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of YETI Company?

- What is Competitive Landscape of YETI Company?

- What is Growth Strategy and Future Prospects of YETI Company?

- How Does YETI Company Work?

- What is Sales and Marketing Strategy of YETI Company?

- What is Brief History of YETI Company?

- What is Customer Demographics and Target Market of YETI Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.