Zensar Bundle

Who Really Controls Zensar Technologies?

Delving into the ownership of a company like Zensar Technologies is like uncovering the levers that drive its strategy and future. From its roots as ICIM to its current status as a digital solutions leader, understanding the evolution of Zensar SWOT Analysis is key. This exploration reveals the key players and influences shaping this dynamic technology firm.

Zensar Technologies' ownership structure, a crucial aspect of its identity, encompasses a diverse mix of stakeholders. As a publicly listed entity on both the BSE and NSE, the company's ownership is a blend of promoter holdings, institutional investors, and public shareholders. This analysis will explore the intricacies of Zensar Technologies owner, its Zensar parent company, and the impact of these stakeholders on its strategic direction, financial performance, and overall governance, including details on where Zensar headquarters is located.

Who Founded Zensar?

The story of Zensar Technologies begins in 1922 with a British firm establishing a unit in Pune, India. This unit later became the Indian manufacturing arm of ICL, a British computer maker. The company's journey through various iterations ultimately led to the formation of Zensar.

In 1963, the company, then known as International Computers Indian Manufacture (ICIM), was listed on the Bombay Stock Exchange. The evolution continued with the establishment of a software-focused subsidiary, International Computers Limited (ICIL), in 1991. The original hardware division of ICIM was closed in 1999, transforming the company into a purely software entity, and it was renamed Zensar in February 2000.

While Ganesh Natarajan's 15-year tenure as CEO, starting in 2001, was significant, the initial ownership structure of Zensar Technologies is not explicitly detailed in available information. The company was promoted with foreign collaborators ICL (UK), Fujitsu (Japan), and Northern Telecom (Canada). In 1988, ICL partnered with RPG Enterprises for joint management, with RPG Enterprises becoming the majority shareholder. The Growth Strategy of Zensar has been influenced by these ownership dynamics.

The primary focus is on understanding Zensar ownership and the evolution of its ownership structure. The company's history reveals transitions from its roots as a regional unit of a British firm to its current status. Key aspects of Zensar company details include its transformation from a hardware manufacturer to a software-focused entity, and its listing on the Bombay Stock Exchange in 1963. The Zensar Technologies owner has changed over time, with RPG Enterprises becoming the majority shareholder.

- Zensar Technologies was initially promoted with foreign collaborators.

- RPG Enterprises became the majority shareholder.

- The company's headquarters location is not explicitly mentioned in the provided text.

- The exact details of early founder equity splits are not available in the provided information.

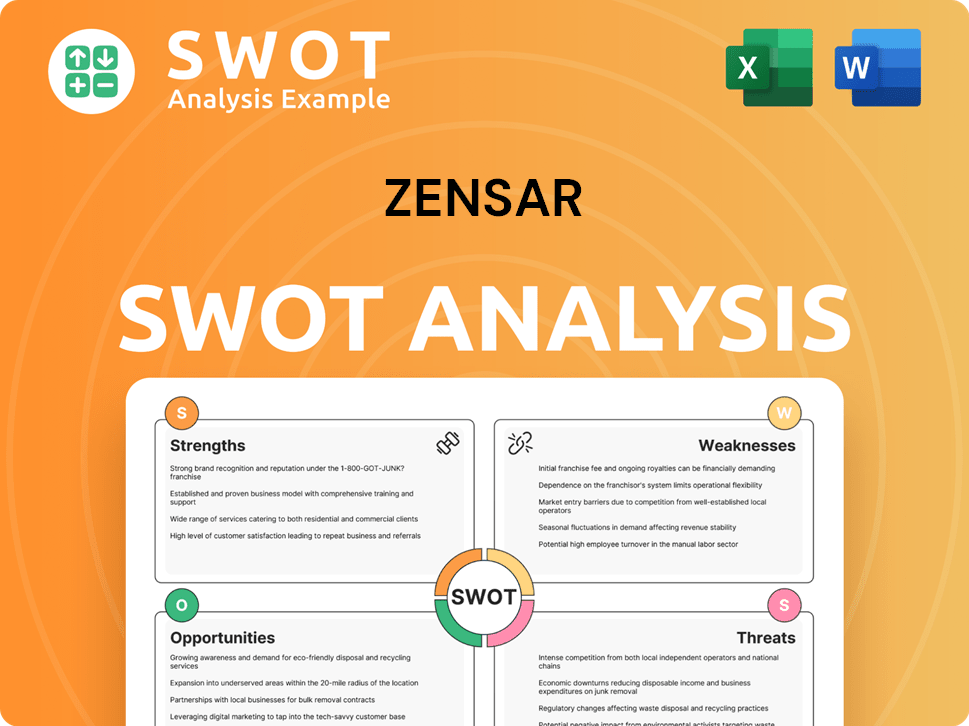

Zensar SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Zensar’s Ownership Changed Over Time?

The ownership of Zensar Technologies, a publicly listed company for over five decades, has seen shifts, particularly after its initial public offering. As of March 31, 2025, the promoter group held the largest stake at 49.07%, a slight decrease from 49.10% in December 2024. Swallow Associates LLP is the primary promoter, holding 26.68% of the shares. This evolution reflects the company's adaptation to market dynamics and strategic initiatives.

Institutional investors play a significant role. Foreign Institutional Investors (FIIs) held 14.97% as of March 31, 2025, and Domestic Institutional Investors (DIIs) held 19.89%. Mutual Funds within DIIs held 17.39% in March 2025. Individual investors collectively own 12.61%. The company's financial performance, including a total income of Rs 1404.90 crore and a profit of Rs 176.40 crore for the quarter ending March 31, 2025, alongside service revenue of $591.3 million for FY2024, with an EBITDA margin improvement to 17.8%, further influences the ownership structure.

| Shareholder Category | March 31, 2025 | December 2024 |

|---|---|---|

| Promoters | 49.07% | 49.10% |

| FIIs | 14.97% | 15.06% |

| DIIs | 19.89% | 19.83% |

The ownership structure of Zensar Technologies, detailing who owns Zensar, is a dynamic reflection of its market position and financial health. The shifts in holdings by promoters, institutional investors, and individual investors highlight the company's ongoing journey. For more insights, you can explore the Competitors Landscape of Zensar.

Promoters hold the largest stake, but there are shifts among institutional and individual investors. The company’s financial performance and strategic decisions influence these ownership changes.

- Promoter ownership stands at 49.07% as of March 31, 2025.

- FIIs and DIIs are key institutional investors.

- Individual investors collectively own a notable percentage.

- The company's financial results impact investor confidence and ownership.

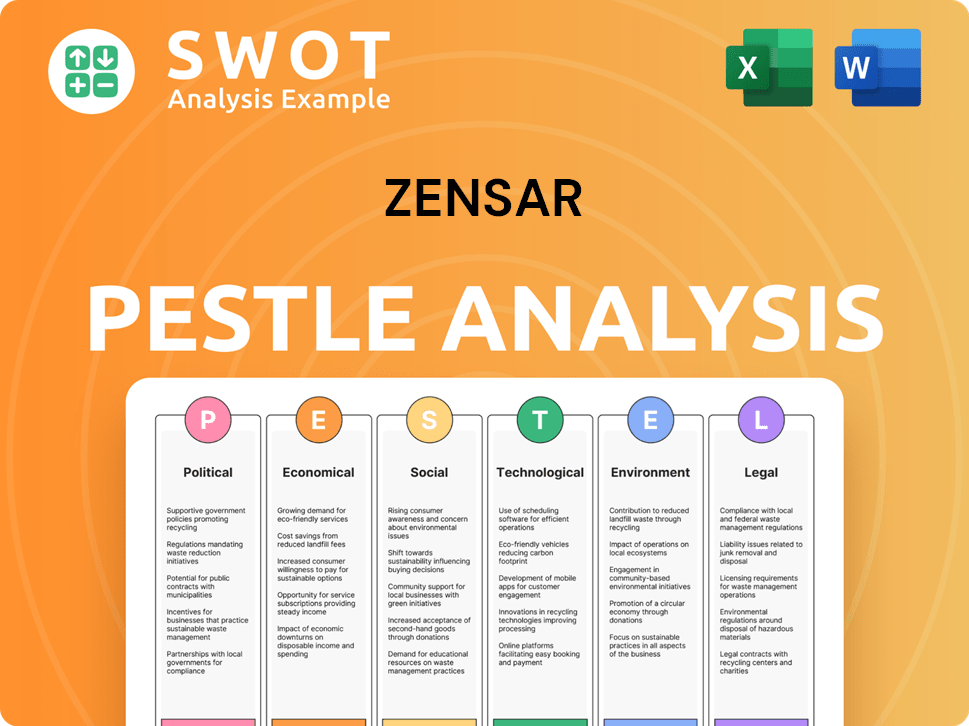

Zensar PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Zensar’s Board?

The current Board of Directors of Zensar Technologies, as of 2024, significantly influences the company's strategic direction and governance. H. V. Goenka serves as the Chairman (Non-Executive), and Anant Goenka is the Vice Chairman (Non-Executive). Manish Tandon holds the position of Chief Executive Officer and Managing Director. The board also includes independent directors such as Ketan Dalal, Ben Druskin, Harsh Mariwala, and Radha Rajappa. Harsh Mariwala joined the board in 2024, focusing on daily operations and strategic implementation. In 2024, Gaurav Tongia joined the board as Company Secretary and Compliance Officer.

The composition of the board reflects a blend of experience and expertise, with independent directors ensuring a degree of oversight and diverse perspectives. The presence of both executive and non-executive directors contributes to a balanced approach to decision-making, aiming to align the interests of shareholders with the long-term success of the company. The board's structure and the roles of its members are crucial for navigating the company's operations and strategic initiatives.

| Board Member | Title | Role |

|---|---|---|

| H. V. Goenka | Chairman (Non-Executive) | Oversees board activities |

| Anant Goenka | Vice Chairman (Non-Executive) | Supports the Chairman |

| Manish Tandon | Chief Executive Officer and Managing Director | Manages daily operations and strategic direction |

| Ketan Dalal | Independent Director | Provides oversight |

| Ben Druskin | Independent Director | Provides oversight |

| Harsh Mariwala | Independent Director | Focuses on daily operations and strategic implementation |

| Radha Rajappa | Independent Director | Provides oversight |

| Gaurav Tongia | Company Secretary and Compliance Officer | Ensures compliance and corporate governance |

Zensar Technologies operates under a one-share-one-vote structure. Each equity share has a par value of INR 2, and each holder is entitled to one vote per share. This structure ensures that voting power is directly proportional to shareholding, reflecting a democratic approach to corporate governance. The Board of Directors, through its Nomination and Remuneration Committee, oversees the effective exercise of voting rights by shareholders. For more insights into the company's operations, you can explore the Revenue Streams & Business Model of Zensar.

Understanding the ownership structure of Zensar Technologies is key to grasping its governance and strategic direction. The company's board of directors, including independent members, plays a vital role in overseeing operations.

- The company has a one-share-one-vote structure.

- The Board of Directors oversees shareholder voting rights.

- Key executives include H. V. Goenka, Anant Goenka, and Manish Tandon.

- Independent directors provide additional oversight.

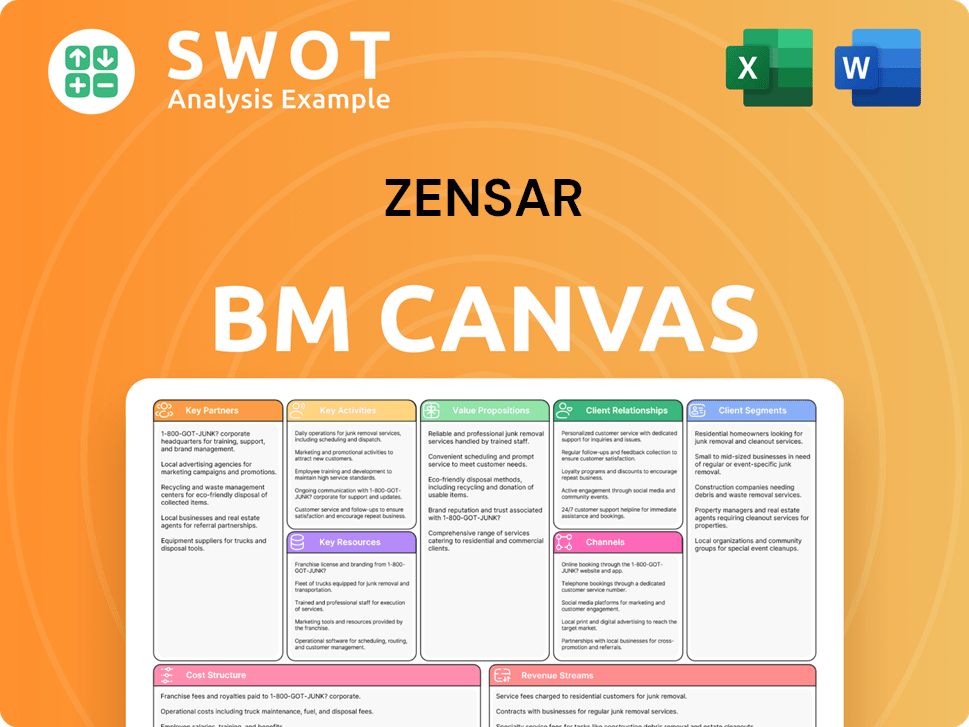

Zensar Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Zensar’s Ownership Landscape?

Over the past few years, Zensar Technologies' ownership structure has evolved through strategic acquisitions and shifts in shareholder holdings. In July 2024, the company acquired BridgeView Life Sciences for $25 million, aiming to strengthen its position in the healthcare technology sector. Earlier, in May 2021, Zensar acquired M3bi for $33 million, which was designed to bolster its digital engineering and data analytics capabilities. These moves reflect Zensar's strategy to expand its service offerings and market presence.

Regarding the current ownership trends, promoter holdings in Zensar Technologies slightly decreased from 49.17% in March 2024 to 49.07% in March 2025. Foreign Institutional Investors (FIIs) also reduced their stake from 15.06% in December 2024 to 14.97% by March 2025. However, Domestic Institutional Investors (DIIs) increased their holdings from 19.83% to 19.89% during the same period. Additionally, other investors and retail investors also increased their holdings, with retail investors' holdings rising from 16.01% to 16.06% by the end of March 2025.

| Ownership Category | March 2024 | March 2025 |

|---|---|---|

| Promoter | 49.17% | 49.07% |

| FIIs | 15.06% (Dec 2024) | 14.97% |

| DIIs | 19.83% | 19.89% |

| Other Investors | 16.01% | 16.06% |

| Retail Investors | 16.01% | 16.06% |

Financially, Zensar declared an interim dividend of ₹2 per share with an ex-date of January 28, 2025. The company’s services revenue for FY2024 reached $591.3 million, with a profit after tax (PAT) of 14.1% in Q4 FY2024. The EBITDA margin improved to 17.8% in FY2024. The company is focusing on strategic investments in service lines, particularly in new-age technologies such as Generative AI. Market analysts generally maintain a positive outlook on the stock, with the majority recommending a 'buy' rating.

Promoter holdings saw a slight decrease, while DIIs and retail investors increased their stakes. Acquisitions like BridgeView Life Sciences and M3bi have shaped the company's growth.

FY2024 saw $591.3 million in services revenue, with a 14.1% PAT in Q4. The EBITDA margin improved to 17.8% in FY2024, reflecting strong performance.

Zensar is investing in service lines and new technologies like Generative AI. The acquisitions support the company's expansion into key sectors.

Analysts have a generally positive view, with most recommending a 'buy' rating. The company's strategic moves are well-received by the market.

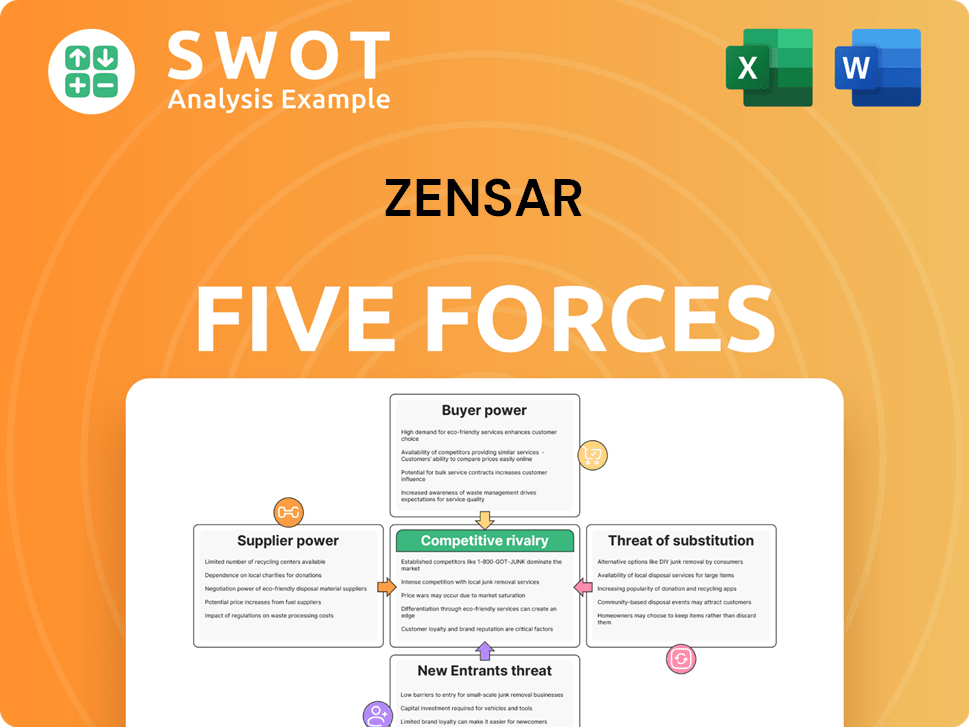

Zensar Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zensar Company?

- What is Competitive Landscape of Zensar Company?

- What is Growth Strategy and Future Prospects of Zensar Company?

- How Does Zensar Company Work?

- What is Sales and Marketing Strategy of Zensar Company?

- What is Brief History of Zensar Company?

- What is Customer Demographics and Target Market of Zensar Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.