CoreWeave Bundle

Who Does CoreWeave Serve in the AI Revolution?

CoreWeave's journey from cryptocurrency mining to a cloud computing powerhouse is a testament to understanding its CoreWeave SWOT Analysis. But who exactly are the customers driving this impressive growth, and what do their needs reveal about the future of AI infrastructure? This exploration dives deep into the customer demographics and CoreWeave target market, offering critical insights for investors and strategists alike.

Understanding the CoreWeave company's shift in focus is key to grasping its current success. From its initial focus on cryptocurrency mining to its current position as a specialized cloud provider, the company's evolution provides valuable lessons in market analysis and adaptability. By examining the target audience and their demands for cloud computing resources, we can better understand CoreWeave's strategic positioning and future growth potential. This analysis will also touch upon CoreWeave's customer profile analysis and CoreWeave's target market industries.

Who Are CoreWeave’s Main Customers?

Understanding the customer demographics and target market of the CoreWeave company is crucial for grasping its business model. CoreWeave primarily focuses on business-to-business (B2B) services, offering specialized cloud infrastructure. This infrastructure is designed for compute-intensive workloads, especially those related to artificial intelligence (AI), machine learning (ML), and visual effects rendering.

The CoreWeave target market is segmented into two main categories: 'AI Enterprises' and 'AI Natives'. AI Enterprises are traditional companies that are integrating AI into their operations, while AI Natives are organizations whose core business revolves around AI technology. This distinction helps CoreWeave tailor its services to meet the specific needs of each group. A comprehensive market analysis reveals that CoreWeave's success is closely tied to the growth and adoption of AI technologies across various industries.

CoreWeave's customer base is characterized by a high degree of concentration. In 2024, a significant 77% of CoreWeave's revenue came from just two customers. Microsoft alone accounted for 62% of the total revenue. Other notable clients include AI startup Cohere, Meta, NVIDIA, and IBM. This concentration highlights both the company's reliance on key clients and the potential risks associated with this dependency. However, CoreWeave is actively working to diversify its customer base. For a deeper dive into the company's origins and evolution, check out this Brief History of CoreWeave.

Traditional companies integrating AI into their existing operations. These businesses often require cloud solutions to support AI initiatives without overhauling their entire infrastructure. They represent a broad spectrum of industries, including finance, healthcare, and manufacturing.

Organizations whose primary focus is AI technology. These companies are deeply involved in AI research, development, and deployment. They typically need highly specialized and scalable cloud infrastructure to handle complex AI workloads, such as model training and inference.

CoreWeave's revenue grew exponentially from $15.8 million in 2022 to $1.9 billion in 2024, driven by the demand for GPU compute. The company's strategic moves, such as the acquisition of Weights & Biases in March 2025 for around $1.7 billion, have expanded its client portfolio by adding 1,400 AI labs and enterprises.

- Customer Concentration: 77% of revenue from two customers in 2024.

- Microsoft's Share: 62% of total revenue in 2024.

- OpenAI Contract: $12 billion five-year cloud-computing contract signed in March 2025, with an additional $4 billion extension through 2029.

- Weights & Biases Acquisition: Added 1,400 AI labs and enterprises to the client portfolio.

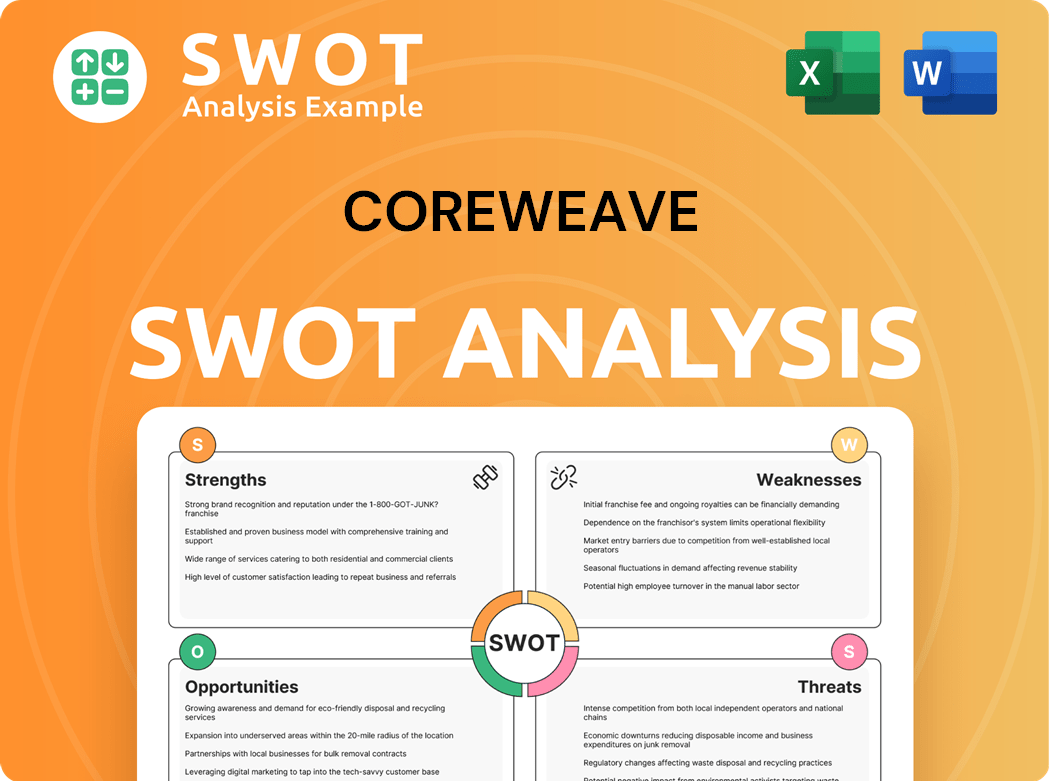

CoreWeave SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do CoreWeave’s Customers Want?

Understanding the customer needs and preferences is crucial for a company like CoreWeave. The company's success hinges on its ability to meet the specific demands of its target market, which includes businesses and organizations that require high-performance computing for demanding workloads. This involves a deep dive into what drives these customers to choose CoreWeave and how the company can best serve them.

CoreWeave's customers are primarily driven by the need for high-performance, scalable, and cost-effective GPU-accelerated computing solutions. These customers often face challenges with traditional cloud providers that may not offer specialized GPU resources or the high costs associated with maintaining such infrastructure in-house. CoreWeave addresses these pain points by providing a specialized, efficient, and accessible platform.

The psychological and practical drivers for choosing CoreWeave include a desire for unparalleled performance, efficiency, and access to the latest GPU technology, particularly NVIDIA's cutting-edge chips. This focus on cutting-edge technology and specialized services sets CoreWeave apart in the competitive cloud computing market.

Customers require high-performance computing for tasks like AI model training, data analytics, and visual effects rendering. These workloads demand significant processing power and specialized hardware, which CoreWeave provides. The demand for these services is rapidly growing, with the global cloud computing market expected to reach $1.6 trillion by 2030, according to recent reports.

Businesses need the ability to scale their computing resources up or down quickly based on their needs. CoreWeave's pay-as-you-go model and flexible infrastructure allow customers to adjust their resources as needed. This is especially important for projects with fluctuating demands, such as AI model training, which can require massive computational power for short periods.

Cost is a major factor for customers, and CoreWeave aims to provide competitive pricing. The company's per-GPU-per-hour pricing model helps businesses avoid large upfront investments. This is particularly appealing to startups and smaller companies that may not have the capital to invest in their own infrastructure.

Customers want access to the newest and most powerful GPUs, such as NVIDIA's GB200 NVL72 and H100. CoreWeave's strategic relationships with chipmakers like NVIDIA provide it with priority access to cutting-edge hardware. This ensures that customers can leverage the latest advancements in GPU technology to stay competitive.

CoreWeave focuses specifically on GPU-accelerated workloads, which allows it to optimize its platform and services for these types of applications. This specialization provides a superior experience compared to general-purpose cloud providers. The global GPU market is projected to reach $190 billion by 2027, highlighting the growing demand for specialized GPU services.

Customers prioritize security and reliability. CoreWeave emphasizes security across its platform and technology stack, leveraging advanced security capabilities. This includes robust data protection and infrastructure security to ensure that customer data is safe and secure.

CoreWeave's customer preferences are shaped by its specialization in GPU-accelerated workloads, high-performance infrastructure, and competitive pricing. The company's business model, which involves renting out computing resources on a per-GPU-per-hour basis, allows for flexible scaling and a pay-as-you-go model. This is particularly appealing to businesses that need supercomputing capabilities for specific tasks without incurring massive upfront capital expenditures. CoreWeave's strategic relationships with chipmakers like NVIDIA provide it with priority access to the newest and most powerful GPUs, ensuring its customers have access to the most advanced hardware. Feedback and market trends, particularly the explosive growth in AI and machine learning, have heavily influenced CoreWeave's product development, leading them to design data centers specifically for AI infrastructure and implement solutions like liquid-cooled infrastructure to support high-density compute. The company tailors its offerings by providing a wide portfolio of NVIDIA GPUs and optimizing every component of its platform for performance, including specialized solutions for data storage and networking. Furthermore, Owners & Shareholders of CoreWeave benefit from these strategic decisions.

CoreWeave's target audience, or ideal customer profile, values several key aspects of its services. These preferences drive customer loyalty and influence the company's strategic decisions.

- Performance: Customers prioritize high-performance computing to meet demanding workload requirements.

- Efficiency: Efficient resource utilization and cost-effectiveness are critical for optimizing budgets.

- Access to Latest Technology: Early access to cutting-edge GPUs ensures a competitive edge.

- Scalability: The ability to quickly scale resources up or down based on demand is essential.

- Specialization: Expertise in GPU-accelerated workloads and tailored solutions are highly valued.

- Security: Robust security measures and data protection are non-negotiable.

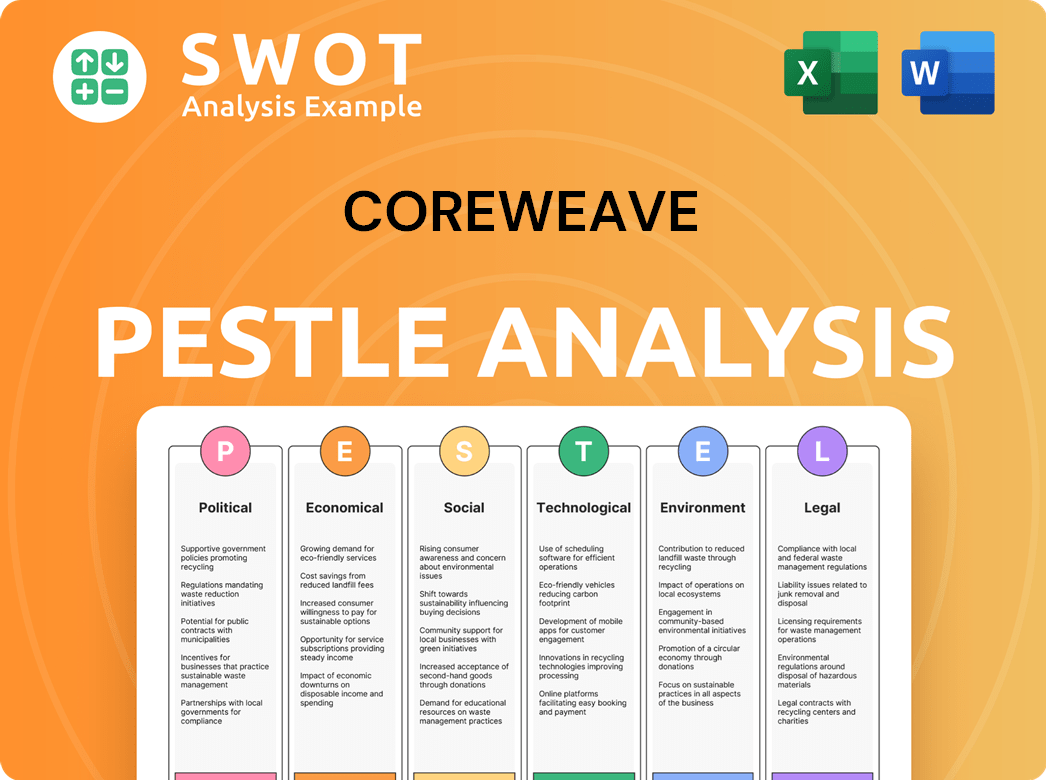

CoreWeave PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does CoreWeave operate?

The geographical market presence of CoreWeave is primarily concentrated in the United States and Europe, reflecting its strategic expansion plans. As of Q1 2025, the company operates a significant network of data centers, with a total of 32 facilities globally. This represents a substantial increase from its 2024 footprint, which included 13 data centers in the United States and two in the United Kingdom.

CoreWeave's headquarters are located in Livingston, New Jersey, United States. The company's expansion efforts highlight a strong emphasis on international growth, especially within the European market. This expansion is driven by the increasing demand for advanced compute infrastructure, particularly from AI model developers and enterprises.

CoreWeave has invested heavily in expanding its European operations. In 2024, CoreWeave announced an initial investment of $2.2 billion across Europe to build new data centers. These centers are designed to deliver AI infrastructure powered by 100% renewable energy. This strategic move is part of CoreWeave's broader plan to capture a larger share of the cloud computing market, as discussed in detail in the Growth Strategy of CoreWeave.

The company has established operational data centers in the UK, which became active in January 2025. These facilities host NVIDIA Hopper (H200) GPUs, enhancing its AI capabilities. CoreWeave's investment in Europe aims to support the growing demand for AI infrastructure.

CoreWeave partnered with Bulk Infrastructure in March 2025 to establish a major NVIDIA AI deployment in Vennesla, Norway, expected to be operational by Summer 2025. In May 2025, CoreWeave launched one of Spain's first large-scale NVIDIA Hopper-based AI supercomputing facilities in Barcelona, a 15MW facility set to expand further in 2026.

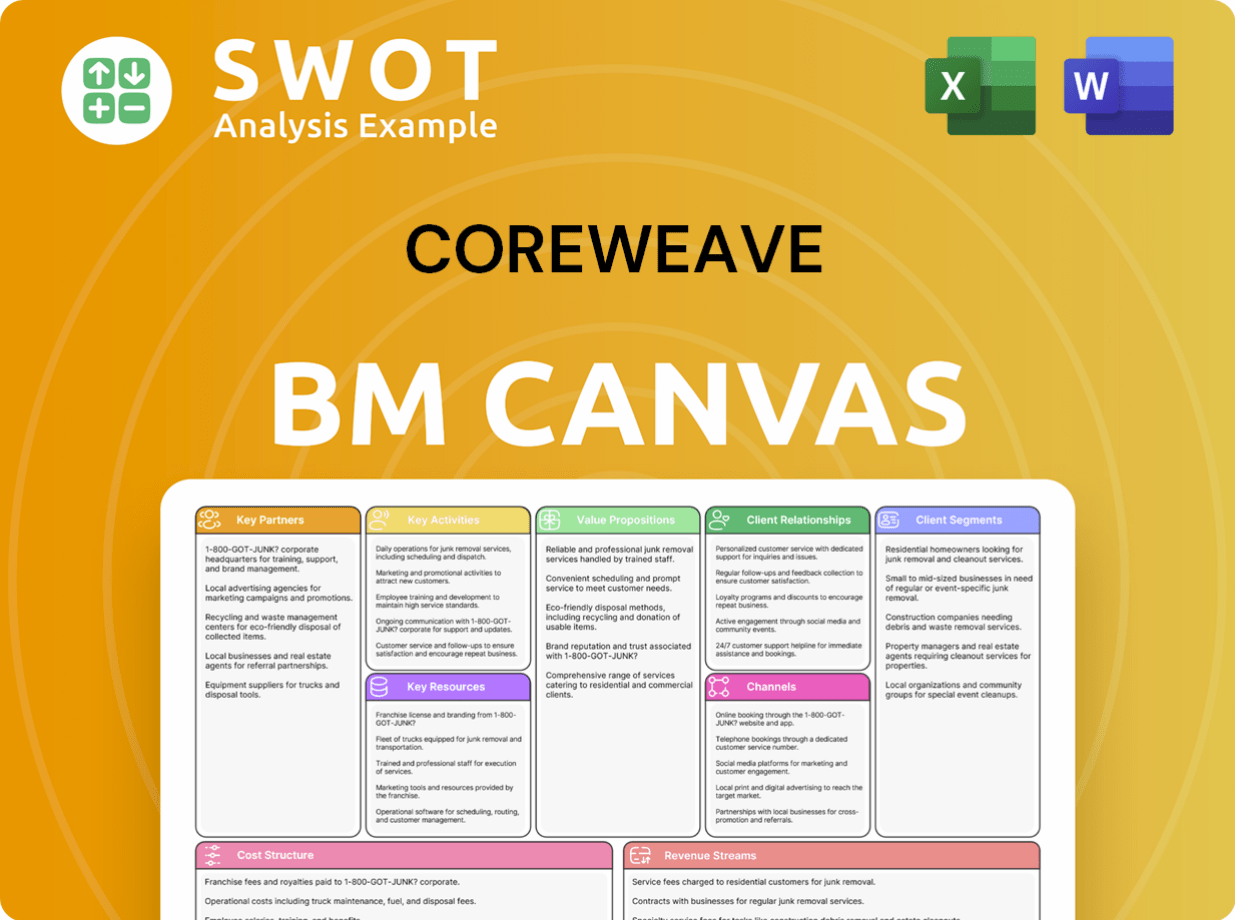

CoreWeave Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does CoreWeave Win & Keep Customers?

The company's strategy for acquiring and retaining customers centers on its specialized offerings and strategic partnerships. It aims to provide a high-performance, cost-effective alternative to traditional cloud providers, especially for AI workloads. The company's relationship with NVIDIA gives it early access to cutting-edge GPUs, which is a significant advantage in attracting AI and machine learning companies.

A key aspect of the retention strategy involves multi-year committed contracts. These agreements provide a predictable revenue stream and guarantee customers access to computing resources. Furthermore, the company focuses on expanding into new industries and verticals, like banking and pharmaceuticals, as they develop dedicated AI solutions.

The company has a strong focus on customer retention, with a significant portion of its revenue coming from long-term contracts. This approach ensures a stable financial foundation and fosters strong customer relationships. Continuous infrastructure upgrades and a wide portfolio of GPUs further contribute to customer loyalty, ensuring access to the most powerful and efficient hardware.

The company's partnership with NVIDIA is crucial for acquiring customers. This relationship grants priority access to the latest GPUs, such as the GB200 NVL72, H100, H200, and GH200, making it attractive to AI and machine learning companies. This early access to advanced hardware is a key differentiator in the competitive cloud computing market.

A significant portion of the company's revenue comes from multi-year committed contracts. As of December 31, 2024, remaining performance obligations totaled $15.1 billion. These contracts, often 'take-or-pay,' provide predictable revenue streams and guarantee customers access to compute resources.

While the company has a strong relationship with Microsoft, accounting for 62% of its revenue in 2024, it is actively diversifying its customer base. The recent $11.9 billion, five-year contract with OpenAI is expected to reduce Microsoft's revenue share to less than 50% of future committed contracts.

The acquisition of Weights & Biases in March 2025 added 1,400 AI labs and enterprises to the company's client portfolio. The company is also expanding into new industries, such as regulated industries like banking, high-frequency trading, and pharmaceuticals, to develop their own dedicated AI solutions.

The company's approach to acquiring and retaining customers includes several key strategies. These strategies are designed to ensure a strong customer base and drive revenue growth. For a deeper understanding of the company's overall strategy, you can refer to an article that provides insights into the company's strategy.

- High-Performance Computing: Offering specialized cloud services tailored for compute-intensive AI workloads.

- Strategic Partnerships: Leveraging relationships with technology providers like NVIDIA for access to cutting-edge hardware.

- Long-Term Contracts: Securing multi-year agreements that provide revenue stability and customer commitment.

- Customer Diversification: Expanding the customer base beyond major clients like Microsoft to reduce concentration risk.

- Industry Expansion: Targeting growth in new verticals, including regulated industries.

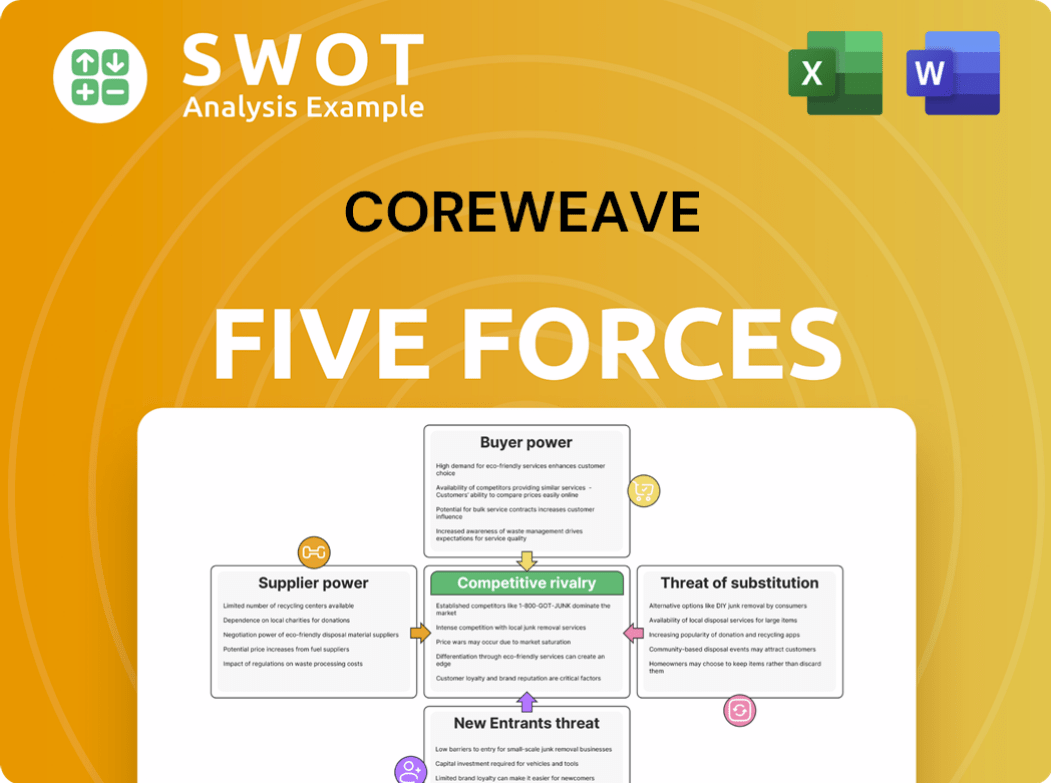

CoreWeave Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CoreWeave Company?

- What is Competitive Landscape of CoreWeave Company?

- What is Growth Strategy and Future Prospects of CoreWeave Company?

- How Does CoreWeave Company Work?

- What is Sales and Marketing Strategy of CoreWeave Company?

- What is Brief History of CoreWeave Company?

- Who Owns CoreWeave Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.