Credicorp Bundle

Who Does Credicorp Serve?

Understanding the customer demographics and target market is crucial for any financial institution, especially one as prominent as Credicorp. Credicorp, a leading financial services holding company in Peru, has demonstrated a remarkable ability to adapt to the evolving financial landscape. A prime example of this adaptation is the impressive growth of its digital payment platform, Yape.

Credicorp's journey, from traditional banking to embracing digital transformation, offers valuable insights into customer segmentation and strategic adaptation. The success of platforms like Yape highlights a significant shift towards digital financial services in Peru. To gain a deeper understanding, consider a comprehensive Credicorp SWOT Analysis to understand the company's position within its target market.

Who Are Credicorp’s Main Customers?

Understanding the Customer Demographics and Target Market of Credicorp is crucial for assessing its market position and growth potential. Credicorp, a major player in the financial services sector, serves a diverse range of customers through its various subsidiaries. This Market Analysis reveals key segments and the strategies employed to cater to their specific needs.

Credicorp's customer base spans both consumers (B2C) and businesses (B2B), reflecting its diversified operations. The company's approach to Customer Segmentation is evident in the varied financial products and services offered by its subsidiaries, including universal banking, microfinance, insurance, pension funds, and investment management. This comprehensive approach allows Credicorp to address a wide spectrum of financial needs across different demographic groups.

The company's focus on digital transformation and financial inclusion further shapes its Target Market. With initiatives like Yape, Credicorp is expanding its reach to include the unbanked and underbanked populations. This strategy is supported by data showing that a significant portion of Yape users are first-time loan recipients, indicating a commitment to broadening access to Financial Services.

BCP, the universal banking arm, caters to a broad customer base across retail and wholesale segments. The majority of BCP's customers are located in Peru, reflecting its strong domestic presence. This segment includes individuals and businesses seeking a wide range of financial products and services, from basic banking to more complex financial solutions.

Mibanco specializes in microcredits and loans, primarily targeting small enterprises in Peru. As of June 2024, Mibanco held a 75.2% market share in microcredits and a 40.6% share in small enterprise loans. A significant portion of Mibanco's clients are women, highlighting its commitment to financial inclusion. In 2023, Mibanco served over 63.6 thousand clients, with 56% being women.

Pacífico Seguros leads in health insurance (43% of premiums) and holds significant shares in life (27% of premiums) and property/casualty segments (21% of premiums). Prima AFP is the second-largest pension fund manager, controlling 30% of assets under management. These subsidiaries target individuals and businesses seeking insurance coverage and retirement planning solutions.

Credicorp Capital serves clients in Peru, Chile, and Colombia, focusing on asset and wealth management. This segment caters to higher-net-worth individuals and institutional clients, providing investment advisory and management services. This segment focuses on individuals and institutions seeking investment solutions.

Yape, Credicorp's digital payment platform, has experienced significant growth, reaching 13.7 million monthly active users by 4Q 2024, with a target of 16.5 million by 2026. Yape's user base includes a substantial number of individuals receiving their first loans in the financial system, with 42% of borrowers being first-time loan recipients. Since 2020, BCP and Yape have successfully included 5.7 million people in the financial system.

- Yape's growth demonstrates Credicorp's commitment to financial inclusion.

- The platform targets the unbanked and underbanked populations.

- Yape's expansion is a key component of Credicorp's digital transformation strategy.

- Credicorp aims to generate 10% of its risk-adjusted revenues from new business models by 2026.

For more insights, consider reading the Growth Strategy of Credicorp to understand how these customer segments align with the company's overall objectives.

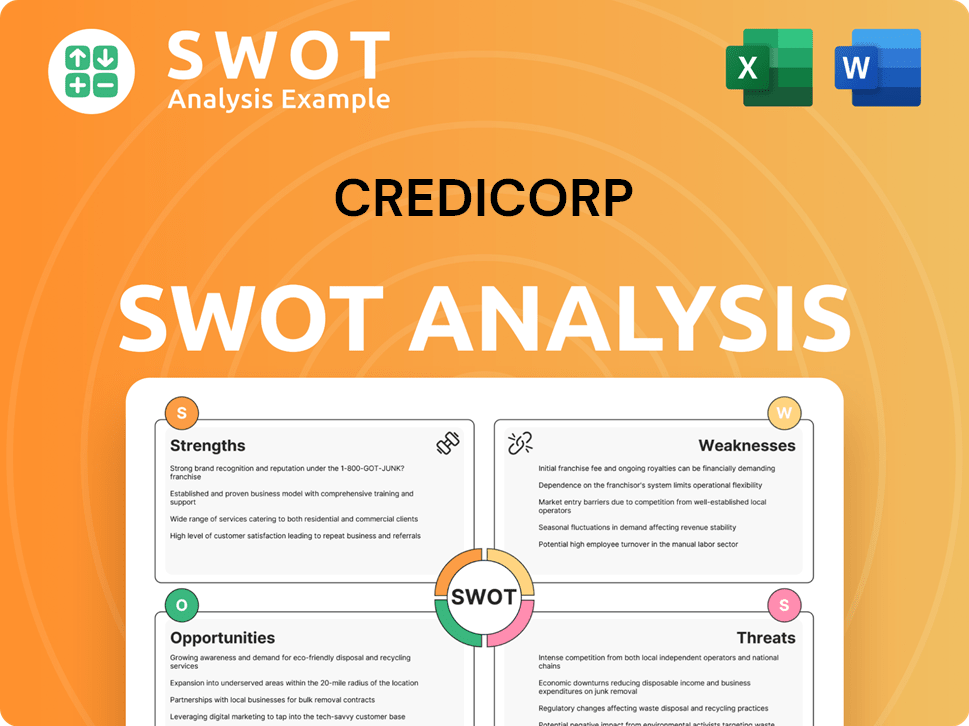

Credicorp SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Credicorp’s Customers Want?

Understanding the needs and preferences of its diverse customer base is crucial for the success of Credicorp. This involves tailoring financial solutions to meet the specific demands of different segments, from digital payment users to microfinance clients and insurance policyholders. Analyzing the customer profile is essential for effective market analysis and strategic planning.

The company leverages customer feedback and market trends to refine its product offerings and marketing strategies. This customer-centric approach, combined with investments in technology and digital platforms, enables Credicorp to maintain a competitive edge and drive innovation in the financial services sector. The goal is to improve client experience and satisfaction.

The rapid adoption of digital platforms, such as Yape, highlights a strong preference for convenient and immediate financial transactions. This aligns with the broader trend of digital disruption in the financial services industry. The company is actively working on its customer acquisition strategy.

Yape's popularity with 13.7 million monthly active users by 4Q 2024, with an average of 51 monthly transactions per user, demonstrates a strong preference for seamless digital payment solutions. This is a key aspect of Credicorp's target market segmentation strategy.

Yape's role in providing first-time loans to 42% of its borrowers highlights a critical need for financial inclusion among previously unbanked or underbanked populations. This is an important demographic of Credicorp's clients.

Universal banking clients, particularly with BCP, seek comprehensive banking services. The preference for low-cost deposits, which represented 56.5% of Credicorp's funding base as of November 2024, indicates a value-conscious customer segment. This is a key element of the customer demographics.

Mibanco's microfinance customers, often small business owners and women, prioritize access to credit. Initiatives like 'Crédito Mujer' and 'Crediagua' (disbursing S/108 million and S/1,407 million respectively in 2023) demonstrate responsiveness to specific needs. This is an important aspect of analyzing Credicorp's customer lifetime value.

Customers in the insurance and pension sectors seek reliable coverage and long-term financial security. Pacífico Seguros' issuance of 3.2 million inclusive insurance policies at affordable rates (S/4 to S/30 per month) indicates a preference for accessible products. This is a critical element of the financial services offered.

The company has focused on improving multichannel value propositions based on Net Promoter Score (NPS) across segments, leading to a 5% increase in average NPS across its businesses in 2024. The company is actively investing in technology and digital disruption initiatives to generate 10% of its risk-adjusted revenues from new business models by 2026. You can learn more about the company's history in Brief History of Credicorp.

Credicorp's customer base values accessibility, convenience, security, and tailored financial solutions. These preferences drive the company's product development and marketing strategies.

- Digital payment solutions for seamless transactions.

- Financial inclusion initiatives for the unbanked.

- Comprehensive banking services with low-cost options.

- Microfinance credit for small businesses and women.

- Accessible and affordable insurance products.

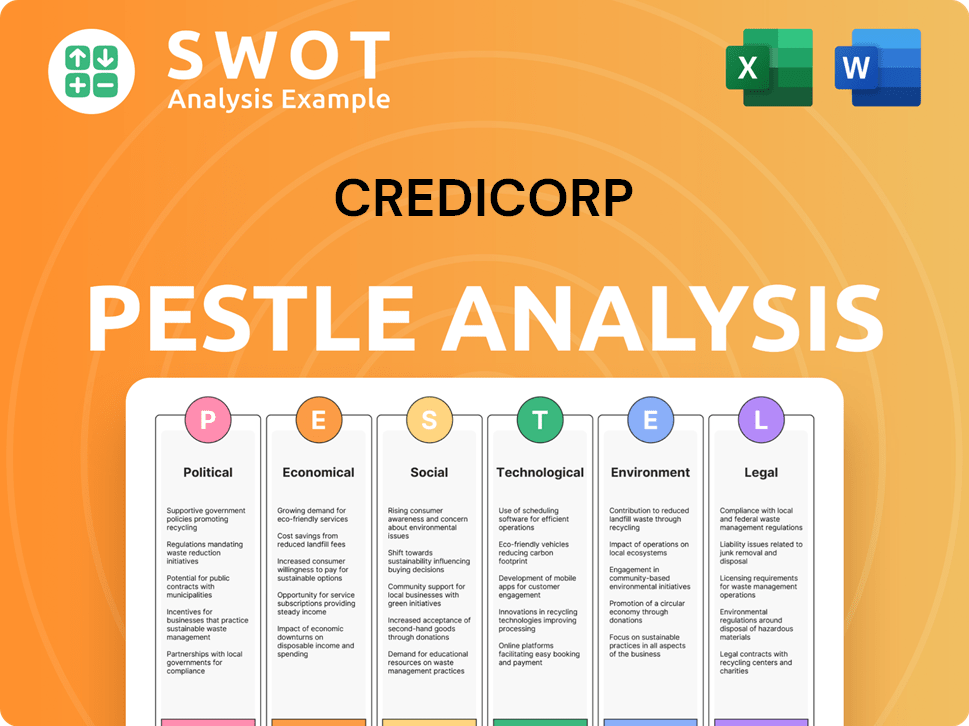

Credicorp PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Credicorp operate?

The geographical market presence of Credicorp is primarily centered in Peru, where it functions as a financial services holding company. This focus is largely due to its subsidiary, Banco de Crédito del Perú (BCP), which holds a significant market share in lending, approximately 37% as of December 2024, including its microlending arm, Mibanco. This strong foothold in Peru forms the foundation for Credicorp's operations and customer base.

Beyond Peru, Credicorp strategically extends its operations across several Latin American countries, including Bolivia, Chile, Colombia, and Panama. This expansion reflects a calculated effort to diversify its market presence and tap into the economic potential of these regions. Each country presents unique opportunities and challenges, necessitating tailored approaches to customer acquisition and service delivery.

Credicorp's expansion strategy involves leveraging its existing franchises and consolidating its operations to create a group with over 36,000 employees across these six countries. The company's 2024 Strategic Update emphasized market expansion as a key highlight, indicating a continued focus on growing its regional footprint. This diversified business model helps generate sustainable earnings across economic cycles. For a deeper understanding of how Credicorp generates revenue, consider exploring the Revenue Streams & Business Model of Credicorp.

Peru remains Credicorp's most significant market, with BCP playing a crucial role. The bank's substantial market share demonstrates its dominance in the Peruvian financial sector. This strong presence allows Credicorp to test and refine strategies before expanding them to other markets.

In Bolivia, Credicorp operates through BCP Bolivia, integrated within its Universal Banking segment. This segment likely offers a range of financial services, catering to diverse customer needs in the Bolivian market. This expansion marks a strategic step in regional diversification.

Colombia is another key market, with Mibanco focusing on microfinance and Credicorp Capital managing assets and wealth. This dual approach allows Credicorp to serve both individual entrepreneurs and high-net-worth clients. The company is adapting its strategies to suit the specific needs of the Colombian market.

Credicorp Capital has a presence in Chile for asset and wealth management. Additionally, Credicorp received provisional authorization for Tenpo Bank Chile in 2024, indicating a strategic move to expand its digital banking services. This expansion shows Credicorp's commitment to adapting to the evolving financial landscape.

ASB Bank Corp., part of Credicorp's Investment Management and Advisory line of business, is based in Panama. This presence allows Credicorp to offer investment management services in the Panamanian market, further diversifying its portfolio and customer base.

The differences in customer demographics, preferences, and buying power across these regions necessitate localized approaches. For instance, Mibanco's microfinance operations in Colombia likely address distinct needs of micro-entrepreneurs in that country. This tailored approach ensures that Credicorp effectively serves its diverse customer base.

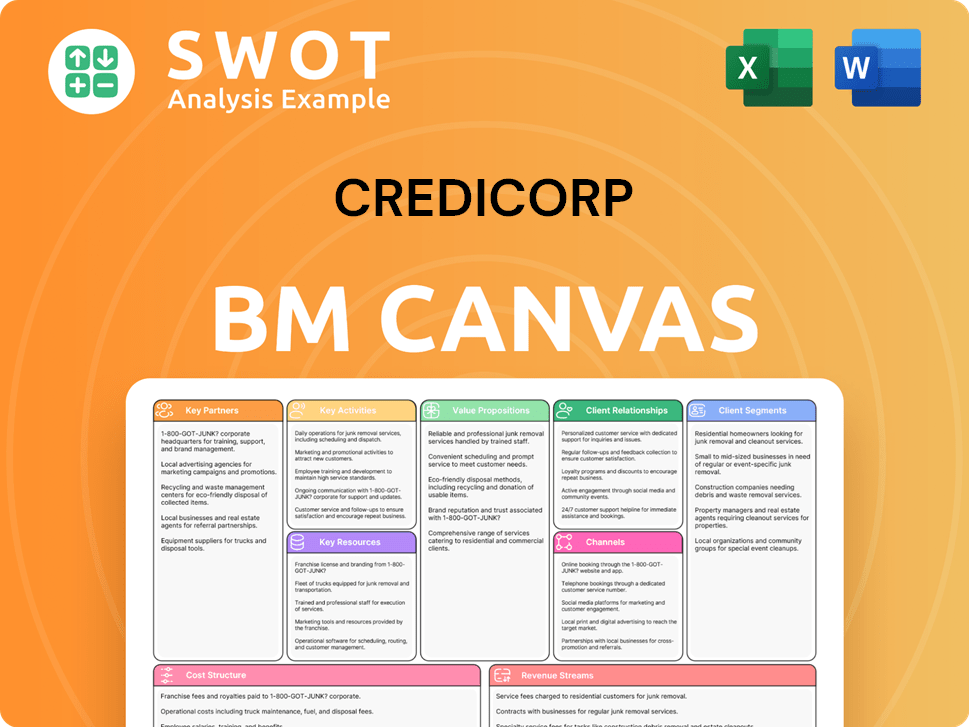

Credicorp Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Credicorp Win & Keep Customers?

Credicorp's approach to customer acquisition and retention is a blend of digital innovation, traditional banking practices, and tailored financial solutions. The company focuses on expanding its customer base through digital channels, particularly the Yape platform, while simultaneously leveraging its extensive branch network. This multi-faceted strategy aims to bring in new customers and build lasting relationships.

The company's retention strategies emphasize personalized experiences, improved customer satisfaction, and loyalty programs. By investing in technology and digital transformation, Credicorp seeks to enhance operational efficiency and agility, ultimately creating a better client experience. This comprehensive approach is designed to meet the diverse needs of its target market and foster long-term customer loyalty.

A key aspect of Credicorp's strategy is its focus on financial inclusion, using digital platforms to bring new customers into the financial system. The goal is to offer accessible and convenient financial solutions that meet the evolving needs of its customer base. This is supported by a diversified business portfolio that provides cross-selling opportunities and strengthens customer relationships.

Yape has been instrumental in acquiring new customers, with 13.7 million monthly active users by 4Q 2024. The company aims to reach 16.5 million active users by 2026. This platform has brought millions into the financial system, making it a key tool for customer acquisition and financial inclusion.

BCP and Mibanco utilize their branch networks to acquire customers across various segments. Mibanco targets micro-entrepreneurs and women with initiatives like 'Crédito Mujer,' showcasing a targeted sales approach. This strategy helps Credicorp reach diverse customer segments effectively.

Credicorp focuses on enhancing customer satisfaction, as evidenced by a 5% increase in the average Net Promoter Score (NPS) across its businesses. This is achieved through optimized multichannel value propositions and efficient risk management, leading to improved customer loyalty.

The company is investing heavily in technology and digital transformation to improve operational efficiency and the client experience. Credicorp aims to generate 10% of its risk-adjusted revenues from new business models by 2026, signaling a strategic shift towards digital-first solutions. This transformation drives customer engagement.

Credicorp's approach to customer acquisition and retention involves a combination of digital and traditional methods. The company leverages its digital payment platform and branch network, focusing on personalized experiences and diversified product offerings. For further insights into the company's structure, you can explore Owners & Shareholders of Credicorp.

- Digital Channels: Yape's success in onboarding new customers and promoting financial inclusion.

- Branch Network: BCP and Mibanco's extensive presence for acquiring customers across different segments.

- Customer Satisfaction: Emphasis on personalized experiences and improved customer satisfaction.

- Digital Transformation: Investment in technology to improve operational efficiency and customer experience.

- Loyalty Programs: Provision of diverse financial products and services.

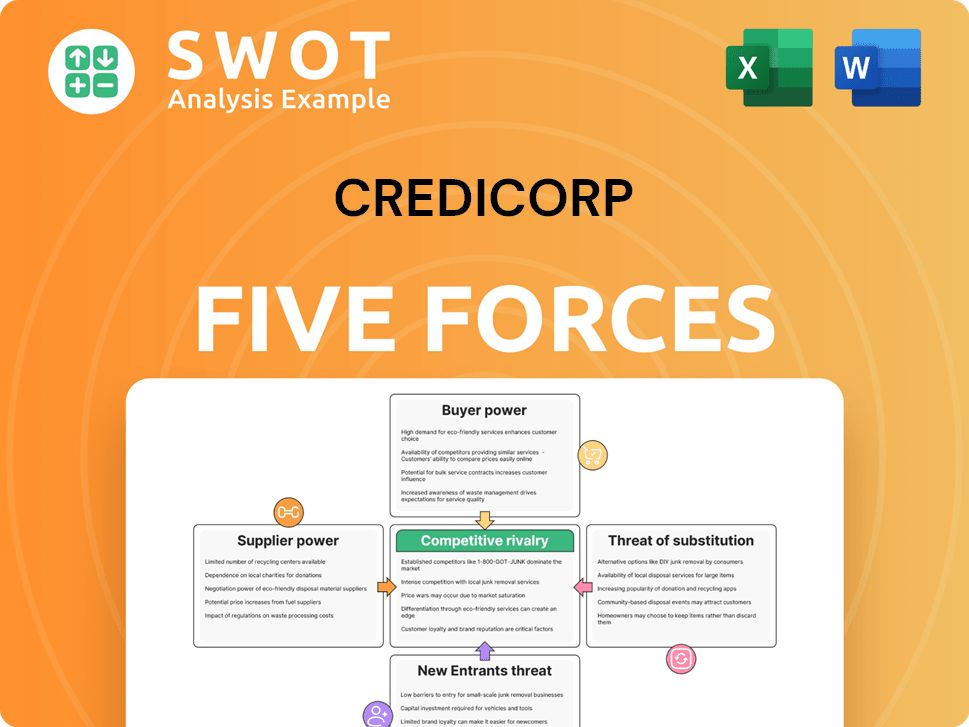

Credicorp Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Credicorp Company?

- What is Competitive Landscape of Credicorp Company?

- What is Growth Strategy and Future Prospects of Credicorp Company?

- How Does Credicorp Company Work?

- What is Sales and Marketing Strategy of Credicorp Company?

- What is Brief History of Credicorp Company?

- Who Owns Credicorp Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.