Guardian Pharmacy Bundle

Who Does Guardian Pharmacy Serve?

Understanding the Guardian Pharmacy SWOT Analysis is crucial for grasping its market position. Guardian Pharmacy's success hinges on a deep understanding of its customer demographics and target market. The company's ability to adapt to the evolving needs of its pharmacy customers is key to its sustained growth.

Guardian Pharmacy's strategic approach to market analysis is vital for its continued success. The company's focus on the 'silver tsunami' and its impact on the long-term care sector highlights the importance of understanding Guardian Pharmacy demographics. This exploration will delve into the specifics of Guardian Pharmacy's customer base, providing insights into their needs, preferences, and geographic locations.

Who Are Guardian Pharmacy’s Main Customers?

The primary customer segments for are centered around a Business-to-Business (B2B) model. Their main focus is on serving long-term care facilities, assisted living communities, and other specialized care settings across the United States. The key demographic isn't individual patients, but rather the administrative and clinical staff within these healthcare institutions.

These customers are typically nursing home administrators, directors of nursing, assisted living managers, and facility owners/operators. They are responsible for resident care and medication management. These professionals' core needs revolve around regulatory compliance, patient safety, operational efficiency, and cost management.

They seek pharmacy partners who can provide reliable medication delivery, comprehensive clinical support, and integrated technology solutions to streamline workflows and improve patient outcomes. Understanding the Brief History of Guardian Pharmacy helps to contextualize its market approach.

The target market primarily includes long-term care facilities and assisted living communities. These facilities are managed by administrators, directors of nursing, and facility owners. Their focus is on regulatory compliance and patient safety.

The primary needs of these customers are reliable medication delivery and comprehensive clinical support. They also seek integrated technology solutions to streamline workflows. Operational efficiency and cost management are critical factors.

The senior population in the U.S. is rapidly growing, particularly those needing assisted living and skilled nursing care. The U.S. Census Bureau projects the 65+ population to reach approximately 73 million by 2030. This demographic shift drives increased demand for services.

The company is adapting to value-based care models and the increasing complexity of medication management. This includes enhancing clinical support and technology offerings. This shift reflects the changing needs of the target market.

The long-term care and assisted living sectors represent the largest share of the market. These segments are experiencing significant expansion due to the aging population. The focus is on providing comprehensive services.

- Long-term care facilities

- Assisted living communities

- Skilled nursing facilities

- Specialty care settings

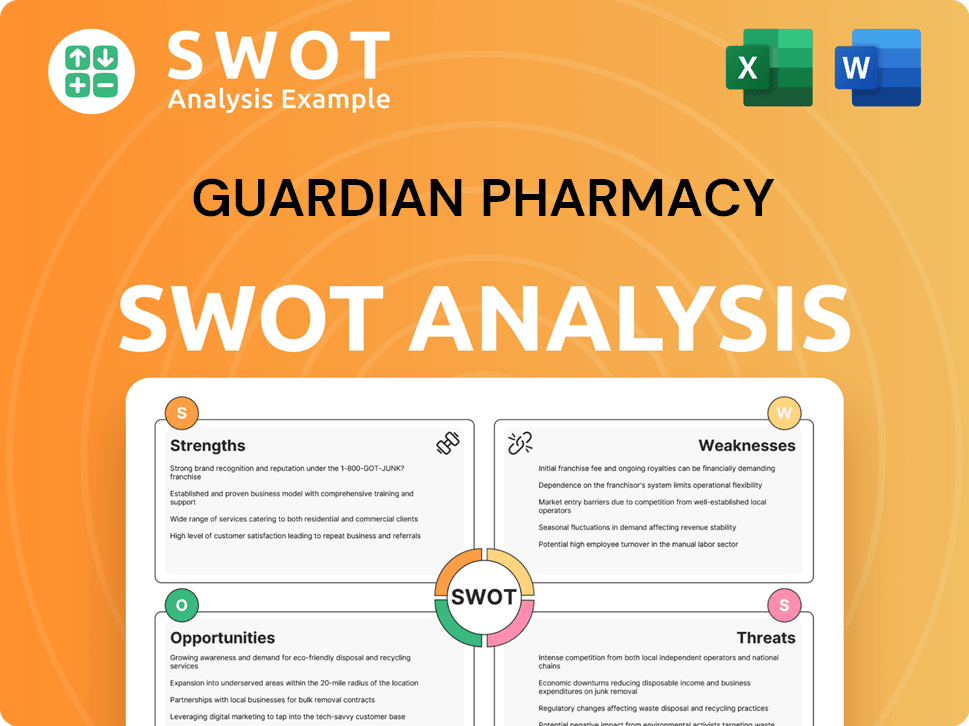

Guardian Pharmacy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Guardian Pharmacy’s Customers Want?

Understanding the needs and preferences of pharmacy customers is crucial for the success of any pharmacy service. For Guardian Pharmacy, this involves a deep dive into the motivations and behaviors of its target market, ensuring that services align with the specific demands of their clientele.

The primary focus for Guardian Pharmacy's customers is efficient and accurate medication management, especially for residents in long-term care facilities. This drives their purchasing behavior, emphasizing reliability, comprehensive support, and cost-effectiveness in their decision-making processes. The need for seamless integration with existing facility systems and clinical expertise is paramount.

The customer base of Guardian Pharmacy, which includes long-term care facilities, assisted living communities, and other healthcare providers, seeks a pharmacy partner that can handle complex medication regimens. They value timely deliveries, access to clinical expertise, and a partner that integrates well with their existing systems. These factors influence their purchasing decisions and loyalty.

Customers prioritize efficient medication management, accuracy, and regulatory compliance. They need reliable service, comprehensive support, and cost-effectiveness. The ability to handle complex medication regimens is also a key requirement.

Purchasing decisions are driven by the need for reliable service, comprehensive support, and cost-effectiveness. Facilities seek pharmacies that can handle complex medication regimens, provide timely deliveries, offer clinical expertise, and integrate seamlessly with their existing systems.

The ability to handle complex medication regimens, timely deliveries, clinical expertise, and seamless integration with facility systems are crucial. Cost-effectiveness and the pharmacy's ability to act as a partner in patient care are also important.

There's consistent demand for daily medication deliveries, emergency medication access, and ongoing clinical consultations. The need for accurate and timely medication management is a constant requirement for residents.

Trust, consistent service quality, and the ability to act as a true partner in patient care build loyalty. The pharmacy's commitment to patient well-being and its ability to meet the specific needs of the facilities are key.

Peace of mind regarding medication safety and regulatory compliance is a significant factor. Streamlined workflows, reduced administrative burdens, and access to specialized pharmaceutical knowledge also play a role.

Practical drivers include streamlined workflows and reduced administrative burdens, while aspirational drivers involve achieving superior resident outcomes and maintaining a high standard of care. Common pain points that Guardian addresses include medication errors and inefficient ordering processes. The company actively seeks feedback from its facility partners, and market trends such as the increasing prevalence of polypharmacy among seniors and the shift towards electronic health records have directly influenced their product development. For more insights on the company's structure, you can explore Owners & Shareholders of Guardian Pharmacy.

Guardian Pharmacy addresses key challenges faced by its customers. These include medication errors, inefficient ordering processes, lack of clinical support for complex cases, and challenges with managing medication waste. By focusing on these areas, Guardian enhances its value proposition.

- Medication Errors: Implementing robust verification processes and technology to minimize errors.

- Inefficient Ordering Processes: Streamlining the ordering process through user-friendly online portals and automated systems.

- Lack of Clinical Support: Providing access to clinical pharmacists who can offer expert advice and support.

- Medication Waste: Implementing medication synchronization programs and return programs to reduce waste.

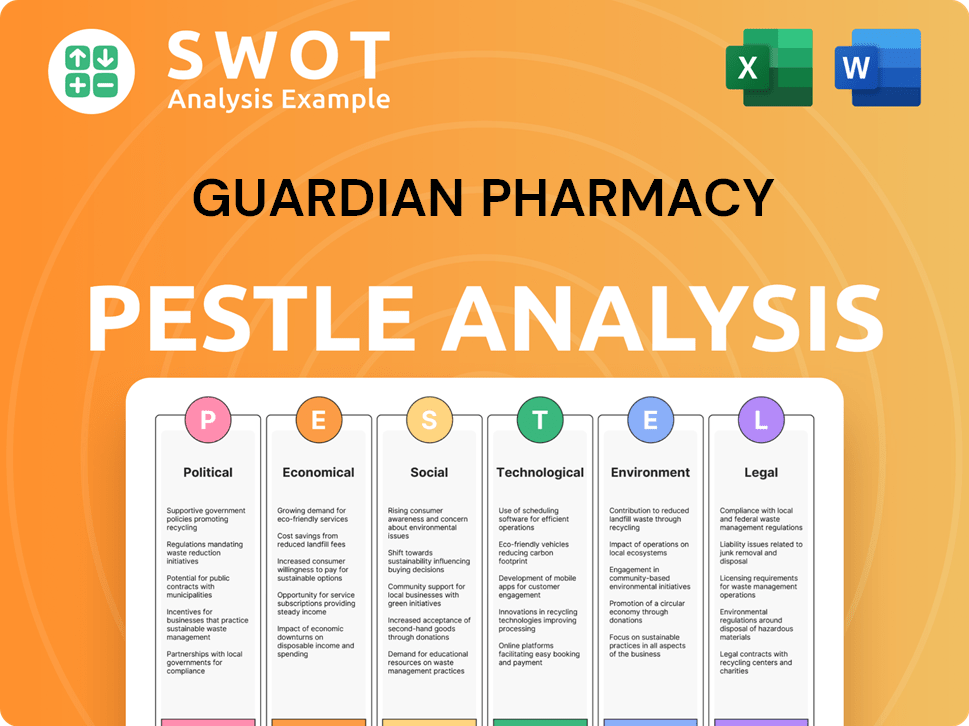

Guardian Pharmacy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Guardian Pharmacy operate?

The geographical market presence of the company reflects a broad national footprint across the United States. This widespread distribution is a key aspect of its operational strategy, enabling it to serve a diverse customer base. The company's approach involves a mix of organic growth and strategic acquisitions, particularly of independent long-term care pharmacies, to strengthen its local presence.

This strategy allows the company to adapt to the varying regulatory environments and healthcare landscapes that exist across different states. The company's market focus is significantly influenced by the concentration of senior living facilities and the overall long-term care infrastructure within specific regions. This targeted approach helps the company to optimize its services and resources effectively.

The company's expansion and market penetration are closely tied to the demographics of the aging population and the density of long-term care facilities in various areas. Recent market data indicates a growing demand for specialized pharmacy services within the long-term care sector, which the company is strategically positioned to meet. The company's ability to understand and respond to local market dynamics is critical to its continued growth and success.

The company operates nationally, with a significant presence across the United States. This extensive reach allows the company to serve a wide range of customers and adapt to regional variations in healthcare needs.

The company's market strategy focuses on areas with a high density of senior living facilities and a robust long-term care infrastructure. This targeted approach allows for efficient resource allocation and specialized service delivery.

The company tailors its offerings to meet local needs, considering state-specific regulations and the competitive landscape of long-term care providers. This localized approach ensures that services are relevant and responsive to regional demands.

The company's growth strategy includes strategic partnerships and acquisitions to broaden its reach and strengthen its presence in key markets. This approach supports ongoing consolidation within the long-term care pharmacy sector.

The company's geographic distribution of sales and growth is directly correlated with the density of long-term care facilities and the aging population trends within those areas. Understanding these dynamics is crucial for strategic planning and resource allocation. The company's market analysis considers factors such as state-specific regulations, reimbursement models, and the competitive landscape to refine its approach. For more insights, consider reading an article about the company's market strategies.

- Customer demographics vary across regions, influenced by state regulations and healthcare infrastructure.

- Target market segmentation is based on the concentration of senior living facilities and the aging population.

- Market research includes analyzing local healthcare needs and competitive dynamics.

- Customer geographic location is a key factor in determining service delivery and resource allocation.

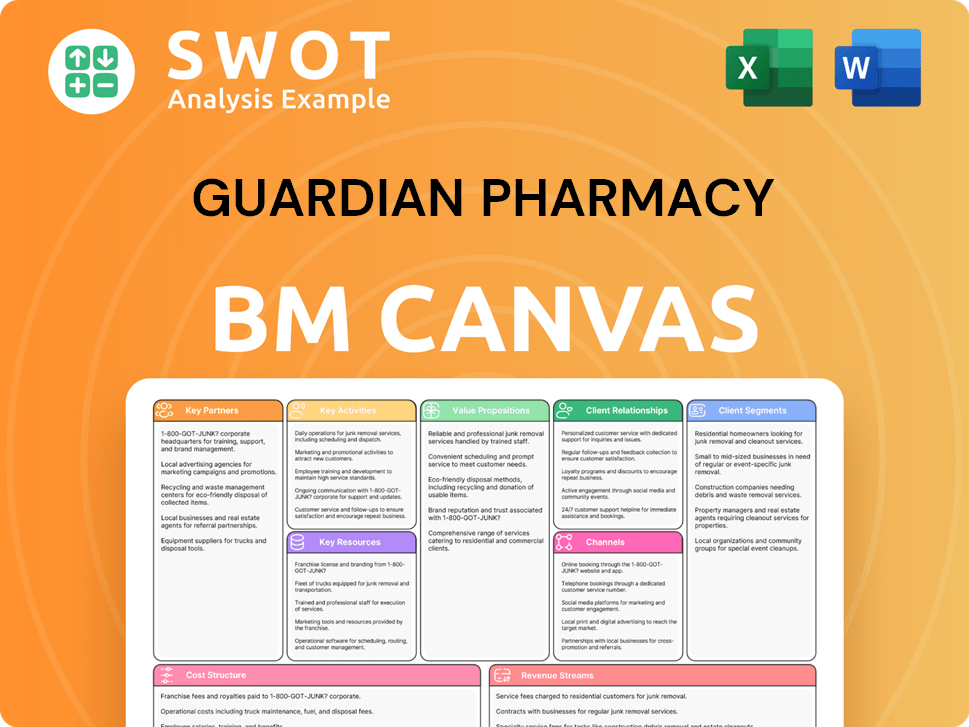

Guardian Pharmacy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Guardian Pharmacy Win & Keep Customers?

Customer acquisition and retention are vital for the success of any pharmacy, and for a specialized provider like [Company Name], these strategies are particularly crucial. Their approach is tailored to the unique needs of long-term care facilities, focusing on building strong, lasting relationships. This involves a multi-faceted strategy to attract and keep customers, emphasizing their expertise in long-term care pharmacy services.

The primary focus for customer acquisition is on direct engagement with facility administrators and decision-makers. Direct sales teams play a key role in this process, highlighting the specialized services offered. Marketing efforts also include participation in industry conferences and trade shows, which serve as valuable platforms to showcase their integrated medication management solutions and clinical support. Referrals from satisfied facility partners are another significant source of new customers.

Retention strategies are centered on providing personalized experiences. This is achieved through dedicated account managers and clinical pharmacists who work closely with facilities to address their specific needs. Proactive communication, regular service reviews, and ongoing training for facility staff on medication management best practices are also key components of their retention efforts. The use of customer data and CRM systems is critical for segmenting facility partners, tracking their needs, and personalizing service delivery.

The company employs direct sales teams to engage with facility administrators and decision-makers. This approach allows for direct communication of their specialized services and building initial relationships. These interactions are crucial for understanding the needs of potential customers and offering tailored solutions. Data from 2024 shows that direct sales efforts can account for up to 40% of new customer acquisitions in the healthcare sector.

Attending industry conferences and trade shows is a strategic marketing channel. This provides opportunities to showcase integrated medication management solutions and clinical support services. These events are important for networking and demonstrating expertise. Industry reports in 2024 indicate that participation in these events can increase brand visibility by 30%.

Referrals from existing satisfied facility partners are a valuable source of new customers. Building strong relationships with existing clients encourages positive word-of-mouth. This strategy is cost-effective and builds trust. Data from 2024 shows that referral programs can lead to a customer acquisition cost that is 60% lower than other methods.

Dedicated account managers and clinical pharmacists are assigned to work closely with facilities. This personalized approach ensures that each facility's specific needs are met. Regular communication and service reviews are integral to maintaining strong relationships. In 2024, companies that provide personalized services reported a customer retention rate increase of 25%.

Regular communication and ongoing training for facility staff on medication management best practices are essential. This ensures that facilities are up-to-date with the latest standards and best practices. Training programs can reduce medication errors by up to 15%, as reported in 2024.

The company is increasingly focused on integrating technology to streamline communication and medication ordering processes. This includes the use of CRM systems to segment facility partners and track their needs. The integration of new technologies can improve operational efficiency by 20%, according to 2024 data.

Customer Relationship Management (CRM) systems play a critical role in segmenting facility partners, tracking their needs, and personalizing service delivery. CRM systems help in anticipating needs and offering tailored solutions. Companies using CRM systems have seen a 15% increase in customer satisfaction, as of 2024.

The company has expanded its clinical support services to address the increasing complexity of patient care in long-term care settings. This includes providing specialized clinical expertise and support. The expansion of clinical services can lead to a 10% improvement in patient outcomes, based on 2024 studies.

The ultimate goal is to enhance customer lifetime value by reinforcing the company's position as an indispensable partner to long-term care providers. This involves continuous improvement in service quality and reliability. Focusing on customer lifetime value can increase profitability by up to 25%, according to 2024 financial reports.

Maintaining regulatory compliance is a critical aspect of customer retention, especially in healthcare. This involves ensuring that all services and practices adhere to the latest healthcare regulations. Compliance efforts can reduce the risk of penalties by 90%, as of 2024.

The company's strategies have evolved over time, with a greater emphasis on technology integration and expanded clinical support. These shifts are designed to meet the changing needs of long-term care facilities. These changes allow to enhance customer lifetime value by reinforcing their position as an indispensable partner to long-term care providers. For more insights, consider reading about the Growth Strategy of Guardian Pharmacy.

- Technology Integration: Streamlining communication and medication ordering.

- Clinical Support: Addressing complex patient care needs.

- Customer Lifetime Value: Reinforcing their role as a key partner.

- Regulatory Compliance: Ensuring adherence to healthcare standards.

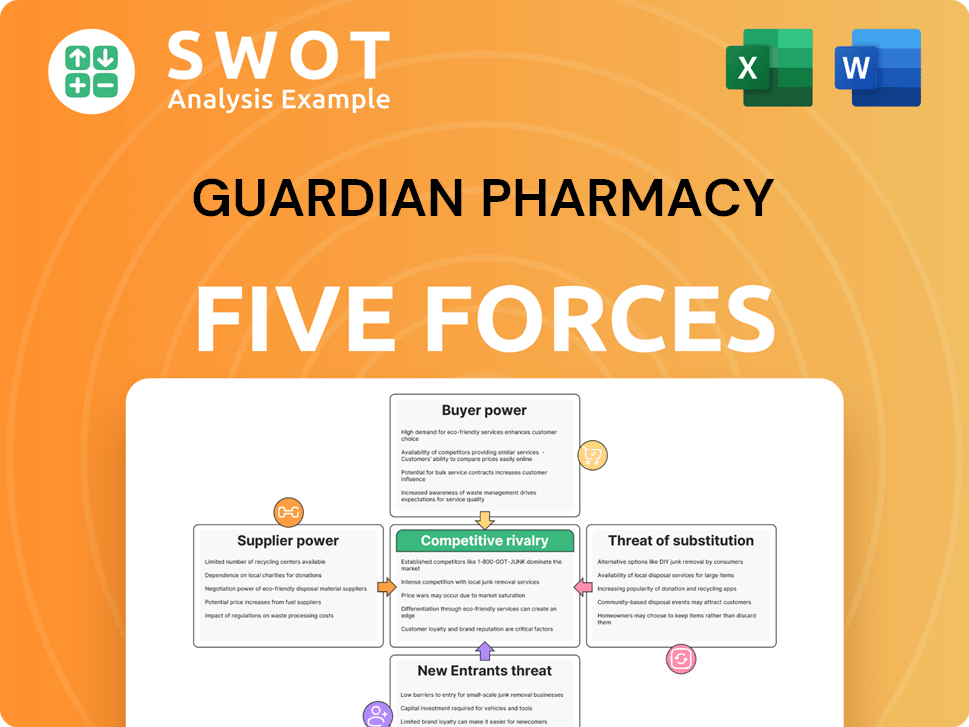

Guardian Pharmacy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Guardian Pharmacy Company?

- What is Competitive Landscape of Guardian Pharmacy Company?

- What is Growth Strategy and Future Prospects of Guardian Pharmacy Company?

- How Does Guardian Pharmacy Company Work?

- What is Sales and Marketing Strategy of Guardian Pharmacy Company?

- What is Brief History of Guardian Pharmacy Company?

- Who Owns Guardian Pharmacy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.