Halliburton Bundle

Who are Halliburton's Key Customers?

Navigating the complexities of the energy sector requires a deep understanding of its players. For Halliburton, a leading provider of oilfield services, identifying and understanding its customer base is critical. This analysis dives into Halliburton's customer demographics and target market, exploring how they've evolved since the company's inception in 1919. The Halliburton SWOT Analysis provides further insights into their strategic positioning.

Halliburton's success hinges on its ability to understand and adapt to the ever-changing needs of its clients within the energy industry. This includes a detailed look at Halliburton's customer geographic distribution and how it aligns with the company's strategic objectives. Moreover, we will explore Halliburton's market analysis, including its customer segmentation strategies and the impact of the oilfield services market on its business. Understanding Halliburton's target market for drilling services and other offerings is essential for investors and industry watchers alike.

Who Are Halliburton’s Main Customers?

The primary customer segments for Halliburton are within the Business-to-Business (B2B) sector. This means their focus is on providing services to other companies rather than individual consumers. The Growth Strategy of Halliburton involves understanding and catering to the specific needs of these business clients in the oil and gas industry.

Halliburton's target market includes a diverse range of upstream oil and gas customers globally. These customers are primarily integrated oil companies, national oil companies, independent oil and gas operators, and drilling contractors. These entities are key players in the energy industry, driving demand for Halliburton's services.

The company's operations are divided into two main segments: Completion and Production, and Drilling and Evaluation. These segments serve different phases of the reservoir lifecycle. This allows Halliburton to provide specialized services tailored to the needs of its diverse customer base.

Halliburton's customer base is primarily composed of large companies in the oil and gas industry. These include major integrated oil companies, national oil companies, and independent operators. These clients have significant operational scale and strategic priorities.

Halliburton's customer base is spread globally, with a strategic shift towards international markets. The company is focusing on regions with high growth potential, such as the Middle East and Asia. This shift is driven by global energy demand and regional activity levels.

Halliburton's market segmentation is based on the two main operating segments: Completion and Production, and Drilling and Evaluation. These segments cater to different phases of the reservoir lifecycle. This allows Halliburton to provide specialized services tailored to the needs of its diverse customer base.

Halliburton's customer needs and preferences vary based on their operational scale, geographical focus, and strategic priorities. The company focuses on providing services that meet these diverse needs. This includes advanced technologies and efficient solutions for exploration, drilling, and production.

Halliburton's strategic focus is evolving, with an emphasis on international markets. In Q4 2024, international markets accounted for 60% of total revenue, surpassing North America. The Middle East/Asia region experienced a 7% revenue increase in Q4 2024 and a +7.5% revenue growth compared to 2023, demonstrating the company's shift towards regions with strong growth prospects. This strategic shift is driven by anticipated market dynamics and the company's focus on profitable international expansion. In fiscal year 2024, North America constituted 41.95% of total revenue.

Halliburton's key customer characteristics include their operational scale, geographical focus, and strategic priorities. The company's customer base is diverse, including major integrated oil companies, national oil companies, independent oil and gas operators, and drilling contractors. These customers operate globally, with a significant presence in North America and a growing focus on international markets.

- Operational Scale: Halliburton's clients are large companies with significant operations in the oil and gas industry.

- Geographical Focus: Customers have diverse geographical footprints, with a strategic shift towards international markets.

- Strategic Priorities: Customers' priorities include maximizing production efficiency and reducing operational costs.

- Market Share Analysis: Halliburton's market share varies by customer type and region, reflecting its diverse customer base.

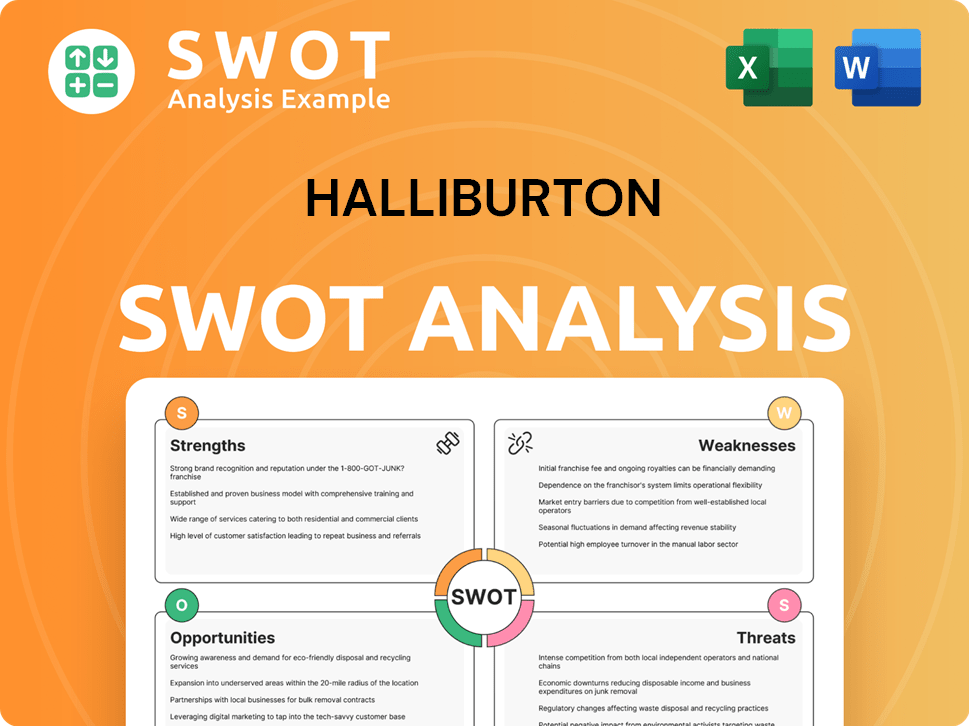

Halliburton SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Halliburton’s Customers Want?

Understanding the needs and preferences of its customers is crucial for the success of any oilfield services company. For Halliburton, this involves a deep dive into the Halliburton customer demographics and the dynamics of its Halliburton target market. This approach allows the company to tailor its services and technologies to meet the specific challenges and opportunities within the energy industry.

The Halliburton market analysis reveals that customers are primarily focused on maximizing the value of their oil and gas reservoirs. This includes optimizing production, reducing operational costs, and improving efficiency and safety. The company's ability to address these needs directly influences customer purchasing behavior and decision-making processes.

Customers in the energy industry are increasingly focused on technologies that can help them reduce drilling time. This is driven by rising rig rates and the need for greater operational efficiency. Halliburton responds by offering solutions like the Zeus™ e-frac solution, which helps reduce carbon footprints and provides operational control. These solutions are vital for the company's Halliburton client profile.

Customers prioritize services and products that enhance production, reduce costs, and ensure operational safety. Technological innovation and the ability to overcome complex drilling and production challenges are also highly valued.

There's a growing emphasis on technologies that reduce drilling time and improve efficiency. This is particularly important given the rising costs associated with drilling operations.

Halliburton is developing AI tools to help operators model operations, optimize exploration, and improve drilling results. These tools aim to increase profitability and streamline processes.

Product development is heavily influenced by feedback and market trends, leading to tailored solutions. New drilling tools are being developed to meet specific needs, especially in deep-water environments.

Halliburton customizes its marketing and product features to specific segments, emphasizing technology, collaboration, and service quality. This approach creates value for its customers.

Halliburton's customer base is spread across various regions, with significant presence in North America and the Middle East. The company adapts its offerings to meet regional demands.

Halliburton's customer acquisition and retention strategies are centered on providing value through technological innovation and reliable service. The company's focus on Halliburton's customer relationship management helps maintain strong relationships with its clients. The Oilfield services market is competitive, and understanding the specific needs of each customer segment is key to maintaining and growing market share. For insights into how Halliburton strategizes for growth, explore the Growth Strategy of Halliburton.

Halliburton's customers, which include major oil and gas companies, independent operators, and national oil companies, are driven by the need to maximize the value of their oil and gas assets. This involves efficient production, cost reduction, and enhanced safety and environmental performance.

- Efficiency and Cost Reduction: Customers prioritize technologies and services that reduce drilling time, optimize production, and lower operational costs.

- Technological Innovation: There's a strong demand for advanced technologies, including AI-driven solutions and digital tools, to improve drilling results and increase profitability.

- Reliability and Performance: Customers value the reliability and performance of services and products, which directly impacts their operational success.

- Environmental Sustainability: Growing focus on reducing carbon footprint and adopting sustainable practices, driving demand for eco-friendly solutions like the Zeus™ e-frac solution.

- Geographic Specificity: Tailored solutions are provided to meet the unique challenges and opportunities in regions like North America and the Middle East.

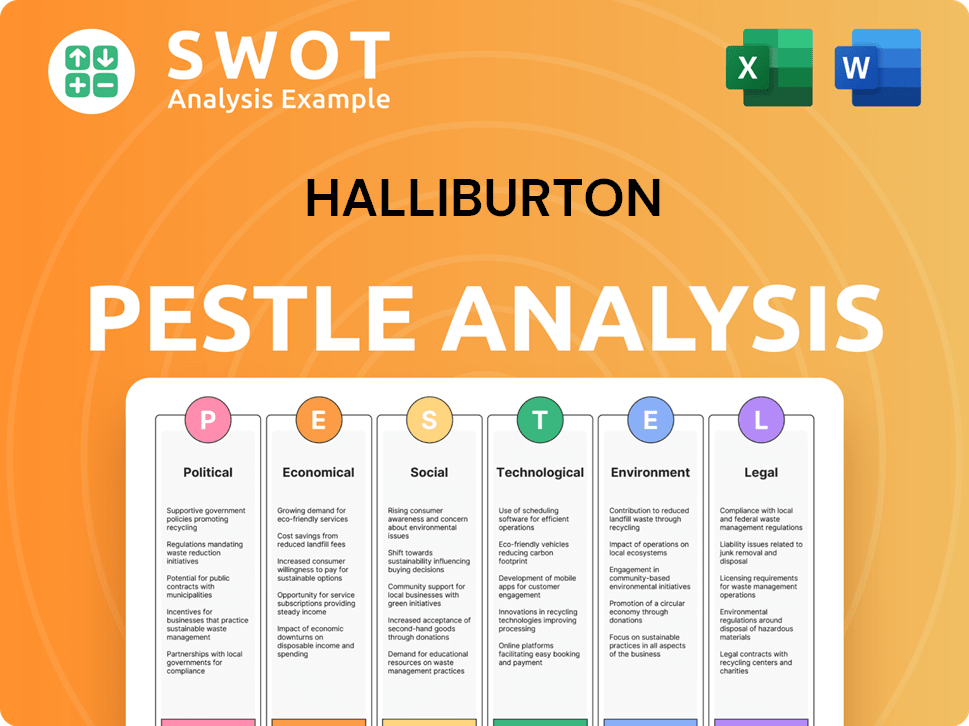

Halliburton PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Halliburton operate?

The geographical market presence of the company is extensive, with operations spanning over 70 countries. This global footprint is supported by a workforce exceeding 48,000 employees, representing 145 nationalities. This extensive reach allows the company to serve a diverse range of clients in the oilfield services market.

In fiscal year 2024, the company's revenue distribution showed a significant presence in North America, which contributed $9.63 billion, accounting for 41.95% of the total revenue. However, a strategic shift is evident, as international markets now constitute a larger portion of revenue. The company's customer geographic distribution highlights its adaptability and focus on global energy demands.

The company's strategic focus is evident in its diverse geographical presence. In Q4 2024, international markets generated 60% of total revenue, while North America contributed 40%. This shift highlights the company's adaptability and strategic focus on global energy demands. For more insights, consider exploring Owners & Shareholders of Halliburton.

The Middle East/Asia, Latin America, and Europe/Africa are key international markets. In fiscal year 2024, the Middle East/Asia generated $6.10 billion (26.6% of total revenue). Latin America contributed $4.21 billion (18.35%), and Europe/Africa/CIS generated $3.00 billion (13.09%).

The Middle East/Asia was the highest growth region in 2024, with a revenue growth of +7.5% compared to 2023. This growth underscores the company's strong presence and strategic focus in this key market. Halliburton's customer demographics by region are crucial for understanding its market dynamics.

In Q1 2025, international revenue was $3.2 billion, a 2% decrease compared to Q1 2024. Latin America saw a 19% year-over-year decrease, primarily due to lower activity in Mexico. Europe/Africa revenue increased by 6% year-over-year in Q1 2025.

The company anticipates stable international revenue throughout 2025, with a strategic emphasis on Europe, Africa, and the Middle East. This focus aligns with the company's long-term growth strategy and market analysis. Halliburton's target market for drilling services is also a key consideration.

The company has secured significant contracts and completed key projects in early 2025. These include a multi-year contract with Petrobras in Brazil for integrated well interventions and plug and abandonment for offshore wells, set to begin in Q2 2025. Additionally, a five-year contract was awarded by Repsol Resources UK in June 2025 to support well lifecycle on their platform assets in the UK North Sea. The company also delivered the first two exploration wells on Block 2914 in Namibia in May 2025. These activities are crucial for the company's customer acquisition strategies.

- Multi-year contract with Petrobras in Brazil for integrated well interventions and plug and abandonment for offshore wells, starting Q2 2025.

- Five-year contract with Repsol Resources UK in June 2025 to support well lifecycle on their platform assets in the UK North Sea.

- Delivery of the first two exploration wells on Block 2914 in Namibia in May 2025.

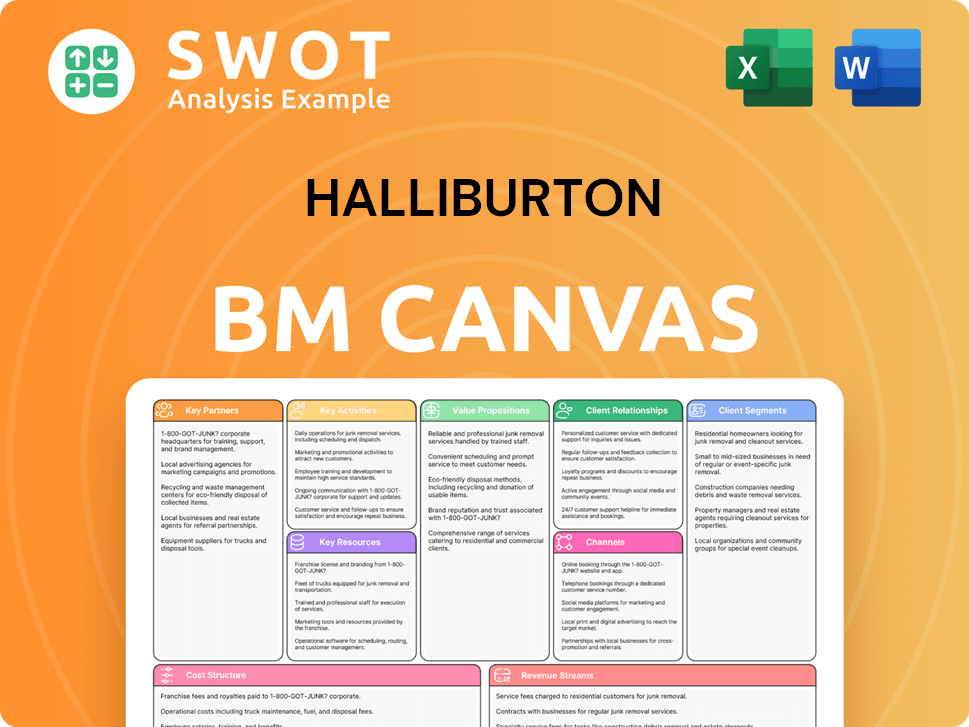

Halliburton Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Halliburton Win & Keep Customers?

Halliburton's customer acquisition and retention strategies are central to its success in the oilfield services market. The company employs a multi-faceted approach, utilizing direct sales, distributors, and its online platform to reach its target market. This strategy focuses on building long-term relationships and providing exceptional service, which is critical in the competitive energy industry.

A key aspect of Halliburton's strategy is its commitment to technological innovation and service quality. This is evidenced by the development and deployment of advanced technologies and digital solutions, such as AI tools for optimizing exploration and drilling. The company's customer relationship management (CRM) systems and customer data are vital for tailoring offerings and targeting campaigns effectively. Halliburton's dedication to customer satisfaction and loyalty is further enhanced by its digital and automation technologies, like the autonomous hydraulic fracturing technology Octiv® Auto Frac.

Halliburton's approach to customer acquisition and retention is designed to foster lasting relationships and drive sustained growth. In Q1 2025, Halliburton secured significant integrated offshore work extending through 2026 and beyond, demonstrating the value of its services and its ability to retain key clients. This success highlights the effectiveness of its customer-focused strategy, which is informed by detailed market analysis and a deep understanding of its client profile.

Halliburton uses sophisticated CRM systems to manage customer interactions and data effectively. This allows for targeted marketing campaigns and personalized service offerings. By understanding customer needs and preferences, Halliburton can tailor its services to enhance customer satisfaction and loyalty.

Halliburton focuses on long-term relationships by offering dedicated account managers, on-site assistance, and technical support. Service agreements are a cornerstone of its retention strategy, ensuring ongoing support and fostering customer loyalty. These agreements move beyond transactional interactions to build lasting partnerships.

Innovation is a key differentiator for Halliburton. The company invests heavily in cutting-edge technologies like AI for oilfield applications. This commitment helps optimize exploration and improve drilling results, providing value to its customers and enhancing its competitive edge. For more insights, see the Marketing Strategy of Halliburton.

Halliburton consistently returns capital to shareholders through share repurchases and dividends. In 2024, over $1.6 billion was returned, which can indirectly signal financial health and stability to its customers. This financial strength supports customer confidence and long-term partnerships.

Halliburton's customer base includes major players in the energy industry, such as national and international oil companies. Its geographic distribution is global, with significant operations in North America and the Middle East. Understanding the specific needs of these customers in different regions is crucial for effective customer acquisition and retention.

- North America: A significant market for fracking and drilling services.

- Middle East: A key region with substantial oil and gas reserves.

- International Oil Companies (IOCs): Major clients driving demand for advanced oilfield technologies.

- National Oil Companies (NOCs): Important partners in various global markets.

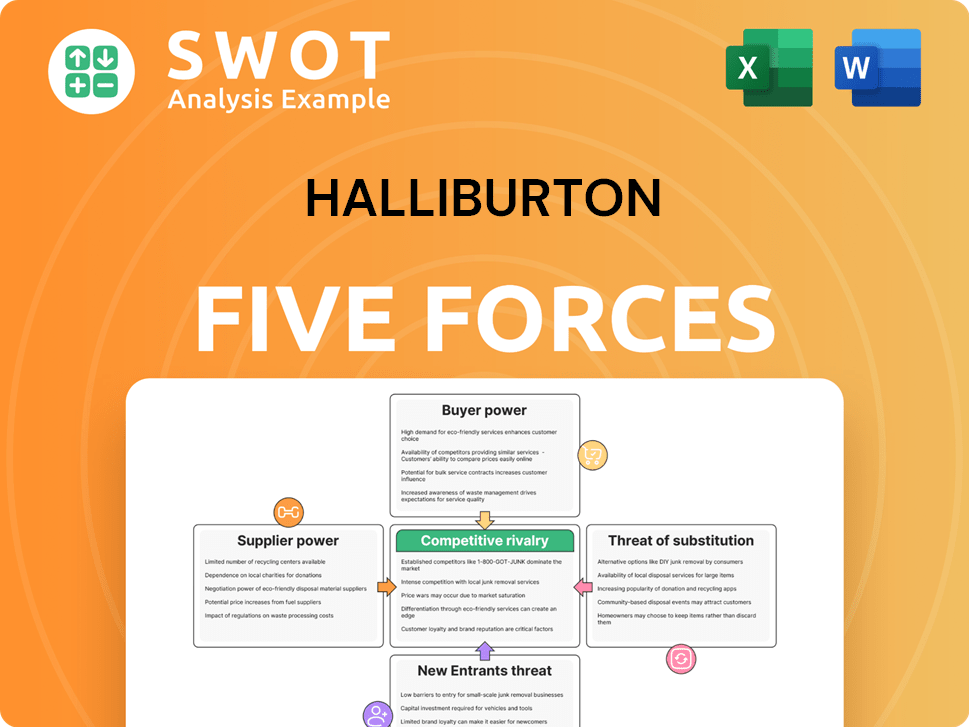

Halliburton Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Halliburton Company?

- What is Competitive Landscape of Halliburton Company?

- What is Growth Strategy and Future Prospects of Halliburton Company?

- How Does Halliburton Company Work?

- What is Sales and Marketing Strategy of Halliburton Company?

- What is Brief History of Halliburton Company?

- Who Owns Halliburton Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.