La Vie Claire, SA Bundle

Who Buys Organic at La Vie Claire, SA?

In the ever-evolving world of organic food retail, understanding the La Vie Claire, SA SWOT Analysis is crucial for sustained success. For over 70 years, La Vie Claire has been a French leader, adapting to market shifts and consumer preferences. This exploration dives deep into the customer demographics and target market of La Vie Claire, uncovering the secrets behind its enduring appeal in a competitive landscape.

This analysis will provide insights into the La Vie Claire SA customer base, examining their consumer profile, market segmentation, and purchasing behaviors. We'll explore the demographic analysis to understand the customer age range, geographic location, and income levels that define La Vie Claire's core consumers. Understanding the target market size and potential will also be a focal point, helping to define the characteristics of La Vie Claire SA's ideal customer and their lifestyle preferences.

Who Are La Vie Claire, SA’s Main Customers?

Understanding the primary customer segments for La Vie Claire, SA involves analyzing the company's focus on health-conscious consumers and sustainable living. While specific demographic data is not always publicly available, market trends offer valuable insights into their target market. This analysis helps to define the characteristics of the ideal customer and informs strategic decisions.

The company primarily serves a business-to-consumer (B2C) market. The core customer profile likely includes educated individuals who are actively seeking natural and organic products. This customer base is driven by health and environmental concerns, as indicated by the growth in specialized organic food stores, even as the broader organic market faces challenges.

La Vie Claire's commitment to quality and ethical practices further defines its target market. The emphasis on 'made in France' products and local sourcing appeals to consumers who value transparency and short supply chains. This focus, combined with the introduction of affordable organic options, suggests a strategy to broaden its customer base and address price sensitivity.

The target market for La Vie Claire, SA, includes health-conscious consumers who prioritize sustainable living. A 2024 study suggests a correlation between higher education levels and satisfaction with organic food consumption. This indicates that the customer base likely includes educated individuals.

The company's target market is also influenced by its commitment to ethical practices. With 75% of branded products made in France in 2024, La Vie Claire appeals to consumers who value transparency and 'made in France' products. This focus helps define the customer profile.

La Vie Claire's market segmentation includes consumers seeking both quality and value. The 'Petits Prix Bio' program aims to attract a wider customer base by addressing price sensitivity. Private label sales, which represented approximately 60% of total sales in 2024, cater to this segment.

The consumer profile of La Vie Claire, SA, is characterized by a preference for organic and natural products. Continued growth in specialized stores, despite market declines, suggests a shift towards alternative retail formats. The company's strategies aim to broaden its appeal and address customer needs.

Analyzing the customer demographics and target market of La Vie Claire, SA, reveals a focus on health-conscious, educated consumers who value sustainability and ethical sourcing. The company's strategies, including the expansion of affordable organic options, are designed to broaden its customer base and address price sensitivity. For a broader understanding of the competitive landscape, consider exploring the Competitors Landscape of La Vie Claire, SA.

The ideal customer for La Vie Claire, SA, is health-conscious, values sustainability, and appreciates ethical practices. The company's strategies are tailored to meet the needs and preferences of this demographic. The customer profile is defined by a desire for quality, value, and transparency.

- Health-conscious consumers seeking organic products.

- Consumers who value transparency and ethical sourcing.

- Customers who appreciate 'made in France' products.

- Price-sensitive consumers looking for affordable options.

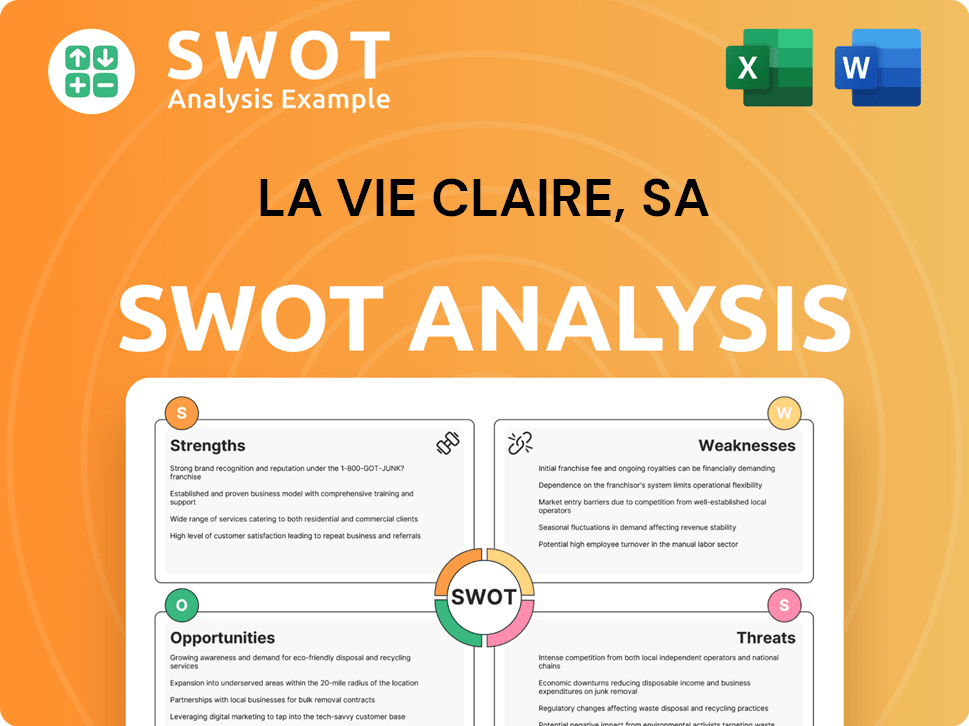

La Vie Claire, SA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do La Vie Claire, SA’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business. For La Vie Claire, SA, this involves a deep dive into the motivations and behaviors of its clientele, who are primarily driven by a desire for healthy, natural, and ethically sourced products.

The company's customer base reflects a broader consumer shift towards health consciousness and environmental awareness. These customers seek products free from synthetic additives and pesticides, aligning with the perceived benefits of organic farming for personal health and sustainability. This focus shapes the company's product development, marketing strategies, and overall business model.

La Vie Claire's commitment to exceeding basic organic regulations and stringent testing for GMOs and pesticides fosters consumer trust. This dedication contributed to a 7% sales increase in 2024, demonstrating the value customers place on product integrity and transparency. This customer-centric approach is essential for defining the company's target market and ensuring its continued growth.

While marginal reductions in organic prices may not significantly impact the decision to buy organic versus conventional products, price elasticities are rather high once consumers already purchase organic products. This suggests that competitive pricing within the organic segment is important.

La Vie Claire addresses price sensitivity by expanding its private label 'Petits Prix Bio' offerings. The plan includes extending this to nearly 200 references in 2025, featuring 100 products under 3 euros with blocked prices for a year.

Customers prioritize transparency regarding product origin and composition. La Vie Claire responds by enriching its offer with over 350 innovations in two years, including a selection of 2,000 references that emphasize taste, organoleptic qualities, and increased transparency on origin and composition.

The strong growth in fresh produce sales, up 4.8% in 2024, and the success of the Vita Claire supplement range, which saw a 15% sales increase in the first half of 2024, illustrate customer demand for fresh, innovative, and health-oriented products.

Grocery sales, accounting for 60% of La Vie Claire's total revenue as of Q1 2025, highlight the importance of staple organic food items in meeting customer needs.

Customer feedback and market trends directly influence product development, as seen with the launch of the Vita Claire food supplement range in late 2024, which caters to evolving consumer needs for health and convenience.

La Vie Claire tailors its marketing by emphasizing the benefits of organic and healthy living, quality, origin, and health/environmental advantages. This approach aims to educate consumers and boost brand trust, reinforcing the company's customer value proposition.

- La Vie Claire SA's customer demographics are characterized by a strong interest in health, sustainability, and ethical sourcing.

- The target market is defined by consumers willing to pay a premium for organic and transparent products.

- Market segmentation strategies focus on price sensitivity, product innovation, and clear communication of product origin and composition.

- Consumer profile includes health-conscious individuals and those concerned about environmental impact.

- Demographic analysis reveals a customer base that values quality, transparency, and access to a wide range of organic products.

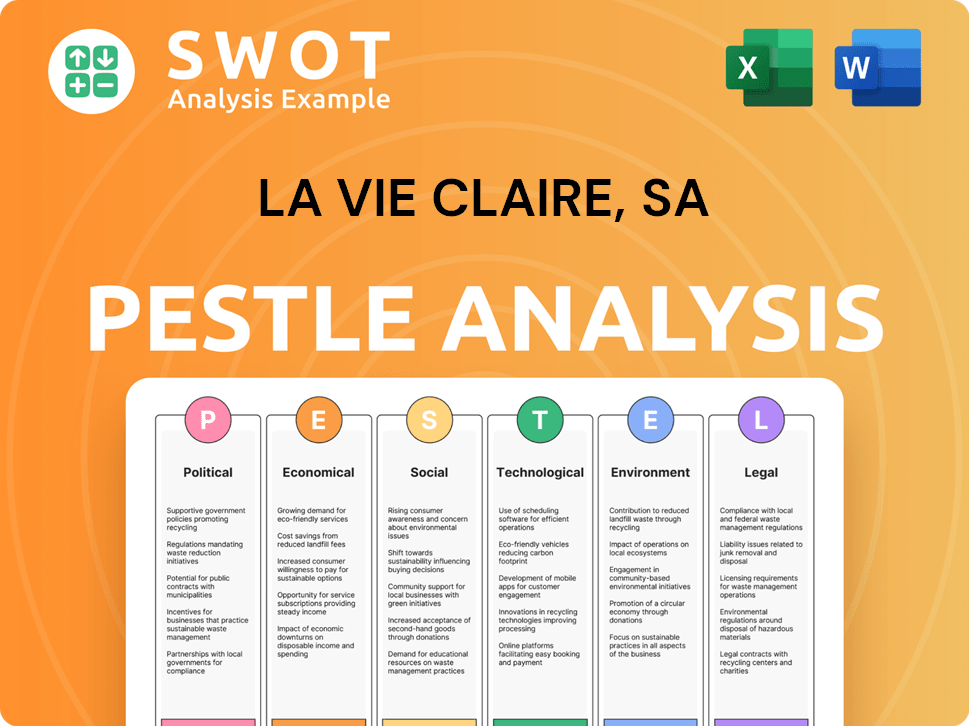

La Vie Claire, SA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does La Vie Claire, SA operate?

The primary geographical market for La Vie Claire is France. The company has established a strong presence with an extensive network of stores across the country. This strategic focus allows for greater accessibility to its products for a broad customer base, which is central to its success.

As of 2025, La Vie Claire operates a total of 327 stores in metropolitan France. This includes 131 owned stores and 196 franchised locations. This widespread presence highlights the company's commitment to serving the French market and providing convenient access to organic products.

La Vie Claire also extends its reach to French overseas departments and territories (DROM-COM) and has a limited international presence. This expansion strategy aims to broaden its physical footprint and customer reach, which could further boost market share and brand recognition. The company's expansion plans include opening new stores, particularly in medium-sized towns.

La Vie Claire's main market is France, with a significant number of stores across the country. This concentration allows the company to effectively target the French consumer market.

The company is actively pursuing expansion, with new store openings planned for 2025. This expansion is focused on medium-sized towns to broaden its customer base.

La Vie Claire prioritizes local sourcing, with over 70% of its products originating from France in 2024. This emphasis on local suppliers resonates with consumers.

The company's commitment to ethical and sustainable practices, including local sourcing, enhances customer loyalty. This focus on quality and freshness is key.

The company addresses differences in customer demographics and preferences through a localized approach to sourcing. La Vie Claire prioritizes French and local suppliers. Over 70% of its products originated from France in 2024. For fresh produce, 85% of fruits and vegetables are of French origin. This strategy supports domestic agriculture and ensures quality and freshness. This approach is further detailed in Marketing Strategy of La Vie Claire, SA.

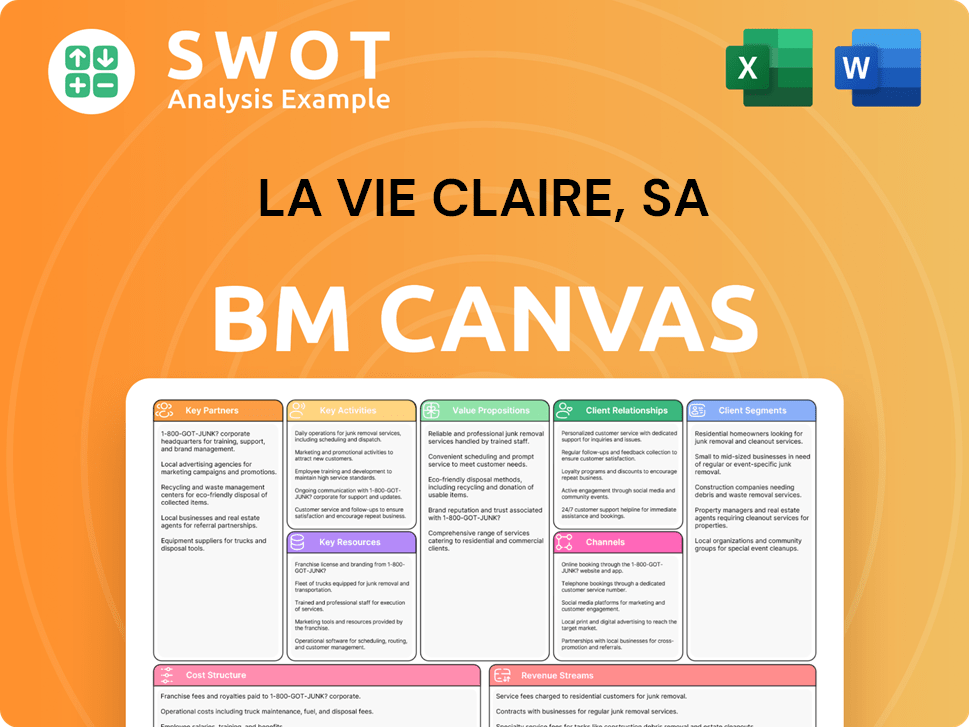

La Vie Claire, SA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does La Vie Claire, SA Win & Keep Customers?

The [Company Name] employs a comprehensive strategy for acquiring and retaining customers, blending traditional retail methods with digital engagement and value-driven initiatives. This approach is designed to attract new customers while fostering loyalty among existing ones. Understanding the customer demographics and tailoring strategies to meet their needs is crucial for sustained growth.

To attract new customers, the company leverages its established brand identity and history in the organic market. This resonates with consumers who prioritize organic and natural products. Expansion through new store openings is a key acquisition strategy, with plans for 10-15 new stores in 2025. These new locations will extend the company's physical presence, particularly in medium-sized towns, to reach a broader target market.

Loyalty programs are a central focus for customer retention. These programs reward customers with points for purchases, offer double points on Tuesdays for the company-branded products, and provide bonus points for birthdays and first-time connections. In 2024, these programs led to a 15% increase in repeat purchases and enhanced customer engagement. The 'Petits Prix Bio' program, offering affordable organic goods, is another important tool for retention, addressing price sensitivity and encouraging repeat visits. This initiative is being expanded in 2025 to include nearly 200 references, with 100 products priced under 3 euros, making organic food more accessible.

Expansion through new store openings is a key acquisition strategy, with plans for 10-15 new stores in 2025. These new locations will extend the company's physical presence, particularly in medium-sized towns, to reach a broader target market.

Loyalty programs are a central focus for customer retention, rewarding customers with points for purchases. In 2024, these programs led to a 15% increase in repeat purchases.

The 'Petits Prix Bio' program, offering affordable organic goods, is another important tool for retention, addressing price sensitivity and encouraging repeat visits. This initiative is being expanded in 2025 to include nearly 200 references.

The implementation of click & collect services, which grew by 20% in Q1 2024, further integrates online and offline shopping experiences, catering to evolving consumer behaviors and boosting sales.

The company also focuses on enhancing its digital presence. Despite a 15% decrease in foot traffic in physical stores across Europe in late 2024 compared to pre-pandemic levels, the company's 2024 sales growth of approximately 8% indicates the effectiveness of its overall strategy. The implementation of click & collect services, which grew by 20% in Q1 2024, further integrates online and offline shopping experiences, catering to evolving consumer behaviors and boosting sales. The company's marketing emphasizes the benefits of organic and healthy living, communicating quality, origin, and health/environmental advantages to educate consumers and build trust. They also highlight their private label, which accounts for approximately 60% of total sales, ensuring quality and transparency with Nutri-Score and Planet-Score ratings. The company plans to apply Nutri-score and Planet-score to all its own-brand products by 2026.

Customer data and CRM systems play a role in personalizing offers and improving engagement, although specific details of their CRM systems are not publicly available. Analyzing customer demographics helps tailor marketing efforts.

Continuous innovation and product development, with over 350 innovations in two years, contribute to customer engagement and retention. The successful launch of the Vita Claire supplement range in late 2024 demonstrates this commitment.

Marketing efforts focus on the benefits of organic and healthy living. This includes communicating quality, origin, and health/environmental advantages. Building trust is key to attracting and retaining customers.

The private label accounts for approximately 60% of total sales. This ensures quality and transparency, with plans to apply Nutri-score and Planet-score ratings to all own-brand products by 2026. This strategy helps define the consumer profile.

Click & collect services, which grew by 20% in Q1 2024, integrate online and offline shopping, catering to evolving consumer behaviors. This helps in market segmentation.

The combination of retail strategies, digital engagement, and value-driven initiatives forms a strong base for customer acquisition and retention. For additional insights, explore the Revenue Streams & Business Model of La Vie Claire, SA.

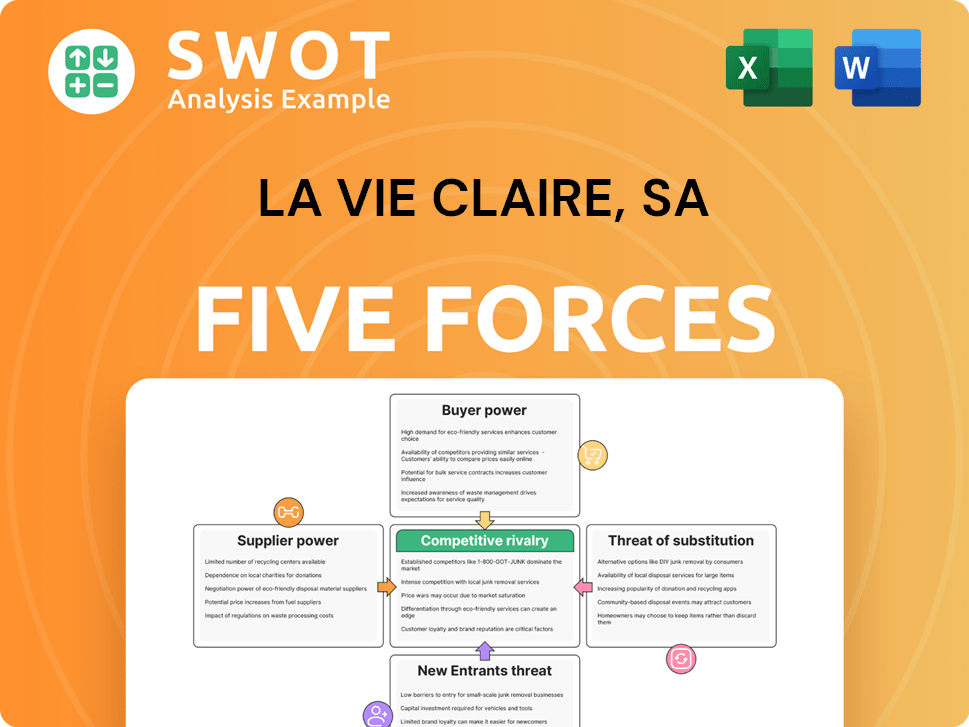

La Vie Claire, SA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of La Vie Claire, SA Company?

- What is Competitive Landscape of La Vie Claire, SA Company?

- What is Growth Strategy and Future Prospects of La Vie Claire, SA Company?

- How Does La Vie Claire, SA Company Work?

- What is Sales and Marketing Strategy of La Vie Claire, SA Company?

- What is Brief History of La Vie Claire, SA Company?

- Who Owns La Vie Claire, SA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.