Pinnacle Financial Partners Bundle

Who Does Pinnacle Financial Partners Serve?

In the competitive world of financial services, understanding your customer is paramount. For Pinnacle Financial Partners, a firm built on personalized relationships, knowing their Pinnacle Financial Partners SWOT Analysis is key. This exploration unveils the core of their success: a deep understanding of their customer demographics and target market. Discover how this Nashville-based bank has cultivated a loyal client base and achieved remarkable growth.

Pinnacle Financial Partners, aiming to be 'more than a bank,' has strategically focused on specific customer demographics within the banking industry. Their initial target market, composed of businesses, their owners, and individuals, has evolved. This analysis will uncover the client profile, geographic reach, and financial needs that define Pinnacle Financial Partners' success, offering insights into their client acquisition and retention strategies.

Who Are Pinnacle Financial Partners’s Main Customers?

Understanding the Customer demographics and Target market of the company is crucial for effective strategic planning. The financial institution primarily focuses on two main groups: businesses (B2B) and affluent individuals (B2C). This dual approach allows for a diverse client base, catering to different financial needs and preferences within the Banking industry.

For B2B clients, the company targets businesses, their owners, and employees. This segment likely includes a range of established companies across various sectors. The B2C focus is on individuals seeking a comprehensive and personalized banking experience. This suggests a Client profile that values in-depth financial advice and integrated solutions. The company's approach goes beyond simply offering the best price; they aim to build long-term relationships.

The company's growth strategy heavily relies on attracting experienced financial professionals. In 2024, they added 161 new revenue-producing associates, a 50% increase from 2023. These new associates contributed nearly $3 billion in loan growth. This indicates a strong emphasis on clients who value the expertise and established networks of their financial advisors. To learn more, you can read the Brief History of Pinnacle Financial Partners.

The B2B segment includes businesses of various sizes, their owners, and employees. The focus is on providing financial solutions tailored to business needs, such as loans, treasury management, and commercial banking services. This segment likely includes established businesses across different industries, seeking a strong financial partner.

The B2C segment targets affluent individuals who desire a comprehensive and personalized banking experience. This includes individuals seeking wealth management, investment advice, and private banking services. The emphasis is on building long-term relationships and providing expert financial guidance.

The Target market of the company values expert advice and integrated financial solutions. They are likely established professionals, business owners, and high-net-worth individuals. The focus is on building long-term relationships, indicating a preference for personalized service over just competitive pricing.

The company's recruitment of experienced financial professionals is a key element of its growth strategy. The addition of 161 new associates in 2024, contributing nearly $3 billion in loan growth, demonstrates the importance of these relationships. This approach allows the company to tap into existing client networks and provide specialized services.

The company's commitment to community involvement and financial literacy programs, such as Business and Consumer Mastermind initiatives, further indicates an engagement with a broad range of individuals and businesses within their operating communities. This shows an aim to foster financial wellness across various demographics.

- Focus on businesses, their owners, and employees.

- Emphasis on affluent individuals seeking personalized banking.

- Strategic recruitment of experienced financial professionals.

- Commitment to community involvement and financial literacy.

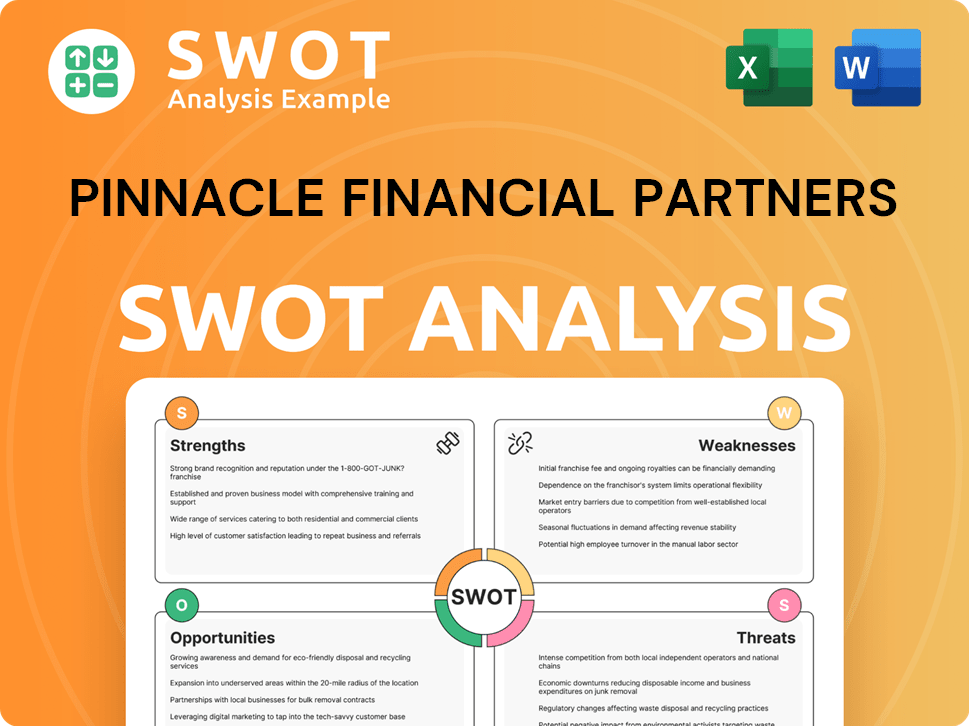

Pinnacle Financial Partners SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Pinnacle Financial Partners’s Customers Want?

Understanding the customer needs and preferences is crucial for any financial institution. For Pinnacle Financial Partners, this means recognizing that clients seek more than just transactions; they desire a personalized banking experience.

The target market for Pinnacle Financial Partners values comprehensive financial solutions, including banking, investment, and insurance products. They prioritize personal relationships and local decision-making, seeking alternatives to the impersonal nature of larger financial institutions. This focus on client needs shapes the firm's approach to service delivery.

The client profile of Pinnacle Financial Partners is driven by the need for distinctive service, effective advice, and extraordinary convenience. Customers are looking for a banking relationship that goes beyond simple transactions, valuing clear information and guidance.

Clients need more than just financial products; they seek a trusted advisor. They value clear, actionable advice to improve their financial wellness and grow their businesses. This includes access to local decision-makers and direct communication with financial professionals.

Purchasing decisions are influenced by the desire for comprehensive financial solutions, including banking, investment, trust, mortgage, and insurance products. Clients are more likely to choose institutions that offer personalized service and local expertise.

Clients are drawn to personal relationships with financial advisors and local decision-making. They seek an alternative to the impersonal experience of larger institutions. The preference is for a 'wisdom-first' approach, focusing on guidance rather than product pushing.

Common pain points include the desire for accessible, local decision-makers and the ability to speak directly with a person. The firm addresses these by attracting experienced financial professionals with significant expertise and client followings.

Product development and service delivery are influenced by feedback and market trends. Initiatives like the Business and Consumer Mastermind programs offer financial education tailored to specific needs. Expansion of programs like the Community Association Program demonstrates responsiveness to niche market needs.

Client retention strategies focus on building long-term relationships with financial partners. This is achieved by attracting and retaining highly experienced financial professionals. Customer satisfaction is a key metric for evaluating the success of these strategies.

Pinnacle Financial Partners' commitment to understanding and meeting customer needs is evident in its strategic initiatives and responsiveness to market trends. For example, the firm's Business and Consumer Mastermind programs, which provide financial education, have seen a 15% increase in participation over the past year, indicating a strong demand for financial literacy. The Community Association Program, tailored for HOAs, has expanded its services by 20% in the last two years, reflecting the firm's ability to identify and serve niche markets. Furthermore, client satisfaction scores consistently remain above 90%, demonstrating the effectiveness of their client-focused approach. The firm's focus on retaining experienced financial professionals has led to a client retention rate of over 95%, showcasing the value clients place on long-term relationships and personalized service.

- Business and Consumer Mastermind programs see a 15% increase in participation.

- Community Association Program has expanded services by 20% in two years.

- Client satisfaction scores consistently above 90%.

- Client retention rate is over 95%.

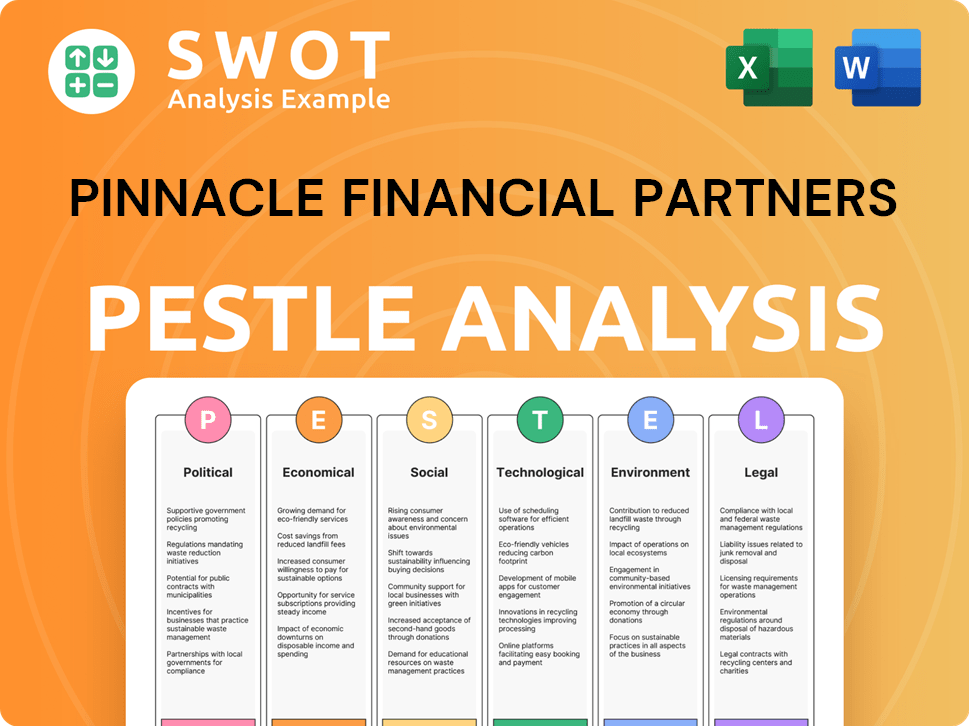

Pinnacle Financial Partners PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Pinnacle Financial Partners operate?

The geographical market presence of Pinnacle Financial Partners is primarily concentrated in the Southeastern United States, specifically targeting urban markets. The firm's strategic focus is evident through its expansion efforts and market penetration within this region. This approach allows for a tailored understanding of the local customer demographics and preferences, which is crucial in the financial services industry.

Headquartered in Nashville, Tennessee, the company holds the leading market share by deposits in the Nashville-Murfreesboro-Franklin MSA as of 2024. This strong local presence serves as a foundation for its broader regional strategy. Recent expansions into Virginia and North Florida, along with continued growth in Kentucky, highlight the firm's commitment to expanding its reach within the Southeast.

Pinnacle Financial Partners' expansion strategy is designed to capture opportunities in high-growth areas. The company's approach to serving its target market involves local decision-making and a relationship-based banking model. This model emphasizes recruiting experienced professionals with local ties to better serve clients and understand their specific needs. This strategy, coupled with strong financial performance, indicates a successful approach to market penetration and client acquisition strategy.

Pinnacle Financial Partners operates in 15 primarily urban markets across the Southeastern United States. This includes Tennessee, North Carolina, South Carolina, Virginia, Georgia, and Alabama. The firm's headquarters is in Nashville, Tennessee.

In April 2025, Pinnacle deepened its commitment to Virginia with a full-service team in Richmond. In June 2025, the company accelerated its expansion in North Florida, adding financial professionals to its Jacksonville office. The firm has been building its presence in Kentucky for two years, with offices in Bowling Green and plans for an additional office.

Pinnacle holds the No. 1 market share by deposits in the Nashville-Murfreesboro-Franklin MSA as of 2024. Loan growth in Q1 2025 was 9.0% year-over-year. Deposit growth was strong, with a $1.6 billion increase in Q1 2025, following a $1.9 billion increase in the previous quarter.

The company uses a relationship-based banking model. Experienced professionals with local ties are recruited to serve clients. This approach helps address differences in customer demographics, preferences, or buying power across different regions. For further insights, you can also explore the Growth Strategy of Pinnacle Financial Partners.

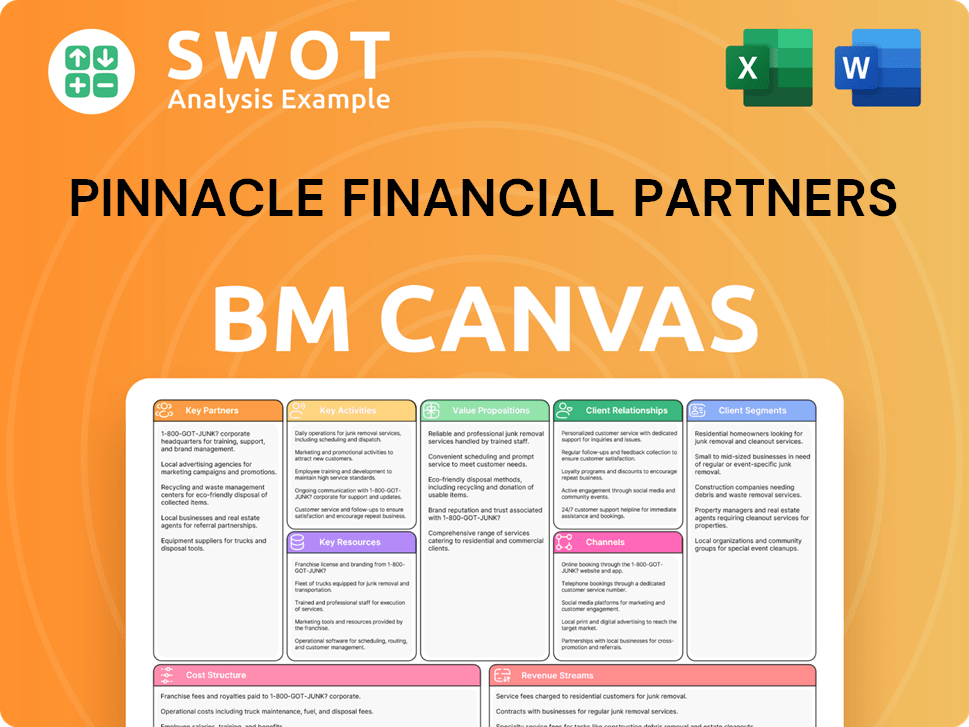

Pinnacle Financial Partners Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Pinnacle Financial Partners Win & Keep Customers?

The customer acquisition and retention strategies of Pinnacle Financial Partners are deeply rooted in its relationship-based banking model. They focus on attracting and keeping clients through a blend of strategic talent acquisition and exceptional service. Their approach emphasizes personalized experiences and local decision-making, fostering strong client relationships. This strategy has led to significant growth, as demonstrated by their financial results.

A key aspect of their customer acquisition strategy involves hiring experienced financial services professionals. This 'lift-out' strategy allows them to quickly expand their client base by bringing in established client relationships. In 2024, they successfully recruited 161 revenue-producing associates, a 50% increase over 2023. These new hires contributed nearly $3 billion in loan growth and $4.3 billion in deposit growth. This approach contrasts with traditional marketing methods, enabling rapid market share expansion.

Retention is a priority, achieved through high associate retention rates and a focus on client satisfaction. The firm invests in community engagement and financial literacy programs to solidify client ties. While specific details on loyalty programs or CRM systems are not extensively disclosed, the emphasis on personalized service and expert advice serves as a robust retention mechanism. These strategies contributed to an impressive financial performance, with adjusted diluted EPS growing 24.2% in Q1 2025 over Q1 2024.

Pinnacle focuses on hiring experienced financial professionals who bring established client relationships. This 'lift-out' strategy accelerates client base expansion. The firm's success in recruiting new associates directly impacts loan and deposit growth, showcasing the effectiveness of this approach. This strategy is a core component of their customer acquisition efforts within the banking industry.

The firm prioritizes personalized service and local decision-making to build strong client relationships. They offer a comprehensive range of financial services, catering to both businesses and individuals. The emphasis on direct human interaction over automated systems fosters loyalty and trust. This approach is a key element of their client profile strategy.

They maintain high associate retention rates, which supports long-term client relationships. Pinnacle provides expert financial advice and personalized service to ensure client satisfaction. Their commitment to client satisfaction is a key driver of retention. This ensures a consistent team of advisors for their clients.

Pinnacle invests in community engagement and financial literacy programs, like the Business and Consumer Mastermind initiatives. These programs offer free educational sessions on financial basics and business planning. These initiatives build trust and strengthen client ties within the community. This approach supports their customer satisfaction efforts.

Pinnacle Financial Partners' success in customer acquisition and retention stems from a combination of strategic talent acquisition, a client-centric approach, and community involvement. Their focus on personalized service and expert advice creates strong client relationships, leading to sustained growth. To learn more about their business model, check out the article Revenue Streams & Business Model of Pinnacle Financial Partners.

- Talent Acquisition: Hiring experienced professionals with established client bases.

- Relationship Banking: Providing personalized service and local decision-making.

- Retention Focus: Emphasizing client satisfaction and associate engagement.

- Community Engagement: Offering financial literacy programs and building trust.

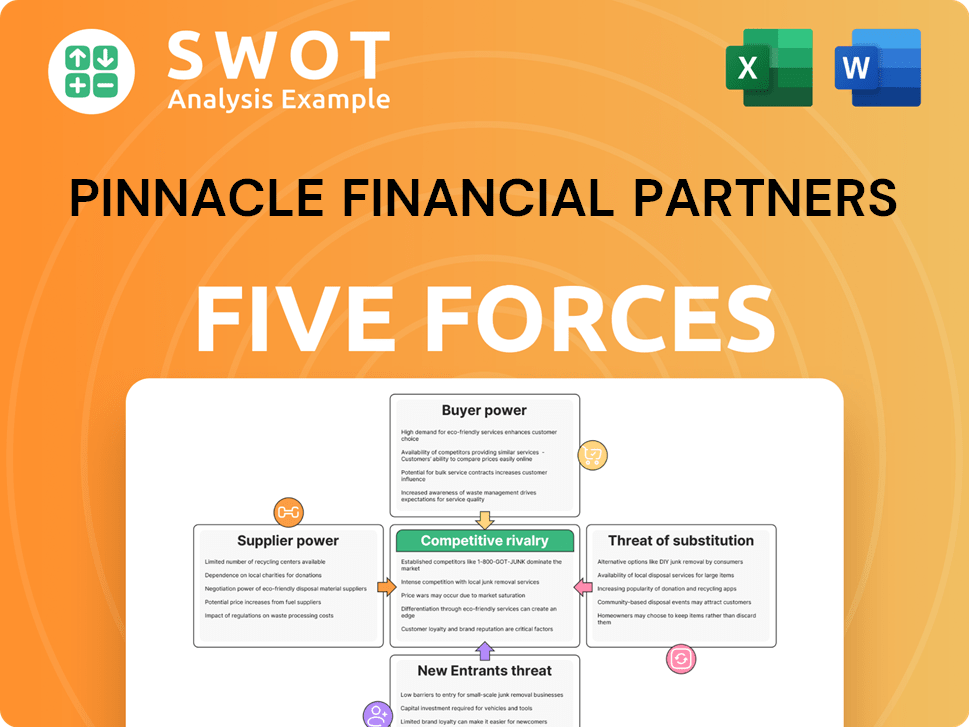

Pinnacle Financial Partners Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Pinnacle Financial Partners Company?

- What is Competitive Landscape of Pinnacle Financial Partners Company?

- What is Growth Strategy and Future Prospects of Pinnacle Financial Partners Company?

- How Does Pinnacle Financial Partners Company Work?

- What is Sales and Marketing Strategy of Pinnacle Financial Partners Company?

- What is Brief History of Pinnacle Financial Partners Company?

- Who Owns Pinnacle Financial Partners Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.