QCR Holdings Bundle

How Well Does QCR Holdings Understand Its Customers?

In the dynamic world of finance, understanding your customer is paramount, especially for community banks like QCR Holdings. The ability to adapt to evolving QCR Holdings SWOT Analysis customer needs and market trends is crucial for sustained success. This analysis dives deep into the customer demographics and target market of QCR Holdings, offering insights that are vital for investors and strategists alike.

This exploration of QCR Holdings' customer demographics and target market provides a crucial market analysis, essential for anyone looking to understand the company's strategic positioning. We'll examine customer segmentation, business strategy, and the factors that drive QCR Holdings' success in a competitive landscape. By understanding who QCR Holdings serves, we gain a clearer picture of its potential for growth and resilience.

Who Are QCR Holdings’s Main Customers?

Understanding the customer demographics and target market of QCR Holdings is crucial for grasping its business model. QCR Holdings, a financial institution, strategically segments its customer base to offer tailored services. This approach allows the company to optimize its offerings and enhance customer satisfaction.

QCR Holdings operates with a dual customer focus, serving both businesses (B2B) and individual consumers (B2C). This dual approach allows the company to diversify its revenue streams and cater to a wide range of financial needs. The company's services are designed to meet the specific requirements of each segment, ensuring a comprehensive financial solution for all its clients.

The company's target market is primarily composed of small and medium-sized businesses (SMBs) and affluent individuals. SMBs benefit from commercial loans and treasury management services, while individuals receive wealth management and trust services. This segmentation strategy enables QCR Holdings to provide specialized financial solutions, fostering strong customer relationships and driving business growth.

The B2B segment of QCR Holdings includes SMBs across various industries. These businesses require commercial loans, treasury management, and financial advice. QCR Holdings aims to provide personalized banking relationships and efficient access to capital. The company's focus on SMBs reflects a strategic decision to support local economies and foster long-term partnerships.

The B2C segment consists of individuals seeking deposit accounts, consumer loans, and wealth management services. This segment often includes affluent individuals and families. QCR Holdings provides sophisticated financial planning, investment management, and estate planning expertise to meet their needs. The B2C segment is crucial for the company's revenue diversification.

While specific demographic data isn't publicly available, QCR Holdings likely targets established business owners, professionals, and high-net-worth individuals. These individuals typically have higher income levels and a need for comprehensive financial services. The company's focus on commercial banking and wealth management indicates its strategic customer segmentation.

- Income Level: High-net-worth individuals and business owners.

- Age Range: Typically, the age range is between 35-65 years old.

- Geographic Location: Primarily in the Midwest, with recent expansion into the Denver market.

- Needs: Comprehensive financial planning, investment management, and business financing.

The company's market analysis and customer segmentation strategies are key to its success. QCR Holdings has shown adaptive strategies by focusing on digital banking and specialized lending programs. These efforts attract technologically savvy businesses and those in specific growth industries. For more insights, explore the Growth Strategy of QCR Holdings.

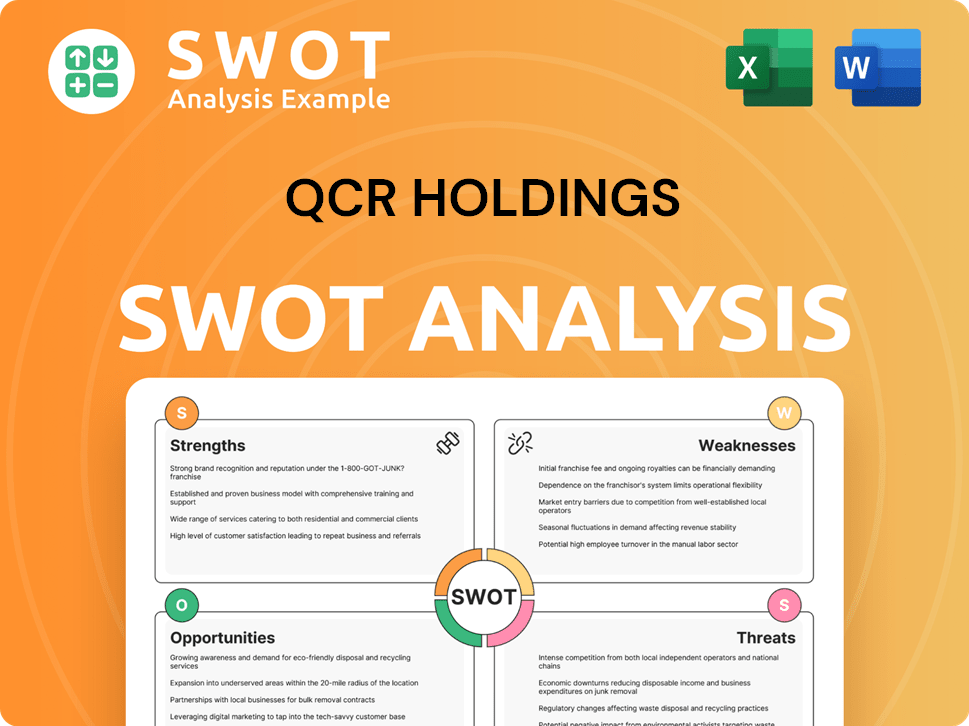

QCR Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do QCR Holdings’s Customers Want?

Understanding the customer needs and preferences is crucial for QCR Holdings. This involves analyzing both business and individual client segments to tailor financial solutions effectively. The focus is on delivering personalized and efficient services that address specific financial goals and challenges.

For business clients, the primary needs revolve around accessible capital, efficient cash management, and expert financial guidance. Individual clients, particularly those seeking wealth management, prioritize wealth preservation, growth, and intergenerational transfer. These varied needs shape the company's approach to customer service and product development.

The company addresses common pain points by emphasizing relationship banking, offering customized financial products, and providing expert advice. This approach helps build trust and loyalty, ensuring customer satisfaction and retention within the target market.

Business clients require accessible capital for growth, efficient cash management, and expert financial strategies. They seek competitive rates, flexible terms, and responsive service.

Individual clients, especially those using wealth management services, focus on wealth preservation, growth, and intergenerational transfer. They value sophisticated financial planning and discretion.

Common pain points include navigating financial regulations, the need for tailored lending solutions, and integrated financial planning. These are addressed through relationship banking and customized products.

QCR Holdings addresses these needs by offering customized financial products, expert advice, and a focus on relationship banking. This approach is highlighted by subsidiaries like Rockford Bank and Trust.

Market trends, such as the increasing demand for digital banking, influence product development. Investments in online platforms and mobile banking solutions are crucial.

Marketing emphasizes community roots and personalized service, contrasting with larger financial institutions. This strategy helps attract and retain customers.

The target market of QCR Holdings values reliability, personalization, and efficiency in financial solutions. Understanding these preferences is key to effective customer segmentation and business strategy. The company's ability to meet these needs directly impacts its market position.

- Relationship-based banking: Customers prefer a trusted advisor who understands their specific needs.

- Customized financial products: Tailored solutions that address unique financial goals are highly valued.

- Expert advice: Access to knowledgeable professionals who can provide guidance on complex financial matters.

- Digital banking options: The convenience and accessibility of online and mobile banking platforms are increasingly important.

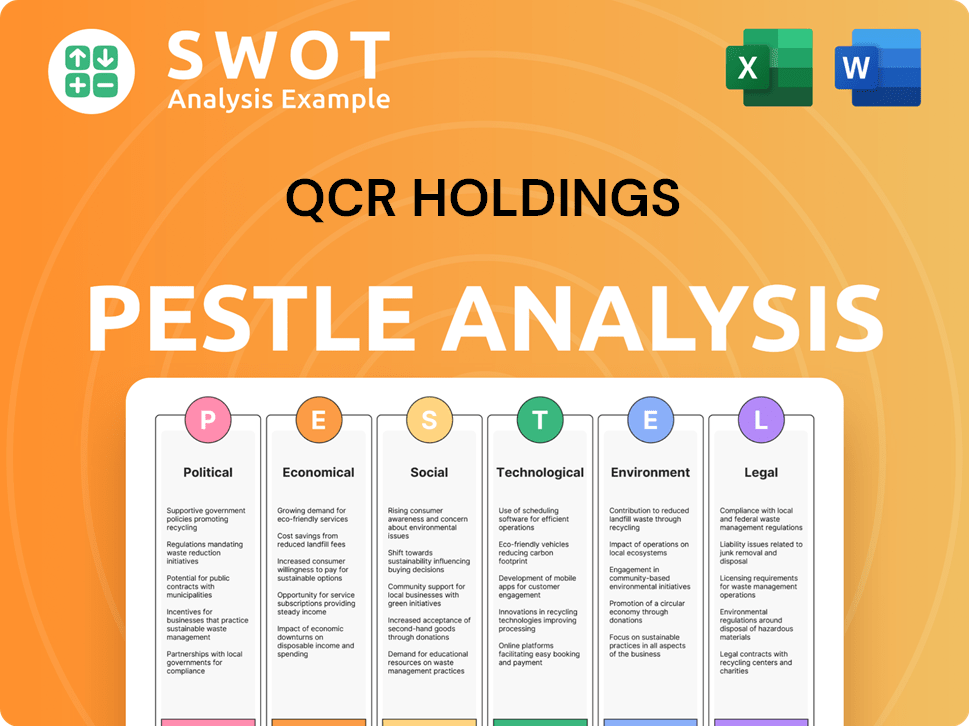

QCR Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does QCR Holdings operate?

The geographical market presence of QCR Holdings is primarily focused on the Midwest, with a strategic expansion into the Western United States. This expansion strategy is designed to broaden its customer base and diversify its revenue streams. The company's approach to its target market involves a deep understanding of regional economic dynamics and customer preferences.

Its core markets include the Quad Cities metropolitan area, Cedar Rapids, Waterloo/Cedar Falls, and Des Moines in Iowa, along with Rockford, Illinois. These areas are crucial for QCR Holdings, where it has established a strong market share and brand recognition, particularly in commercial banking. The company leverages its established relationships and local presence to effectively serve its target market.

The company's recent strategic move into Denver, Colorado, in 2024, with the opening of an office for QCR Capital, marks a significant expansion. This move reflects a deliberate effort to tap into a high-growth market. This expansion is part of a broader strategy to replicate its successful community banking model in new territories, demonstrating its commitment to sustainable growth and market penetration. For more insights, you can explore the Owners & Shareholders of QCR Holdings.

QCR Holdings conducts thorough market analysis to understand the specific needs and opportunities within each region. This includes assessing the economic conditions, competitive landscape, and customer demographics. The company uses this data to tailor its products and services.

QCR Holdings employs customer segmentation strategies to identify and cater to various customer groups. This involves analyzing factors such as age, income level, and buying habits. This approach allows the company to create targeted marketing campaigns.

The company's geographic focus is primarily on the Midwest and the Western United States. This strategic approach allows QCR Holdings to leverage its existing infrastructure and expertise. The expansion into Denver, Colorado, exemplifies this strategy.

The target market of QCR Holdings includes businesses and individuals within its geographic footprint. The company tailors its offerings to meet the diverse needs of these customers. This includes commercial lending, wealth management, and retail banking services.

QCR Holdings empowers its subsidiary banks to operate with a degree of autonomy, allowing them to make local decisions. This approach ensures that products and services are tailored to the specific needs of each community. This includes local decision-making on loan applications.

The expansion strategy of QCR Holdings involves careful consideration of market opportunities and customer demographics. The company's entry into the Denver market in 2024 is a key example of its strategic growth plan. This expansion is part of a long-term strategy.

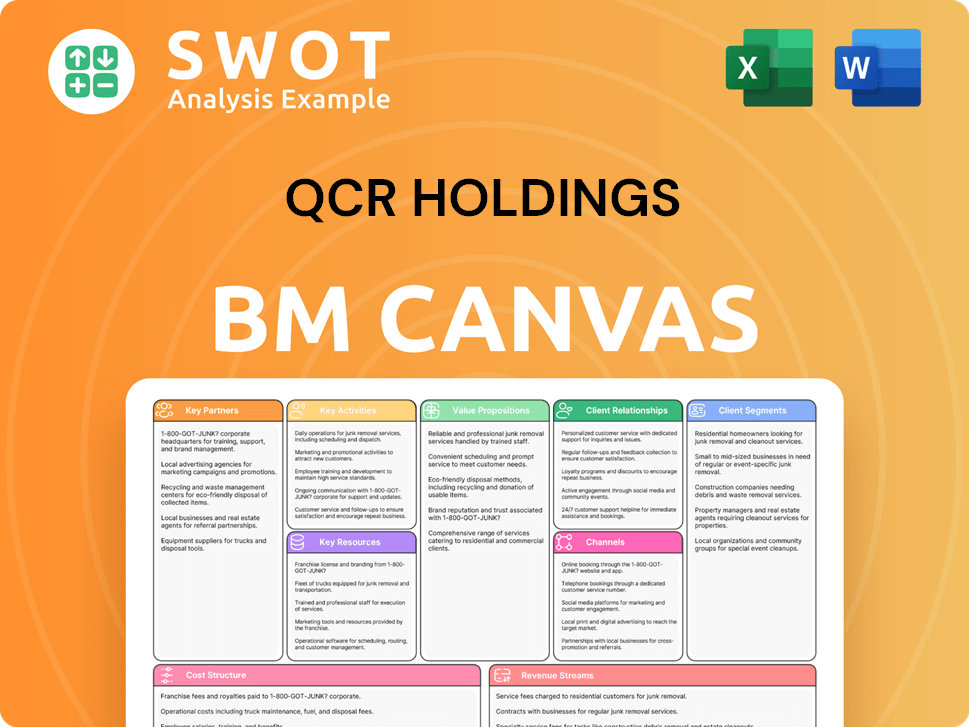

QCR Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does QCR Holdings Win & Keep Customers?

The acquisition and retention strategies of QCR Holdings center on relationship banking and personalized service, particularly within its commercial and wealth management segments. Key acquisition strategies involve direct sales by experienced bankers, referrals from existing clients, and targeted marketing campaigns. Digital marketing, including a strong online presence, complements traditional outreach efforts. Given the focus on businesses and high-net-worth individuals, direct engagement through industry events and community partnerships is also crucial.

Retention efforts prioritize exceptional customer service and long-term relationship building. This includes proactive client communication, customized financial solutions, and a deep understanding of each client's evolving needs. Customer data and CRM systems are critical for segmenting the client base, personalizing communications, and identifying cross-selling opportunities. The company's consistent growth in deposits and loans suggests effective strategies.

For example, QCR Holdings reported a 10.1% increase in total deposits to $7.15 billion and a 12.0% increase in total loans to $6.30 billion for the first quarter of 2024 compared to the same period in 2023, indicating successful acquisition and retention efforts. Over time, as digital banking becomes more prevalent, the company has likely invested in enhancing its online and mobile platforms to meet customer expectations, thereby impacting customer loyalty and lifetime value by providing convenient access to services.

Experienced bankers use their professional networks to directly solicit new clients. This approach allows for building relationships and understanding the needs of potential customers. This method is particularly effective for attracting businesses and high-net-worth individuals.

Referrals from satisfied clients are a significant source of new business. This strategy leverages the trust and satisfaction of existing customers to attract new ones. Referral programs often result in high-quality leads and conversions.

Marketing campaigns focus on the company's local expertise and community involvement. These campaigns are designed to attract potential customers who value local knowledge and community support. Targeted marketing helps in reaching specific segments of the target market.

A strong online presence and targeted advertising on professional platforms are used. This includes maintaining an informative website and utilizing digital advertising to reach potential customers. Digital strategies are important for reaching a wider audience.

Prioritizing exceptional customer service is a key retention strategy. This involves going above and beyond to meet and exceed customer expectations. Consistent, high-quality service builds loyalty and encourages long-term relationships.

Proactive communication helps maintain strong client relationships. This includes regular check-ins and updates on financial matters. Keeping clients informed builds trust and demonstrates care.

Offering customized financial solutions is crucial for meeting client needs. Tailoring services to individual circumstances ensures that clients receive the most appropriate support. This approach fosters client satisfaction and retention.

A deep understanding of each client's evolving needs is essential. Regularly assessing and adapting to changes in clients' financial situations is important. This allows for providing the best possible support over time.

CRM systems are used for segmenting the client base and personalizing communications. This helps tailor interactions and offers to specific client needs. CRM systems also aid in identifying cross-selling opportunities.

Identifying opportunities for cross-selling additional services is a key retention strategy. Offering wealth management services to commercial clients is an example. This increases the value of the relationship.

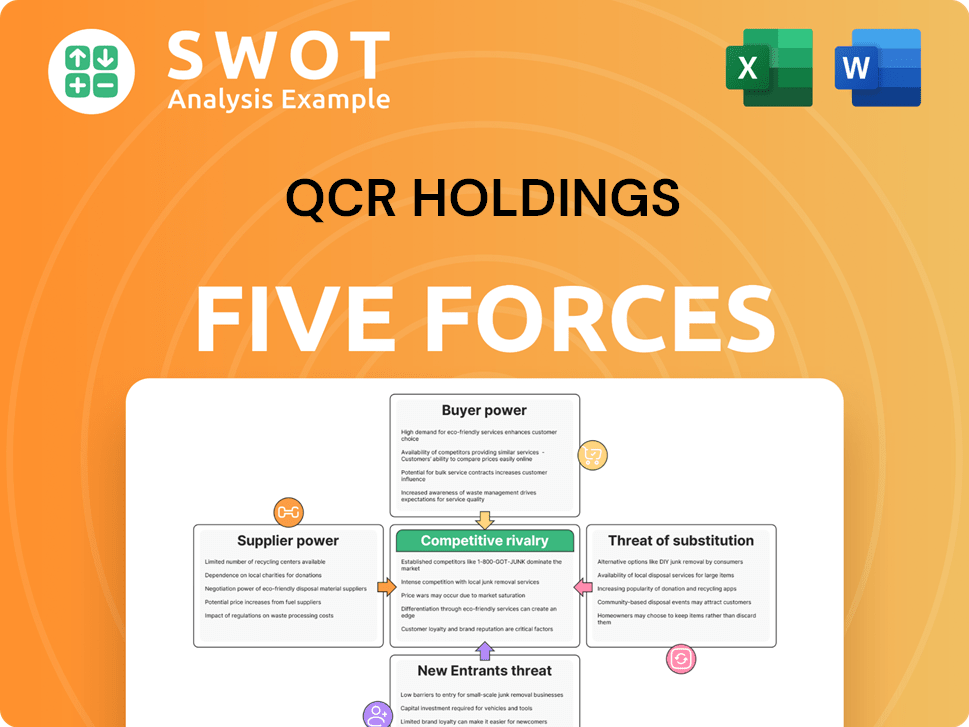

QCR Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of QCR Holdings Company?

- What is Competitive Landscape of QCR Holdings Company?

- What is Growth Strategy and Future Prospects of QCR Holdings Company?

- How Does QCR Holdings Company Work?

- What is Sales and Marketing Strategy of QCR Holdings Company?

- What is Brief History of QCR Holdings Company?

- Who Owns QCR Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.