Sallie Mae Bundle

Who Does Sallie Mae Serve in Today's Education Finance Landscape?

Navigating the complexities of student loans and financial services requires a keen understanding of the players involved, especially for a company like Sallie Mae. The Sallie Mae SWOT Analysis reveals the strategies employed to adapt to the ever-changing needs of its customer base. But who exactly are these customers, and how has Sallie Mae's target market evolved over time?

Understanding the customer demographics and the Sallie Mae target market is crucial for grasping the company's strategic direction. From its origins as a government-sponsored enterprise to its current focus on private education loans, Sallie Mae's customer profile has undergone a significant transformation. This shift reflects broader trends in the student loan market, including changes in student loan borrowers' characteristics, income levels, and geographic locations. This analysis delves into the specifics of who Sallie Mae's ideal customer is, offering insights into their needs, wants, and how Sallie Mae adapts its offerings to meet them.

Who Are Sallie Mae’s Main Customers?

Understanding the customer demographics and target market is crucial for any financial institution. For Sallie Mae, the focus is primarily on students and families seeking financial solutions for higher education. Their services are tailored to meet the specific needs of this demographic, offering a range of student loans to cover various educational expenses.

Sallie Mae's primary customer segments are students and their families who are looking for private education loans. The company directly serves consumers (B2C), providing loans for undergraduate, graduate, and career training programs. This approach allows them to cater to a diverse group of individuals pursuing higher education.

The company's strategic focus on private student loans has allowed it to maintain a significant market share in the sector. A look into the Growth Strategy of Sallie Mae reveals how the company has adapted to changes in the market, focusing on its core customer base.

The target market includes undergraduate, graduate, and career training students. Sallie Mae also offers specialized loans for specific graduate programs, such as MBA, medical, and law school. This broadens their reach within the education financing sector.

Parents are another key segment, with Sallie Mae offering parent loans for those who wish to borrow on behalf of their child's education. This caters to families looking for ways to fund their children's education.

Sallie Mae emphasizes lending to high-quality borrowers. In Q1 2025, the average FICO score at approval for originations was 753, reflecting a focus on creditworthy applicants. This is up from 748 in Q1 2024.

A significant portion of loans are cosigned, with 93% of loans in Q1 2025 having a cosigner, an increase from 91% in Q1 2024. This indicates that many students rely on cosigners to secure loans.

While specific income levels are not publicly detailed, the focus on private loans suggests a target demographic that has possibly exhausted federal aid options. The 'How America Pays for College 2024' report indicates that nearly half (49%) of American undergraduate families reported borrowing for college in the 2023-2024 academic year, up from 41% in 2023.

- Market Share: Sallie Mae holds a 30% market share in the private student loan sector.

- Strategic Shift: After spinning off Navient, Sallie Mae focused on private student loans, banking products, and credit cards.

- Product Roadmap: The company aims to enhance its market share through increasing enrollments.

- Customer Needs: Sallie Mae aims to meet the needs of students and families seeking financial solutions for higher education.

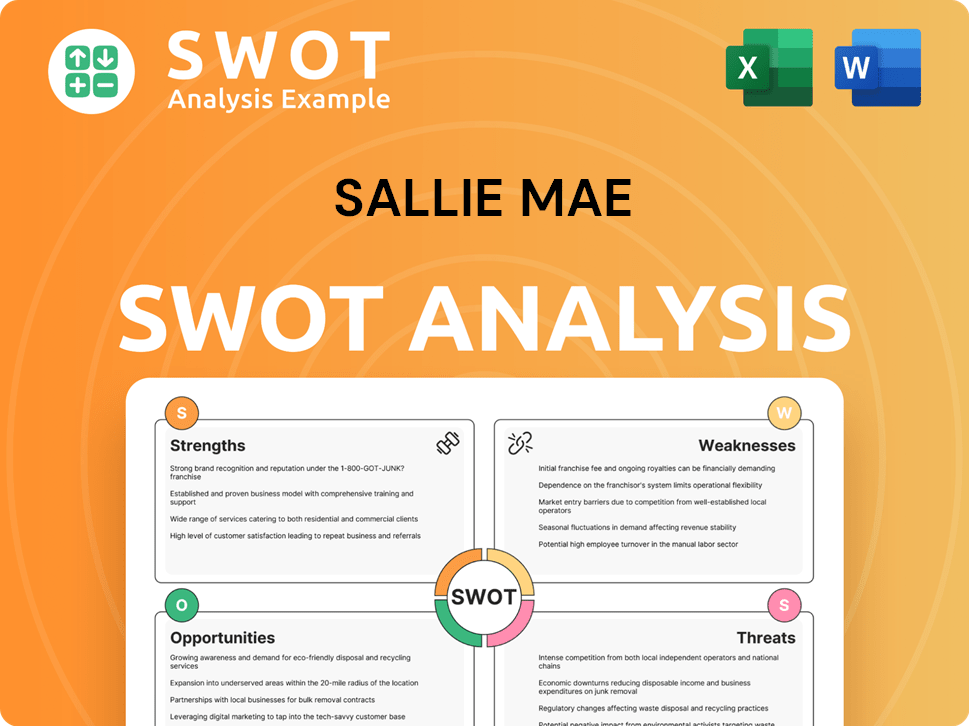

Sallie Mae SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Sallie Mae’s Customers Want?

Understanding the needs and preferences of its customers is crucial for [Company Name]'s success in the competitive financial services market. The primary focus is on assisting customers in financing their higher education endeavors, particularly when their financial needs surpass available savings, grants, scholarships, and federal aid. This focus shapes the company's offerings and marketing strategies, aiming to meet the specific demands of its target audience.

The company's customer base includes a diverse group of individuals and families seeking to fund their education. These customers have specific needs, including flexible financing options, ease of application, and access to financial planning tools. By addressing these needs, the company aims to provide valuable services and build strong customer relationships.

The company's approach to customer service is also influenced by market research and feedback. The company continuously monitors trends and adapts its offerings to meet evolving customer needs. This proactive approach ensures the company remains relevant and responsive to the financial needs of its borrowers.

Customers seek competitive interest rates and flexible repayment plans to manage their loan obligations. The company offers both fixed and variable interest rates, with options for deferred payments, fixed payments while in school, or interest-only payments.

A significant preference for borrowers is the absence of origination fees, which the company offers. This contributes to cost savings compared to some other lenders.

The ability to apply online and receive a credit result in approximately 10 minutes is a valued aspect of the application process. This quick turnaround enhances the customer experience.

Customers need a variety of loan products tailored to different educational stages and programs, from undergraduate to specialized graduate degrees like medical or law school.

Beyond loans, customers often seek assistance with college planning, including finding scholarships and understanding the financial aid process. The company provides free tools like its scholarship search tool, Scholly Scholarships.

There is a growing awareness among students and families about responsible borrowing. The company advocates for responsible lending, encouraging students to exhaust 'free money' options and federal aid before considering private loans, and to borrow only what they can reasonably afford to repay. Roughly half of the company's customers choose to make payments while in school, which can help reduce the total cost of their loans.

The company's understanding of its customer base is continually refined through market research and feedback. For example, a 2025 study by the company and Ipsos found that 75% of recent graduates who borrowed for school are confident in their ability to repay their student loans. This data underscores the importance of clear communication and support regarding repayment options. The company also uses market research reports, such as 'How America Pays for College' and 'How America Succeeds After College,' to inform its product development and marketing strategies. These reports provide insights into family spending on college, borrowing trends, and post-college outcomes, helping the company tailor its offerings to meet evolving customer needs. For instance, the company has adapted its marketing to appeal to Gen Z, focusing on engaging and entertaining content on relevant platforms to address their stresses around higher education financing. This targeted approach helps the company connect with its target audience and provide relevant financial services. Furthermore, the company's loan products include options for undergraduate loans with fixed rates ranging from 5.49% to 14.83% and variable rates from 6.12% to 16.70% in 2024, catering to different borrower preferences and financial situations.

- The company's customer base is primarily driven by the need to finance higher education.

- Customers seek flexible financing options, including competitive interest rates and repayment plans.

- The company provides financial planning tools and resources to assist customers with college planning.

- The company emphasizes responsible borrowing and provides guidance to help customers manage their loans.

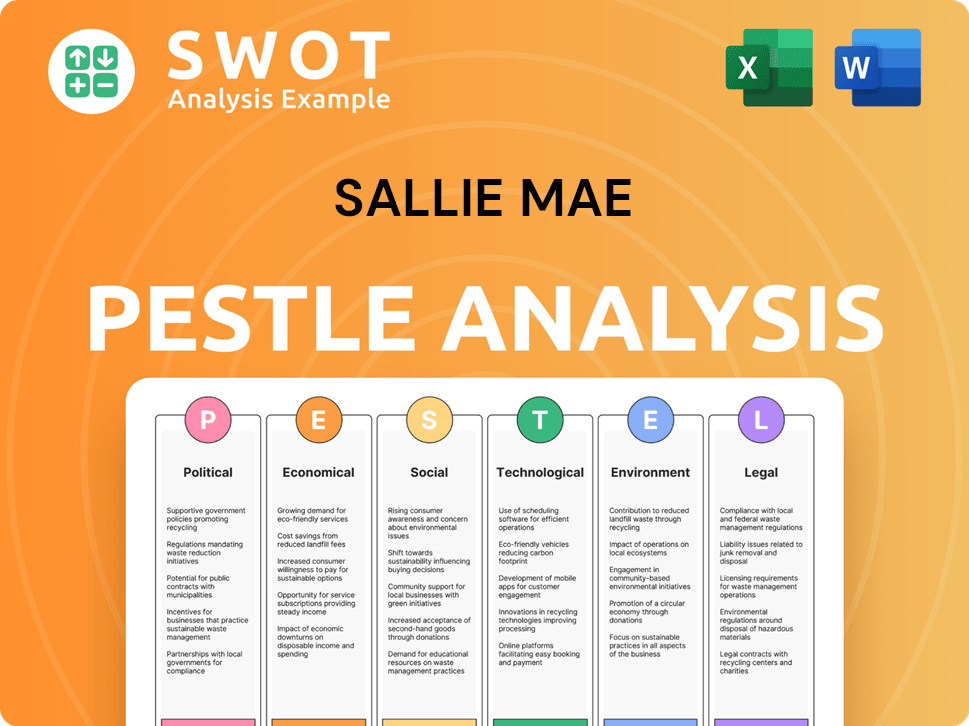

Sallie Mae PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Sallie Mae operate?

The geographical market presence of the company is predominantly within the United States. Its core business revolves around providing private education loans, focusing on students and families across the nation. The company's operational footprint is closely tied to the distribution of higher education institutions and student populations throughout the U.S.

The company's headquarters are located in Newark, Delaware, serving as the central hub for its U.S.-based operations. It collaborates with colleges and universities nationwide, indicating a broad presence across academic institutions. Its services are available nationally, aligning with the geographic distribution of higher education and student populations.

The company primarily concentrates on the U.S. education financing market, offering private student loans to eligible borrowers. While the main focus is domestic, the company also extends its services to U.S. citizens and permanent residents studying in the U.S., as well as international students under specific conditions. The company's market share in the private student loan sector is estimated at approximately 30%.

The company's primary market is the U.S. education financing sector. Its headquarters are in Newark, Delaware. This focus is reflected in the company's operations and customer base.

The company works with colleges and universities across the U.S. This collaboration facilitates loan disbursement directly to schools. This implies a wide geographic reach across the U.S.

While primarily U.S.-focused, the company offers loans to U.S. citizens or permanent residents studying in the U.S. International students may also qualify with a U.S. cosigner. Some international institutions facilitate loans for U.S. students studying abroad.

The company holds a significant market share in the private student loan market. The broader student loan market is projected to grow at a compound annual growth rate (CAGR) of 9.2%. The company's market share is estimated at 30%.

The company's financial products, like the Smart Option Student Loan, are designed to meet the diverse needs of students across the U.S. The company's marketing efforts consider regional demographics and educational landscapes. For a deeper dive into the company's strategic approach, consider reading the Growth Strategy of Sallie Mae.

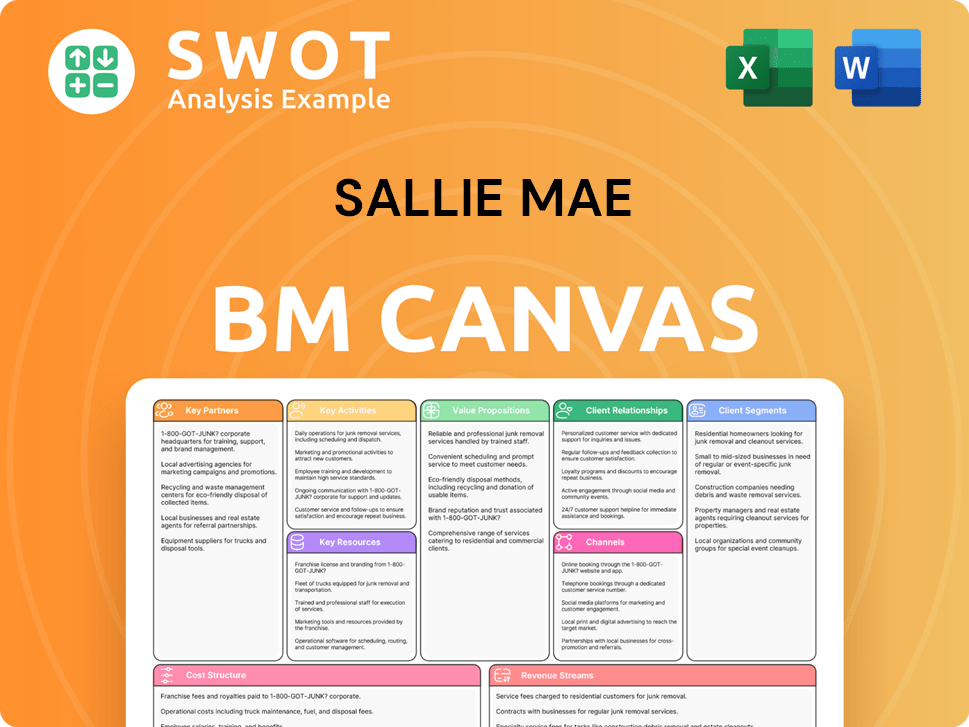

Sallie Mae Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Sallie Mae Win & Keep Customers?

The company, a prominent player in the financial services sector, employs a multi-faceted approach to customer acquisition and retention. Their strategies are designed to attract and retain borrowers, specifically focusing on digital engagement, strategic partnerships, and a strong emphasis on responsible lending and customer support. This approach helps them maintain a competitive edge in the student loans market.

Their focus on digital platforms and social media, particularly targeting Gen Z, shows a commitment to adapting to the evolving preferences of potential borrowers. They also leverage a direct-to-consumer model, alongside marketing through the school channel, for their private education loans, aiming to reach customers through multiple channels. This multi-channel strategy is a key component of their customer acquisition efforts.

The company's strategic initiatives, including a focus on operational efficiencies, aim to drive growth and shareholder value. The company reported a net income of $590 million for the full year 2024. This financial health and growth trajectory reinforce the company's ability to invest in customer acquisition and retention.

The company actively engages with potential borrowers through digital platforms and social media. They partner with agencies to transform financial information into compelling content on relevant platforms. The direct-to-consumer model is used alongside marketing through the school channel for private education loans.

The company offers a wide array of private student loans, including undergraduate, graduate, and career training loans. They highlight competitive rates, no fees, and the advantage of a cosigner. Students are significantly more likely to be approved for a loan with a cosigner.

Roughly half of the company's customers choose to make payments while in school. They analyze customer finances and payment patterns to assist customers with post-graduation plans. They provide free college planning resources, including a scholarship search tool.

The company's strategic initiatives aim to drive growth and shareholder value. The company reported a net income of $590 million for the full year 2024. They provided strong EPS guidance of $3.00 to $3.10 for 2025, with an expected private education loan origination growth of 6% to 8%.

The company's approach to customer acquisition and retention has evolved over time, adapting to market conditions and regulatory environments. For more insights, consider reading about the Marketing Strategy of Sallie Mae.

Actively engages with potential borrowers through digital platforms and social media. Targets Gen Z with engaging content to navigate the complexities of higher education financing. They partner with agencies to create compelling content.

Leverages a direct-to-consumer model for its private education loans. This approach complements marketing efforts through the school channel. This dual approach increases reach and accessibility.

Partnerships with banks like Great Southern Bank serve as an acquisition channel. These partnerships help in reaching a wider audience. This indirect approach broadens their market reach.

Offers a wide array of private student loans, including undergraduate, graduate, and career training loans. This caters to a broad spectrum of educational needs. The variety of loan options enhances customer appeal.

Offers competitive variable and fixed interest rates, along with no origination fees or prepayment penalties. These features are key selling points for attracting borrowers. This transparency builds trust with borrowers.

Highlights that students are significantly more likely to be approved for a loan with a cosigner. Between October 2023 and September 2024, students were four times more likely to be approved with a cosigner. This encourages the use of cosigners to improve approval rates.

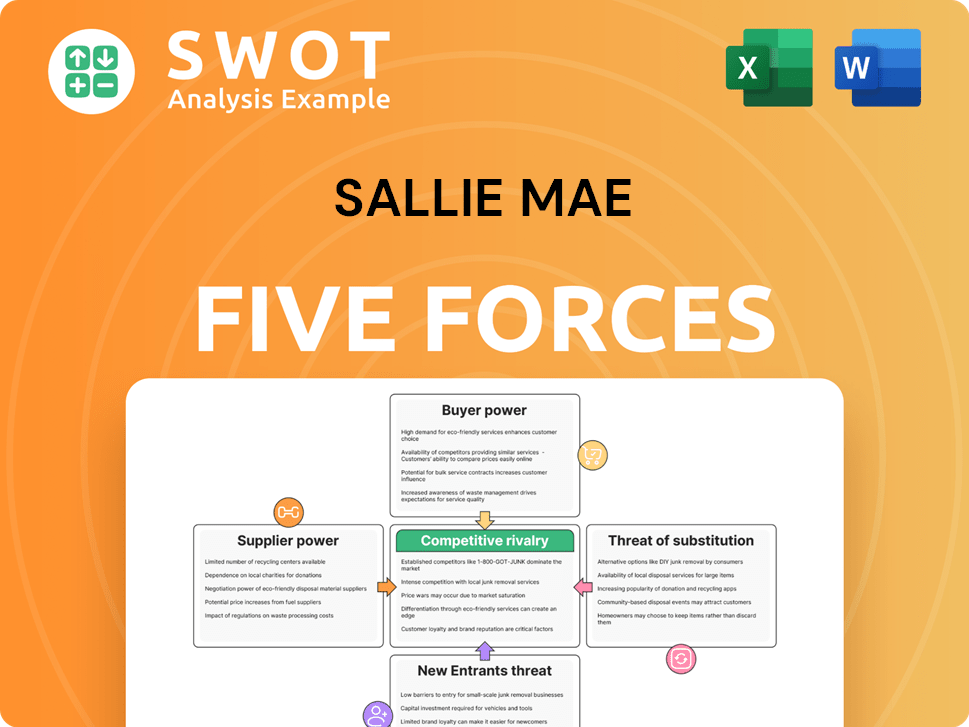

Sallie Mae Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sallie Mae Company?

- What is Competitive Landscape of Sallie Mae Company?

- What is Growth Strategy and Future Prospects of Sallie Mae Company?

- How Does Sallie Mae Company Work?

- What is Sales and Marketing Strategy of Sallie Mae Company?

- What is Brief History of Sallie Mae Company?

- Who Owns Sallie Mae Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.