Transaction Capital Bundle

Who Exactly Does Transaction Capital Serve?

Transaction Capital's success hinges on a deep understanding of its Transaction Capital SWOT Analysis. Navigating the complexities of the South African market, particularly within the minibus taxi industry, requires a laser focus on customer demographics and target market analysis. This exploration is crucial for understanding the company's strategic evolution and future growth prospects in the financial services sector.

Understanding the customer profile of Transaction Capital is essential for effective market analysis. This analysis will delve into the company's customer segmentation, revealing who Transaction Capital's customers are, their needs, and how the company adapts to serve them. Examining the demographics of Transaction Capital clients helps illuminate the company's market positioning and customer acquisition strategy within South Africa's competitive landscape.

Who Are Transaction Capital’s Main Customers?

Understanding the customer base is crucial for any company, and for Transaction Capital, this involves a deep dive into its primary customer segments. The company's focus is split between the minibus taxi industry and debt collection services, each with distinct demographics and needs. This segmentation allows for tailored financial solutions and services, driving the company's strategic direction.

Transaction Capital's operations are primarily centered on these two key areas. The minibus taxi industry represents a significant portion of its business, particularly through its SA Taxi division. Debt collection services, on the other hand, cater to a broader range of clients, including financial institutions and individual consumers. This dual approach requires a nuanced understanding of its target market and customer demographics to ensure effective service delivery.

A detailed Marketing Strategy of Transaction Capital reveals how the company strategically positions itself within these key segments, focusing on customer needs and market dynamics. This targeted approach allows Transaction Capital to maximize its impact and tailor its offerings to the specific requirements of each customer group.

The core of this segment comprises individual taxi owners and operators. These entrepreneurs often lack access to traditional banking finance. They typically operate within the informal sector. Their livelihoods depend on their vehicles.

This segment includes B2B clients like financial institutions and retailers, and B2C customers, who are individuals with outstanding debts. The B2C demographics span various age groups, income levels, and occupations. Ethical collection practices are a key focus.

Transaction Capital has increasingly specialized in the minibus taxi sector. The company aims to develop tailored solutions for this underserved industry. The gross loan book for SA Taxi amounted to R9.4 billion as of March 31, 2024.

Understanding the needs of both segments is crucial for Transaction Capital. For the minibus taxi industry, this includes financing, insurance, and other services. For debt collection, it involves ethical practices and a focus on vulnerable customers.

Transaction Capital's success hinges on understanding and serving its diverse customer base. The company's strategic focus on the minibus taxi industry and debt collection services highlights its commitment to tailored financial solutions.

- The minibus taxi industry is a significant revenue driver, particularly through SA Taxi.

- Debt collection services cater to a broad range of B2B and B2C clients.

- The company is focused on ethical practices, especially when dealing with vulnerable customers.

- The SA Taxi gross loan book reached R9.4 billion as of March 2024, indicating strong growth.

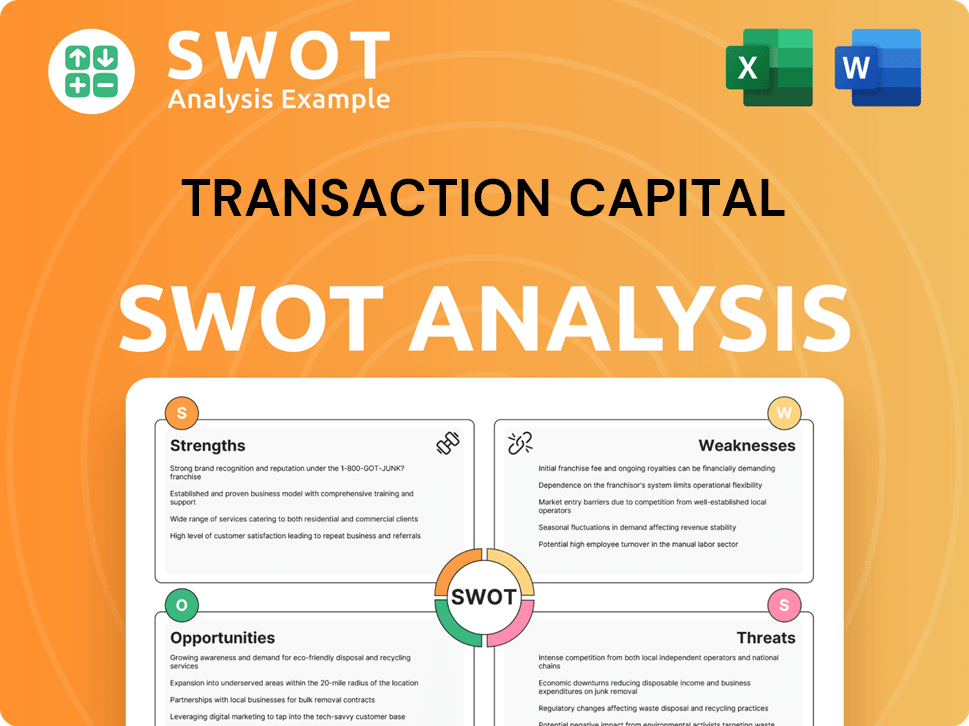

Transaction Capital SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Transaction Capital’s Customers Want?

Understanding the customer needs and preferences is crucial for Transaction Capital's success. The company's customer base spans diverse segments, each with unique requirements shaped by their specific operational environments and financial constraints. Effective customer segmentation and tailored service offerings are key to meeting these varied demands and maintaining a competitive edge in the market.

For the minibus taxi industry, the primary customer need revolves around accessible and flexible financing. Debt collection clients, both businesses and individuals, have distinct needs, with businesses seeking efficient debt recovery solutions and individuals needing manageable repayment options. Transaction Capital addresses these needs through specialized financial products and ethical debt collection practices.

The company's approach is centered on understanding and addressing the core needs of its customers. This includes providing quick loan approvals, manageable repayment terms, and value-added services for taxi operators, while offering empathetic and flexible repayment solutions for individuals facing debt. This customer-centric strategy is vital for building lasting relationships and ensuring customer satisfaction.

The primary needs of Transaction Capital's customers are centered on financial accessibility and effective debt management. Minibus taxi operators require financing for vehicle acquisition and maintenance, while debt collection clients seek efficient and compliant solutions. These needs drive the company's product development and service delivery strategies.

- Minibus Taxi Operators: Require affordable and flexible financing, quick loan approvals, manageable repayment terms, and value-added services.

- Debt Collection Clients (B2B): Need efficient, compliant, and reputation-sensitive debt recovery solutions.

- Debt Collection Clients (B2C): Seek empathetic and flexible repayment solutions to resolve debts and improve their financial standing.

- Psychological Drivers: Include the desire for financial independence and entrepreneurial sustainability for taxi operators.

- Practical Drivers: Focus on vehicle uptime and profitability for taxi operators, and effective debt recovery for businesses.

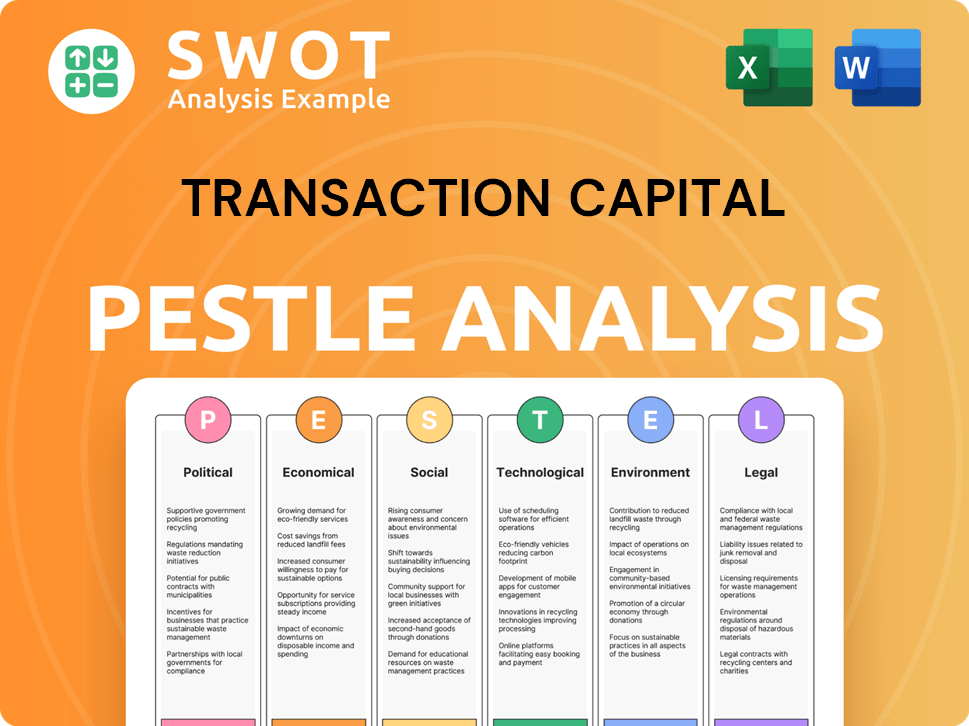

Transaction Capital PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Transaction Capital operate?

The primary geographical market for Transaction Capital is centered in South Africa. Its operations are predominantly focused within the South African economy. This concentration allows for a deep understanding of the local market dynamics and customer needs. The company's strong presence and brand recognition are particularly evident within the minibus taxi industry, a crucial sector for public transportation in South Africa.

Major markets for Transaction Capital are primarily located in urban and peri-urban centers across South Africa. These areas are where the minibus taxi industry is most active, representing a significant customer base. While specific regional breakdowns of sales or market share are not publicly detailed, provinces like Gauteng, KwaZulu-Natal, and the Western Cape are likely key areas of focus due to the density of taxi operations.

Differences in customer demographics and preferences across these regions mainly relate to the scale of operations and local economic conditions. For instance, taxi operators in densely populated urban areas might have different financing needs or vehicle preferences compared to those in more rural settings. This localized approach allows for tailored services and products that meet the specific requirements of each region.

Transaction Capital concentrates its efforts within South Africa, leveraging its deep understanding of the local market. This strategic focus allows for efficient resource allocation and targeted customer engagement. The company's operations are designed to meet the specific needs of the South African market.

Key areas of focus include Gauteng, KwaZulu-Natal, and the Western Cape, where the minibus taxi industry is most prevalent. These provinces represent significant opportunities due to the high concentration of potential customers. Understanding the unique characteristics of each region is crucial for effective market penetration.

Transaction Capital customizes its offerings by establishing a physical presence in key taxi hubs. This includes integrated service models like workshops and fitment centers across the country. This approach ensures that services are readily accessible to customers.

The company has historically prioritized deepening its presence within South Africa rather than pursuing substantial international expansion in its core segments. This strategic decision allows for a more focused approach to customer relationship management and market positioning. For more insights, consider reading about the Growth Strategy of Transaction Capital.

Transaction Capital maintains a significant market share within the South African financial services sector, particularly in the minibus taxi industry. The company's strategic focus on the local market has enabled it to build a strong brand and customer base.

- The 2024 interim results indicate that the group's operations remain predominantly South African.

- SA Taxi, the largest segment, operates exclusively within the country.

- The company's customer base is primarily composed of minibus taxi operators across South Africa.

- Transaction Capital's customer acquisition strategy focuses on building relationships with these operators.

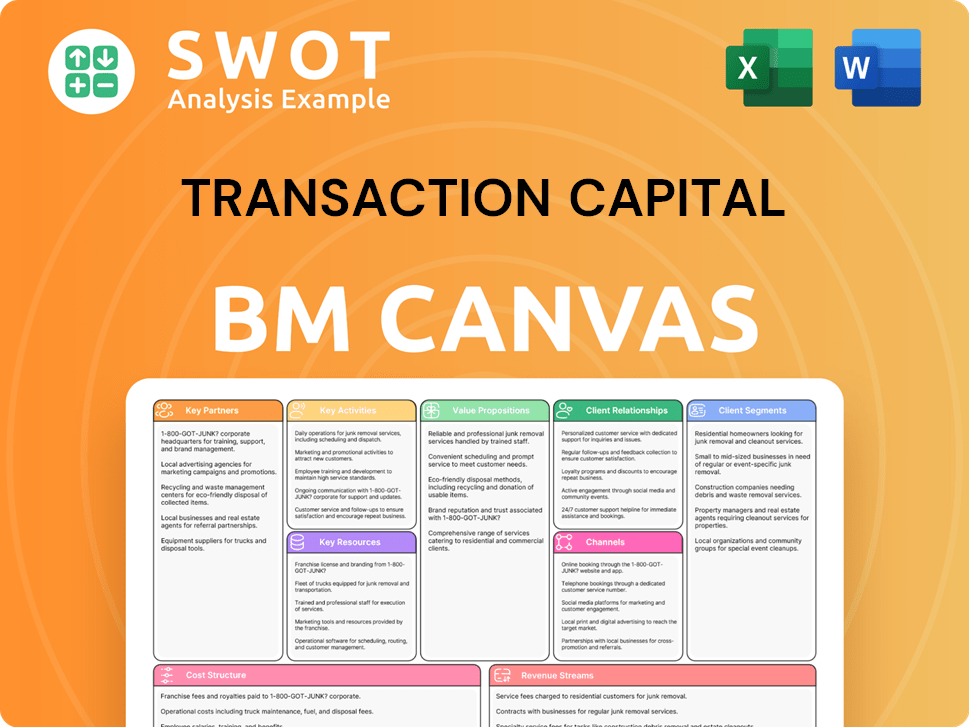

Transaction Capital Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Transaction Capital Win & Keep Customers?

The customer acquisition and retention strategies of Transaction Capital are primarily focused on the South African market, particularly within its SA Taxi business. The company uses a multi-faceted approach to attract and retain customers. This includes direct engagement, digital marketing, and leveraging its vertically integrated model to offer comprehensive financial services.

A key acquisition channel involves direct interactions with taxi operators at industry touchpoints. The company's strategy also includes sales representatives and word-of-mouth referrals. The integrated model, providing finance, insurance, vehicle tracking, and maintenance, acts as a strong acquisition tool, differentiating it from traditional lenders. The gross loan book grew by 1% from September 2023 to March 2024, reaching R9.4 billion, which indicates ongoing customer acquisition.

Retention strategies emphasize long-term relationships. This includes personalized customer service, loyalty programs, and after-sales support for vehicle maintenance and insurance claims. Data-driven segmentation and targeted campaigns are used to offer relevant financial products and services. The focus on responsible lending and ethical collections contributes to both acquisition and retention by building trust and maintaining a positive reputation.

Transaction Capital acquires customers through direct engagement with taxi operators, sales representatives, digital marketing, and word-of-mouth referrals. These channels are crucial for reaching the target market and building relationships. The company also uses its integrated service model to attract new clients.

Retention strategies include personalized customer service, loyalty programs, and after-sales support. Data-driven segmentation and targeted campaigns are used to offer relevant financial products. A focus on responsible lending and ethical collections builds trust and maintains a positive reputation.

SA Taxi is central to Transaction Capital's customer acquisition and retention efforts. Its vertically integrated model, offering finance, insurance, and maintenance, provides a comprehensive solution. This model differentiates the company and attracts customers. The gross loan book's growth reflects successful customer acquisition.

For debt collection services, acquisition involves securing contracts with businesses and financial institutions. Retention is driven by successful collection rates, ethical practices, and transparent reporting. The company's reputation for responsible practices aids in both acquisition and retention.

Transaction Capital's primary market focus is the South African taxi industry. The company's strategies are tailored to the specific needs and behaviors of this target market. Understanding the market dynamics allows for effective customer acquisition and retention.

Customer data is used for segmentation, allowing Transaction Capital to offer relevant financial products and services. This targeted approach helps in retaining customers by meeting their specific needs at different stages of their business cycle. This approach also aids in identifying the ideal customer profile.

Building long-term relationships is a key focus of Transaction Capital's customer relationship management. Personalized service, loyalty programs, and after-sales support are essential components. This approach enhances customer lifetime value.

Transaction Capital's competitive advantage comes from its vertically integrated model and focus on the taxi industry. The company's ability to offer a comprehensive suite of services differentiates it from traditional lenders. This approach helps in market positioning.

Transaction Capital provides a range of financial services, including finance, insurance, and vehicle tracking. These services are tailored to meet the needs of taxi operators. The company’s focus on responsible lending and ethical collections is also a key aspect.

Understanding customer behavior is critical for effective acquisition and retention strategies. Transaction Capital analyzes customer needs and preferences to offer relevant products and services. This data-driven approach enhances customer loyalty and satisfaction.

Transaction Capital’s commitment to responsible lending and ethical collections is a core value. This builds trust with customers and contributes to a positive reputation. It supports both customer acquisition and retention. This approach is detailed further in this article about Transaction Capital.

- Ethical practices enhance brand perception.

- Transparency in reporting builds customer trust.

- Responsible lending ensures customer viability.

- Focus on sustainability and profitability.

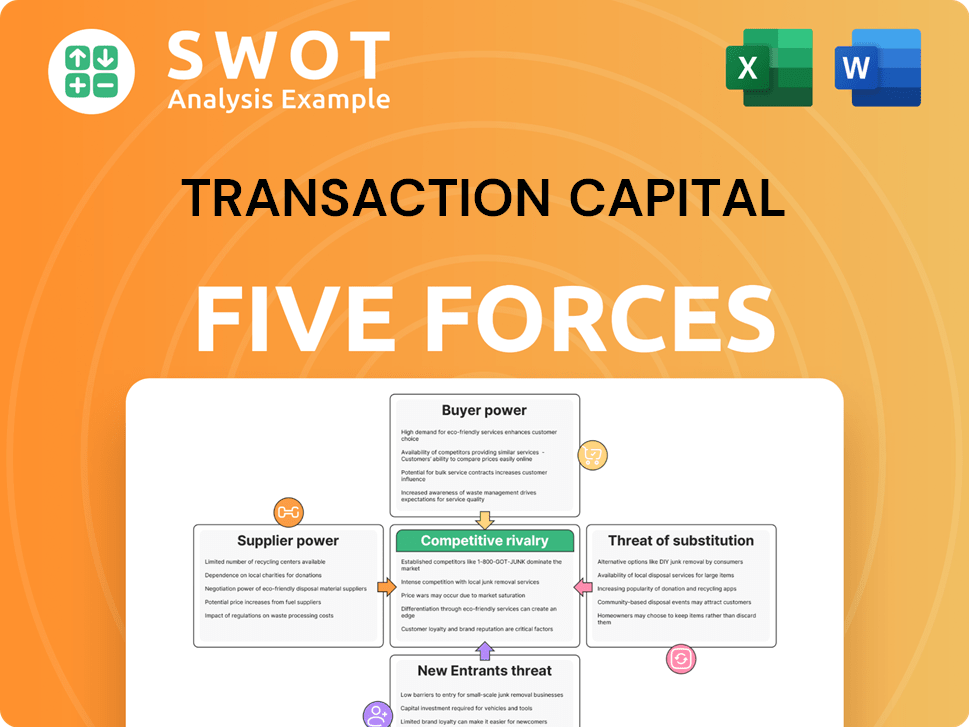

Transaction Capital Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Transaction Capital Company?

- What is Competitive Landscape of Transaction Capital Company?

- What is Growth Strategy and Future Prospects of Transaction Capital Company?

- How Does Transaction Capital Company Work?

- What is Sales and Marketing Strategy of Transaction Capital Company?

- What is Brief History of Transaction Capital Company?

- Who Owns Transaction Capital Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.