United Bank Bundle

Who Are United Bank Company's Customers?

In the ever-evolving landscape of the United Bank SWOT Analysis, understanding customer demographics and conducting a thorough target market analysis is crucial for any financial institution. United Bank Company's recent acquisition of Piedmont Bancorp in January 2025, expanding its reach to approximately $33 billion in assets, underscores the importance of adapting to changing market dynamics. This strategic move highlights the need to understand the evolving needs of its customer base within the competitive banking industry.

This exploration delves into the core of United Bank Company's customer profile, examining demographic data, geographic locations, and financial product preferences. By analyzing the target audience of United Bank Company, we can uncover how the company segments its market, identifies customer needs, and formulates effective customer acquisition strategies. This analysis will provide valuable insights into how United Bank Company navigates the complexities of the financial services sector and maintains its competitive edge.

Who Are United Bank’s Main Customers?

Understanding the customer demographics and target market of the United Bank Company involves analyzing both its consumer (B2C) and business (B2B) segments. The company provides commercial and retail banking services, alongside wealth management and trust services. While specific detailed demographic breakdowns are not publicly available, insights can be gathered from its community banking focus and strategic acquisitions.

The company's geographic footprint spans across Washington, D.C., Virginia, West Virginia, Maryland, North Carolina, South Carolina, Ohio, Pennsylvania, and Georgia. This broad reach indicates a diverse customer base. The average deposit account size is approximately $36,000, with over 650,000 total deposit accounts as of December 31, 2024, showing a wide range of individual customers.

The commercial banking segment targets businesses of varying sizes, offering commercial loans and treasury management services. The acquisition of Piedmont Bancorp, Inc. in January 2025, specifically strengthened its presence in the Southeast market, particularly in Georgia, indicating a strategic focus on expanding its business client base in high-growth metropolitan statistical areas (MSAs).

The consumer banking segment likely serves a broad demographic within its operational areas. With over 650,000 deposit accounts, the customer base is diverse. The average deposit account size of $36,000 suggests a mix of customers.

This segment focuses on businesses of various sizes, offering commercial loans and treasury management services. The acquisition of Piedmont Bancorp, Inc. in January 2025, enhanced its presence in the Southeast market. This strategic move aims to grow its business client base in high-growth MSAs.

This segment targets affluent individuals and businesses requiring specialized financial planning. These services typically appeal to customers with higher income levels and a need for sophisticated financial solutions. Specific demographic data isn't available for this segment.

The company has a strong presence in stable, rural markets while also expanding into more densely populated, high-growth MSAs. In 2024, the company achieved the number one deposit market share in West Virginia, its founding state. This demonstrates the strength of its core deposit franchise.

The United Bank Company's target market is diverse, encompassing both consumers and businesses across multiple states. The company's strategy includes organic growth and strategic acquisitions, adapting to market opportunities and demographic shifts. Understanding the Growth Strategy of United Bank helps in analyzing its evolving target market.

- Focus on community banking with a broad geographic reach.

- Serves a mix of individual customers and businesses of varying sizes.

- Wealth management services target affluent clients.

- Strategic acquisitions expand its market presence.

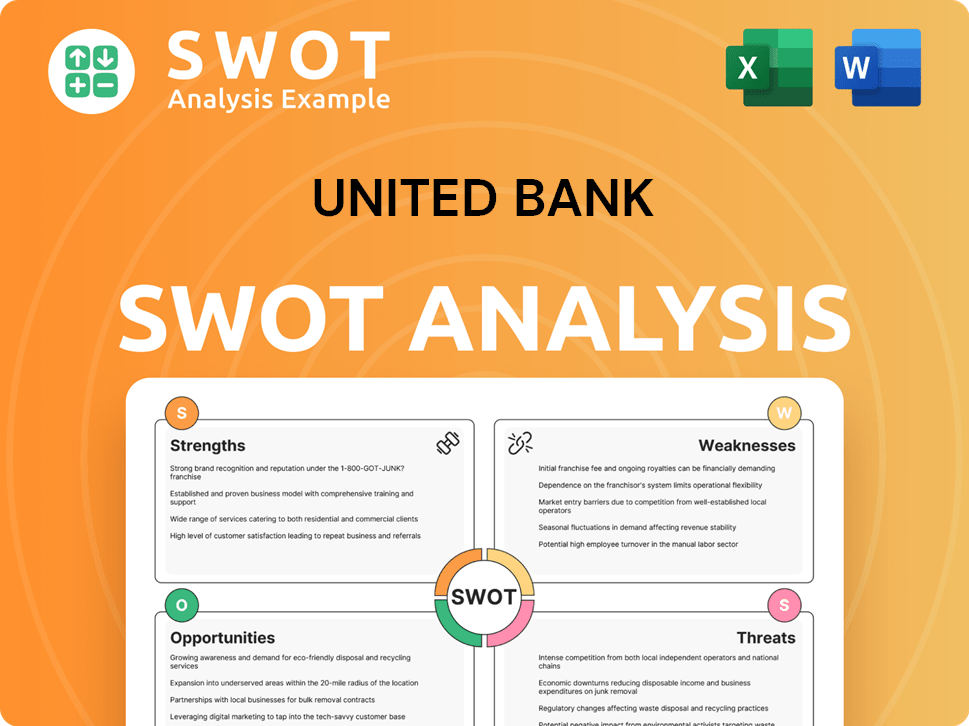

United Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do United Bank’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of United Bank Company. The bank serves a diverse customer base, each with unique requirements that drive their banking choices. From basic transactional services to complex wealth management solutions, the bank aims to cater to a broad spectrum of financial needs.

Accessibility and convenience are key drivers for customers. Digital banking is also increasingly important, with customers seeking seamless online and mobile experiences. United Bank continually enhances its digital services to meet these evolving demands, ensuring a user-friendly and efficient banking experience.

For retail customers, factors such as competitive interest rates, ease of account opening, and reliable customer service are important. Commercial clients prioritize efficient treasury management and tailored loan products. Wealth management clients seek expertise and personalized advice.

United Bank Company customers are driven by several key needs and preferences that influence their banking choices. These include the desire for accessibility, convenience, and competitive financial products. The bank's focus on digital banking and community involvement also caters to the evolving demands of its diverse customer base.

- Accessibility and Convenience: Customers value easy access to banking services. The bank has an extensive network of over 240 offices across its operating states and Washington, D.C.

- Digital Banking: Customers seek seamless online and mobile banking experiences. The bank has launched over 20 new services in internet and mobile banking.

- Competitive Financial Products: Retail customers prioritize competitive interest rates on deposits and loans.

- Community Banking: Some customers prefer banking with institutions involved in their local communities.

- Commercial Banking: Efficient treasury management and tailored commercial loan products are important for business clients.

- Wealth Management: Customers seek expertise and personalized advice for managing their financial assets.

The bank's focus on customer needs is evident in its strategic initiatives. For example, the merger with Piedmont Bancorp, Inc. in January 2025, aimed to integrate services and provide a more unified customer experience. Moreover, the bank leverages digital advancements, such as AI techniques in marketing campaigns, to engage with the public and promote its digital services, demonstrating an adaptive approach to customer communication. For more information on the bank's ownership and structure, you can read about the Owners & Shareholders of United Bank.

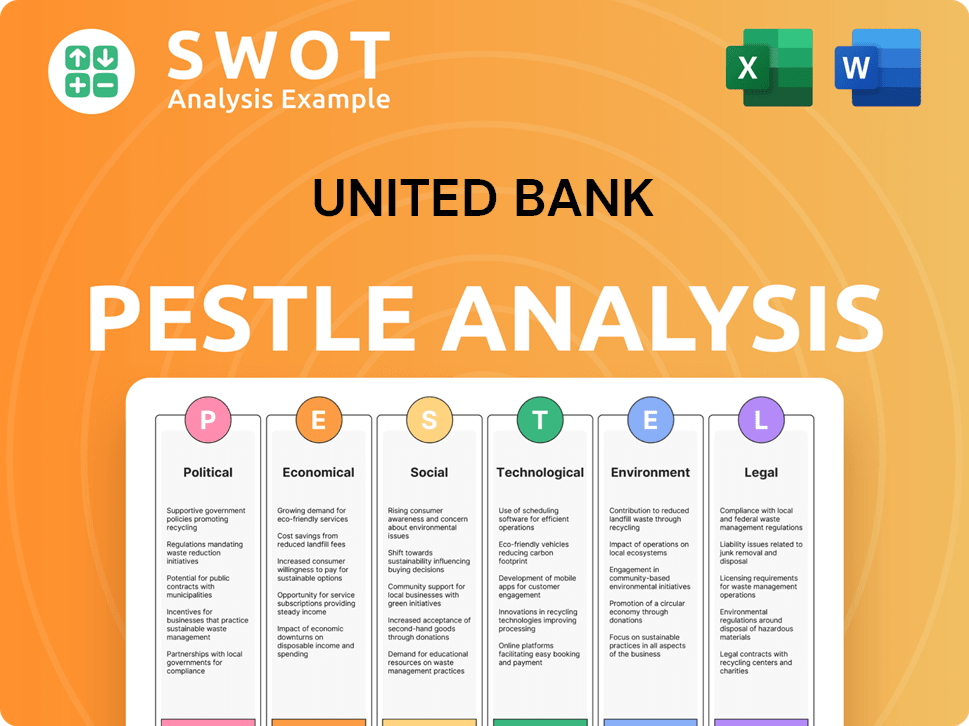

United Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does United Bank operate?

The geographical market presence of United Bankshares, Inc. is primarily concentrated in the Mid-Atlantic and Southeast regions of the United States. As of March 31, 2025, the company's banking subsidiary, United Bank, operates over 240 offices. These offices span across Washington, D.C., Virginia, West Virginia, Maryland, North Carolina, South Carolina, Ohio, Pennsylvania, and Georgia, showcasing a strategic footprint designed to serve diverse communities.

United Bank's approach involves operating through community banks, which allows for a localized focus and tailored services. This strategy has enabled the company to establish a strong presence and brand recognition in several key markets. The recent acquisition of Piedmont Bancorp, Inc. in January 2025 further solidified its position in the Southeast, adding approximately $2.4 billion in assets and 16 locations to its portfolio.

The company's expansion strategy is a key element of its growth, particularly in high-growth metropolitan statistical areas (MSAs). United Bank's ability to adapt its offerings and marketing strategies to suit diverse markets, from stable rural areas to rapidly expanding urban centers, is crucial to its success. The company's focus on understanding customer demographics and preferences allows it to effectively target its services and maintain a competitive edge within the banking industry.

United Bank holds a dominant position in its founding state of West Virginia. In 2024, it became the No. 1 bank in West Virginia by deposit market share. This reflects its strong roots and established presence in the state, demonstrating a deep understanding of the local market and customer needs.

United Bank ranks as the No. 1 regional bank and No. 7 overall in the Washington D.C. MSA. As of December 31, 2024, United held $10.1 billion in deposits, significantly increasing its market share from No. 15 in 2013. This growth highlights its successful expansion in a competitive market.

Including deposits within the D.C. MSA, United Bank holds the No. 7 position in Virginia. With $9.1 billion in deposits, the bank demonstrates a strong presence in the state. This reflects its strategic focus on serving customers in the Mid-Atlantic region.

The acquisition of Piedmont Bancorp, Inc. in January 2025, marked United's 34th acquisition, and significantly strengthened its foothold in the Southeast. This expansion brought approximately $2.4 billion in assets and 16 locations. The Southeast market is a key area for growth.

United Bank Company employs market segmentation to tailor its services. This involves understanding the diverse customer demographics and preferences across different regions. The company adapts its offerings to meet the specific needs of each market segment.

Understanding customer demographics is critical for United Bank's target market analysis. This includes factors like age, income levels, and geographic location. The company uses this data to refine its customer acquisition strategies.

United Bank Company conducts thorough target market analysis to identify its ideal customer. This includes analyzing customer interests, behaviors, and financial product preferences. This analysis helps the bank stay competitive.

Loan growth in the Carolinas, where United Bank first established its presence in 2020, was a significant driver. The loan growth in these markets was up 12.5% in 2024. This growth reflects the company's success in expanding its services.

Deposit balances increased across all regions in 2024. The fourth quarter of 2024 marked the 13th consecutive quarter of loan growth. The bank's financial performance is a testament to its strong market presence.

United Bank Company's competitive analysis includes understanding the strategies of other banks in its target markets. This helps the bank refine its customer acquisition strategies and financial product preferences. This ensures it remains competitive.

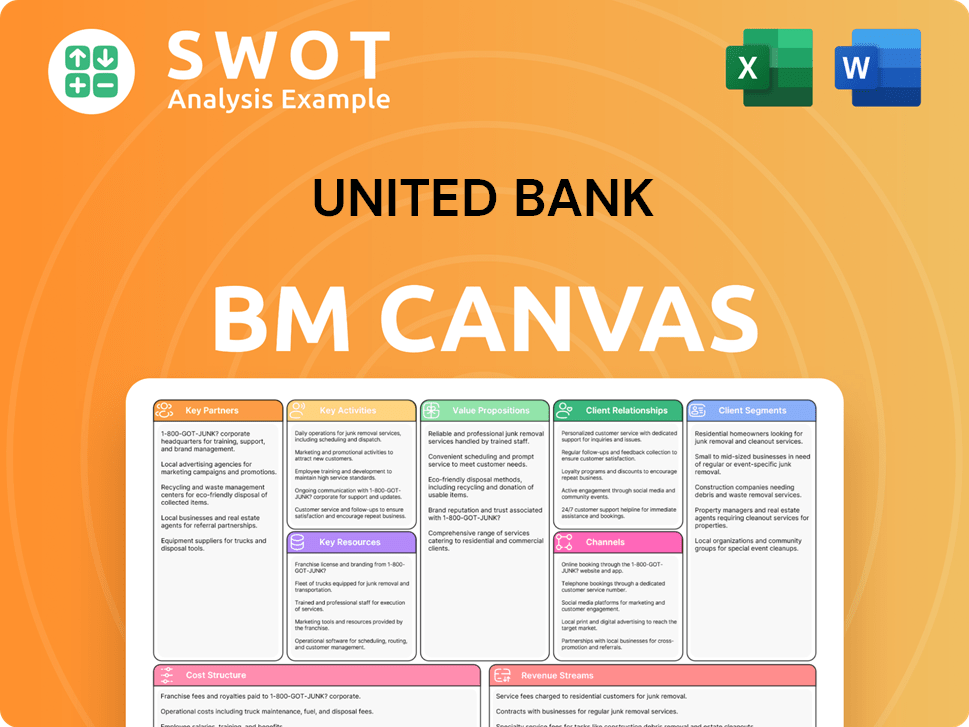

United Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does United Bank Win & Keep Customers?

Customer acquisition and retention strategies at United Bankshares are designed to cultivate long-term customer relationships, leveraging both traditional and digital channels. The company’s approach combines relationship-focused banking with digital innovation to attract and retain customers. This strategy is supported by a strong physical presence and a commitment to understanding and meeting evolving customer needs.

The bank employs a multi-faceted strategy, utilizing digital advertising, relationship-focused sales tactics, and robust loyalty programs. Digital campaigns, including the use of AI in advertising, aim to increase awareness of digital services. The company also focuses on securing comprehensive banking relationships rather than just selling individual products. This approach is designed to build lasting customer loyalty and drive sustainable growth.

Customer retention is strengthened through loyalty programs, efforts to increase shareholder value, and personalized experiences. The commitment to customer satisfaction is evident in the bank's approach to understanding customer needs. This focus influences product development and service tailoring, which supports customer retention and minimizes churn rates.

United Bank uses digital media campaigns to increase awareness of its digital services. These initiatives include the use of AI techniques in advertisements. This strategic move aims to reach a broader audience and improve customer engagement.

The bank focuses on building meaningful relationships with new prospects. This strategy prioritizes securing the entire banking relationship. The goal is to provide comprehensive financial solutions, fostering customer loyalty.

United Bank has consistently increased dividends for 51 consecutive years, demonstrating a commitment to shareholder value. This indirectly contributes to customer confidence and loyalty. The focus on shareholder value also supports customer retention.

The bank continues to enhance its digital banking platforms, including the activation of instant payment networks. It has launched over 20 new digital services to meet evolving customer preferences. These improvements enhance customer experience and retention.

United Bank's customer acquisition strategies include leveraging digital and traditional marketing channels. The bank’s physical presence, with over 240 branch offices, supports these efforts. Sales tactics emphasize building strong customer relationships to secure comprehensive banking relationships. For a deeper look into the competitive environment, consider reading about the Competitors Landscape of United Bank.

The bank is focused on optimizing existing digital tools and platforms. This strategy aligns with its long-term goals of improving customer experience. These enhancements aim to meet the evolving needs of customers.

The recent integration of Piedmont Bancorp, Inc. is a significant acquisition and retention strategy. This expands the customer base and strengthens the bank's market presence. The bank aims to provide comprehensive and convenient banking solutions.

While specific segmentation details aren't available, the focus on relationship-based banking suggests segmentation based on customer needs and financial goals. This allows for personalized service. This approach supports better customer engagement.

The bank emphasizes understanding evolving customer needs through feedback and market trends. This approach influences product development and service tailoring. This is a key retention strategy.

The bank's strategy involves understanding customer financial needs before offering tailored products. This approach ensures that the bank is meeting customer needs effectively. This strategy supports customer loyalty.

The bank's focus on digital maturity and customer experience reflects its competitive strategy. By enhancing digital tools and personalizing services, the bank aims to differentiate itself. This supports a strong market position.

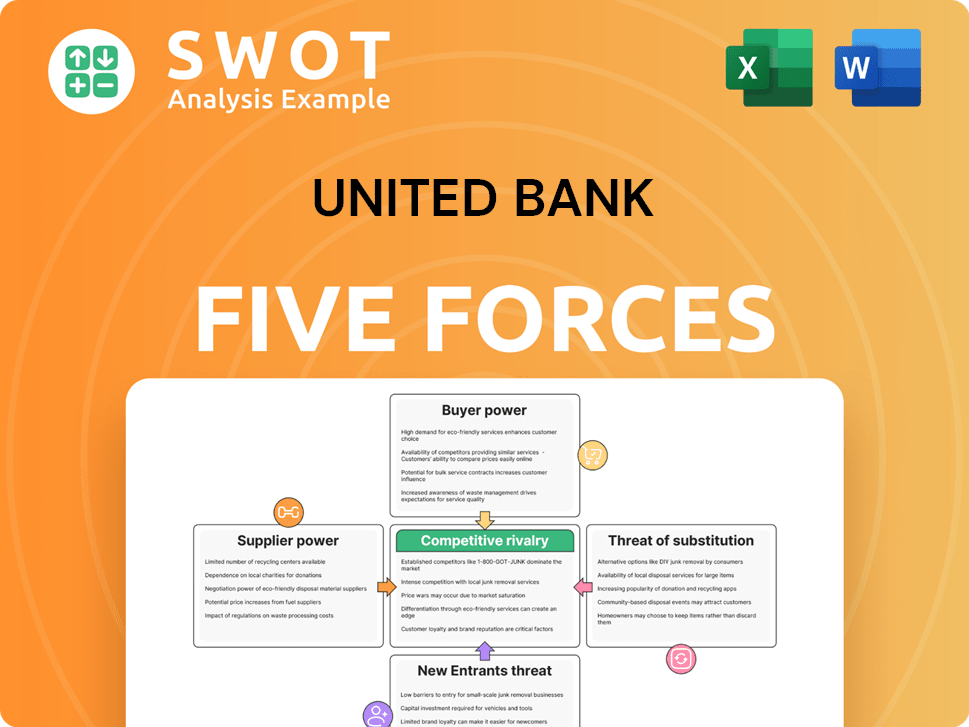

United Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of United Bank Company?

- What is Competitive Landscape of United Bank Company?

- What is Growth Strategy and Future Prospects of United Bank Company?

- How Does United Bank Company Work?

- What is Sales and Marketing Strategy of United Bank Company?

- What is Brief History of United Bank Company?

- Who Owns United Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.