Walker & Dunlop Bundle

Who Does Walker & Dunlop Serve?

In the complex world of commercial real estate, understanding the customer is key. For Walker & Dunlop, a deep dive into customer demographics and target market reveals the core of their success. From its beginnings, Walker & Dunlop has strategically evolved its focus to meet the changing needs of its clientele. This evolution highlights the importance of adapting to market dynamics.

This exploration into Walker & Dunlop SWOT Analysis will uncover the firm's customer demographics and target market, from the early days of single-family homes to its current position in commercial real estate finance. We'll delve into their market segmentation strategy, examining the types of properties they finance and the geographic locations they serve. This analysis provides valuable insights into Walker & Dunlop's customer profile and how they acquire and retain clients in the competitive real estate finance landscape, including a detailed market analysis.

Who Are Walker & Dunlop’s Main Customers?

Understanding the customer demographics and target market of Walker & Dunlop is crucial for anyone analyzing the commercial real estate sector. The company primarily focuses on serving businesses within the commercial real estate industry, making it a B2B (business-to-business) enterprise. Their core clientele includes real estate developers, institutional investors, property owners, and corporate clients, all of whom are involved in commercial property.

The target market for Walker & Dunlop is centered on entities with significant capital or investment portfolios in commercial real estate. While specific demographic breakdowns like age, gender, or income levels are not publicly detailed for their B2B clients, the focus remains on identifying and serving these high-value entities. The company's services are tailored to meet the complex financial needs of these sophisticated clients.

Walker & Dunlop's market segmentation strategy has evolved over time, adapting to the changing landscape of commercial real estate. This includes expanding beyond traditional multifamily lending to include specialized advisory services and investment opportunities in emerging sectors. This approach allows them to cater to a broader range of clients and property types, solidifying their position in the market.

Walker & Dunlop's primary customer segments include real estate developers, institutional investors, property owners, and corporate clients. These entities typically possess substantial capital and investment portfolios in commercial real estate. The company's services are designed to meet the complex financial needs of these sophisticated clients, ensuring they receive tailored solutions.

Multifamily properties represent a significant portion of Walker & Dunlop's business, accounting for 62% of their total volume in 2022. Other key property types include retail (15%), office (10%), industrial (8%), and healthcare facilities (5%). This diverse portfolio demonstrates the company's broad reach within the commercial real estate market.

Walker & Dunlop has consistently been a top GSE lender, ranking as the largest Fannie Mae DUS lender for the sixth consecutive year. They also held the position of the second-largest HUD lender in 2024. This highlights a significant segment of their clientele being involved with government-sponsored financing programs, particularly in the multifamily housing sector.

Walker & Dunlop has expanded its target segments beyond traditional multifamily lending. The addition of a data infrastructure advisory team, focusing on assets like data centers, reflects an adaptation to the evolving needs of institutional investors. The acquisition of Alliant Capital in 2021 expanded their reach into affordable housing, further diversifying their client base.

Walker & Dunlop continues to refine its market segmentation strategy to deliver tailored advisory services. This involves strategic hires in the private client space and the expansion of their investment sales team in the Southeast U.S. in 2025. These initiatives are designed to serve both institutional and private clients nationwide, ensuring the company remains competitive and responsive to market changes.

- Focus on commercial real estate developers, institutional investors, property owners, and corporate clients.

- Multifamily properties are a key focus, representing a significant portion of their business.

- Expansion into data infrastructure and affordable housing demonstrates adaptability.

- Ongoing market segmentation efforts to deliver tailored services to institutional and private clients.

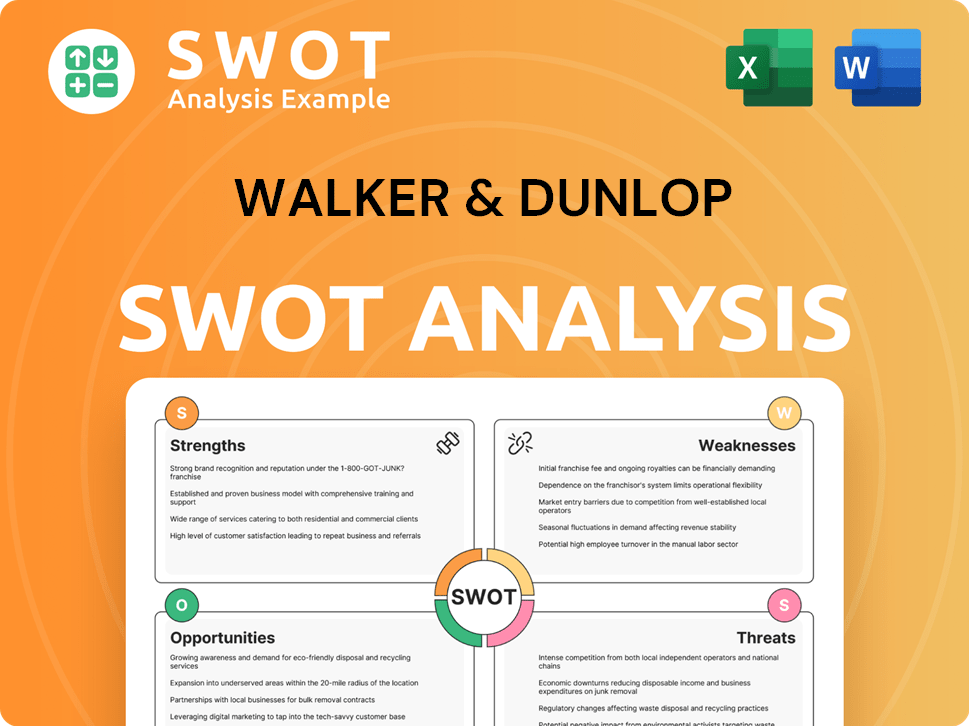

Walker & Dunlop SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Walker & Dunlop’s Customers Want?

The core customer base of Walker & Dunlop, focusing on the commercial real estate sector, is driven by the need for efficient and tailored financing solutions. Their preferences and purchasing decisions are significantly shaped by factors such as interest rates, market liquidity, and the demand for commercial real estate assets. Clients seek streamlined access to capital and comprehensive solutions across various property types and investment platforms.

A key psychological driver for choosing Walker & Dunlop is the need for trusted advisory services and expertise in a complex market. Clients look for partners who can help them build partnerships, manage risk, and source capital for transactions of all sizes and scopes. The company addresses common pain points by providing diverse financing solutions, including debt and equity capital, and offering competitive pricing models that vary based on loan type, property type, and geographic location.

Understanding the customer demographics and the target market is crucial for any financial institution. Walker & Dunlop's success is closely tied to its ability to meet these needs. The company's strategic approach to customer service and product development further solidifies its position in the market.

Walker & Dunlop's clients, encompassing a wide range of commercial real estate investors, developers, and owners, prioritize several key factors when selecting financing and advisory services. These include access to capital, expert guidance, and tailored solutions that address specific property types and investment strategies. The company's ability to meet these needs is critical to its success. For more insights into the company's broader strategy, consider exploring the Growth Strategy of Walker & Dunlop.

- Efficient Financing Solutions: Clients require streamlined access to capital with competitive terms.

- Expert Advisory Services: Clients value trusted advisors who can navigate complex market conditions.

- Comprehensive Solutions: Clients seek a full suite of services, from debt and equity financing to advisory and servicing.

- Tailored Approach: Solutions must be customized to fit specific property types and investment strategies.

- Competitive Pricing: Clients are sensitive to interest rates and fees, seeking the best value.

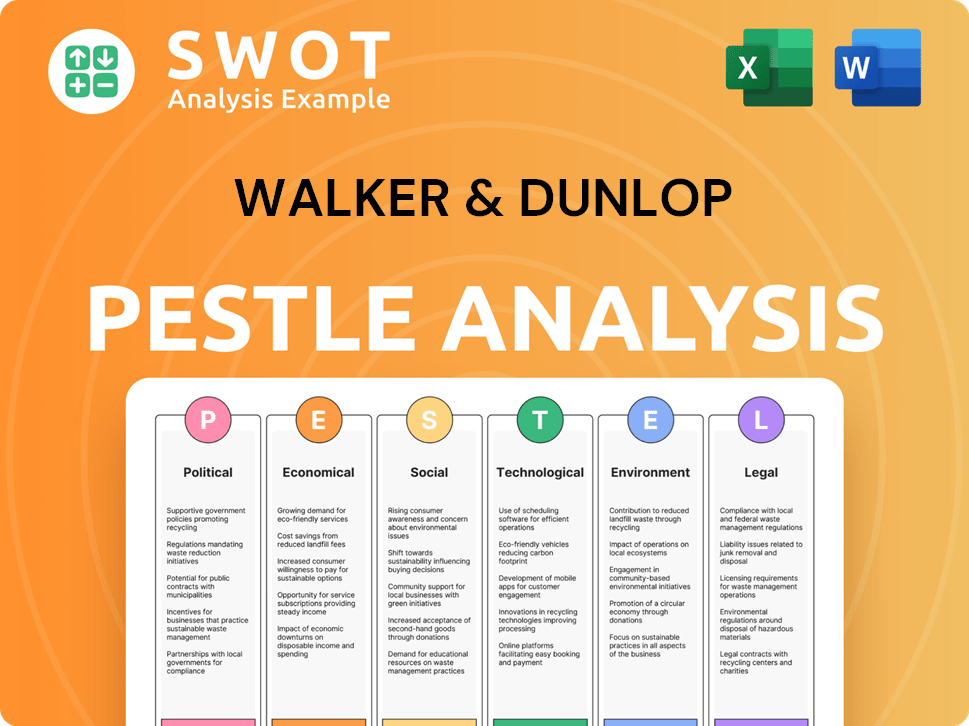

Walker & Dunlop PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Walker & Dunlop operate?

The geographical market presence of the company is primarily focused on the United States, where it maintains a strong national footprint. Their advisory services are available in 19 of the top 20 traded markets, indicating a broad reach across key metropolitan areas. This extensive presence allows them to capitalize on robust commercial real estate activity across various regions.

The company has a significant market share in the multifamily sector, consistently ranking as a leading lender for Fannie Mae DUS and a top lender for Freddie Mac and HUD. This dominance in the multifamily market underscores their ability to serve clients nationwide. They also strategically expanded internationally, establishing a London-based brokerage and capital markets advisory team in February 2025.

This expansion into the EMEA region is a strategic step to strengthen relationships with global investors and extend their commercial real estate expertise. This move is designed to localize their offerings and partnerships to succeed in diverse markets. The company's market segmentation strategy addresses differences in customer demographics, preferences, and buying power across regions.

The company's operations are predominantly in the United States, with advisory services covering 19 of the top 20 traded markets. This broad coverage enables them to serve a diverse range of clients across the country. Their strong national presence is key to their success in the commercial real estate sector.

The company is a leader in the multifamily sector, holding a significant market share. They are consistently ranked as the largest Fannie Mae DUS lender and a top lender for Freddie Mac and HUD. This leadership position highlights their expertise and strong relationships within the industry.

In February 2025, the company expanded internationally by establishing a London-based brokerage and capital markets advisory team. This move into the EMEA region aims to strengthen ties with global investors. This expansion supports their goal to extend commercial real estate expertise.

The company tailors its approach to regional opportunities, such as expanding its investment sales team in the Southeast U.S. in May 2025, with a focus on multifamily property sales. This targeted approach allows them to address specific market needs and capitalize on regional growth. The company's ability to facilitate over $10 billion in capital markets transactions in 2022, regardless of client location, highlights their national reach and capacity to connect clients to financing opportunities across various geographies.

The company's strategic focus on geographic markets is directly tied to the performance of regional commercial real estate markets. Their ability to facilitate over $10 billion in capital markets transactions in 2022, regardless of client location, highlights their national reach and capacity to connect clients to financing opportunities across various geographies. For more insights into the company's history and evolution, you can read a Brief History of Walker & Dunlop.

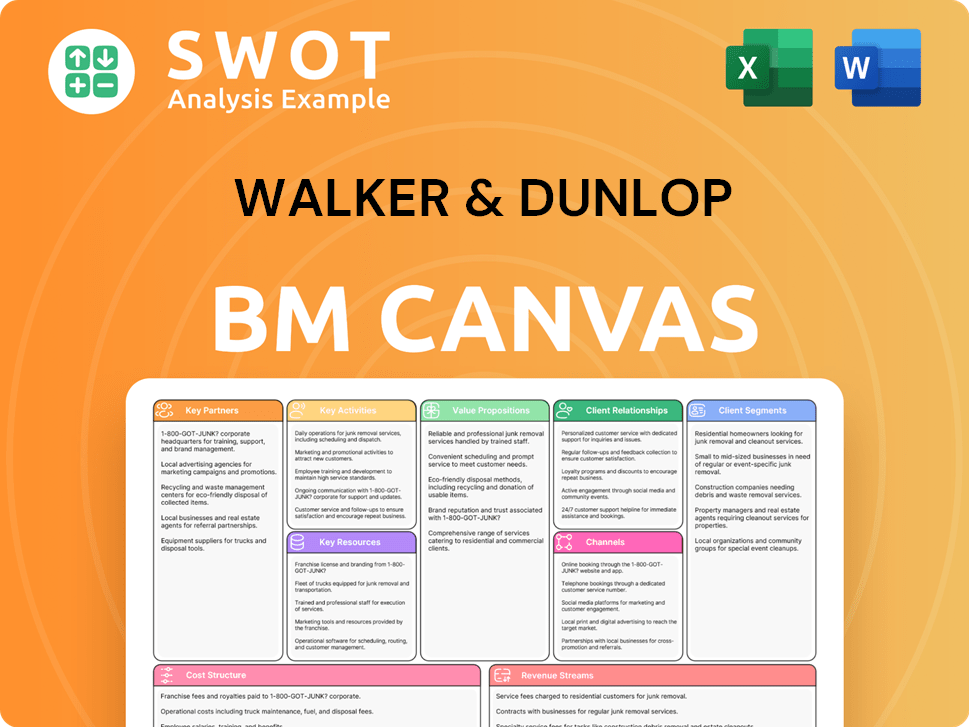

Walker & Dunlop Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Walker & Dunlop Win & Keep Customers?

Walker & Dunlop (W&D) employs a comprehensive strategy for acquiring and retaining customers in the competitive commercial real estate finance market. Their approach combines robust marketing efforts with a client-focused service model. This strategy is supported by a strong brand reputation built over many years, making them a trusted name in the industry.

The company's customer acquisition strategy leverages multiple channels to reach potential clients. These channels include digital platforms, press releases, and industry-specific reports. For example, their publications, such as the 2025 Student Housing Report, provide valuable market insights, attracting both new and existing clients. This approach helps in effectively targeting their commercial real estate and real estate finance target market.

Retention is a key focus, with W&D emphasizing long-term client relationships. This is achieved through personalized service, technology integration, and a deep understanding of client needs. As of March 31, 2025, their servicing portfolio grew by 3% to $135.6 billion, reflecting effective client retention and ongoing relationships.

W&D utilizes a variety of marketing channels, including digital platforms, press releases, and industry reports. Their strong brand reputation, built over 85 years, is a key factor in attracting new clients. They regularly release reports like the 2025 Student Housing Report to provide market analysis.

A national network of financial experts and asset class specialists provides debt and equity solutions. They emphasize a client-centric approach, tailoring solutions to individual needs. Expert analysts are assigned to each loan, providing a single point of contact and trusted advisor.

W&D leverages technology for better service delivery and analysis. This includes proprietary loan origination platforms and advanced data analytics tools. They focus on integrating technology to enhance communication and transaction tracking through digital client portals.

Successful acquisition campaigns are often tied to strong relationships with Government-Sponsored Enterprises (GSEs). In 2024, they were the largest Fannie Mae DUS lender for the sixth consecutive year. They were the fourth largest Freddie Mac Optigo lender, and the second largest HUD lender.

These strategies contribute to customer loyalty and lifetime value by providing comprehensive solutions and consistent support throughout the real estate lifecycle. For more insights into the competitive landscape, consider exploring the Competitors Landscape of Walker & Dunlop.

W&D continues to invest in its Capital Markets platform. They also focus on strategic hires and expansions, such as bolstering their private client space and expanding investment sales in the Southeast U.S. This allows them to attract and retain a broader client base.

W&D's strong position in key lending areas such as Fannie Mae, Freddie Mac, and HUD provides access to a wide array of financing options. They hold a significant market share in these areas, ensuring a steady flow of business.

Assigning an expert analyst to each loan in their servicing portfolio provides a single point of contact. This personalized service fosters strong client relationships, leading to higher client retention rates. They focus on the needs of their target audience.

W&D uses advanced data analytics tools for market assessment and decision-making. This ensures they are well-informed about market trends and can tailor their services to meet client needs effectively. They are always analyzing their target market.

The company's servicing portfolio grew by 3% to $135.6 billion as of March 31, 2025, indicating effective retention. This growth demonstrates the strength of their client relationships and their ability to retain customers over time.

W&D provides comprehensive solutions that support clients throughout the real estate lifecycle. This includes debt and equity solutions, market analysis, and ongoing support, ensuring clients remain satisfied and loyal.

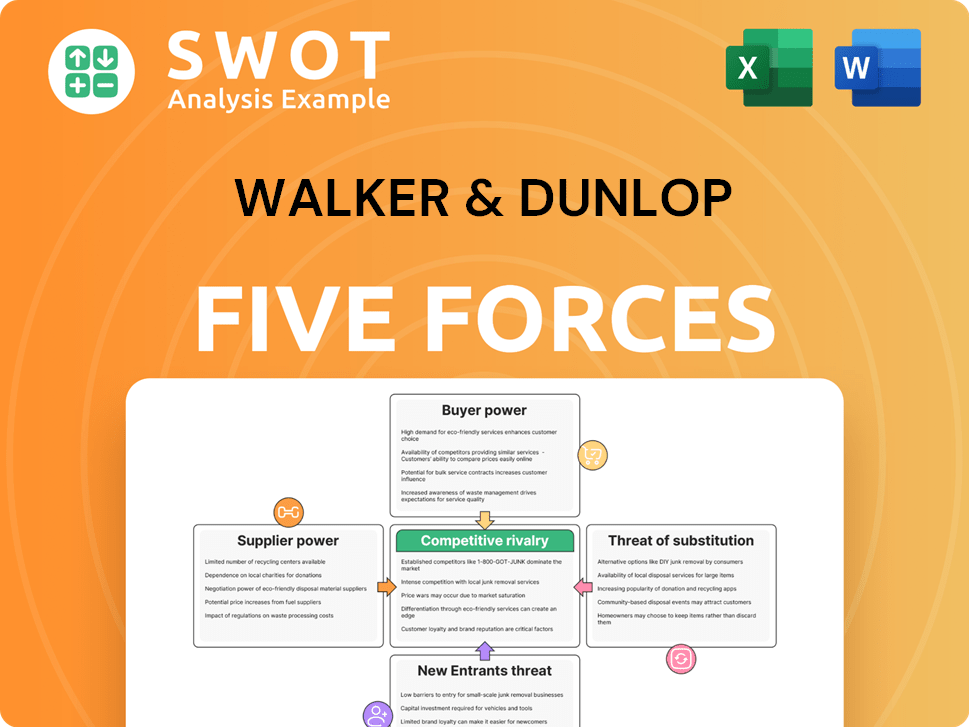

Walker & Dunlop Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Walker & Dunlop Company?

- What is Competitive Landscape of Walker & Dunlop Company?

- What is Growth Strategy and Future Prospects of Walker & Dunlop Company?

- How Does Walker & Dunlop Company Work?

- What is Sales and Marketing Strategy of Walker & Dunlop Company?

- What is Brief History of Walker & Dunlop Company?

- Who Owns Walker & Dunlop Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.