Zijin Mining Bundle

Who Buys Billions in Minerals from Zijin Mining?

Unveiling the customer demographics and target market of Zijin Mining Company is key to understanding its global dominance in the mining industry. From its humble beginnings in China to its current status as a multinational powerhouse, Zijin Mining's strategic evolution reflects a keen understanding of its customer base. This deep dive explores the company's journey, its impressive financial performance, and the vital role of Zijin Mining SWOT Analysis in navigating the complex market landscape.

Understanding Zijin Mining Company's customer profile is crucial for investors and strategists alike. This analysis delves into the company's target audience analysis, examining customer segmentation, market share by region, and customer acquisition and retention strategies. We'll explore Zijin Mining's ideal customer, considering factors like customer age range, income levels, geographic location, and interests to provide a comprehensive market analysis.

Who Are Zijin Mining’s Main Customers?

Understanding the customer base of Zijin Mining Company involves examining its business-to-business (B2B) focus. The company primarily serves industrial clients, including refiners, processors, and the Shanghai Gold Exchange. This customer segmentation is crucial for Zijin Mining's strategic planning and market analysis.

The target market for Zijin Mining is defined by the demand for raw materials like gold, copper, zinc, lithium, silver, and molybdenum. These materials are essential for various manufacturing sectors and global economic growth. Therefore, customer demographics for Zijin Mining are less about individual consumer profiles and more about the operational needs and strategic goals of its business clients.

Zijin Mining's customer profile is centered around large-scale industrial entities that require significant volumes of mineral resources. The company's market share by region is influenced by the location of its mining operations and the distribution networks for its products. The company's ideal customer is one that can purchase large quantities of minerals, ensuring a steady revenue stream.

Zijin Mining segments its customers based on the type of mineral and the scale of their operations. Major customer groups include refining and processing enterprises. The company's focus is on providing high-quality mineral raw materials to support global economic growth.

The target market for Zijin Mining is driven by the accelerating demand for essential minerals due to electrification trends and clean energy initiatives globally. Copper and lithium are key strategic priorities. The company aims to be among the world's top copper producers.

Zijin Mining's market trends are closely linked to the global demand for minerals used in various industries. The company's strategy includes expanding its production capacity for copper and lithium. The competitive landscape includes other major mining companies vying for market share.

Customer acquisition strategies for Zijin Mining involve securing long-term supply agreements with key industrial clients. Customer retention strategies focus on providing reliable, high-quality mineral products. The company's success hinges on its ability to meet the evolving needs of its customers.

Zijin Mining's primary customer segments include refining and processing enterprises, particularly those involved in copper and zinc production. The company also supplies the Shanghai Gold Exchange for gold transactions. The company is targeting a copper production of 750,000 tonnes by 2025, and a lithium carbonate equivalent production capacity of 40,000 tonnes by 2025.

- The company's focus on copper is driven by the increasing demand from the electric vehicle and renewable energy sectors.

- Zijin Mining aims to become a major lithium producer to capitalize on the growing market for lithium-ion batteries.

- The company's strategic goals are supported by its Owners & Shareholders of Zijin Mining, who are committed to long-term value creation.

- Zijin Mining's customer geographic location is influenced by the location of its mining operations and the distribution networks for its products.

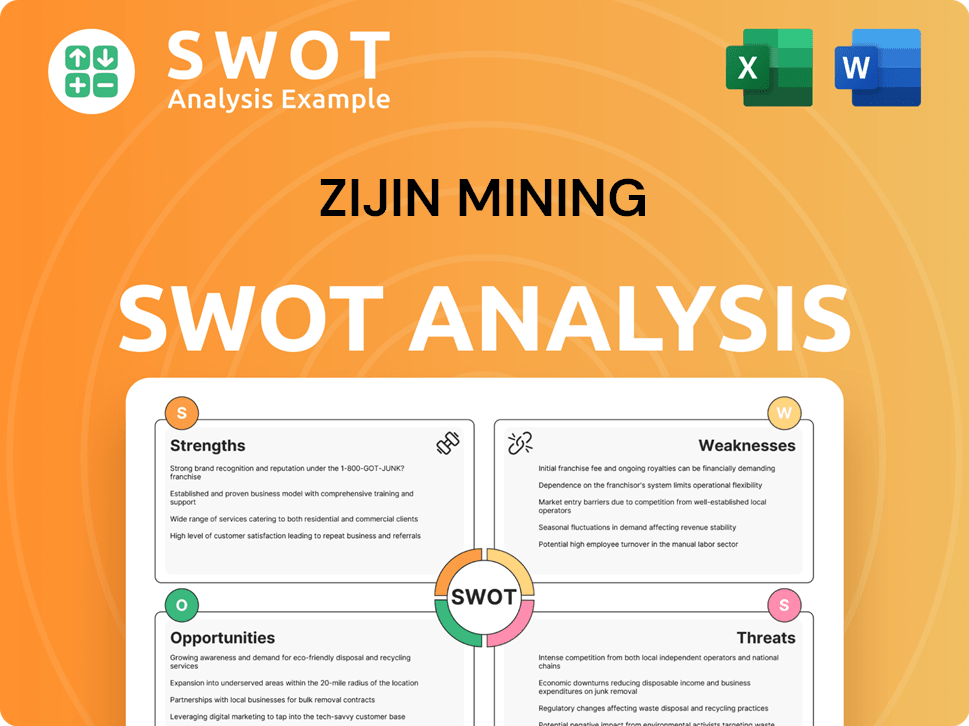

Zijin Mining SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Zijin Mining’s Customers Want?

Understanding the customer needs and preferences is crucial for any company's success, and for Zijin Mining Company, this involves a deep dive into the demands of its primarily industrial customer base. This analysis helps in refining strategies, ensuring customer satisfaction, and maintaining a competitive edge in the mining industry.

Zijin Mining Company's focus on consistent supply, high-quality raw materials, and cost-effectiveness addresses the core needs of its customers. These factors are paramount in the decision-making processes of industrial entities, which are heavily influenced by global commodity prices, production demands, and the stability of the supply chain.

The company's ability to maintain a low-cost structure is a significant advantage. For instance, the 2024 copper C1 cost decreased by 14% year-on-year to USD 0.93/Ib, positioning it in the top 20% percentile globally. This cost-effectiveness is a key factor for cost-sensitive industrial buyers. The Revenue Streams & Business Model of Zijin Mining provides insights into how the company generates value, which is directly related to its ability to meet customer demands.

Customers are drawn to Zijin Mining Company because of its reliability and the scale of its production. These factors are critical for industrial customers who need a consistent and substantial supply of raw materials.

Adherence to quality standards is another key driver. Industrial buyers require materials that meet stringent specifications, and Zijin Mining Company aims to meet these needs.

Zijin Mining Company addresses common pain points by focusing on large-scale development and leveraging advanced technological innovation in geological exploration, hydrometallurgy, and comprehensive recycling of low-grade refractory resources.

Zijin Mining Company maintains a customer needs database to promptly communicate customer suggestions and needs to relevant departments, facilitating continuous improvement in product quality and service.

The company's commitment to becoming a 'Green, High-Tech, Leading Global Mining Company' aligns with increasing industry demand for responsibly sourced and sustainably produced materials, particularly as the global energy transition accelerates.

This is especially relevant for critical metals like copper and lithium, which are vital for low-carbon technologies. The company's focus on these metals positions it well to meet future customer demands.

Understanding the customer needs and preferences of Zijin Mining Company's target market is crucial for strategic planning and maintaining a competitive edge. Here are key considerations:

- Cost-Effectiveness: The company's ability to maintain low production costs, as demonstrated by its 2024 copper C1 cost, is a significant advantage.

- Reliability and Scale: Customers value a consistent supply of high-quality materials, which Zijin Mining Company aims to provide through its large-scale operations.

- Quality Standards: Meeting stringent quality specifications is essential for industrial buyers.

- Technological Innovation: Investing in advanced technologies, such as hydrometallurgy, improves efficiency and addresses customer needs.

- Sustainability: Aligning with the growing demand for responsibly sourced and sustainably produced materials is crucial for long-term success, especially in the context of the global energy transition.

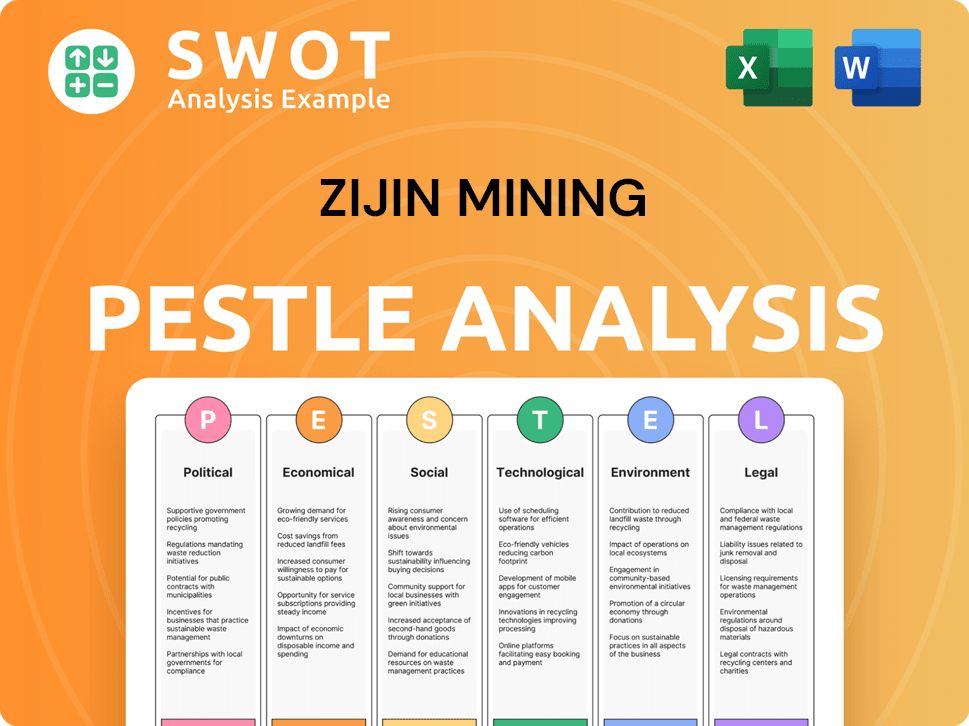

Zijin Mining PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Zijin Mining operate?

The geographical market presence of Zijin Mining Company is extensive, encompassing operations in numerous countries across Asia, Africa, Europe, and the Americas. With over 30 large-scale mineral resource development bases, the company has a significant global footprint. This widespread presence is a key factor in its ability to serve a diverse customer base and navigate varying market conditions.

Zijin Mining's strategic focus on international expansion is evident through its investments and operations in resource-rich regions. This global strategy allows the company to tap into diverse mineral resources and serve a broad target market. The company's approach includes both organic growth and strategic acquisitions to strengthen its market position.

The company's market share and brand recognition are particularly strong in key regions. Zijin Mining's success is underpinned by its ability to localize operations, adapt to local regulations, and build strong relationships within each market.

Key regions for Zijin Mining include the Democratic Republic of Congo (DRC), where the Kamoa Copper Mine is a cornerstone of its copper production. Serbia, home to the Čukaru Peki Copper and Gold Mine and the Bor Copper Mine, is another major contributor. Peru, Colombia, Suriname, Argentina and China also represent significant markets for the company.

Zijin Mining plans to acquire at least three major mining operations by mid-2025, demonstrating its commitment to expanding its global presence. The company restructures internally to mobilize dedicated regional management teams that can respond swiftly to local market opportunities and regulatory environments.

In 2023, Zijin Mining's segment revenue from sales to external customers reached RMB 293.403 billion, highlighting the company's strong market position and diversified customer base. This figure underscores the company's ability to generate substantial revenue across its various geographical segments.

The Tres Quebradas Salar Mine in Argentina is a key lithium asset, with total lithium carbonate equivalent production capacity expected to reach 40,000 tonnes by 2025. This expansion will significantly contribute to the company's diversification into the lithium market.

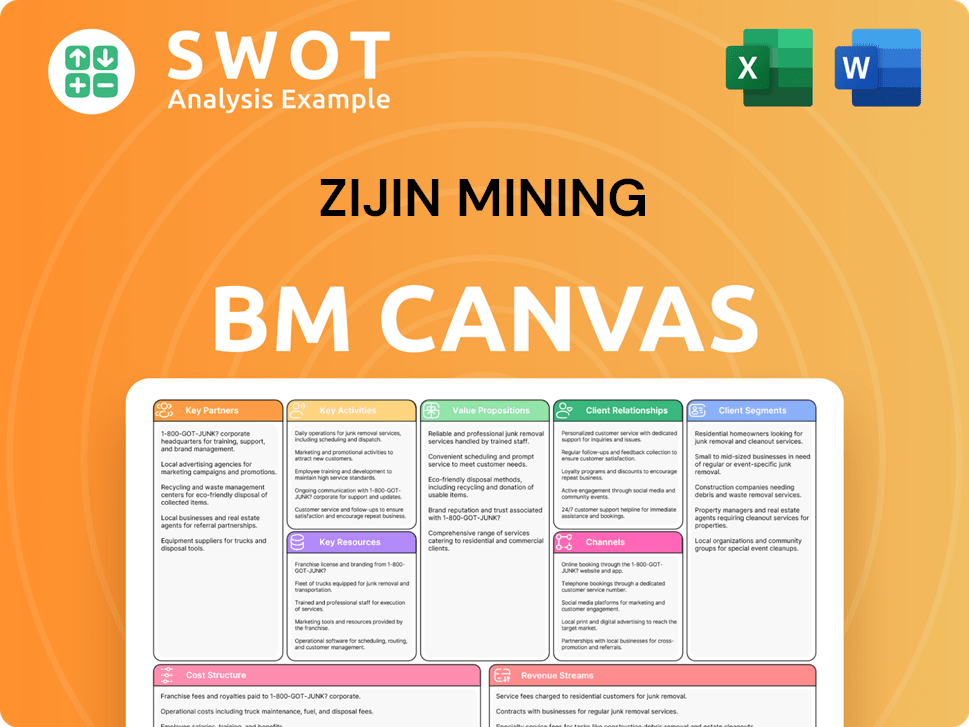

Zijin Mining Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Zijin Mining Win & Keep Customers?

The customer acquisition and retention strategies of Zijin Mining are intricately linked to its business-to-business (B2B) model, focusing on securing and expanding its resource base and production capacity. As a major supplier of raw mineral resources, the company's primary strategy revolves around attracting industrial buyers by ensuring a steady supply of essential materials. This involves a combination of strategic acquisitions, technological advancements, and a commitment to operational excellence.

Zijin Mining's approach to customer acquisition and retention is heavily influenced by its focus on the mining industry's long-term supply agreements and the consistent delivery of high-quality products. Their strategies are designed to foster strong relationships built on reliability and trust, crucial in the B2B mining sector. The company's commitment to sustainable practices and responsible supply chain management further enhances its appeal to customers who prioritize environmental, social, and governance (ESG) factors.

Zijin Mining's customer acquisition strategy is primarily driven by securing and expanding its resource base to meet the global demand for minerals. This is achieved through strategic mergers and acquisitions, technological innovation, and a focus on production growth and reliability. The company's ability to provide a consistent and reliable supply of minerals at competitive prices is a key factor in attracting and retaining industrial buyers.

Zijin Mining has a robust M&A strategy, allocating over $7 billion for international acquisitions and development projects. This includes acquiring assets in resource-rich regions, such as the La Arena Copper-Gold Mine in Peru and the Akyem Gold Mine in Ghana. In early 2025, Zijin Mining announced the proposed acquisition of a controlling stake in Zangge Mining, which holds significant interests in copper, potash, and lithium assets.

Technological innovation is a core strength, with advanced methods used in geological exploration and resource utilization. This focus on efficiency and cost control, such as the 14% year-on-year decrease in copper C1 cost to USD 0.93/Ib in 2024, enhances attractiveness to industrial customers seeking competitive pricing. These advancements directly contribute to the company's ability to offer competitive pricing and maintain profitability.

Consistent growth in mineral output ensures a reliable supply for customers. The projected compound annual growth rate (CAGR) for copper is 8% and 14% for gold between 2024-2026. Consistently surpassing production targets for key minerals builds confidence among buyers. This growth in production capacity is essential for meeting the increasing global demand for minerals.

Zijin Mining uses various channels to gather customer feedback related to products and services. They establish a customer needs database to promptly communicate feedback to production, technical, and quality departments, leading to continuous product improvement. This ensures that the company can adapt its offerings to meet the evolving needs of its customers.

Customer retention in the B2B mining sector is largely driven by long-term supply agreements, consistent product quality, and strong relationships built on reliability and trust. Zijin Mining focuses on responsible supply chain management, customer service, and ESG performance to maintain and strengthen these relationships. The company's commitment to sustainability and operational excellence is critical for retaining its customer base.

- Responsible Supply Chain Management: Zijin Mining aims to continuously improve and standardize processes for responsible supply chain management, providing training for employees on sustainable development and strengthening collaboration with upstream and downstream partners.

- Customer Service and Feedback Integration: Zijin Mining utilizes various channels to collect customer information related to products and services. They establish a customer needs database to promptly communicate feedback to production, technical, and quality departments, leading to continuous product improvement.

- ESG Performance and Sustainable Development: The company integrates ESG principles into its operations, aiming to become a 'Green, High-Tech, Leading Global Mining Company.' This commitment to sustainable development and providing materials for a low-carbon future resonates with customers who prioritize environmental responsibility.

The company's focus on ESG principles and sustainable development is a key factor in attracting and retaining customers who prioritize environmental responsibility. Zijin Mining's commitment to becoming a "Green, High-Tech, Leading Global Mining Company" aligns with the increasing demand for sustainable and ethically sourced materials. Further insights into the strategies can be found in the Growth Strategy of Zijin Mining.

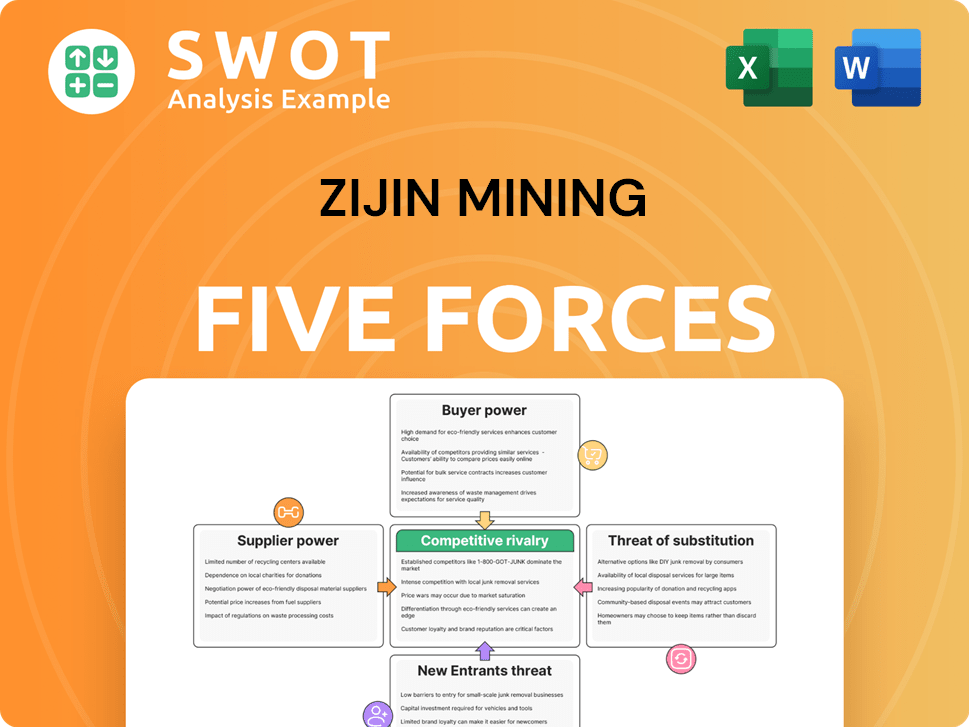

Zijin Mining Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Zijin Mining Company?

- What is Competitive Landscape of Zijin Mining Company?

- What is Growth Strategy and Future Prospects of Zijin Mining Company?

- How Does Zijin Mining Company Work?

- What is Sales and Marketing Strategy of Zijin Mining Company?

- What is Brief History of Zijin Mining Company?

- Who Owns Zijin Mining Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.