Aon PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aon Bundle

What is included in the product

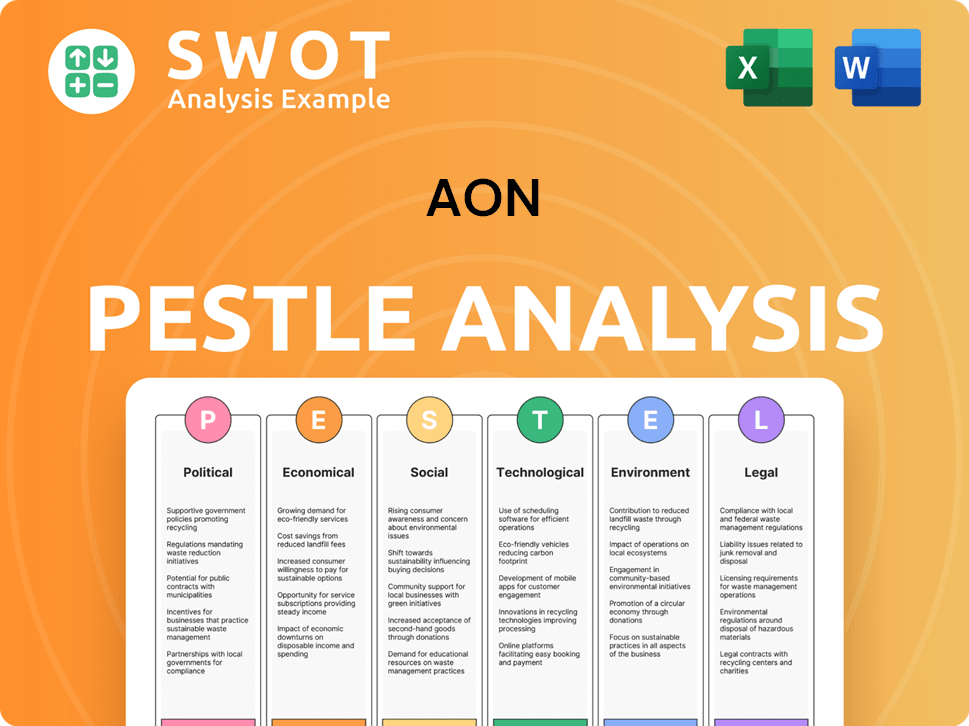

Analyzes how external factors shape Aon across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

The Aon PESTLE analysis streamlines complex data with readily available key insights.

What You See Is What You Get

Aon PESTLE Analysis

We're showing you the real product. This Aon PESTLE analysis preview reveals the complete, expertly crafted document.

What you see here is what you'll download immediately after purchasing. Get the same professional structure.

Every detail displayed here—from content to format—is fully preserved. The finished document awaits.

PESTLE Analysis Template

Uncover Aon's strategic landscape with our concise PESTLE Analysis.

We dissect political, economic, social, technological, legal, and environmental factors impacting Aon. Understand market forces shaping their trajectory, gaining a vital competitive edge.

This insightful report equips you to navigate complexities, forecast trends, and make informed decisions. Purchase the full analysis now for actionable intelligence and unlock a deeper understanding.

Political factors

The insurance and risk management industries are heavily regulated worldwide. Aon must comply with a complex web of rules, including NAIC in the U.S. and Solvency II in the EU. These regulations affect Aon's global operations significantly. In 2024, Aon reported $13.4 billion in revenue, reflecting its compliance costs.

Geopolitical risks and political instability can affect Aon's international business. The Russia-Ukraine conflict, for example, has led to increased compliance costs. Political uncertainties in key countries can impact insurance markets and increase risk assessment expenses. In 2024, Aon reported that geopolitical risks continue to be a significant factor in its operations.

Changes in trade policies, like those seen with the USMCA agreement, directly influence Aon's international business. These shifts can reshape global supply chains, affecting the risks companies manage. For instance, new tariffs could raise costs for Aon's clients, impacting their insurance needs. Aon's expertise in navigating these changes is crucial, especially with the potential for further trade policy adjustments in 2024-2025.

Government Scrutiny of Corporate Practices

Government scrutiny of corporate practices is intensifying, focusing on risk management and regulatory compliance. This includes areas like anti-bribery and trade restrictions, which can trigger investigations and penalties. Aon's Code of Business Conduct is designed to address these concerns and ensure adherence to laws. In 2024, the DOJ secured over $5.2 billion in False Claims Act settlements and judgments.

- The Securities and Exchange Commission (SEC) issued 807 enforcement actions in fiscal year 2024.

- Aon faces potential risks from non-compliance, including financial penalties and reputational damage.

- Aon's commitment to compliance is crucial to navigate these challenges effectively.

Political Violence and Civil Unrest

Political instability, including violence, strikes, and civil unrest, poses significant risks to businesses. These events can disrupt operations, damage infrastructure, and halt supply chains, leading to financial losses. Aon offers political risk insurance and risk management services to help clients navigate these challenges.

- In 2023, global political violence caused over $100 billion in economic damage.

- Aon's political risk solutions cover various threats, including expropriation and currency inconvertibility.

- Political risk insurance premiums have risen by 10-15% in high-risk regions in 2024.

Political factors critically shape Aon’s operations globally, particularly through regulations and geopolitical events. Compliance with evolving rules and managing geopolitical risks, like conflicts, are essential.

Changes in trade policies and rising government scrutiny also significantly affect Aon’s strategies. Non-compliance leads to penalties.

Political instability, including violence, can severely disrupt businesses and impact insurance needs. Aon’s services help mitigate these complex political exposures.

| Political Factor | Impact on Aon | Data Point (2024-2025) |

|---|---|---|

| Regulations | Compliance Costs | Aon revenue $13.4B (2024) |

| Geopolitical Risks | Increased Costs/Risks | Political risk premiums up 10-15% |

| Trade Policies | Reshape Supply Chains | USMCA impacts intl. business |

Economic factors

Aon's financial health is tied to global economic cycles and market volatility. Slow economies, inflation, and changing interest rates can influence the need for Aon's services, impacting revenue. For instance, in 2024, Aon's revenue was about $13.4 billion, reflecting these economic shifts. Rising interest rates could affect insurance premiums and affect Aon's advisory services.

Inflation and interest rate shifts are key for Aon. Rising rates, like the Federal Reserve's 2023 hikes, can slow investment and business growth. This impacts Aon's revenue and costs. For instance, higher rates affect the pricing of insurance premiums. Aon's wealth solutions are also influenced by market performance tied to interest rates.

Economic shifts prompt clients to rethink investments and business plans, influencing demand for Aon's services. For example, in Q1 2024, global M&A activity decreased by 15% year-over-year. This decrease can affect Aon's transaction solutions. Economic downturns can also lead to budget cuts, potentially impacting consulting projects.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly affect Aon's financial performance. These fluctuations can negatively impact adjusted earnings per share and the profitability of its global operations. For example, a strong U.S. dollar can reduce the value of Aon's earnings from international markets when translated back into U.S. dollars. In 2024, Aon's international revenue accounted for a substantial portion of its total revenue. Therefore, managing currency risk is crucial for Aon's financial stability.

- Currency fluctuations can lead to lower reported earnings.

- International operations are particularly vulnerable to currency risk.

- A strong dollar can diminish the value of foreign earnings.

- Aon uses hedging strategies to mitigate currency risks.

Market Competition and Pricing

Aon faces intense competition in insurance brokerage and consulting. This competitive landscape affects pricing strategies and market share. Competitors constantly vie for clients, impacting profitability margins. Aon's ability to adapt to pricing pressures is crucial.

- In 2024, the global insurance market was valued at over $6 trillion, with fierce competition among major players.

- Pricing dynamics are influenced by factors such as risk assessment models and claims payouts.

- Aon's market share in specific segments can vary, for example, Aon's revenue in Q1 2024 was $3.3 billion.

Economic factors heavily affect Aon's financial outcomes and service demand. Fluctuations in interest rates, currency exchange rates, and inflation significantly influence the company's profitability. In 2024, Aon reported approximately $13.4 billion in revenue. Also, in Q1 2024, the company's revenue was $3.3 billion.

| Economic Factor | Impact on Aon | Data Point (2024) |

|---|---|---|

| Interest Rates | Affects insurance premiums, investments, wealth solutions | Federal Reserve interest rate hikes |

| Currency Exchange Rates | Influences international earnings, profitability | International revenue a key portion of total. |

| Inflation | Influences client investment, service demand | Q1 2024 M&A decreased by 15%. |

Sociological factors

Aon must navigate evolving workforce demographics, including varying generational expectations. Data from 2024 shows a shift with Gen Z entering the workforce, demanding different work-life balance and tech integration. Attracting and retaining top talent is critical; Aon's 2023 report highlighted a 15% increase in talent acquisition costs. Employee wellbeing and strong value propositions, such as enhanced benefits, are crucial. A 2024 study indicates that companies with robust wellbeing programs see a 10% increase in employee retention.

Social determinants like income, education, and housing significantly influence employee health and well-being, impacting productivity and healthcare costs. Aon's solutions help employers identify and mitigate health disparities, potentially boosting employee engagement. For example, companies with robust wellness programs see a 15% reduction in healthcare expenses. Addressing these factors can enhance workforce performance. Aon's data shows that companies with strong social support programs have 10% lower absenteeism rates.

DEIB is increasingly critical, shaping corporate policies and practices. Aon actively develops DEIB solutions, reflecting societal shifts. In 2024, 68% of companies reported DEIB initiatives. Aon's DEIB consulting saw a 15% growth in 2024. This focus is vital for talent acquisition and retention.

Changing Attitudes Towards Risk and Responsibility

Shifting societal views on risk, encompassing climate change and corporate social responsibility, are reshaping investor choices and business conduct. Aon is actively integrating Environmental, Social, and Governance (ESG) factors into its service offerings and internal operations. This strategic pivot reflects a broader trend toward stakeholder capitalism. This is influencing market dynamics.

- 2024: ESG-focused investments reached $40.5 trillion globally.

- Aon's ESG-related revenue grew 15% in the last year.

- Over 70% of institutional investors now consider ESG factors.

Impact of Social Inflation on Insurance Claims

Social inflation, fueled by factors such as rising jury awards, significantly impacts insurance claims, especially in casualty coverage. This trend increases the severity of claims, affecting the cost and availability of specific insurance types. For example, the average jury award in the U.S. has risen, with some sectors facing substantial payout increases. This inflates insurers' expenses, influencing premiums and coverage options.

- In 2024, social inflation is projected to continue impacting insurance costs.

- Casualty insurance is especially vulnerable to these rising claim costs.

- The legal environment, including litigation funding, is a key driver.

Workforce demographics shift, impacting talent management and retention efforts. Addressing social determinants and DEIB initiatives boosts employee well-being and productivity, affecting corporate policies. Evolving views on risk, including ESG factors, drive market dynamics, requiring strategic integration.

| Aspect | Impact | Data (2024-2025) |

|---|---|---|

| Workforce Demographics | Changes in expectations and preferences. | Gen Z entry, talent acquisition cost up 15%. |

| Social Determinants | Influence on employee health, productivity. | Wellness programs boost retention by 10%. |

| DEIB Initiatives | Shape corporate policies, impact talent. | 68% companies report DEIB programs; Aon's DEIB consulting grew by 15%. |

Technological factors

The swift advancement of technology and the embrace of digital transformation are reshaping industries globally. Aon is actively using technology to improve its services and internal processes. For instance, Aon's digital platforms saw a 20% increase in user engagement in 2024, enhancing client interactions. They are also investing heavily in AI and data analytics, with a planned $150 million investment by early 2025.

Cybersecurity risks are a major worry for businesses worldwide, with cyberattacks and data breaches on the rise. Aon offers cybersecurity risk management solutions to help clients assess and reduce these threats. According to a 2024 report, the average cost of a data breach hit $4.45 million globally. Aon's services are crucial to navigate the ever-changing tech landscape.

Aon leverages data, analytics, and AI for advanced risk assessment and client solutions. Aon's investments in data analytics, including AI, aim to enhance its advisory capabilities. For instance, in 2024, Aon's data-driven solutions helped clients manage over $1 trillion in assets. This allows Aon to provide more tailored and effective services.

Technology and System Failure

Technology and system failures pose significant risks, potentially causing business disruptions and reputational harm for Aon and its clients. The increasing reliance on digital platforms and data processing makes robust technology infrastructure essential. Aon must prioritize system reliability and resilience to mitigate these risks effectively. In 2024, cyberattacks cost businesses globally an average of $4.5 million.

- Aon's technology spending increased by 8% in 2024.

- Cybersecurity incidents rose by 15% in the insurance sector in Q1 2024.

- The average downtime cost due to system failures is $5,600 per minute.

Innovation in Service Delivery

Technological advancements are reshaping how professional services, like those offered by Aon, are delivered. This includes the use of online platforms, mobile apps, and data-driven tools to improve service delivery. Aon is allocating significant resources to technology to enhance client experiences. In 2024, Aon's technology investments showed a 15% increase. This focus on tech integration is key to staying competitive.

- Aon's tech investments rose by 15% in 2024.

- Focus on digital platforms for service delivery.

- Use of data analytics to enhance client value.

Aon's tech investments increased by 8% in 2024, with cybersecurity incidents rising. Aon leverages AI and data analytics, helping manage over $1 trillion in assets in 2024. The average downtime cost from system failures is $5,600 per minute. Digital platforms enhance service delivery, with a 15% increase in tech investments by Aon.

| Factor | Details | Impact |

|---|---|---|

| Digital Transformation | 20% increase in user engagement in 2024. | Improved client interactions. |

| Cybersecurity | Cybersecurity incidents rose by 15% in the insurance sector in Q1 2024 | Increased risk, necessitates proactive solutions. |

| Data and Analytics | Helped clients manage over $1 trillion in assets in 2024. | Enhanced advisory capabilities, better risk assessment. |

Legal factors

Aon faces intricate global compliance demands, spanning insurance, risk, and financial reporting. It must adhere to data privacy rules like GDPR and anti-corruption laws, such as FCPA and UK Bribery Act. In 2024, Aon's legal expenses were approximately $250 million, reflecting compliance efforts.

Legal shifts in insurance and risk management directly affect Aon. Recent updates involve capital requirements and underwriting rules. For instance, the implementation of Solvency II in Europe continues to shape Aon's strategies. These regulations affect how Aon manages risk and offers products. Compliance costs also rise due to these changes, impacting profitability.

Aon faces strict data privacy laws, including GDPR, which mandate strong data protection. Compliance raises operational costs. In 2024, Aon's legal and regulatory expenses were approximately $300 million, reflecting these compliance needs. The company's robust data security measures are essential given its handling of sensitive client information.

Litigation and Legal Liability

Aon and its clients face potential litigation and legal liability related to professional services and unforeseen events. The legal landscape is evolving, with social inflation affecting jury awards, potentially increasing liabilities. For instance, in 2024, the insurance industry faced significant legal challenges, with billions paid out in settlements. Changes in regulations, such as those impacting data privacy, also increase legal risks.

- In 2024, the insurance industry paid out billions in settlements due to litigation.

- Data privacy regulations continue to evolve, increasing legal risks for companies.

Antitrust and Competition Law

Aon's operations, particularly mergers and acquisitions, face scrutiny under antitrust and competition laws globally. These laws, like the Sherman Act in the U.S. or the EU's competition regulations, aim to prevent monopolies and ensure fair market practices. Compliance is critical, considering potential fines that can be significant, such as the $1.1 billion fine imposed on Google by the EU in 2017 for antitrust violations.

- In 2024, the FTC blocked several mergers due to competition concerns.

- Antitrust investigations can delay or halt Aon's strategic moves.

- Aon must ensure fair pricing and prevent anti-competitive behavior.

Aon navigates complex legal demands, including data privacy and anti-corruption laws; in 2024, compliance expenses totaled around $300 million. Changes in insurance and risk regulations, like Solvency II, drive up costs and shape business strategies. Litigation risks and antitrust scrutiny, especially in M&A, pose further legal challenges for Aon, potentially delaying strategic moves and attracting hefty fines.

| Legal Area | 2024 Impact | Examples/Data |

|---|---|---|

| Compliance Costs | Increased expenses | ~ $300M in compliance, per company reports |

| Regulatory Changes | Strategic adjustments | Solvency II impacts risk management in EU |

| Litigation/Antitrust | Increased risks | Antitrust fines can reach billions (e.g., Google) |

Environmental factors

Climate change poses a major environmental risk for businesses. The rise in extreme weather events, such as floods and storms, is increasing. Aon assists clients in assessing and handling these climate-related dangers. In 2024, insured losses from natural disasters reached $118 billion. Businesses must adapt and mitigate these risks.

The move towards a net-zero economy globally is transforming business landscapes. Aon is actively working towards net-zero emissions in its operations. They are also helping clients manage risks and seize opportunities in this transition. In 2024, the global market for green technologies is estimated at $3 trillion, growing yearly.

Evolving environmental regulations and sustainability standards significantly affect business operations. Aon actively integrates sustainability into its practices. This includes helping clients comply with these standards. For instance, in 2024, Aon's ESG-related revenue increased by 15%.

Increased Focus on ESG Factors

Aon actively addresses the rising importance of Environmental, Social, and Governance (ESG) factors. Investors, regulators, and the public are increasingly focused on ESG, influencing business strategies. Aon incorporates ESG considerations into its services, aiding clients in managing related risks. The company also publishes its own ESG performance data. In 2024, sustainable investments reached $4.2 trillion in the U.S.

- Aon integrates ESG into risk management and consulting.

- The company reports on its ESG performance.

- Sustainable investments are a growing market.

Natural Catastrophe Exposures

Changing weather patterns and other elements are causing more natural catastrophes, which can result in major economic losses. These events have a big impact on the insurance and reinsurance markets. Aon offers solutions to help clients handle these increasing exposures effectively. In 2024, global insured losses from natural catastrophes reached $118 billion.

- 2024: Global insured losses from natural catastrophes reached $118 billion.

- Aon's solutions help manage and mitigate risks.

- Changing climate patterns increase the frequency and severity of disasters.

Environmental factors significantly shape business strategies due to climate change impacts, net-zero transitions, and stringent regulations. Businesses face escalating risks from extreme weather, with $118B in insured losses in 2024. Moreover, the expanding green technology market, estimated at $3T in 2024, highlights growth opportunities and regulatory demands.

| Environmental Factor | Impact | 2024 Data/Trend |

|---|---|---|

| Climate Change | Increased risks from extreme weather | $118B insured losses from nat cats |

| Net-Zero Transition | Business transformation, opportunities | Green tech market estimated at $3T |

| ESG and Regulations | Compliance costs, changing operations | ESG-related revenue +15% (Aon) |

PESTLE Analysis Data Sources

Our PESTLE analyzes leverage diverse, credible data from governmental, institutional & research sources, including financial markets and demographic data.