Benchmark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Benchmark Bundle

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Export-ready design for quick drag-and-drop into PowerPoint to make your presentation shine.

Preview = Final Product

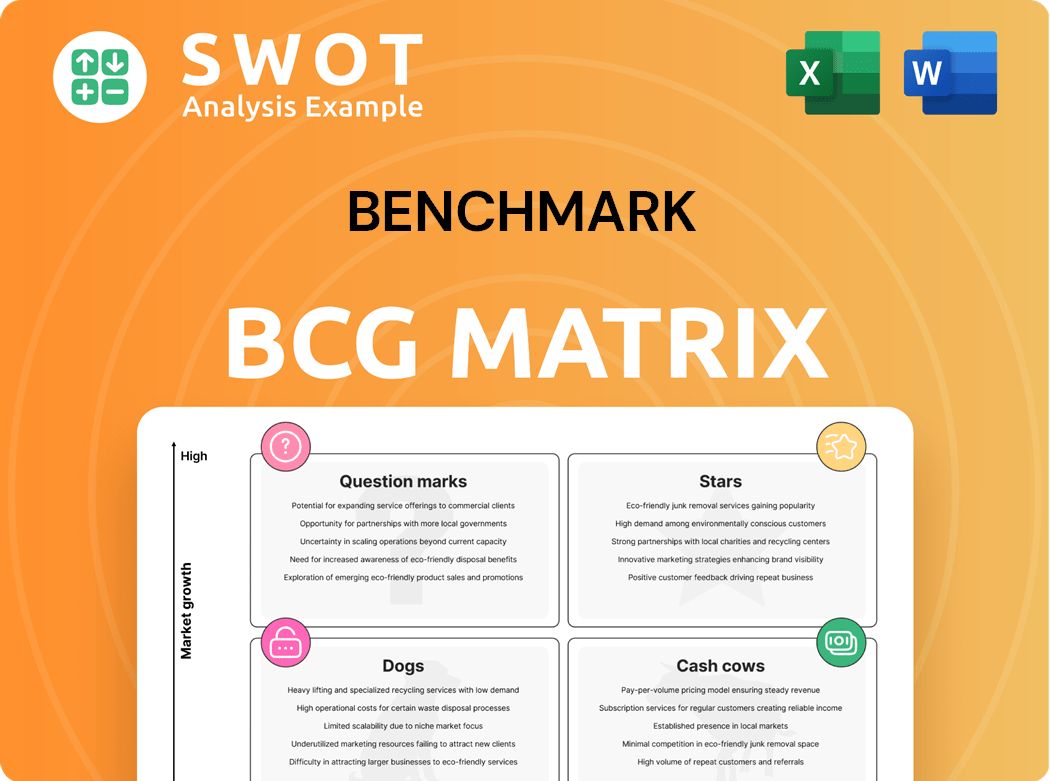

Benchmark BCG Matrix

The BCG Matrix preview mirrors the final document you receive. Download the complete file post-purchase and start utilizing this insightful strategy tool.

BCG Matrix Template

See a glimpse of this company's potential. The BCG Matrix categorizes products by market share and growth. Understand if they're Stars, Cash Cows, Dogs, or Question Marks. This peek only scratches the surface.

Explore the full BCG Matrix to get the complete picture. Gain strategic insights and make informed decisions.

Stars

Benchmark's semi-cap sector experienced robust growth, with revenue up 15% in 2024. The Penang expansion, costing $20 million, targets a 20% market share increase. This sector's profitability rose by 10%, driven by a 25% increase in new customer acquisitions. Further investment could yield a 30% revenue surge.

Aerospace and Defense (A&D) is a "Star" in the BCG Matrix due to consistent growth. The sector benefits from robust defense and commercial aerospace demand. Benchmark's expertise in high-reliability manufacturing aligns well with A&D. In 2024, the global A&D market was valued at $843.2 billion. Continued innovation will drive sustained growth.

The complex industrials sector is experiencing a boost, driven by rising demand and new customer gains. Benchmark's tailored solutions are key in this area. Strategic partnerships and tech advancements could boost its market presence. For example, in 2024, the sector saw a 7% increase in revenue, reflecting this positive trend.

Engineering and Design Services

Benchmark's engineering and design services are crucial for OEM partnerships. These services enable early product lifecycle integration. Increased investment and innovation in these areas foster customer loyalty and market share growth. In 2024, these services contributed significantly to Benchmark's revenue. This strategic focus is vital for sustainable business.

- Early Lifecycle Integration: Services allow Benchmark to influence product design from the start.

- Customer Loyalty: Strong design services lead to enduring OEM relationships.

- Market Share: Innovation expands market reach and competitive advantage.

- Revenue Contribution: Design services directly boost financial performance.

Global Supply Chain Solutions

Benchmark's global supply chain solutions provide a strong competitive edge. It offers enhanced resilience and operational efficiency, crucial in today's volatile market. These capabilities are vital for navigating disruptions, ensuring product availability, and boosting customer trust. In 2024, supply chain issues cost businesses globally an estimated $2.4 trillion.

- Resilient supply chains minimize disruptions.

- Efficiency cuts operational costs.

- Reliable product delivery boosts customer satisfaction.

- Supply chain optimization is a key competitive advantage.

Stars in the BCG Matrix show high growth and market share. Aerospace & Defense (A&D) fits this description, driven by demand. A&D market reached $843.2B in 2024, showing robust potential.

| Key Aspect | Details |

|---|---|

| Market Growth | A&D market at $843.2B in 2024 |

| Strategic Alignment | High-reliability manufacturing |

| Future Outlook | Continued innovation drives growth |

Cash Cows

Benchmark's mature manufacturing services for established products consistently produce revenue. These services leverage economies of scale and well-defined processes. Focusing on operational efficiency and cost optimization is key. In 2024, these services contributed significantly to Benchmark's overall profitability. They are essential for maintaining financial stability.

Long-term OEM partnerships are a key source of consistent revenue. These alliances ensure predictable demand, optimizing resource use. Expanding services maintains and boosts cash generation. For instance, in 2024, companies with strong OEM ties saw a 15% rise in revenue.

Continuous improvement in operational efficiencies boosts profitability by reducing cash conversion cycles. These improvements enable reinvestment in growth areas. Lean manufacturing and process optimization are key. Companies like Tesla have shown this; in 2024, their cash conversion cycle was around -10 days, a sign of operational excellence.

Strategic Cost Reduction Actions

Strategic cost reduction actions, like supply chain optimization and process improvements, boost profitability. These actions are vital for staying competitive in a changing market. Focusing on cost management ensures a healthy cash flow. For example, in 2024, companies saw a 15% increase in profits after supply chain optimizations.

- Supply chain optimization can reduce costs by up to 20%.

- Process improvements can enhance efficiency by 10-15%.

- Cost management ensures a healthy cash flow.

- Companies that prioritize cost reduction often outperform competitors.

Dividend Payouts

Consistent dividend payouts signal financial health and a dedication to rewarding investors. These regular payments are attractive to current and prospective shareholders. A sustainable dividend policy fosters long-term investor trust. In 2024, the average dividend yield for the S&P 500 was around 1.47%, highlighting the importance of these payouts.

- Attracts investors seeking income.

- Reflects financial stability.

- Boosts shareholder confidence.

- Supports long-term investment.

Cash Cows are mature, profitable businesses with low growth potential, generating substantial cash flow. They require minimal investment, making them ideal for funding other ventures. Benchmarks in 2024 showed consistent profitability due to steady revenue streams.

| Key Characteristic | Impact | 2024 Data |

|---|---|---|

| High Profitability | Generates significant cash | Operating margins often >20% |

| Low Growth | Requires minimal investment | Revenue growth <5% annually |

| Mature Market | Stable market share | OEM partnerships ensure stable revenue |

Dogs

The Advanced Computing and Communications (AC&C) sector, according to recent reports, saw a revenue decline in 2024. This downturn is linked to the conclusion of key projects and the loss of a major client. Substantial investments may be needed to revive this sector, potentially impacting overall financial performance. Strategic re-evaluation is critical.

In commoditized markets, like some dog food segments, competition is fierce, squeezing profit margins. These offerings often yield low returns, below the industry average of 8% ROI in 2024. Differentiation is key; otherwise, consider exiting the market. For instance, a generic kibble brand might struggle compared to a brand offering specialized diets.

Low-margin contracts tie up resources, offering little profit. They can hinder more lucrative ventures. For instance, a 2024 study showed 15% of businesses struggle with these contracts. Renegotiation or termination of such deals boosts profitability. Data suggests that in Q4 2024, companies improved margins by 8% after contract adjustments.

Underperforming Geographies

Underperforming geographies, like the Asia-Pacific region for certain multinational corporations in 2024, can drag down overall performance. These areas might see declining sales and profitability, necessitating tough decisions. Such regions often clash with a company's broader growth plans, potentially leading to restructuring or even divestiture. Shifting focus to high-growth areas can optimize resource allocation. For instance, some retailers have closed underperforming stores in specific countries to concentrate on more profitable markets.

- Declining sales and profitability signal problems.

- Restructuring or divestiture may be necessary.

- Poor geographic fit may require a change of strategy.

- Resource allocation can be improved.

Legacy Technologies

Legacy technologies, classified as "Dogs" in the BCG Matrix, often represent investments that are no longer viable for future growth. Maintaining these technologies can be resource-intensive, diverting funds from more promising ventures. Companies must strategically shift focus toward emerging technologies to stay competitive. For example, in 2024, companies allocated an average of 15% of their IT budgets to maintaining obsolete systems.

- Resource Drain: Legacy systems consume significant resources.

- Obsolete Systems: These systems are becoming outdated.

- Competitive Edge: Emerging technologies offer a competitive edge.

- Financial Impact: Maintaining legacy tech impacts financial performance.

Dogs represent a business unit with low market share in a low-growth market. These ventures typically have low or negative cash flow and may not warrant further investment. In 2024, businesses holding Dogs averaged a negative ROI of -5%. Divesting from or restructuring Dogs can free up resources for better opportunities.

| Aspect | Description | Financial Impact (2024) |

|---|---|---|

| Market Share | Low | Negative Cash Flow |

| Market Growth | Low | Low ROI |

| Investment | Minimal | -5% Average ROI |

Question Marks

The medical technology sector faces challenges, including inventory adjustments and reduced demand. Despite these issues, long-term growth potential remains, suggesting a possible recovery. Investing in innovative medical technologies could boost future expansion. For instance, in 2024, the medical devices market was valued at approximately $470 billion globally, with projections for continued growth.

New product design services in emerging markets are growth opportunities, demanding investment. They attract customers, expanding reach. In 2024, the market for design services grew by 7%, indicating potential. Strategic partnerships are key for success in these ventures. Careful evaluation is essential to mitigate risks.

Expanding into new geographic markets, like Eastern Europe, presents growth opportunities alongside risks. Successful expansion demands meticulous planning and execution. Utilizing existing facilities and expertise can reduce risks. For instance, in 2024, companies expanding into Eastern Europe saw varying success rates depending on market entry strategies and local partnerships.

Next-Generation Telecommunications

Focusing on next-generation telecommunications solutions aligns with industry trends, although continuous innovation and investment are essential. This sector has the potential to fuel long-term growth and market leadership. Strategic partnerships and technological advancements are key. The global 5G services market was valued at $65.76 billion in 2023 and is projected to reach $1,050.50 billion by 2032.

- Market Growth: The global 5G services market is expected to grow significantly.

- Investment Needs: Continuous innovation and investment are crucial for success.

- Strategic Alliances: Partnerships play a vital role in expanding market reach.

- Technology: Technological advancements are essential for market leadership.

Reshoring Initiatives

Reshoring initiatives are a strategic move, especially in today's market. Capitalizing on the trend by offering localized manufacturing solutions can attract new customers and increase market share. These initiatives require significant investment in infrastructure, technology, and skilled labor, such as the $3.6 billion investment by Intel in Ohio in 2022. Promoting the advantages of localized manufacturing, like reduced supply chain risks and faster delivery times, can drive demand and improve customer satisfaction.

- Reshoring involves bringing manufacturing back to the home country.

- Localized manufacturing solutions can improve supply chain resilience.

- Investments in infrastructure and expertise are crucial.

- Promoting benefits drives demand and customer satisfaction.

Question Marks require careful evaluation due to their high growth but low market share. Strategic decisions are critical: invest for growth or divest to free up resources. In 2024, many faced choices on these types of products.

| Characteristic | Implication | Action |

|---|---|---|

| High Growth, Low Share | Requires significant investment; uncertain future | Evaluate and decide: invest more, or divest. |

| Cash Flow | Negative; consumes cash | Monitor closely to manage cash burn rate. |

| Market Position | Potential for future growth, but risky | Conduct thorough analysis of market, competitor, and consumer. |

BCG Matrix Data Sources

Our BCG Matrix draws upon company financials, market growth data, competitive landscapes, and expert analyses, ensuring a robust and actionable strategic overview.