Brown-Forman Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Brown-Forman Bundle

What is included in the product

Tailored analysis for Brown-Forman's diverse product portfolio.

Printable summary optimized for A4 and mobile PDFs.

What You’re Viewing Is Included

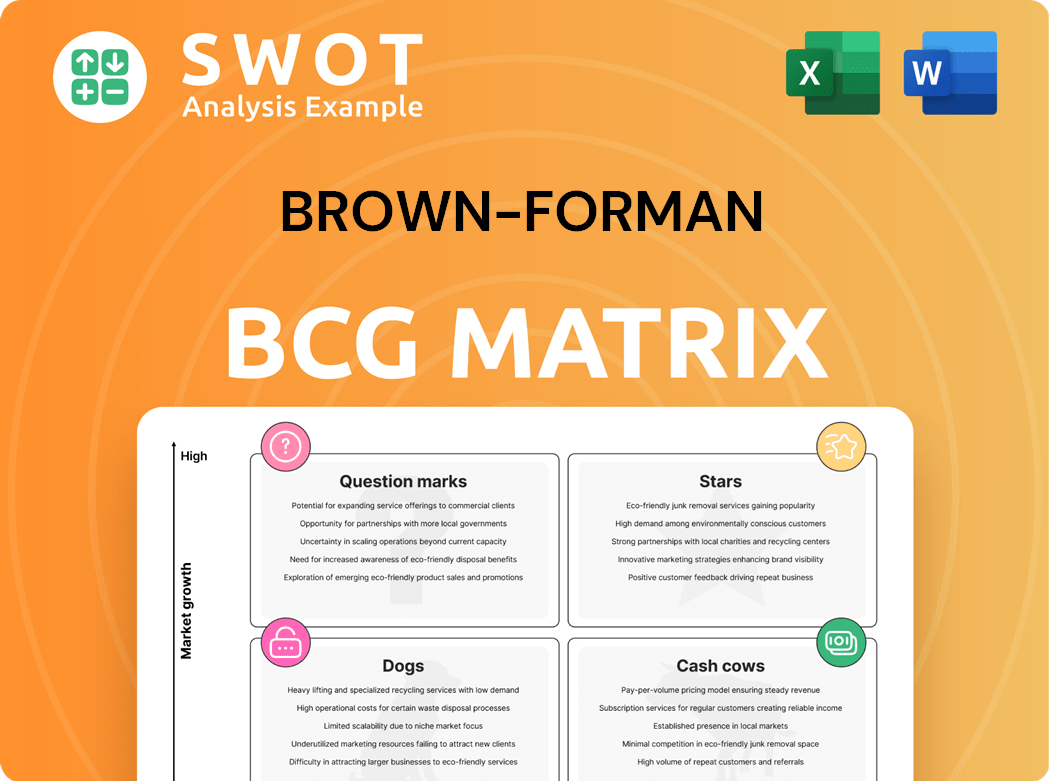

Brown-Forman BCG Matrix

The BCG Matrix you see here is the full version you'll receive instantly after purchase. Complete with comprehensive analysis, it's a ready-to-use tool for immediate strategic planning.

BCG Matrix Template

Brown-Forman's BCG Matrix maps its diverse brands across market growth and share. This tool reveals which products drive revenue (Cash Cows). It also identifies potential future stars and those needing strategic attention (Question Marks). Discover which brands are market leaders (Stars) and those to consider divesting (Dogs).

This glimpse provides a taste, but the full BCG Matrix offers comprehensive insights. Gain a deep understanding of each brand's strategic position and recommended actions. Purchase now for a clear, actionable roadmap.

Stars

Jack Daniel's is a star for Brown-Forman, benefiting from strong brand recognition. The brand's global net sales grew by 1% in fiscal year 2024. Innovations like Jack Daniel's & Coca-Cola RTD boost its market position. Jack Daniel's continues to be a key revenue driver.

Woodford Reserve, a star in Brown-Forman's portfolio, demonstrates robust growth. Its premium positioning and innovative offerings, like the Kentucky Derby bottle, drive success. The brand's commitment to sustainability also attracts consumers. In fiscal year 2024, Brown-Forman's reported net sales increased by 3%, with Woodford Reserve contributing significantly.

Herradura, a premium tequila by Brown-Forman, shines as a "Star" in its BCG matrix. Tequila's popularity surged, with the category growing significantly in 2024. Despite US market competition, Herradura leads, supported by innovations like Herradura Legend. Brown-Forman's 2024 Q3 report showed strong tequila sales, solidifying Herradura's position.

Diplomático Rum

Diplomático Rum, acquired by Brown-Forman in 2022, is a star in their portfolio, showing strong double-digit growth. This growth is fueled by solid performance in Europe and travel retail. Diplomático is the second-largest super-premium+ rum in Global Travel Retail (GTR). Special releases, like the Single Vintage 2008, boost its appeal.

- Acquired in 2022, Diplomático Rum fuels double-digit growth.

- Second-largest super-premium+ rum in GTR.

- Strong performance in Europe and travel retail.

- Special releases like Single Vintage 2008.

Gin Mare

Gin Mare, a rising star in Brown-Forman's portfolio, shows robust growth, especially in key markets like Germany and Spain. Its appeal lies in its unique Mediterranean botanicals and premium positioning. Brown-Forman's strategic investments boost its expansion. Gin Mare's sales surged, reflecting its strong consumer appeal.

- Gin Mare's ultra-premium gin sales are increasing.

- The brand's revenue growth is supported by strong demand.

- Brown-Forman's investments are boosting Gin Mare's market presence.

These brands are key revenue drivers for Brown-Forman, with strong growth and global recognition. In fiscal year 2024, brands such as Jack Daniel's and Woodford Reserve showed sales increases. Innovations and premium positioning enhance market presence.

| Brand | Fiscal Year 2024 Net Sales Growth | Key Strategy |

|---|---|---|

| Jack Daniel's | 1% | RTD innovation |

| Woodford Reserve | 3% | Premium positioning, sustainability |

| Herradura | Strong sales | Market leadership |

| Diplomático | Double-digit | GTR, Europe growth |

Cash Cows

Jack Daniel's, a Brown-Forman cash cow, consistently generates substantial revenue. In fiscal year 2024, the brand's net sales were $986 million. It benefits from high brand recognition and consumer loyalty, maintaining profitability despite market fluctuations. Efficient distribution and pricing strategies support its financial stability.

Old Forester, a Brown-Forman brand, exemplifies a cash cow due to its steady growth, especially in the US. The premium bourbon's appeal is boosted by effective marketing. In 2024, Brown-Forman reported consistent sales for Old Forester, driven by consumer preference for quality. Its established market presence and consistent revenue streams solidify its cash cow status.

Korbel California Champagnes, a cash cow for Brown-Forman, leverages its strong brand presence in the sparkling wine market. Despite experiencing some volume decreases, Korbel maintains steady cash flow. Its efficient operations support profitability, with the brand holding a significant market share. In 2024, Korbel's sales contributed to Brown-Forman's overall revenue.

El Jimador Tequila

El Jimador, a key player in Brown-Forman's portfolio, is categorized as a Cash Cow. Despite seeing sales dip recently, it maintains a strong market presence, particularly in Mexico. This tequila's widespread appeal and affordability solidify its position as a reliable revenue generator. Strategic marketing is key to sustaining its profitability.

- El Jimador experienced a 2% sales decline in 2023.

- It holds a significant market share in the mid-price tequila segment.

- Its distribution network spans across numerous countries.

- Its profitability is supported by efficient production.

New Mix

New Mix, Brown-Forman's tequila-based RTD, is a "New Mix" in the BCG matrix. It has seen strong organic sales growth, with double-digit increases in 12 of the last 13 quarters. This growth is fueled by the RTD's popularity, especially among younger consumers, and its expansion in Mexico. Innovation like the new tamarind flavor supports its cash-generating potential.

- Double-digit organic sales increases in most recent quarters.

- Market share gains in Mexico.

- Benefits from rising RTD popularity.

- Continued innovation with new flavors.

Brown-Forman's cash cows consistently yield substantial revenue. Jack Daniel's generated $986 million in net sales in fiscal year 2024. Korbel and El Jimador also contribute, though El Jimador saw a 2% sales dip in 2023.

| Brand | Category | 2024 Sales (approx.) |

|---|---|---|

| Jack Daniel's | Cash Cow | $986M |

| Old Forester | Cash Cow | Steady |

| Korbel | Cash Cow | Steady |

| El Jimador | Cash Cow | Steady |

Dogs

Finlandia Vodka, once part of Brown-Forman's portfolio, was divested in 2023. This strategic move allowed Brown-Forman to concentrate on brands with greater growth potential. The sale resulted in a pre-tax gain for the company. Brown-Forman's focus is now on core spirits.

Sonoma-Cutrer, once part of Brown-Forman, was divested in 2019. This move, announced in 2018, did not align with the company's long-term strategy. The sale allowed Brown-Forman to focus on its core spirits portfolio. This strategic shift freed up capital for growth initiatives. Brown-Forman's net sales in fiscal year 2024 were $4.25 billion.

Slane Irish Whiskey, part of Brown-Forman's portfolio, might be struggling. The brand's growth hasn't met initial hopes. Its market share and growth rate could place it in the 'Dog' category. Strategic changes are needed to boost performance.

Coopers' Craft

Coopers' Craft, a bourbon brand by Brown-Forman, faces challenges in the market. Despite its innovative approach, it hasn't gained substantial market share. Limited brand recognition and distribution are key obstacles to its expansion. To succeed, strategic marketing and product differentiation are crucial. Brown-Forman's 2024 reports should provide insights into Coopers' Craft's performance.

- Market Position: Coopers' Craft is in a "Dog" position in the BCG matrix.

- Sales: The brand's sales data in 2024 may not be significant compared to other Brown-Forman brands.

- Challenges: Limited brand awareness and distribution are major hurdles.

- Strategy: Revitalization needs strong marketing and product differentiation.

Glenglassaugh

Glenglassaugh, a Brown-Forman brand, faces challenges. Sales decline suggests it's a 'Dog' in BCG Matrix, due to low growth and market share. Production is paused, with job losses. Repositioning or investment might be needed. In 2024, Brown-Forman's net sales grew 1% to $4.26 billion.

- Sales decline indicates low growth.

- Production pause, job cuts signal trouble.

- Requires strategic action to improve.

- Brown-Forman's 2024 sales were $4.26B.

Several Brown-Forman brands are categorized as "Dogs" in the BCG matrix, indicating low market share and growth. Coopers' Craft, for example, faces hurdles in brand recognition and distribution. Similarly, Glenglassaugh's sales decline placed it as a "Dog." These brands require strategic interventions for potential revitalization.

| Brand | Category | Challenges |

|---|---|---|

| Coopers' Craft | Dog | Limited brand awareness |

| Glenglassaugh | Dog | Sales decline |

| Slane Irish Whiskey | Dog | Growth not meeting expectations |

Question Marks

The Glendronach, part of Brown-Forman, likely sits in the "Question Mark" quadrant of the BCG matrix. Its growth potential is uncertain, given the competitive Scotch whisky market. In 2024, Brown-Forman's net sales increased by 4%, showing overall growth, but this doesn't specify Glendronach's performance. Strategic moves are vital to boost its market share and possibly transform it into a "Star" brand.

Benriach, under Brown-Forman, mirrors The Glendronach's growth hurdles. Its niche status and distribution limitations restrict market share expansion. In 2024, Brown-Forman's net sales grew, but specific brand performance varies. Strategic moves are crucial for Benriach to evolve. Innovative marketing can boost its potential.

Fords Gin, under Brown-Forman, is a question mark in the BCG Matrix, suggesting low market share in a growing market. Its market position needs strategic attention. Investments in marketing and distribution are crucial. In 2023, Brown-Forman's net sales grew 6%, indicating potential for Fords Gin to capitalize on market trends.

Chambord

Chambord, a raspberry liqueur, is a Question Mark in Brown-Forman's BCG Matrix. It struggles for market share in a competitive spirits market. To boost Chambord's prospects, Brown-Forman could explore new flavor profiles and collaborations. This strategy aims to capture the attention of consumers.

- Market share for Chambord is relatively small compared to Brown-Forman's other brands.

- Innovation in flavors and marketing is crucial for brand growth.

- The global liqueur market was valued at $38.4 billion in 2024.

- Partnerships with mixologists and creative cocktail recipes are key.

Ready-To-Drink (RTD) Innovation

In Brown-Forman's BCG matrix, Ready-To-Drink (RTD) innovations are categorized as a question mark. This is because, while Brown-Forman has RTD products, the market is dynamic, with new competitors emerging and consumer preferences shifting. To succeed, Brown-Forman needs strategic investments in unique flavors, sustainable packaging, and targeted marketing.

- The global RTD market was valued at $34.1 billion in 2023.

- Brown-Forman's RTD portfolio includes brands like Jack Daniel's RTDs.

- Key strategies involve flavor innovation and eco-friendly packaging.

- Successful execution could elevate RTD products to star status.

In Brown-Forman's BCG matrix, the "Question Mark" category includes brands with low market share in growing markets. Chambord faces challenges in a competitive spirits market, while RTDs navigate dynamic consumer trends. Strategies like flavor innovation and targeted marketing are crucial to transform these brands. The global liqueur market reached $38.4 billion in 2024, presenting opportunities for growth.

| Brand | Category | Market Challenge |

|---|---|---|

| Chambord | Question Mark | Low market share, competitive market |

| RTDs | Question Mark | Dynamic market, emerging competitors |

| Overall | - | Need for strategic investments and innovation |

BCG Matrix Data Sources

Brown-Forman's BCG Matrix leverages financial filings, market reports, and industry analyses to build a trustworthy overview of its product portfolio.