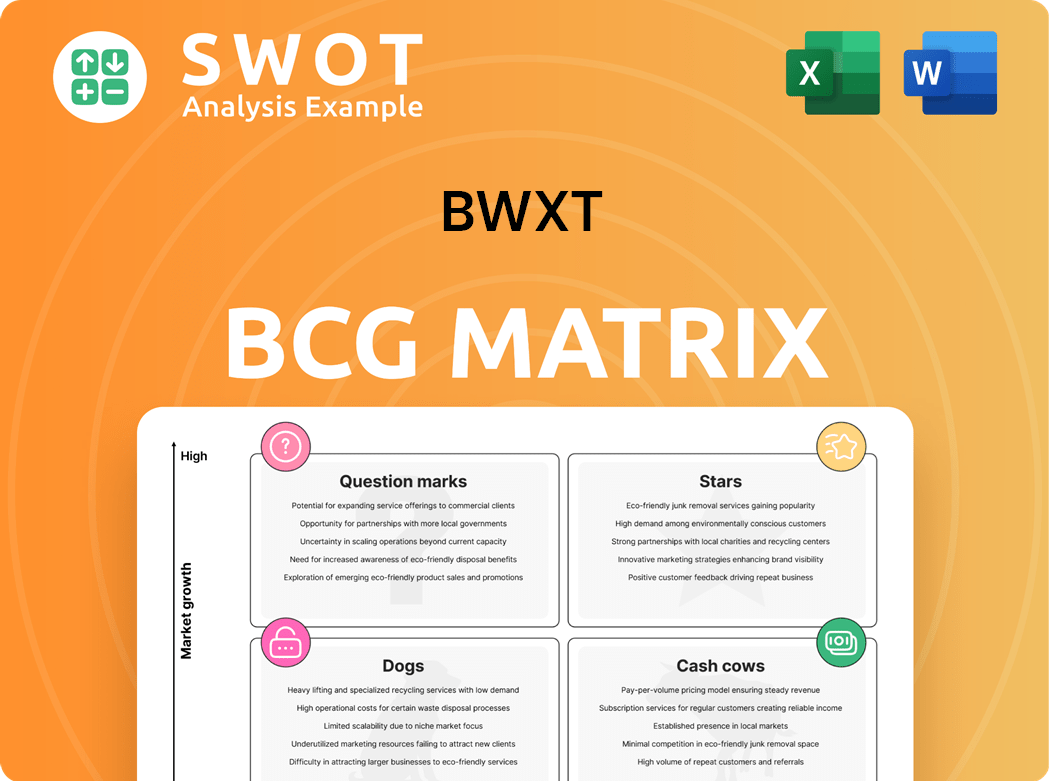

BWXT Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

BWXT Bundle

What is included in the product

BWXT's BCG Matrix highlights investment, holding, and divestment strategies across its portfolio.

Clean and optimized layout for sharing or printing, presenting a concise overview of BWXT's business units.

What You’re Viewing Is Included

BWXT BCG Matrix

This preview is the complete BWXT BCG Matrix report you'll receive post-purchase. It's a fully realized document, ready for immediate strategic analysis and decision-making without any alterations. Download the final version to use as you wish.

BCG Matrix Template

BWXT's BCG Matrix offers a glimpse into its diverse portfolio, categorizing products by market share and growth. This preview highlights key areas: Stars, Cash Cows, Dogs, and Question Marks. Understand product potential and resource allocation. The complete matrix reveals detailed quadrant placements, strategic recommendations, and more. Get the full report for a complete breakdown and strategic insights.

Stars

BWXT's naval nuclear components, including those for Columbia and Virginia class subs and Ford class carriers, are a revenue driver. Contracts valued in billions showcase their market strength and product demand. These long-term agreements offer stability and growth, solidifying this segment's star status. In 2024, BWXT secured a $2.3 billion contract for nuclear components.

BWXT is manufacturing components for SMRs, like the BWRX-300. They are a leader in the advanced nuclear reactor market. Investments, including the Cambridge facility expansion, show growth. SMRs are key for future energy needs, offering BWXT high growth. In Q3 2024, BWXT's revenue increased to $674.2 million.

BWXT's medical radioisotope business is flourishing, particularly in therapeutic isotopes. The acquisition of Kinectrics boosted its market position. Demand is rising, especially for cancer treatments. In 2024, BWXT's revenue increased, highlighting growth in this sector. The future looks bright.

Domestic Uranium Enrichment

BWXT is significantly involved in the Domestic Uranium Enrichment Centrifuge Experiment (DUECE) program, aiming to restore U.S. uranium enrichment capabilities, critical for national security. Their contracts and land acquisitions underscore governmental trust in BWXT. This program helps secure the U.S. defense supply chain, promising long-term growth. The U.S. government has invested heavily in domestic uranium enrichment to reduce reliance on foreign sources.

- BWXT's involvement in DUECE enhances U.S. national security.

- Government contracts and land acquisitions confirm BWXT's capabilities.

- DUECE addresses a vulnerability in the U.S. defense supply chain.

- Long-term growth is anticipated due to strategic importance.

Technical Services

BWXT's technical services are a crucial part of their business. They support both government and commercial operations, boosting revenue and profits. Their skills in managing projects and offering services like site operations and environmental restoration are highly valued. This segment's stability and growth are supported by continuous demand.

- In 2024, technical services generated approximately $1.2 billion in revenue.

- BWXT's backlog for technical services contracts was over $2 billion.

- The segment's operating margin consistently exceeds 10%.

- Key clients include the U.S. Department of Energy and various commercial nuclear facilities.

BWXT's "Stars" include naval nuclear components, SMRs, and medical radioisotopes, all showing high growth potential. The company's naval nuclear components, supported by multi-billion dollar contracts, are key revenue drivers. Additionally, their involvement in SMRs and the DUECE program positions them for future expansion, as shown in their Q3 2024 revenue of $674.2 million.

| Segment | Key Activities | 2024 Financial Data |

|---|---|---|

| Naval Nuclear Components | Manufacturing for subs/carriers | $2.3B contract secured |

| SMRs | Component manufacturing | Revenue growth in Q3 |

| Medical Radioisotopes | Production of isotopes | Increased revenue in 2024 |

Cash Cows

BWXT's commercial nuclear services, manufacturing components and fuel, are cash cows. These services ensure the operation and longevity of existing nuclear plants. Demand is stable, providing reliable cash flow. In 2024, BWXT's revenue from nuclear operations was approximately $1.8 billion. This steady income supports the company's financial stability.

BWXT's nuclear fuel fabrication is a cash cow, offering consistent revenue. The company benefits from steady demand and established relationships. In 2024, BWXT's revenue was approximately $2.5 billion. This stable segment supports overall profitability.

BWXT's steam generator business is a Cash Cow. They manufacture steam generators for nuclear plants, including CANDU reactors. Their expertise makes them a key supplier, and replacement/refurbishment contracts generate consistent revenue. In 2024, BWXT secured a $1.2 billion contract for nuclear components. This segment provides stable cash flow.

Reactor Pressure Vessels

BWXT's reactor pressure vessels (RPVs) business is a cash cow, particularly for Small Modular Reactors (SMRs) such as the BWRX-300. This established business line leverages BWXT's extensive experience, making them a dependable supplier. These contracts ensure consistent revenue and strong cash flow.

- In 2024, BWXT secured a $1.1 billion contract for nuclear components.

- The SMR market is projected to grow significantly by 2030.

- BWXT's backlog provides a strong financial foundation.

A.O.T. Business

BWXT's acquisition of Aerojet Ordnance Tennessee (A.O.T.) in early 2025 positions it as a "Cash Cow" in the BCG Matrix. This strategic move integrates A.O.T.'s special materials expertise, ensuring a steady revenue stream. Although not a high-growth sector, A.O.T. bolsters BWXT's financial stability and contributes to its overall strength. The acquisition is part of BWXT's strategy to maintain a balanced portfolio.

- Acquisition Date: January 3, 2025.

- Revenue Stability: Provides a reliable income source.

- Strategic Fit: Enhances BWXT's special materials capabilities.

- BCG Matrix: Classified as a "Cash Cow" due to stable revenue.

BWXT's "Cash Cows" provide steady revenue streams. These include commercial nuclear services, fuel fabrication, and steam generators. Acquisitions like Aerojet Ordnance Tennessee further solidify this category. In 2024, key revenue streams totaled billions, bolstering BWXT's stability.

| Business Segment | 2024 Revenue (Approximate) | Notes |

|---|---|---|

| Nuclear Operations | $1.8 billion | Stable demand, reliable cash flow. |

| Nuclear Fuel Fabrication | $2.5 billion | Consistent revenue, established relationships. |

| Steam Generator Business | Secured $1.2 billion contract | Replacement and refurbishment contracts. |

Dogs

BWXT's field services activity has recently experienced a downturn, potentially underperforming relative to its other business segments. This underperformance could signal a need for strategic adjustments. Unless profitability improves, divestiture or restructuring of this area might be considered. In 2024, BWXT's revenue was approximately $2.6 billion, with field services potentially contributing a smaller share.

Legacy government contracts at BWXT, though established, can face profitability challenges. These older agreements may struggle due to market shifts or heightened competition, potentially limiting growth. In 2023, BWXT's revenue was $2.5 billion, with a focus on margin improvements. Careful evaluation is crucial, considering renegotiation or termination if these contracts hinder overall financial performance.

BWXT engages in non-strategic joint ventures, particularly in managing U.S. Department of Energy and NASA facilities. These ventures might not fit its long-term strategy. In 2024, BWXT's revenue was approximately $2.5 billion. Assess if these ventures boost BWXT's value. Divest if they are not aligned with strategic goals.

Underperforming Acquisitions

Underperforming acquisitions can weigh down BWXT's portfolio, potentially becoming "Dogs" in the BCG matrix. These acquisitions might fail to meet revenue or profitability targets, demanding further investment to improve performance. BWXT should carefully assess these assets, considering their long-term viability and strategic fit. For example, if an acquisition's projected revenue growth is less than the industry average, it may be a Dog.

- Low Revenue Growth: Acquisitions with growth below industry benchmarks.

- Unmet Profitability Targets: Acquisitions failing to achieve expected profit margins.

- High Investment Needs: Require significant capital to improve performance.

- Strategic Misfit: Acquisitions not aligning with BWXT's core competencies.

Commoditized Products

In the BWXT BCG Matrix, "Dogs" represent offerings that have become commoditized. These products or services encounter fierce price competition, squeezing profit margins. BWXT might need to focus on cost-cutting to remain competitive. For instance, in 2024, BWXT's revenue was approximately $2.5 billion, with some segments facing margin pressures.

- Commoditized offerings experience intense price competition.

- Profit margins are typically low in this category.

- Cost-cutting measures are essential to remain competitive.

- BWXT's 2024 revenue was around $2.5 billion.

In the BWXT BCG Matrix, "Dogs" are offerings facing intense price competition, squeezing profit margins. These commoditized products require focus on cost-cutting to remain competitive. BWXT's 2024 revenue was approximately $2.5 billion, with some segments experiencing margin pressures.

| Characteristic | Impact | Action |

|---|---|---|

| Low Growth, Low Market Share | Limited Profitability | Divest or Restructure |

| Commoditized | Intense Price Competition | Cost-Cutting Measures |

| Underperforming Acquisitions | Failing Revenue Targets | Strategic Assessment |

Question Marks

BWXT's microreactor initiatives, like Project Pele for the Department of Defense, position it in a high-growth, yet uncertain market. The microreactor market is still developing, facing regulatory and technological challenges. To capitalize, BWXT must invest significantly to secure market share. In 2024, BWXT's revenue reached $2.6 billion, reflecting ongoing strategic investments.

BWXT's BANR is a Question Mark in its BCG matrix. It targets the energy market with a 50 MW high-temperature gas reactor. This project needs substantial investment, potentially facing rivals. Securing funds and partnerships is crucial for BANR's success, as estimated by the U.S. Department of Energy, advanced reactors could generate $400 billion in economic activity by 2050.

BWXT is deeply engaged in nuclear thermal propulsion (NTP) system design, collaborating with NASA and the DOE. This venture is classified as a "Question Mark" in the BCG Matrix. In 2024, BWXT secured a $16.6 million contract from NASA for NTP technology development, highlighting the high-risk, high-reward nature. Continuous investment in R&D is crucial for BWXT to lead and secure future contracts within this emerging field.

Kinectrics Integration

BWXT's acquisition of Kinectrics in 2023, a nuclear services provider, is a strategic move to bolster its capabilities. This integration is crucial for BWXT to capitalize on market opportunities. Effective management is essential to fully leverage Kinectrics' specialized expertise and ensure operational alignment. The success hinges on seamless integration to drive growth and enhance BWXT's market position.

- Acquisition Cost: Approximately $400 million.

- Revenue Impact: Expected to add over $200 million annually.

- Synergy Targets: Aiming for $20 million in annual cost savings.

- Integration Timeline: A multi-year plan to fully integrate operations.

New Nuclear Partnerships

BWXT's collaborations, such as the one with Westinghouse, are a key part of its growth strategy, particularly in the nuclear energy sector. These partnerships are designed to facilitate the construction of new nuclear projects both in Canada and internationally, opening up significant avenues for expansion. However, these ventures also present challenges that must be carefully managed to ensure success.

Effective execution is crucial, requiring diligent project management to keep projects on schedule and within budget. BWXT must foster mutually beneficial relationships with its partners to optimize the outcomes of these collaborative endeavors.

Here's a look at what's involved:

- Partnerships with companies like Westinghouse are key.

- These partnerships are essential for global expansion.

- On-time and within-budget project delivery is critical.

- BWXT needs to ensure these partnerships are beneficial.

BWXT's "Question Marks" face high growth potential with significant investment needs. Success depends on navigating market uncertainties and securing crucial funding. These ventures, like NTP, offer high rewards but also carry considerable risk.

| Project | Description | Challenges |

|---|---|---|

| BANR | 50 MW high-temp gas reactor | Requires substantial investment, faces competition. |

| NTP Systems | Nuclear thermal propulsion with NASA | High-risk, high-reward; R&D intensive. |

| Microreactors | Department of Defense's Project Pele | Market is developing with regulatory hurdles. |

BCG Matrix Data Sources

BWXT's BCG Matrix leverages financial reports, market share data, and industry analysis, offering reliable quadrant positioning.