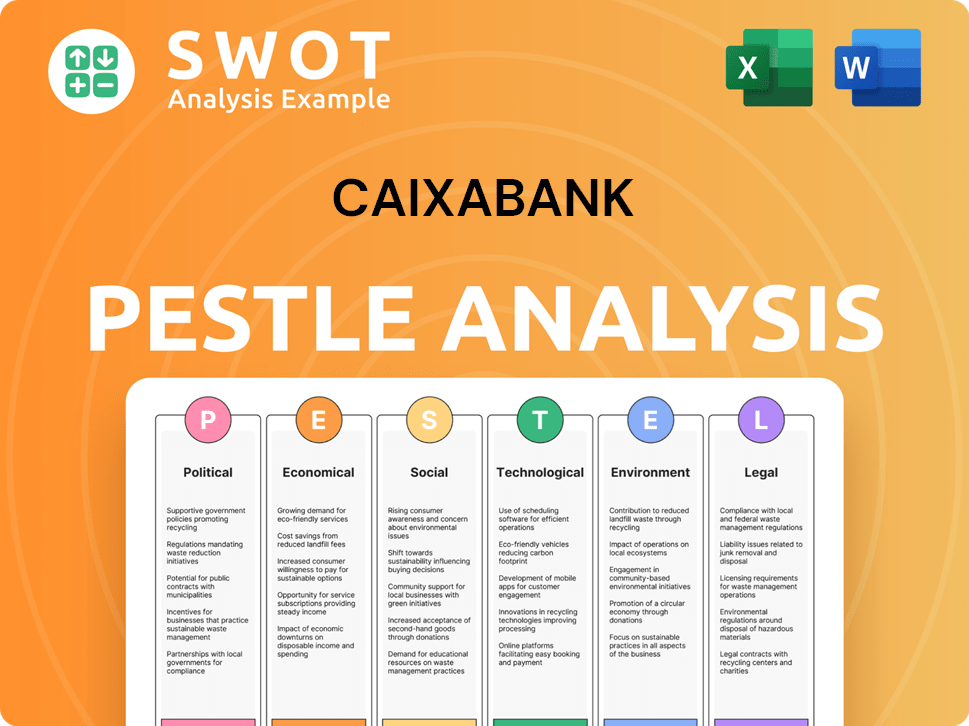

CaixaBank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CaixaBank Bundle

What is included in the product

Assesses CaixaBank via PESTLE, examining political, economic, social, tech, environmental, and legal factors.

Allows users to modify or add notes specific to their own context, region, or business line.

Preview the Actual Deliverable

CaixaBank PESTLE Analysis

The CaixaBank PESTLE analysis preview offers a clear view of the document. This showcases the depth and organization of our strategic review. The content shown mirrors what you receive post-purchase.

PESTLE Analysis Template

Navigate CaixaBank's complex environment with precision. Our PESTLE analysis explores critical external factors. Understand political, economic, social, and technological forces shaping the bank. Get deep insights for strategic planning and decision-making. Access the full report now!

Political factors

Spain's political stability and EU policies heavily influence CaixaBank's regulatory environment. Recent shifts in government, alongside evolving financial regulations, introduce operational uncertainties. For example, the EU's focus on digital finance and sustainable investment impacts CaixaBank's strategies. In 2024, the Spanish government's budget allocated €1.5 billion for digital transformation initiatives, directly affecting banking operations.

CaixaBank is overseen by the ECB and national bodies. It must meet capital requirements and pass stress tests. In 2024, the ECB increased scrutiny on banks' climate risk management. Regulatory changes impact capital, liquidity, and risk. Stricter rules could raise operational costs.

Geopolitical risks, like the war in Ukraine and uncertainties like the "Trump effect," heighten market volatility. Such instability can affect CaixaBank's investments and international ventures. Data from 2024 shows a 15% increase in market volatility due to these factors, impacting financial confidence. This necessitates careful risk management.

Government Support and Intervention

Government actions significantly impact CaixaBank. Policies boosting the economy can lead to more lending and better asset quality. However, intervention or new taxes create hurdles. In 2024, Spain's government focused on economic stimulus. The banking sector faced increased scrutiny.

- Spain's GDP growth in 2024 is projected at around 2%.

- Government spending on infrastructure increased by 10% in Q1 2024.

- A new tax on financial transactions was discussed in late 2024.

International Relations and Trade Policies

Changes in global trade policies significantly influence CaixaBank's business, affecting loan performance and trade finance demand. The bank actively participates in initiatives aimed at bolstering trade, especially in Africa, a key growth area. For instance, CaixaBank has increased its trade finance volume by 15% in the past year, reflecting its strategic focus. These efforts are crucial as global trade volumes are projected to increase by 3.5% in 2024.

- CaixaBank's trade finance volume increased by 15% year-over-year.

- Global trade volumes are forecasted to rise by 3.5% in 2024.

- Focus on strengthening trade flows, particularly in Africa.

Political factors significantly shape CaixaBank’s operations. Government stability and EU policies, especially on digital finance and sustainable investment, create both opportunities and challenges. Regulatory scrutiny and geopolitical risks, such as the war in Ukraine and elections, drive market volatility. Changes in trade policies and government spending on infrastructure and digitalization also greatly affect CaixaBank.

| Factor | Impact on CaixaBank | Data/Statistics (2024) |

|---|---|---|

| Government Policies | Economic stimulus, regulations | Spain’s GDP growth (proj. 2%), digital transformation spending (€1.5B) |

| EU Regulations | Capital requirements, climate risk | ECB scrutiny on climate risk, potential increased costs |

| Geopolitical Risks | Market volatility, investments | 15% increase in market volatility |

Economic factors

The European Central Bank's interest rate decisions directly affect CaixaBank's earnings, especially net interest income. CaixaBank Research anticipates falling interest rates in 2024 and 2025. This could squeeze lending margins. However, it might boost borrowing and economic growth. In 2023, the ECB raised rates, impacting bank profitability.

Spain's GDP growth directly impacts CaixaBank's performance. CaixaBank Research predicts GDP growth of 1.9% in 2024 and 1.7% in 2025. This sustained growth supports increased loan demand and deposit growth for the bank. However, the slight moderation in 2025 requires careful strategic planning.

Inflation significantly impacts purchasing power, affecting both consumers and businesses. Elevated inflation rates increase operational costs and complicate loan repayment for CaixaBank's clients. In Spain, the inflation rate was 3.4% in April 2024. A projected moderation in 2025, with forecasts suggesting a drop below 2%, could boost economic activity and benefit CaixaBank.

Unemployment Rate and Labor Market

The unemployment rate and labor market dynamics significantly influence CaixaBank's operations by affecting consumer spending and loan demand. A strong labor market, as anticipated, boosts household income and confidence, potentially increasing demand for banking products. High unemployment, conversely, could lead to decreased demand and increased loan defaults. In Spain, the unemployment rate was 11.6% in Q4 2023, and projections for 2024 suggest continued improvement, which could support CaixaBank's growth.

- Unemployment rate in Spain: 11.6% (Q4 2023)

- Impact on consumer confidence and loan demand

- Projected labor market improvements for 2024

Real Estate Market Trends

The Spanish real estate market significantly impacts CaixaBank, particularly its mortgage business and asset values. CaixaBank Research forecasts ongoing housing price increases in 2025, driven by decreasing interest rates and robust demand. In 2024, housing prices in Spain rose by approximately 6%, with transaction volumes showing resilience. This positive trend is expected to continue, benefiting CaixaBank's financial performance.

- 2024: Housing prices in Spain increased by roughly 6%.

- 2025: CaixaBank anticipates further housing price growth.

- Key drivers: Falling interest rates, strong demand.

Falling interest rates in 2024/2025, as predicted by CaixaBank Research, could impact earnings. Spain's GDP growth, expected at 1.9% (2024) and 1.7% (2025), will influence loan demand. Inflation, at 3.4% (April 2024), moderating below 2% in 2025, is a key factor. Unemployment was 11.6% (Q4 2023). Housing prices grew by 6% in 2024.

| Factor | Data Point | Year |

|---|---|---|

| GDP Growth | 1.9% (Forecast) | 2024 |

| Inflation Rate | 3.4% (April) | 2024 |

| Unemployment | 11.6% | Q4 2023 |

| Housing Price Increase | 6% (Approx.) | 2024 |

Sociological factors

Changes in population size and structure significantly affect CaixaBank. Population growth, as highlighted by the bank, directly boosts housing demand. Spain's population is projected to reach 48.6 million by 2030, impacting mortgage and loan needs. Shifts in age demographics also influence financial product preferences.

CaixaBank must adapt to evolving digital expectations. In 2024, over 70% of CaixaBank customers used digital banking. Personalized offerings are key, and the bank is investing heavily in AI. Ethical considerations, such as data privacy, are also crucial. CaixaBank's focus on digital channels reflects these trends.

CaixaBank actively promotes financial inclusion and literacy. This approach broadens its customer base, especially among underserved groups. In 2024, CaixaBank's sustainability plan focused on financial and social inclusion initiatives. For example, in 2023, CaixaBank trained 100,000+ people in financial literacy. This is a key part of their strategy.

Social Impact and Reputation

CaixaBank's social impact hinges on its community support and reputation. Sustainable finance and social development are key. In 2024, CaixaBank allocated €2.3 billion to social projects. This commitment boosts its standing. It secures its social license to operate.

- €2.3 billion allocated to social projects in 2024.

- Focus on sustainable finance and social development.

- Impact on public perception and reputation.

Employment Trends and Skills

Shifting employment dynamics and required skills significantly impact both individual and corporate financial health. CaixaBank actively addresses these changes through initiatives promoting entrepreneurship and enhancing employability. These efforts are crucial, given the evolving landscape of work. For instance, the European Commission's 2024 report highlights a growing demand for digital skills.

- The EU aims to have at least 70% of the workforce with basic digital skills by 2025.

- CaixaBank's investments in digital literacy programs support this goal.

- Entrepreneurship support from CaixaBank helps navigate economic shifts.

Sociological factors heavily influence CaixaBank's operations and strategy. Community support and social impact, like allocating €2.3 billion to social projects in 2024, are key. Shifts in employment, like the EU's goal of 70% digitally skilled workers by 2025, demand adaptation. These initiatives enhance reputation.

| Aspect | Impact | 2024 Data |

|---|---|---|

| Social Projects | Enhances reputation | €2.3 billion allocated |

| Digital Skills | Adaptation needed | EU target: 70% workforce with digital skills by 2025 |

| Financial Inclusion | Expands customer base | 100,000+ trained in financial literacy (2023) |

Technological factors

Digital transformation is key, demanding investments in digital channels and innovative solutions. CaixaBank heavily invests in technology, focusing on cloud adoption and AI. In 2024, CaixaBank's digital sales reached 68.1%, showcasing strong digital adoption. The bank plans to invest €2.4 billion in technology between 2022 and 2024 to boost digital capabilities.

Cybersecurity risks are a major concern for CaixaBank due to its heavy use of digital platforms. In 2024, the financial sector saw a 20% rise in cyberattacks. CaixaBank must invest in strong cybersecurity. This helps protect customer data and maintain trust. It also reduces potential financial losses from breaches.

CaixaBank is leveraging AI and machine learning to boost efficiency and customer service. The bank has invested €60 million in AI projects. This includes using AI for fraud detection, and personalized banking experiences. As of 2024, AI is integral to CaixaBank's digital transformation strategy.

Development of Fintech and Challenger Banks

The fintech sector's growth and the emergence of digital challenger banks are reshaping the financial services landscape, intensifying competition. This compels CaixaBank to enhance its digital offerings and customer experience. For example, in 2024, fintech investments in Europe reached $13.3 billion. CaixaBank's digital transformation efforts are crucial for maintaining its market position.

- Increased competition from digital-first banks.

- Need for CaixaBank to invest in technology and innovation.

- Growing customer expectations for digital services.

IT Infrastructure and Resilience

CaixaBank heavily relies on its IT infrastructure to provide banking services. The bank invests significantly in its data centers and overall IT systems to boost efficiency and ensure resilience. In 2024, CaixaBank allocated a substantial portion of its budget to IT, aiming to enhance its technological capabilities. This investment is crucial for adapting to evolving digital banking trends and protecting against cyber threats.

- IT spending in 2024 reached €2.5 billion.

- Data center upgrades increased processing capacity by 30%.

- Cybersecurity budget grew by 15% to enhance protection.

- Cloud migration initiatives saved 10% on operational costs.

Technological advancements are pivotal, driving CaixaBank to heavily invest in digital platforms, cloud solutions, and AI. Cybersecurity is crucial, given the 20% rise in cyberattacks in the financial sector in 2024, demanding robust protection measures. Fintech competition forces CaixaBank to innovate and improve digital offerings.

| Factor | Details | Impact |

|---|---|---|

| Digital Transformation | €2.4B investment (2022-2024), 68.1% digital sales (2024) | Enhances customer experience, operational efficiency. |

| Cybersecurity | IT spending reached €2.5B (2024), 15% budget increase | Protects against threats, maintains trust. |

| AI & Fintech | €60M investment in AI projects, $13.3B Fintech in Europe | Drives innovation, increases competition. |

Legal factors

CaixaBank must comply with stringent banking regulations at national and EU levels. These rules govern capital, liquidity, and risk management. For example, the bank's CET1 ratio was 12.5% in December 2024, showing strong capital health. Consumer protection laws also require compliance. These regulations directly shape CaixaBank's operations and strategic planning.

CaixaBank must adhere to strict data protection laws, including GDPR, which govern data handling. Non-compliance can lead to substantial fines, potentially impacting its financial performance. In 2023, GDPR fines totaled €1.65 billion across Europe. CaixaBank has faced data protection challenges.

CaixaBank, like all financial institutions, must comply with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations. These regulations, such as those from the Financial Action Task Force (FATF), demand rigorous measures. Compliance requires extensive efforts, including customer due diligence and transaction monitoring. In 2024, the European Banking Authority (EBA) reported over €1 billion in AML-related fines across the EU.

Consumer Protection Laws

Consumer protection laws significantly shape CaixaBank's operations, dictating product terms and conditions, transparency standards, and complaint processes. Compliance is crucial, as breaches can lead to substantial fines and reputational damage. In 2024, the European Banking Authority (EBA) intensified its focus on consumer protection, particularly regarding digital financial services. CaixaBank must adhere to evolving regulations to maintain customer trust and avoid legal repercussions. The bank's compliance costs related to consumer protection increased by 7% in 2024.

- EU Consumer Rights Directive: Ensures clear information and fair contract terms.

- MiFID II: Protects investors by enhancing transparency and conduct of business rules.

- GDPR: Safeguards customer data privacy, crucial for digital banking.

- Spanish Consumer Law: Governs consumer rights within Spain.

Competition Law

Competition law significantly influences CaixaBank's strategic decisions. Regulations can restrict mergers and acquisitions, affecting the bank's growth potential. The Spanish banking sector's consolidation is directly impacted by these laws. For instance, in 2024, the European Commission approved the merger of two major Spanish banks, highlighting the scrutiny involved.

- EU antitrust rules are particularly relevant.

- Market share and pricing strategies are under constant review.

- Compliance costs can be substantial.

- The regulatory landscape is dynamic, requiring continuous adaptation.

CaixaBank operates under rigorous banking regulations in Spain and the EU, impacting capital, risk, and consumer protection. Data privacy laws like GDPR mandate compliance to avoid significant penalties. Anti-money laundering regulations demand robust customer due diligence. Consumer protection laws and competition regulations also significantly shape CaixaBank’s activities and strategic direction.

| Regulation | Impact on CaixaBank | 2024/2025 Data |

|---|---|---|

| Banking Regulations | Capital adequacy, risk management, consumer protection | CET1 ratio: 12.5% (Dec 2024). Increased compliance costs. |

| Data Protection (GDPR) | Data handling, fines for non-compliance | 2023 GDPR fines in Europe: €1.65B. Ongoing audits. |

| AML/CTF | Customer due diligence, transaction monitoring | EBA reported over €1B in AML fines (2024) |

Environmental factors

Climate change poses significant risks to CaixaBank, including physical risks from extreme weather and transition risks from low-carbon policies. These factors can affect the bank's assets, loan portfolio, and investments. CaixaBank is actively assessing and managing these climate-related risks. The European Central Bank (ECB) has increased its focus on climate risk disclosures. The bank is working on its climate strategy.

CaixaBank faces growing pressure to meet sustainable finance regulations. These regulations, along with net-zero targets, push the bank to include environmental factors in its financial decisions. For instance, CaixaBank aims to mobilize €60 billion in sustainable finance by 2025. The bank also targets a 50% reduction in financed emissions by 2030.

CaixaBank's operations, though not as impactful as manufacturing, face environmental scrutiny. It must comply with regulations on energy use and waste. In 2024, the bank invested heavily in green initiatives. This included €100 million in renewable energy projects.

Demand for Green Products and Services

Growing environmental awareness is boosting the need for green products. Customers and investors favor eco-friendly options, pushing demand for green bonds and renewable energy financing. CaixaBank is responding actively to this trend. In 2024, the green bond market reached $1.2 trillion globally. CaixaBank's sustainability strategy includes significant investments in green initiatives.

- Green bond market hit $1.2T in 2024.

- CaixaBank is expanding green financing.

- Customers prioritize eco-friendly choices.

Reputational Risks related to Environmental Issues

CaixaBank faces reputational risks tied to environmental issues, which can harm its image. Negative publicity about its environmental practices or funding of controversial projects can erode trust. This could lead to customer and investor backlash, impacting the bank's financial performance. In 2024, environmental concerns significantly influenced investment decisions.

- In 2024, ESG-focused funds saw inflows of over $200 billion globally.

- CaixaBank's ESG rating is a key factor for many investors.

- Public perception can affect stock prices.

CaixaBank encounters risks and opportunities driven by environmental factors, focusing on sustainable finance regulations and net-zero targets. The bank is actively responding to growing environmental awareness. A pivotal factor is CaixaBank's response to shifting investor preferences.

| Environmental Aspect | Impact on CaixaBank | 2024 Data/Targets |

|---|---|---|

| Climate Change Risks | Affects assets, loans, and investments | €60B sustainable finance by 2025 |

| Sustainable Finance Regulations | Increased focus on ESG and green finance | 50% reduction in financed emissions by 2030 |

| Customer & Investor Preferences | Boosts demand for green products | $1.2T global green bond market in 2024 |

PESTLE Analysis Data Sources

This CaixaBank PESTLE draws from reputable sources, including financial reports, market data, and economic forecasts, alongside policy updates.