Deere Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deere Bundle

What is included in the product

Analysis of Deere's business units within the BCG Matrix framework, suggesting investment, holding, or divestment strategies.

One-page overview placing each business unit in a quadrant

Full Transparency, Always

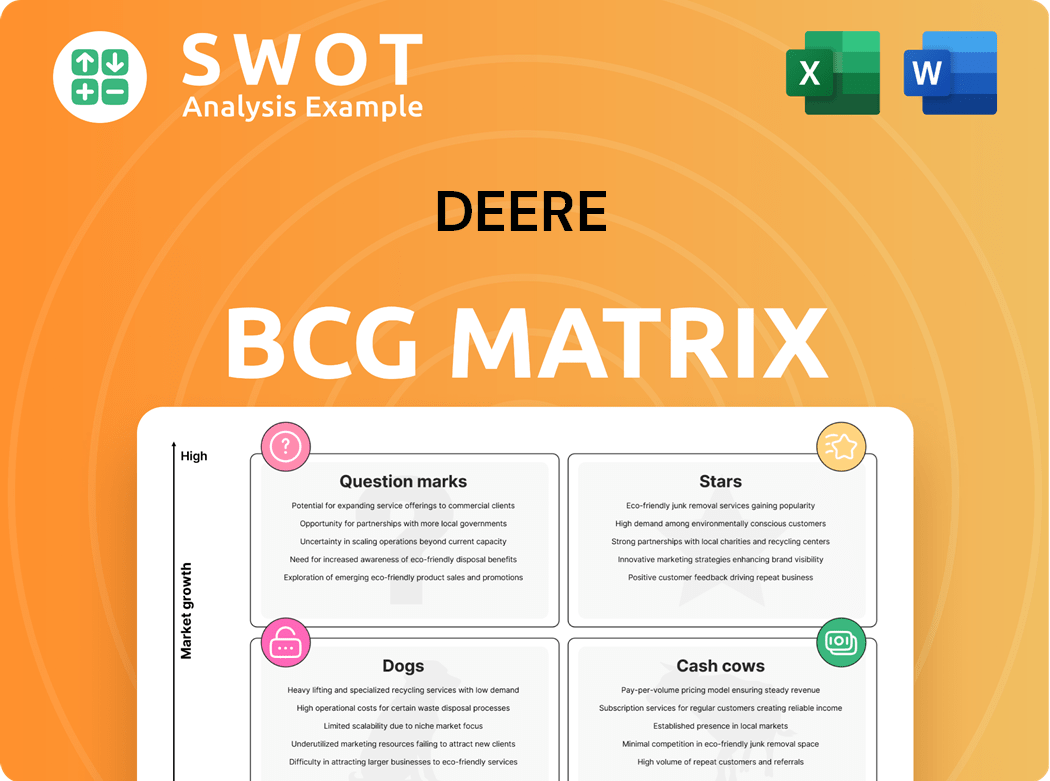

Deere BCG Matrix

The BCG Matrix you see is the complete document you'll receive instantly after purchase. This isn't a sample; it's the fully realized, actionable report ready for your strategic planning.

BCG Matrix Template

Deere's BCG Matrix categorizes its diverse offerings, from tractors to technology, for strategic evaluation.

This framework assesses product market share and growth, revealing key investment areas.

The matrix identifies Stars, Cash Cows, Question Marks, and Dogs, guiding resource allocation.

Understanding this analysis unlocks Deere's competitive landscape and potential.

See the full BCG Matrix for detailed quadrant placements, uncovering strategic insights.

Get a complete breakdown and make informed decisions with actionable recommendations.

Purchase now for a ready-to-use strategic tool and transform your business approach.

Stars

Deere's precision agriculture technologies, including AI and sensors, show high growth and market share. Investments in innovations like See & Spray solidify their leadership. In Q1 2024, Deere's net sales of Production and Precision Ag increased. They are addressing the demand for efficient, sustainable farming. Net sales reached $12.1 billion in fiscal year 2024.

Deere's autonomous machinery, like the 9RX tractor and electric mowers, is a rising star. These products address labor shortages and boost efficiency, driving market adoption. In 2024, the autonomous tractor market is projected to reach $10 billion. Advanced tech, including AI and cameras, enables navigation.

John Deere's high-horsepower 9RX tractors, including 710-hp, 770-hp, and 830-hp models, are classified as "Stars" in its BCG Matrix. These tractors have a strong market position, with full order books extending into Q4 2025, reflecting robust demand. The redesigned tractors offer improved towing power and operator comfort. In 2024, Deere's large agricultural equipment sales increased, demonstrating the success of these models.

Financial Services

Deere's financial services are a "Star" in its BCG matrix, consistently performing well and boosting customer equipment purchases. This segment is a key revenue and profit driver for Deere. The financial services saw a net income increase of 11% in Q1 2024, demonstrating its strong and stable nature. These services provide essential support, making them a vital part of Deere's success.

- Q1 2024 net income up 11%

- Supports customer equipment purchases

- Key revenue and profit driver

- Strong and stable performance

Recurring Revenue Model for Precision Tech

Deere's transition to a recurring revenue model for precision tech boosts adoption and stabilizes income. Farmers access advanced tech with smaller upfront costs, encouraging wider use. Increased engagement acres show this pricing's effectiveness. This shift supports Deere's growth strategy in the precision agriculture market.

- In 2024, Deere's precision ag revenue grew, indicating strong adoption.

- Recurring revenue models offer predictability, crucial for long-term planning.

- The strategy aligns with industry trends toward subscription-based services.

- Deere's precision ag segment saw significant growth in 2023, continuing into 2024.

John Deere's high-horsepower 9RX tractors are "Stars". These models, like the 710-hp to 830-hp versions, have a robust market position. Strong demand is indicated by full order books extending to Q4 2025. In 2024, large agricultural equipment sales increased.

| Model | Horsepower Range | Market Status |

|---|---|---|

| 9RX Tractors | 710-830 hp | Strong, with high demand |

| Order Books | Extending to Q4 2025 | Indicating high demand |

| 2024 Sales | Increased | Large agricultural equipment |

Cash Cows

Deere's core tractors and combines are cash cows, providing steady revenue. Despite market challenges, their brand and dealer network sustain demand. These products thrive in a mature market, with Deere holding a significant market share. In 2024, Deere's revenue was approximately $61.2 billion. The company continues to generate strong cash flow from these established product lines.

Deere's construction and forestry segment remains a cash cow, supporting overall financial stability. In 2024, this segment's revenue was robust, demonstrating continued strength. Deere's global presence and diverse offerings help cushion against market fluctuations. The company's operational efficiency ensures sustained profitability, even amid a potential downturn.

Deere's worldwide dealer network is a robust distribution channel, supporting consistent sales and customer service. This network gives Deere a competitive edge in established markets, fostering stable cash flow. In 2024, Deere's revenue reached approximately $61.2 billion. Strengthening dealer ties and giving them resources is key to preserving this advantage.

Parts and Service Operations

Deere's parts and service operations are a reliable revenue source, especially in established markets where equipment sales can vary. These operations profit from the existing Deere equipment and continuous maintenance and repair needs. Dealers anticipate growth in parts and service revenue, even if equipment sales decrease. In 2023, Deere's net revenue from equipment operations was $58.367 billion, with parts and service contributing significantly.

- Steady Revenue: Parts and service provide consistent income.

- Installed Base: Benefit from the existing Deere equipment.

- Dealer Expectations: Dealers foresee growth in this area.

- Financial Data: Parts and service are key contributors to overall revenue.

Brand Loyalty

Deere & Company's brand loyalty is a key strength, driving repeat business and stable revenue. Their reputation for quality and innovation fosters customer loyalty. This is crucial for sustaining their cash cow products. The company's strong brand helps maintain market share, especially in competitive agricultural markets. In 2024, Deere's customer retention rate remained high, reflecting robust brand loyalty.

- Deere's brand recognition scores consistently place it at the top of the industry.

- Customer satisfaction surveys show high levels of loyalty among Deere's core customer base.

- Deere's service network further enhances brand loyalty by providing excellent support.

- Investments in new technologies and product innovation continue to strengthen brand loyalty.

Deere's cash cows consistently generate strong profits. Core products like tractors and parts & service fuel financial stability. Brand loyalty and a robust dealer network further ensure sustainable revenue.

| Aspect | Details |

|---|---|

| Revenue (2024) | Approx. $61.2B |

| Brand Loyalty | High customer retention |

| Key Products | Tractors, Combines, Parts |

Dogs

Deere's legacy products, lacking tech integration, are dogs, facing declining market share. These products might need expensive turnarounds with poor returns. Divesting these lines lets Deere focus on growth. In 2024, Deere's revenue was ~$61.2 billion, highlighting the need for strategic focus.

Products tied to shrinking markets, like some big North American farm equipment, often become "dogs." Declining sales mean these lines need a strategic look. In 2024, Deere saw a sales dip in some key areas. Inventory control and cost cuts are vital to prevent losses. Deere's 2024 report highlights these challenges.

High-horsepower tractors with high used inventory levels are considered dogs in Deere's BCG Matrix. Excess used inventory hurts pricing and diminishes demand for new items. Deere prioritizes normalizing used inventory to boost these product lines. In Q4 2023, Deere's used equipment inventory rose, indicating a challenge.

Products Facing Intense Competition and Price Pressure

Products in highly competitive markets with price pressure face profit challenges, potentially classified as dogs. These items might need substantial investment to keep market share without boosting profitability. Deere's focus on innovation and value-added services is crucial here. For instance, in 2024, the compact tractor market saw intense competition, impacting margins.

- Intense Competition: Deere faces rivals like Kubota in the compact tractor segment.

- Price Pressure: Competitors often engage in price wars to gain market share.

- Investment Needs: Maintaining market share demands continuous product updates and marketing.

- Profitability Challenges: High competition can limit profit margins.

Segments with High Operating Expenses and Low Margins

Segments with high operating expenses and low margins, like those facing unfavorable pricing and increased research and development costs, are considered dogs. Deere's Construction & Forestry segment, for example, might face these challenges. Turning these segments around requires reducing expenses and boosting efficiency. Strategic cost-cutting and a better sales mix are key to improving profitability.

- Deere's 2024 operating expenses were notably high, reflecting investments in R&D and supply chain costs.

- The Construction & Forestry segment's margins were under pressure due to market conditions.

- Cost-cutting initiatives and strategic pricing adjustments are crucial for improving profitability in these segments.

- Efficiency improvements are a constant focus to mitigate the impact of unfavorable pricing.

Deere's "Dogs" include products in shrinking markets with declining sales and high used inventory, demanding strategic review. These lines often face intense competition and price pressure, especially in segments like compact tractors. In 2024, these segments faced margin pressure, leading to increased operational expenses and lower profitability.

| Category | Description | 2024 Impact |

|---|---|---|

| Market Position | Declining Sales, Shrinking Market | Inventory Build-up |

| Competitive Landscape | Intense, Price Wars | Margin Pressure |

| Strategic Actions | Cost Cuts, Efficiency | Focus on Innovation |

Question Marks

Deere's electric and alternative fuel equipment ventures are question marks. The market is evolving, with adoption rates uncertain despite rising interest in sustainable practices. In 2024, Deere's investments in electrification totaled around $150 million. Strategic partnerships are essential for growth.

Deere's shift towards subscription-based services for precision tech is a question mark. This model aims for recurring revenue, but faces hurdles like customer acceptance. In 2024, Deere's tech revenue grew, but adoption rates vary across products. Pricing strategies and customer feedback are key to success.

New autonomous technologies represent a "question mark" in Deere's BCG Matrix. These innovations, crucial for future growth, demand considerable investment with uncertain immediate returns. For instance, Deere invested $305 million in the first quarter of 2024 in R&D, including autonomous tech. Strategic partnerships are vital; Deere's collaboration with GUSS Automation exemplifies this, enhancing prospects for these technologies. Realizing their potential hinges on continuous innovation and market adoption.

Expansion into Emerging Markets

Deere's foray into emerging markets, although promising, is fraught with unknowns. These markets often have unique customer demands, regulatory hurdles, and competitive dynamics. Successful expansion demands thorough market research and strategic alliances. For instance, Deere has been increasing its presence in India, with sales up 15% in 2024.

- Market analysis is crucial to understand local preferences.

- Regulatory compliance varies widely across different countries.

- Partnerships can provide vital local market expertise.

- Currency fluctuations pose financial risks.

Integration of AI and Machine Learning

The integration of AI and machine learning places Deere in the question mark quadrant of the BCG matrix. This is due to the substantial investments needed for AI development and the evolving landscape of its applications in agriculture. While the potential for transformation is high, the specific benefits and market acceptance are still uncertain. Continued R&D is critical for Deere to capitalize on these technologies.

- Deere's R&D spending in 2023 was approximately $2.08 billion.

- The agricultural AI market is projected to reach $5.1 billion by 2028.

- Deere has made several acquisitions in the AI space, including Blue River Technology in 2017.

Deere's autonomous tech, AI, and emerging market ventures are question marks due to investment needs and uncertain returns. Adoption rates and market acceptance remain key hurdles. In 2024, significant R&D spending and strategic partnerships underscored efforts.

| Aspect | Details | 2024 Data |

|---|---|---|

| R&D Investment | Focus on tech, AI, and emerging markets. | $305M in Q1 |

| Market Growth | AI in agriculture | Projected to $5.1B by 2028 |

| Sales Growth | Emerging Markets | India +15% |

BCG Matrix Data Sources

Deere's BCG Matrix relies on financial reports, market analyses, competitor data, and industry benchmarks for its positioning.