Fidelity Investments Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fidelity Investments Bundle

What is included in the product

Tailored analysis for Fidelity's product portfolio, assessing each unit's market position.

Printable summary optimized for A4 and mobile PDFs, providing clarity and actionable insights.

Full Transparency, Always

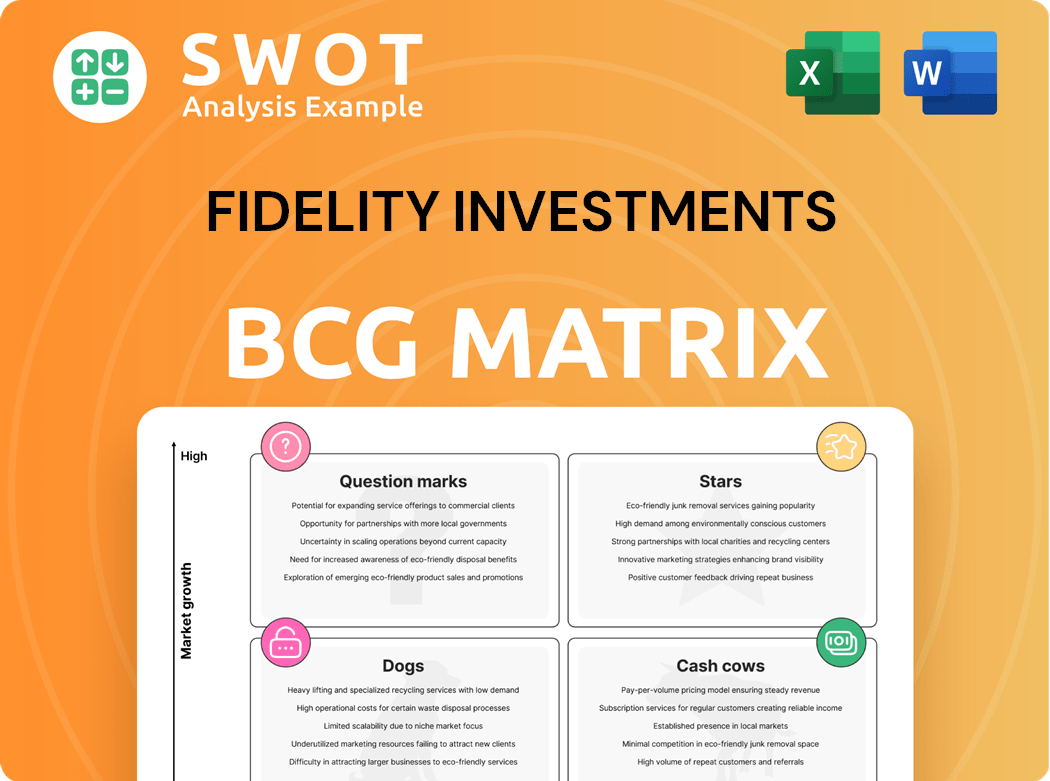

Fidelity Investments BCG Matrix

This preview showcases the complete Fidelity Investments BCG Matrix report you'll gain access to after purchase. Expect no differences; it's the full, downloadable document with all the strategic insights.

BCG Matrix Template

Fidelity Investments operates across diverse sectors, making strategic asset allocation crucial. This preview hints at which offerings shine as Stars, driving market growth. Are there Cash Cows providing steady revenue streams? What about Question Marks needing careful nurturing, or Dogs that need reevaluating? Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Fidelity's ETF platform is expanding, offering 66 ETFs. This includes active equity, fixed income, and thematic ETFs. Notably, the introduction of the Fidelity Wise Origin Bitcoin Fund (FBTC) highlights their response to market trends. In 2024, Fidelity's ETF assets reached over $500 billion, indicating strong performance.

Fidelity's retirement planning services, including 401(k)s, IRAs, and 403(b)s, are categorized as Stars. In 2024, the number of 401(k) millionaires increased by 27%, and average 401(k) balances rose by 11%. This growth, fueled by contributions, positions Fidelity strongly in the market.

Fidelity's digital assets offerings, including Bitcoin in 401(k) plans, have proven successful. Their spot Bitcoin ETF launch and no-fee crypto trading in IRAs highlight innovation. In 2024, Bitcoin's price surged, reflecting growing investor interest. Fidelity's move aligns with the trend of digital asset adoption.

Wealth Management Services

Fidelity's wealth management services shine as Stars in its BCG Matrix, fueled by a growing customer base seeking personalized financial solutions. They offer dedicated advisor support and tailored portfolios. The expansion of model portfolio lineups, including all-ETF suites, highlights their commitment to comprehensive offerings. This focus aligns with the increasing demand for diversified investment options. These services are key drivers of growth for Fidelity.

- Fidelity's assets under administration reached $12.8 trillion in Q4 2023.

- Over 4.6 million clients use Fidelity's wealth management services.

- Fidelity added 360,000 new brokerage accounts in Q4 2023.

Technology and Innovation

Fidelity's "Stars" status in the BCG Matrix reflects its strong tech focus. They've invested heavily in their online platform and mobile app, offering a user-friendly experience. This includes AI-driven investment tools and robo-advisors, attracting new clients. In 2024, Fidelity's digital assets under administration grew substantially.

- Digital assets under administration saw significant growth in 2024.

- AI and robo-advisor adoption rates increased.

- Platform user engagement metrics improved.

- Investment in new tech initiatives continued.

Fidelity's "Stars" are high-growth, high-market-share offerings like retirement planning, digital assets, and wealth management. These areas saw strong growth in 2024, fueled by tech investments and a growing customer base. This positions Fidelity well for continued market leadership, with strong growth in key areas.

| Category | 2024 Performance | Key Drivers |

|---|---|---|

| ETF Assets | Over $500 billion | New ETF offerings, market demand |

| Digital Asset Growth | Substantial growth | Bitcoin ETF, no-fee crypto |

| Wealth Management Clients | 4.6M+ users | Personalized solutions, expanding portfolios |

Cash Cows

Fidelity's brokerage services are a cash cow, boasting a massive retail customer base and high trading volumes. In 2024, Fidelity processed an average of over 2 million trades daily. Its commission-free trading and robust research tools solidify its market leadership.

Fidelity's mutual funds, like Fidelity Zero, are cash cows. These funds, offering no expense ratios, consistently bring in significant cash flow. Their no-transaction-fee structure and customer-focused approach build a loyal customer base. In 2024, Fidelity managed over $4.5 trillion in assets.

Fidelity's asset management arm is a cash cow, managing trillions in assets. In 2024, Fidelity reported over $4.5 trillion in discretionary AUM. Their diverse offerings, like equities and fixed income, ensure steady revenue streams.

Workplace Investing

Fidelity's workplace investing is a cash cow. It includes 401(k) plans and employee benefit programs. These programs support many businesses and investors. They ensure a steady flow of assets, boosting Fidelity's finances.

- Fidelity manages $3.9 trillion in workplace savings assets.

- Over 24.5 million individuals are served by Fidelity's workplace investing.

- Fidelity's revenue from workplace solutions was $8.5 billion in 2023.

Fidelity Charitable

Fidelity Charitable, a donor-advised fund, stands out as a cash cow within Fidelity Investments. It allows clients to donate securities, boosting Fidelity's brand and client ties. This service generates reliable revenue streams, solidifying its cash cow role. As of 2024, Fidelity Charitable held over $60 billion in assets.

- Donor-Advised Fund: A key service for clients.

- Client Relationships: Enhances ties, boosting loyalty.

- Revenue Streams: Generates consistent income.

- Asset Size: Over $60 billion in assets in 2024.

Fidelity's cash cows are crucial for its financial stability and growth. These divisions bring in consistent profits, fueling investments in other areas. Workplace investing and asset management are two key cash cows.

| Cash Cow | Key Feature | 2024 Data |

|---|---|---|

| Workplace Investing | 401(k) Plans | $3.9T in savings assets |

| Asset Management | Diverse Investments | $4.5T AUM |

| Fidelity Charitable | Donor-Advised Funds | $60B+ in assets |

Dogs

Some of Fidelity's active strategies may lag benchmarks, especially in turbulent times. The Fidelity Growth Strategies Fund, for instance, has shown underperformance versus its targets. As of late 2024, some active funds saw lower returns compared to passive alternatives. Investors should review performance data carefully.

Dogs in Fidelity's portfolio could be niche products with low market share. This might include specialized funds or services facing strong competition. Consider underperforming sector-specific ETFs or those with high expense ratios. In 2024, some actively managed funds struggled against passive index funds.

High-fee products with low returns fall into the "Dogs" category. Investors are fee-conscious, and underperforming products face market share struggles. In 2024, actively managed funds with high expense ratios saw outflows. For instance, a study showed that funds in the top quartile for fees underperformed.

Outdated Technology

Outdated technology at Fidelity Investments can be classified as a "dog" in the BCG matrix. These legacy platforms may struggle to compete with modern, agile solutions, leading to reduced customer engagement. For example, outdated systems can increase operational costs. This can be seen in the financial services sector, where companies with old tech often have higher maintenance expenses.

- Reduced customer satisfaction due to slow or cumbersome interfaces.

- Higher operational costs because of maintenance and support needs.

- Potential security vulnerabilities that can be a major liability.

- Inability to integrate with current market technologies.

Geographic Regions with Low Penetration

In regions where Fidelity's presence is sparse, its market share may struggle. These areas can be categorized as dogs within the BCG matrix, often requiring strategic reassessment. This could involve focusing on areas with higher growth potential or considering exiting the market. For example, Fidelity's expansion in Southeast Asia saw varying success in 2024. The company might need to re-evaluate its strategy in underperforming regions.

- Market share in specific regions may be low.

- Strategic investment or divestiture decisions are needed.

- Focus on growth areas or exit underperforming markets.

- Re-evaluate strategies in less successful regions.

Fidelity's "Dogs" include underperforming, low-market-share offerings. High fees and outdated tech also fit this category. Consider sector-specific ETFs struggling in 2024. In 2024, actively managed funds with high fees saw outflows.

| Category | Characteristics | Examples |

|---|---|---|

| Underperforming Funds | Low market share, high fees. | Certain sector-specific ETFs. |

| Outdated Technology | Legacy platforms, high maintenance costs. | Slow interfaces, security issues. |

| Sparse Regional Presence | Low market share, strategic needs. | Southeast Asia expansion struggles in 2024. |

Question Marks

Fidelity's sustainable investing products, including ESG funds, are expanding, yet they are still a smaller segment. In 2024, approximately 10% of Fidelity's assets under management are in sustainable strategies. With rising investor interest, these could evolve into "stars."

New technology platforms, like blockchain and AI-driven investment tools, fit the question mark category. These have high growth potential but face uncertain market adoption. Consider that the global AI in fintech market was valued at $9.4 billion in 2023. Their success hinges on competitive positioning, and Fidelity's strategy will be key.

Fidelity's international push into emerging markets offers high growth prospects but also presents risks. The company must overcome regulatory challenges, cultural nuances, and competition. In 2024, emerging markets' financial services grew by 12%, showing potential.

Innovative Financial Advice Models

Innovative financial advice models are question marks in Fidelity's BCG matrix, representing high-growth potential but also uncertainty. These models, including subscription-based services and personalized digital platforms, are still relatively new. They need strong marketing to show their value and gain traction. As of late 2024, digital advice assets have grown, but adoption rates vary.

- Subscription models are gaining traction, with some platforms seeing a 20% annual growth.

- Personalized digital advice is becoming more popular, with a 15% increase in users in 2024.

- Marketing spend is crucial, with successful firms allocating up to 30% of revenue to promotion.

- Client retention rates vary; successful firms retain 70-80% of clients annually.

Expansion of Digital Asset Services

Fidelity's digital asset services, while present, represent a question mark in its BCG Matrix. The firm needs to decide on further expansion, including custody and trading platforms. The cryptocurrency market's volatility and regulatory uncertainty demand cautious investment strategies. Careful navigation is crucial for success in this area.

- Fidelity Digital Assets launched in 2018.

- In 2024, the SEC continues to scrutinize the crypto market.

- Market volatility impacts investment decisions.

- Regulatory changes can significantly alter the business landscape.

Subscription-based financial advice models are a question mark for Fidelity due to their high growth potential but uncertain adoption rates. These models, including digital platforms, require strong marketing to show value and gain traction. In 2024, these subscription models are gaining traction, with some platforms seeing a 20% annual growth.

| Aspect | Details | 2024 Data |

|---|---|---|

| Growth Potential | Subscription Models | 20% annual growth |

| Adoption Rate | Personalized Digital Advice | 15% user increase |

| Marketing | Successful Firms | 30% revenue for promotion |

BCG Matrix Data Sources

The Fidelity BCG Matrix is built upon verified financial data, market research, and expert analysis. Our core sources are company reports and industry publications.