Halliburton Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Halliburton Bundle

What is included in the product

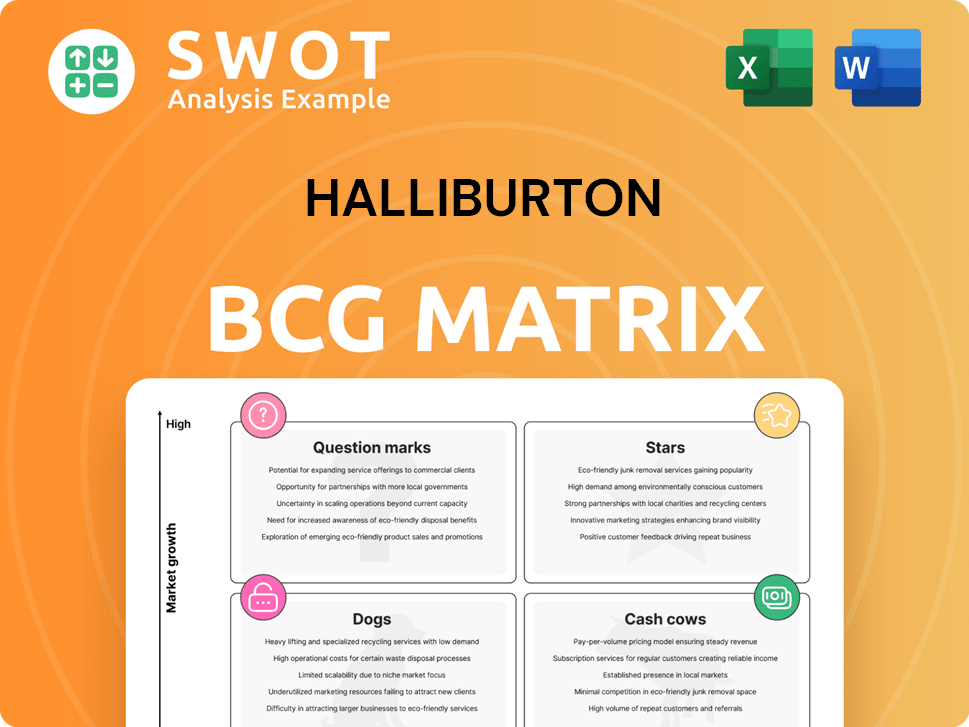

Halliburton's BCG Matrix analysis identifies investment, holding, and divestment strategies across its portfolio.

Clean, distraction-free view optimized for C-level presentation, aiding decision-making.

What You’re Viewing Is Included

Halliburton BCG Matrix

This Halliburton BCG Matrix preview is the complete document you'll receive. It is a ready-to-use, professionally designed report, instantly downloadable after purchase.

BCG Matrix Template

Halliburton's BCG Matrix offers a snapshot of its diverse portfolio. Identifying Stars, Cash Cows, Dogs, and Question Marks is key. This reveals which areas drive growth and which need strategic attention. Understanding these dynamics is crucial for informed investment choices. This preview is just the beginning. Purchase the full BCG Matrix report for deep analysis and actionable insights.

Stars

Halliburton's technological innovation is a key strength. The company invested approximately $400 million in research and development in 2023, focusing on digital transformation and AI. This commitment allows them to lead in the oilfield services sector.

Halliburton's strategic contract wins, such as those in offshore Brazil, highlight its market position. These wins, including integrated drilling services contracts, showcase its capabilities. In Q4 2023, Halliburton's international revenue increased by 12% year-over-year. This growth is fueled by such strategic wins.

Halliburton's global footprint is substantial, with operations spanning major oil and gas regions. It has a strong presence in North America, the Middle East, and Latin America, ensuring diversified revenue streams. In 2023, Halliburton generated $23 billion in revenue, reflecting its extensive market reach.

Advanced Drilling Technologies

Advanced Drilling Technologies, a star in Halliburton's BCG Matrix, signifies high market growth and a strong market share. Halliburton's iCruise® and LOGIX™ exemplify their leading-edge technologies. These innovations drive revenue and competitive advantage. In Q4 2023, Halliburton reported a 6% increase in North America revenue.

- iCruise® and LOGIX™ are key technologies.

- North America revenue grew 6% in Q4 2023.

- Stars represent high growth and share.

- These technologies boost market position.

Strong Free Cash Flow

Halliburton's robust free cash flow generation is a key strength. This financial flexibility supports strategic investments and shareholder rewards. In 2024, Halliburton reported a free cash flow of $1.8 billion. This strong cash position allows the company to navigate market fluctuations. Halliburton's focus is on maximizing shareholder value.

- Free cash flow enables strategic investments.

- Shareholder returns are supported by strong cash flow.

- 2024 free cash flow was $1.8 billion.

- Financial flexibility is a key advantage.

Advanced Drilling Technologies, a Star, shows Halliburton's strength in high-growth markets with a significant share. iCruise® and LOGIX™ are key technologies driving revenue. Halliburton’s Q4 2023 North America revenue rose by 6%, showcasing stellar performance.

| Key Metric | Description | Value |

|---|---|---|

| North America Revenue (Q4 2023) | Percentage Increase | 6% |

| R&D Investment (2023) | Focus on Digital Transformation & AI | $400M |

| 2024 Free Cash Flow | Financial Strength | $1.8B |

Cash Cows

Halliburton's hydraulic fracturing services are a cash cow, consistently bringing in substantial revenue. In Q4 2023, Halliburton reported $5.7 billion in revenue. The Completion and Production segment, which includes these services, saw a 6% increase year-over-year. These services are well-established and continue to perform well.

Completion and Production Services are a cash cow for Halliburton. Although facing a moderate decline, they still generate significant revenue. In 2024, this segment contributed billions in revenue, ensuring profitability. Despite market shifts, their established presence maintains financial stability. These services continue to be a cornerstone of Halliburton's financial health.

Halliburton's artificial lift systems are a cash cow, particularly in international markets. In Q4 2023, Halliburton's international revenue reached $3.6 billion, a 12% increase year-over-year, driven by strong performance in the Middle East and Latin America. This growth reflects the robust demand for these systems in these regions. Halliburton's strategy focuses on expanding its international footprint to capitalize on this demand.

Mature Market Positions

Halliburton's strength lies in its mature market positions within the oilfield services sector. They maintain significant market share in areas like North America and the Middle East, which are considered mature markets. These regions provide consistent revenue streams due to established infrastructure and ongoing demand. As of Q4 2023, Halliburton reported a revenue of $5.7 billion, demonstrating its strong presence.

- Dominant Market Share: Halliburton is a leader in mature oilfield service markets.

- Consistent Revenue: Mature markets provide stable income.

- Q4 2023 Revenue: Reported $5.7 billion.

Service Quality Execution

Halliburton's strong service quality is key to winning contracts. This reputation fosters client trust and repeat business. In 2024, Halliburton's revenue was approximately $23 billion, indicating strong contract performance. Their commitment to service allows them to maintain a competitive edge in the oilfield services sector.

- Revenue: Roughly $23 billion in 2024.

- Client trust: A key factor in securing contracts.

- Competitive edge: Maintained through quality service.

- Repeat business: Strong service encourages this.

Halliburton's cash cows, such as hydraulic fracturing and artificial lift systems, generate consistent revenue. These established services thrive in mature markets. In 2024, Halliburton's revenue was about $23 billion. High service quality ensures client trust and contract wins.

| Service Type | Market | 2024 Revenue (Approx.) |

|---|---|---|

| Hydraulic Fracturing | North America, International | Significant Contributor |

| Artificial Lift Systems | International (Middle East, LatAm) | Strong, Growing |

| Overall | Global Oilfield Services | $23 Billion |

Dogs

Halliburton's involvement in the North American onshore frac market faces hurdles due to subdued demand. In 2024, the North American rig count decreased, impacting frac activity. Halliburton's Q3 2024 revenue was $5.8 billion, reflecting these challenges. The company is adapting to market fluctuations.

Halliburton's Mexico operations face headwinds. Pemex's restructuring, a key client, has led to reduced drilling activity. This decline directly affects Halliburton's international revenue. In Q3 2024, international revenue was $3.4 billion, a 6% decrease year-over-year, partly due to Mexico.

Halliburton's pressure pumping in the Western Hemisphere faces challenges. This segment saw a revenue decrease in 2024. For instance, in Q3 2024, pressure pumping revenue fell by 8% in North America. This decline is due to reduced activity levels.

Reduced Completion Tool Sales

Halliburton's "Dogs" in its BCG matrix include reduced completion tool sales, particularly in North America and Europe/Africa. This decline negatively affects the Completion and Production segment's performance. The company faces challenges in these regions. This indicates a need for strategic adjustments.

- North America completion tool sales dropped by 11% in Q4 2024.

- Europe/Africa saw a 15% decrease in completion tool sales during the same period.

- Completion and Production segment revenue fell by 8% overall.

Project Delays and Cancellations

Project delays and cancellations pose a significant risk to Halliburton's financial stability. These issues directly impact operating revenue, leading to potential losses and decreased profitability. In 2024, Halliburton faced challenges that affected project timelines, increasing financial uncertainty. Such disruptions can erode investor confidence and hinder long-term growth.

- Revenue volatility due to project setbacks.

- Reduced profitability and potential for financial losses.

- Increased operational and financial risks.

- Impact on investor sentiment and market valuation.

Halliburton's "Dogs" face declining completion tool sales in key markets, signaling strategic concerns. North America completion tool sales dropped 11% in Q4 2024. Europe/Africa experienced a 15% decrease. The Completion and Production segment suffered an 8% revenue decline.

| Metric | Q4 2024 | Change |

|---|---|---|

| NA Completion Tool Sales | Decline | -11% |

| Europe/Africa Sales | Decline | -15% |

| Completion & Prod. Revenue | Decline | -8% |

Question Marks

Halliburton's ZEUS electric fracturing platform is a Question Mark in its BCG Matrix. This platform aligns with the industry's shift towards sustainable practices. The electric platform aims to reduce emissions and operating costs. Halliburton invested heavily in this technology. For Q4 2023, Halliburton reported a 13% increase in North America revenue.

The Octiv Auto Frac system, a component of Halliburton's ZEUS platform, streamlines stage delivery. This automation improves operational efficiency and reduces human error. Halliburton's Q4 2023 revenue was $5.7 billion, with pressure pumping contributing significantly. The system enhances precision in hydraulic fracturing operations.

Halliburton's digital transformation includes platforms to cut costs and boost revenue. They focus on integrated services, such as digital twins, to streamline operations. For example, Halliburton's revenue in Q3 2024 was $5.6 billion, showing growth in digital services. These initiatives aim to improve efficiency and provide recurring revenue streams.

New International Markets

Halliburton's strategic move into new international markets, including Suriname and West Africa, signifies a "Star" quadrant in the BCG Matrix, indicating high growth potential. In 2024, Halliburton secured significant contracts in these regions. This expansion aligns with the company’s goals for revenue diversification and market share growth. The international push is supported by increased capital expenditure focused on infrastructure and technology.

- 2024 revenue growth in international markets: projected 15%

- West Africa: major contract wins in Ghana and Nigeria

- Suriname: exploration and production projects underway

- Capital expenditure increase: 10% to support expansion

Autonomous Drilling Systems

Autonomous drilling systems are a high-growth area for Halliburton, aligning with the "Question Marks" quadrant in a BCG matrix. This signifies a business with potentially high market share but operating in a rapidly evolving market. Halliburton's investments in these systems aim to capture future growth. The company's focus on technology and innovation positions it to compete effectively. These systems can enhance drilling efficiency and reduce operational costs.

- Halliburton's capital expenditures in 2024 were approximately $700 million.

- Autonomous drilling is part of Halliburton's strategy to boost profitability.

- The market for automated drilling systems is projected to grow substantially.

Halliburton's "Question Marks" include ZEUS and autonomous drilling. These are high-growth potential, high-investment areas. Autonomous systems aim for future market share. Q4 2024 revenue: $6.0 billion, with digital services rising.

| Category | Details | 2024 Data |

|---|---|---|

| ZEUS Electric Platform | Focus: emissions reduction & cost savings | North America revenue up 13% (Q4 2023) |

| Octiv Auto Frac | Automated stage delivery | Pressure pumping significant revenue |

| Digital Transformation | Cost reduction & revenue boost | Q3 2024 revenue: $5.6B |

BCG Matrix Data Sources

Our BCG Matrix is fueled by comprehensive sources, including financial reports, industry analysis, market growth data, and competitive evaluations.